Binance vs Coinbase – Which Crypto Exchange is Best?

Looking to trade cryptocurrencies online but not sure whether Binance or Coinbase is right for you?

If so, this Binance vs Coinbase Comparison is a must-read. Within it, we cover each and every factor that needs to be considered – such as supported coins, commissions, minimum deposits, payment methods, safety, and more.

What are Binance and Coinbase?

Binance and Coinbase are cryptocurrency exchanges that dominate the industry. They are both home to billions of dollars worth of trading activity each and every day – which is why the two platforms now boast a huge customer base.

Launched in 2012, Coinbase is now home to over 35 million customers. The platform also went through its initial public offering earlier this year – opting for the NASDAQ. At the time of writing, Coinbase is trading with a market capitalization of just over $49 billion. Binance, on the other hand, wasn’t launched until 2017.

In the 24 hours prior to writing this comparison page, Binance facilitated more than $26 billion in trading activity. In terms of their core services, both Binance and Coinbase offer brokerage services that allow you to buy cryptocurrency with a debit card or bank account transfer.

Both platforms also offer exchange services that are more suited to active day traders. Binance and Coinbase have since expanded into a range of other crypto-related products and services.

For example, Binance offers cryptocurrency derivatives – which is inclusive of both Bitcoin futures and options. Binance also offers crypto savings accounts. Coinbase offers a fully-fledged crypto debit card as well as corporate investments.

Binance Pros & Cons

Pros:

- More than 100 million clients now using Binance

- Largest cryptocurrency exchange for trading volume

- Hundreds of supported cryptocurrencies

- Crypto savings account allow you to earn interest

- Low trading commissions

Cons:

- Fiat deposit facilities now available in all countries

- High debit/credit card fees

- Its exchange is a bit complex for beginners

Your capital is at risk

Coinbase Pros & Cons

Pros:

- Trade 64 popular cryptocurrencies

- Accepts credit cards, debit cards, and PayPal

- Excellent security protocols in place

- Simple instant buy or more advanced Coinbase Pro interfaces

- Earn rewards for learning more about crypto

- Tools for businesses and developers

- Integrated cryptocurrency wallet

- Regulated in the US and publicly traded on the NASDAQ

Cons:

- No margin trading or crypto futures

- High trading fees

- Huge debit card transaction fees

- Limited customer support

Your capital is at risk

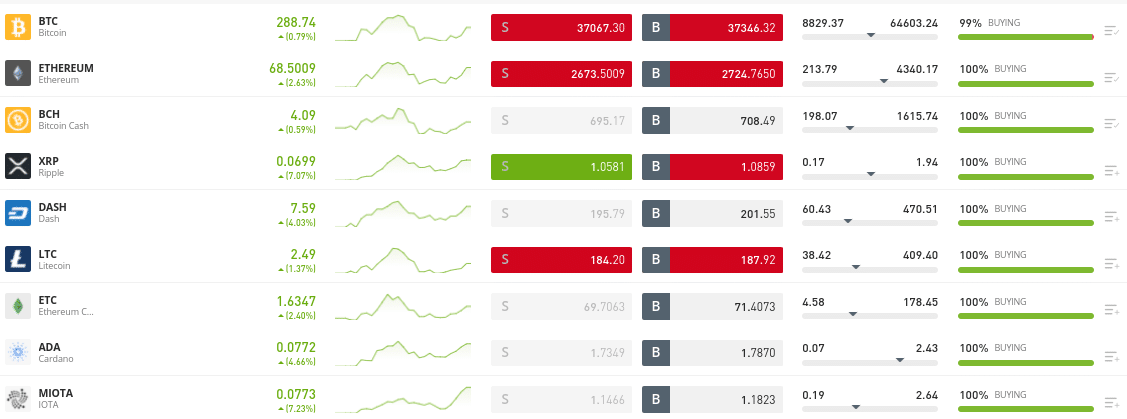

Supported Coins

In the first section of our Binance vs Coinbase review, we are going to discuss which cryptocurrencies the platform supports.

Binance

Starting with Binance, the platform's list of supported markets will ultimately depend on what you are looking to achieve. For example, if you want to buy cryptocurrency instantly with a Visa or MasterCard, you will have access to 28 coins.

