Where & How to Buy Tesla (TSLA) Stock in February 2026

While innovative and tech-led companies make some of the most attractive stock picks for beginner investors, those looking to buy Tesla stock are advised to familiarize themselves with the firm’s turbulent history.

At the hands of eccentric and often controversial CEO, Elon Musk, the EV company has seen numerous price swings since it went public in 2010. Just this year, its Q3 earnings per share are down 44% year-on-year ($0.53).

But this takes nothing away from Tesla’s impressive overall success, with the automaker now boasting a market capitalization of over $700bn.

In this guide, we will address the question of how to buy Tesla stock in 2026, in addition to examining Tesla’s price history, and our top recommended broker to buy Tesla stock on a zero commission basis.

-

-

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

How to Invest in Tesla (TSLA) Stock Step by Step

Step 1: Research the best online brokers and choose a platform that suits your investment strategy.

Step 2: Sign up to your chosen broker and verify your identity by providing two forms of ID.

Step 3: Deposit funds into your account using a debit card or bank transfer. It is a good idea to choose a broker that has a low minimum deposit if you’re new to investing.

Step 4: Search for TSLA through the broker’s explore function. If you’re looking to invest through ETFs or Indices, you will need to search for these tickers instead.

Step 5: Fill out the order form and execute the transaction. Tesla shares will appear in your portfolio after a few minutes.

What is Tesla?

Despite being a relative newcomer when compared with the legacy brands it competed with, Elon Musk’s Tesla has become almost entirely synonymous with the global electric vehicle (EV) industry.

Founded in 2003 by Martin Eberhard and Marc Tarpenning, the California-based firm has consistently captured the world’s attention by creating attractive, accessible fully electric vehicles, starting with the now iconic Tesla Roaster. Popular models such as the Model S, 3, X and Y shortly followed, completing an industry-leaning EV product suite. Tesla’s automotive segment includes over 67.2 billion dollars in sales, as of 2022.

More than fully electric vehicles

Beyond creating fully electric vehicles, Tesla has strengthened its grip on renewable energy solutions with stationary energy storage products such as the Powerwall and Powerpack. Furthermore, Tesla recently acquired solar firm SolarCity which creates solar energy systems. The company is leading the way for sustainable energy generation, making it one of the best green stocks to consider in 2026.

As well as automotive and energy generation, Tesla also recently launched Tesla Pay – an innovative payment system that aims to simplify the process of sending and receiving payments. The application aims to help customers ‘tap’ into the future by offering an efficient system that is suitable for both individuals and businesses.

But despite its success, Tesla has also become synonymous with volatility, largely at the hands of CEO Elon Musk, whose questionable public persona has raised eyebrows on numerous occasions.

However, the company looks set to fortify its strong market position, with plans to further advance the world of autonomous driving technology and disrupt the global automotive industry.

Tesla’s Stock Price in February 2026

Tesla posted record revenues for 2022, with profits more than doubling year-on-year to $12.6bn. However, amid an increasingly competitive market and challenging economic conditions, 2023 has been a different story, with the EV maker’s Q3 results falling short of expectations.

According to CNBC, the company’s revenue was $700,00 lower than expected at $23.4bn, while earnings per share hit 66 cents compared to a projected 73 cents.

Similarly, Investor’s Business Daily reported that Q3 vehicle deliveries saw a 6% shortfall. The Model 3 and Model Y were also cut in price by $1,250 and $2,000 respectively.

These shortcomings have seen Tesla stock take a substantial hit, with the firm’s share price falling around 21% in the four weeks after its Q3 financials were made public.

At the time of writing, the price stands at $237, a nearly 42% drop from its October 2021 peak.

However, this arguably does little to detract from a strong overall 2023, with Tesla’s share price having more than doubled since the beginning of the year.

Why Invest in Tesla (TSLA) Stock in 2026?

Those looking to buy Tesla stock in 2026 should be wary that the company’s explosive growth of the last decade is unlikely to be seen again.

However, there is plenty to be optimistic about. Despite shortfalls in Q3 financial targets, the automaker’s market capitalization still more than doubles that of Toyota, Ford and General Motors combined. And though major swings have occurred with some regularity, Tesla’s share price has continued its impressive overall growth, having jumped 118% since January 3.

Tesla’s ambition and future prospects are also a major factor in this equation, with a pickup, semi-truck, a supercar, and fully self-driving cars (including taxis) all in development and slated for future release.

