Best Ethereum Staking Platform 2025 – How to Stake Crypto

In the dynamic landscape of blockchain technology, Ethereum staking emerges as a pivotal practice, allowing participants to play a crucial role in the network’s security and efficiency. By engaging in staking, individuals commit their ETH tokens to the Ethereum network, not merely as a form of investment, but as a fundamental contribution to the blockchain’s operational integrity. This commitment is rewarded, akin to earning interest, as stakers receive additional Ethereum tokens over time. The process is more than just a profitable endeavor; it represents an active engagement in the Ethereum ecosystem, contributing to its stability and growth.

As we navigate through [current_year], it’s essential to understand the nuances of Ethereum staking and its evolving landscape. This article delves into the mechanics of Ethereum staking, elucidating how it functions as a cornerstone of the blockchain industry. We also provide a comprehensive review of the leading Ethereum staking platforms of the year, offering insights into their features, benefits, and suitability for various types of investors. Whether you’re a seasoned participant in the blockchain domain or new to the concept of staking, our exploration will equip you with the knowledge to make informed decisions in this exciting segment of the cryptocurrency world.

Best Ethereum staking platforms list 2025

The following are the top eight Ethereum staking sites to join.

- AQRU – Overall best Ethereum staking platform

- Crypto.com – Best Ethereum staking platform for flexible withdrawals

- Lido – Simplified and secure participation in staking

- eToro – One of the top Ethereum staking platforms

- Coinbase – Best staking crypto platform USA

- Binance – Top Ethereum staking platform with large repository

- Kraken – The safest and most trusted staking platform

- Nexo – Ethereum staking platform with flexible lock-up periods

Best Ethereum Staking Platforms Reviewed

In our comprehensive exploration of the top Ethereum staking platforms for 2023, we delved into an array of critical factors that define a superior staking experience.

Our criteria extended beyond just analyzing potential yields and the flexibility of lock-up periods. We meticulously examined the security framework of each platform, assessing their adherence to regulatory standards and the robustness of their safeguards to protect your digital assets. Additionally, we considered user experience, platform reliability, and the diversity of staking options to provide a holistic view.

What follows is a discerning compilation of our findings, offering you a detailed guide to the most proficient Ethereum staking platforms available this year

1. AQRU – Overall Best Ethereum Staking Platform

AQRU is the first platform to consider for Ethereum staking. This provider’s website offers an easy-to-use interface free of jargon and is easy to navigate to target newbies. In addition, the Aqru app allows you to access your crypto ETH staking account.

Fiat currency and digital tokens are both supported by this top crypto lending platform, the former including EUR and GBP. Among these are large-cap tokens like Bitcoin and Ethereum and other stablecoins, such as Tether and USDC. Of course, yields will differ depending on the crypto asset you want to stake. Ethereum, for example, yields 7% annually. Because of this, Aqru is our top pick for the best Ethereum interest accounts and staking platforms.

AQRU is considered one of the best Ethereum staking platforms for several reasons:

- Attractive Interest Rates: AQRU offers flat returns of 7% on Bitcoin and Ethereum balances, which is notably high compared to other platforms. This flat rate applies to the entire wallet balance, meaning that users are not subjected to tiered interest rates that might reduce returns for larger balances. This feature is particularly beneficial for investors with smaller holdings or those who prefer a simple, straightforward interest structure.

- Ease of Use: The AQRU platform is designed with a user-friendly interface, making it particularly suitable for beginners in the cryptocurrency space. It simplifies the process of staking and managing digital assets, offering an accessible entry point for new investors. Moreover, AQRU provides the flexibility to deposit fiat currency (GBP, EUR, USD) or cryptocurrencies, and allows conversions between them within the platform.

- Security Measures: To ensure the safety of users’ assets, AQRU employs robust security measures. The platform stores its uninvested crypto with a third-party custodian, Fireblocks, which provides protection against hacking and fraud. Additionally, AQRU has $30 million insurance coverage against crypto losses. The platform also has implemented two-factor authentication within its app to further enhance security levels.

- Regulatory Compliance: AQRU is regulated by the Republic of Lithuania and operates under Lithuanian law. Such regulatory oversight adds a layer of credibility and trust to the platform, assuring users of its compliance with relevant financial standards and practices.

- Fees and Withdrawals: For crypto withdrawals, AQRU charges a flat fee ($10 for Bitcoin withdrawals and $20 for other cryptocurrencies), while there is no fee for fiat withdrawals. This fee structure is transparent and straightforward, albeit it may be less suitable for smaller investments due to the flat withdrawal fee.

In summary, AQRU’s appeal as an Ethereum staking platform lies in its competitive interest rates, user-friendly interface, strong security measures, regulatory compliance, and transparent fee structure. These aspects combine to make it an attractive option for both beginners and seasoned investors looking to stake Ethereum.