This covers a good blend of options - ranging from Bitcoin, Ripple (XRP), BNB, Cardano and Dogecoin to Ethereum, and Vechain. If, however, you are planning to use the Binance exchange, you'll have access to hundreds of digital currencies.

In fact, Binance is often the go-to place to purchase newly created tokens that have yet to be listed on other exchanges. In particular, this includes a significant number of ERC-20 tokens.

You then have the crypto derivative department, which covers futures and vanilla options. This largely focuses on Bitcoin against Tether - meaning that you will be speculating on the future value of BTC/USDT.

Coinbase

Things are a bit more simple over at Coinbase, as the number of supported coins and markets is considerably lower than that of Binance. In fact, at the time of writing, Coinbase is home to just 64 cryptocurrencies. These can be bought, sold, and traded relatively easily at Coinbase.

You can read our Coinbase review to get a full breakdown of what cryptocurrencies the platform supports.

Binance vs Coinbase Fees

Next up in our Binance vs Coinbase comparison we are going to break down what fees the two platforms charge.

Let's start with trading fees.

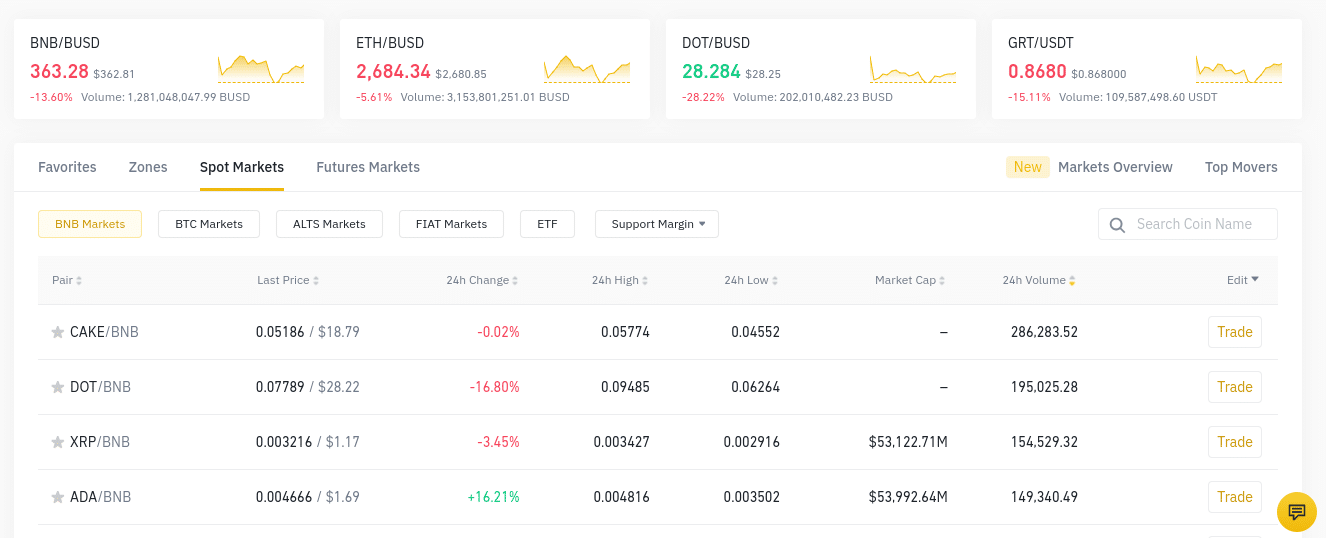

Trading Fees

Trading fees and commissions at Binance will vary wildly depending on the specific market you are looking to access. Additionally, Binance operates a 'maker' and 'taker' system on most instruments, and discounts are available when you hold BNB Coins or you trade large volumes.

Nevertheless, we can give you a basic overview so that you have a ball-park figure. So, standard trading commissions on the Binance exchange amount to 0.10% per slide. This is very competitive indeed. If trading M-futures at Binance, the market taker is just 0.04%.

Holding an allocation of BNB Coins will get you a 10% discount on futures trading fees and 25% on standard exchange commission.

Over at Coinbase, the platform charges a standard trading commission of 1.49% per slide. It goes without saying that this is significantly more than the 0.10% charged by Binance. Plus, in percentage terms, you will pay even more than this if your trade carries a stake of $200 or less.

