How to Invest in Energy ETFs 2026 – With 0% Commission

An energy ETF invests in stocks in the energy sector, including companies producing oil and natural gas, wind farms, solar panels, and utilities. With around $25 billion in assets under management, the Energy Select Sector SPDR Fund (XLE) is currently the largest energy ETF.

This guide reviews the best energy ETFs available for investors. Additionally, we demonstrate how you can invest in energy ETFs from the comfort of your home in a regulated broker.

How To Buy Energy ETFs – Quick Steps

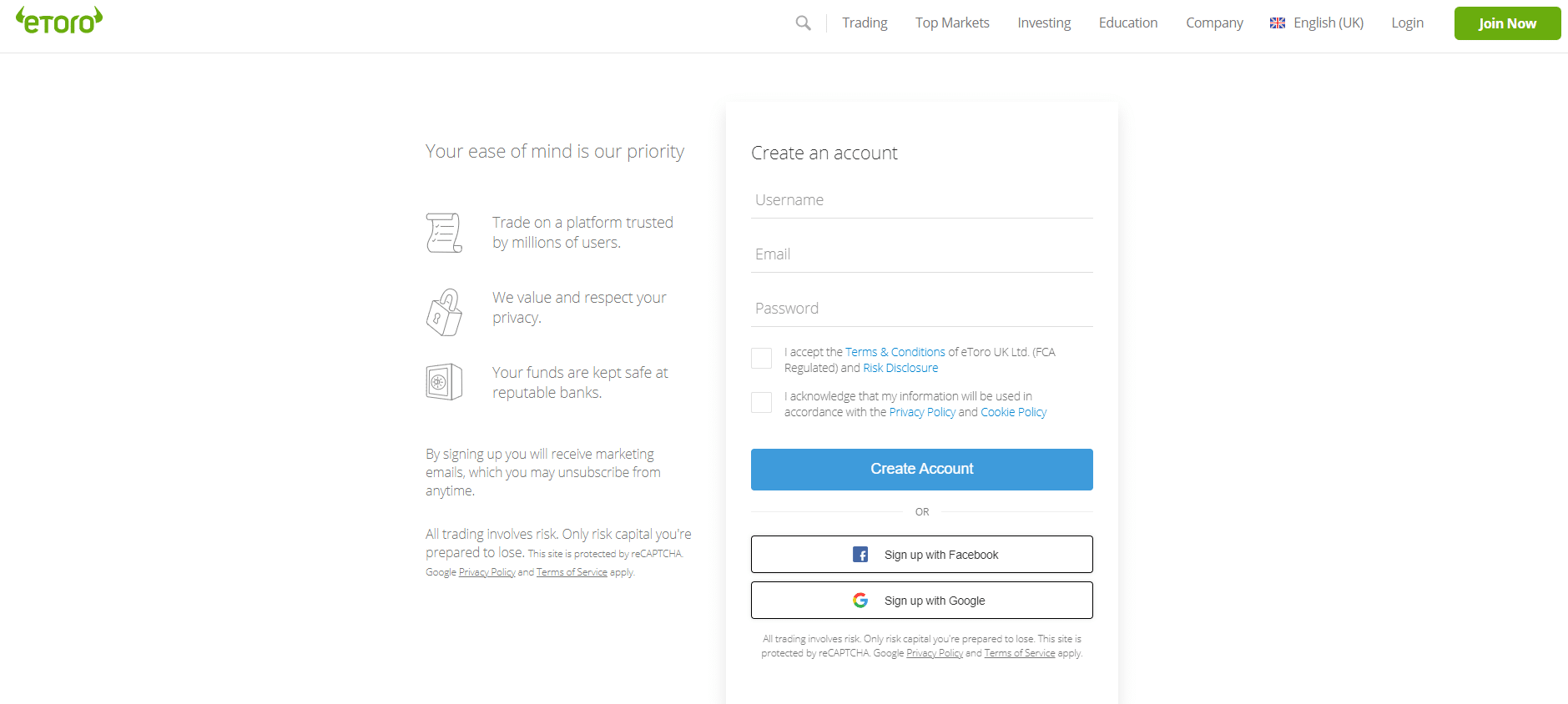

It is recommended that you access the eToro platform if you want simple instructions on trading energy ETFs. Follow these steps:

- Create your account – Create a free eToro account or sign in using Facebook or Google.

