How to Buy Litecoin (LTC) in February 2026

There have been several trends in the cryptocurrency markets over the past few weeks, and the biggest among them being the fact that people have now begun to invest in cryptocurrencies beyond merely Bitcoins. This includes coins like Ethereum, Cardano, Ripple, and even Litecoin.

Coins that are not Bitcoins are called altcoins, and their market cap has been largely expanding over the past year or so. Among these, Litecoin is definitely an altcoin that is picking up steam and becoming more and more popular among investors and crypto enthusiasts. In this guide, we review the different brokers and peculiarities of Litecoin as a cryptocurrency.

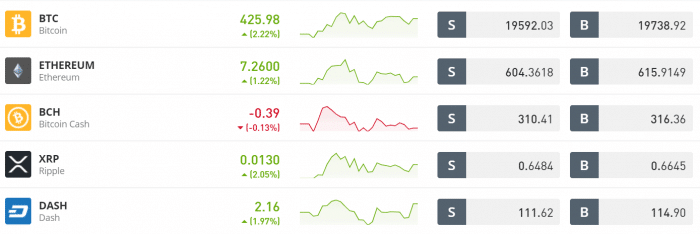

-

-

How to Buy Litecoin in 2026

As a summary of the steps that you can use to easily buy Litecoin if you do not wish to go through the entire article, this is what you need to do in order to buy Litecoin on eToro, the best platform overall to buy Litecoins:

- Open an account on eToro simply by heading over to their website and registering for an account via filling up a small form that asks for your contact details and lets you set up your login credentials.

- Upload a copy of your identity and address proof in order to verify your account is in compliance with the regulatory guidelines

- Deposit funds into your account through the use of either a credit/debit card, bank transfer, or an electronic wallet like PayPal.

- Buy Litecoin through their platform with a minimum deposit of as little as $25.

One of the most important decisions that you have to make when you decide to invest in Litecoins is the platform that you will be using for this purpose. Your choice of brokers is very important and has a direct impact on your profitability.

What is Litecoin?

Litecoin is a cryptocurrency that initially appeared in 2011. This makes it one of the industry’s oldest cryptocurrencies. Litecoin was designed by Charlie Lee to address the ‘deficiencies’ of its older sibling Bitcoin.

Simply put, this meant developing a speedier and more scalable digital payment network. Even back then, there were several issues with the Bitcoin technology that the other cryptocurrencies were aiming to improve on or fix, and this was one of them. In terms of the former, Litecoin can complete a fund transfer in 2.5 minutes against 10 minutes for Bitcoin.

Furthermore, while Bitcoin can only handle 7 transactions per second, Litecoin can process 56. The two cryptocurrencies are very similar in terms of their basics. Both, for example, are supported by blockchain technology, which is decentralized. This means that Litecoin is neither owned nor controlled by a single person.

Litecoin is also exchanged on public exchanges, similar to Bitcoin. This means that it has a real-world value that fluctuates based on supply and demand. As a result, if you purchase Litecoin, you are betting that its value will rise over time. Investing in a stock is analogous to this.

Best Exchanges To Buy Litecoin in 2026

1. eToro – The Overall Best Broker to Buy Litecoin US

eToro

is a well-known internet broker with a user base of over 13 million people. Those who have little or no experience investing online may find the site particularly enticing. This is due to the broker’s preference for simplicity. The entire platform has just been designed like a social media website, which means that even if you have very little experience dealing with investing and trading, you will not feel lost while trading through the platform or navigating it. In addition to this, eToro also has the functionality of a demo account that you can use in order to get familiar with the platform before you decide to invest real capital.

It only takes a few minutes to get started, it accepts a variety of handy payment ways, and investing is simple. eToro offers a wide range of asset classes to choose from when it comes to trading. This includes 16 of the most popular cryptocurrencies, such as Bitcoin, Ethereum, Ripple, and, of course, Litecoin. Stocks and shares from 17 US and international exchanges, as well as ETFs and CFD trading, are all available on the site. Whether you’re buying Litecoin, stocks, ETFs, or CFD instruments, eToro is a completely commission-free broker. There will be no transaction fees or monthly expenses that you will have to incur while trading through eToro. In addition to this, the platform also does not charge any deposit fees, and withdrawal fees are only $5 per withdrawal.

