Invest in Bitcoin in the US – Beginner’s Guide

The most popular cryptocurrency in the world is Bitcoin at the moment. A decade later, its value has grown from a few cents in 2010 to more than $60,000. People invest in Bitcoin for many reasons. It is often called ‘digital gold,’ serving as both a medium of exchange and a store of value.

You should learn how Bitcoin works and invest if you are new. Various platforms offer different features, trading options, fees, and deposit options.

How to Invest in Bitcoin in the US?

What about an in-depth guide about how to invest in Bitcoin? Below, you will discover how to invest in Bitcoin most cost-effectively and safely.

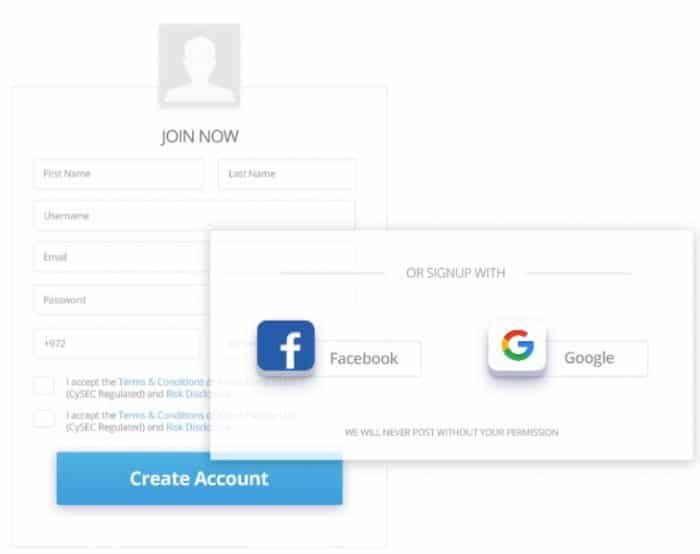

Step 1: Open an Account with eToro

eToro typically allows you to open an account, deposit money, and invest in bitcoin within 10 minutes. In addition, it verifies your personal information through automated technology.

If you are interested in joining eToro, simply go to the website and click on the ‘Join Now’ button.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Then, fill out the information below by providing your first and last name, email address, phone number, username, and password.

After that, you will need to provide additional personal information, such as your home address, birth date, and national tax ID number. Then you will receive an SMS on your mobile device. To complete your registration, enter the code you will receive from eToro.

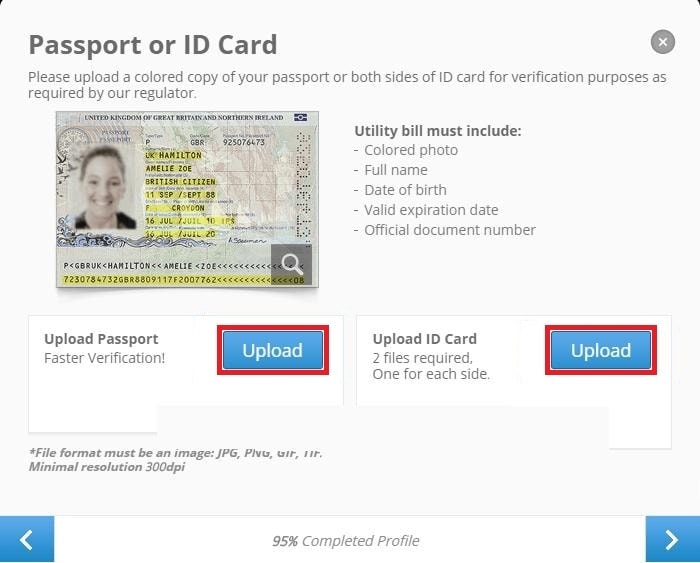

Step 2: Upload ID

Several reputable bodies regulate eToro. Therefore, you must prove your identity. This step does not need to be completed immediately – it must be completed before you can:

- Deposit more than $2250

- Withdraw your funds

Due to this, you should upload the documents now to avoid future delays.

You need to submit the following documents:

- An identification card, passport, or driver’s license

- Recent utility bills or bank statements

In most cases, eToro will authenticate your documents instantly, removing all restrictions on your account.