- Verify your identification – Next, provide a driver’s license, passport, or ID card to verify your identity.

- Deposit funds – Use any payment options to deposit the funds you will use as your initial investment.

- Buy energy ETFs – Finally, you should search for the best energy ETFs and begin buying the stocks you like most.

Step 1 – Choose An Energy ETFs Broker

To have the best experience, it is always important to choose a regulated broker that offers all security guarantees. Let’s look at some reviews in the following section to help you choose the right broker.

1. eToro – Invest In Energy ETFs With 0% Commission

The popularity of eToro has increased over the past few years – more than 20 million people now use this top trading platform. In addition, more than 2,400 shares and 250+ ETFs can be purchased from 17 international markets through the broker.

eToro offers all the best commodity ETFs we will discuss on this page. Moreover, it only takes minutes to invest – as all you have to do is open an account, deposit some funds, and pick how much you want to stake in your chosen ETF.

In addition to not charging any commissions, eToro does not charge any fees for trading. It is not just the case for ETFs but stocks, forex, commodities, indices, and cryptocurrencies. Also, there are no ongoing platform fees, so you can keep your oil ETF for as long as you like. However, you should consider the ETF provider’s expense ratio. With eToro, you can invest in oil ETFs starting at $50.

The benefit is that you don’t have to be over-exposed to this highly volatile asset class. Alternatively, you could diversify across several energy ETFs or consider other asset classes altogether.

The Copy Trading feature is another tool available on the eToro platform. You can copy an eToro trader of your choice like-for-like. You can also invest passively in a basket of renewable energy stocks through a CopyPortfolio.

You can use a debit card, credit card, bank account, or e-wallets such as PayPal or Skrill when it comes to payment methods. As eToro is denominated in US dollars, a very small currency conversion charge of 0.5% when you deposit funds. Nevertheless, this is offset by the commission-free service you will receive. Regarding eToro’s safety, it is not only regulated by the FCA but also covered by the FSCS.

eToro fees:

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading (for US users available) fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros:

Pros:

- Easy-to-use online trading platform

- Invest in stocks without paying any commissions or share dealing fees

- Invest in stocks, commodities, indices, and forex with CFDs

- Over 2,400 stocks are listed on the London Stock Exchange and 16 international markets

- You can deposit funds with a debit/credit card, an e-wallet, or a bank account

- Copying trades from other users is possible

- Protection from FCA and FSCS

Cons:

Cons:

- For advanced traders, technical analysis is unsuitable

Your capital is at risk.

Note: For US users available Crypto trading.

2. Webull - One Of The Most Popular Brokers To Buy Energy ETFs In The US

Among the most prominent platforms in the US market, Webull has built a reputation. Users can navigate the interface easily and without any problems.

Users of Webull are usually people who intend to invest just a small amount of money. Small investments can be made starting at $1. In addition, this platform doesn't charge a single commission.

Webull offers more than 2,000 ETFs, including Energy ETFs, available for as little as $1 per trade. In addition, Webull allows you to gain ownership of two free stocks worth up to $1,850 as a promotional offer and incentive.

Webull charges a monthly fee for access to details about level II markets. Therefore, you will have to pay $1.99 per month for this. Another important aspect is that security is not an issue, as it is regulated and registered by the SEC and FINRA and is a member of SIPC.

Webull fees:

| Fee | Amount |

| Stock trading fee | 0% |

| Forex trading fee | Not Supported |

| Crypto trading fee | 0% |

| Inactivity fee | No |

| Withdrawal fee | $25 |

Pros:

Pros:

- A wide range of stocks and ETFs are available

- Foreign companies are supported through ADRs

- Stock options and cryptocurrency trading

- 0% commission on trading

- Easy-to-use interface

- iOS/Android apps are available

Cons:

Cons:

- A platform fee of $1.99 per month is charged for Level II pricing data

Your capital is at risk.

3. TD Ameritrade - The Best Broker For Experienced Traders To Buy Energy ETFs

As a result of its reliability, comprehensive portfolio, and prestige, this platform stands out. It offers stocks, bonds, and mutual funds.

If you're interested in short-term investing, TD Ameritrade also offers trading services for options, futures, currencies, and ETFs, including energy ETFs. Furthermore, TD Ameritrade now offers commission-free trading of US-listed stocks and exchange-traded funds.

