Best CFD Brokers & Platforms with Low Fees in February 2026

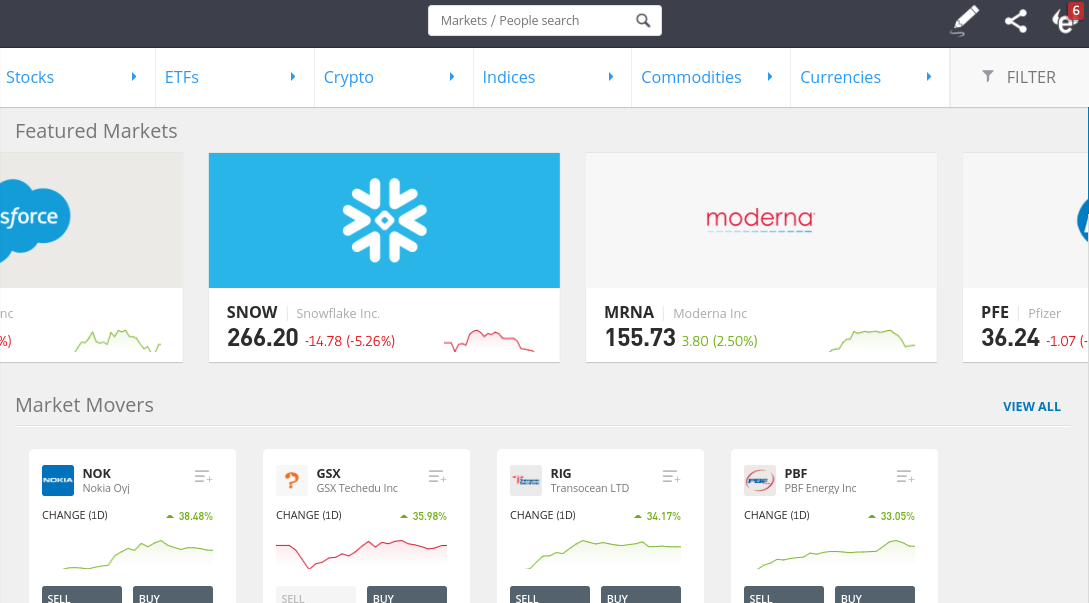

CFD trading platforms typically allow you to trade thousands of financial instruments – with no requirement for you to own the underlying asset. Instead, you will be looking to predict whether the price of the asset – whether that’s stocks, commodities, cryptocurrencies, or forex – will rise or fall.

In this guide, we review the best CFD trading platforms to consider in 2026. We take into account key metrics that will make or break a CFD trading platform – such as available markets, commissions, platforms, payments, and regulation.

-

-

Top CFD Trading Platforms for 2026

Below you will find a list of the best CFD trading platforms available in the market right now. Scroll down to read of review of each top-rated CFD provider!

- Plus500: Plus500 is a regulated CFD broker that provides a diverse range of instruments. The platform is also compatible with third party charting tools and users can deposit funds with a range of payment methods. Plus500 is available to use on mobile.

- eToro: eToro is a popular CFD trading platform with over 20 million users around the globe. The broker is regulated in several jurisdictions and provides commission-free trading for some CFDs. The platform also supports social trading and copy trading as well as Smart Portfolios which are suitable for long term investors. eToro offers CFDs in stocks, forex, cryptos and commodities.

- Axi: The best CFD trading platform for spread betting in Australia. Axi offers over 200 products to trade including stocks, indices, commodities and currencies. Spreads start from 0 pips and spread betting is tax-free.

- IG: IG is a well-known forex CFD trading platform that offers over 80 currency pairs. The platform provides tight spreads and low commissions. IG is user-friendly and available to use on mobile.

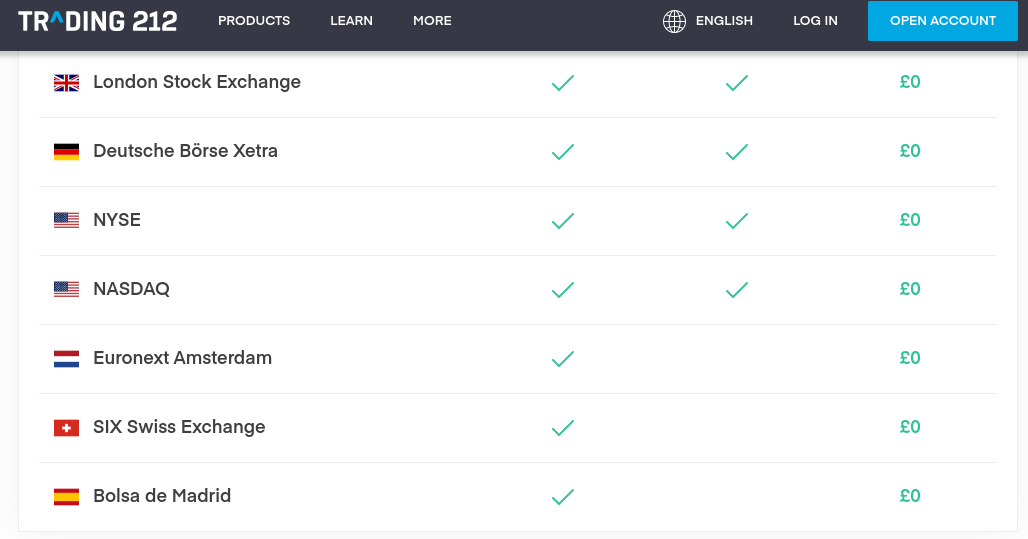

- Trading 212: It is possible to trade CFDs on Trading 212 with just $1. This makes it suitable for traders who have a tight budget. Trading 212 doesn’t charge commissions and is regulated by the UK’s Financial Conduct Authority.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Is CFD Trading?

CFD trading it is a method of trading derivatives. Instead of trading an asset, you are trading a contract whose value is directly related to the asset’s value. This means that you are not buying shares but buying contracts whose value depends on the value of the corresponding shares.

CDF trading is quite simple, even if the person is a beginner. As mentioned above, CFDs are directly related to stocks, which means trading them is very similar to trading stocks. So, for example, if a stock goes up in price, the value of the CFDs contract will go up by the same value.

CFD trading offers many benefits, one of which can trade using any financial item with CFDs. For example, you can trade stocks, commodities, exchange-traded funds (ETFs), currencies, and cryptocurrencies.

Let’s take an example to understand it better. Suppose you want to buy a stock of coffee. For this example, we will use Starbucks; this company has a value of a share of 50 dollars, and therefore your preferred broker offers a margin of close to 10%. This means that you can buy a share for 10 dollars; your broker lends you the rest, which would be 40 dollars. The stock rises to $60, and you decide to close your position, then you return the borrowed $40, recover your initial investment and earn $10, which means you earn double your investment.

