Best Leveraged Trading Platforms & Brokers in 2026

Over the last few years, leveraged trading has become extremely popular among traditional finance and cryptocurrency traders. Its popularity stems from the promise of large rewards without requiring too much investment on your part. Instead, your trading platform/broker provides the rest of the funds while you contribute a fraction.

As a result, leveraged trading is also a much higher risk and should only be attempted by experienced traders. It would help if you learned all you can about leveraged trading before you try your hand at it, and you can start here.

-

-

Best High Leverage Brokers in 2026

If you simply wish to know which are the best platforms for leveraged trading and be on your way, we can recommend four of them.

- eToro: eToro is a highly-regulated broker that is used by over 20 million people around the globe. The platform supports over 2400 financial instruments and offers leverage trading of up to 30x for retail clients. Forex pairs can be traded with leverage of 30:1 whereas crypto and stocks can be traded with leverage up to 2:1. The broker also offers a professional leverage trading option which allows more experienced traders to use leverage up to 500:1.

Note: Crypto CFDs are not available with eToro for US/ UK users - WeBull: Webull is a beginner-friendly leverage trading option that provides conservative leverage of up to 4x for day-trading. While the broker doesn’t support high leverage, it is a good option for less-experienced traders who want to minimize their risk. Leverage is only available for margin accounts with a minimum of $2000 equity. if you do not have these funds in your account, you will not be able to access leverage.

- Libertex: Libertex is a popular platform for advanced traders who want to conduct technical analysis or use algorithmic tools. The platforms is compatible with the MT4 and MT5 charting tools which can be used on both mobile and desktop. Retail accounts can trade with leverage up to 30x (for European accounts) and 500x (for non-EU accounts). The platform also offers a professional trading account that can access leverage up to 600x.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What is Leveraged Trading?

Exposure to the market can be increased through leveraged trading. Having the broker cover part of the investment is a huge advantage to you because you pay less than the full amount. In order to increase the position of those without enough capital to trade large positions, they may be able to borrow money to do so.

Leveraged Crypto Trading

The recent emergence of leveraged crypto trading on traditional brokerage platforms has coincided with the surge in cryptocurrency trading interest over the past few years. It should be noted, however, that, as of this point, the cryptocurrency industry is unregulated, since there are only a few best-performing leveraged trading platforms that are capable of offering leveraged crypto trading.

There is usually only the option of max leverage of x2 when the market is highly volatile, due to the high volatility. Consequently, betting on cryptocurrency is a risky investment under any circumstance. Leveraged crypto trading takes the risks even higher because it considerably increases your investment.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Assets Can You Use for Leveraged Trading?

Stocks

In the world of traditional and leveraged trading, stocks have been found to be one of the most popular trading assets. There are however risks involved when purchasing shares of a company as they could run into problems, controversies, or even go out of business. Retail traders are generally only allowed a leverage of x5 because of this reason.

ETFs

In the ETF world, we track commodities, indices, and entire sectors of the economy via exchange traded funds. Investing in some of the ETFs’ portfolios can allow you to track groups of companies, which can then be leveraged in order to produce high returns. Moreover, there are plenty of trading strategies for this type of asset, so traders shouldn’t make the mistake of making two identical trades with ETFs at once.

Forex

The next stop will be the forex market. Most leveraged traders are engaged in foreign currency trading, mainly because most forex strategies use small margins and frequent trades to maximize returns. Leveraged trading makes so much sense when you have a smaller capital pool, which is precisely why traders with a smaller capital pool may have a difficult time. In addition to the ability to leverage the hedge, many also use Forex as a hedging instrument, and this makes it that much more effective. As a result of low volatility among currencies, leverage can be increased up to 30 times.

Commodities

There are a wide range of commodities such as gold, silver, oil, etc, which are considered assets. It is because commodities are used as hedges against other asset classes, such as the foreign exchange markets, that they have a strong inverse relationship with them. For example, gold trading that is leveraged rises in value when the dollar falls, for example. Therefore, in the case of commodities, it may be a strategy to use a commodity as a way to anticipate economic or political events.

Indices

The average stock can outperform the index, but investors consider it a risk not worth taking when selecting individual stocks. In many ways, they are similar to ETFs, except that they have less liquidity on indices and they can only be sold at market closing. In addition, buy-and-hold strategies often utilize indices that are derived from historical data in order to estimate the average long-term returns to the market. It should be noted, however, that this generally implies high overnight costs for leveraged investors, who take these fees into account when choosing an investment platform.