Its unique "thinkorswim" day trading platform offers numerous functions and modern strategies that prove TD Ameritrade best suits more experienced traders. If you are not experienced in trading, TD Ameritrade may not be the best option.

TD Ameritrade fees:

| Fee | Amount |

| Stock trading fee | 0% |

| Forex trading fee | Not Supported |

| Crypto trading fee | Not Supported |

| Inactivity fee | No |

| Withdrawal fee | Free |

Pros:

Pros:

- There are thousands of traditional investment products available

- ETFs, stocks, and exchange-traded funds on US exchanges

- Active traders have access to forex, futures, and options

- Get 0% commissions on stocks and ETFs listed in the US.

Cons:

Cons:

- It’s too complex for new traders

- The fee structure is confusing

- Debit/credit cards are not accepted

Your capital is at risk.

4. Interactive Brokers- Best Broker To Diversify Your Investment In Energy ETFs

This company is listed under the symbol IBKR on the NASDAQ, and its market capitalization is $28.08 billion. Since Interactive Brokers is a publicly-traded company, its financial statements must be made public. Because of this, many investors consider this platform one of the most reliable ones.

Additionally, Interactive Broker offers commission-free trading and one of the widest portfolios of products and markets. It offers conventional stocks and ETFs, energy ETFs, futures, CFDs, and forex trading at a low price and without commissions, allowing you to diversify your portfolio.

Interactive Brokers offers access to the best energy ETFs listed on international exchanges. On this free investment platform, you can even invest in fractional shares. As a result, beginners and more experienced traders can invest to meet their expectations, meet their deadlines, and diversify their portfolios without being limited by the number of stocks that can be purchased.

Interactive Brokers fees:

| Fee | Amount |

| Stock trading fee | 0% |

| Forex trading fee | Not Supported |

| Crypto trading fee | $5.00 per contract |

| Inactivity fee | No |

| Withdrawal fee | One free withdrawal request per month. |

Pros:

Pros:

- For US clients, ETFs and stocks can be traded commission-free

- It offers low-interest rates

- Social trading and robo-advisory services are available

- You can purchase shares of stocks listed on international exchanges.

- It is possible to buy and sell fractional shares.

Cons:

Cons:

- There is a $20 monthly inactivity fee for accounts with less than $2,000 in balance.

- The interface could be difficult to use for inexperienced or new traders.

Your capital is at risk.

Step 2 – Research On Energy ETFs

Energy ETFs are exchange-traded funds that invest in energy stocks, including oil and gas, companies that produce alternative energy such as wind farms or solar panel producers, and companies in the utility sector. Energy Select Sector SPDR Fund (XLE) manages around $25 billion in assets, making it the largest energy ETF.

As with other types of funds, ETFs offer diversification, but they can be bought and sold throughout the day, unlike mutual funds. Moreover, they are generally more affordable than other forms of investment.

Best Energy ETFs

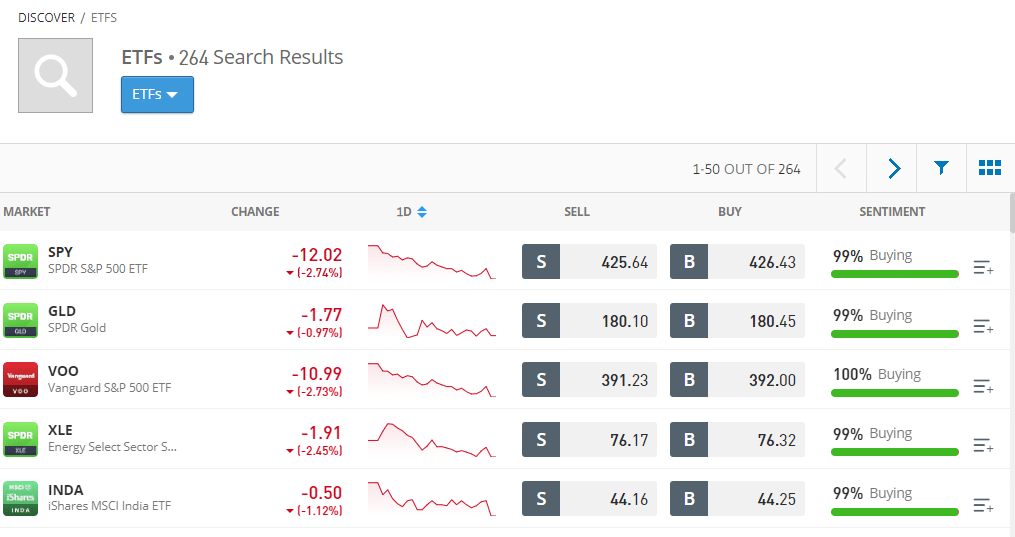

Here we have listed the best energy ETFs you can buy. All of them are available in eToro.

