How & Where to Buy Tether (USDT) in June 2025

The high returns shown by the cryptocurrency markets have meant that more and more people are now gravitating towards investments in this emerging asset class. However, the uncertainty and volatility plaguing the markets right now mean that people are also looking for a safe haven to maintain their investments without missing out on future opportunities.

As a hedge against this volatility and to ensure that you can still be poised to profit when opportunities arise, stablecoins have become increasingly popular. In this guide, we discuss one of the most popular stablecoins, and where to buy Tether.

-

-

A List of the Best Platforms to Buy Tether in June 2025

- eToro: Buy Tether from a regulated platform that charges a flat 1% fee for all crypto transactions. eToro makes it possible to build a diverse portfolio of crypto, stocks, forex, indices, commodities, ETFs and bonds all in one place. The platform also offers crypto Smart Portfolios that are created by experts and make investing in crypto simple.

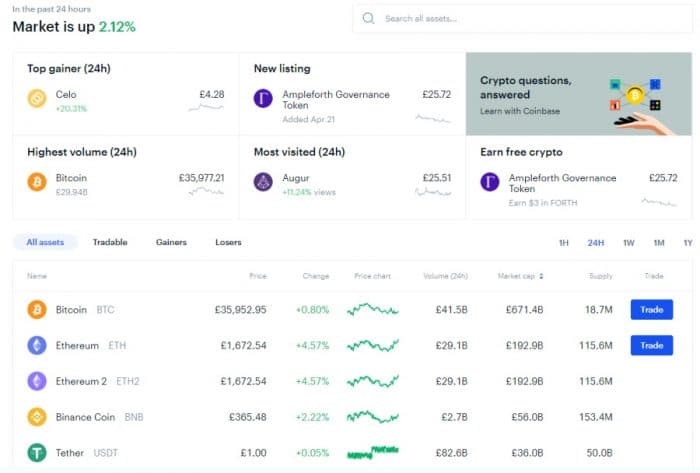

- Coinbase: Coinbase is a beginner-friendly crypto trading platform that offers a range of appealing features. On the platform, users can stake their tokens for passive rewards and access a range of educational resources. The Coinbase crypto wallet is a secure DeFi wallet that can be connected with most Dapps, providing access to the wider web3 space.

- Binance: Binance is one of the largest crypto exchanges, offering over 200 crypto assets. The exchange is built on blockchain technology and is secured by cryptography. Users can access staking, lending, yield farming, crypto interest and more.

- Gemini: Gemini is a simple crypto trading platform that allows users to buy cryptos instantly. The platform is available as a mobile app but can also be accessed via desktop. As well as a simple trading interface, Gemini provides an advanced charting tool that can be used to conduct technical analysis and implement more advanced trading strategies.

- Bittrex: Bittrex is a secure crypto exchange that offers zero fees on selected crypto markets. The platform places a strong focus on security and implements multiple layers of protection to keep client funds safe.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

What is a Stablecoin?

Any cryptocurrency that isn’t Bitcoin (BTC) is referred to as an altcoin. In some aspects, they are comparable to Bitcoin, but they usually differ from BTC in one or more ways. Some altcoins, for example, utilize a different consensus technique to generate blocks. Other altcoins, such as Ethereum and Litecoin, provide features that Bitcoin does not, such as lesser price volatility and smart contracts. There are already over 10,000 cryptocurrencies in circulation, which are traded on a number of wallets and platforms.

There are several different types of altcoins available in the market, and stablecoins are among the most popular category of altcoins. The extreme level of volatility that plagues the cryptocurrency markets is well-known. Stablecoins are the answer to this problem. They lower the overall volatility of the coins by tying them to a specific asset with an intrinsic value. Precious metals, fiat currency, and even other cryptocurrencies could be included. Stablecoins are backed by a basket of products and are intended to serve as a reserve that can be used to redeem holders if the cryptocurrency goes bankrupt. Stablecoins have an extremely low level of volatility, and their prices cannot go beyond a specific range. Stablecoins are a type of cryptocurrency that is widely used by cryptocurrency traders. This includes Tether’s USDT and the USD Coin (USDC), both of which are tied to the US dollar as their names suggest. Stablecoins have gained in popularity recently, especially since Visa stated that it would begin utilizing USDC and USDT to settle some of its transactions.