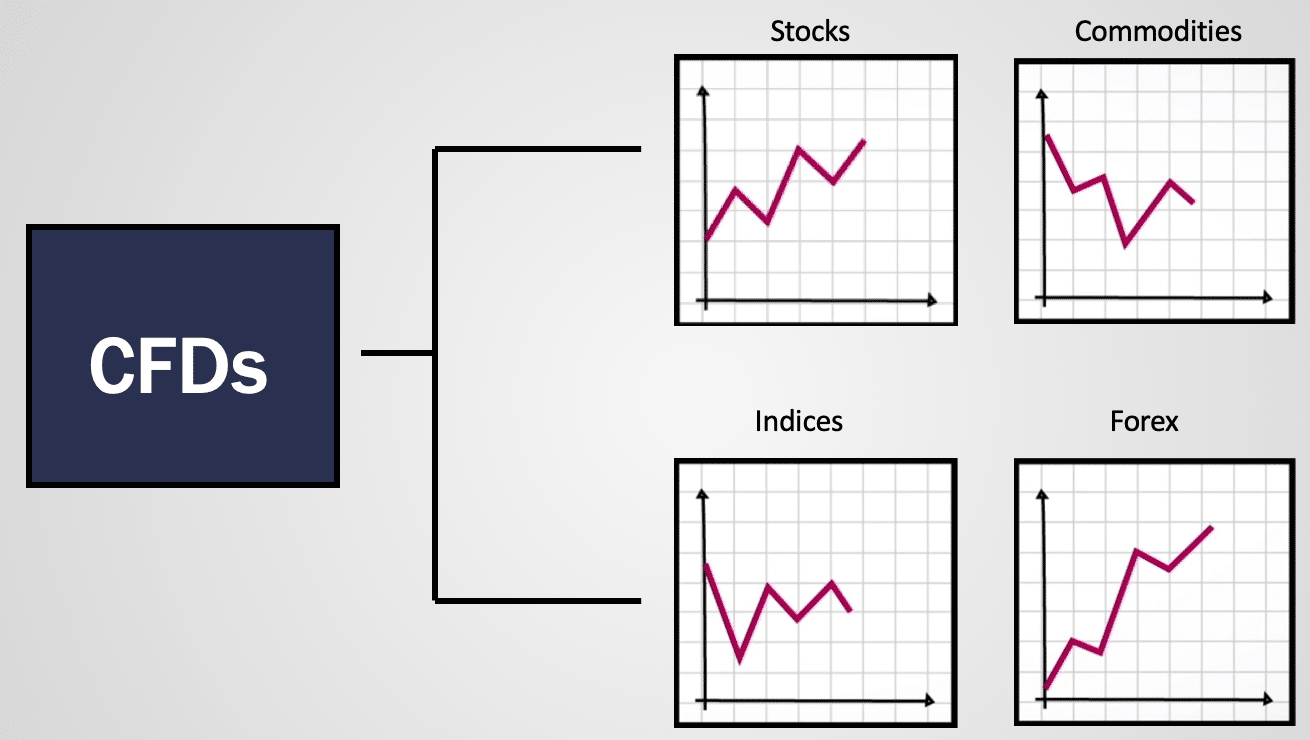

What Can You Trade With CFDs?

As mentioned above, CFDs can be used to trade any type of financial asset. Among the best-known CFDs are:

- Stocks

- Commodities

- Indices

- Cryptocurrencies

It is possible to trade CSDs using the best brokers in the market. However, it would help if you always kept in mind that the value of the CFD will always be related to the value of the digital asset. So if your asset, for example, a sugar stock, goes up 5%, the CFD value of the share will go up the same. The same goes for commodities, cryptocurrencies, or any other digital asset you want to trade with CFDs.

It should be noted that many traders choose to start their business with instruments that they have mastered or about which they can easily obtain information. More experienced traders sometimes diversify their investment portfolios to maximize their trading potential and improve risk management.

Why Trade CFDs?

Given that it is feasible to buy stocks and other assets outright, why use CFDs? Various fundamental benefits explain the popularity of online CFD trading.

Asset Ownership

With CFDs, you are not the asset owner, as the share certificates are held digitally in an account where the shares can be traded, so you do not need to intervene to buy and sell them.

You do not necessarily have to be the owner of a currency. Still, you have to convert the dollar into another currency, which can sometimes cause you to lose money in commissions and learn about regulations and financial institutions.

With CFDs, it is not essential to be aware of all these aspects, as you are the owner of the contract and can always benefit from changes in the asset.

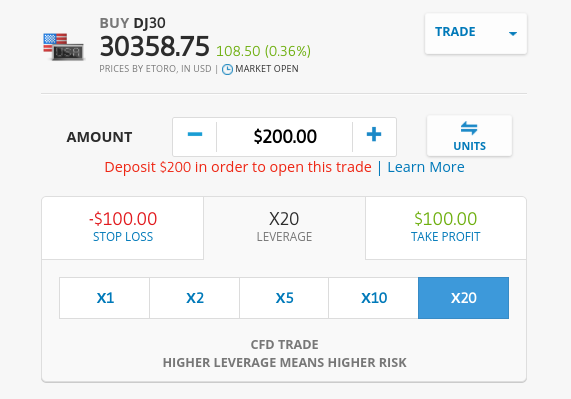

Leverage

Leverage is the reason why CFDs are so famous today. It consists of you paying only a percentage of the total price of an asset. This is called margin, while your broker lends you the remaining value.

For beginners, when you make a relationship between leverage and margin, both refer to opening a larger position than you have the capital to do so. To explain it better, the margin is usually written in % and leverage in ratio, for example, 1:20. Now, let’s think that a Facebook share is worth $200. If your broker recommends you a CFD with a leverage of 1:20, you have to pay one-twentieth of the total price: 200 divided by 20 is also 10 dollars.

If leverage is employed, it is possible to maximize potentially multiply the profits from the successful trades. Furthermore, since less money is needed for each trade, it is possible to diversify your trades without putting more money in your account.

Diversity Of Trading Options

Brokers today offer CFDs on stocks, indices, treasuries, currencies, sectors, and commodities. This makes it possible for investors interested in various financial vehicles to trade CFDs as an exchange option.

Possibility Of Long-term Trading

If you are looking to invest over a long period, CFDs can be a good option as they do not have an exact expiration date, which allows positions to be held over long periods.

However, it is crucial to keep in mind the interest and maintenance fees because if you have these costs foreseen from the beginning, you can make a better profit.

They Can Be Used In Any Type Of Market

Since you and your broker have a contract on the asset “found in the market,” it does not matter what the asset is. In other terms, you can trade in a whole range of markets using the same format. There is no need to learn new skills if you switch from trading stock CFDs to cryptocurrency CFDs. The fundamental concepts remain the same.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Best CFD Brokers Ranked & Rated

There are hundreds of CFD trading platforms that allow you to buy and sell financial instruments at the click of a button.

In order to find one that meets your needs, you need to look at what markets the CFD platform offers, how much it charges in fees and commissions, and other metrics surrounding regulation, payments, and trading tools.

To help clear the mist, below you will find a selection of the best CFD trading platforms in 2026 and beyond. Wether you’re looking for CFD stock trading platforms or CFD forex trading platforms, we’ve got you covered.

1. Plus500 – UK CFD Broker with Tight Spreads

Plus500 is a global CFD trading platform that is licensed, authorized, and/or regulated by several jurisdictions. This includes the UK, Cyprus, Australia, Singapore, New Zealand, and South Africa.

One of the main attractions of choosing Plus500 as your CFD trading platform is that it offers a hugely diverse asset library of over 2800 instruments. This includes forex, crypto, shares, ETFs and indices.

Plus500 also offers hard metals, energies, and agricultural CFD markets. This includes everything from wheat, live cattle, and gasoline, to gold, silver, and oil.