With that said, if you elect to use Coinbase Pro, the make fee will set you back 0.50% per slide. Sure, this is much lower than the 1.49% found on the main Coinbase website. But, it's still a lot more expensive than Binance. You can get this down to 0.35% on Coinbase Pro, but you would need to trade at least $10,000 in a 30-day period.

Non-Trading Fees

Non-trading fees at both Binance and Coinbase largely centre on deposits and withdrawals. Both platforms allow you to fund your account with a cryptocurrency on a fee-free basis. Bank account transfers are also very competitive and depending on your country of residence - are often free.

However, our Binance vs Coinbase comparison found that both providers charge an arm and a leg when using a debit card. For example, at Binance, this will cost you anywhere from 1.8% to 4% per transaction. At Coinbase, you will pay a transaction fee of 3.99% to use your debit card.

Here's a breakdown of the main fees charges by both Binance and Coinbase.

| Standard Commission | Instant Buy Fee | Deposit Fees | Withdrawal Fees | |

| Binance | 0.10% | Between 1.8% and 4% when using a debit card | Typically no fees on bank transfer deposits | Varies by payment method and country of residence |

| Coinbase | 1.49%, 0.5% on Coinbase Pro | 3.99% when using a debit card | Typically no fees on bank transfer deposits |

Up to 2% on debit card withdrawals |

Buying Limits

We found that Coinbase's buying limits are not clearly stated on the website. It appears as if limits are implemented on a case-by-case basis, depending on factors such as your country of residence and account tier. Binance doesn't haven't buying limits per-say. But, you will be asked for additional identification once you hit a certain threshold.

For example, the platform allows you to buy up to $300 worth of cryptocurrency with a debit/credit card by simply providing your name, date of birth, and home address. However, to move up to the next buying limit of $5,000 per day, you'll need to provide some ID documentation.