What is Tether (USDT)?

Tether is a fiat currency-pegged stablecoin. Tether’s most prevalent peg is to the US Dollar (ticker symbol USDT). One USDT is supposed to be exactly equivalent to one dollar—not a cent more or less. It’s essentially a digital currency (at least in value). The Euro, in the form of EURT, is another currency that Tether employs. It’s worth emphasizing that while Tether users are insulated from bitcoin volatility, they are still subject to swings in the pegged fiat currency’s price. Consider what would happen if a major event occurred that instantly reduced the value of the US dollar. USDT would lose the same amount of value as the USD if you held it.

Tether was founded using the Omni Platform initially. This platform is used to store a variety of digital assets linked to the Bitcoin network. Following Bitcoin, Ethereum-based Tether coins were introduced, with Ethereum becoming their most popular network. Tether currencies are currently available on more than eight other blockchains, including Tron, OMG Network, and Solana.

Collateral is used to keep the Tether peg in place. They say that for every USDT in circulation, a US Dollar’s worth of money or other assets is held in reserve.

To be worth $1, 1 USDT must be redeemable for $1 in fiat currency at any moment. USDT is currently only directly convertible to USD through a small number of exchanges or Tether (which has a $100K minimum and costs significant fees). To summarise, in order for 1 USDT to be truly worth $1, Tether and exchanges must maintain a dollar reserve to back every USDT in circulation.

How to Buy Tether on eToro

Do you want to buy USDT right now but are unsure where to start? Simply follow the measures outlined below if this is the case.

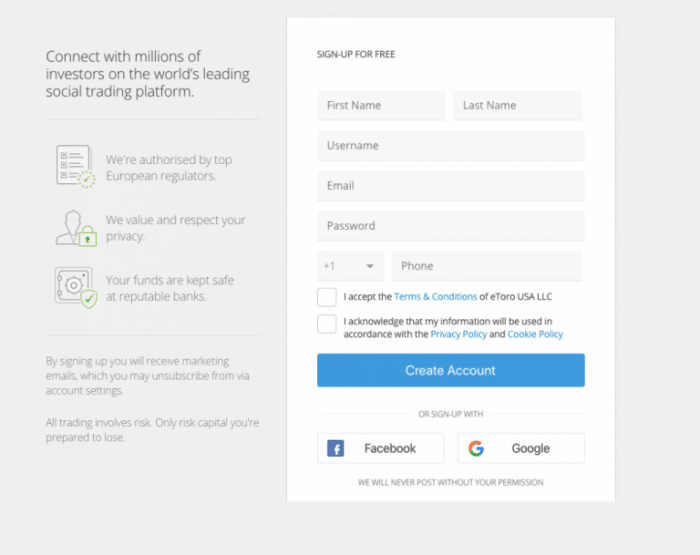

Step 1: Open an account

Create an account on the eToro website to get started. It only takes a few minutes and some personal information. Your full name, birth date, and home address are all included in this information. Your phone number and email address are also required. While it is not essential, it is also worthwhile to download the eToro trading app. As a result, as long as you have access to the internet, you’ll be able to buy and sell USDT from anywhere on the globe. The program is free to download from the eToro website and is accessible for both iOS and Android.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

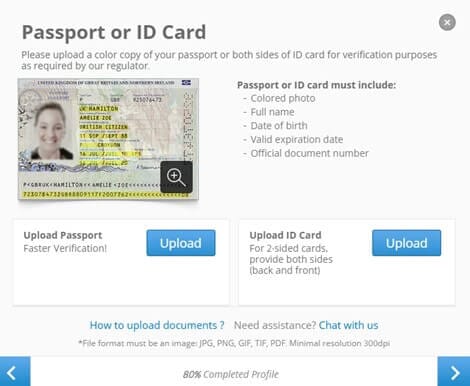

Step 2: Upload ID

After that, you must submit a copy of your ID to prove your identification. You must first complete the KYC (Know Your Customer) protocol before trading on eToro because it is a regulated site. This checking technique is divided into two stages. The first step is to confirm that you are who you claim to be. To do so, you must submit a copy of any government-issued identification, such as a passport, driver’s license, or visa. Following that, you must upload evidence of address, which can be a bank statement or a utility bill. When you upload the documents, eToro responds quickly and usually verifies your account within a few hours.