One of the most appealing features of this platform is the 0% commission model. Users can trade CFDs with zero-fees. Spreads on major assets are usually very competitive, too.

Although Plus500 is not compatible with third-party trading platforms like MT4 or cTrader, its proprietary platform offers all of the tools and features that you need. This includes multiple order types, leverage, buy/sell positions, and real-time charting tools that can be fully customized.

In terms of the fundamentals, Plus500 requires a minimum deposit of $100. It supports debit and credit cards, bank transfers, and Paypal. There are no fees to deposit or withdraw funds, although Plus500 reserves the right to charge you if you exceed the monthly limit of withdrawals or requests payment for less than the minimum withdrawal amount.

Plus500 fees

Fee Amount CFD trading fee Variable spread Forex trading fee Spread. 1.3 pips for GBP/USD Crypto trading fee Spread. 4.11% for Bitcoin Inactivity fee £10 per month after three months Withdrawal fee Free Pros:

- A commission-free CFD trading platform

- Tight spreads

- Huge library of CFD markets

- Leverage offered on all financial instruments

- Plenty of features including risk management tools and price alerts

- Heavily regulated by several jurisdictions

- Minimum deposit just $100

Cons:

- No copy trading tools

- CFDs only

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

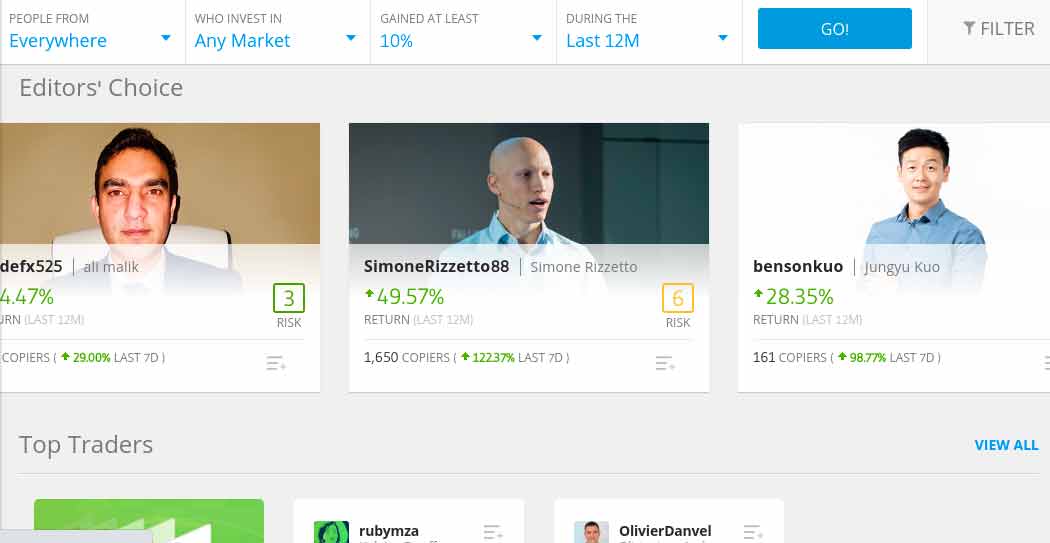

2. eToro – Overall Best CFD Broker of 2026

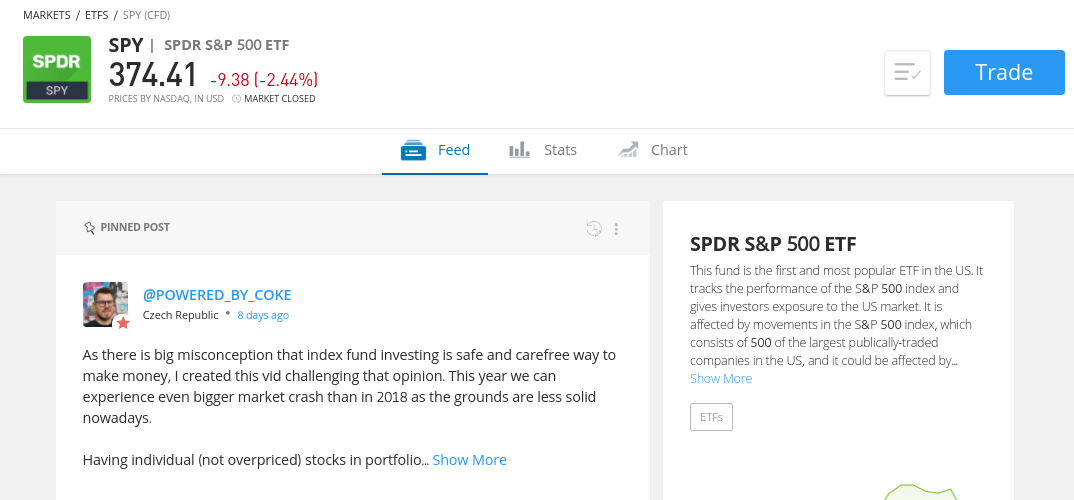

eToro – which is now home to over 17 million investors, is a Jack of All Trades in the online trading space. This is because the provider not only offers traditional shares and ETFs but heaps of CFD markets, too.

This includes everything from stocks and cryptocurrencies to forex and commodities. Irrespective of which CFD trading instrument you decide to access, eToro does not charge any commissions at all.

In fact, there are no ongoing maintenance fees and spreads are typically very tight, too. major forex pairs come with spreads of just 0.008% upwards, while gold stands at around 0.05%. As is the case with all of the best CFD trading platforms in the online arena, eToro gives you access to leverage. The amount of leverage you can get will, however, depending on your location.

In most cases, this is capped at 1:30 on major currency pairs, 1:20 on minors/exotics and gold, and less on other asset classes. All CFD trading markets at eToro also give you the option of going long and short. This allows you to profit from both rising and falling markets.

eToro is also a great CFD trading platform to consider if you are a newbie. The trading platform itself was built from the ground up – with the view of attracting non-professional traders. The minimum stake size starts at just $25 too – which is great for traders on a budget.

We also like the Copy Trading feature at eToro, which allows you to ‘copy’ an experienced CFD trader. In doing so, each and every buy/sell position that the trader places will be mirrored in your own eToro portfolio. This comes with no additional charge, albeit, you do need to meet a minimum investment of $200 per trader.

In terms of getting started, opening an account, uploading ID, and making a deposit usually take less than 10 minutes. You can choose from several popular payment types – including debit/credit cards, bank transfers, and e-wallets such as Paypal and Skrill. Finally, eToro is regulated by the FCA (UK), ASIC (Australia), and CySEC (Cyprus).

To learn more about this trading platform, check out our eToro review.

eToro fees

Fee Amount CFD trading fee 0.09% per trade in ETF CFDs and stocks CFDs; from 0.75% per trade in crypto CFDs Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- Super user-friendly online broker and trading platform

- Trade thousands of assets with tight spreads

- 100% commission-free

- You can also trade stocks, indices, ETFs, cryptocurrencies, and more

- Deposit funds with a debit/credit card, e-wallet, or bank account

- Social trading and copy trading

- Accepts PayPal

- Regulated by the FCA, ASIC, and CySEC

Cons:

-

- Not suitable for advanced traders that like to perform technical analysis

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

3. Axi – The best CFD trading platform for spread-betting with spreads from 0 pips

Axi is a reputable online trading platform that offers over 200 CFD products to trade. As well as traditional CFD trading, the platform can also be used for tax-free spread betting, copy trading, and paper trading.

