Stockpile vs Robinhood – Cheapest Broker Revealed

With a simple Google search, you will be able to access hundreds of free trading platforms that provide commission-free trading. This means that you can buy and sell assets without paying a penny in commissions. But, how do you decide which online broker is the best match for your needs?

Throughout this Stockpile vs Robinhood review, we will explore all the key metrics from fees and assets, to account types and safety. So, keep reading as we reveal the best online broker for 2025!

What are Stockpile and Robinhood?

In short, both Robinhood and Stockpile are discount stock brokers that allow you to buy and sell financial instruments with the click of a button. With user-friendly interfaces and simple fee structures, these two investment platforms make online trading accessible to beginners.

Furthermore, both brokers give you access to fractional shares which means that you can invest in a slice of a company’s stock. Rather than purchasing full shares of major companies, which can be costly, you buy a percentage or fraction of a full share.

For example, let’s suppose you want to buy shares of stock that cost $100 but you only have $50 to invest. With fractional shares, you could buy half of the share, and therefore you would own 50% of that share.

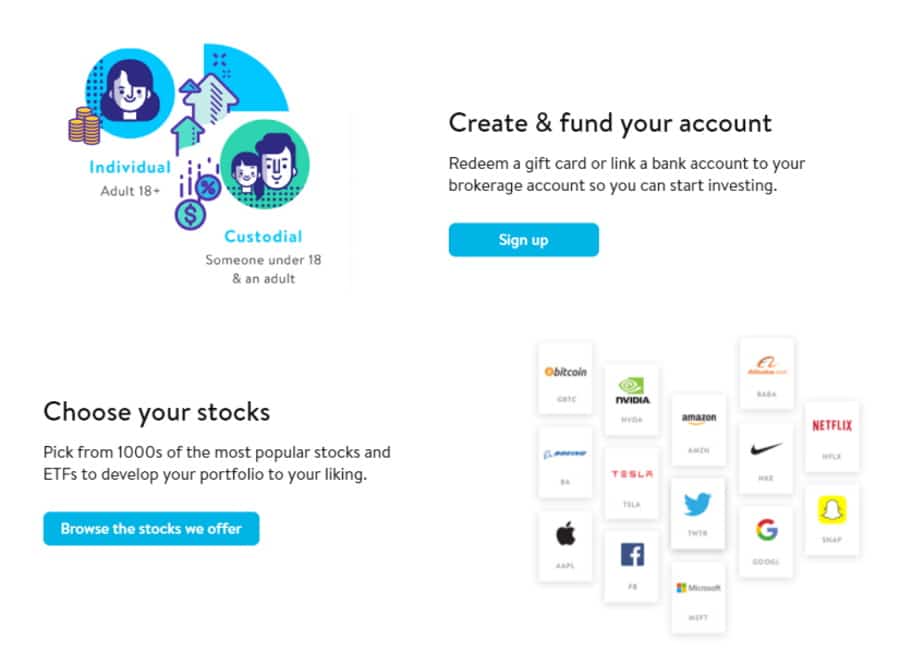

Launched in 2010, Stockpile is a US-based discount broker designed with new investors at its core. Stockpile makes it simple and affordable to trade stocks and ETFs, and even give stocks as a gift. There are roughly4,000 different exchange-traded funds, stocks, and American depositary receipts on offer. Moreover, with its fractional share offering, you can buy portions of shares on a low budget.

