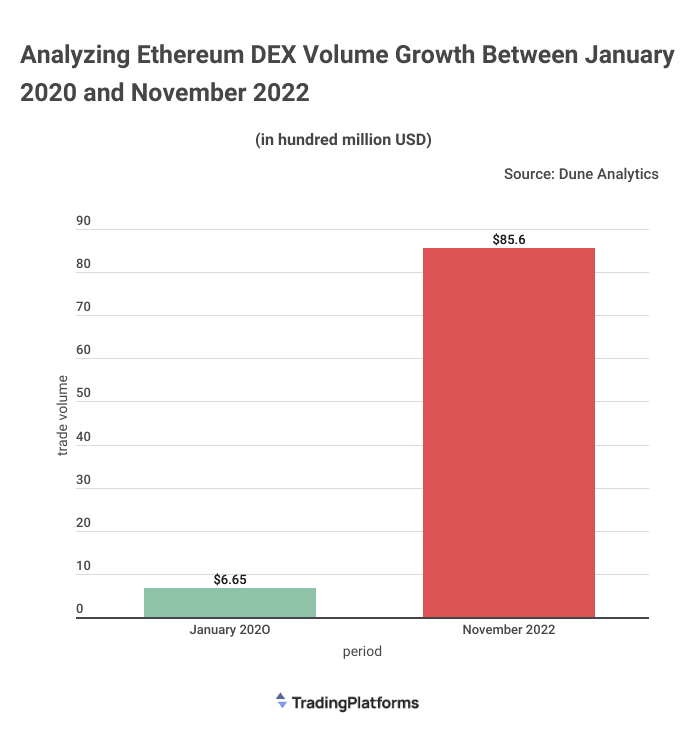

The Ethereum (ETH) decentralized exchanges (DEX) recorded unprecedented growth over the past three years. Between January 2020 and November 2022, ETH DEX volumes grew at a compound annual growth rate (CAGR) of 405%. That’s per a TradingPlatforms.com report showing those volumes rose sharply from $665,410,734 to $85,634,045,737 in that period.

According to TradingPlatforms’ investments lead, Edith Reads, “This surge in Ethereum trade volumes indicates the increasing popularity of decentralized exchanges and the growing demand for Ethereum-based assets. It suggests that despite market dips during periods of volatility, investors believe in the promise of ETH-based asset trading and are willing to capitalize on the opportunities available through these exchanges.”

So, What’s Behind This Surge in ETH DEX Volumes?

One factor driving this trend has been the rise in decentralized finance (DeFi) protocols and applications that use Ethereum as their base layer. These include lending and borrowing platforms, yield farming protocols, and stablecoin projects.

All these rely heavily on ETH-based tokens or ERC20s for liquidity purposes. And as more users flock to DeFi protocols to take advantage of high returns on investment or to speculate with crypto assets, ETH DEX volumes have soared accordingly.

Another contributing factor has been the emergence of non-fungible token (NFT) artworks. One can authenticate these pieces through the blockchain and trade them on DEXs for crypto tokens or even fiat currency. Furthermore, with Ethereum being the leading blockchain for hosting smart contracts, many developers have flocked to it to build their protocols.

Smart contracts have been central to recent advancements in automated market-making (AMM) protocols. AMMs enable users to deploy algorithmic strategies on DEXs, allowing them to take advantage of market opportunities faster while eliminating counterparty risks. This, too, has helped propel ETH DEX trade volume growth even further.

An Alternative to Centralized Exchanges

Ethereum DEXs have emerged as a powerful alternative to traditional centralized exchanges (CEXs). Unlike the latter, with their rigid requirements for identity verification and restrictive KYC policies, DEXs provide users with direct access to trustless transactions.

Their open environment allows traders to manage their funds without relying on external custodians or brokers. Moreover, DEXs are non-custodial platforms making them ideal for those looking for privacy and more control over their crypto assets.

Moreover, the fees associated with these platforms are generally lower than those seen in CEXs due to their lack of custody fees or trading commissions. This feature has led many traders to flock to these platforms for better returns when trading digital assets.

As more investors become aware of the advantages of DEXs over CEXs, this trend will likely continue, resulting in increased trading volumes across the sector.

Question & Answers (0)