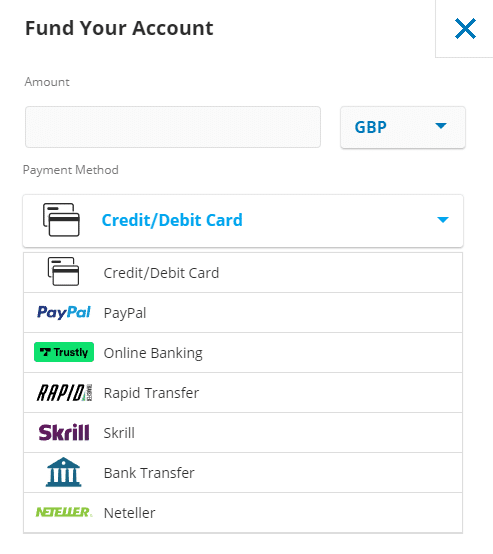

Step 3: Deposit funds

The third and last step is to make a deposit into your account. On eToro, the minimum deposit is $50. This can be accomplished in a variety of ways. To get started, you can fund your eToro account with a bank transfer or Skrill, and other e-wallets are also accepted. PayPal and credit card are not available for the FCA users. You can deposit money in a number of other currencies, including the US dollar, the British pound, and the Euro. There are no fees or charges when you put money into your account, and the funds appear virtually instantly.

Step 4: Buy Tether

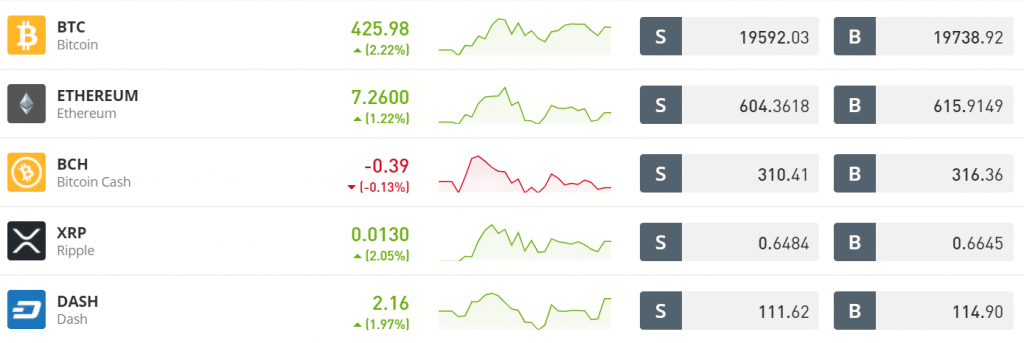

If you utilised an instant payment mechanism like a debit/credit card or an e-wallet, you can now buy USDT at eToro. Search for ‘Tether’ and click the top result, which appears to take you directly to the trading website. On the next screen, select the ‘Trade’ option. You’ll now be presented with a form similar to the one below. All that’s left to do now is write in the amount of USDT you want to buy. Make sure your account has at least $25 in it. You are free to invest any amount over this amount. Finally, click the ‘Open Trade’ button to complete your commission-free Tether investment. You won’t be able to do anything else unless you sell your investment. You may check the value of your Tether investment at any time by navigating to the ‘Portfolio’ section of your eToro dashboard.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Where to Buy USDT in 2025

There are several brokers that you can choose from in order to invest in Tether, and they each have their own set of advantages and disadvantages that makes them preferable to investors. Some of the top platforms that you should definitely consider in order to purchase Tether have been discussed below.

1. eToro – The overall best broker to buy Tether

eToro

delivers a user experience that has been perfected over 15 years to offer comfort, speed, and peace of mind to over 20 million consumers in 120+ countries. eToro, as one of the FCA, ASIC, and CySEC-regulated brokers, offers three primary types of flexible and zero-commission crypto trading:

- CFDs on cryptocurrency price movements are available on eToro (Contracts-For-Difference).

- You can also buy cryptocurrency on eToro and store it in your own crypto wallet. eToro offers its own cryptocurrency wallet, eToro Money, which you may use to store and transfer cryptocurrency.

