How to Buy HEX in February 2026

New projects and technological improvements are constantly coming to the cryptocurrency market, thanks to Bitcoin and Ethereum. At the end of 2019, HEX (HEX) was launched as an ERC-20 token. The HEX network aims to replace traditional certificates of deposit with a store of value. Investors interested in decentralized finance may find HEX an affordable and intriguing asset.

While HEX is a complete project, it is a team effort. Moreover, its low price may attract investors. As a result, cryptocurrency investments are easier than ever. In this review, you’ll learn how to buy HEX.

-

-

Where to Buy HEX in 2026

- eToro: eToro is a popular broker that is regulated in several jurisdictions around the globe, including the FCA, ASIC and CySEC. The platform supports 25 cryptocurrencies as well as stocks, forex, ETFs, commodities, and indices. Crypto traders can store their crypto in the eToro Money Wallet, which can be used to transfer tokens to third-party platforms. As well as traditional trading, eToro provides social trading features, smart Portfolios and copy trading.

- Binance: Binance is an established centralized exchange that facilitates the trading, swapping, lending and staking of crypto tokens. The platform is built on the Binance Smart Chain network and uses blockchain technology to verify and secure transactions. All data is protected by encryption. There are over 350 assets available to trade on the exchange, and users can benefit from high liquidity.

- Coinbase: Coinbase is one of the largest crypto exchanges that offers over 200+ crypto assets, including HEX. Unlike eToro, Coinbase only offers crypto trading and does not cater to traditional stocks and shares. This means that the platform offers a range of crypto trading features that you may not find on multi-asset brokers. This includes staking, yield farming and NFTs. Users can store their tokens in the Coinbase wallet, which can be easily connected to other decentralized applications.

- Kraken: Kaken is a user-friendly crypto exchange with excellent functionality and a good range of tokens. Users can take advantage of low crypto trading fees as well as helpful features such as real-time data and expert market insight. There are over 200 tokens available on Kraken, and you can trade with as little as $10.

- Crypto.com: Crypto.com is used by more than 80 million traders around the globe. It is a trusted platform that caters to cryptos and NFTs. Crypto.com is also committed to adhering to regulatory compliance, although crypto assets themselves are not regulated. Crypto.com also offers an exclusive crypto card, which makes it possible to use your crypto to make purchases.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

What is HEX?

That is the first blockchain equivalent to traditional certificates of deposit (CDs), which financial institutions worldwide use. HEX was launched on December 2, 2019, as a smart contract based on the ERC-20 protocol. A certificate of deposit (CD) is a type of deposit offered by banks and other financial institutions. A buyer agrees to place a lump-sum deposit into the bank’s custody. In exchange for an agreed-upon interest rate, investors will leave their deposits untouched for a number of years before withdrawing their money.

Token holders can stake their HEX tokens in exchange for a share of the following upcoming coin minting as part of the HEX smart contract. The TruthEngine technology developed by HEX rewards users for staking more of their tokens over a longer period, punishing them if they withdraw them before the agreed-upon deadline. Unlike many other smart contracts, two independent security agencies have reviewed the HEX smart contract independently.

The HEX platform has seen an approximate return on investment of 3,855% since its launch in December 2019. On May 11, 2020, the token reached an all-time high price of $0.049, a record price.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Why Buy HEX?

According to the current market cap, HEX is currently the 204th largest cryptocurrency. Unfortunately, only a few select exchanges offer this small cryptocurrency. As a result, HEX is an extremely volatile offering that can reach $0 at any time. Therefore, HEX (or any other minor altcoin) should only make up a small percentage of your portfolio if you decide to invest.

How much does it cost to buy HEX?