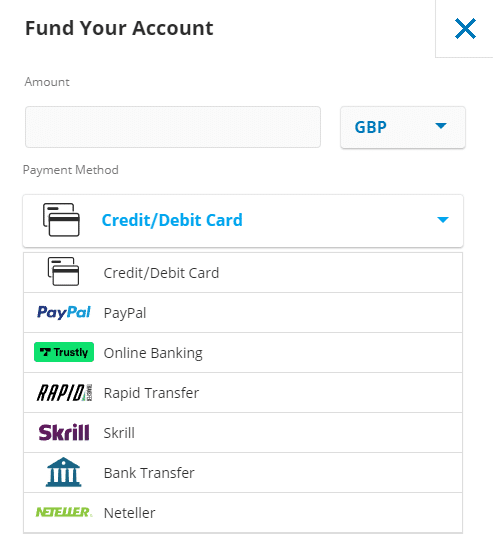

Step 3: Deposit Funds

Bitcoin cannot be purchased through eToro. A deposit is required first. Except for bank transfers, all deposit methods are instant.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

When you make deposits at eToro, you don’t have to pay any fees – regardless of how you make them. With Coinbase, for example, you can invest in Bitcoin with a debit card for 3.99%. Their competitors charge higher fees.

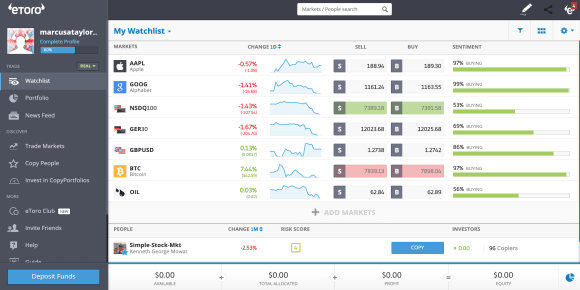

Step 4: Invest in Bitcoin

Our step-by-step guide should now have funded your eToro account. You can now invest in bitcoins. You can do this by typing ‘BTC’ into the search box at the top of the page.

Click the ‘Trade’ button to open a trade order box. Additionally, you can now enter the stake amount in the ‘Amount’ box (minimum $25).

Why invest in Bitcoin?

Here are some reasons you should invest in cryptocurrencies as soon as possible if you are not familiar with them but curious about them.

- The benefit of cryptocurrency is that it is decentralized, meaning you have control over your funds.

You need a decentralized platform to trade cryptocurrencies, so you don’t need a third party. Cryptocurrencies give you full control over your store assets, and there is no outside influence. Prices on exchanges and brokers don’t affect the value of the assets.

- Cryptocurrencies tend to be deflationary.

Cryptocurrency tends to be deflationary because of its limited supply. The purchasing power of cryptocurrencies increases consequently over time. However, an algorithm usually puts a cap on the total supply of cryptocurrencies.

- A cryptocurrency is a transparent and secure asset.

Cryptocurrencies are popular because of their security and transparency. Blockchain technology boosts investors’ confidence by ensuring the security and transparency of crypto transactions. In addition, the fact that cryptocurrencies are open-source and publicly verified makes them a favorite among traders.

Where can you buy Bitcoin in the US?

Choosing the right trading platform can be challenging for beginners. As a result, we compiled a list of cryptocurrency trading websites that facilitate cryptocurrency trading intuitively.

1. eToro – Overall Best Place To Invest In Bitcoin

To invest in Bitcoins, we highly recommend using eToro. In contrast to other cryptocurrency trading platforms, this platform is highly regulated. A number of Tier-1 agencies worldwide recognize its licenses, including the FCA in the UK and CySEC in Cyprus. Consequently, when you invest with eToro, you can rest assured that the capital you put into it will be highly secure. You won’t find this level of security with other crypto-trading platforms. Additionally, the platform allows you to trade other cryptocurrencies besides Bitcoin. Some examples are Ethereum, Cardano, and Ripple.

eToro also offers derivatives on major cryptocurrencies, depending on your location and jurisdiction. You can invest in Bitcoins directly or for other cryptocurrencies, depending on the currency of your account. You can sell Bitcoin for USD or ETH depending on your preferences. Because eToro does not charge commissions, they make money by charging spreads on your trades.

CFD trading is not available for U.S. users.