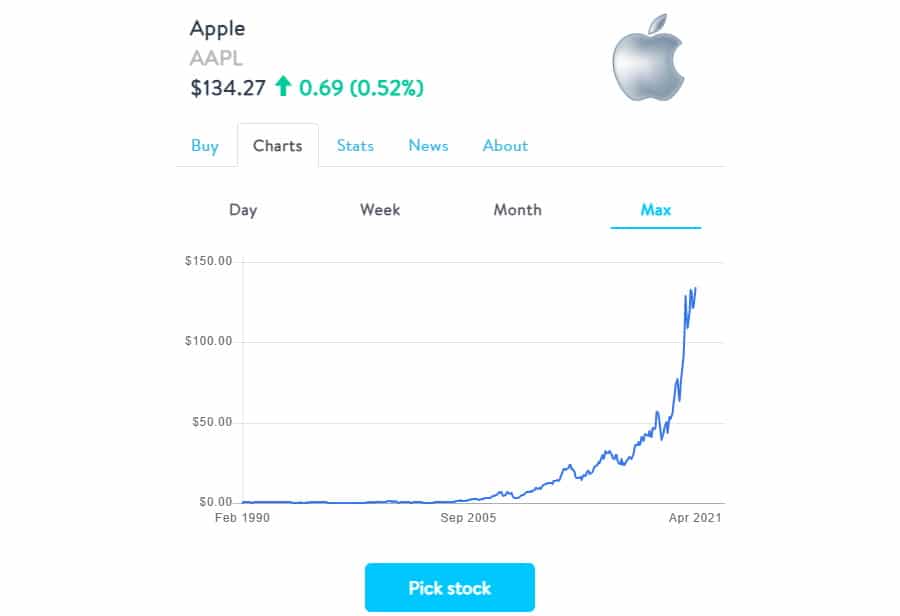

Robinhood, on the other hand, was started in 2013 and is also a free trading platform that is targeted towards beginner traders. Users have access to commission-free options, ETFs, US stocks, and cryptocurrencies

including Bitcoin trading. You can also trade international stocks via ADRs, as well as fractional shares.

Seeing as Robinhood Financial LLC provides access to fractional shares, you can buy and sell ETFs and stocks in fragmented shares, as well as investing in whole share increments. The fractional shares that Robinhood offers can be as small as a millionth of a share, and Robinhood charges 0% commission when purchasing fractional shares.

Stockpile vs Robinhood Tradable Assets

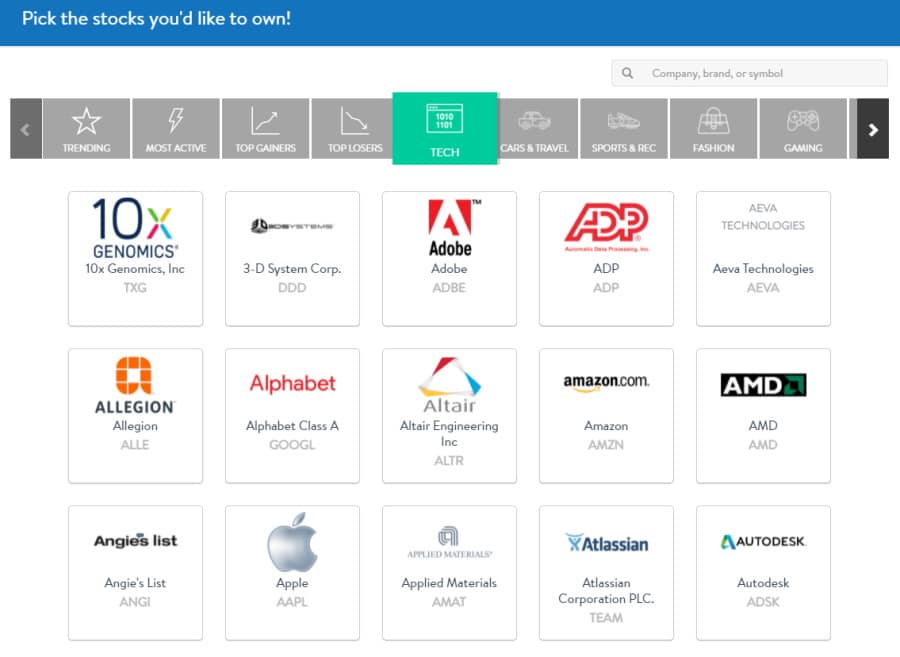

At Stockpile, you can access thousands of stocks and ETFs which cover all the stocks listed in the S&P 500 index. Some examples include Nvidia and Coinbase stocks, as well as Vanguard 500 ETFs to iShares MSCI USA ESG Select ETFs. You can search through the wide range of tradable assets by category, or you can search by entering the name of the company or the ticker symbol.