Best Leveraged Trading Platforms Reviewed

If you are interested in knowing which are the best platforms for leveraged trading, we can recommend five of them. Those are state-of-the-art platforms in which you could start leveraged trading and leveraged crypto trading.

1. eToro — The best platform for leveraged trading overall

As one of the most popular platforms of this kind globally, eToro is the first on our list and by far the best-leveraged trading platform. You can trade leveraged stocks and other assets, including leveraged ETFs, cryptocurrencies, and more, with eToro.

Founded in 2007, eToro is now 15 years old. Over the years, they have improved their service and expanded to more countries. As a result, it currently services more than 20 million traders from 140 different countries. Thus, it is heavily regulated by several major regulatory bodies, including ASIC, CySEC, FCA, etc.

There are more than 2,400 markets available, several cryptocurrencies, and nearly 50 currency pairs available. The leverage varies depending on the asset. For example, major pairs on Forex leverage ratios are 30:1, while smaller pairs have a 20:1 leverage ratio. Professional traders have a 400:1 leverage ratio. You must take a test before you can get an eToro professional account.

Due to additional risks and the fact that cryptocurrencies are still unregulated, leverage for the stock is x10, ETFs x5, and cryptocurrency only x2. Suppose you are new to trading but interested in leveraged trading. In that case, you can engage in eToro’s social trading element and copy experienced traders as they trade in real-time.

Furthermore, eToro does not charge any commissions for trading, although it does charge spreads and withdrawal fees. In addition to that, eToro is very easy to use and designed for novice traders, so navigating it shouldn’t be a problem.

Note: Crypto CFDs are not available with eToro for US/ UK users

Pros:

- Trading of cryptocurrencies, as well as all assets, on a leveraged basis

- No commission on any trade

- Completely licensed and regulated

- Over 2,400 markets

- Easy to use

- Copies the trades of experts

- Low deposit requirements

Cons:

- Withdrawal and inactivity fees apply

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

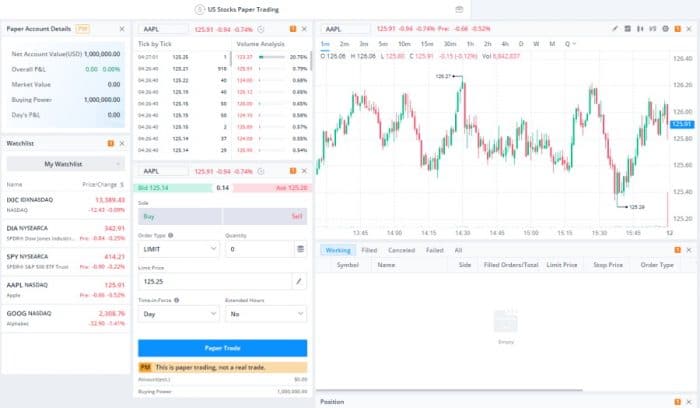

2. WeBull – One of the Best Platforms For Leveraged Trading

WeBull is an online and mobile brokerage platform launched in 2017 that offers an easy user experience. Investments can be made in various assets, such as stocks and ETFs, options, cryptocurrencies, and ADRs (American Depositary Receipts).

Webull is one of the most popular brands in America because of a number of reasons. It does not matter whether an investor invests online or through the app, Webull offers an easy-to-use user interface that does not create stress. This makes it a good choice for those who are just starting out.

Besides investing small sums of money with Webull, you can also participate in other types of investments. For example, you can invest as low as $1 per trade if you wish to take part in the ownership. There are also no fees associated with Webull. It competes directly with other platforms such as Robinhood, eToro, and CedarFX that for example charge zero fees.

In order to access Level II market data, Webull charges a subscription fee just like Robinhood. A monthly fee of $1.99 will be charged to access Level II market data. We make sure our clients’ safety is guaranteed by our registration with the SEC, FINRA, and SIPC.

Pros:

- A range of stocks and ETFs are available for trading

- Foreign companies’ ADRs

- Trading in cryptocurrencies and stock options

- Trading with 0% commission

- Easy-to-use and very simple interface

- Android and iOS devices can be used with the mobile app

Cons:

- There is a $1.99 monthly platform fee for Level II pricing data

- PayPal and debit/credit cards are not accepted

- A bit basic for experienced investors

- No facilities for trading commodities, indices, or Forex

- The response time for customer support is slow

There is no guarantee that you will make money with this provider. Proceed at your own risk..