Pros:

Pros:

- High Interest Rates

- User-Friendly Interface

- No Tier System for Rates

- Robust Security Measures

- Regulatory Compliance

Cons:

Cons:

- Withdrawal Fees

- Limited Crypto and Fiat Options

- High Risk/Reward Tolerance

- Unclear Investment Strategy

- Relative Newness

Cryptoassets are a highly volatile unregulated investment product.

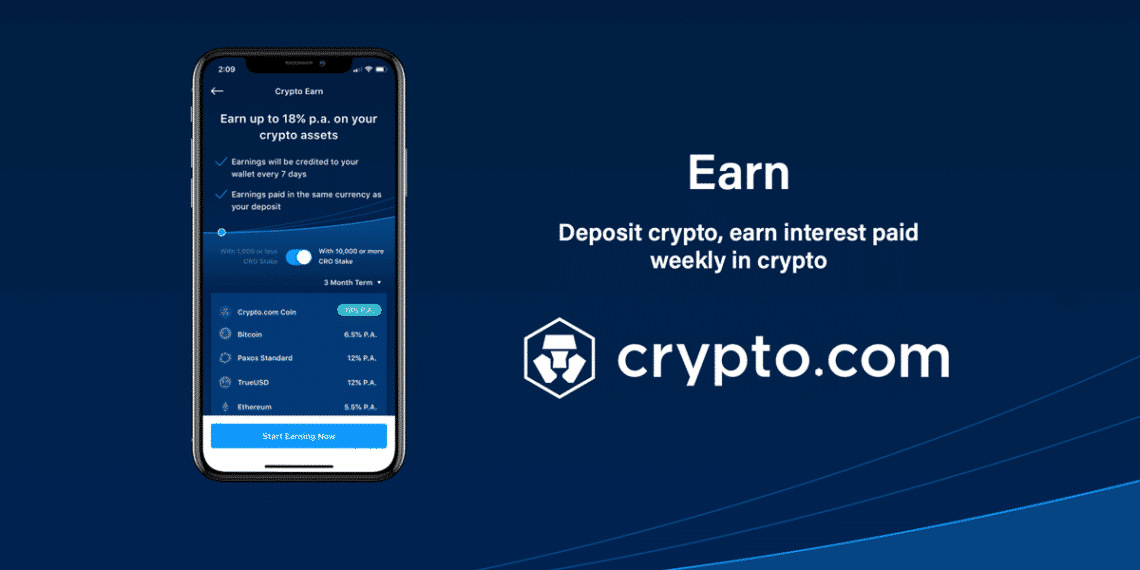

2. Crypto.com – Best Ethereum Staking Platform For Flexible Withdrawals

With millions of customers, Crypto.com has grown to be one of the world’s largest cryptocurrency exchanges since its launch in 2016. Despite offering simple and low-cost exchange services across more than 250+ tokens, Crypto.com is also involved in various crypto-centric products.

Crypto.com also offers stake services through its Crypto Earn facility and digital asset loans, crypto credit cards, and debit cards. Once you deposit your digital tokens, Crypto.com will allocate the funds to provide loans to account holders who wish to borrow capital. In addition, you will receive daily interest payments from the end-borrower after the funds are repaid.

Crypto.com is considered an excellent choice for Ethereum staking, particularly for its flexibility in withdrawals, due to several key features:

- No Lockup Periods: One of the most significant advantages of staking ETH with Crypto.com is the absence of mandatory lockup periods. This feature provides users with the flexibility to stake and unstake their Ethereum as per their preference, aligning with individual investment strategies or liquidity needs.

- Liquid Staking: Crypto.com offers liquid staking, a feature that allows users to stake Ethereum and earn rewards while still maintaining the flexibility to use their staked assets. This approach is particularly beneficial for users who wish to remain active in trading or other investment activities while their assets are staked.

- Wrapped Staked ETH (CDCETH): The platform provides Wrapped Staked ETH (CDCETH), a tradable receipt token that represents the user’s staked ETH. This feature enables users to continue trading or engaging in other crypto activities with their staked assets. Furthermore, users can wrap their staked ETH for CDCETH without incurring conversion fees, even during the unbonding process. This flexibility enhances the liquidity of staked assets, making it an attractive option for users who need to access their funds more dynamically.

- Ease of Unstaking: Although there is no specific lockup period imposed by Crypto.com, it’s important to note that there may be an unstaking queue imposed by the Ethereum network itself. This means there might be a short waiting time for ETH to become available for withdrawal after initiating the unstaking process. However, this is a relatively minor consideration given the overall flexibility offered by the platform.

- Regular Reward Payouts: Users on Crypto.com receive regular reward payouts distributed via the platform’s protocol. This consistent distribution of rewards adds to the appeal of staking on Crypto.com, as it enables users to realize returns on their investments at regular intervals.

In summary, Crypto.com’s staking program is highly regarded for its flexibility, particularly with its no lockup period policy, liquid staking options, and the innovative Wrapped Staked ETH feature. These aspects make it an excellent choice for users seeking a staking platform that offers both high returns and the ability to access and use their staked assets with ease.