Stockpile regularly updates its stock offering, with trending companies that recently went public with IPOs (Initial Public Offerings). One of the most recent examples being Coinbase, a cryptocurrency exchange, which debuted its shares on the Nasdaq stock exchange in the middle of April.

According to Stockpile, you can request stocks to be added to their offerings list if they aren’t already present. Furthermore, this broker also makes it clear that it does not offer penny stocks, stocks that trade below $3, cryptocurrencies, pink sheet stocks, bulletin board securities, and foreign ordinaries.

Additionally, Stockpile also offers an innovative and unique gift card. Simply put, a Stockpile gift card is an easy and effective way to offer stocks as gifts to friends and family. You can purchase electronic gift cards for stocks between the price of $5 and $2,000 with several clicks. Furthermore, you can do all of this safely from most browsers and the Stockpile mobile trading app with a debit or credit card. Alternatively, you could also purchase actual material gift cards of any stock on offer.

Turning our attention to Robinhood now, this online discount broker offers commission-free US stock, ETF, options, and cryptocurrency trading. In keeping with the low-cost trading structure, Robinhood has low non-trading fees, which means that opening an account and depositing funds will cost you $0.

With Robinhood, you can access roughly 5,000 different ETFs and stocks, as well as several international stocks through ADRs. Unlike Stockpile, Robinhood allows you to trade cryptocurrencies and options. When it comes to options trading you are limited to stock index and stock options, but this is still enough if you want to diversify your portfolio.

If cryptocurrency trading is more your style, then you’ll be pleased to know that there are 7 different digital currencies on offer. Ranging from Litecoin to Ethereum trading, you can buy and sell cryptos commission-free from the web trading platform or the native mobile trading app. Robinhood offers the following cryptos to trade with 0% commission:

- Ethereum

- Bitcoin

- Ethereum Classic

- Litecoin

- Bitcoin Cash

- Dogecoin

- Bitcoin SV

Stockpile vs Robinhood Account Types

Both Robinhood and Stockpile have designed their services, and investment platforms in such a way as to suit the needs of new traders.

Robinhood offers three different account types: Gold, Instant, and Cash. So, here’s a quick breakdown of each account type:

Robinhood Instant

By default, when you open a new Robinhood account you automatically start with an Instant account. This type of brokerage account allows you to deposit funds up to $1,000 instantly, and access extended-hours trading. You also have access to unsettled funds when you sell securities. If you qualify for options trading, you have access to options trades that would otherwise require a margin account.

Robinhood Gold

Gold and Instant accounts share several qualities and features, however, there are some key differences. For instance, with a Robinhood Gold account, you have more buying power through margin investing and can use instant deposits for funds up to $50,000. You can also trade with unsettled funds from securities you have sold, access options trades, and margin trading. Other benefits include advanced research and level II market data from third-party providers such as Morningstar. But, there is a $5 monthly membership fee.

Robinhood Cash Account

With a Robinhood Cash account, you can use Instant Deposits up to the initial $1,000. But, you will not have access to Instant Deposits for anything above the $1,000 limit. Furthermore, you do not have access to unsettled funds from assets that you have already sold. When it comes to day trading, Cash accounts are not limited by Pattern Day Trading standards and rules.

What account types are available at Stockpile?

Stockpile keeps it very simple when it comes to accounts as it only offers two types: custodial accounts and individual brokerage accounts. To open an individual brokerage account you need to be above the age of 18.

For those below the age of 18 or looking to create an account for a friend or relative under 18, you can open a custodial account in which you become the custodian and the minor becomes the beneficiary. The custodian of the account is allowed to manage and execute all trading strategies and orders set by the beneficiary.

To sign up for a Stockpile account you will need to have a valid Social Security Number, proof of address, and be based in the United States.

Stockpile does not offer joint accounts or retirement accounts, such as Roth IRA, Traditional IRA.