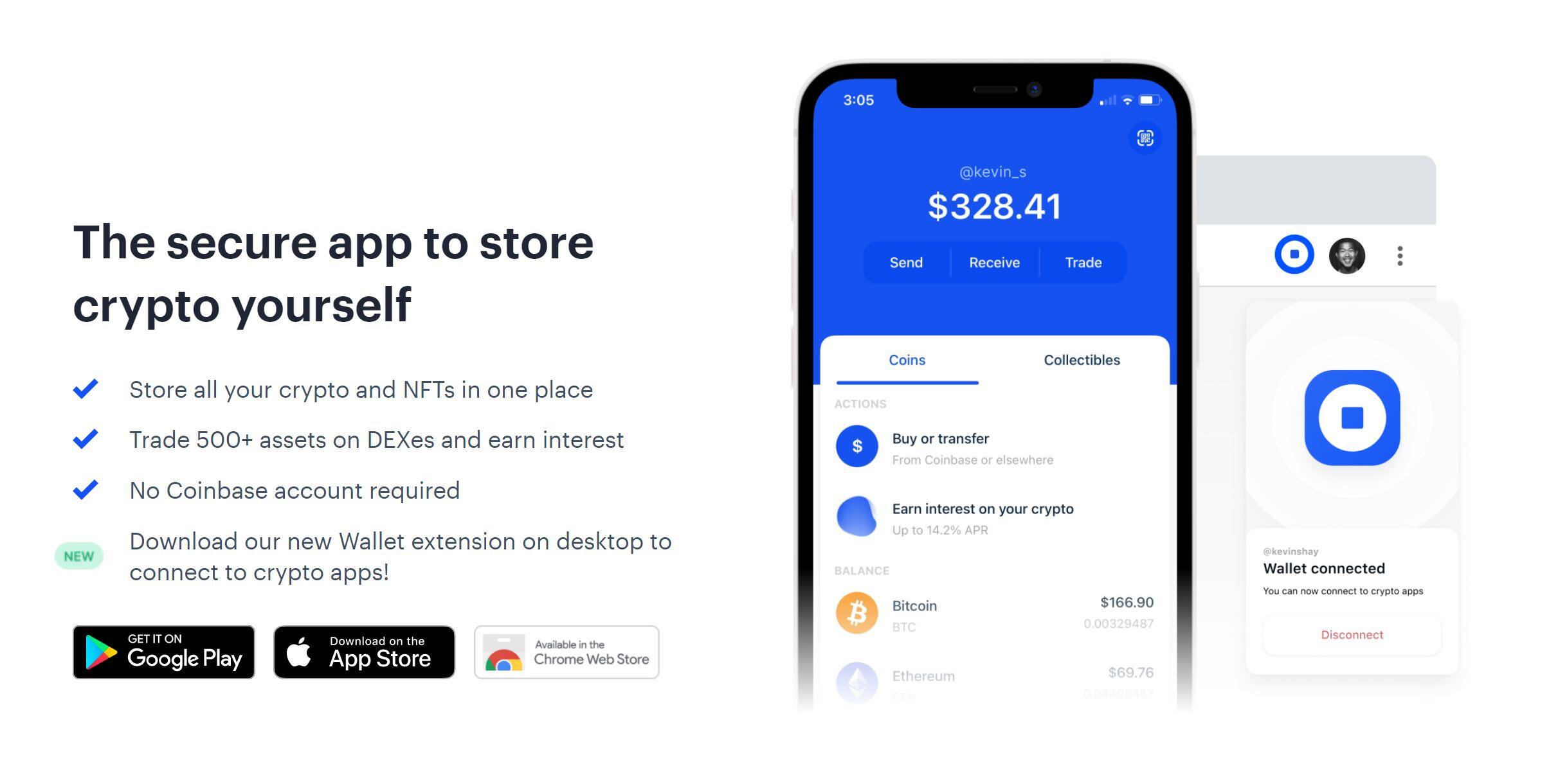

Binance Wallet vs Coinbase Wallet

Our Binance vs Coinbase comparison found that both platforms offer a duo of wallet types. The first a standard web wallet, which is where your digital tokens will be stored upon making a purchase. This offers a convenient way for you to access your crypto assets without needing to download a wallet.

The web wallet offered by both Binance and Coinbase comes packed with security features, including:

- Two-factor authentication

- IP whitelisting

- Device whitelisting

- Internal security team

- Cold storage for the vast bulk of client funds

It's also worth mentioning the Secure Asset Fund for Users (SAFU) offered by Binance. In a nutshell, Binance will put a small percentage of all trading commissions it collects into the SAFU. This is with the view of repaying users in the unfortunate event the exchange is hacked.

If you want to be in full control of your private keys - which you won't be if using the web wallet, both Binance and Coinbase offer a mobile wallet. Both wallets are compatible with iOS and Android devices and ensure that you, and only you, have access to your private keys.

Both mobile wallets come with several useful features, such as:

- Being able to buy and sell cryptocurrency

- Send and receive digital assets

- Instantly check the value of your portfolio in multiple currencies

If you can't decide whether a web or mobile wallet is right for you - have a think about your priorities when it comes to security and convenience.

Mobile App

If you're the type of trader that likes to buy and sell cryptocurrencies on the move - you'll be pleased to know that both Binance and Coinbase offer a fully-fledged app. Once again, this is available on both iOS and Android devices.

The respective apps give you access to most account features - such as being able to deposit and withdraw funds, as well as buy, sell, and trade cryptocurrencies. The app is also worth having if you like to keep tabs on how your crypto portfolio is performing in real-time.

User Experience

When it comes to user experience, our Binance vs Coinbase comparison found that both providers offer basic and advanced options. For example, if you are looking to use your debit card to buy cryptocurrency - the process at both Binance and Coinbase is very simple.

It's just a case of following the on-screen instructions by:

- opening an account

- uploading some ID

- choosing the digital asset

- entering your stake

- entering your card details

- and confirming the transaction

Even as a beginner, you should have no issues with either platform. With that said, both Binance and Coinbase also offer an advanced platform that is suited for seasoned traders. At Binance, you can access this by hovering over the 'Trade' button and clicking on 'Advanced'. At Coinbase, you will need to switch over to Coinbase Pro.

The advanced platforms offered by Binance and Coinbase give you access to in-depth chart analysis tools. This includes drawing tools, technical indicators, and advanced order types.

Trading Tools and Features

Our Binance vs Coinbase comparison found that on top of core brokerage and exchange services, both platforms offer a number of additional features that you might find of interest.