Axi offers CFDs in a variety of instruments including stocks, commodities, indices, and currencies. Users can access advanced charting tools to conduct analysis, place trades and monitor their positions.

Perhaps one of the most stand-out features of Axi is that traders can trade in tax-free conditions with spreads from 0 pips. This makes it one of the most affordable CFD trading platforms available to Australian traders.

The platform has received excellent reviews on TrustPilot and currently has over 60,000 users in 100+ countries. Axi places a strong focus on customer satisfaction, offering 24/5 customer support as well as a friendly user interface.

Pros:

- Trade CFDs tax-free with an Axi copy trading or spread betting account

- Over 220 CFD instruments are available

- Axi is regulated by the Financial Conduct Authority and ASIC

- Users can access MT4 for advanced charting

- The platform offers a free demo trading account

- Axi is available on desktop and mobile

Cons:

-

- Available products are limited to CFDs

- Support is not available 24/7

- Axi does not support cryptocurrencies

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.3% of retail investor accounts lose money when trading with this provider.

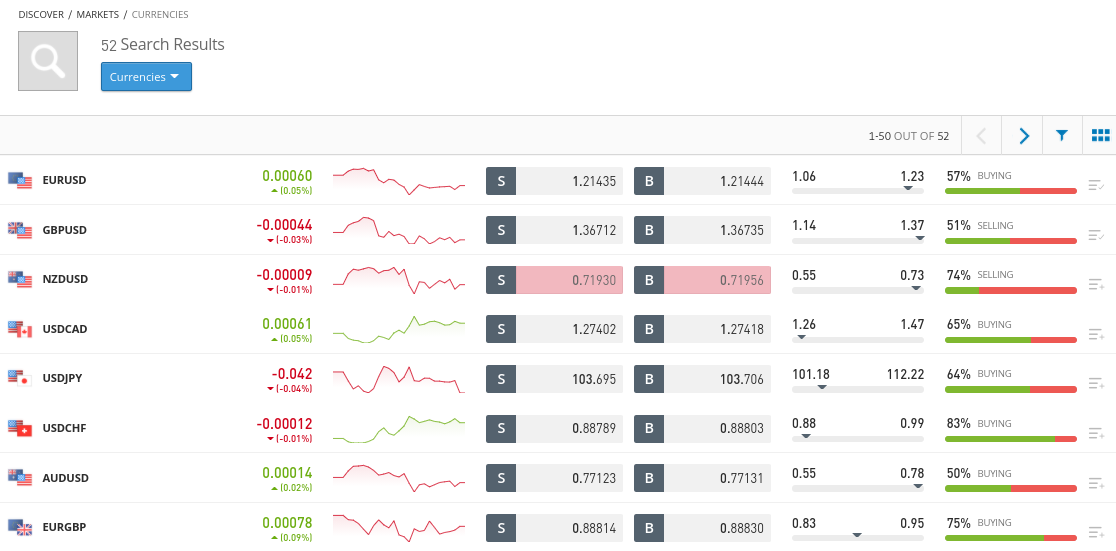

4. IG – Best CFD Trading Platform for Forex

IG is a trusted and regulated broker firm that was first launched in 1974. It holds is authorized to offer CFD trading accounts to over 100+ countries, which has resulted in more than 239,000 clients actively using the platform to trade. In total, IG offers more than 17,000 markets – which is huge.

However, it is the CFD forex trading department that stands out for us – with the platform supporting more than 80 currency pairs. In particular, IG is great if you want to access less liquid currency markets like the Mexican peso or South African rand.

Fees and really competitive too at this top-rated CFD trading platform. For example, forex can be traded commission-free, with spreads starting at just 0.6 pips on major pairs. Even minor pairs are competitive, with the likes of EUR/JPY coming in at an average spread of just 1.5 pips. According to IG itself, the average spread on the aforementioned pair is 2.27 pips.

IG also offers leverage on its CFD forex trading markets – with the ability to trade major pairs with a margin of just 0.5%. This means that a $100 stake could potentially give you access to over $20,000 in trading capital. We should note that IG is more than just a forex broker.

On the contrary, the platform also offers CFD markets on stocks, indices, cryptocurrencies, bonds, interest rates, commodities, indices, and more. Once again, these markets not only cover major exchanges – but the emerging economies too. In terms of supported platforms, IG offers its own native web trading facility that can be accessed online or via the mobile app.

IG is also compatible with MT4. If you want to get started with IG today, you can open an account in minutes. You will, however, need to meet a minimum deposit of $250 before you can start trading. With that said, IG also offers a demo account feature that does not require a deposit. Supported payment methods include debit/credit cards and bank transfers.

IG fees

Fee Amount CFD trading fee Spread, as low as 0.2 on indices Forex trading fee Spread, 0.9 pips for EUR/USD Crypto trading fee Spread, 40 pips for Bitcoin Inactivity fee $18 for two years of inactivity Withdrawal fee Free Pros:

- Best trading platform for forex

- More than 80 currency pairs offered

- 17,000 markets supported

- Spreads start at just 0.6 pips and no commissions charged

- Trade on the IG website or via the app

- MT4 is supported

- More than four decades in the brokerage space

- Easily fund your account with a debit card or bank transfer

Cons:

- A minimum deposit of $250

- No traditional stocks or ETFs for US traders

There is no guarantee that you will make money with this provider. Proceed at your own risk..

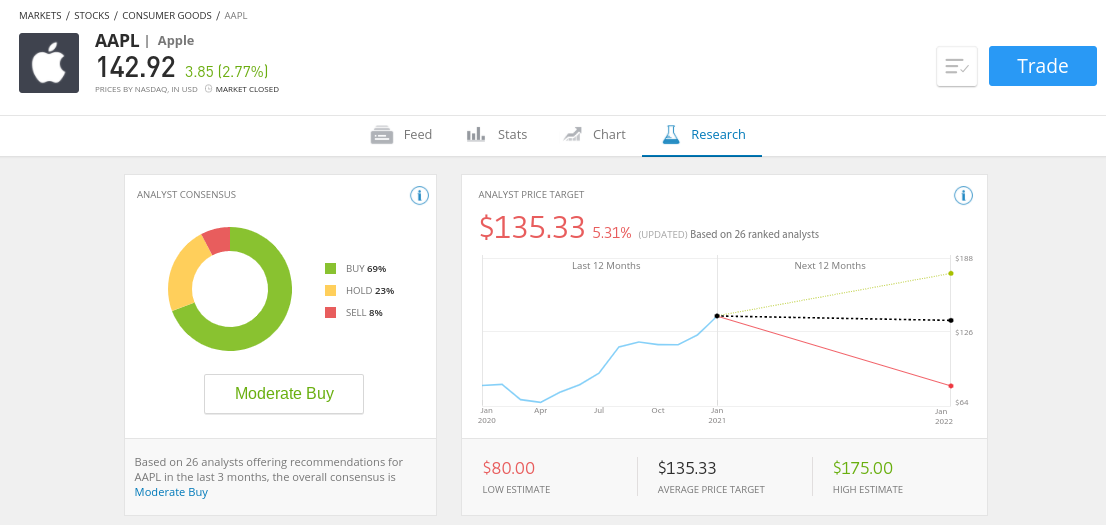

5. Trading 212 – Best CFD Broker for Small Stakes ($1 Minimum)

Under normal circumstances, if you don’t have any experience or knowledge of CFD trading, you are best advised to stick with a demo account facility until you get comfortable with how things work.