Because account minimums are low, the site is also suitable for people on a tight budget. For example, while a minimum deposit of $50 is required, the minimum Litecoin investment is only $25. Stocks and ETFs are slightly more expensive at $50, however, this is still a tiny difference when compared to other online brokers. eToro is a wonderful place to invest passively because of its low costs and low minimums. There are two ways to accomplish this. The Copy Trading function allows you to trade exactly like an eToro trader of your choice. To put it another way, if they put 3% of their portfolio into Litecoin, you’ll do the same. CopyPortfolios, on the other hand, is fully handled by the eToro staff. When it comes to payments, you can use a UK debit/credit card, e-wallet, or bank account to deposit and withdraw money. Finally, because eToro is authorized and regulated by the FCA, you won’t have any concerns about your safety. It also has ASIC and CySEC licenses as an added degree of protection.

eToro fees

Fee Amount Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- User-friendly platform with an easy-to-use interface

- Allows for copy trading and other social trading options

- Regulated by various agencies worldwide

- Provides cryptocurrency derivatives in certain areas

- No commissions on trades

- Provides a variety of other assets to trade on such as stocks, currencies, indices, and ETFs

- Provides access to a curated CryptoPortfolio managed by the eToro team

Cons:

- Not suitable for advanced charting or technical analysis

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

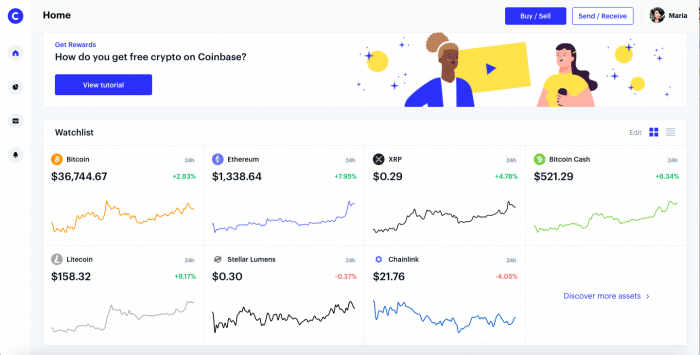

2. Coinbase – The Best User-Friendly Platform to Buy Litecoin

Coinbase

is one of the best cryptocurrency exchanges and one of the most trusted cryptocurrency brokers in the world. It is based in the United States and presently has over 35 million customers in over 100 countries.

Institutional-grade security procedures are also in place at Coinbase, to ensure that your money is protected and that your data is as safe as it can be. This includes storing approximately 97% of client cash in ‘cold storage,’ which means the crypto assets are never connected to the internet. This significantly minimizes the possibility of malpractice.

Coinbase is known for its user-friendly interface in addition to providing a safe, secure, and regulated option to acquire Litecoin. The platform is simple to use and does not require any prior investment knowledge. You can buy Litecoin either online or using the Coinbase app. With that stated, there is a tiny disadvantage to Coinbase in terms of its fees, which are on the high side. The platform, for example, charges a typical commission of 1.49%. When you buy Litecoin, you’ll have to pay this fee, and you’ll have to pay it again when you cash out. Given that the commission at eToro is 0%, so this is a significant difference.

Following the latest trends in crypto, Coinbase is also currently building a marketplace where you’ll be able to buy NFTs.

If you want to buy Litecoin with your debit card, the fees will be slightly higher. This is due to the fact that you will be charged a 4% all-in fee. For every $1000 you deposit, this means approximately $40 goes into fees. However, Coinbase is a highly used platform because of its trustworthiness, security, and user-friendliness, despite the fact that it is not the cheapest alternative on the market.