Pros:

- The fees are very low

- Easy cryptocurrency payments

- It’s easy to convert money

- Visa cards offer cashback rewards

- Gain interest in cryptocurrencies

- Selection of cryptocurrencies

- A strong security system

Cons:

- A difficult site to navigate

- There is no universal supply of coins

- A poor level of customer service

- There is a shortage of resources for education

Cryptoassets are a highly volatile unregulated investment product.

3. Lido – Simplified and secure participation in staking

Lido stands at the forefront of decentralized finance, offering a pioneering solution for Ethereum staking. As a platform designed to democratize access to staking rewards, Lido addresses some of the fundamental challenges faced by individual stakers, such as high entry barriers and liquidity issues.

By blending ease of use with innovative features, Lido has carved out a niche in the rapidly evolving landscape of blockchain technology. Whether for seasoned investors or newcomers to the crypto world, Lido represents a gateway to participating in Ethereum’s growth while mitigating the typical complexities and limitations of traditional staking processes.

Lido is a popular choice for Ethereum staking due to several compelling reasons:

- Liquidity: Lido allows users to stake their Ethereum while maintaining liquidity. When users stake ETH through Lido, they receive stETH (staked ETH) in return, which can be used in various DeFi applications. This feature enables users to earn staking rewards without locking up their assets, providing greater flexibility compared to traditional staking.

- Ease of Use: Lido simplifies the staking process, making it accessible to a broader range of users. It removes the technical complexities typically associated with setting up and managing a validator node.

- No Minimum Staking Requirement: Unlike Ethereum’s mainnet, which requires a minimum of 32 ETH to become a validator, Lido allows users to stake any amount of ETH. This democratizes access to staking rewards for smaller investors.

- Decentralization and Security: Lido is decentralized and collaborates with multiple professional node operators, enhancing the security and resilience of the staking process.

- Staking Rewards: Users earn staking rewards on their staked ETH, which are competitive and in line with Ethereum’s network rewards.

These features collectively make Lido an attractive option for users looking to stake Ethereum while retaining liquidity and avoiding the complexities and limitations of traditional staking methods.

However, it’s important to note that BlockFi faces challenges like withdrawal limitations and customer service issues, which potential users should consider before investing

Pros:

- Enhanced Liquidity

- Accessibility

- Decentralized and Secure

- Competitive Staking Rewards

Cons:

- Smart Contract Risks

- Dependence on stETH Value

- Regulatory Uncertainty

Cryptoassets are a highly volatile unregulated investment product.

4. eToro – One of the Top Ethereum Staking Platforms in 2023

eToro is one of the most prominent brokerage firms that have adapted its business model to accommodate cryptocurrencies, boasting a vibrant and thriving community of 20 million active users.

- eToro is considered one of the top Ethereum staking platforms in 2023 due to several compelling features:

- Versatile Trading Platform: eToro is primarily a brokerage platform that supports a wide range of assets including cryptocurrencies, stocks, ETFs, forex, indices, and commodities. This versatility appeals to a broad spectrum of investors, not just those interested in crypto but also in various other financial markets.

- Automated Staking: On eToro, the tokens purchased on the platform are automatically eligible for staking rewards. This user-friendly feature simplifies the staking process, particularly for beginners or those not wanting to manually manage their staking activities. As of the latest information, eToro supports staking on major cryptocurrencies including Ethereum, offering a streamlined experience for users.

- Reward Structure Based on User Status: The platform has a tiered reward system where the share of staking rewards depends on the user’s status. For example, diamond and platinum members receive up to 90% of the staking rewards. This structure incentivizes and benefits users who are more active or hold higher account statuses on the platform.

- Regulatory Compliance: eToro is regulated by multiple authoritative bodies including the SEC, FCA, ASIC, and CySEC. This regulatory oversight provides a level of security and trust, making it a reliable platform for investors who are cautious about the regulatory aspect of crypto trading and staking.

- Flexible and User-Friendly Features: eToro offers flexible staking with no lock-in period and allows for flexible withdrawals, which is highly beneficial for users who require liquidity. Additionally, the platform’s user interface is designed to be intuitive, catering to both seasoned traders and beginners. They also offer a free demo account with $100,000 in paper trading funds for those who want to try out the platform before committing real funds.

- Additional Trading Tools: eToro provides unique features like copy trading, allowing users to passively trade by automatically copying the positions of experienced traders. This feature is particularly attractive for new or less experienced investors who wish to leverage the expertise of seasoned traders.

These factors combined make eToro a compelling choice for both new and experienced investors looking to stake Ethereum in 2023.

Pros:

Pros:

- Highly regulated by top bodies

- A user-friendly and easy-to-use interface

- Staking crypto for high rewards

- Supports a variety of asset classes

- The top performer in the social trading niche

Cons:

Cons:

- Limited Service in the U.S.