Trading cryptocurrencies, especially Bitcoin, depends heavily on pattern recognition and momentum analysis. However, this may not be as effective for beginners as for more experienced traders. You can copy other experienced traders using eToro’s copy trading tools, where the passive trading tools come in. Copy-trading at their website lets you filter through over a thousand traders by their gains, their instruments, and the number of copier accounts they own. When you select a trader you are interested in copying; it is simply a matter of clicking copy and selecting how much to copy. Users of eToro can deposit funds with various methods, including debit/credit cards, bank transfers, and e-wallets such as Paypal.

eToro fees

| Fee | Amount |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros:

- User-friendly platform with an easy-to-use interface

- Social trading features, including copy-trading, are available

- Regulated by various agencies worldwide

- It offers cryptocurrency derivatives in certain areas

- There is no commission on trades

Cons:

- Not suitable for advanced charting or technical analysis

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

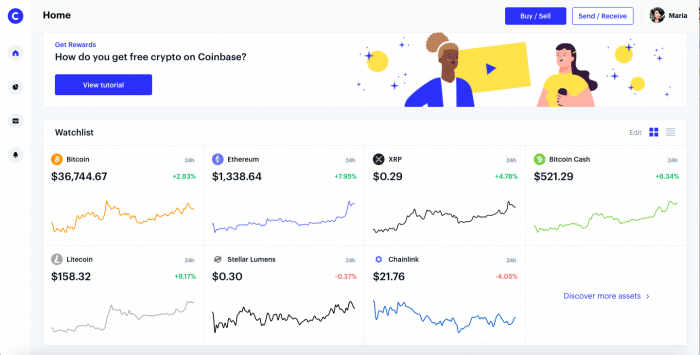

2. Coinbase – Largest Crypto Exchange in the US To Invest In Bitcoin

Since its founding in 2012, Coinbase has been a crypto exchange and wallet. The company has about 73 million users in over 100 countries. Furthermore, it is trusted by over 10,000 institutions and 185,000 ecosystem partners.

The website makes it easy for beginners to buy, sell, and deal in cryptocurrencies. In addition, it ensures the safety and security of its users’ information on its platform and offers an enjoyable trading experience to all its users. The majority of cryptocurrencies use two-factor authentication (2FA) to increase security.

Trading on its platform is fee-based, and it offers a wide range of digital currencies. However, users must deposit a minimum amount to trade on this user-friendly platform.

Coinbase fees

| Fee | Amount |

| Cryptocurrency trading fees | Commissions starting at 0.50% |

| Fee for inactivity | It’s free |

| Fees for withdrawals | 1.49 % to an account in the US. |

Pros:

- Provides a charting platform with numerous technical indicators

- Hundreds of pairs supported

- It is easy to use even for cryptocurrency beginners

- Support for a variety of cryptocurrencies

- Earnings from cryptocurrencies

- Coinbase Pro has a lower price

Cons:

- A 2% fee is assessed for credit/debit card deposits

- Responses to customer service requests may sometimes be delayed

Your money is at risk.

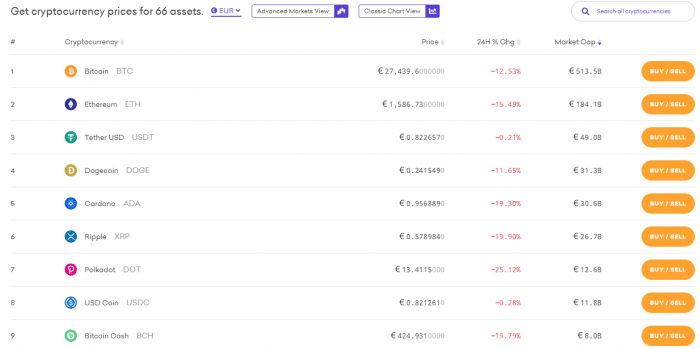

3. Kraken – Lower Price Than Competitors

Kraken is one of the largest cryptocurrency exchanges in the world, founded in 2011. Its Bitcoin trading platform was launched in 2013, and since then, it has been used by more than 4 million people worldwide. In addition, 66 different cryptocurrencies can be traded and staked on its platform. As a Money Services Business (MBS), FinCEN regulates Kraken in the US and FINTRAC in Canada. As well as the FCA, AUSTRAC, and FSA of the UK, some of its subsidiaries are also regulated by these agencies.