As we have already discussed, Robinhood and Stockpile target beginner traders with little experience in the world of online trading. This is apparent when you look at the account types they offer. Albeit, Robinhood is a more versatile broker in comparison to Stockpile, especially when it comes to tradable assets, and account types. But, generally speaking, both online trading platforms keep it simple, as they try to democratise financial trading for the average trader.

Stockpile vs Robinhood Fees & Commissions

Most new and seasoned traders will ask the same question: how much will it cost me to trade with this broker? That is to say, you will be looking to keep your trading expenses as low as possible to make the most ROI (return on investment). But, this isn’t exclusive to just trading fees as there are important non-trading fees that you need to look out for if you want to trade for free.

That being said, in this section, we review each brokers’ trading and non-trading fees.

Stockpile trading fees

Stockpile charges $0.99 per trade to purchase stocks using cash in your brokerage account. This means that if you wanted to buy $100 of Amazon stock, the total amount you would pay for the entire trade would be $100.99.

To buy stocks with a debit or credit card you will face the same $0.99 per trade fee as well as 3% commission to cover the card fees. Therefore if you wanted to buy $100 worth of Tesla stock, it would cost $103.99 ($100 + $0.99 + $3.00).

When it comes to giving an e-gift of stock, the fee structure is as follows: $2.99 for the first stock + $0.99 per stock thereafter + 3% credit and/or debit card fee to cover the trading commissions and card fees. For example, if you wanted to give your friend one electronic gift card of one stock, the fee would be the stock price plus the $2.99 for the stock and a 3% credit card or debit card fee.

Stockpile’s offering of physical gift cards come in three amounts: $100, $50, and $25. The prices of each gift card are as follows:

- $25 gift card = $29.95

- $50 gift card = $56.95

- $100 gift card = $107.95

The fees are there to cover the card fees, trading commissions, and the actual cost of creating the plastic gift card.

Stockpile has very low non-trading fees, with no account minimums and no monthly account fees making buying and selling ETFs and stocks a simple and hassle-free experience.

On the flip side, Robinhood offers commission-free crypto, options, ETF, and stock trading, which unquestionably reduces your trading expenses. Furthermore, you can also trade several international stocks via American depositary receipts which are typically priced between $0.01 and $0.03 per share.

You will need a Robinhood Gold account if you want to trade assets on margin. Put simply, margin trading is when you borrow funds from a broker to invest in financial instruments. The interest that you pay on this borrowed capital is known as the margin rate. It’s important to keep in mind that while margin trading can maximize your potential returns it can also maximize potential losses. Robinhood’s annual margin interest rate is just 2.5% which is amongst the lowest and most competitive in the online trading industry.

As aforementioned, margin trading is accessible via the Robinhood Gold account, which includes an array of investment tools such as Nasdaq Level II market data and research reports from reputable third-party providers such as Morningstar, for just $5 per month. The initial $1,000 margin is covered by the $5 monthly membership fee. Thereafter, traders incur a 2.5% fixed margin rate on any amount above the $1,000 threshold.

In terms of non-trading fees, these are practically non-existent, from zero account fees or inactivity fees to $0 withdrawal and deposit fees. Having said this, there is a $75 fee when you want to transfer securities out from a Robinhood account to another brokerage account using the Automated Customer Account Transfer Service (ACATS) which is operated by the National Securities Clearing Corporation.

| Inactivity fee | Deposit fee | Withdrawal fee | Account fee | US Stock fee | ETF fee | USD margin rate | ACAT Transfer fee | |

| Robinhood | No | $0 | $0 | $0

$5 fee per month for Gold account |

0% | 0% | 2.5% | $75 |

| Stockpile | No | $0 | $0 | $0 | $0.99 per trade | $0.99 per trade | n/a | $75 |

Stockpile vs Robinhood User Experience

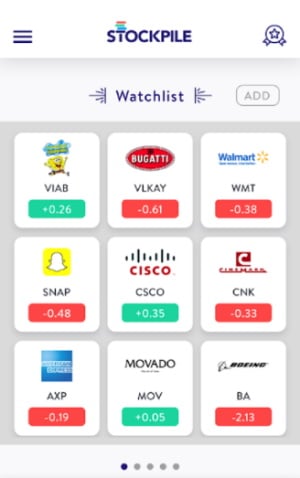

The Stockpile trading platform is very user-friendly and well designed. This online broker is designed with beginner traders in mind and this is apparent from the very moment you land on the page. There is no complex terminology, and the interface is very well structured allowing you to navigate seamlessly.