Coinbase fees

Fee Amount Crypto trading fee Commission, starting from 0.50% Inactivity fee Free Withdrawal fee 1.49% to a U.S. bank account Pros:

- Advanced charting platform with numerous technical indicators

- Hundreds of pairs supported

- Easy to use for cryptocurrency beginners

- Support for a large number of cryptocurrencies

- Opportunities to earn cryptocurrency

- Lower pricing available with Coinbase Pro

Cons:

- Charges up to 2% on credit/debit card deposits

- Customer service responses can be delayed at times

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

3. Binance – The Best Place to Buy Litecoin with a Credit/Debit Card

Binance is the world’s largest cryptocurrency exchange. Despite the fact that it was only created in 2017, it currently processes over $15 billion in daily trading. These figures are incredible, and they are essentially unmatched by any typical brokerage site. When it comes to purchasing Litecoin, you can use a debit or credit card. The card purchase will be handled immediately once you upload your passport or driver’s license. If you want to buy Litecoin right now, Binance is a good option. Binance charges a variable rate of 2% in terms of fees.

Again, at 2%, it’s a little on the high side, but it’s still less expensive than Coinbase. On the other hand, if you opt to use Binance to trade cryptocurrencies, the platform really shines. You will, for example, pay a 0.1% trading commission on every trade that you make. Even if you’re only risking a tiny amount, this makes it ideal for low-cost trading. Furthermore, Binance hosts hundreds of cryptocurrency pairs, making it an excellent venue for gaining access to less well-known digital assets aside from Litecoin.

Binance fees

Fee Amount Crypto trading fee Commission, starting from 0.1% Inactivity fee Free Withdrawal fee 0.80 EUR (SEPA bank transfer) Pros:

- Advanced charting platform with numerous technical indicators

- Hundreds of pairs supported

- Very low commissions

- Supports fiat currency deposits

- Low fees, with additional discounts for using BNB

- Has a top-rated NFT Marketplace

- Security measures are very tight and proven to be among the best in the industry

Cons:

- Charges up to 2% on credit/debit card deposits

- Customer service responses can be delayed at times

Your Money Is At Risk.

4. Gemini – The Best Litecoin Trading Platform for Every Experience Level

Gemini is one of the few lesser-known cryptocurrency trading platforms that stands out simply because it is suitable for every experience level. This puts it squarely between eToro, which is suitable primarily for beginners, and Binance, which is tailored towards day traders and those wishing to perform technical analysis. Gemini has a suite of services and features that make it a very suitable option that you can use to trade Litecoins with ease. For example, if you are a beginner trader, then you can make use of their various guides and manuals in order to better understand different coins and the trading patterns that could present opportunities. At the same time, their suite of features for experienced traders includes their Gemini ActiveTrader package, which provides several incentives and rebates for experienced traders.

The platform boasts over 40 cryptocurrencies, and it allows you to exchange them for both fiat currencies as well as other crypto pairs. The biggest advantage of using Gemini, however, is the low minimum trade amount that you can take advantage of when trading through it. For every cryptocurrency available on the platform, including Litecoins, the minimum trade amount is the lowest possible amount that can be traded for that cryptocurrency. This is useful for new traders who do not wish to risk a large amount of capital.

Gemini fees

Fee Amount Crypto trading fee Commission, starting from 0.5% Inactivity fee Free Withdrawal fee Free Pros:

- Available across all US states

- Cryptopedia available for beginner traders

- A wide variety of tools available for experienced traders

- Very high security and safety measures

Cons:

- Only allows CFD trading

- Higher fees than some other platforms

Your capital is at risk

6. BlockFi – Fastest Low Fee Trading Platform For Litecoins

If you’re looking for a platform that will allow you to trade Litecoins while paying some of the lowest fees of any other similar platform, then BlockFi is exactly what you need. Through this platform, you can trade by paying almost 0 trading fees, which makes it a very attractive option to trade cryptocurrencies. The platform is available across all US states, offers instant trades, and charges no commissions.

The platform describes itself as the best way to “bridge the gap between traditional finance and cryptocurrencies”. It does this through a combination of crypto-specific tools and standard technical analysis indicators. Through this, it allows you to shorten your learning curve across different asset classes, and make sure that you are able to use this knowledge while trading Litecoins.