This platform offers some of the industry’s best safety and security features, as well as the ability to trade futures using cryptocurrencies, which isn’t offered by most other platforms. Furthermore, it offers a large range of currencies that can be traded on large margins, and it is quite easy to use. The Kraken exchange, for example, offers up to 10x leverage on BTC trades.

Kraken fees

| Fee | Amount |

| Crypto trading fee | For sellers, commissions start at 1% per trade. Free for buyers |

| Inactivity fee | Free |

| Withdrawal fee | According to the currency withdrawn. 0.0005 for BTC |

Pros:

- Provides a charting platform with numerous technical indicators

- 66 pairs and futures are available for trading

- An easy-to-use cryptocurrency

- Margin trading is permitted

- Earning cryptocurrency by staking

- Lowest prices in the industry

Cons:

- Deposit and withdrawal methods are limited

- Customer service sometimes takes a long time to respond

Your money is at risk.

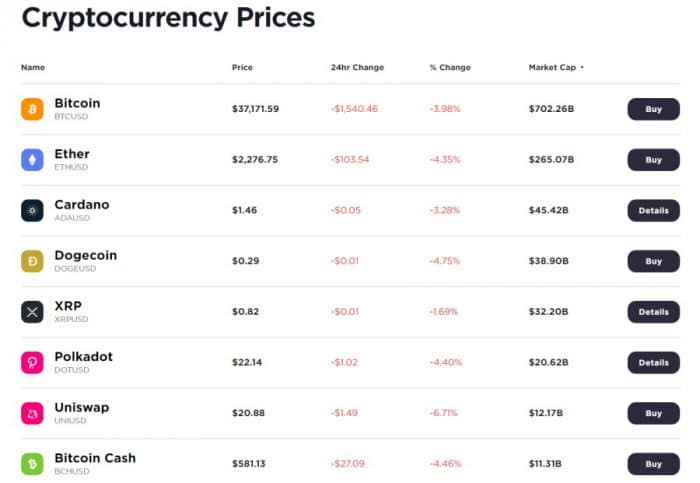

4. Gemini – Regulated Broker To Invest In Bitcoin In The US

A mobile Bitcoin trading platform like Gemini is ideal for mobile traders. Depending on how you want to trade, you choose three iOS and Android apps.

Gemini’s custom Bitcoin wallet will be one of the first apps most traders need. It allows you to store cryptocurrencies securely and is simple to use. In addition, you can exchange fiat currency for Bitcoin and other digital currencies using the second application.

The company’s advanced cryptocurrency trading platform, ActiveTrader, is also available. Custom charts can be created in this tool and dozens of technical indicators. This tool is specifically designed for cryptocurrency orders. For example, placing a ‘maker or cancel’ order can get the lowest spreads.

In addition, Gemini hosts daily auctions for popular cryptocurrencies. Through these auctions, you can purchase more bitcoin for less money. Gemini’s daily auctions are accessible on your smartphone, even on weekends and holidays.

Trading is available in over 45 cryptocurrencies, in addition to Bitcoin, at this brokerage. Gemini is regulated by the New York State Department of Financial Services in the US, so the company is subject to some rules designed to protect customers. Currently, the company’s limited staff only accepts customer service requests by email

Gemini fees

| Fee | Amount |

| Crypto trading fee | 0.50% + 1.49% |

| Inactivity fee | Free |

| Withdrawal fee | Free on bank wire withdrawals |

Pros:

- Several apps to invest in Bitcoin

- You can place or cancel orders

- Reduced auction fees

- Low commissions when it comes to generating liquidity

- US-registered

Cons:

- Viewing the Bitcoin order book is not possible

- Limited customer support

Your money is at risk.