Most notably, the long-delayed Tesla Cybertruck is due to enter mass production imminently, with the first deliveries due at the end of November.

But many have raised concerns regarding the soaring rates of global inflation and its impact on Tesla. While the automaker’s Q3 results showed a 9% jump in revenue year-on-year, its gross profit, operating and EBITDA margins all fell by over 7%.

In fact, while Tesla once comfortably led the automotive industry on gross margin, the firm was bested by key competitor Toyota Motor Corp in Q3.

Investing in Tesla in 2026 demands a careful consideration of both the company’s remarkable achievements and potential challenges. While Tesla’s rapid growth may not be replicated in the coming years, its market capitalization, ambitious projects, and imminent product releases provide grounds for optimism.

The impending mass production of the Cybertruck signals a significant milestone, yet concerns linger regarding the impact of global inflation on Tesla’s financial metrics. Investors should monitor these dynamics closely, recognizing that the landscape for electric vehicles and sustainable energy is evolving rapidly.

Where to Buy Tesla (TSLA) Stock in 2026

Before investing in TSLA, it is important to research different brokers that you could use. Each broker will be better suited to a different investment strategy so, it is a good idea to shop around until you find one that offers everything you need.

Below, we take a look at four different brokerages that are suitable for both beginners and experienced Tesla investors.

1. eToro – Overall best investment account to buy Tesla shares

eToro is our recommended broker to buy Tesla shares in 2026 because the platform allows investors to buy TSLA commission-free. There are also no account management fees, deposit, or withdrawal costs involved with using the platform which makes it a suitable option for investors who have a lower budget.

eToro facilitates fractional investing and users can buy Tesla for $10. This makes eToro one of the most accessible options which is why the trading platform is popular amongst beginners.

The social trading platform caters to a variety of strategies that could be used for investing in Tesla shares. As well as facilitating fractional investing in TSLA, users can also invest in the stock through ready-made Smart Portfolios, ETFs, and indices. This makes it easy for investors to build a diverse portfolio while gaining exposure to the tech giant.

For example, through eToro it is possible to invest in the NASDAQ100 Index and the SPY ETF, which both contain Tesla shares. The platform also offers several smart portfolios such as Big Tech and Altia Investment SAS which include TSLA shares. eToro offers Tesla investing for all trading strategies.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. Robinhood – Top mobile app for investing in Tesla

Robinhood, a widely recognized zero-commission trading platform, offers the best mobile app for investing in Tesla shares and managing your portfolio on the go.

As well as being one of the easiest brokers to use, Robinhood also offers zero fees for buying Tesla stock. The minimum investment is just $1, making it possible for investors to accumulate Tesla shares through popular strategies such as dollar cost averaging. Users can buy TSLA in small increments, reducing the risk that is involved with purchasing Tesla stock.

Robinhood also supports TSLA options trading which is suitable for experienced day traders. This allows traders to speculate on the future price of Tesla and implement complex strategies to take advantage of small price fluctuations.

3. Charles Schwab – Best educational tools and resources for stock trading

Charles Schwab is a reputable US brokerage that offers stocks, options, bonds, and ETFs. This provides investors with a range of assets that they can choose from when buying Tesla shares in 2026.

As well as catering to a variety of investment strategies, Charles Schwab is known for offering an excellent range of educational resources and research tools. For Tesla investors, the broker provides up-to-date news, expert insight, and guidance on how to analyze the stock. This makes the broker a great option for new investors who are looking to improve their knowledge before buying TSLA.

The minimum deposit requirement for Charles Schwab is $0 and the broker supports fractional investing. The investment platform doesn’t offer zero fees however, the cost of buying Tesla is fairly low. Investors must pay a fixed rate of $0.65 per contract.

4. Webull – The most suitable platform for advanced trading and analysis

Webull, is a relatively new trading platform that was founded in 2018. This platform is ideal for investors who want to trade Tesla shares using advanced strategies that require technical analysis tools.

It is possible to connect a Webull trading account with the popular MetaTrader 4 charting platform. By doing this, investors can access a range of indicators, APIs, risk management tools, signals, and more. This makes it the best option for experienced investors.

Webull also offers a demo account which can be used to practice trading Tesla without putting any real funds at risk as well as its own proprietary trading platform for active traders. Investors can trade fractional shares, ETFs, and Tesla options.

How To Buy Tesla Shares on eToro

In the following section, we will take a closer look at how to buy Tesla stock from our recommended broker eToro. If eToro isn’t the most suitable platform for you, the process of buying Tesla is fairly similar to most other brokerage accounts.