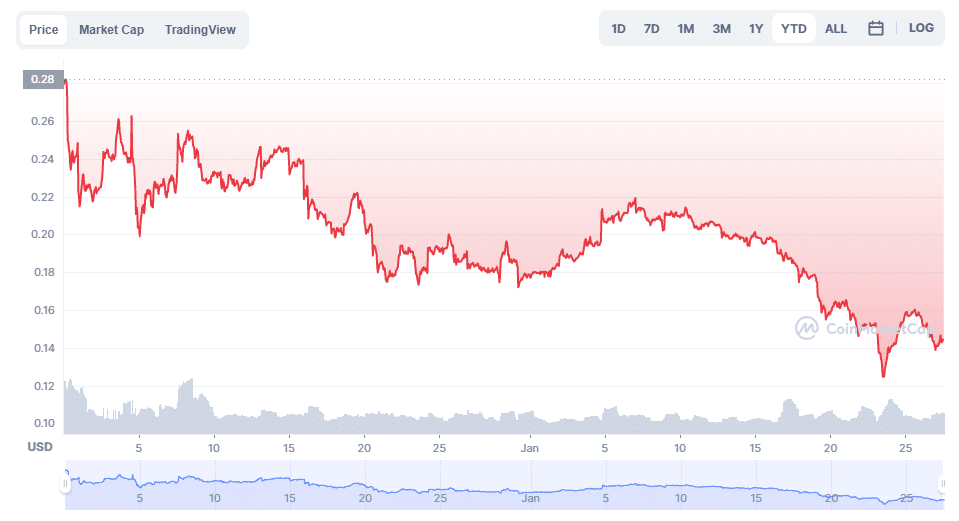

Cryptocurrency markets are notoriously volatile. When trading smaller cryptocurrencies such as HEX, it’s not uncommon to see major price fluctuations daily. As a result, it is crucial to monitor how the market is doing each morning before investing. As of the time of writing, according to CoinMarketCap, HEX is trading at $0.004559, and it has a market capitalization of $790,529,890.

How to buy HEX with Bitcoin

HEX can also be purchased using Bitcoin on some cryptocurrency exchanges. You can fund your trading account with Bitcoin instead of a bank account or credit card. To fund your HEX trade, you will need to link your Bitcoin wallet to your exchange account.

Risks of Buying HEX

Buying HEX has some risks as far as cryptocurrency is concerned.

One of the biggest risks is the potential for loss of money. But, on the other hand, you may be able to sell it for less than you paid for HEX if the coin’s popularity fades.

Another risk is that HEX becomes hackable. As with other cryptocurrencies, HEX uses the same underlying blockchain technology, which is very secure. However, you are taking a risk any time you invest in a decentralized currency, such as HEX.

As a final point, it is always possible for your cryptocurrency exchange to be hacked or go out of business. However, owning your crypto wallet doesn’t pose a huge problem since you control your coins. Additionally, if you use an FCA-regulated broker, any cash in your account will be protected by the Financial Services Compensation Scheme for up to $85,000.

Buying HEX Safely

The first step in purchasing HEX is to open an account with a brokerage that supports the purchase and sale of HEX. Unfortunately, there are limited options to purchase HEX directly with fiat currency if you live in the United States. In addition, HEX is currently available only on smaller exchanges, which are more likely to be hacked.

When you decide where and how you want to trade HEX, it’s a good idea to open an off-chain wallet to store HEX. You can use a cryptocurrency wallet, a physical device, or an application to store your tokens. There are two main categories of crypto wallets:

A hardware wallet, also known as a cold storage wallet, is a physical device that works using the same mechanism as a flash drive. To transfer tokens to an offline wallet address, you must connect your hardware wallet to your computer via Bluetooth or USB. Tokens stored in hardware wallets tend to be more secure, but they hold fewer types of coins and tokens.

Software wallets: Also called “hot storage” wallets, they store your tokens and coins on an online wallet. Wallet software isn’t as secure as hardware ones, but it’s free, and it usually holds more types of assets than hardware wallets. As a result, new investors or those who need to store only a small amount of crypto can benefit from them.

Make your purchase once your account has been opened and your wallet has been selected. First, explore your broker’s platform and the types of orders you can use to purchase HEX. Depending on the broker you choose, you might have access to dozens of order types that will affect the price at which you execute your order.

