Best ETF Brokers for February 2026

ETF trading has been extremely popular in recent years, as it is a versatile investment method that appeals to both new and experienced investors. From bond ETFs to stock ETFs and everything in between, ETF trading can be used to access a variety of markets and assets while helping you diversify your portfolio.

In this guide, we help you find the best ETF trading platform for your situation. We’ll review the best ETF brokers for 2026, cover some ETF trading strategies, and walk you through you can begin trading ETFs today with the best online brokers.

-

-

Best Brokers For ETF Investing in 2026

With so many options at your disposal, finding the best ETF trading platform can be difficult. To help, here are some of our top ETF trading platforms for 2026:

- Plus500: Plus500 is a CFD trading platform that also caters to ETF traders. The platform is well-known for it’s user-friendly mobile app and low fees. Traders can trade CFD ETFs.

- eToro: Trade ETFs on a platform that is regulated by the FCA and several other regulators. Use Smart Portfolios to invest in a selection of promising ETFs that have been handpicked by experts. eToro also offers zero-commissions on CFD stock trading, low fees on crypto trading and competitive spreads for forex.

- Libertex: Libertex is the best platform for ETF traders who want to conduct technical analysis. Access the best charting tools with numerous indicators, automated systems and real-time market data. Libertex also offers low fees and excellent customer support.

- Robinhood: Trade US ETFs with zero commissions. Robinhood provides users with access to hundreds of ETFs making it a great platform for traders who want to diversify their portfolio. Robinhood is an established US exchange that was first launched in 2013.

- Vanguard: Vanguard is a US-based investment management company that is suitable for long-term investors. It offers commission-free ETF trading for a wide array of products. While the platform lacks advanced analysis tools, it provides a great range of educational resources.

- Charles Schwab: It is possible to trade US ETFs on Charles Schawb – a renowned US broker. Traders cannot access international ETFs however, the selection of US stocks is very strong.

- Fidelity: Fidelity is a trusted online broker that supports ETF trading as well as stock trading, CFDs and a range of other financial instruments. The platform provides great customer support and is very user-friendly. However, Fidelity’s fees are quite high compared to other brokers.

- TD Ameritrade: TD Ameritrade offers a wide range of ETFs to US traders. Traders can take advantage of low fees, competitive pricing and great customer support. It is also possible to trade stocks, indices and commodities.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What is ETF Trading?

An Exchange-traded fund — ETF for short, is a portfolio of assets that is traded on stock exchanges. These investment funds consist of multiple securities like stocks, bonds, commodities and more, and can track various assets, indices, sectors, and strategies.

Often referred to as a “basket” of assets, ETF trading allows investors to purchase shares of this collection of securities without actually purchasing the underlying assets. This way, they can diversify their portfolio and invest in a wide range of assets, markets, and sectors without having to purchase individual stocks.

ETF Providers

There are dozens of ETF issuers around the world, but the five largest account for the majority of total ETF assets under management (AUM). These five companies are iShares, Vanguard, State Street SPDR, Invesco, and Charles Schwab. Here’s how these top ETF providers compare:

Issuer Year founded AUM # of ETFs Revenue 3-month fund flow Avg expense ratio iShares 2000 $1.8 trillion 372 $3.5 billion $35.2 billion 0.19% Vanguard 1975 $1.3 trillion 80 $769.3 million $45 billion 0.06% State Street SDPR 1978 $771.7 billion 139 $1.3 billion -$567.1 million 0.17% Invesco 1935 $260.2 billion 218 $764.4 million $9.7 billion 0.29% Charles Schwab 1971 $170.2 billion 25 $125.3 million $1.1 billion 0.07% Why Trade ETFs?

ETF trading has become increasingly popular in recent years, as it offers a number of benefits to investors. Whether you are looking for a long-term investment or a way to generate short-term returns, there are many reasons why you might want to trade ETFs.

Easy entry

ETF trading is done on stock exchanges, making ETFs easy to buy and sell without help from a broker or investment advisor. And since they are funds made up of collections of assets, they offer investors easy entry into various markets, sectors, indices, and more since investors don’t need to buy each underlying asset individually.

Diversification

Rather than using stock trading and other securities to diversify your investment portfolio, you can simply purchase shares of an ETF. Unlike stocks, where the market price is attached to a single company, ETFs are diversified by nature, as they are made up of a selection of various assets and securities. So even if the value of one security falls, there are many others in the fund that can help limit downside risk.