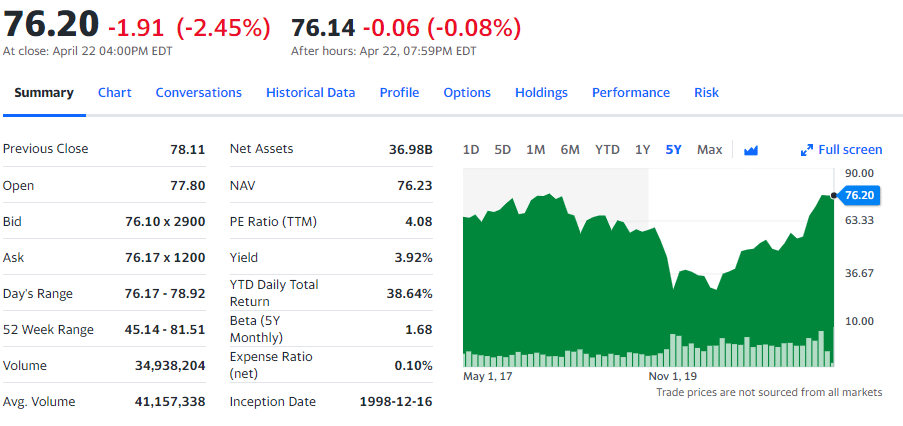

Energy Select Sector SPDR Fund (XLE)

The Energy Select Sector SPDR Fund tracks the S&P 500 energy sector index, and it is Woodard's top pick for the diversified energy sector. Woodard says the XLE fund has the most bullish price momentum and the best Sortino ratio among the energy exchange-traded funds he covers. Sortino ratios measure a fund's risk-adjusted performance. Exxon Mobil Corp. (XOM), Chevron Corp. (CVX), and EOG Resources Inc. (EOG) are among the fund's top holdings in the energy sector. In addition, a dividend yield of 3.4%, more than double that of the S&P 500, is paid by the XLE fund, which charges a 0.1% expense ratio.

Your capital is at risk.

Note: For US users available Crypto trading.

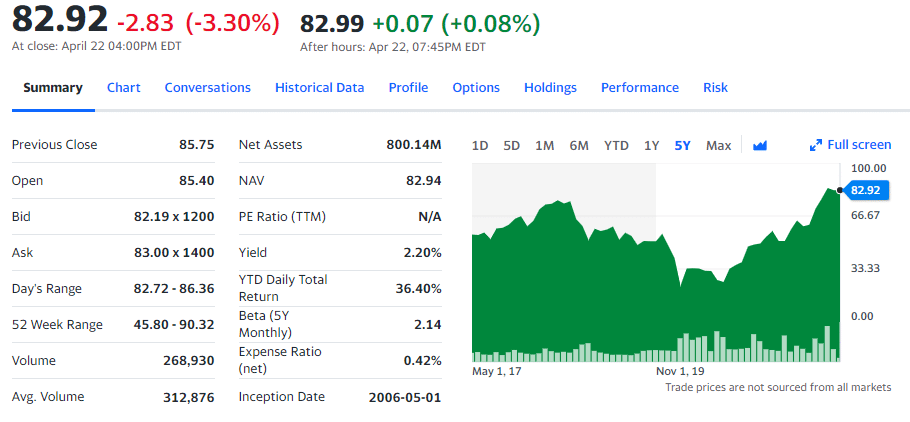

iShares US Oil & Gas Exploration & Production ETF (IEO)

Woodard recommends the iShares US Oil & Gas Exploration & Production ETF among US oil exploration and production funds. Approximately 68% of the IEO fund's stock holdings have Bank of America analysts' "buy" rating. Woodard says oil exploration and production companies are now more aware of the long-term consequences of unnecessary growth than they were previously. IEO holds 54 stocks, including ConocoPhillips (COP), EOG Resources, and Pioneer Natural Resources Co. (PXD).