- No Crypto-to-Crypto Trading Pairs

- Limited Customer Support Options

Cryptoassets are a highly volatile unregulated investment product.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

5. Coinbase – Best Staking Crypto Platform USA

Coinbase is another top US crypto exchange for Ethereum staking. Current CEO Brian Armstrong founded Coinbase in 2012 to enable crypto adoption globally. Coinbase is a top choice for US investors looking to gain exposure to cryptocurrencies with its intuitive and user-friendly platform.

Coinbase is considered one of the best platforms for staking cryptocurrency, particularly Ethereum, in the USA for several reasons:

- Streamlined and Accessible Platform: Coinbase is known for its user-friendly approach, simplifying the staking process and making it accessible even to those who are new to cryptocurrency. This accessibility is crucial in lowering the entry barrier for new investors who might be daunted by the complexities of blockchain technology and staking mechanisms.

- Security Measures: The platform emphasizes security, implementing measures to mitigate risks associated with staking. These measures are essential for protecting users’ investments and ensuring a trustworthy staking environment. Furthermore, Coinbase offers the flexibility to opt-out of staking at any time, giving users control over their investments.

- Competitive APY for Staking: As of the latest update, the annual percentage yield (APY) for staking Ethereum on Coinbase is around 3.3%. This APY allows users to earn rewards on their staked Ethereum, providing an avenue for earning passive income through cryptocurrency staking. The ability to earn a return on investments while contributing to the security and operation of the Ethereum blockchain is a significant draw for users.

- Low Minimum Staking Amounts: Coinbase allows staking with small amounts, even as low as $1, making it accessible for a wide range of investors. This low minimum staking amount is particularly advantageous for small-scale investors or those who are cautious about investing large sums in cryptocurrency staking.

- Lock-up Periods and Asset Management: While staked assets on Coinbase are locked and cannot be traded or transferred until the unstaking process is complete, the platform provides clear guidelines on these lock-up periods. Additionally, Coinbase allows users to regularly monitor their staked ETH and the rewards they are earning, ensuring transparency and control over their investments.

In summary, Coinbase’s combination of a user-friendly interface, robust security measures, competitive staking rewards, low minimum staking amounts, and transparent asset management makes it an attractive choice for both new and experienced investors looking to stake Ethereum in the USA.

Pros:

Pros:

- An intuitive and user-friendly platform

- Provides custodial services for large institutions

- It reflects that it is regulated as a public company

- A good collection of eligible cryptos for stake

Cons:

Cons:

- Staking fees are expensive

- Limited Cryptocurrency Selection

- Privacy Concerns

Cryptoassets are a highly volatile unregulated investment product.

6. Binance – Top Ethereum Staking Platform With Large Repository

Binance, the world’s largest crypto exchange, boasts an average daily trade value of more than $50 billion. As a result, Binance Coin (BNB) currently occupies the fourth position on our ranking of the top cryptocurrencies in terms of value.

Through its Binance Earn program, Binance offers stake services and trading of large-cap cryptocurrencies such as Bitcoin, Ethereum, and Cardano.

This initiative offers flexible savings, locked assets, and DeFi staking to enable users to generate profits from holding assets. Stakings that are easy to break attract little interest. Locked savings require much more time, with a three-month maximum lock-up.

Binance is considered one of the top Ethereum staking platforms with a large repository for several reasons, and here’s an elaboration on why it has gained this reputation:

- Wide Range of Supported Cryptocurrencies: Binance is renowned for offering a wide range of supported cryptocurrencies beyond just Ethereum. This diversity allows users to stake various digital assets, thereby diversifying their crypto holdings and potentially earning rewards from multiple sources. Binance’s extensive selection of assets makes it a versatile platform for users who want to stake different tokens.

- High Liquidity: Binance is one of the largest and most liquid cryptocurrency exchanges globally. This liquidity ensures that users can easily buy, sell, or trade their staked Ethereum or any other assets, without facing significant liquidity constraints. High liquidity can be crucial for traders looking to seize opportunities in the market or exit their positions swiftly.

- User-Friendly Interface: Binance offers an intuitive and user-friendly interface for staking and managing assets. It provides users with a seamless experience, making it easy for both beginners and experienced traders to navigate and use the platform. This accessibility is vital for attracting a wide range of users interested in staking Ethereum and other cryptocurrencies.

- Competitive Staking Rewards: Binance frequently offers competitive staking rewards for Ethereum and various other cryptocurrencies. These rewards can include staking rewards in the form of additional tokens, yield farming opportunities, or other incentives. By offering attractive rewards, Binance attracts users seeking to maximize their returns on their staked assets.

- Security and Trustworthiness: Binance places a strong emphasis on security and has implemented robust measures to protect user assets. This commitment to security is crucial for users who want to stake their Ethereum with confidence. Binance’s track record in terms of security and reliability has contributed to its status as a trusted staking platform.

- Educational Resources: Binance provides educational resources and guides for users interested in staking. These resources help users understand the staking process, the risks involved, and the potential rewards. Educational materials can be invaluable for users looking to make informed decisions about staking their Ethereum.