Blockfi fees

Fee Amount Crypto trading fee Commission, starting from 0.7% Inactivity fee Free Withdrawal fee Rate-based withdrawal fee for some coins. Pros:

- 0% commission

- Highly regulated in the US, available across the country

- No monthly trading fees

- No deposit or withdrawal fees

Cons:

- Does not allow CFD trading

- Does not offer joint or custodial accounts

Your capital is at risk

Why Buy Litecoin?

At the moment, there are over 200 cryptocurrencies out there that you can invest in, and the thing is, most of these are pretty worthless. This means that there are very few cryptocurrencies that have any intrinsic value at all. If you are planning to risk your capital in order to invest in these cryptocurrencies, you need to do your research and be able to identify the coins that might be useful and actually have an intrinsic value to them. Below, we have discussed some of the reasons why we think Litecoin makes this cut and can be an extremely useful cryptocurrency to invest in.

Despite the fact that Bitcoin is by far the most popular and largest cryptocurrency in terms of almost every observable metric, Litecoin technology is actually better. Litecoin has the superior technology of the two, making it the finest cryptocurrency to invest in. This is for a variety of reasons. To begin with, Litecoin transactions are four times faster than Bitcoin transactions, as we briefly mentioned earlier. This implies you can send money to someone in 2.5 minutes, rather than 10 minutes. Not only are Litecoin transactions speedier, but the underlying blockchain can handle eight times the amount of data. As a result, the blockchain can process 56 transactions per second, whereas Bitcoin can only handle 7. As a result of the network being less congested, Litecoin transactions are cheaper.

In addition to this, partnerships are critical in the crypto world, and Litecoin harnesses this better than almost every other cryptocurrency out there. When a well-known institution expresses interest in a digital coin like Litecoin, for example, it lends credibility and legitimacy to the initiative. Additionally, depending on the type of cooperation, this could expand the digital coin’s real-world usage. This raises public awareness, which might lead to increased demand for cryptocurrencies. In the case of Litecoin, it has engaged in a variety of collaborations. For example, Litecoin sponsored a major UFC event in late 2018. Since then, Litecoin has been designated as the ‘official cryptocurrency’ of the Miami Dolphins of the National Football League. Litecoin has also purchased a 30% share in a tiny German bank, along with other partners. There are other collaborations, including NordVPN, Glory Kickboxing, and Travala. All of these lend the project credibility and enable it to gain legitimacy among traders who might not be very aware of what cryptocurrencies do or what Litecoin is.

Lastly, one of the most appealing advantages of purchasing Litecoin is its high liquidity. This means you can enter and exit the market at any time, so you don’t have to worry about not being able to get your money when you need it. This is especially true in the case of Litecoin, which is a multi-billion-dollar asset class. As a result, you’ll never have trouble finding a buyer when it’s time to cash out. You can sell your Litecoin investment on eToro 24 hours a day, 7 days a week. The cash will be available for withdrawal as soon as you complete this step.

How Much Does It Cost to Buy Litecoin?

Market forces determine the price of Litecoin. This is the same as investing in stocks and shares. That is to say, as more people become interested in Litecoin, its value will rise naturally. However, if the market sentiment is deteriorating, the price of Litecoin will deteriorate as well. At the time of writing this article in January 2022. 1 Litecoin will cost $148.

How to Buy Litecoin with PayPal

Paypal is accepted by only a few Litecoin brokers and exchanges. This is due to the fact that the e-wallet provider is strictly regulated, which means it must conduct checks on cryptocurrency platforms before allowing them to utilize its payment mechanism. Fortunately, one broker in particular not only accepts Paypal deposits but also allows you to buy Litecoin without paying a commission. That’s eToro, an online broker with more than 13 million customers. To do this, all you have to do is create an account and choose Paypal as your preferred deposit method. After that, a pop-up box appears, prompting you to input your PayPal login details. After you confirm the transaction, the funds will be transferred to your account, and you will be able to purchase Litecoin!