Simplicity

Instead of purchasing individual stocks, bonds, and other securities in pursuit of an investment goal, investors can simply purchase shares of an ETF that hold a selection of their preferred assets. For example, if you believed that the agricultural industry was going to do well, you could research and purchase a selection of agricultural stocks and commodities, but that is both time-consuming and expensive. In this situation, an ETF would allow you to purchase shares of an already-diversified fund that tracks the agricultural sector.

Liquidity

Mutual funds are another popular investment fund product that work similar to ETFs, but they are professionally managed and therefore more difficult to buy and sell.

ETFs, on the other hand, are openly traded on stock exchanges, making them extremely easy to buy and sell since you don’t need to go through a fund manager or investment advisor. This makes them a far more liquid investment vehicle.

Low fees

If you did decide to go the route of buying individual stocks and securities, you would probably need to pay a commission on each trade you complete. So if you wanted to buy up all of the assets that make up an ETF, you’d be on the hook for significant fees that could limit your return on investment.

By purchasing shares of an ETF, you’ll only be responsible for the commission on that one trade. And with a growing number of commission-free ETF trading platforms out there, you might not pay any fees at all.

Affordability

ETF prices are generally much lower than the sum of all of the assets they include, making them much more affordable to invest in markets, sectors, and indices. For example, SPDR’s S&P 500 ETF Trust is currently trading for around $400 per share, but it holds stocks like Amazon and Alphabet (Google’s parent company), which are currently trading at around $3,100 and $2,100 respectively. So instead of purchasing a fractional share of one of those companies, you could just purchase shares of the ETF, which would serve a similar purpose.

Dividends

Similar to stocks, ETFs can also pay dividends. So if you are looking for passive income or you just prefer dividend stocks, you might want to consider investing in dividend-paying ETFs. These ETFs payout distributions in two ways, depending on the preference of the fund manager:

- Dividends are distributed as cash to investors

- Dividends are reinvested into the ETF

It’s important to keep in mind that dividend yield and timing are at the discretion of the fund manager, so your experience may vary depending on which dividend-paying ETFs you invest in.

Best Online Brokers for ETF Investing Reviewed

The broker you choose will determine which ETFs you’ll be able to trade, the tools you’ll have access to, and the fees you’ll pay per trade. Deciding which trading platform is right for you can be difficult, but we’re here to help.

We’ve reviewed some of the best ETF trading platforms available right now so that you can determine which one to start trading with.

1. Plus500 — Best ETF trading platform user experience

Plus500 is a global CFD broker that was founded in 2008 and currently listed on the London Stock exchange. The company is overseen by several financial regulators and regularly discloses its financials, so it has a trusted reputation amongst traders.

Its products are used by clients in countries all over the world, although CFD trading is not available to traders in the US or Canada.

Plus500 specialises in CFDs and offers a range of ETF CFDs for you to invest in. These include iShares Silver, GLD Gold, USO-Oil Fund and more.

Trading is not easy as it requires knowledge and experience, and risks are involved.

However, Plus500 charges fees (Overnight Funding, Currency Conversion Fee, Guaranteed Stop Order, and Inactivity Fee. More information you can find via https://www.plus500.com/Help/FeesCharges), which means that the platform may not be suitable for long-term ETF investing. Instead, the platform is catered towards active traders.

Plus500 fees

Fee Amount ETF trading fee Variable spread Forex trading fee Spread. 1.3 pips for GBP/USD Crypto trading fee Spread. 4.11% for Bitcoin Inactivity fee £10 per month after three months Withdrawal fee Free Pros:

- Great user experience

- Low ETF trading fees

- Solid web and mobile trading platforms

- Good educational resources

Cons:

- Plus500 is not compatible with third-party charting tools

- Traders can only access CFD instruments

- Not available to US and Canadian investors

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

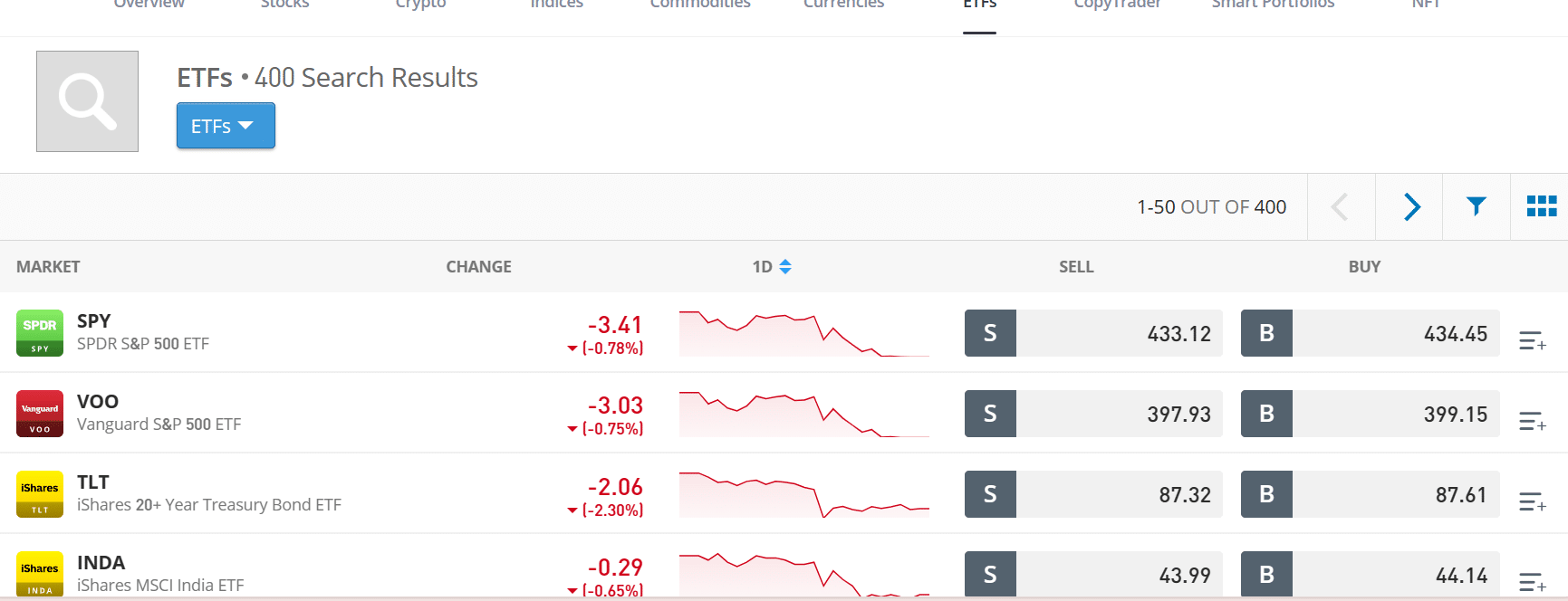

2. eToro – Best ETF Trading Platform UK & US – 0% Commission

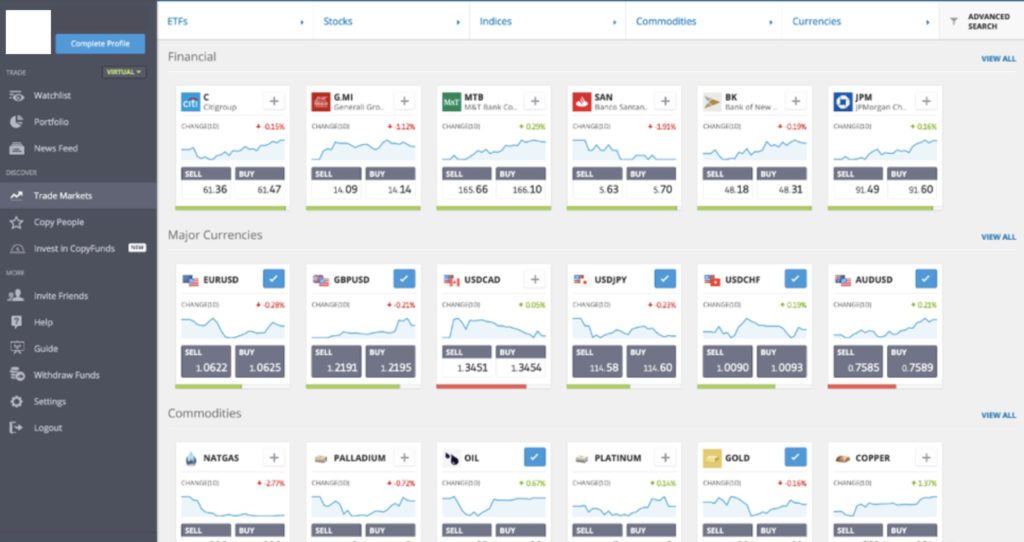

Founded in 2006, eToro has grown to become one of the largest and most popular ETF trading platforms. It aims to make financial markets more accessible to all investors and is now home to over 20 million users around the world.