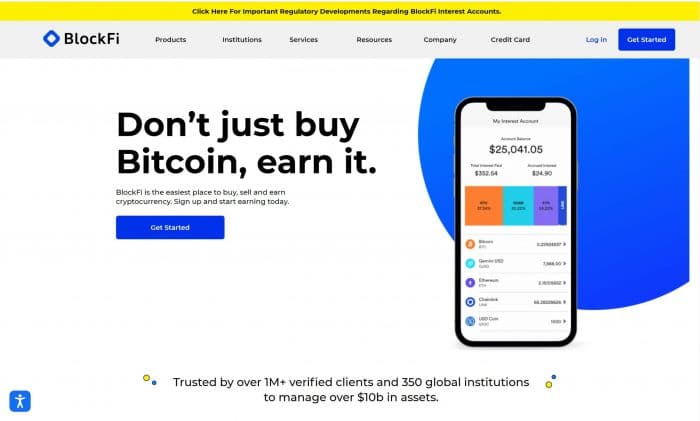

5. BlockFi – Commission o% To Invest In Bitcoin US

If you’re interested in trading cryptocurrencies while paying some of the lowest fees of any similar platform, then BlockFi is exactly what you need. Traders can trade cryptocurrencies on this platform for almost no fees, making it a very attractive option. In addition, all US states are covered by the platform, and it provides instant trades and does not charge commissions.

According to the platform, it is best to “bridge the gap between traditional finance and cryptocurrencies.” That is accomplished by using crypto-specific tools and standard technical analysis indicators. Consequently, you can shorten your learning curve for different asset classes and ensure that you can use this knowledge while trading crypto.

BlockFi fees

| Fee | Amount |

| Crypto trading fee | Commission, starting from 0.7% |

| Inactivity fee | Free |

| Withdrawal fee | Rate-based withdrawal fee for some coins. |

Pros:

- Commission of 0%

- Across the country, highly regulated

- There are no monthly trading fees

- Fee-free deposits and withdrawals

Cons:

- CFDs are not permitted

- Offers no joint or custodial accounts

Your money is at risk.

Invest in Bitcoin US – Fee Comparison

| Platform | Crypto trading fee | Inactivity fee | Withdrawal fee |

| eToro | Spread, 0.75% for Bitcoin | $10 a month after one year | $5 |

| Binance | Commission, starting from 0.1% | Free | 0.80 EUR (SEPA bank transfer) |

| Coinbase | From 0.50% commission | Free | 1.49% to a US bank account |

| Kraken | For sellers, commissions start at 1% per trade. Free for buyers | Free | According to the currency withdrawn. 0.0005 for BTC |

| Gemini | 0.50% + 1.49% | Free | Free on bank wire withdrawals |

| BlockFi | Commission, starting from 0.7% | Free | Rate-based withdrawal fee for some coins. |

What is Blockchain?

Blockchain technology makes it difficult or impossible to change, hack, or cheat the system.

Distributing and replicating transactions across multiple computers is the function of a blockchain. Each time a new block is added to the chain, a new transaction is added to every participant’s ledger. The Distributed Ledger Technology (DLT) is a decentralized database managed by multiple parties.

Blockchains record transactions using immutable cryptographic signatures called hashes.

What to know before you invest in Bitcoin

Bitcoin is Volatile

This one attracted quite a bit of attention. Cryptocurrencies like Bitcoin are extremely volatile. Bitcoin’s value can drastically change within a day. In December of last year, Bitcoin was just a few points away from $20,000, a perfect example of this. The asset traded around $3,000 in the following month after losing 83 percent of its value.

In May 2021, Bitcoin’s price fell from $64,000 to $30,001. In the cryptocurrency market, price fluctuations are common. Bitcoin’s price is determined by demand and supply. Higher prices indicate greater demand. Bitcoin’s price is also influenced by market news and events. At some point, regulators or the government will release bad news, which will affect Bitcoin’s price.

Public Transactions

No payment method on earth offers more transparency than Bitcoin. Due to the blockchain, every Bitcoin transaction is public and illustrative. As a result, when Bitcoins are purchased and sold, they are immediately entered into the blockchain for everyone to see.

Addresses are Anonymous

The transaction details are available to everyone, but it’s hard to determine who owns what. Wallet addresses, letters, and numbers are used in a Bitcoin transaction. In order to check your account balance and transaction history, anyone checking your wallet address will need to know your wallet address.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Bitcoin Price Forecast 2026

Fibonacci retracements can be used to identify critical levels for Bitcoin in the future.

Increasing institutional interest in Bitcoin will lead to an increase in investors using it to rebalance their portfolios. According to a survey by Natixis Investment, 28% of large enterprises have increased their exposure to cryptocurrencies. In addition, several top retailers accept bitcoins as a form of payment, and VISA says that banks should have cryptocurrency policies by the year 2026.