How to Buy Litecoin with Bitcoin

In the vast majority of circumstances, Litecoin is purchased using a common payment method. Using a debit/credit card, an e-wallet, or a bank account transfer is simple for beginners. If you already own a cryptocurrency like Bitcoin, though, you won’t need to use a traditional payment method. On the contrary, you can easily convert your Bitcoin to Litecoin. Using a trustworthy bitcoin exchange is the most effective way to do this. Coinbase and Binance are two popular solutions in this regard. Both platforms accept Bitcoin as a form of payment.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Buying Litecoin Safely

With a market capitalization of over $10 billion, Litecoin is a top-10 cryptocurrency. As a result, hundreds of third-party cryptocurrency exchanges now provide you with access. However, with the exception of a handful, these exchanges all have one thing in common: they don’t have a regulatory license. As a result, you can never be certain that you will be able to buy Litecoin safely.

Instead, there’s a good possibility you’ll be cheated if you choose an unregulated exchange. Even if the exchange has excellent intentions, we read about platforms being hacked and users losing their money all the time. Therefore, it is of the utmost importance that the platform you choose in order to trade Litecoins or any other cryptocurrency is regulated by Tier-1 regulatory agencies. This would include agencies such as the FCA, the ASIC, and the CySEC. eToro, luckily, is regulated by all 3, making it the best choice for you to invest your funds.

Risks of Buying Litecoin

Litecoin, despite all its advantages and intrinsic value, is still a cryptocurrency and is therefore subject to a higher level of volatility and risk than most other asset classes. Therefore, if you are planning to trade Litecoins, there are several risks that you need to be aware of and keep in mind. Some of these risks are general risks that plague the entire cryptocurrency market, whereas some are more specific to Litecoin itself. These have been discussed below.

Most crypto platforms are unregulated

The great majority of exchanges that handle Litecoin purchases are unregulated, as we briefly noted previously. The trouble is that as a novice investor, you may not realize this. In the end, if you put funds into an exchange that does not have a license, your money is in danger. This is why, before opening an account – and especially before making a deposit – you should look into the platform’s regulatory status. Most websites will disclose which regulators they are authorized by if you scroll down to the bottom of the page. It’s a positive sign if you see an FCA license number, for example.

The real-world applications of Litecoin are bleak

When it comes down to it, you must assess what Litecoin has to offer in terms of real-world applications. Yes, it is a decentralized payment network that allows for quick, low-cost, and secure transactions. However, it is exceedingly improbable that Litecoin will ever become widely used. On the contrary, if cryptocurrencies do become a medium of exchange in the future, Bitcoin is likely to take the lead. It’s also worth mentioning that, while the Litecoin blockchain outperforms Bitcoin, there are significantly more advanced blockchains in the industry. Ripple transactions, for example, take less than a second to complete, while Litecoin transactions take 2.5 minutes. Ripple can process 1,500 transactions per second, whereas Litecoin can only handle 56. As a result, even if Litecoin becomes ubiquitous, it currently lacks the technology to support large-scale usage.

Selling Litecoin

The method of selling Litecoin will vary depending on whatever trading platform you use. For example, on eToro, you may just go to your portfolio and click on sell. After you’ve decided on the quantity and type of order you want to place, all you have to do now is click place order, and your cryptocurrencies will be converted into fiat currency. If you use a single cryptocurrency exchange, on the other hand, you will have greater possibilities. You might want to change your Litecoin into other cryptocurrencies like Bitcoin, Etheruem, or Binance Coin, for example. These cryptocurrencies will subsequently be kept in your wallet once you’ve completed this.

Best Way to Buy Litecoin – eToro Tutorial

As mentioned in the review above, the best platform for you to be able to buy Litecoins is easily eToro. The good thing is that setting up an account on eToro only takes 10 minutes and the process involved just 4 steps, which have been discussed below.