With that said, if you’re keen to trade with real money – Trading 212 allows you to get started with a minimum deposit of just $1. This is an inconsequential amount to trade – making it perfect for those of you that want to learn the ropes of CFD instruments bit-by-bit.

Trading 212 is able to support such small stakes because it offers fractional assets. For example, let’s say you decide to trade Apple stocks -which are currently priced at $142 per share. If you were to trade $1, you would be trading 0.70% of a single Apple stock. On top of stocks, Trading 212 also offers CFDs on forex, commodities, cryptocurrencies, and more.

You will not need to pay any commission if the asset in question is priced in the same currency as your Trading 212 account. For example, if you were to deposit in US dollars and traded gold, no commissions would come into play as hard metals are priced in USD.

If, however, you decide to trade assets that are priced in a different currency from your Trading 212 account, a small FX fee of 0.5% will kick in. We should also note that Trading 212 also gives you access to traditional stocks and ETFs. This means that you can invest in the asset and collect your share of dividend payments.

This is also commission-free at Trading 212 – even on assets priced in a different currency. In terms of safety, Trading 212 has been offering brokerage services since 2004 – The provider is regulated and its mobile trading app has excellent reviews. For example, the app is rated 4.2/5 on Google Play and 4.7/5 on the Apple Store.

Trading 212 fees

Fee Amount CFD trading fee Variable spread Forex trading fee Spread, 1.4 pips for EUR/USD in average Crypto trading fee Spread, 40 pips for Bitcoin Inactivity fee Free Withdrawal fee Free Pros:

- Buy more than 10,000 shares and ETFs commission-free

- No deposit or withdrawal fees

- Very user-friendly

- Regulated by the FCA

- Trade CFDs with leverage

- Mobile app supported on iOS and Android devices

- Minimum investment just $1

Cons:

- 0.5% FX fee on CFD instruments not priced in your primary currency

- Too basic for experienced trading pros

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How to Choose the Best CFD Trading Platform for You

Although we have discussed the best CFD trading platforms available in the online arena right now, there are hundreds of other providers active in the space. As such, you might come across a platform that you like the look of that we haven’t discussed today.

If this is the case, we would suggest that you perform lots of research before you open a CFD trading account. In doing so, you can be 100% sure that the provider is right for you.

The most important metrics that need to be considered when searching for the best CFD trading platforms are as follows:

Regulation

The CFD trading industry is heavily regulated in most countries around the world. This is because CFDs are complex instruments that allow you to trade with more money than you have in your account via leverage. As such, in certain nations – such as the US, CFD trading is outlawed in its entirety.

Crucially, when searching for the best CFD trading platform for your needs, you must ensure that the provider has the legal remit to operate. This is a fairly straight forward process, as there are a number of tier-one regulators that dominate this space.

This includes:

- FCA (UK)

- CySEC (Cyprus)

- ASIC (Australia)

- MAS (Singapore)

Therefore, if your chosen CFD platform is licensed by at least one of the aforementioned bodies – like each of our selected providers are, you can be sure that it is heavily regulated. For example, eToro is licensed by the FCA, ASIC, and CySEC – meaning that you have regulatory oversight on three fronts.

These regulators ensure that your funds are kept in separate bank accounts from the CFD platform and that it does not offer you more leverage than your country of residence permits.

CFD Assets and Supported Markets

The beauty of CFD platforms is that they often give you access to thousands of financial markets. After all, CFDs are only tasked with tracking the price movements of the asset in real-time – meaning there is no requirement or need for you to own the instrument.

With that said, there is often a vast disparity in what assets you will have access to at your chosen CFD trading platform. For example, eToro covers everything from stocks, ETFs, indices, cryptocurrencies, forex, and commodities.

This covers the bulk of the global trading sphere – so if a market exists, you’ll likely find it at eToro. At the other end of the spectrum, we did come across a lot of CFD brokers that offer a very small number of markets.

As such, make sure you check what assets your can trade before opening an account with a CFD trading platform.

Fees

An additional benefit from trading CFDs – as opposed to buying and selling traditional assets, is that you will often benefit from low fees. Once again, this is because the broker is not required to purchase the asset on your behalf.

However, CFD trading fees can vary quite considerably depending on which platform you choose, so we’ve broken down the main charges to look out for below.

Commissions

Make no mistake about it – the best CFD brokers in the online space allow you to trade commission-free. Of course – platforms still need to make money, but they often do this via the spread.

Nevertheless, some trading platforms will charge a commission – which is usually in the form of a percentage. For example, if the CFD trading platform charges 0.2% and you stake $500, your commission will amount to $1.

Spreads

Although there are heaps of providers offering a commission-free service, the best CFD trading platform will always charge a spread.

The spread is an indirect fee that you need to take into account and is reflected by the gap between the bid and ask price of the asset.

- For example, if the difference between the two prices amounts to 0.5%, this is what you are paying via the spread.

- In simple terms, you would need to make gains of 0.5% on your CFD trade to break-even, so anything above this is actual profit.

When we went through the research process ourselves, we found that eToro offers the perfect combination between zero commissions and tight spreads.

For example, forex and gold can be traded from an average spread of 0.008% and 0.05%, respectively. We should note that not all CFD trading platforms clearly advertise what spreads they change.

As such, you might need to perform some calculations of your own. You can do this easily by calculating the percentage difference between the bid (buy) and ask (sell) price of the financial instrument in question.

Overnight Financing

Although CFD trading instruments come with the benefit from low commissions and spreads, there is a chink in the armor – overnight financing. For those unaware, this is a fee charged by CFD trading platforms for each day that you keep the position open. The platform might implement this charge at a certain time of the day – such as 10 pm.

-

- The reason that overnight financing is charged is that CFDs are leveraged financial products.

- As such, overnight financing could be viewed as a daily interest charge that you pay to access your chosen markets.

- In terms of how much you will pay, this is usually calculated as an annual interest rate that is then calculated against your exposure.

The best CFD trading platforms will clearly display what you will pay in overnight financing fees before you place your trade. eToro, for example, displays the daily fee in dollars and cents.

Ultimately, overnight financing means that CFD trading is best suited for day or swing traders. As such, if you wish to trade assets for several months or years, you are best advised to opt for traditional investment vehicles like stocks or ETFs.

Other CFD Trading Platform Fees

There are several other fees that you might come across when researching the best CFD trading platforms.

This includes:

-

-

- Deposit and Withdrawal Fees: You might need to pay a fee to deposit and/or withdraw funds. If so, this is often a percentage charge that is multiplied against the size of the transaction.

- FX Fees: Some CFD trading platforms charge you an FX fee when you trade an asset that is priced in a different currency from that of your account. FX fees can also come into play when you make a deposit.

- Short-Selling Dividend Stocks: If you are short-selling a stock CFDs that pay dividends, the platform will likely debit your account to cover the payment. At the other end of the transaction, those going long on the stock CFD will receive the dividends.