Your capital is at risk.

Note: For US users available Crypto trading.

Global X MLP & Energy Infrastructure ETF (MLPX)

Global X MLP & Energy Infrastructure ETF tracks the Stuttgart Solactive MLP & Energy Infrastructure Index. Due to its higher trading volume, the MLPX fund offers investors more liquidity than the TPYP fund. However, MLPX is much less diversified, with only 27 holdings, and it pays only 5.1% for distributions. Williams, TC Energy, and Enbridge are among its top holdings. Over the past five years, the MLPX fund has slightly underperformed the TPYP fund in total return.

Your capital is at risk.

Note: For US users available Crypto trading.

Invesco Dynamic Energy Exploration & Production ETF (PXE)

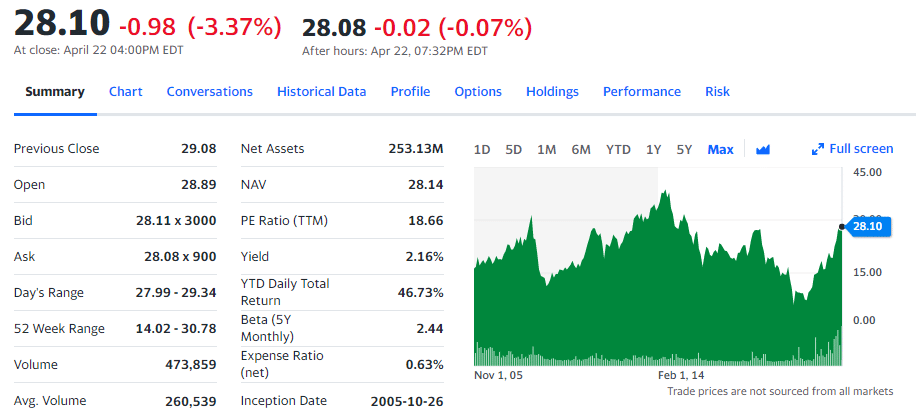

PowerShares' Intellidex series contains the Invesco Dynamic Energy Exploration & Production ETF, a market capitalization-weighted fund designed to outperform its benchmarks. However, despite having a higher expense ratio than the IEO ETF, the PXE fund's total return over the past five years has lagged behind the IEO fund's, at 7.2% versus IEO's 8%. PXE's liquidity is also relatively low. A total of 33 holdings are in the fund, including top holdings such as Occidental Petroleum Corp. (OXY), ConocoPhillips, and Devon Energy Corp. (DVN). As a result, Bank of America rates the PXE ETF, which has an expense ratio of 0.63%, as "attractive."

Your capital is at risk.

Note: For US users available Crypto trading.

VanEck Oil Services ETF (OIH)

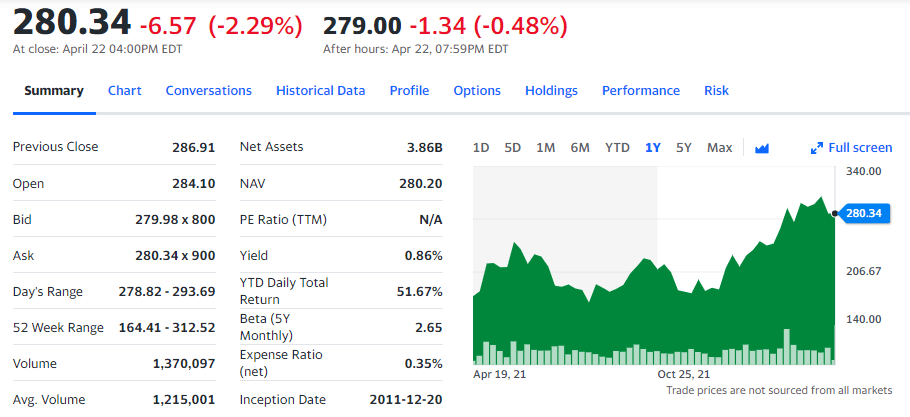

Woodard's top pick in oil services ETFs is VanEck Oil Services ETF, which tracks the largest 25 U.S.-listed oil services companies. Thanks to soaring oil prices, Bank of America estimates that exploration and production capital expenditures should rise nearly 50% in 2022 and that spending growth will be a major tailwind for oilfield services stocks. By far, the most liquid oil services ETF is OIH. The company's top holdings include Schlumberger Ltd. (SLB), Halliburton Co. (HAL), and Baker Hughes Co. (BKR). Bank of America rates the OIH ETF, which has an expense ratio of 0.35%, as "more attractive."