Finally, your broker will fill the order at the price or under the conditions you specify when you submit your order. In most cases, your broker will notify you by email or in-app message when your order is complete.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

A Step-by-Step Guide on How to Buy HEX in 2026

HEX Crypto coin has not yet been added to many trading platforms’ lists, but you can always buy some crypto, transfer them to your wallet, and then purchase it in exchange on a platform that offers it. The best option for you is to buy cryptos here on our site and then exchange them for HEX later.

1. eToro – Overall best crypto trading platform

We recommend eToro as our top pick for crypto trading platforms since it not only offers crypto but also allows users to invest in stocks, ETFs, indices, commodities, and more. Moreover, this platform is recommended for beginners since its ease of use, intuitive nature, online social activities, and educational features make it ideal for getting started.

Cryptocurrencies have become easy for beginners to invest in, and there are currently more than 40 cryptocurrencies to choose from. Unfortunately, HEX has not been listed yet. On the other hand, new cryptocurrencies are also coming out regularly; for that reason, it might be possible that HEX will be listed during the current year.

Before you begin trading on eToro with live equity, it’s a good idea to try the demo account feature before you decide to go live trading. It is only $10 to open an account with eToro, and your deposit can be made with a debit or credit card of your choice or with many e-wallet options available today.

eToro fees

Fee Amount Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- Bank transfers and debit/credit cards accepted

- Buying bitcoins is commission-free

- There is a deposit of $10 that needs to be made

- You can choose from over 2,400 global shares and 250 ETFs

- CFDs can also be traded if you want

- There is an online community for copy-trading

- Licensed by FCA, ASIC, and CySEC

- Approval by the SEC and FINRA

Cons:

- Fees of $5 for withdrawals

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Binance - Best crypto exchange for new coins

Among the best places to trade and invest in new cryptocurrencies is Binance, a crypto trading platform with a huge selection of 500 cryptocurrencies and virtual tokens.

In addition, the platform's member team stays abreast of the latest trends and upcoming coins so that users can invest their money

early, when they are still available. The result is that traders and investors on the platform have access to extremely high leverage levels.

There is a minimum deposit of $20 when you use a credit or debit card. In addition, you are required to spend at least $10 per trade when you are executing a trade, so you should be spending at least $10 when executing a trade.

Binance fees

Fee Amount Crypto trading fees Commission, starting from 0.1% Inactivity fee Free Withdrawal fee 0.80 EUR (SEPA bank transfer) Pros:

- There are currently over 100 cryptos available

- Trading fees are low compared to other exchanges

- You can use debit/credit cards and bank transfers

- Cryptocurrency is currently buzzing with activity

Cons:

- Beginners should not invest

- Credit and debit cards currently have high fees

Your money is at risk.

3. Coinbase - Largest cryptocurrency exchange in the U.S

Since 2012, Coinbase has been operating as the largest cryptocurrency exchange in the U.S. With the Coinbase platform, traders and investors have the opportunity to trade and invest in a wide variety of cryptocurrencies.

Coinbase is one of the easiest places to trade cryptocurrencies because it is user-friendly and offers an easy-to-use interface. Moreover, its simple sign-up and investment process was designed especially for beginners to make the whole process as easy as possible.

To begin trading with Coinbase, there is no minimum deposit to make, but the minimum purchase amount is $2 per order to purchase cryptocurrencies.

Coinbase fees

Fee Amount Cryptocurrency trading fees Commissions starting at 0.50% Fee for inactivity It's free Fees for withdrawals 1.49 % to an account in the U.S. Pros:

- Both new and experienced users can use the simple interface.

- Among the most liquid exchanges, Coinbase runs quickly

- Coinbase supports a wide range of altcoins

- There is a low requirement for balance in the workplace

Cons:

- The fee schedule is a very complex one

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

4. Kraken – One of the largest cryptocurrency exchanges to trade

With over 50 cryptocurrencies to choose from, Kraken is one of the oldest and first cryptocurrency exchanges to exist.

Having been launched ten years ago, Binance has been one of the world's biggest exchanges and has been used by several cryptocurrency investors since then.