While it isn’t the most advanced interface we’ve come across, the platform is extremely user-friendly, which makes it easy to get started, even if you’re an active trader.

One of its most notable features is social trading, which allows users to follow other traders to find out what they’re buying and selling, then copy their portfolio to mimic their trades.

eToro’s ETF trades platform provides access to over 150 equity, bond, commodity, and other ETFs that can be purchased outright or through CFDs.

The company has options for both leveraged and non-leveraged ETFs index funds, along with the ability to purchase fractional shares. The best part is that it does not charge any trading commissions on its ETFs and has low fees on its ETF CFDs that are already built into its spreads.

eToro fees

Fee Amount ETF trading fee Free Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- Commission-free stock trading

- Wide selection of ETFs

- Traditional and CFD ETF trading

- Leveraged and fractional ETFs

- Social trading

Cons:

- Only trades in USD — Conversion fees may apply

- Product offering varies depending on your location

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

3. Libertex — Best Mobile ETF trading platform

Founded in 1997, Libertex is another popular ETF broker that allows investors to partake in ETF trading. This ETF trading platform has over 2 million clients across 11 countries and is best known for its low minimum deposit requirements for new trading accounts.

It’s easy to sign up, but you’ll need to verify your identity online in order to comply with international money-laundering rules.

You’ll be able to trade forex, commodities, cryptocurrency, stock, shares, indices, metals, ETFs, CFDs, and more. It has zero spreads on all account types and instruments and instead takes variables commissions starting from 0.006%.

The broker does not accept US and UK traders at the time of this writing.

Libertex also offers a suite of educational resources that can help new traders learn the basics and help experienced investors hone their skills. Experienced investors would also be happy to know that this ETF trading platform also offers MT4 along with an automated trading feature.

Libertex fees

Fee Amount ETF trading fee Commission. Starting from 0.08% Forex trading fee Commission. 0.008% for GBP/USD Crypto trading fee Commission. 1.23% for Bitcoin Inactivity fee $5 a month after 180 days Withdrawal fee Free Pros:

- Traditional and CFD ETFs

- Low account minimum deposit

- Leveraged and non-leveraged ETFs

- Powerful mobile trading app

Cons:

- Limited product offering outside of the UK

- Limited ETF offerings

- Only 2 account options

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

4. Robinhood – Invest in US ETFs with Zero Commission

If you’re based in the US, then there is every chance that you have heard of Robinhood. Launched in 2013, this online trading platform is now home to over 10 million clients. Primarily, investors in the US use Robinhood to buy ETFs in a simple and cost-effective way.

In fact – and much like eToro, Robinhood allows you to buy ETFs on a commission-free basis. In total, the platform for charting offers hundreds of ETFs – most of which are US-listed. This covers both primary exchanges – the NYSE and NASDAQ.

A lot of Robinhood users opt to trade and invest on the Robinhood app which is available on both iOS and Android devices to place your stock trades.

The mobile app gives you access to the very same account features as you will find on the main website. Finally, as a US-based broker, Robinhood is heavily regulated. This includes the authorization from both FINRA and the SEC, according to its legal disclaimer.

Robinhood fees

Fee Amount ETF trading fee Free Forex trading fee N/A Crypto trading fee Free Inactivity fee No inactivity fee Withdrawal fee No withdrawal fee Pros:

- Hugely popular trading platform in the US

- Buy thousands of stocks

- ETFs, cryptocurrencies, and stock options also supported

- Does not charge any commissions

- No minimum deposit in place

- Very simple to use and ideal for newbies who want to trade online stocks

- Heavily regulated in the US

Cons:

- Limitred international ETFs

- No debit/credit card or e-wallet deposits

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. Vanguard – Best ETF Trading Platform for New Investors

Vanguard Group is a US investment management company and a brokerage firm that was founded in 1975 and based in Malvern, Pennsylvania. It has a long history and is regulated by both the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority, so it is widely considered safe.

While Vanguard is best known as one of the world’s largest providers of ETFs, it also offers brokerage account services, meaning you can trade ETFs through its ETF trading platform in real-time.

As a major provider of ETFs, it comes as no surprise that Vanguard’s ETF trading platform offers a wide array of ETF products.