- Inactivity Fees: Even the best CFD trading platforms in the online arena charge inactivity fees. For example, if your account is marked as dormant after 12 months of inactivity, you might need to pay a monthly fee. If, however, your balance is zero, no fees will be applicable.

-

The best thing you can do to find a low-cost online CFD trading platform is to check the fee table on the provider’s website before signing up.

Trading Tools & Features

The best CFD platforms will offer an assortment of tools and features that can enhance the trading experience, while others offer a skin and bones service.

Some of the most notable tools to look out for are as follows:

Leverage

The best online CFD trading platforms offer leverage on all supported marketplaces. As we briefly covered earlier, leverage allows you to boost your account balance and thus – enables you to trade CFDs with more than you have available. In essence, this allows you to amplify your profits on successful positions.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Once again, the amount of leverage that you will have at your disposal will depend on several factors, such as:

-

-

- The financial instrument – major forex pairs usually come with the highest limits

- Your country of residence – Europeans and UK residents are restricted to a maximum of 1:30, while other nations have no limits at all

- Whether you are a retail client or a professional trader

-

Take note, leverage not only has the capacity to boose your profits – it will do the same for your losses. As such, tread with caution and make sure you understand the risks.

Trading Orders

The best online CFD trading platforms ensure that you have multiple order types to choose from.

This includes:

-

-

- Buy and Sell Orders

- Limit Orders

- Market Orders

- Stop-Loss Orders

- Trailing Stop-Loss Orders

- Take-Profit Orders

- Good ’til Cancelled Orders

-

If your chosen online CFD trading platform doesn’t offer your preferred order types, an alternative root is to trade via MT4/5 or cTrader. This is, however, on the proviso that the provider in question is compatible with the aforementioned third-party platforms.

Copy Trading

The ‘Copy Trading’ phenomenon has grown to exponential heights in recent years. As we briefly explained earlier, this allows you to copy a successful trader like-for-like. In doing so, this allows you to actively day trade CFDs without needing to have any experience. In other words, this is a 100% passive way of accessing the global financial markets.

There are several ways in which you can utilize the Copy Trader feature, such as buying and installing a robot into MT4. However, the most user-friendly, transparent, and safe way of doing this is to use eToro. This is because the regulated CFD trading platform gives you access to thousands of verified traders.

Everything at eToro is transparent, meaning that you can view the following statistics of your chosen Copy Trader:

-

-

- Total profit and loss since joining eToro

- Average monthly returns

- Preferred asset class (e.g. stocks or forex)

- Risk rating

- Average trade duration

- And more

-

Not only is the Copy Trading tool at eToro simple to use, but there are no additional fees to take into account. Plus, you can still add assets to your portfolio as and when you see fit – so you retain full control over your account.

Alerts and Notifications

Irrespective of which CFD trading market you are interested in, financial instruments change in value on a second-by-second basis. As such, it’s important to keep abreast of what is happening at all times.

The best way of staying ahead of the curve is to choose an online CFD trading platform that offers alerts and notifications. In its most basic form, the platform might allow you to set up a price alert on CFD assets you are interested in trading.

-

-

- For example, gold might be priced at $1,850 per ounce, but you might not want to enter the market until it breaches $2,000.

- When it does, the platform will send an alert to your mobile phone in real-time.

-

The best online CFD trading platforms take things one step further by allowing you to set up volatility alerts. For example, if Facebook stocks move up or down by more than 5% in a single day of trading, an alert will be sent out by the provider.

Education, Research & Analysis

The best CFD trading platforms recognize that not all account holders are seasoned pros. On the contrary, many traders are entering the CFD space for the very first time.

As such, we find that the best CFD trading platforms offer an abundance of educational resources. This might include guides on how to buy and sell specific assets, an explanation of key order types, and even weekly webinars that are hosted by an in-house trader.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

We also find that the best CFD trading platforms provide research and analysis tools. At the forefront of this is the ability to perform in-depth technical analysis from within the platform. Alternatively, if MT4/5 is supported, this is also sufficient.

Your chosen asset class can also be influenced by real-world news events – such as an adjustment of interest rates, an interruption of supply, or wider geopolitical uncertainty. As such, the best CFD trading platforms also provide you with financial news.

User Experience

CFD trading platforms can be an intimidating battleground for those with little to no experience of how the financial markets work. This is why the end-to-end user experience offered by the platform is a crucial metric to consider. You normally get a feel for whether or not the provider is suitable for newbies when you first head over to the platform’s website.

However, in order to get a true understanding of whether or not the CFD trading platform is user-friendly, you need to test it out yourself. The best way to do this is to choose a platform that offers CFD trading demo accounts. All of the providers that we discussed earlier on this page offer this – with no requirement to make a deposit.

Ultimately, this allows you to try the platform out before making a financial commitment. In addition to the trading experience itself, the best CFD platforms should make the process of depositing and withdrawing funds a simple one.

Mobile App

All of the best CFD trading platforms that we have discussed today offer a fully-fledged mobile app. Although you might not be interested in trading via a mobile app, having access to one is crucial nonetheless. After all, you might be away from your main desktop computer and want to enter a new position.

Or, you might be out of the house and find out that one of your positions is tanking and thus – wish to close it immediately. Not only do the best CFD trading apps offer a great user experience that is fully optimized for your operating system, but they give you access to all of the same account features as found on the main desktop platform.

This should include the ability to o deposit/withdraw funds, check the value of your portfolio, enter and exit positions, perform research, and more.

Payment Methods

When using traditional, old-school stock trading platforms, there is every chance that you will only be able to fund your account via a bank wire.

This means that you’ll likely need to wait 2-3 days for the funds to arrive – sometimes more. As such, the best CFD trading platforms allow you to make an instant deposit with a debit/credit card.

This is something offered by all of the providers listed on this page. eToro takes things one step further by also supported e-wallet deposits and withdrawals.

This includes Paypal, Neteller, and Skrill. Don’t forget to check whether any fees are payable on your chosen payment method. Specifically, some CFD trading platforms will charge you an additional fee when using a credit card. IG, for example, charges 0.5% and 1% on MasterCard and Visa credit cards, respectively.

Customer Service

The best CFD trading platforms are there for you when you need assistance. This is best facilitated by a live chat feature that can be accessed on the provider’s website without needing to log in. Although telephone support is sometimes offered, this can be cumbersome if the provider is located overseas.

We came across a plethora of CFD trading platforms that only offer email assistance – meaning you won’t be able to speak with an agent in real-time. In terms of support hours, some platforms operate 24/7, while others opt for 24/5 – in-line with the financial markets.

What is the most reliable CFD broker?

A reliable CFD trading platform is a broker that has excellent customer service, fast transaction speeds, strong security features and transparency. While a number of the brokers that we have reviewed could be considered reliable, eToro is by far the most reliable trading platform for CFD trading.

Plus500 is fully regulated in a number of countries around the globe including the UK, Europe and Australia. The platform also offers several effective customer service options to it’s users which means that you can get help with any issues that you may have while using the web trader. Furthermore, eToro is transparent about fees, security and restrictions. As long as you conduct research before signing up to the platform, you will not run in to any hidden costs or unexpected requirements.