As well as allowing you to invest in a wide variety of cryptocurrencies and pairs, Kraken also enables you to stake your cryptocurrency and earn interest in it. In addition, you will be able to deposit as little as $10 with Kraken, and their customer service department is always on hand to help with any questions or issues you may have.

Kraken fees

Fee Amount Crypto trading fee Commission, starting from 1% per trade for sellers. Free for buyers Inactivity fee Free Withdrawal fee According to the currency withdrawn. 0.0005 for BTC Pros:

- A charting platform that integrates multiple technical indicators

- There are 66 pairs and futures available

- Beginners will have no problem understanding the platform

- The possibility of margin trading exists

- Staking cryptocurrency to earn cryptocurrency

- Their prices are lower than their competitors

Cons:

- Withdrawals and deposits are limited

- Customers may have to wait a little while for a response from the service

Your money is at risk.

5. Crypto.com - Fast and secure cryptocurrency exchange

Crypto.com was established in 2013 and is one of the best cryptocurrency exchanges on the web when it comes to security and speed. A strong marketing and development team is at its disposal to facilitate its rapid growth.

The Crypto.com application not only allows users to store, buy, and store cryptos, but it also offers a DeFi wallet, which allows users to earn a yield on their cryptos while storing them in the app. In addition to the exchange for HEX, users can still purchase cryptos supported on the platform, such as CRO, which is also available on the platform and the exchange for HEX.

As a result, if you want to purchase HEX through Crypto.com, you will need first to purchase crypto and then store it on the wallet of crypto.com to proceed with purchasing HEX.

Crypto.com fees

Fee Amount Crypto trading fee 0.04% maker and taker fees Inactivity fee Free Withdrawal fee According to the currency withdrawn. 0.0004 for ETH Pros:

- Provides support for more than 250 cryptocurrencies

- Staking stablecoins on the platform gives 14% annual returns

- Get up to 8% back on your purchases with the Crypto.com Visa Card

- The NFT marketplace is now available

- DeFi is integrated on the site in multiple ways

- Transparent and competitive fee structure with discounts

- Develop an ecosystem for cryptocurrencies

Cons:

- If you don’t use CRO, you’ll pay more

- Discounts on trading fees are hard to find

Your money is at risk.

HEX Trading Platforms Fees

Platform Crypto trading fee Inactivity fee Withdrawal fee eToro Spread, 0.75% for Bitcoin $10 a month after one year $5 Binance Commission, starting from 0.1% Free 0.80 EUR (SEPA bank transfer) Coinbase Commission, starting from 0.50% Free 1.49% to a US bank account Kraken Commission, starting from 1% per trade for sellers. Free for buyers Free According to the currency withdrawn. 0.0005 for BTC Crypto.com 0.04% maker and taker fees Free According to the currency withdrawn. 0.0004 for ETH Selling HEX

Your tokens will appear in your wallet on the exchange if your broker can fill your order according to your specifications. There are two options here:

Store your tokens in your wallet: If you plan to hold them for a longer period, you should move them immediately from the exchange to your private wallet. That increases your level of security and allows you to monitor your investment's value over time. In addition, your tokens can be converted to an intermediary currency or stablecoin once you decide to cash out.

Actively trade your tokens: You can take advantage of short-term price changes by trading daily or weekly if you decide to become an active investor. In view of HEX's volatility, you might be able to profit from day-to-day price movements with this strategy.

When you become an active investor, you'll need a platform that's responsive and intuitive. Check out some of our favorites above.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