- Many crypto pairings (where crypto is exchanged for fiat) and crypto crosses are available as CFDs (where crypto is traded against another crypto).

eToro has a well-deserved reputation as a social trading platform that is constantly expanding its customer base. In this regard, two services stand out. CopyTrader is an eToro feature that allows you to copy more experienced investors for free. With copy trading, you may evaluate other traders based on their performance and risk tolerance, and the software will automatically match their trades with the funds you’ve set aside. You can buy into one of a number of strategic investment portfolios, some of which are entirely crypto-based. All spread fees for buying in (and matching any later transactions) will be charged to you, but the copying service is free.

What types of orders are available on eToro?

For opening a trade, eToro offers the following options:

- Market order: This order allows you to buy or sell an asset at the best available price with an immediate execution when you click ‘Open Trade.’

- Out of hours order: A subset of the market order, this is placed when the market is closed and gets executed as soon as the market reopens or during extended hours trades.

- Limit order: This order is executed once the specified rate is reached, enabling you to capitalize on market price fluctuations.

For closing a trade, eToro provides:

- Stop Loss (SL): This instruction closes a trade at a predetermined rate or amount if the market moves against you, serving as a risk management tool to protect your investment and limit potential losses.

- Take Profit (TP): This instruction closes a trade at a specific rate when the market moves in your favor, ensuring that your profit is realized and added to your available cash balance.

eToro fees

Fee Amount Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- User-friendly platform with an easy-to-use interface

- Allows for copy trading and other social trading options

- Regulated by various agencies worldwide

- Provides cryptocurrency derivatives in certain areas

- No commissions on trades

- Provides a variety of other assets to trade on such as stocks, currencies, indices, and ETFs

- Provides access to a curated CryptoPortfolio managed by the eToro team

Cons:

- Not suitable for advanced charting or technical analysis

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Coinbase – The best Tether trading platform for maximum crypto assets

When it comes to reputation, Coinbase is possibly the most well-known bitcoin broker in the industry. This broker has garnered more than 35 million customers from more than 100 countries since its launch in 2012. The platform is also regulated by the Financial Conduct Authority, as it holds an Authorized Payment License (FCA). As a result, you should feel confident acquiring Tether from Coinbase. If you’re looking for a user-friendly platform to acquire USDT, Coinbase, like eToro, is a good choice. This is because the complete purchase process should take no more than 15 minutes and does not necessitate any prior knowledge of financial principles.

You can even start with small sums, with minimums varying depending on the payment method you pick. Payments can be made with a debit card or a bank transfer. The most significant disadvantage of Coinbase is that it is one of the most expensive ways to purchase USDT. Coinbase will take a 3.99% commission on debit card payments, whereas eToro would only take a 0.5% commission. Then there’s the 1.49% trade commission from Coinbase. There are no commissions to pay at eToro. Coinbase has institutional-grade security systems in place. The fact that 98% of its coins are kept in cold storage is at the forefront of this. The coins cannot be hacked by a third party since they are never connected to a live server. This broker is popular among customers because of its user-friendly interface and great customer service. Finally, unlike eToro, Coinbase allows you to withdraw Bitcoin to a personal wallet.

Coinbase fees

Fee Amount Crypto trading fee Commission, starting from 0.50% Inactivity fee Free Withdrawal fee 1.49% to a bank account Pros:

- Advanced charting platform with numerous technical indicators

- Hundreds of pairs supported

- Easy to use for cryptocurrency beginners

- Support for a large number of cryptocurrencies

- Opportunities to earn cryptocurrency

- Lower pricing available with Coinbase Pro

Cons:

- Charges up to 2% on credit/debit card deposits

- Customer service responses can be delayed at times

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

3. Binance – The best platform to buy Tether for day trader

Due to its daily trading volume, Binance is the world’s largest cryptocurrency exchange. In addition, the exchange has a sizable cryptocurrency offering. The Bitcoin exchange is also well-known for its low trading fees, which are as low as 0.1%, making it one of the finest places to invest in the Tether and use it to trade other cryptocurrencies. It’s also simple to use, allowing you to place an order in a matter of seconds. Binance provides a full picture of the crypto asset you want to trade by allowing you to view trading charts using its in-house tools or the TradingView integration.

