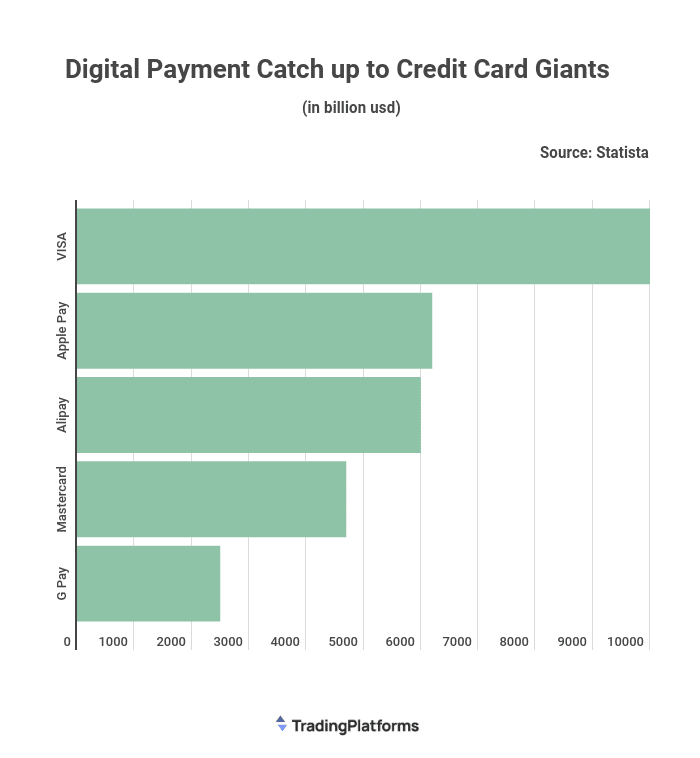

The prevalence of Apple Pay increases as more stores and apps begin to accept the payment method. TradingPlatforms.com reports that Apple Pay has surpassed Mastercard as the payment system handling the most annual transactions at over $6 trillion. According to the data, Apple Pay could pose a severe challenge to VISA’s market share in the future.

Commenting on the data, Edith Reads from TradingPlatforms.com said. ” Apple Pay is increasingly becoming the go-to payment method for consumers and businesses alike. The fact that it has now processed more transactions than Mastercard is a testament to its popularity. Already, it has outdone Mastercard with only VISA remaining on top. Apple Pay has an undue advantage and benefits from their monopoly on iPhone NFC hardware. We expect to see Apple Pay continue to grow in popularity and market share in the coming years.”

Apple’s Global Expansion

Apple Pay is rolling out in multiple countries. In 2021, Apple expanded its global footprint by delivering its mobile wallet to nine new areas. Notable among the nine countries are Colombia, Israel, and Mexico. Besides, they are currently in talks with Hyundai to expand to Korea. With this expansion, the company’s presence reaches approximately 60 countries and regions. Additionally, public transportation networks in over 200 cities are supported with Apple Wallet.

Apple Pay is a mobile payment that holds various advantages over plastic cards. Mobile payments allow clients to have their points added in real-time, unlike credit cards, which are tied to incentives at the end of purchase. Also easily included in the payment process are coupons and prizes.

This improves loyalty program retention with interactive elements. Additionally, biometrics that secures smartphone digital wallets adds an extra degree of protection. They go above and beyond the chip and pin used for credit card transactions.

What Drives Apple Pay Adoption?

Tap-to-pay (T2P) technology is not new but has seen tremendous growth over the past two years. While Apple Pay is snowballing in brick-and-mortar stores, it is exploding in the online and mobile shopping markets.

Covid 19 undoubtedly played a role in the uptick (store closures, the rise of social alienation, and lockdowns). Besides, consumers shifted their attitude towards digital wallets over plastic credit cards.

People are under pressure to embrace digital habits and payment alternatives. A digital wallet that saves payment information only requires one click to purchase. Apple Pay populates shipping and contact details, making online shopping a breeze for the user.

Question & Answers (0)