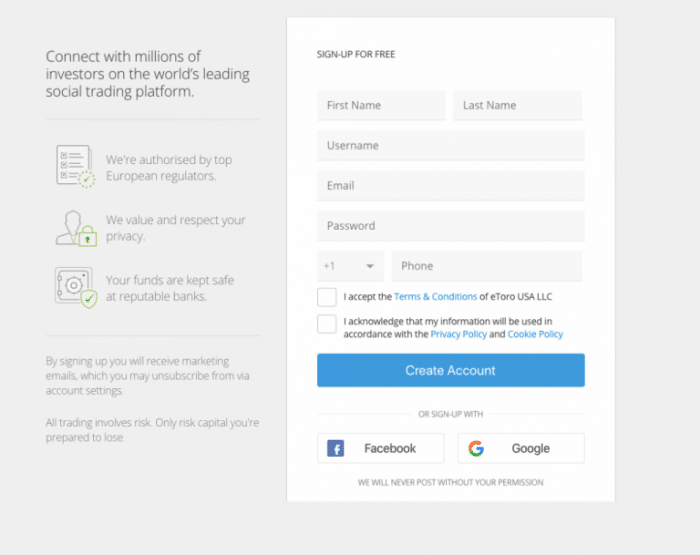

Best way to buy HEX – eToro tutorial

Online exchanges are the easiest way to purchase HEX. However, as HEX is relatively new and still trying to gain traction, it is unavailable for all major brokerages. In addition, you can use a regulated exchange such as eToro to buy crypto and then exchange it in another exchange such as Unisawp, where it is listed. Still, the ease with which eToro manages your crypto makes it your best option.

Step 1: Open an account

As soon as you click the “Join Now” button in the center of the screen, you will be taken to the eToro website and asked to register for a trading account and enter the following details:

- Full name

- Nationality

- DOB

- Address

- Contact Information

- Password and Username

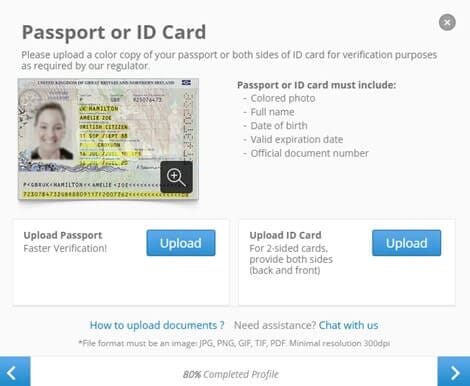

Step 2: Upload ID

To eToro will ask for a copy of your driver’s license or passport to comply with government regulations. Utility bills or bank statements will also be required to verify the address. After these documents are uploaded, the address will be verified automatically.

Step 3: Deposit funds

To open an account with eToro, a minimum deposit of $10 is required, which can be deposited in any of the following ways:

- Debit and credit cards

- PayPal

- Skrill

- Direct Bank Transfer

- Neteller

eToro does not charge fees for deposits. Therefore, it is less expensive than some of its key competitors, such as Coinbase, which charges 3.99 percent when purchasing Bitcoin with a debit card.

Additionally, US residents who deposit funds via USD-backed payment methods do not incur transaction fees. The minimum deposit for American residents is $10.

There are no direct HEX purchases on eToro. You must first purchase Bitcoin before you can purchase HEX. Bank transfers are the only deposit method that does not credit your account instantly.

Step 4: Buy HEX

By this point in our step-by-step guide, your eToro account should already be funded. You can now purchase HEX. A visitor to HEX’s website can easily find out how to join the investor group. Unswap is a small decentralized exchange where you can purchase the currency.

You need to type the amount in the ‘Amount’ box ($25 minimum). After that, Unisawp allows you to purchase HEX with Bitcoin.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Is Hex a Good Investment?

According to our experts, it is not clear whether HEX coin is a good investment or not. When deciding if one should invest in HEX, they may consider its history first. Before buying any HEX tokens, you may want to consider:

Controversy over scams. A number of commentators have criticized HEX, claiming it's a scam or borderline Ponzi scheme. As a result, this project should be approached with extreme caution, despite the HEX website having a section dedicated to dealing with scam claims.

Availability. HEX was available on more than 20 exchanges at the time of writing, but it was not listed on any of the world's largest crypto exchanges (in terms of trading volume). As a result, the future value of HEX may be affected by this.

In July 2023, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Heart, accusing him of failing to register HEX, PulseChain, and PulseX as securities and defrauding investors about where their money went.

The lawsuit alleges Heart raised over $1 billion from investors through unregistered securities offerings and misappropriated at least $12 million of investor funds to purchase luxury goods. In November 2023, the SEC said it was having issues serving Heart with the lawsuit's complaint, a procedural step necessary for the case to proceed in court.