Your capital is at risk.

Note: For US users available Crypto trading.

Energy ETFs Fundamentals

Among the fundamentals are cash flow and return on assets (ROA). Energy ETFs are subject to fundamental analysis. It deals with any data that may impact the price factor or value received. Furthermore, it differs from trading models. The fundamental analysis goes back to the basics.

According to fundamental analysis, a company's value is determined by its shares, bought and sold based on their value. You can value a company's fundamentals by considering the following indicators:

- Cash flow

- Return on assets

- Use of moderate leverage

- Earnings retention history for financing future growth

Best Energy Companies

Apart from knowing the best energy ETFs to buy, it is also important to know the best companies in this field. So here we have reviewed some of the best energy companies.

Brookfield Renewable

Brookfield Renewable is a leading global provider of renewable energy. The company operates hydroelectric, solar, wind, and energy transition assets. The company sells the power generated by these assets to electric utilities and other large power users through long-term power purchase agreements (PPAs).

Brookfield can generate relatively steady cash flows used primarily to pay dividends. Retaining the rest, the company will acquire, develop, and expand its renewable energy operations.

There is an enormous backlog of renewable energy development projects for the company. In addition to acquisitions and higher power prices, Brookfield expects to increase its cash flow per share by 20% annually through 2026, supporting a 5% to 9% dividend increase and making the company an excellent renewable energy investment.

ConocoPhillips

It is a diversified oil and natural gas company. It operates worldwide and produces oil and natural gas in various ways.

ConocoPhillips is known for its low operating costs. Its average cost of supply is less than $30 per barrel. Furthermore, it has a strong balance sheet to complement its low supply cost. It has a high bond rating backed by a low leverage ratio. As a result, it has plenty of cushions to weather frequent low oil and gas prices.

ConocoPhillips will generate significant cash flow thanks to its low operating costs in the coming years. It estimates that it can produce a cumulative free cash flow of $80 billion by 2031. It assumes oil prices will average $50 per barrel by then. By 2022, ConocoPhillips will generate a gusher of free cash flow as oil prices will have risen to that point.

The company expects to return almost all of that windfall to investors over the next few years. In response to higher oil prices, the company plans to repurchase shares, pay a quarterly dividend that grows, and make a variable return of cash payments (incremental dividend payments from its excess cash).

Chevron

Chevron is one of the world's leading companies in the energy sector. The company operates a global integrated oil and gas business, including exploration, production, refining, and chemicals. Its large-scale and integrated operations help it weather the energy market's volatility.

The cash flows generated by Chevron's legacy oil and gas operations are used for dividends, share repurchases, and investments. In 2022, Chevron raised its dividend for the 35th straight year, making it a Dividend Aristocrat.

Chevron's goal of reducing its carbon emissions is a part of its investments in the future. Carbon capture and storage are a part of this investment. The company also agreed to acquire Renewable Energy Group (NASDAQ: REGI) in 2022 for more than $3.15 billion. As a result of the deal, Chevron will be able to expand its capacity to produce 100 000 barrels of renewable fuel per day by 2030.

The company aims to provide the fuels the economy needs today while preparing for the low-carbon fuels it will need in the future. Due to its balance, it is an ideal choice for investors seeking to invest in the energy transition from fossil fuels to cleaner options.

NextEra Energy

NextEra Energy is one of the largest electric utility companies in the United States. Furthermore, through its Energy Resources segment, the company is one of the world's leading wind and solar power producers, which sells clean energy to other utility companies and end-users across the country.

As a result, the business's cash flow remains relatively stable. In addition, the company sells electricity under government-regulated rates and a fixed-price PPA with its customers. Because businesses and households need a constant power supply, the business model is extremely resilient.

The financial profile of NextEra Energy is one of the best in the electric utility industry. The company has the highest credit rating among its peers. NextEra also pays dividends at a conservative rate for a utility. Because of those factors, NextEra can pay a stable and growing dividend. It expects to increase its payout by 10% annually through 2024, making it an excellent renewable energy dividend stock.

