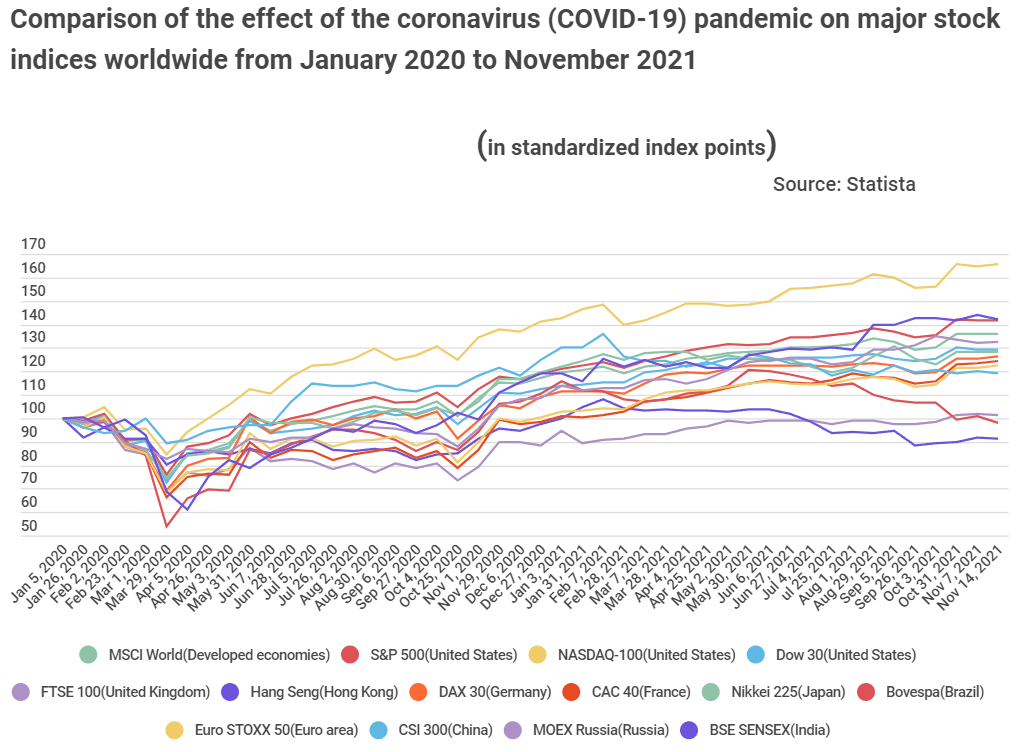

The NASDAQ composite index made the fastest recovery from COVID-19 effects globally. According to data presented by Tradingplatforms.com, the index rebounded by 65 per cent on 14th November 2021 from its January 2020 values. In contrast, most of the other leading stock markets had only appreciated by approximately 20 to 40 per cent.

The coronavirus (COVID-19) plague affected the global economy significantly. As a result, leading stock market indices plummeted in March 2020. Nevertheless, those declines have differed in extent from one index to another.

Different recovery patterns

The markets have shown different recovery patterns. For instance, on 15th March 2020, traditional stocks in the US had shed 40 per cent of their value. That was the case, too, with leading European exchanges. That drop was in comparison to their values as of 5th January 2020.

Contrastingly, NASDAQ and most Asian markets have done better. They lost 20 to 25 per cent of their values. Again, they were quick to shake off the COVID-19 effects.

Many regard the New York-based NASDAQ as the tech industry’s benchmark. That notion is due to most tech giants listing their stocks there. And technology had a hand in the index’s massive upswing.

During the pandemic, the tech sector registered healthy performances, shoring up NASDAQ’s fortunes. Edith Reads from tradingplatform.com affirms that view.

Commenting on the same, she said, “A shift to online commerce saw NASDAQ listed giants profit significantly. These include Netflix, Paypal, and Amazon that already have a strong online presence. Consequently, the index made huge gains too. Thus it recorded the fastest recovery compared to other leading global stock markets.”

The energy sector took the most beating

The global energy industry suffered the most from the COVID-19 epidemic. Oil corporations witnessed massive declines in their share prices owing to several reasons. First, many workers cut their commute as firms allowed them to work from home.

Secondly, Covid-19 containment measures severely dented the tourism sector that relies heavily on oil-powered transport. Travel restrictions had the industry on its knees, leading to further plummeting of oil demand.

Additionally, poor performances of two leading indices compounded the sector’s woes. The London (FTSE 100) and Hong Kong (Hang Seng) stock exchanges have fared poorly. They have been slow to recover in comparison to other leading indices.

That said, the pandemic isn’t the only factor that influenced the performances of the FTSE 100 and the Hang Seng. There is a likelihood that other underlying issues caused their slower recoveries. For the former, we can’t ignore the effects of Brexit. While for the latter, there was the civil unrest that Hong Kong experienced.

Question & Answers (0)