Crypto swaps, financing, and derivatives trading are also available on Binance. Synthesized share tokens of publicly traded stocks like Tesla and bitcoin exchange Coinbase are also available. It is incredibly simple to trade on the Binance platform if you have never done so before. All you have to do is register an account and verify it with a valid photo ID. You’ll also have to make a face recognition test, which might be tedious at times. Binance accepts bank wire transfers, peer-to-peer (P2P), debit/credit cards, and e-Wallet providers such as PayPal for deposits. You can easily acquire Tether and swap it for other cryptocurrencies once you’ve made your deposit.

Binance fees

Fee Amount Crypto trading fee Commission, starting from 0.1% Inactivity fee Free Withdrawal fee 0.80 EUR (SEPA bank transfer) Pros:

- Advanced charting platform with numerous technical indicators

- Hundreds of pairs supported

- Very low commissions

- Supports fiat currency deposits

- Low fees, with additional discounts for using BNB

- Security measures are very tight and proven to be among the best in the industry

Cons:

- Charges up to 2% on credit/debit card deposits

- Customer service responses can be delayed at times

Your money is at risk.

4. Gemini – The best Tether trading platform for all experience levels

Gemini is one of the few lesser-known cryptocurrency trading platforms that stands out due to its suitability for traders of all levels of experience. This places it in the middle of eToro, which caters mostly to newbies, and Binance, which caters to day traders and those interested in technical analysis. Gemini offers a comprehensive set of services and features that make it an excellent choice for trading USDT. If you’re a newbie trader, for example, you can use their many guides and manuals to learn more about different coins and trading patterns that may present chances. At the same time, their Gemini ActiveTrader package, which gives many incentives and rebates for experienced traders, as part of their array of services for experienced traders.

Over 40 cryptocurrencies are available on the platform, which may be exchanged for both fiat currencies and other crypto pairings. However, the main benefit of using Gemini is the minimal minimum trade amount that you can use when trading with it. The minimum trade amount for each cryptocurrency available on the platform, including USDT, is the smallest amount that can be traded for that coin. This is beneficial for beginner traders who do not want to risk a significant quantity of money.

Gemini fees

Fee Amount Crypto trading fee Commission, starting from 0.5% Inactivity fee Free Withdrawal fee Free Pros:

- Available across all US states

- Cryptopedia available for beginner traders

- A wide variety of tools available for experienced traders

- Very high security and safety measures

Cons:

- Only allows CFD trading

- Higher fees than some other platforms

Your capital is at risk

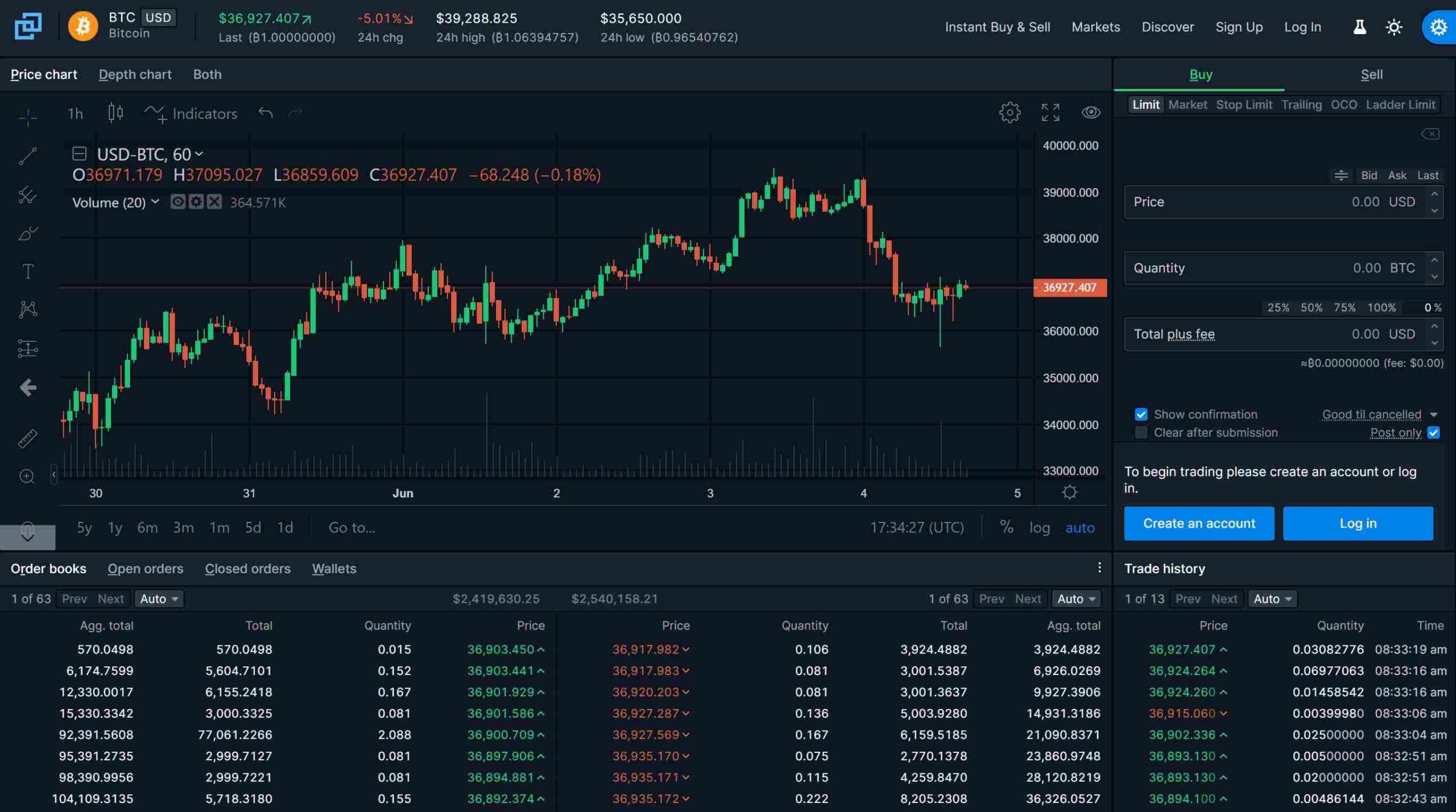

5. Bittrex – The best Tether trading platform for low minimum deposits

If you’re looking to get started with cryptocurrency trading through stablecoins such as Tether, but are afraid to do so due to the volatility and uncertainty that plagues the markets, Bittrex might be the solution to all your problems. For starters, the platform only requires a minimum deposit of $3, making it among the most suitable platforms to trade crypto with very low capital investment. As for the platform, it is state-of-the-art, boasting over 100 cryptocurrency options including most major and minor crypto pairs.

The security of the platform is also top-notch, as it allows you to easily add two-factor authentication to your account, making it harder for anyone to gain access to your account. They also keep a vast majority of the crypto stored on their platform under cold storage, and since it is never online, it cannot be hacked by malicious third parties. However, the platform is not free from its drawbacks. It does not have a lot of educational resources that you can use as a beginner to start trading through the platform, and it does not allow you to trade on margin.

Bittrex fees

Fee Amount Crypto trading fee Flat fee. 0.25% on all trades Inactivity fee Free Withdrawal fee Free Pros:

- Available across all US states except New York and Hawaii

- Very low minimum deposit

- Easy to deposit and withdraw funds into the platform

- Over 100 crypto pairs are available

Cons:

- No margin trading permitted

- Higher fees than some other platforms

Your capital is at risk

Why Buy Tether?

Given that the majority of mainstream interest in cryptocurrencies stems from price fluctuations, one could wonder what the point of a cryptocurrency that is based on a set price is. There are no pumps, no dumps, and no bubbles. Owning Tether is more akin to making a 0% interest deposit in a (very hazardous) bank account. So, why use Tether at all if it is riskier than ordinary cryptocurrencies and offers no financial gains? Tether is, in fact, a very helpful alternative to fiat currency for traders and investors. There are several compelling reasons for this:

Very low transaction times

Deposits and withdrawals of US dollars to and from foreign exchanges can take a long time. They take 1 to 4 business days to finish on average. Wait times may be significantly increased if the transaction occurs after banks have closed for the night, weekend, or holiday. Tether transactions, on the other hand, are processed in minutes. Because bitcoin traders frequently need to move cash quickly and take advantage of arbitrage opportunities, this benefit is considerable.