The inclusion of bitcoin in corporate and household balance sheets is making its way into treasury management. For example, Tesla includes Bitcoin as an investment on its balance sheet, which sets the stage for the government to develop a framework for taxing cryptocurrencies.

In the United States, newly elected officials are already calling for regulation of these emerging assets. For example, to make the city a crypto-capital, New York’s incoming mayor, Eric Adams, wants his first paycheck to be in bitcoin.

Is Bitcoin a Good Investment?

The outstanding performance of bitcoin as a currency and investment has attracted both institutional and traditional investors alike. So what is bitcoin’s investment potential? Traditional assets have some advantages over bitcoin.

Liquidity

Since Bitcoin can be traded on multiple platforms, exchanges, and online brokerages worldwide, it is one of the most liquid investment assets. With very low fees, you can instantly convert bitcoin into cash, gold, or other assets. In addition to being long-term investments, digital currencies are also in high demand.

Lower inflation risk

The bitcoin currency is not government-controlled. Furthermore, due to the limitless nature of the blockchain system, your cryptos can never lose value.

Minimalistic trading

Licensed brokers only trade securities. A broker is also required to trade shares of a company. Comparatively, bitcoin trading has a minimalistic approach: buying or selling bitcoins is as simple as storing them in a wallet. Additionally, unlike stock trading orders, cryptocurrency transactions are instant, which may take days or weeks to settle.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

How to Invest in Bitcoin US – Pros & Cons

Many mainstream investors believe it is difficult to invest in bitcoin. The truth is, many cryptocurrency platforms make it simple to invest in Bitcoin now, which is far from the case.

You’ll learn how to invest in Bitcoin using a regulated, safe broker with low fees.

Quick steps to getting started with Bitcoin

We recommend eToro for investors interested in Bitcoin (BTC).

- Register with eToro – Click the Join Now button on eToro, then provide the required documentation.

- Bank wire transfers, credit cards, PayPal, Skrill, Neteller, and other payment options are available for deposits.

- Type BTC into the search bar to locate the currency.

- Upon clicking ‘Trade,’ you will be taken to the order page, where you can specify how much BTC you would like to purchase. Finally, click on ‘Open Trade’ to complete the transaction.

How to Store your Bitcoin in a Secure Wallet?

eToro Money Wallet

Traders new to bitcoin will be surprised at how easy it is to use eToro’s Bitcoin wallet. The wallet, for example, supports storing 120 other digital currencies besides bitcoins. Thus, you can easily store all your crypto assets in one wallet if you own multiple crypto assets.

eToro wallet is available on iOS and Android devices for free. If you create a wallet, you can start trading cryptocurrency directly from the app. Additionally, eToro offers over 500 cryptocurrency pairs and can exchange them.

The Guernsey Financial Services Commission (GFSC) regulates and authorizes eToro Bitcoin wallets. Using a password recovery service is also an option if you lose your private keys.

Check out Reddit if you’re interested in reading and sharing Bitcoin news. 2.9 million people are part of the Bitcoin community.

Reddit posts interesting posts and viewpoints about Bitcoin around the clock. If you are not a Reddit member, you can view posts, but you need to sign up as soon as possible to post and reply to comments.

Coinbase Wallet

Coinbase is a good choice for crypto wallets. Within a few years, it could provide next-level security and crypto-transaction efficiency. Despite only supporting a limited number of digital currencies, the wallet can also be used with other wallets and fiat currencies. Additionally, Coinbase wallets are easy to use and have the best security features compared to any other wallet, making them the most popular cryptocurrency wallets.

A Coinbase wallet is a great companion for those who use the exchange platform. Moreover, as a result of its comprehensive security measures and a history of hacker-free operation, Coinbase wallet is suitable for both beginners and experts. Therefore, it attracts cryptocurrency enthusiasts in every single part of the world.

Binance Exchange Wallet

Binance.US is insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000. Deposits are held at custodial banks. However, in the case of losses from brokerage failures, unauthorized trading, or theft, investors who use cryptocurrency exchanges such as Binance US are not protected by the Securities Investor Protection Corporation.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Is Bitcoin Mining a Better Investment?

People who wish to make money with Bitcoin often buy and trade the currency. Mining Bitcoin is another option. The process of mining bitcoins involves verifying transactions on the Bitcoin blockchain through complex mathematical calculations. Your contribution to the Bitcoin ecosystem consists of validating and confirming transactions, adding them to the Bitcoin blockchain.