Its platform is designed for long-term investors focused on financial planning who plan to buy and hold their investments, so it doesn’t have some of the more common tools and resources that other online brokerages offer. With that said, it offers great resources for new investors, a great mobile trading app, and even has commission-free ETFs.

Vanguard fees

Fee Amount ETF trading fee Free Forex trading fee N/A Crypto trading fee N/A Inactivity fee No inactivity fee Withdrawal fee No withdrawal fee Pros:

- Large product selection

- Commission-free ETFs

- Great educational resources

- Solid mobile app

Cons:

- Lengthy signup process

- Lacks advanced trading tools

- High non-trading fees

- No ETF CFDs

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. Charles Schwab – Best ETF trading platform for advanced traders

Founded in 1971, Charles Schwab is an American financial services corporation that’s headquartered in Westlake, Texas. It provides retail and commercial banking services along with wealth management advisory services to both retail and institutional clients and is a major provider of ETFs.

The company is listed on the NYSE and regulated by both the SEC and FINRA, so it has a trusted reputation among investors.

Charles Schwab also offers an ETF trading platform that has no commissions, account fees, or minimum deposit requirements. This platform comes packed with a wide selection of ETFs along with one of the most comprehensive research offerings available to retail investors.

This, paired with its zero-commission ETFs, makes it one of the best ETF trading platforms for advanced trade.

However, if you are looking for a platform that offers a wider variety of assets so that you can diversify your portfolio then it’s best to compare it to other options, see our TD Ameritrade vs Charles Schwab review for a more in-depth look.

Charles Schwab fees

Fee Amount ETF trading fee Free Forex trading fee N/A Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free Pros:

- Amazing research tools

- Almost no fees

- Large selection of ETFs

- User-friendly platform

Cons:

- No ETF CFDs

- Subpar educational platform

- Only allows investments in US and Canadian markets

- High withdrawal fee

There is no guarantee that you will make money with this provider. Proceed at your own risk..

7. Fidelity — Best ETF Broker for iShares ETFs

Founded in 1946, Fidelity is a financial services company that’s based in Boston, Massachusetts, and serves over 35 million clients around the world.

It also provides commercial services that support over 13,000 financial institutions and is regulated by both the SEC and FINRA, so it has an extremely trusted reputation.

Fidelity aims to strengthen and secure its clients’ financial well-being, offering a range of financial products and financial advisor services to 12 regional sites across the globe.

Fidelity’s ETF trading platform offers a wide array of ETFs and other investment products, but unlike some of the other providers, does not offer CFDs.

However, its platform is extremely easy to use and it has $0 commissions on a number of trading products, along with a comprehensive learning center that aims to help investors make better-informed decisions. Fidelity recently partnered with iShares, the world’s largest ETF provider to offer zero commission on over 350 ETFs.

Fidelity fees

Fee Amount ETF trading fee Free Forex trading fee N/A Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free Pros:

- Massive product offering

- Leveraged and non-leveraged ETFs

- Comprehensive learning center

- No-commission ETFs

Cons:

- No ETF CFDs

- High broker-assisted trading fees

- Product offerings can be limited depending on location

- Disorganized platform

There is no guarantee that you will make money with this provider. Proceed at your own risk..

8. TD Ameritrade — Best ETF broker for US investors

Founded in 1971, TD Ameritrade is headquartered in Omaha, Nebraska, and is one of the largest US-based stockbrokers. The company is regulated by a number of top-tier financial authorities like the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA).

It is currently home to over 12 million customers and manages over $1.2 trillion in client assets, making it a trusted provider in its space.

Like many other ETF trading platforms on this list, TD Ameritrade offers a wide range of ETFs. It doesn’t have minimum deposit requirements and there are no commissions on ETFs, making it a great choice for both new and advanced traders.

However, the platform only allows users to trade on US markets and accounts are generally limited to US residents, so it’s not the best ETF trading platform for UK residents. To gauge how TD Ameritrade is compared to other brokers available, you can see a more clear comparison in our Fidelity vs TD Ameritrade review.

TD Ameritrade fees

Fee Amount ETF trading fee Free Forex trading fee Spread. 1.2 pips average during peak hours Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free for ACH, $25 for wire transfer Pros:

- Low fees and deposit requirements

- Great mobile app

- Wide selection of investment options

- Solid customer support

Cons:

- US Markets only

- Accounts generally limited to US residents

- No funding via debit/credit cards

- Only one base currency

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Best ETF Brokers Fee Comparison

Fees are an important consideration when choosing the best ETF trading platform for you. We’ve summarized some of the fees charged by the top ETF brokers.