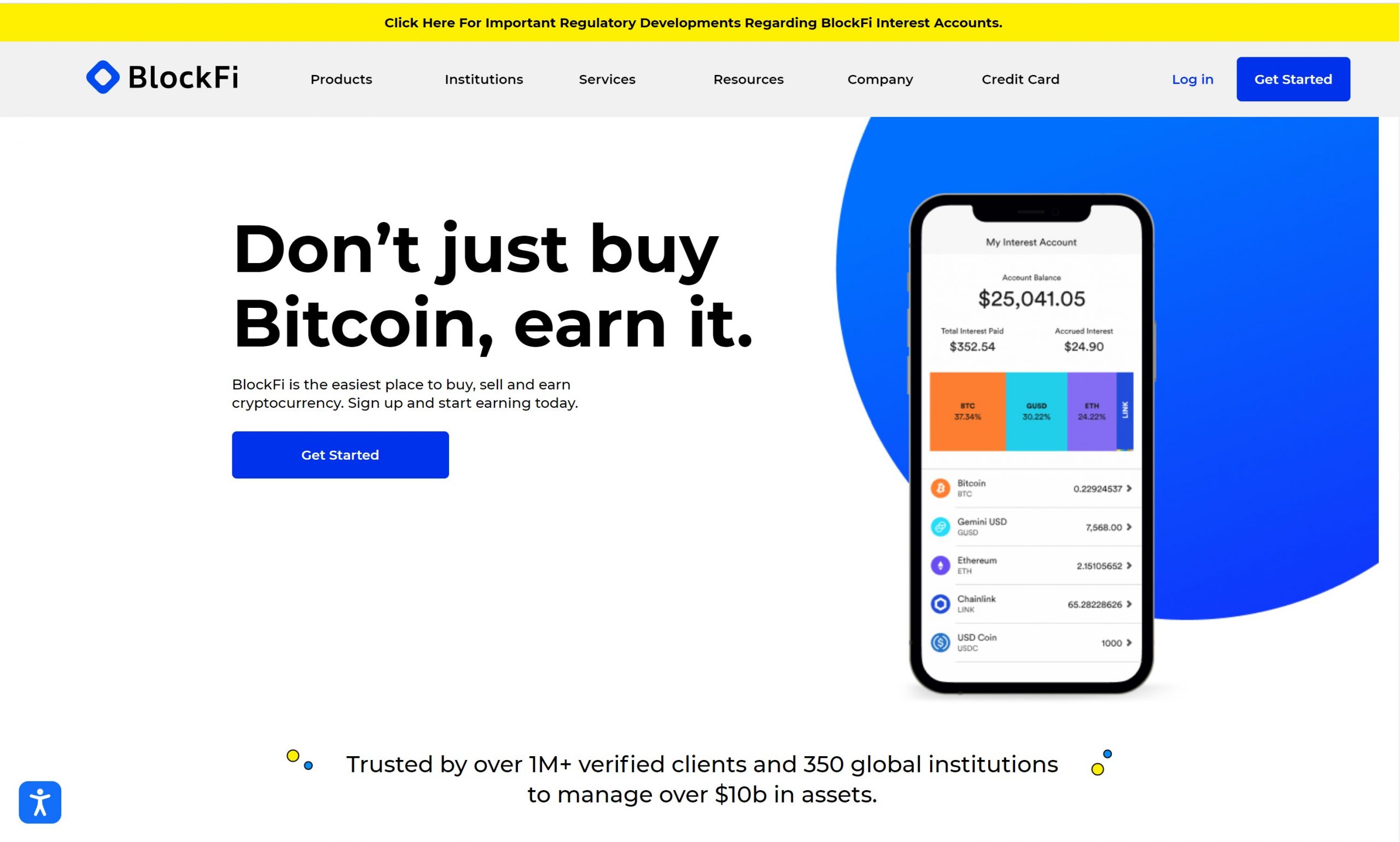

Step 1: Open an Account

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

The first step is to go to the eToro homepage and click on “Join Today.” Then you’ll be prompted to complete a brief form that requests your contact information and requires you to set up your login credentials. For simpler sign-ins and to avoid having to remember your username and password, you can also sign up using your Facebook or Google account.