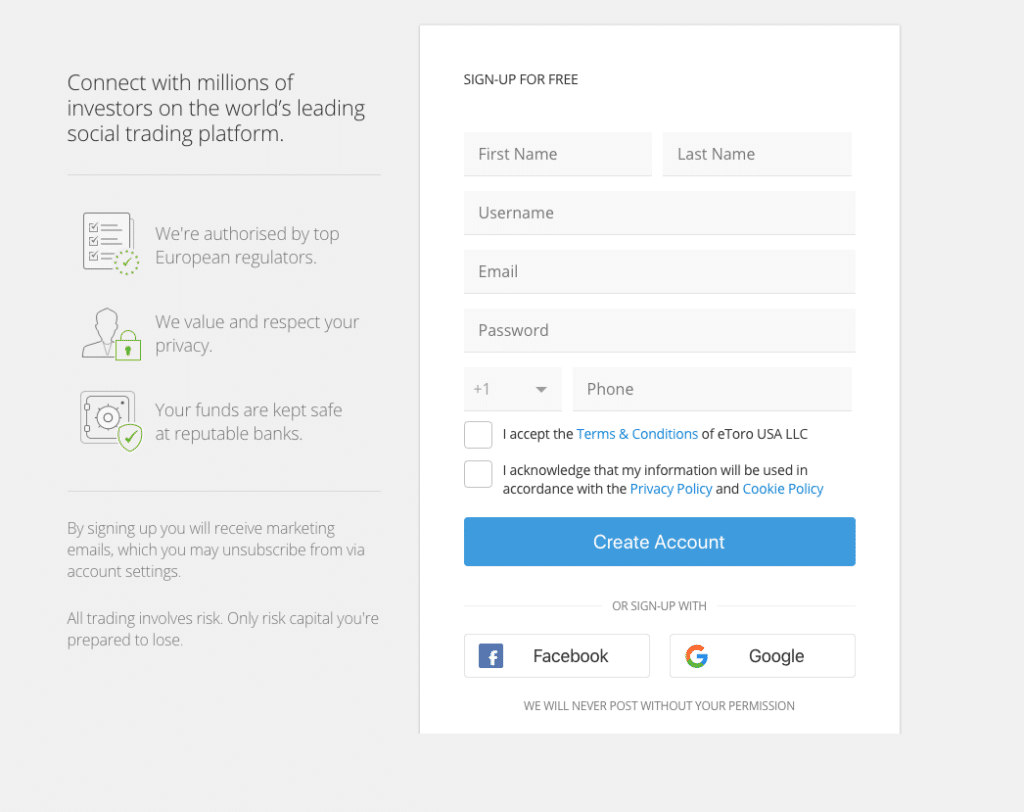

Step 1: Sign up for an eToro brokerage account

Visit the eToro website and click on “Sign up” to create a new account. You can either sign up using your email or connect with your Google or Facebook account. The registration process takes around 15 minutes to complete.

After this, you will be asked to verify your ID by uploading photos of two documents. Take clear photos in good lighting to speed up the process.