This includes:

Crypto Savings Accounts

Coinbase doesn't offer crypto savings accounts, so this feature is offered by Binance alone. As the name suggests, by putting your crypto assets in the Binance savings account, you will be able to earn interest on your digital funds. In a time not so long ago this would have been unthinkable, as rarely do cryptocurrencies yield dividends.

However, at Binance, you can earn up to 6% per year. The specific amount that you can earn will depend on the digital currency, whether you opt for a flexible or locked account, and how long you keep your digital assets in the account.

Crypto Debit Card

Our Binance vs Coinbase comparison found that both platforms offer a fully-fledged debit card. Both are prepaid debit cards issued by Visa, meaning you can use it at millions of locations around the world. This includes spending online and in-store, as well as at an ATM.

The standout feature with both the Binance and Coinbase Visa card is that you can spend your cryptocurrency holdings in the real world. At the time of the transaction, the provider in question will convert digital currency into fiat money so that your purchase goes through instantly.

Native Cryptocurrency

We also found that both Binance and Coinbase have created their very own cryptocurrency. In fact, Binance has two. First, you have the Binance Coin (BNB), which at the time of writing, is the fourth largest cryptocurrency in terms of market capitalization.

Secondly, Binance is also behind BUSD - which is a regulated stablecoin tied to the US dollar. This means that each BUSD can be converted into US dollars at any given time.

In partnership with Circle, Coinbase is also behind a stablecoin that is pegged to the US dollar. This is called USD Coin (USDC) and it can be purchase from a number of leading cryptocurrency exchanges.

Binance vs Coinbase Payments

Our Binance vs Coinbase review found that both platforms can facilitate deposit and withdrawals in cryptocurrencies and fiat currency. When funding your account with crypto at Binance, you will be able to trade anonymously.

This is on the proviso that you do not trade more than 2 BTC worth of digital currencies in a 24-hour period. This option of anonymity is not available at Coinbase. When it comes to fiat currency payment methods, both Binance and Coinbase support debit cards and bank transfers.

Minimum Deposit

There is no minimum deposit at Coinbase. Binance has a minimum deposit when using a debit card that typically amounts to $15. This can vary depending on your country of residence.

Binance vs Coinbase Regulation & Licensing

When it comes to regulation, Coinbase wins hands down. This is because the US-based broker is regulated by the Security and Exchange Commission (SEC). Furthermore, Coinbase is now a publicly-traded company on the NASDAQ, so this invites significantly more scrutiny from regulators.

Binance as a parent company isn't regulated by a single financial body. The platform doesn't have a formal HQ, as it operates in several jurisdictions. With that said, Binance does have the legal remit to accept fiat currency deposits and withdrawals in all of the countries that it offers this facility.

Contact and Customer Service

Our Binance vs Coinbase review found that customer support varies widely between the two platforms. Over at Binance, you will have access to a live chat facility 24/7. This is impressive when you consider the platform is home to over 100 million users.

Coinbase, on the other hand, is known for its sub-par customer service. There is no live chat or telephone support facility - meaning the only option is to raise a ticket from within your account. Emails are also supported but again, you will need to wait for a reply.

Binance vs Coinbase vs eToro

This Binance vs Coinbase comparison has outlined the core pros and cons of each platform. If you are yet to make a decision - we would suggest considering a third option - eToro.

We found that this super popular online broker covers all bases when it comes to supported assets, fees, payments, regulation, and more.

Here's why:

Fees

When you buy cryptocurrency on eToro, you will only pay the spread. This allows you to invest in a very low-cost way - especially when you consider that Coinbase charges a standard commission of 1.49% per slide. eToro also wins hands-down when it comes to deposit and withdrawal fees.

| Trading Fee | Deposit Fees | Withdrawal Fees | |

| Binance | 0.10% per slide | Up to 4% on debit cards | Varies depending on payment method and country |

| Coinbase | 1.49% per slide | 3.99% on debit cards |

Up to 2% on debit card withdrawals |

| eToro | Spread-only (varies by coin) | Free for US traders, 0.5% for non-US traders | $5 per withdrawal |

US traders can deposit funds without paying any fees at all and all other users pay just 0.5%. As we noted earlier - Coinbase charges 3.99% and Binance can go as high as 4% (country-specific). Withdrawals at eToro cost just $5.