- Global Reach: Binance has a global presence, serving users from numerous countries around the world. This international reach allows users from various regions to access its staking services and contribute to its large repository of staked assets. It also provides users with options for trading, converting, or withdrawing their staked assets in their preferred fiat currencies.

In summary, Binance is considered a top Ethereum staking platform with a large repository due to its diverse range of supported cryptocurrencies, high liquidity, user-friendly interface, competitive rewards, security measures, educational resources, and global accessibility. These factors collectively make Binance an attractive choice for users looking to stake Ethereum and other digital assets while enjoying the benefits of a well-established and reputable exchange platform.

Pros:

- Large pool for staking crypto

- Multiple earnings available with varying interest rates

- A safe and secure crypto staking site

- User funds are insured

Cons:

- Concerns about compliance with local regulations

- Complex Interface for Beginners

- Limited Customer Support

- Security Concerns

- Diverse interests in digital assets

Cryptoassets are a highly volatile unregulated investment product.

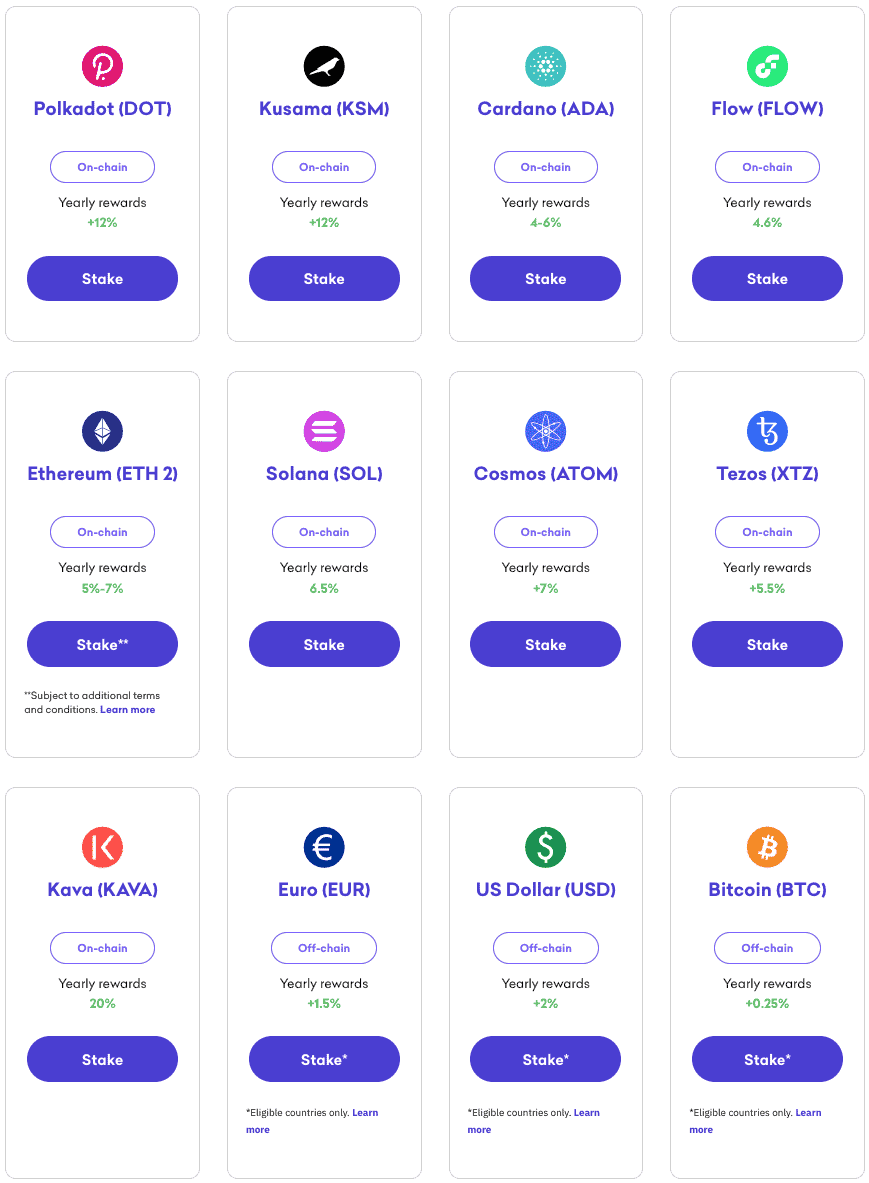

7. Kraken – The Safest And Most Trusted Staking Platform

Founded in 2011, Kraken is one of the first and most respected cryptocurrency exchanges in the US. However, regardless of their experience level, those interested in crypto staking will also find it an excellent option.

Kraken is often considered one of the safest and most trusted staking platforms in the cryptocurrency industry for several compelling reasons, and here’s an elaboration on why it has gained this reputation:

- Regulatory Compliance: Kraken places a strong emphasis on regulatory compliance. It has obtained licenses in multiple jurisdictions, including the United States and Europe, making it one of the most regulated cryptocurrency exchanges. This commitment to compliance provides users with a level of trust and confidence in the platform’s operations and adherence to legal requirements.