Lowest transaction fees

Transfers using SWIFT (Society for Worldwide Interbank Financial Telecommunication) are quite costly. They can cost up to $20 in fees, with an average of $30. Furthermore, if you use a fiat currency that isn’t supported by the exchange, the banks will charge you a foreign exchange conversion fee and a % on the transfer. Tether, on the other hand, has no transaction fees between Tether wallets.

Stability of prices

Cryptocurrencies are notoriously volatile, and swapping one risky currency for another adds a layer of complexity and danger to the equation. That is why a solid base currency is so important. Consider the following situation involving Bitcoin and Ethereum trade to see why:

- You exchange BTC for ETH.

- The value of ETH has increased by 10%.

- You want to sell your ETH for BTC to make a profit.

- Bitcoin plummets by 15% as the transaction is being executed.

Even if you were correct about ETH’s path, you would lose money due to the decline in BTC. When you use USDT, the price of Ethereum is your only worry.

How much does it cost to buy Tether?

Unlike other asset classes like equities and shares, the price of Tether is not determined by market forces. Instead, because USDT is tied to the dollar, its prices are influenced by the price of the dollar in relation to other currencies. Simply put, the price of the US dollar swings on a second-by-second basis due to constantly shifting demand and supply. As a result, when there is a lot of enthusiasm and positive feeling surrounding the US$, there will be more buyers in the market. The price of USDT will grow as a result of increased demand. Of course, if the opposite occurs, the value of the USDT will collapse. Our recommended broker, eToro, is currently offering $1 per USDT at the time of writing in January 2022.

How to buy Tether with PayPal

Many people wish to buy USDT with Paypal. Paypal is a very simple, safe, and convenient way to make online purchases that is faster than bank transfers and debit cards. Only a few brokers allow you to invest using an electronic wallet. Instead, they prefer to use debit cards and bank transfers.

Buying Tether Safely

Tether is the most widely used stablecoin in the world. As a result, you now have access to hundreds of cryptocurrency exchanges operated by third parties. With the exception of a few, all of these exchanges have one thing in common: they lack a regulatory license. As a result, there’s no guarantee that you’ll be able to get USDT in a secure manner.

Instead, there’s a good possibility you’ll be misled if you use an unregulated exchange. We constantly hear about platforms being hacked and users losing their assets, even if the exchange has good intentions. As a result, it’s crucial that the platform you use to trade Tether or any other cryptocurrency be regulated by Tier-1 regulators. The FCA, ASIC, and CySEC are examples of such organizations. Because all three govern eToro, it is the best place for you to put your money.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Risks of Buying Tether

However, there is significant confusion around Tether, notably in terms of whether every single Tether can be redeemed for a US dollar one-to-one. Tether’s detractors are still skeptical that its token is entirely backed by cash reserves; in the past, the company’s most outspoken critics have claimed that it was minting currencies out of thin air. If this is accurate, it would be a major issue.

The fear is that Tether, which has a market capitalization of nearly $60 billion, artificially inflates the price of Bitcoin. In 2018, academics John M. Griffin and Amin Shams claimed that Tether could be created “independent of investor demand,” suggesting that Tether’s production schedule was only consistent with a coin that was partially backed by reserves rather than completely backed.

“The actual story here is that cash now accounts for less than 3% of Tether’s reserves,” Amy Castor, a journalist who covers Tether issues, stated. “The reckoning will come when people want to cash out of bitcoin, and it dawns on them there is no real money in the system to back withdrawals because the markets were founded on silly money,” Castor said, accusing Tether of “creating money out of thin air.” The debate, however, has two sides. Tether has been criticized in the past, but Sam Bankman-Fried, CEO of crypto exchange FTX, has defended it by pointing out that USDT may be redeemed for US dollars. Tether’s critics are also frequently confronted with the counter-argument that Tether’s printing schedule is completely unrelated to Bitcoin’s price. In reality, as stated in a UC Berkeley research from April 2021, fresh Tethers have been produced both during Bitcoin bull runs and market falls.