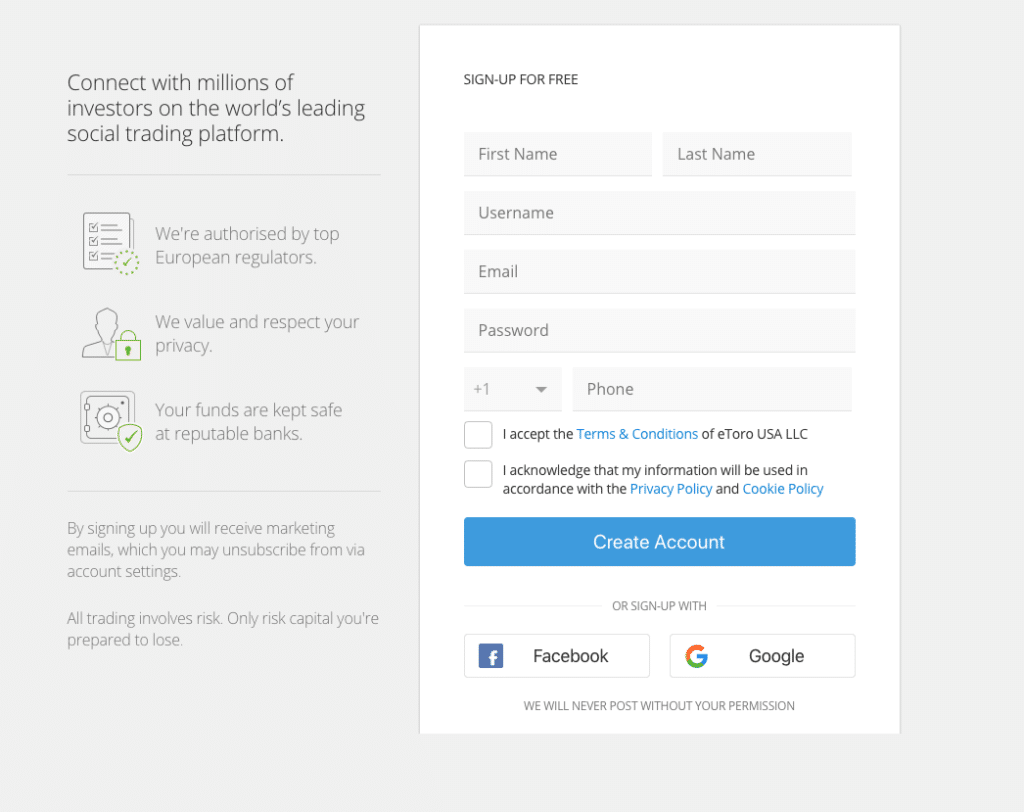

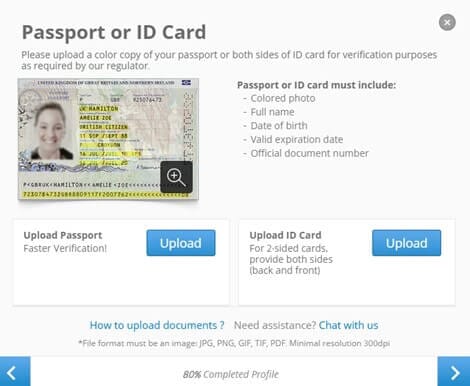

Step 2: Upload ID

You must then authenticate your identity by submitting a copy of your identification. Because eToro is a regulated site, you must first go through the KYC (Know Your Customer) process before you can trade. There are two components to this checking process. The first step is to confirm your identity. You can do this by submitting a copy of any government-issued identification, such as a passport, driver’s license, or visa. The next step is to provide proof of address, which you can do by uploading a bank statement or a utility bill.

After you’ve uploaded the documents, eToro responds quickly and usually verifies your account within a few hours.