When you click on a stock it automatically opens a transaction window where you can specify the exact amount you want to invest, and then with several more clicks, the trade is finalized. Moreover, you can also access simple charts, news, and fundamental analysis by clicking on the other tabs in the trade window. In short, you can trade thousands of stocks and ETFs with the click of a button.

You also have access to fractional shares which allow new traders with low account balances to invest in portions of shares of major stocks like Netflix, Tesla, and Microsoft.

Robinhood follows the same suit when it comes to user experience. Aimed at beginner-level traders and investors, Robinhood’s trading platform is very easy to use and expertly designed to make online trading as simple as possible.

From the homepage, you can access the broker’s products, educational resources, support, and sign up for or log into your account. Robinhood users also have access to a feature called Cash Management. This allows you to use Robinhood to earn interest and spend your money. With Cash Management you receive a debit card from Sutton Bank which you can use for everyday purchases and even paying utility bills. Your money is swept into a network of program banks where it earns 0.30% APY (annual percentage yield).

If you’ve enjoyed this broker comparison so far, then you should read our Coinbase vs Robinhood review as well.

Stockpile vs Robinhood Mobile App

Mobile trading is now one of the most popular and constantly growing sectors in the investment industry. With that in mind, both brokers offer mobile investment apps that are compatible with iOS Apple, and Android devices. All in all, having the option to buy and sell financial instruments wherever you are is not only convenient but essential. For example, during volatile market movements, you could decide to buy or sell a stock at a particular price instantly on your mobile device.

Firstly, the Stockpile mobile trading app offers all the features that you can find on the web trading platform. You can trade stocks and ETFs for $0.99 per trade or purchase e-gift cards of stock to give to friends and family with the click of a button.

From the mobile trading app, you can set up individual or custodial accounts, send gift cards that are redeemable for stock ownership. Since Stockpile is aimed at beginner traders, you can also trade fractional shares of more than 4,000 stocks and ETFs with a minimum investment of just $5. This means that you can spend as much money as you want without having to buy the entire share which can be costly.

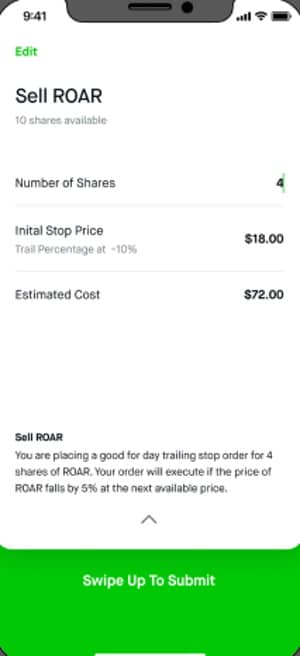

Robinhood also provides a mobile trading app that is supported by iOS Apple and Android devices. The trading app delivers the same layout, interface, and user-friendly features that are present on the web trading platform. When it comes to research tools, the stock screener is not offered on the mobile app.

You can deposit funds into your Robinhood account with the click of a button, browse through thousands of financial instruments, and even place different order types such as stop-loss orders. The Robinhood mobile app makes it easy to monitor your investment portfolio and the status of any open positions. In addition, there are no account minimums, and the mobile interface is well designed and user-friendly.

Stockpile vs Robinhood Trading Tools, Education, Research & Analysis

Both Robinhood and Stockpile share the same mission; to make online trading accessible for everyone regardless of their skill level and experience. After all, after you have opened a brokerage account and deposited funds, you will have unfettered access to thousands of stocks and ETFs, and in the case of Robinhood cryptocurrencies and options trading.