Selling Tether

When it’s time to cash out your USDT, the procedure will vary depending on how you bought it and how you’re storing it.

If you wanted to buy USDT on eToro, for example, you’d do the following steps:

- You buy $500 worth of USDT on eToro with a debit card. This is what you use to buy other cryptocurrencies.

- eToro stores the USDT and other cryptocurrencies you purchase on your behalf. You can transfer your cryptocurrencies back to USDT if you’ve made a profit and they’re worth $2,000 each.

- You instruct eToro to sell the USDT, which it executes with a single click.

- The $2,000 is transferred into your eToro cash account, from which you can withdraw money using your debit card.

However, if you acquired USDT on a traditional cryptocurrency exchange, the cash-out method would be as follows:

- After acquiring USDT, you withdraw the funds to a private wallet.

- You’ll have to return the coins to the exchange when you’re ready to sell your USDT after converting your cryptocurrency positions to USDT.

- Then you’ll need to convert USDT to US dollars again.

- Finally, the monies are deposited into your bank account.

As you can see from the examples above, eToro is far more user-friendly. If you do it this way, you won’t have to worry about holding USDT in a private wallet. This, of course, means that you can withdraw your money whenever you want.

Selecting a Platform

The initial step in acquiring Tether involves selecting the right platform, which is the digital marketplace for your purchase. Numerous cryptocurrency exchanges are available, each offering unique features. Options include Binance, Kraken, Coinbase, Bitfinex, and many more.

Binance, a globally recognized platform, boasts high trading volumes and an extensive cryptocurrency selection. It caters to both experienced traders with advanced features and newcomers with a user-friendly interface. Binance is also known for its robust security measures.

Kraken, another reputable exchange, places a strong emphasis on security. It offers a variety of products like futures trading and margin trading, making it suitable for both new and experienced investors. Additionally, Kraken provides detailed guides to help users understand the trading process.

On the other hand, Coinbase is renowned for its user-friendly interface, making it a popular choice for cryptocurrency beginners. It offers a range of educational resources to help users better understand trading and is one of the few platforms with insurance coverage, enhancing security measures.

The Verdict

If you live in the United States and want to buy USDT, you have a variety of options. However, as we’ve mentioned throughout this tutorial, you should do some research into the platform’s legitimacy. This is the situation since a large portion of the cryptocurrency exchange industry works without a brokerage license.

This is why we recommend using an FCA-regulated site like eToro to trade. Tether can be purchased using a debit/credit card or an e-wallet in minutes. By investing as little as $25, you may avoid paying any trading commissions.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

FAQs

What is Tether?

Tether is a fiat currency-pegged stablecoin. Tether's most prevalent peg is to the US Dollar (ticker symbol USDT). One USDT is supposed to be exactly equivalent to one dollar—not a cent more or less.Who created Tether?

The precursor to Tether, originally named 'Realcoin,' was announced in July 2014 by co-founders Brock Pierce, Reeve Collins, and Craig Sellars as a Santa Monica based startup.What is the market cap of Tether?

The market cap of USDT, at the time of writing this article in January 2022, is $78.55 billion.Do I need a crypto wallet to buy Tether?

No, you do not need a crypto wallet in order to buy USDT. Usually, your trading platform will provide you with a wallet and will automatically store any cryptocurrencies you buy through it.Can I buy Tether in the US?

Yes, you can buy Tetherin the US through a variety of platforms such as Coinbase, Binance, and eToro.How much money do I need to buy Tether in the United States?

The amount of money you need to buy Tether will depend on the trading platform you use. For example, on eToro you only need $25 to buy 1 USDT.References:

https://coinmarketcap.com/currencies/tether/

Nishit Kumar Finance Writer and Analyst

View all posts by Nishit KumarNishit is a NGL Trader Analyst at Akari Trading. He has also worked as an analyst for Morgan Stanley and Onyx Commodities.

Before starting his career in finance, Nishit studied at the University of Warick where he was an active member of the Hedge Fund society. Due to his qualifications and experience, Nishit is considered an industry expert and enjoys writing content that could help traders to make informed decisions.

As well as writing, Nishit worked as Associate Editor for The Economic Transcript until 2021. He has also written for Newsweek and has good knowledge of current events that could affect the financial markets.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up