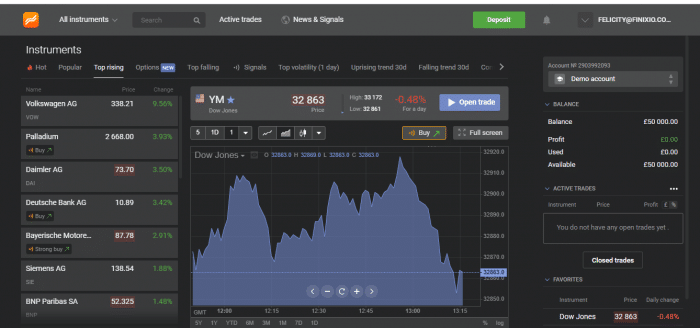

3. MT5 via Libertex — Excellent choice for expert traders seeking high leverage

Libertex is an award-winning and reputable trading platform with over 2 million active traders. Founded by industry experts in 1997, Libertex was founded in Cyprus. Libertex offers over 250 financial CFD instruments and a leverage of up to 600:1 (30:1 in the UK), making it popular among experienced traders.

Some traders have completed their transition from Metatrader 4 to Metatrader 5 with LiberTex (available for both MT4 and MT5), but many continue to use MT4. There are some similarities between MT4 and MT5, however, MT5 offers more exchanges and better backtesting capabilities.

If you make a deposit or sit on your account inactively, you are not charged a fee. If you make a withdrawal (based on the method), you may be charged a fee. MT5 provides a number of trading tools, which allow you to automatically exit positions, and it has a wealth of charting capabilities and plugins that can help you make the most of these tools.

Pros:

- Low minimum deposit

- Good leverage for retail traders and massive leverage for professionals

- Supports three trading platforms in total

- Regulated by CySec

- Around for almost 25 years

- MetaTrader 4 and MetaTrader 5 are supported

- Some financial instruments have zero spreads

- (Depending on the trader’s jurisdiction) High leverage maximums

Cons:

- In addition, it is only regulated by CySEC and is not available to clients in many countries

- There is a limited selection of financial instruments

- Customer service is limited

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Brokers with High Leverage Comparison

To display this more clearly, let us show you what the maximum leverage looks like for traders when we only look at the heavily regulated platforms mentioned in the above paragraph.

Stocks ETFs Forex Crypto Indices Commodities eToro x5 x5 x30 x2 x20 x10 WeBull x5 x5 x30 x2 x20 x10 Libertex x5 x5 x30 x2 x20 x10 Leveraged Trading Strategies

Leveraged trading can be used in numerous strategies which traders and investors developed over the years, some of which are short-term, while others are long-term. They can differ in a variety of aspects, or only a few. Here are some of the most common and most popular ones.

1. Leveraged day trading

The leveraged day trading strategy is called that because it includes leveraged trading within a day. Basically, you enter your leverage trade at some point in the day, and you exit before the day ends. This has plenty of benefits, such as allowing or more opportunities to earn. You can make smaller profits every day, or even multiple times per day, rather than make a potentially grand score once per week, or month, or during an even longer period.

But, if the asset that you choose to trade is particularly volatile, it can also be quite risky. This is the most common issue with leveraged crypto and forex trading.

2. Leveraged scalping

This is because arbitrage and scaling are similar in that buying and selling are measured in minutes or hours. In order to achieve this goal, interest rate analysts hope to identify price discrepancies early in the process, allowing them to buy prior to the market’s full reaction. Scalers take a small profit on every trade, but they trade with a high frequency, making leverage easy to manage.

3. Leveraged Swing trading

Lastly, we have leveraged swing trading, which is a type of trading where traders look to make a profit on price swings over a day or so. Once again, technical analysis is the most useful here, as it allows those with experience to detect various patterns and buy or sell based on this information. Charting capabilities are, therefore, of great importance, and if you wish to engage in this kind of trading — you need to make sure that your broker of choice offers good charting tools.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Benefits of Leveraged Trading

It is a good idea to leverage an asset since it lets you release capital since only a small part of the value of that asset is invested. Beginners and retail investors may find it easy to spot these opportunities because they have limited capital at their disposal. This is even more effective for those who choose a trading strategy that takes small profits and uses a large position size to earn profits since the profits are multiplied while the risk is kept right in check by using a short-term position.

Risks of Leveraged Trading

Speaking of risks, we stress once again that they are much higher when trading with leverage, regardless of the asset. Yes, leveraged crypto trading will still be the riskiest, since crypto is volatile and risky even under everyday circumstances, but the same is true for leveraged stock, forex, indices, and other types of assets.