HEX Price Prediction

In the opinion of Mikhail Karkhalev, the HEX project is a logical continuation of the growth of the DeFi sector in the crypto market. According to him, the desire to eliminate the banking system as a middleman is progressing. Having made it possible for cross-border P2P transactions and loans secured by cryptocurrencies, now we're able to open deposits (stakes) at high interest rates without being involved in Ponzi schemes.

That is certainly progress, and we would even call it a revolution for the banking system. DeFi projects like HEX offer the opportunity to earn more without being an intermediary and profit-maker like a bank, Karkhalev said, unlike a bank that offers slightly higher interest rates on time deposits than standard deposits that barely cover inflation.

According to Karkhalev, staking is one of the most lucrative investments in today's cryptocurrency market. Still, it is also pertinent to consider the risks of "hacks, smart contract errors, and exit scams."

Additionally, an algorithm-based prediction from Wallet Investor (on February 23) predicted that the HEX coin price would hit $0.4 in a year. However, the coin price may reach $1.33 by February 2027, based on the HEX price trend analysis.

Gov Capital, another algorithm-based crypto prediction service, predicted a potential one-year surge in the price of HEX crypto to $0.58 this time next year and as much as $4.1 in five years.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Conclusion

In this article, our experts talked about the HEX coin, an ERC-20 token with a unique rewarding system and mechanism for staking. Its network aspires to replace traditional certificates of deposit with a store of value.

Investors interested in decentralized finance may find HEX to be a cost-effective and exciting asset. However, its future is uncertain due to market volatility and mistrust. For those looking to buy HEX, we find out that eToro may be the most suitable exchange for that. eToro is known for its high level of security, low fees and rapid withdrawal times.

FAQs

What is HEX?

The HEX cryptocurrency launched on December 2, 2019, on the Ethereum network. HEX is an ERC20 token intended to replace deposit certificates and act as a store of value. The blockchain equivalent of this financial product is used in traditional financial markets.

Who created HEX?

In 2008, Richard Heart founded Hex to launch a project similar to a certificate of deposit. Dan Emmons, Cody Lamson, and Brent Morrissey are currently working on the project.

What is the market cap of the HEX coin?

As of the time of writing, HEX is trading at $0.004559, and it has a market capitalization of $790,529,890.

Do I need a crypto wallet to buy HEX crypto?

The use of a wallet is not a requirement for purchasing HEX, but it can provide an extra layer of security for your crypto investments. You can own your digital assets through cryptocurrency wallets rather than cryptocurrency exchanges.

Can I buy HEX in the US?

You can buy HEX in the US by exchanging it for any other cryptocurrency where it is listed. Our experts recommend using the eToro platform.

References:

- https://coinmarketcap.com/currencies/hex/

- https://www.cnbc.com/2023/07/31/sec-sues-entrepreneur-over-1-billion-in-unregistered-crypto-sales.html

- https://finance.yahoo.com/news/richard-hearts-hex-does-10x-140000352.html

- https://medium.com/@cryptoharsh24/what-is-hex-cryptocurrency-fully-explained-use-cases-supply-etc-3080c64b4867

- https://www.sec.gov/news/press-release/2023-143

Pilar Chia Freelance Writer

View all posts by Pilar ChiaPilar is an experienced English translator and writer who has previously worked for Capital.com and Currency.com. Pilar has a strong interest in blockchain technology, cryptocurrencies and investing. She uses her writing skills and enthusiasm for the DeFi industry to write informative, engaging content that helps readers to make informed decisions.

Outside of work, Pilar actively researches and participates in the DeFi space to enhance her knowledge and stay up to date with the latest developments.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

That is the first blockchain equivalent to traditional certificates of deposit (CDs), which financial institutions worldwide use. HEX was launched on December 2, 2019, as a

That is the first blockchain equivalent to traditional certificates of deposit (CDs), which financial institutions worldwide use. HEX was launched on December 2, 2019, as a