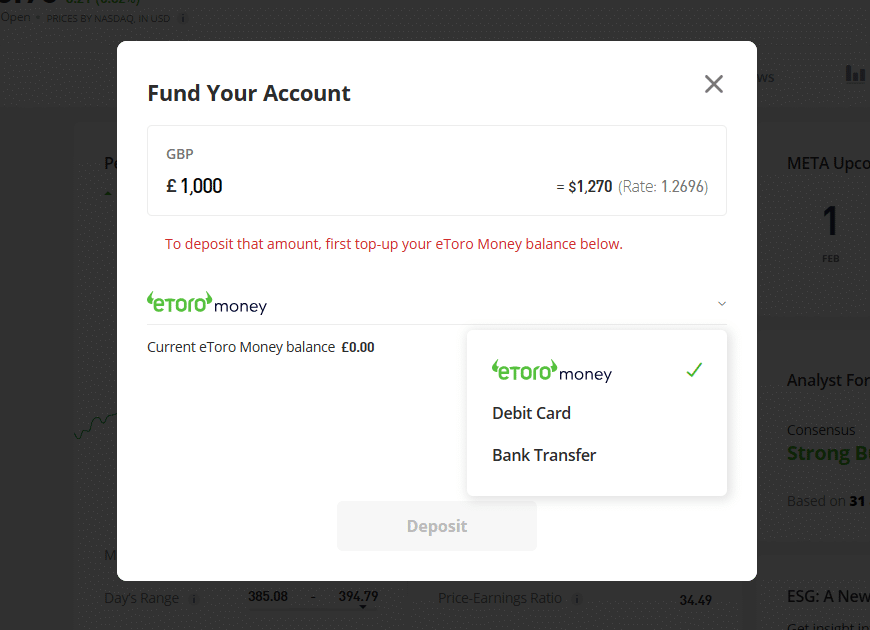

Step 2: Deposit funds

Once your profile is complete, you’ll need to deposit funds into your eToro account. Click on the “Deposit” button and choose your preferred payment method. eToro accepts various payment options such as bank transfers

and debit card.

The minimum amount that you can deposit is $20 and there are no fees charged for depositing funds with eToro.

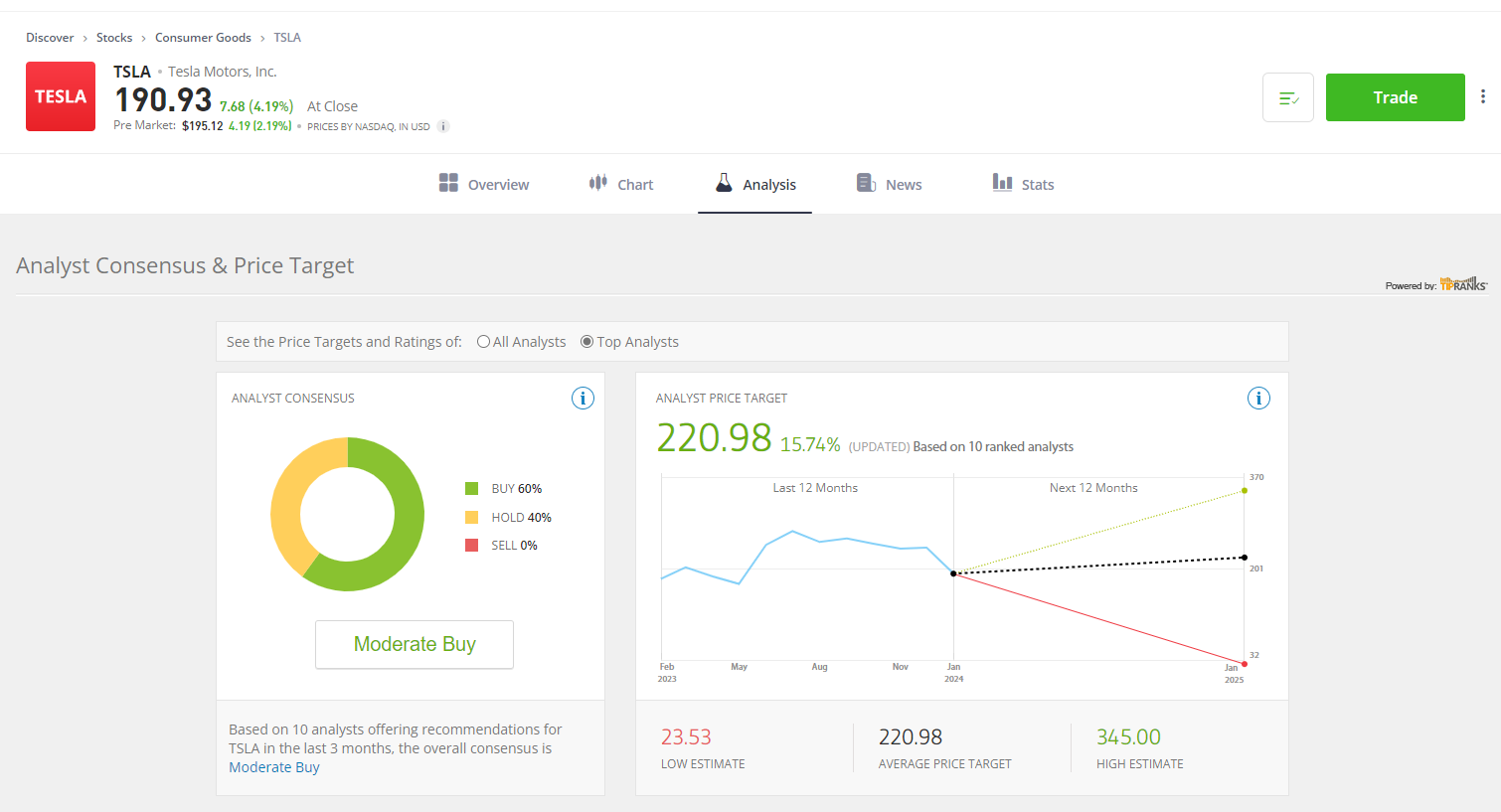

Step 3: Search for Tesla stock ticker symbol

On the eToro dashboard, you’ll find a search bar. Type “Tesla” or the stock ticker symbol “TSLA” and select it from the search results. From here, you will be able to view all available data about Tesla stock.