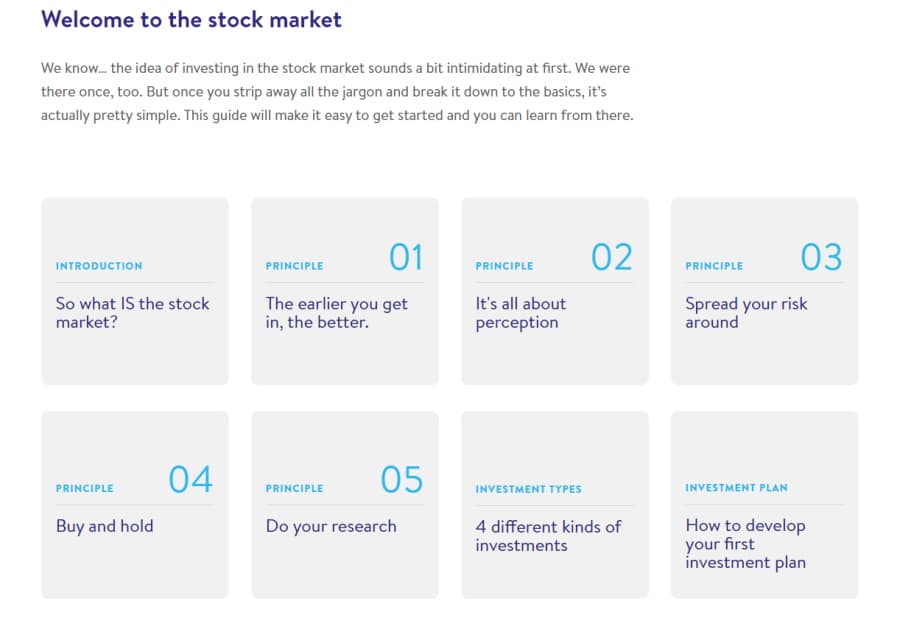

Stockpile and Robinhood are perfect for new investors with little to no experience in online trading. As such, there is a comprehensive beginner’s guide to getting started with stock market trading. However, video content, platform tutorials, and webinars are not available.

Similarly, at Robinhood, you can access educational articles and material under the Learn tab at the top of the site. These range from investing basics to frequently asked questions. Additionally, you can also access ‘Snacks’ which is a daily newsletter that outlines the top trending financial and market news. These are available with daily Apple, Google, and Spotify podcasts.

Stockpile vs Robinhood Demo Account

Simply put, demo accounts are simulated trading accounts that allow you to get to grips with online investing without the risk of losing real capital. Otherwise referred to as paper trading, you can test your trading strategies with virtual funds to give you a hands-on trading experience without having to spend real money.

During our broker comparison research, we found that both trading platforms do not provide demo accounts.

Stockpile vs Robinhood Payments

First of all, Robinhood offers free deposits and withdrawals, but the only available payment option is via bank transfers, like debit/credit cards, and e-wallets are not supported. Furthermore, instant deposits are available up to the initial $1,000 and anything above this limit can take approximately 4-5 business days. On the other hand, Gold account users have access to a higher instant deposit limit.

If you have an Instant account you are allowed to deposit any amount up to $1,000 immediately, in contrast, if you are a Gold account holder the instant deposit limit is $50,000. While ACH withdrawals are free of charge, domestic wire transfers come with a $25 fee, and the international wire withdrawal fee is $50. Also, there is a $75 fee per transaction when it comes to transferring securities out of your Robinhood account.

On the other hand, Stockpile tries to make the process of buying and selling assets as accessible and simple as possible. To this end, they offer several payment options.

The first option, which is the cheapest and most convenient, is to link your bank account to your Stockpile trading account. Alternatively, you can also use e-wallets like Apple Pay, as well as debit cards and credit cards.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Stockpile | $0 | Free | 3-5 business days | Free |

| Robinhood | $0 | Free | Instant, depending on account type | Free |

Stockpile vs Robinhood Customer Service

Compared to other online trading platforms the available options for contacting support are limited. With this in mind, you can contact Stockpile’s customer support by email, by fax, or by sending a letter to the address you can find on their website. Responsiveness is fairly quick depending on the number of requests and emails they receive. It typically takes 1-2 business days to receive a response. There is also a live chat tool but this is not available 24/7.