- Robust Security Measures: Kraken has a well-documented history of prioritizing security. It employs industry-leading security practices, including cold storage for user funds, two-factor authentication (2FA), advanced encryption protocols, and regular security audits. These measures help safeguard users’ staked assets and personal information from potential threats, such as hacks and cyberattacks.

- Transparency: Kraken is known for its transparency in disclosing its financial health and security practices. The exchange regularly publishes audits and reports on its holdings to demonstrate its solvency and reassure users that their assets are safe. This level of transparency fosters trust among the user base.

- Insurance Coverage: Kraken has implemented insurance coverage for digital assets held on its platform. This insurance provides an additional layer of protection for users’ assets in the event of unforeseen events like security breaches or other potential losses. Knowing that their assets are insured can give users peace of mind when staking on the platform.

- Proven Track Record: Kraken is one of the oldest cryptocurrency exchanges, having been established in 2011. Over the years, it has built a solid reputation for reliability, security, and trustworthiness. Its longevity in the industry and its ability to weather various market conditions contribute to its status as a trusted staking platform.

- User-Friendly Interface: Kraken offers a user-friendly interface that caters to both beginners and experienced traders. The platform’s intuitive design and easy navigation make it accessible to a broad range of users interested in staking. Users can stake assets with ease, monitor their holdings, and access detailed analytics and reports.

- Range of Supported Assets: Kraken supports a wide variety of cryptocurrencies for staking, including major assets like Bitcoin (BTC) and Ethereum (ETH) as well as smaller-cap coins. This diverse selection allows users to stake a variety of assets, potentially increasing their staking portfolio’s earning potential.

- Excellent Customer Support: Kraken is known for its responsive and helpful customer support team. Users who encounter issues or have questions can typically expect timely assistance, which is crucial for resolving any concerns or technical difficulties promptly.

In summary, Kraken’s reputation as the safest and most trusted staking platform is based on its strong commitment to regulatory compliance, robust security measures, transparency, insurance coverage, proven track record, user-friendly interface, wide asset support, and responsive customer support. These factors collectively make Kraken an appealing choice for users looking to stake their cryptocurrencies with confidence and peace of mind.

Pros:

- There are 15 ways to stake cryptocurrencies on-chain

- Bitcoin, EUR, and USD are available for off-chain staking

- Currency-based rewards

- Every two weeks, you’ll receive rewards based on your staked assets

- Staking is easy and fast

Cons:

- Limited Geographic Availability

- Complex User Interface for Beginners

- Slower Verification Process

Cryptoassets are a highly volatile unregulated investment product.

8. Nexo – Ethereum Staking Platform with Flexible Lock-Up Periods

Since its launch in 2018, it has gained most of its popularity in recent years, having over 3.5 million people using the platform. The company’s slogan is “Banking on Crypto.” By using cryptocurrency, it wants to replace traditional banking services.

Nexo is often considered one of the best Ethereum staking platforms with flexible lock-up periods due to several compelling reasons, and here’s an elaboration on why it has gained this reputation:

- Flexible Lock-Up Periods: One of Nexo’s standout features is its flexibility when it comes to lock-up periods. Unlike many staking platforms that require users to commit to fixed and often extended lock-up periods, Nexo offers a unique model where users can stake their Ethereum without any predefined lock-up duration. This means users can deposit and withdraw their assets at any time without penalties, providing unparalleled liquidity and flexibility for stakers.

- Earn High Yields: Nexo offers competitive and potentially high yields for Ethereum staking. Users can earn interest on their staked Ethereum assets, and the yields tend to be attractive, making it an appealing option for those seeking passive income from their crypto holdings. The absence of rigid lock-up periods allows users to capitalize on market opportunities or access their funds as needed.

- Security Measures: Nexo places a strong emphasis on security. It employs advanced security practices, such as cold storage for user funds, multi-signature wallets, and regular security audits, to protect users’ assets from potential security breaches. Users can feel confident that their Ethereum holdings are safeguarded on the platform.

- Insurance Coverage: Nexo provides insurance coverage for digital assets held on its platform. This insurance offers an additional layer of protection in case of unexpected events, including security breaches. Knowing that their assets are insured can further boost users’ confidence in staking their Ethereum with Nexo.

- User-Friendly Interface: Nexo offers a user-friendly interface that makes it easy for both beginners and experienced users to stake Ethereum. The platform provides clear information on staking rewards, interest rates, and account balances. Users can monitor their staked assets, view their earnings, and manage their holdings effortlessly.

- Transparency: Nexo is transparent about its operations and regularly publishes information about its financial health. This transparency helps build trust among users, as they can easily verify the platform’s solvency and reliability.

- Diverse Cryptocurrency Support: While Nexo is known for its Ethereum staking services, it also supports a range of other cryptocurrencies. Users can diversify their staking portfolio by choosing from various assets, enhancing their overall staking strategy.

- Customer Support: Nexo offers responsive customer support to assist users with any questions or issues they may encounter while staking on the platform. Quick and effective customer support can be essential for resolving concerns and ensuring a positive user experience.