It is a good idea to spend time carefully analyzing Tesla stock before you make a purchase. eToro provides analysis, market news and a social trading feed.

Step 4: Place a market order

After selecting Tesla’s stock, click on the “Trade” button. A trading window will appear, allowing you to customize your order. Decide on the amount you want to invest and choose whether to buy the stock or set certain conditions for the order, such as stop loss or take profit.

Step 5: Review and execute the trade

Before finalizing your purchase, double-check the trade details, including the investment amount, the current price, and any additional conditions. Once you’re satisfied, click on “Open Trade” to execute the trade.

Tesla stock will appear in your eToro portfolio within a few minutes.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

How To Sell Tesla Stock in 2026

Investors can sell their Tesla stock within their investment accounts. If you use eToro, this involves navigating to the portfolio section, on your dashboard, and selecting Tesla stock.

From here, click ‘close’ to begin the selling process.

- A close order box will appear on the screen. In this box, you can check the trade and choose how much of your Tesla stock you would like to sell.

- Click ‘close trade’ to verify the transaction.

- Capital will be sent to your cash balance. You can either use this to invest in different stocks or withdraw it to your bank account.

Our Verdict on Tesla (TSLA) Stock in 2026

Though volatility has plagued Tesla in years gone by, the firm’s overall success is plan to see, with a market cap now surpassing $700bn.

What’s more, the automaker has performed handsomely in recent times, battling headwinds to see its share price more than doubled since the beginning of January 2023, now sitting at $237.

The launch of the Cybertruck is also cause for optimism, Tesla having finally launched a competing product in the world of EVs with offroad capabilities, further threatening smaller competitors such as NIO and Rivian.

These factors, in combination with Tesla’s ongoing persistence in delivering innovation in the world of electric vehicles, renders the stock a potentially worthwhile investment in 2026.

FAQs

Can I buy Tesla stock directly?

No, Tesla stock must be purchased through a brokerage platform. One popular option is eToro, a user-friendly platform offering access to a variety of stocks, including Tesla.

How much does it cost to buy Tesla stock?

The cost of Tesla stock is determined by its current market price, which can fluctuate. Check the real-time price on your chosen brokerage platform, and consider factors like fees and market conditions before making a purchase. At the time of writing, Tesla’s share price is around $237.

Is Tesla a good stock to buy right now?

Weighing up the decision to invest in Tesla stock demands an understanding of the company’s dynamic history and recent performance. Despite Q3 earnings setbacks, Tesla’s overall success is evident, with a market cap surpassing $700 billion. This, combined with the raft of new and innovative products slated for future production, would suggest that Tesla is a good investment in 2023.

How to buy Tesla stock online?

Potential investors can explore various online brokerage platforms, including eToro, Robinhood, Charles Schwab, and Webull. These platforms offer diverse features, from social trading to commission-free structures. In TradingPlatforms’ view, eToro is the best all-round choice for most investors.

References:

- https://www.cnbc.com/2023/10/18/tesla-tsla-earnings-q3-2023.html#:~:text=Revenue%3A%20%2423.35%20billion%20vs%20%2424.1%20billion%20expected

- https://www.investors.com/news/tesla-earnings-slide-37-cybertruck-coming-margins-bottomed/

- https://uk.sports.yahoo.com/news/tesla-cybertruck-production-seems-might-204200130.html

- https://www.barrons.com/articles/toyota-earnings-tesla-flaw-c553b8f7

Sam Alberti

View all posts by Sam AlbertiSam Alberti has recently joined Trading Platforms as a content editor, having spent the past four years working as a journalist across various financial and business niches. He graduated from the University of Kingston in 2019 with a Master’s Degree in Journalism and an NCTJ Diploma, and has since developed a passion for both consumer and corporate finance. He now specializes in producing engaging and thoroughly-researched web content on all things finance.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up