In comparison, customer services at Robinhood can only be contacted through email, as telephone and live chat support are not available. To submit a ticket request you will need to select the topic that relates to your question or issue. The responses are usually very helpful and relevant and take around one business day to reply.

Stockpile vs Robinhood Safety & Regulation

So far in this Robinhood vs Stockpile comparison we have examined all the key metrics you need to consider when weighing up the pros and cons to decide which broker is best suited to your trading and investing needs.

In this section, we will look at the fundamentals with regards to regulation, safety, and client fund protection. Making sure you pick a regulated broker should be a number one priority when selecting a broker.

In the case of Robinhood, this online free trading platform is regulated by the US Securities and Exchange Commission and is a member of the Financial Industry Regulatory Authority. You should bear in mind that two entities operate under Robinhood: Robinhood Financial LLC and Robinhood Crypto LLC.

Robinhood Financial LLC is FINRA-regulated and thus is covered by the Securities Investor Protection Corporation which is a US investor protection scheme. SIPC cover is limited to $500,000 including $250,000 for cash claims. If Ethereum trading is more your style then you should bear in mind that Robinhood Crypto LLC is not a member of FINRA and therefore does not offer client fund protection.

Stockpile is a member of FINRA and therefore all investment accounts are covered by the US SIPC protection. At Stockpile your account is managed by Apex Clearing, a digital wealth management solutions company, which is a member of SIPC and FINRA. All investment accounts are covered up to $500,000 which includes up to $100,000 of cash.

Stockpile vs Robinhood vs eToro

Overall, if you are new to online trading both Stockpile and Robinhood offer great services and a user-friendly platform to allow you to buy and sell stocks and other assets from the comfort of your own home.

Nevertheless, if you want to trade more than just stocks and ETFs without paying anything in commissions then Robinhood is the way to go. With access to 7 different cryptocurrencies, options trading, fractional shares, thousands of stocks, ADRs, and ETFs, you will be more than happy with Robinhood.

However, if you’re looking for a social trading platform that is built with both new and advanced traders in mind then eToro takes the number one spot on our recommendation list.

eToro offers CFD trading, tons of currency pairs, real stocks, ETFs, and 16 different cryptos. As well as having access to leverage, you can change the level of leverage you trade with to suit your trading budget and financial needs.

At eToro you can benefit from its innovative copy trading tools which allow you to copy the trades of other experienced investors on the platform. You can browse through the portfolios of thousands of traders and access a plethora of related statistics such as risk ratings and previous performances.

67% of retail investor accounts lose money when trading CFDs with this provider.

Additionally, you could use eToro’s CopyPortfolio which in Layman’s terms is a CFD portfolio. When you use CopyTrader you copy the trades of individual investors, whereas with CopyPortfolios you can invest in a portfolio of several eToro traders or a category such as investment banks or stocks.

Here’s a quick breakdown of eToro’s main trading and non-trading fees:

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Typical spread for EUR/USD: 1 |

| Crypto trading fee | 1.90% spread for Ethereum |

| Inactivity fee | $10 a month after 12 months |

| Withdrawal fee | $5 |

| ETF trading fee | Free |

| Account fee | No |

| Deposit fee | $0 |

Stockpile vs Robinhood – The Verdict

With eToro you can access CFD, forex, stocks, ETFs, cryptos, commodities, and index trading as well as 17 international stock markets, with 100% zero commission.

Furthermore, this discount broker is tailored for beginner traders as it offers a demo account with $100,000 worth of virtual funds for you to practice online trading without risking any actual capital.

So, if you want to start trading with a FCA, CySEC, and ASIC regulated broker, without paying a penny in commissions, simply click the link below and open an eToro account today!

eToro – Overall Best Free Trading Platform 2025

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.