In summary, Nexo’s reputation as the best Ethereum staking platform with flexible lock-up periods is rooted in its unique approach to staking, which prioritizes user flexibility, high yields, security, insurance coverage, user-friendliness, transparency, diverse asset support, and responsive customer support. These factors collectively make Nexo an attractive choice for users looking to stake Ethereum with the added benefit of liquidity and freedom to manage their assets as they see fit.

Pros:

- Having a high level of insurance ($100 million)

- Benefits associated with Nexo Card

- A mobile app simplifies management

- Improved security features

- Customer service is available 24/7

Cons:

- Lack of educational materials

- Low interest compared to competitors

Cryptoassets are a highly volatile unregulated investment product.

Best Ethereum Staking Platforms – Rates Comparison

| AQRU | Crypto.com | Lido | eToro | Coinbase | Binance | Kraken | Nexo | |

| Staking Rewards on Cryptocurrencies | ETH – 3% | ETH up to 14.5% | ETH 3.8% | ETH up to 4.3%. | ETH 3.49% | ETH 4.5% | ETH3-6%% | ETH Up to 4-12% |

| Min & Max Staking Amounts | €100 (£110.80) minimum; no maximum stated. | Minimum – Varies depending on the coin

Maximum – $500,000 (USD equivalent) |

No minimum or maximum balances | USD equivalent that allows staking rewards of at least $1 per month | You can stake starting at $1; the maximum is not specified. | It varies depending on the coin.

|

It varies depending on the coin. | It varies depending on the coin. |

| Lock-In Period | No lock-in period; flexible withdrawals offered | Three months, one month, or flexible | 24 hours | No lock-in period; flexible access | It varies depending on the asset | You can choose between flexible, 7, 10, 15, 30, 60, 90, or 120 days. | Flexible | Flexible, 1 month or 3 months |

| Security & Regulation Features | Regulated by the Republic of Lithuania

VASP under Lithuanian law |

Tier 4 assessment from NIST Cybersecurity

Stress-tested by Kudelski Security |

SEC | SEC, FCA, ASIC regulated

Licensed by FINRA and FinCEN |

Regulated by the SEC

Listed on the NASDAQ |

Not regulated by international institutions

Applying for a trading license |

Regulated by FINTRAC, FCA, and FinCEN | ISO 27001:2013 certification

Licensed & Regulated Digital Assets Institution.

Audited by Armanino |

| Additional Rewards Offered | Earn $75 USDT when you refer a friend and 10 USDT when you sign up | Increasing CRO staked, crypto wallet benefits, and access to crypto.com visa increased APR. | incentives program on Lybra Finance, integration with Base, and integration with Argent Mobile for ETH staking | Club members at higher tiers of membership retain more of their stake rewards. | spin-the-wheel reward for new users with rewards ranging from $3 to $200 in USD or Bitcoin | Owners of BNB can earn benefits in BNB Vault | staking rewards of up to 26% | Get an additional 2% APR as a Platinum loyalty member with Nexo tokens |

| Payout Frequency | Daily | Weekly | Monthly | Monthly | Depending on the asset, it can range from daily to weekly | Daily | Twice a week | Daily |

What Is Crypto Staking?

Crypto staking involves committing one’s digital assets to support a blockchain network and validate transactions. This process is integral to the Proof-of-Stake (PoS) mechanism, where participants lock their cryptocurrencies to be selected as validators for transaction blocks. In return, they receive rewards, often in the form of additional cryptocurrency.

Distinct from Proof-of-Work (PoW), used in networks like Bitcoin, PoS is a more energy-efficient method of maintaining blockchain integrity. By staking, participants contribute to the security and operability of the blockchain while earning passive income, making it an appealing aspect of digital asset management.

Most major cryptocurrency exchanges provide staking services, allowing users to participate directly through their digital wallets. This feature enables them to join a staking pool, where they can combine their assets with others to increase their chances of being chosen as validators and earning rewards. Staking not only offers a method to earn from holdings but also plays a crucial role in the functioning and governance of many blockchain ecosystems.

Read on to find out more.

How Does Ethereum Staking Work?

In contrast to Proof-of-Work (PoW) based blockchains, Proof-of-Stake (PoS) powered blockchains, such as Ethereum 2.0, consolidate 32 transaction blocks during each validation cycle, known as an “epoch,” which typically lasts approximately 6.4 minutes. An epoch becomes finalized and its transactions irreversible once two subsequent epochs are added to the chain.

Within the validation process, the Beacon Chain organizes stakeholders into 128 distinct committees, each assigned to a specific shard block for validation duties. An epoch comprises 32 slots, correlating to 32 sets of committees, each responsible for validating transactions within a given timeframe.

The committee allocated to a particular block is charged with proposing a new block of transactions. Simultaneously, the other 127 committees are responsible for voting and verifying the proposed block. Once a majority within the committee confirms the new block, it’s appended to the blockchain, and a “cross-link” is created, signifying its inclusion.