The risk increases when profits are amplified. Even though there are many ways to limit losses through risk management, the risk/reward relationship doesn’t change simply because you’re leveraged. The relationship slightly alters when using leverage due to the added fees incurred, which must be considered when devising and implementing a strategy.

There can also be extra fees that you might have to account for at some brokers, so there is a lot to keep in mind, and all of that can take a high psychological toll on the trader.

How to Make Leveraged Trades on eToro

If you wish to start trading with leverage on eToro, you will be pleased to know that it is not at all difficult to start. In fact, there are only a few steps to take before you can try it out for yourself.

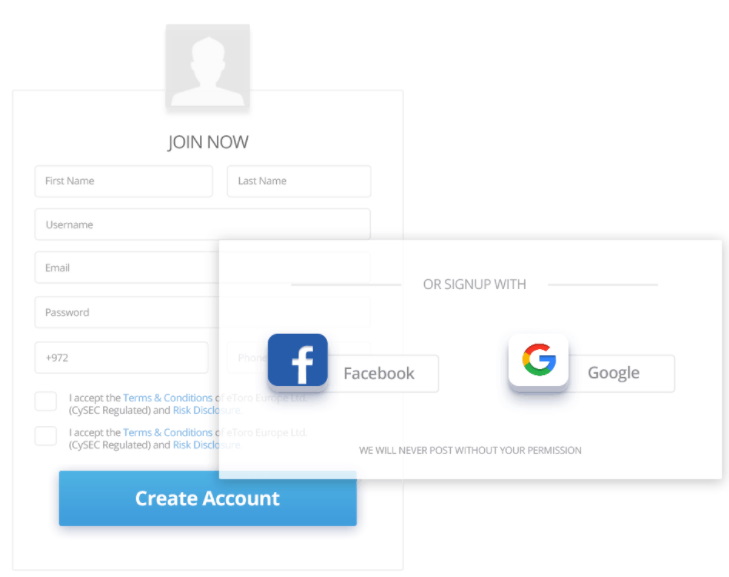

Step 1: Create an Account on eToro

Start by creating a free account on eToro, either with your Facebook/Google account, or you can create a brand new one with your email and password alone.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

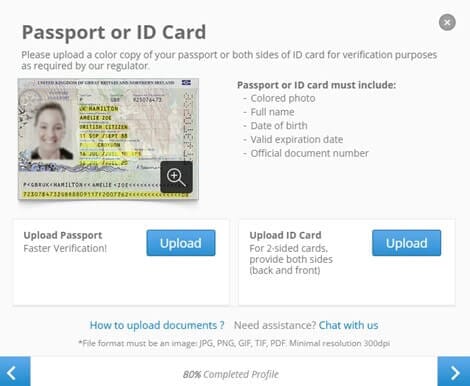

Step 2: Verify Your Account

Next, you need to verify your identity in order to be able to use eToro. Since the platform is heavily regulated, this is a requirement in order to be able to start trading. You can verify your account by uploading documents such as your ID, driver’s license, or passport, as well as your bank statement. Other than that, all you need to do is provide truthful information about yourself, all of which can be done in a few minutes.

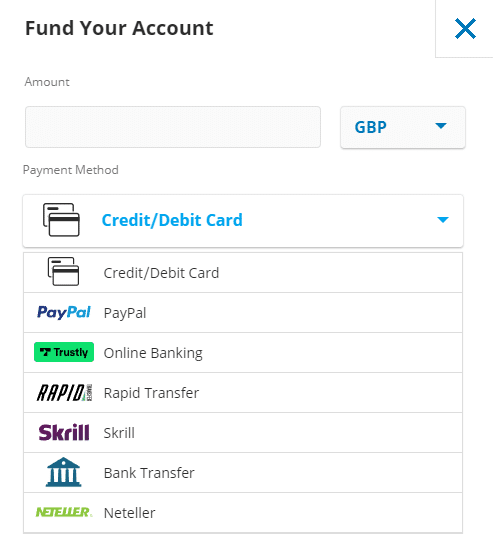

Step 3: Deposit Some Money

At this point, you are ready to start engaging with the platform. Before you do it, of course, you will first need to deposit some money that will serve as your initial investment. eToro is good for this because it lets you deposit as little as $50. You cannot deposit less than that, but for most traders, this should be more than affordable. Deposit the funds by clicking the “Deposit Funds” button on your dashboard, and then filling out the details such as the desired amount, your payment method of choice, as well as your payment details.