TC Energy

TC Energy is one of the largest operators of natural gas pipelines in North America. The company has natural gas pipelines in the United States, Mexico, and its own country, Canada. In addition, the company has an extensive liquids pipeline network, making it one of Canada's leading oil exporters. It is also one of its largest power producers, focusing on nuclear energy and renewable energy.

Cash flows from these energy infrastructure assets are relatively stable. Fee-based contracts and regulated rates apply to the leasing of the company's capacity. TC Energy has proven to be highly durable due to its low-risk business model, which generates stable cash flow regardless of market conditions.

Meanwhile, the dividend payout ratio of the company is conservative. In addition, it has one of the best credit ratings in the pipeline sector. As a result of those factors, the company can continue expanding its pipeline network and increasing its dividend. Also, they make TC Energy a low-risk company in the energy sector.

Is It Worth Investing in Energy ETFs?

The global economy needs an energy sector that provides fuel and power for trade and transportation. During recessions, such as COVID-19, the economy can slow significantly, impacting energy demand and prices. Consequently, energy stock prices can be impacted. In contrast, when the economy accelerated in 2021, demand soared, and prices usually followed.

Due to this, the best energy stocks to buy are those that can survive a downturn easily. Additionally, that factor allows them to thrive when the market improves. Additionally, energy stock investors should pay more attention to companies that use renewable energy sources.

Step 3: Open Account & Invest With eToro

We will now guide you through the process step-by-step so that you can invest in energy ETFs of your choice from the comfort of your own home.

In the following tutorial, we will show you a step-by-step guide on investing in an oil ETF using eToro since there are no dealing fees and the minimum trade size is just $50.

Step 1: Open An Account And Upload ID

Start by visiting the eToro website. Register by clicking on the 'Join Now' button. It will require personal information from you - such as your name, address, etc.

Then, you will be required to upload a copy of your passport or driver's license. You will also need a recent bank statement or utility bill to prove your home address. eToro will verify your documents pretty quickly.

Please note that You can deposit up to $2,250 without uploading the above ID documents. Nevertheless, you must complete the process before you can withdraw - so you should begin the process as soon as possible.

Your capital is at risk.

Note: For US users available Crypto trading.

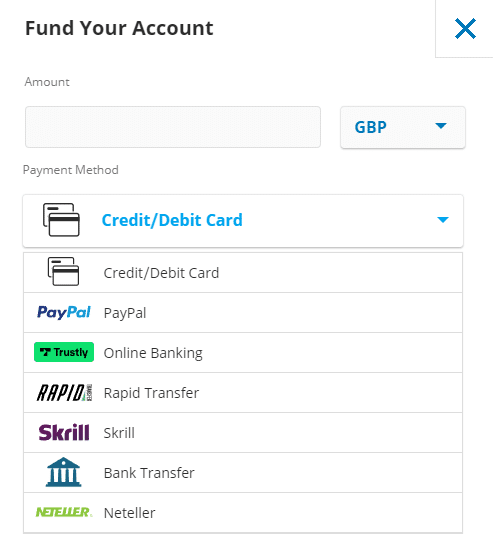

Step 2: Make A Deposit

Once you have registered with eToro, you can proceed to make a deposit. The FCA-regulated broker supports various payment methods, most of which are credited to your account instantly.

These include:

- Debit and Credit Cards

- E-Wallet (Paypal, Skrill, Neteller)

- Bank Transfer

Step 3: Search For An Energy ETF

On eToro's website, click on 'Trade Markets' to find the ETF you would like to invest in.

Step 4: Complete Your Energy ETF Investment

As you can see in the image below, an order box appears. eToro asks you to enter your desired investment amount (in US dollars, a minimum investment of $50).

After clicking the 'Open Trade' button, you can complete your commission-free investment.

Conclusion

ETFs provide easy access to energy companies without picking and choosing stocks. Consider choosing energy ETFs that suit your portfolio if you want to be more selective with your investments. It's noteworthy that some clean energy ETFs focus on renewable energy if you're interested in sustainable investing.

Suppose you want to proceed with an energy ETF investment right now. In that case, you can do so easily and affordably with eToro as you can do it without paying any commissions or ongoing platform fees. Opening an energy ETF account takes just 10 minutes and requires a minimum investment of $50.

Your capital is at risk.

Note: For US users available Crypto trading.