ETF trading platform Cost per trade Annual fee Minimum deposit eToro $0 $0 $200 Vanguard $0 $20 $0 Libertex Variable N/A $10 Charles Schwab $0 $0 $0 Fidelity $0 $0 $10 Plus500 $0 $0 $100 TD Ameritrade $0 $0 $0 ETF Trading Strategies

Just like other types of investments, there are a number of ways you can trade ETFs. Here are a few of the many position ETF trading strategies.

Long ETFs

Just like stocks and other popular securities, ETFs are great for long-term investing. If you speculate that an index, market, asset class, or sector is going to do well, you can purchase shares of an ETF and sell them once you’re ready. If you’re right about the pricing movement and the price goes higher than your purchase price, you can sell them for a profit.

Short ETFs

On the other hand, if you believe that prices of a market, index, or sector are going to fall, you can take out a short position or use an inverse ETF. In this situation, your investment will increase in value as the market price falls, or decrease in value if the market price rises. If you sell your shares when the market price is below your purchase price, you’ll make a profit.

Hedging ETFs

Alternating between both of the above strategies, you can also use ETFs to hedge against your existing positions. For example, if your portfolio is full of oil stocks that appreciate in value as prices rise, you could short an oil ETF to protect your downside in the event that oil stocks fall.

On the other hand, if you are currently shorting a number of tech stocks (which would appreciate in value as market prices fall), you could buy a tech ETF to reduce your risk in case market prices went up.

Swing Trading ETFs

Many experienced investors use swing trading (also called day trading) to capitalize on price movements within a short time frame. While this is most commonly done with stocks, it is also possible with ETFs.

The main goal of swing trading is to take out a position and sell it as soon as you’ve made a profit, and this can be done with both short and long positions.

ETF Sector rotation

Finally, another popular ETF trading strategy is called sector rotation. This strategy involves buying and selling ETFs based on various stages of the economic cycle.

For example, when the economy emerges from a recession, many investors tend to gravitate towards the financial sector, which involves banks, insurance companies, etc. As consumer confidence returns and people begin to start spending again, investors tend to invest in consumer markets such as vehicles, travel, electronics, and so on.

How to Get Started with the Best ETF Platforms

eToro is one of the best ETF trading platforms; it has an easy-to-use interface, low fees, and a wide selection of ETFs available. Here’s how to get started with the best ETF broker:

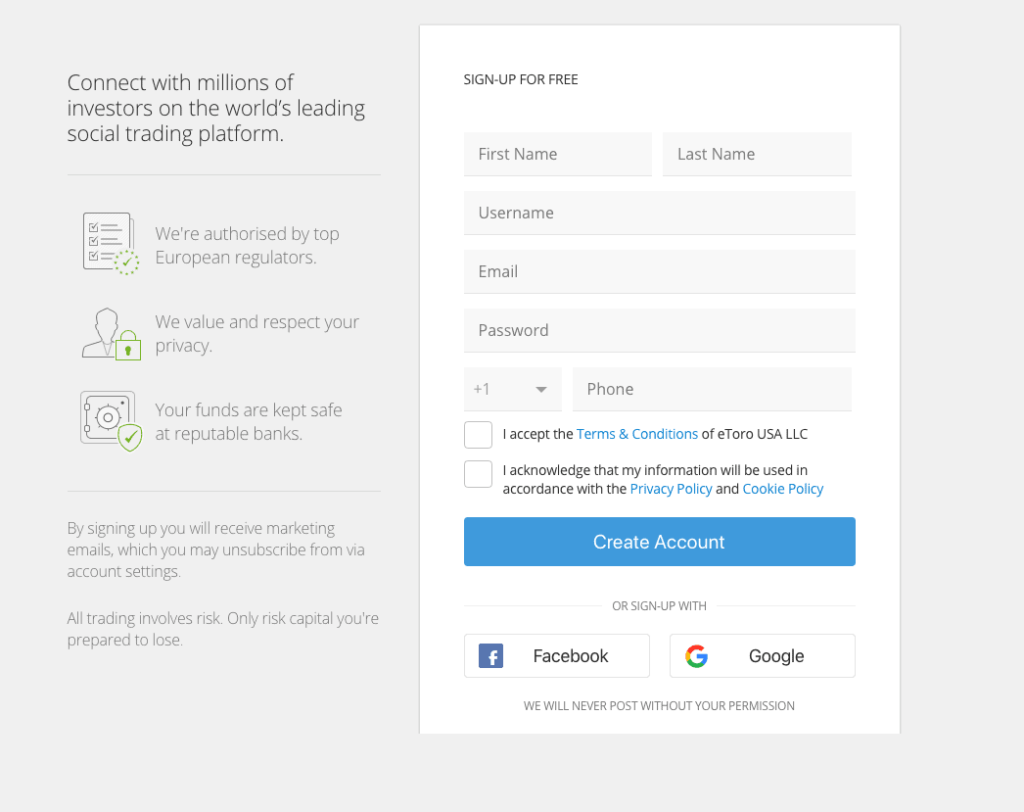

Start by visiting the eToro website and clicking “Join Now”

Enter your personal information and any other necessary details.

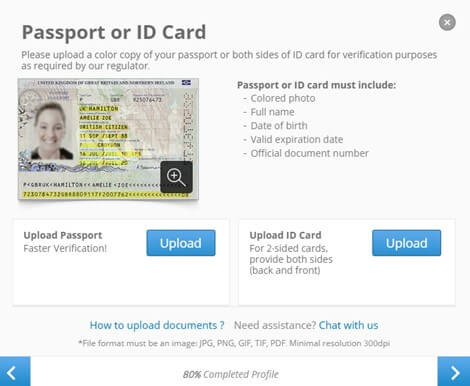

Verify your identity by uploading a picture of your verification documents.

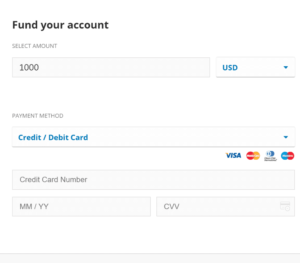

Fund your account. There are many payment methods available.

Go to your dashboard and click “Trade Markets”

Search for ETFs to find options that suit your investment strategy.

Our Final Thoughts on the Best ETF Brokers

ETF trading has become extremely popular among investors, as it provides an easy way to access both domestic and international markets. Whether you are looking for long-term investments, portfolio diversification, or other investment goals, ETF trading offers a number of benefits.

But like any investment, the ETF trading platform you choose will have a significant impact on your investment strategy, options, and fees, so it’s important to pick one that’s right for you.

We recommend Plus500, one of the best ETF brokers available right now, as it offers extremely low-cost fees, a wide range of CFD investment options, and an assortment of additional features to help you reach your investment goals. Its user-friendly interface makes it a great choice for new investors, but its no-commission trades are a huge selling point for experienced traders.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

How does ETF trading work?

ETF trading works similarly to stock trading, as both of these products are openly traded on stock exchanges. But unlike stock trading where you buy and sell shares of a single company, ETF trading involves the purchase and sale of investment funds made up of a selection of underlying assets.What is the best ETF for day trading?

Every investor has different goals, risk tolerance, and other preferences, so it's difficult to pick a single best ETF for day trading. That said, many day traders like ETFs such as the Vanguard Total Stock Market ETF, SPDR S&P 500 ETF Trust, Schwab US Broad Market ETF, and iShares 20+ Year Treasury Bond ETF. With that in mind, it's best to do your own research to find out which ETF is best for your day trading strategy.Can you trade ETFs with leverage?

Yes. Many ETF trading platforms (like eToro) allow you to trade ETFs with leverage. Before signing up, check with the platform to find out whether that option is available or not.Can you get ETF trading signals?

Yes. Similar to stocks and other securities, there are a number of websites and resources that publish ETF trading signals and recommendations.What are the tax laws for trading ETFs?

ETFs, like the vast majority of investment products, are subject to capital gains tax. Generally speaking, any capital gains that are realized when an ETF is sold are taxed, and the same goes for any distributions of dividends. However, the exact tax laws for trading ETFs vary depending on your country of residence, the country the ETFs are listed in, and more, so it’s important to consult an accountant or tax advisor for advice tailored to your situation.Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

eToro: Best Trading Platform - Trade Stocks & ETFs

61% of retail CFD accounts lose money. Your capital is at risk.

Visit eToroeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.61% of retail CFD accounts lose money. Your capital is at risk.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up