Another reason that Plus500 could be considered reliable is that the platform is easy to use, even for less advanced traders. The platform interface has a clear, simple design which makes it easy to find the tools and resources that you need whilst trading. This adds a layer of reassurance for new traders who may be intimidated by more complicated trading platforms.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How to Start CFD Trading

If you are completely new to the world of CFD trading, we are now going to walk you through the process of getting started. This includes opening an account, making a deposit, and placing your first order.

The guidelines below will show you how to trade CFDs at commission-free platform eToro.

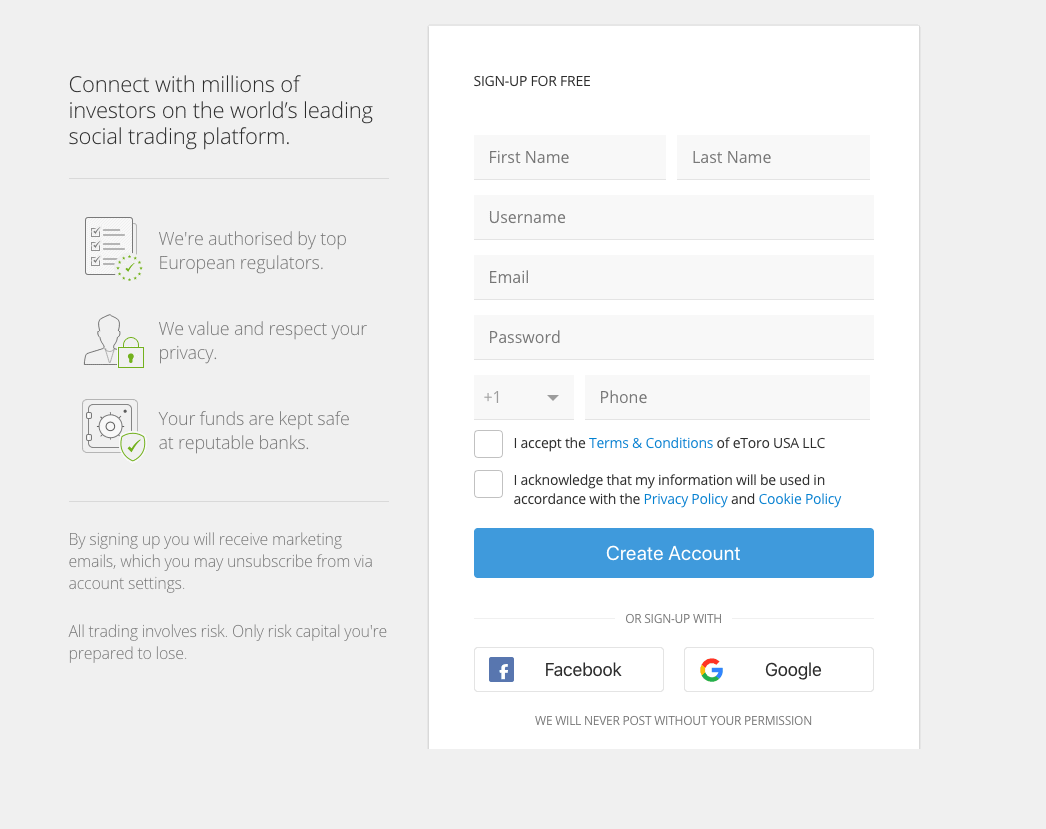

Step 1: Open an Account

As we noted earlier, the CFD trading scene is heavily regulated. As such, eToro requires you to go through a quick registration and verification process before you can start trading.

To get the ball rolling, head over to eToro and click on ‘Join Now’.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

The CFD trading platform will then collect some information from you, which includes:

-

-

- Personal Information

- Contact Details

- National Tax Number

- Prior Trading Experience

-

You will also need to create a username and a strong password.

Step 2: Confirm Identity

Once you have opened an account on eToro, the provider will then ask you to submit some ID documents.

This includes:

-

-

- Valid passport or driver’s license

- Utility bill or bank account statement (issued within the last 3 months)

-

eToro uses automated FinTech products to verify documents, so you should get the green light in less than a couple of minutes.

Step 3: Deposit Funds

You will now need to make a deposit so that you can start trading CFDs with real money.

On eToro, you can choose from the following payment methods:

