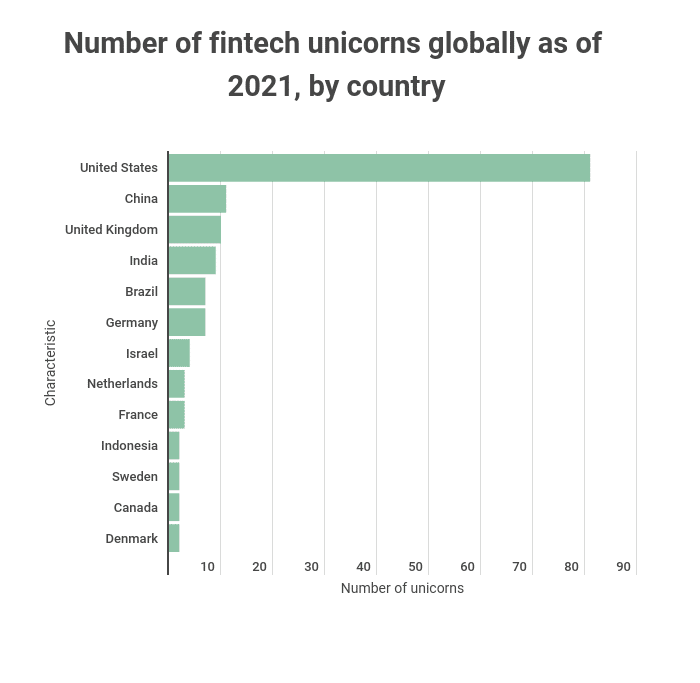

The United States leads in the number of fintech Unicorns globally. That’s per a TradingPlatforms analysis of the global unicorn trends. It concludes that America contributes 81 out of 157 worldwide fintech firms with valuations exceeding $1 billion. That figure gives the U.S. a 51% dominance over the other nations.

This statistic is not a surprise because America has been one of the most prolific investors in fintech in recent years. The country has been investing heavily into different branches of fintech, including insurance, cryptos, payments, and lending services, to stay ahead of the competition.

“The reasons for this dominance are two-fold: funding and innovation capability, “ holds TradingPlatforms’s Edith Reads. She further asserts, “The U.S has more venture capital funding than any other country. This allows entrepreneurs to launch projects without worrying about funding. It also boasts greater innovation capabilities than most countries due to its strong education system that encourages experimentation with ideas and solutions.”

China follows the U.S. a distant second, with 11 startups attaining the unicorn status. Meanwhile, the UK and India have 10 and 9 of these institutions, respectively. Brazil and Germany tie in the fifth spot with 7 of these each.

New frontiers for fintech unicorns

In a world where the fintech sector is growing at an unprecedented rate, it’s not surprising that some countries are looking to grow their fintech sectors. In addition, as the industry evolves, we are seeing the rise of fintech innovation hubs.

The sector is recording massive growth in countries like China and India. Others, including Brazil and Malaysia, are also following suit. These two countries jointly host over 380 fintech companies, which means they could be home to the next generation of fintech unicorns.

Brazil has been making strides in building its fintech ecosystem. For example, it is working towards boosting market competition and expanding the scope for financial education, which could help create an environment ripe for innovation. Moreover, it is implementing open banking, which could support Brazilian businesses in implementing new technologies.

Malaysia’s huge unbanked and underbanked population provides the ideal environment for fintech firms to thrive. In addition, the country has a high mobile penetration rate, a big boon for companies pursuing fintech opportunities. Some estimates say e-payments companies make up nearly 40% of the country’s fintech industry.

Creating conducive environments for unicorns

A country can rise to the ranks as a hub for leading fintech unicorns by creating an ideal breeding ground for fintech startups. It can do this by creating a balanced environment that connects talent, capital, and policy to develop the best fintech industry.

First, it must develop its ability to attract, develop and retain talent in finance, technology, and entrepreneurship. Without such talent, any efforts to develop the fintech industry will be futile. Secondly, the country must enhance access to seed and scale capital, whether public or private.

Additionally, the country must build its demand for such products. Countries with established fintech markets inspire more innovation in that space. Finally, governments and regulators need to strike a balance between encouraging innovation, promoting competition, and protecting consumers.

Question & Answers (0)