It’s crucial to distinguish between the rewards for block proposers and attesters. Generally, the block proposer receives one-eighth of the base reward, denoted as “B,” while the attester is allocated the remaining seven-eighths of B. This attester reward is dynamically adjusted based on the promptness of the block proposer’s submission. To claim the full seven-eighths B, the attester must submit their attestation immediately. Any delay leads to a decrement in the reward, with specific reductions occurring over successive time slots.

The base reward serves as a key determinant for the issuance rate of Ethereum 2.0. As the validator population on the network grows, the individual base reward per validator diminishes. This reduction is due to the base reward’s inverse relationship with the square root of the total balance held by all Eth 2.0 validators, ensuring a scalable and sustainable reward system as the network evolves.

Advantages of staking Ethereum

Staking Ethereum offers several noteworthy advantages:

- Earning Rewards: Participants who actively contribute to the network’s consensus mechanism are compensated. This involves running software that accurately processes and batches transactions into new blocks, as well as verifying the actions of other validators. Active engagement in maintaining the blockchain’s functionality is thus financially incentivized.

- Enhanced Network Security: The security of the Ethereum network is bolstered as the quantity of staked ETH increases. A greater proportion of ETH staked means that a potential attacker would need to control a substantial majority of ETH to influence the network. This high threshold significantly reduces the likelihood of successful attacks, making the network more robust against threats.

- Environmental Sustainability: Unlike the Proof-of-Work (PoW) model, which requires energy-intensive computing resources, the Proof-of-Stake (PoS) system employed by Ethereum can be operated using standard home computers or even smartphones. This shift dramatically reduces the environmental impact of the network, positioning Ethereum as a more eco-friendly blockchain option.

Is Ethereum Staking Taxed?

Taxation in the cryptocurrency sector, including Ethereum staking, is complex and varies significantly based on individual circumstances and jurisdiction. The tax implications for staking earnings differ from country to country, influenced by factors like residency status and investor profile. Due to these complexities, it’s advisable to consult with a professional tax advisor for specific guidance tailored to your situation.

Risks Associated with Ethereum Staking

- Market Volatility: Cryptocurrency investments, including Ethereum, are subject to high volatility. For example, Ethereum’s price peaked at around $4,300 in May 2021 but fell below $2,000 by June. Such drastic fluctuations are not unusual in the cryptocurrency market, unlike in traditional stock or Forex trading. Investors should be prepared for the possibility of extended periods before seeing returns, especially if they purchase at peak prices.

- Liquidity Concerns: While Ethereum, ranked second by market capitalization, generally does not face liquidity issues, it’s a different scenario for smaller, micro-cap altcoins. The top ten or twenty cryptocurrencies by market cap usually have good liquidity, minimizing liquidity risks for investors.

- Lockup Periods in Ethereum Staking: With the introduction of Ethereum 2.0 and its phased approach, including the Beacon Chain and upcoming integration with Ethereum’s mainnet, staked ETH is locked until at least the completion of Phase 1.5. This lockup means that staked ETH, along with any earned rewards, cannot be sold, transferred, or withdrawn until this phase is complete. Investors need to be aware of these constraints, as staking Ethereum is a long-term commitment.

- Risks of Being a Validator: Operating a validator node on the Ethereum network requires significant technical expertise and a commitment to maintaining the node’s continuous operation. Mistakes or downtime can lead to penalties, impacting stake returns. Ethereum’s slashing mechanism poses a risk of partial or total loss of staked ETH for actions deemed malicious or for failure to validate transactions correctly. This risk underscores the importance of either possessing the necessary technical skills or considering delegating stakes to a reputable third-party validator or joining a mining pool to mitigate risks.

- Operational Costs: While not as intensive as Proof-of-Work (PoW) mining, staking Ethereum does incur hardware and energy costs. Although these are generally lower than PoW expenses, they can accumulate over time and should be factored into the overall investment strategy.

It is crucial for potential investors in Ethereum staking to thoroughly understand these risks and consider their long-term investment goals and risk tolerance before committing their assets.

Conclusion

In conclusion, Ethereum staking presents an attractive investment opportunity with average interest rates ranging from 5% to 7%. The actual annual return, however, is influenced by factors such as exchange fees, the specific Ethereum staking protocol employed, and the total volume of Ethereum staked across the network. For those optimistic about Ethereum’s future prospects and seeking alternatives to the traditionally lower yields of conventional finance, Ethereum staking offers a compelling avenue.

For newcomers eager to delve into Ethereum staking and start accruing rewards, Aqru emerges as an optimal choice for individuals outside the United States. In contrast, eToro stands out as the preferred platform for those based in the U.S., providing a user-friendly and efficient staking experience. Both platforms cater to the evolving needs of modern investors, blending accessibility with the potential for substantial returns in the dynamic world of cryptocurrency staking.

AQRU – Best Platform to Stake Cryptocurrencies

Cryptoassets are highly volatile unregulated investment products.