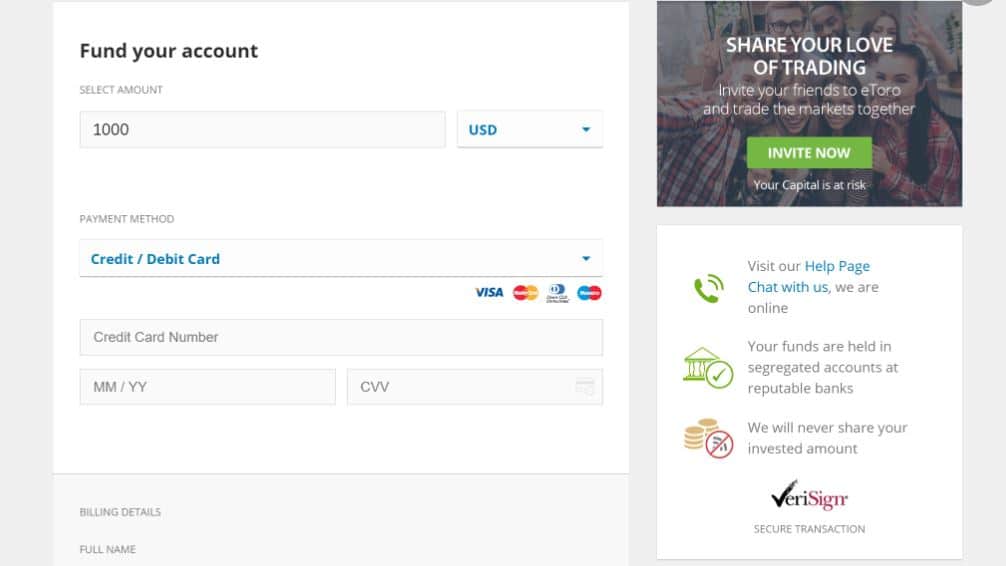

Step 3: Deposit Funds

The third and last step is to make a deposit into your account. On eToro, the minimum deposit is $200. This can be accomplished in a number of ways. To begin, you can fund your eToro account with a bank transfer or credit/debit card. They also take PayPal and Skrill, among other e-wallets. You can also add funds in a variety of currencies, including USD, GBP, and EUR. There are no fees or charges for depositing money into your account, and the funds appear virtually instantly.

Step 4: Buy Litecoin

The final stage is to start trading Litecoin. Simply type Litecoin or LTC into the search field, input the amount you want to buy or sell, and click the order button.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Conclusion

If you live in the United States and want to buy Litecoin, you have a lot of options. However, as we’ve emphasized throughout this tutorial, you should spend some time researching the trustworthiness of the platform you’ve chosen. This is due to the fact that a large portion of the cryptocurrency exchange industry operates without a brokerage license.

This is why we recommend using an FCA-regulated platform such as eToro. When using a debit/credit card or e-wallet, you can purchase Litecoin in minutes. You can also spend as little as $25 and avoid paying any trading commissions.

eToro – Best Crypto Exchange to Buy Litecoin in the US With 0% Commission

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

FAQs

Who created Litecoin?

Litecoin was created by a computer scientist, Charlie Lee, in 2013.What is the market cap of LTC?

The LTC market cap, as of the time of writing this article in January 2022, is $10.28 billion.Do I need a crypto wallet to buy Litecoin?

No, you do not need a crypto wallet if you choose to buy Litecoins through CFD platforms such as eToro. However, buying actual Litecoins through a wallet means that you will be able to transfer cryptocurrencies between platforms.Can I buy Litecoin in the US?

Yes, you can buy Litecoins in the US through any established cryptocurrency trading platforms such as eToro, Binance, or Coinbase.How much money do I need to buy Litecoin in the United States?

The amount of money you need to need to buy LTC will depend on the minimum balance requirements associated with your platform, however, in general, it can be as low as $100.Nishit Kumar Finance Writer and Analyst

View all posts by Nishit KumarNishit is a NGL Trader Analyst at Akari Trading. He has also worked as an analyst for Morgan Stanley and Onyx Commodities.

Before starting his career in finance, Nishit studied at the University of Warick where he was an active member of the Hedge Fund society. Due to his qualifications and experience, Nishit is considered an industry expert and enjoys writing content that could help traders to make informed decisions.

As well as writing, Nishit worked as Associate Editor for The Economic Transcript until 2021. He has also written for Newsweek and has good knowledge of current events that could affect the financial markets.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up