The Bitcoin blockchain contains blocks of verified transactions. When a block is verified, its transactions are added to the blockchain, and the miners are rewarded with Bitcoins. However, mining is not as simple as it seems. Bitcoin miners now need specialized tools to work on their blockchain because of its excessive congestion. Bitcoin mining used to be done with a personal computer back in the day.

PC mining has become obsolete due to competition in the blockchain industry as the industry has evolved. Profit from mining by using Application-Specific Integrated Circuits (ASIC). These are, unfortunately, rather costly. Many ASICs cost upwards of $5,000. You must consider the cost of electricity if there are government subsidies on electricity. Mining is an energy-intensive endeavor except in areas where renewable energy is abundant.

However, mining might not be profitable even if you do all this. You will likely need some time before earning any coins since mining is based on first-come-first-serve. Until mining is profitable enough to justify the costs, it takes a long time for the process to be labor-intensive. Investing in bitcoins is the best way to earn bitcoins. It is possible to start with whatever amount of money you have available, which is less costly.

Is Bitcoin Staking a Better Investment?

By storing cryptocurrency on an exchange, you can earn interest or rewards over time. The stake-based model works in this way. You will earn a percentage yield based on how many cryptocurrencies you have in a staking pool.

You will earn more if you stake more coins. Crypto enthusiasts have recently become more interested in staking due to the possibility of earning passive income through rewards or interest. Ethereum 2.0 staking is poised to revolutionize this industry.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Taxes and Regulations Regarding Bitcoin in the US

Bitcoin transactions should be reported to the Internal Revenue Service by U.S. taxpayers. Now that Bitcoin has been listed on exchanges, it has been matched with world currencies, such as the euro and the U.S. dollar. When it announced that bitcoin-related investments and transactions cannot be considered illegal, the U.S. Treasury acknowledged bitcoin’s importance.

Bitcoin transactions are subject to taxes?

That question has a short answer: yes. It is clear that bitcoin is taxed as an asset. Regardless of the value of the Bitcoin transaction, taxpayers must report all bitcoin transactions to the IRS. The IRS requires every U.S. taxpayer to keep a record of all cryptocurrency purchases, sales, investments, and usage. Taxpayers that is suspected of failing to file income and pay the resulting tax on virtual currency transactions or not reporting their transactions properly received warning letters from the IRS in July 2019. It warned of penalties, interest, and even criminal prosecution when incorrectly reporting income.

Bitcoin transactions – what types are taxed?

Bitcoin transactions of the following types are taxable:

- Mining Bitcoins and selling them to a third party.

If you mined Bitcoin and sold it to another party for a profit, you must pay capital gains taxes.

- A third-party buys Bitcoins, which are then sold to that third party.

Suppose you purchase Bitcoin from a cryptocurrency exchange or from a third party and then sell it for a profit, you would be subject to capital gains taxes.

- Buying goods and services with mined Bitcoins.

Taxes must be paid on transactions involving bitcoins mined at home, such as when you purchase coffee with bitcoins you mined at home. There are taxes due, depending on the specifics of the transaction, such as the exchange rate and the price of coffee at the time of sale.

- Buying services and goods with Bitcoin, which has been purchased from someone

A capital gains tax will apply if, for instance, Bitcoin is withdrawn from exchange to a wallet and used to purchase goods.

Following the deduction of expenses incurred during the mining process, the first and third scenarios are taxed as personal income or business income, respectively. Scenarios two and four are treated more like investments.

We will assume you purchased a Bitcoin for $200 and sold it for $300, or you purchased goods of equal value. The $100 gain from the transaction is subject to capital gains tax.

Conclusion

Bitcoin has proven to stay in the global investment world for the foreseeable future. In the past 12 months, the value of Bitcoin has increased by more than 1,000%. Therefore, people are now looking to invest in Bitcoins and hold them for future gains. The ten billionaires who bought Bitcoin here include Elon Musk, Mark Cuban, and George Soros.

eToro, our recommended broker, is a good option for anyone who wants to invest in Bitcoin right now. The process takes less than three minutes.

eToro – Invest In Bitcoin With 0% Commission in the US

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.