Assets

Binance and Coinbase specialize exclusively in digital currencies. This is somewhat problematic, as you won't be able to create a diversified portfolio without opening an account with another platform. eToro, however, has you covered - as the platform not only supports cryptocurrencies but thousands of other financial instruments.

This includes commission-free stocks and ETFs from 17 international markets, alongside low-cost CFDs in the form of forex, indices, and commodities.

Regulation

When it comes to safety, eToro is heavily regulated. This includes a license with the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). eToro is also approved by the SEC and the Financial Industry Regulatory Authority (FINRA).

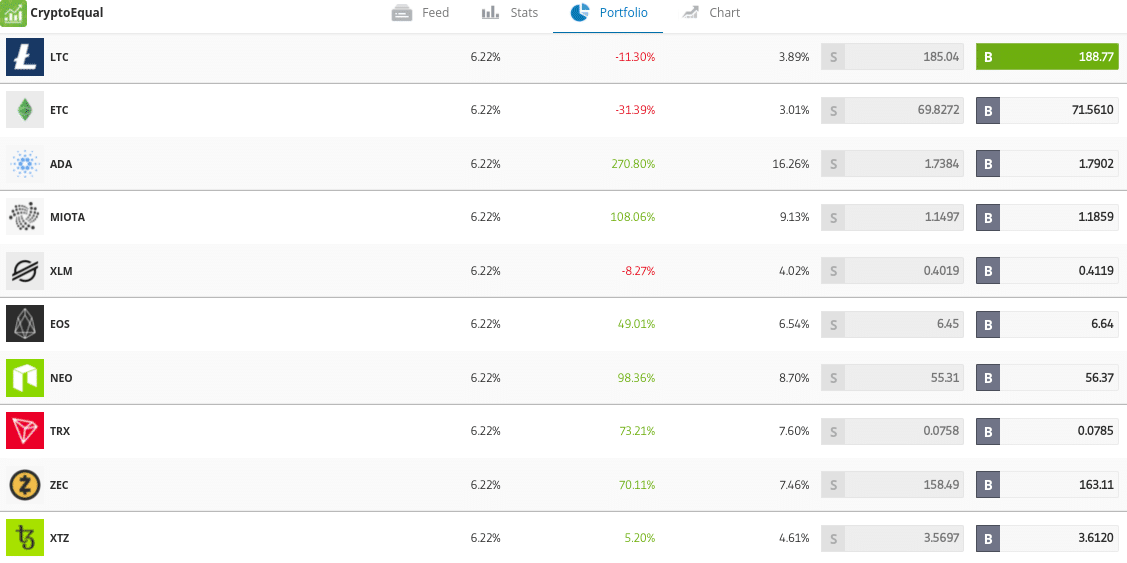

Cryptocurrency Portfolios

By using Coinbase or Binance, the only way to diversify your cryptocurrency portfolio is to buy coins on an individual basis. This is both cumbersome and time-consuming. At eToro, you can invest in a full basket of different cryptocurrencies via a single trade.

The portfolio is weighted based on market capitalization, meaning it is representative of the wider digital currency industry. Most importantly, CryptoPortfolios are managed internally - meaning that the team at eToro will rebalance your basket of cryptocurrencies on your behalf.

Copy Trading

The final icing on the cake with eToro is that the platform offers a Copy Trading tool. This allows you to actively day trade digital currencies without needing to do any research or place any orders.

Instead, once you have selected a cryptocurrency trader you like the look of, all ongoing positions will be reflected in your own portfolio. Nothing like this exists at either Binance or Coinbase.

67% of retail investor accounts lose money when trading CFDs with this provider.

Past performance does not guarantee future results.

The Verdict

This Binance vs Coinbase comparison has revealed that both platforms excel in many areas - especially when it comes to supported cryptocurrency markets, user-friendliness, and reputation. However, we concluded that eToro is by far a better option.

Instead of paying 3-4% at Binance or Coinbase, eToro allows you to deposit funds with fiat currency at just 0.5% - and 0% if you're based in the US. Plus, eToro offers a wide variety of assets and even a diversified CryptoPortfolio that is professionally managed.

eToro - Overall Best Broker to Trade Cryptocurrencies

67% of retail investor accounts lose money when trading CFDs with this provider.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.