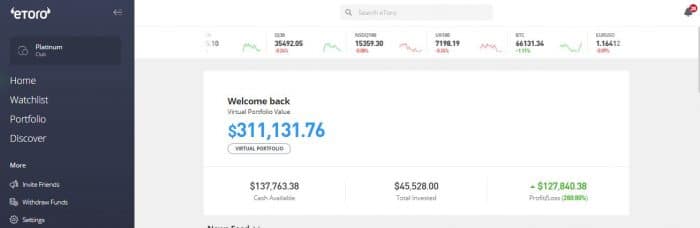

Step 4: It Would Be Ok To Start With a Demo Account

Now, you might think you are ready to start trading, but if you are not an experienced trader, we strongly suggest trying it out with the Demo account first, where eToro provides you with a simulated version of the market. On your demo account, you will be using fake money, so you cannot really earn yet, but you can test different strategies and see which one works and which one does not.

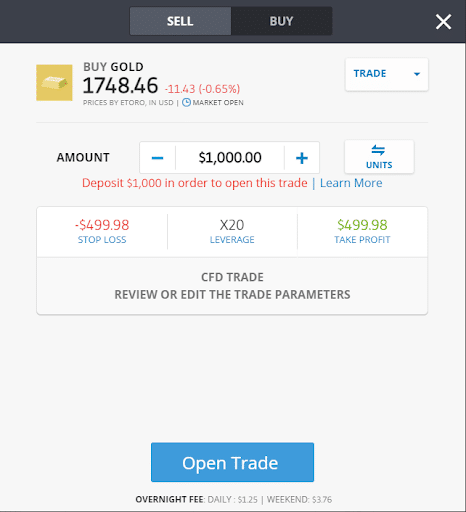

Step 5: Start Trading

If you click on a certain asset, such as gold, which spiked quite strongly in the last two years due to COVID-19, you will see a graphical interface showing you its performance.

On the right side of the page, you will see a trade button at the top. Click it to bring out a new tab where you can select specific aspects and details of your trade.

Notice the middle button that says “Leverage” here. Below it, you have different offered leverage, including x1, x2, x5, x10, and x20. Select the amount that you wish to apply. After that, you can click open trade and your trade will be executed.

Note: Crypto CFDs are not available with eToro for US/ UK users

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Conclusion

Leverage trading carries a high risk but also a high reward potential. All of the recommended high leverage forex brokers above are excellent places to start trading with leverage, and they are all safe, regulated, and reliable platforms.

The biggest advantage of eToro is its accessibility and social features, which make online trading a shared experience and make data transparent.

eToro – Overall Best Leveraged Trading Platform

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

What is a leveraged trade?

Leveraged trading involves only putting down a fraction of the capital needed to increase exposure to the market. The broker will pay for the rest of your investment, which will incur a cost and increase profits/losses in light of the increased exposure.How does leverage trading working?

Retail investors are allowed maximum leverage by brokers (depending on the jurisdiction and asset class). A trade can be executed with mostly borrowed funds if the trader meets the initial margin requirements. The scenario is similar to purchasing a house with a mortgage, where the deposit is paid, but the return is amplified.How much money do you need to make leveraged trades?

As long as the leverage ratio stays within the regulatory maximum, no minimum amount is needed to make leveraged trades. However, a broker will often require a minimum deposit (such as $100).Can you go into debt with leveraged trading in the US?

It depends on the broker. Some leveraged trading accounts permit you to enter a negative balance, but most of the time, it is determined by the broker's rules.What is the best leveraged trading platform in the United States?

eToro is the best-leveraged trading platform in general. There are many reasons novice traders choose this platform, including low spreads, zero commissions, copy trading, extensive market coverage, and more.References:

- https://www.etoro.com/en-us/customer-service/help/1291348052/do-we-offer-leverage/

- https://www.wealthwithin.com.au/learning-centre/leveraged-trading/leverage-trading-the-pros-and-cons

- https://www.bitpanda.com/academy/en/lessons/what-is-leverage-in-trading/

- https://www.youtube.com/watch?v=F6W517OWpvA

- https://www.youtube.com/watch?v=7CWjZuU2g2A

Jhonattan Jimenez Finance and Crypto Writer

View all posts by Jhonattan JimenezBefore starting his career as a freelance writer, Jhonattan studied at the Universidad La Gran Columbia from which he graduated in 2019. Jhonattan describes himself as a crypto enthusiast and regularly writes price prediction articles for new projects. During his time as a writer, Jhonattan has gained great knowledge about the crypto space and has mastered technical analysis skills that he uses when writing token price predictions. As well as writing for Trading Platforms, Jhonattan has written for Stocksapps.com and Buyshares.co.uk.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up