-

-

- Visa

- MasterCard

- Maestro

- Paypal

- Skrill

- Neteller

- Bank Transfer

-

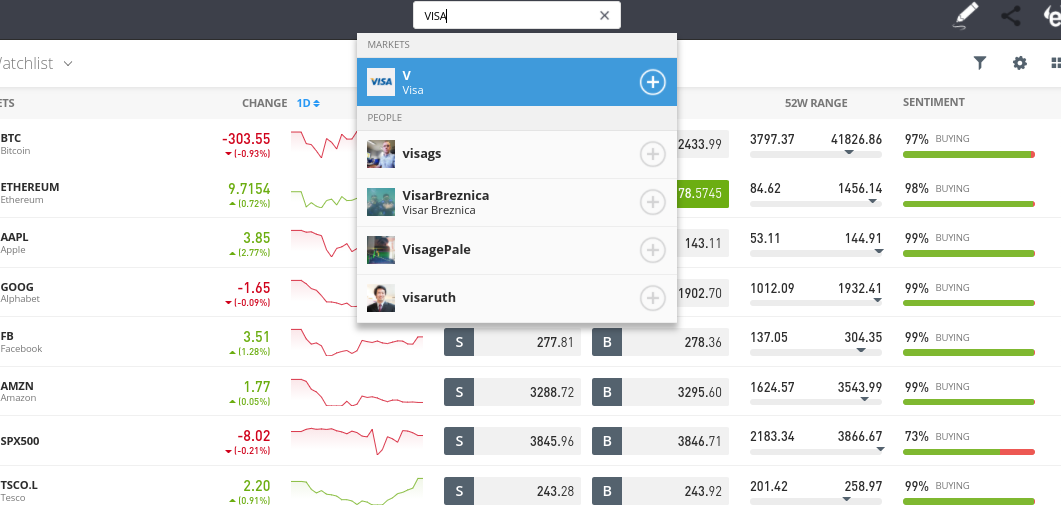

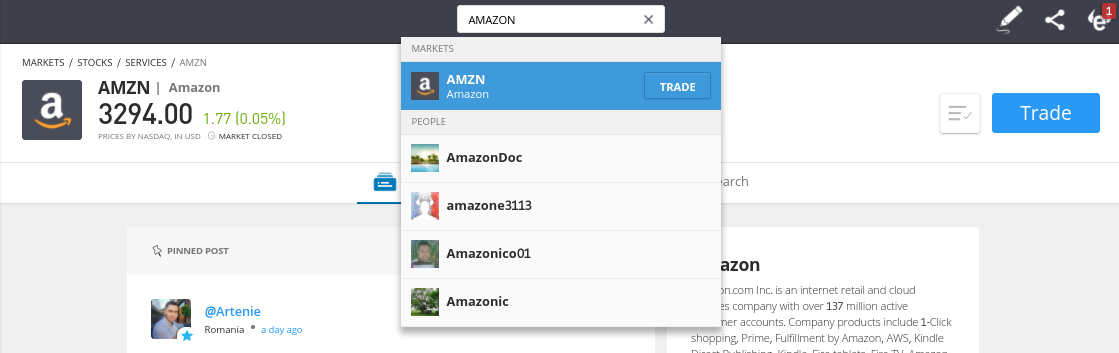

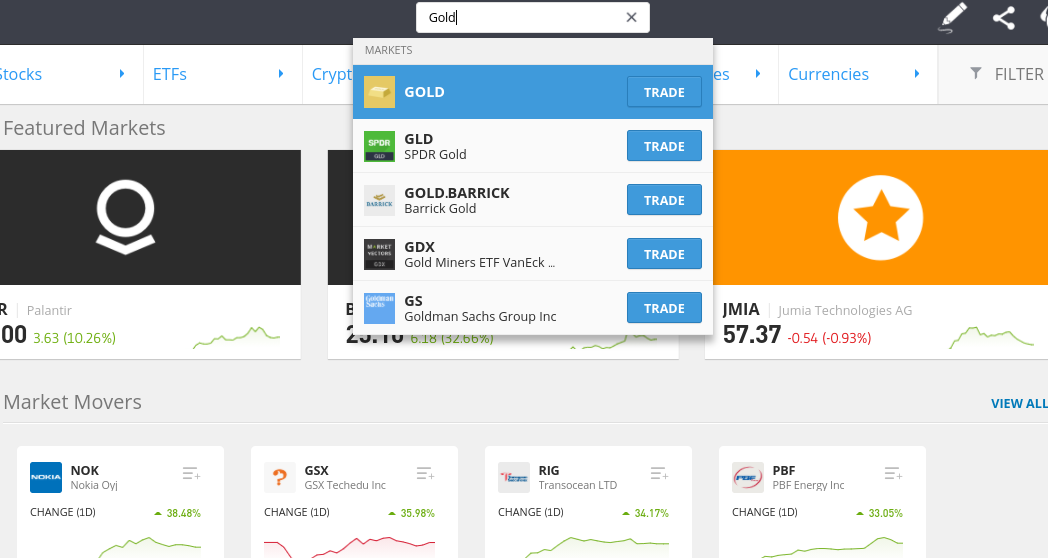

Step 4: Search for a CFD Trading Market

eToro makes it easy to find your chosen CFD trading markets. In fact, if you already know which financial instrument you are interested in – simply search for it.

As per the example below, we are looking to trade gold CFDs – so we enter ‘gold’ into the search box and click on the ‘Trade’ button.

Alternatively, by clicking on the ‘Trade Markets’ button on the left-hand side of the dashboard, you will be presented with all of the assets available on eToro. You can break this down by the respective asset class – for example, commodities or indices.

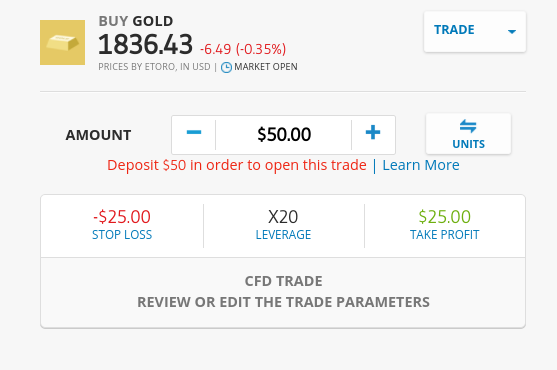

Step 5: Place a CFD Trade

The final stage of the process is to place an order. In essence, this tells eToro what trade you are looking to place on your chosen CFD market.

The fields that you will be asked to fill out are as follows:

-

-

- Buy/Sell: This stipulates whether you think the CFD instrument will rise (buy order) or fall (sell order) in value.

- Amount: The ‘Amount’ box is where you need to enter your stake. In our example, we are staking $50.

- Leverage: If you want to apply leverage, select your required multiple. In our example, we are applying leverage of 1:20 on our gold CFD trade.

- Stop-Loss: By entering a stop-loss order price, eToro will automatically close your CFD trade if it goes down in value by a certain amount.

- Take-Profit: You also enter a price that you want your CFD trade closed at when it hits a specific profit target.

-

Finally, click on the ‘Open Trade’ button to place your commission-free CFD trade on eToro!

Conclusion

The CFD trading platform space is now an overly saturated battleground. With so many providers at your disposal, knowing which platform to sign up with can be a time-consuming and daunting process. This is why we have outlined the best CFD trading platforms in the online arena in 2026.

With that said, we found that Plus500 is by far the best CFD trading platform of all the providers we reviewed. This is because the platform is commission-free, offers tight spreads, and hosts thousands of tradeable CFD markets. The platform is also available on both mobile and desktop devices.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

What is the meaning of a CFD?

CFDs are contracts-for-differences. They are created by regulated online brokers and will track the real-time price of an asset. This allows you to speculate on whether the asset will rise or fall in value without needing to take ownership.Which CFD trading platforms have the lowest fees?

There are many fees that you need to take into account when searching for the best low-cost CFD trading platform. This includes commissions, spreads, and overnight financing. We found that eToro excels in all three departments - as it is commission-free, offers tight spreads, and charges reasonable overnight financing fees.What is the best CFD trading platform?

After reviewing dozens of providers, we found that eToro is the best CFD trading platform of 2022. Crucially, you can trade thousands of CFDs at this heavily regulated platform without paying any commission.What CFD trading platforms do professional traders use?

Most CFD trading platforms offer accounts that are dedicated to professional traders. For example, a lot of experienced traders will open a professional account with commission-free platform eToro - as this gives them access to much higher leverage limits.Are CFDs legal in the US?

No, the US is one of few countries around the world that does not allow its citizens to trade CFDs. As such, if you come across a CFD platform that claims to offer accounts to US residents, it is likely doing so illegally.How do commission-free CFD trading make money?

CFD trading platforms that offer a commission-free service will make money from the spread. This secures a consistent means of revenue, as the platform will make money irrespective of which way the markets goWhat CFDs can you trade online?

CFDs can track the value of virtually any asset class. As such, the best CFD trading platforms allow you to trade stocks, indices, bonds, interest rates, ETFs, forex, cryptocurrencies, commodities, and more!References:

- https://www.etoro.com/trading/cfd/what-is-cfd/

- https://www.youtube.com/watch?v=Chd4ukrCr4g

- https://pepperstone.com/en-au/education/how-trade-cfds/

- https://en.wikipedia.org/wiki/Contract_for_difference

- https://www.investopedia.com/articles/stocks/09/trade-a-cfd.asp

- https://www.youtube.com/watch?v=gFhjf5KIPTQ

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

eToro: Best Trading Platform - Trade Stocks & ETFs

61% of retail CFD accounts lose money. Your capital is at risk.

Visit eToroeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.61% of retail CFD accounts lose money. Your capital is at risk.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

CFD trading it is a method of trading derivatives. Instead of trading an asset, you are trading a contract whose value is directly related to the asset’s value. This means that you are not buying shares but buying contracts whose value depends on the value of the corresponding shares.

CFD trading it is a method of trading derivatives. Instead of trading an asset, you are trading a contract whose value is directly related to the asset’s value. This means that you are not buying shares but buying contracts whose value depends on the value of the corresponding shares. Leverage is the reason why CFDs are so famous today. It consists of you paying only a percentage of the total price of an asset. This is called margin, while your broker lends you the remaining value.

Leverage is the reason why CFDs are so famous today. It consists of you paying only a percentage of the total price of an asset. This is called margin, while your broker lends you the remaining value.