Best Crypto Credit & Debit Cards for 2025

Many people hold cryptocurrency, making ‘crypto cards’ an increasingly popular concept. Cardholders can use these cards much like regular credit and debit cards, except they can use cryptocurrency holdings easily – without converting to FIAT currency first.

Therefore, this article is dedicated to explaining the best crypto credit cards in detail, reviewing the top providers on the market, and demonstrating how you can use a highly-rated crypto card right now – all from your own home.

Best Crypto Credit Cards List

- eToro Money Card – The Best Crypto Credit Card

- Crypto.com – The Best Crypto Card With Up To 8% Cashback

- BlockFi – The Best Crypto Card With Restriction-Free Cashback

- Nexo – Mastercard crypto card with Apple Pay support

- Celsius – Zero-Fee Crypto Card Coming Soon

- Gemini – Premium Crypto Credit Card with Instant Reward Payments

Best Crypto Cards Reviewed

Listed below are six of the best crypto credit cards available right now. These cards will be discussed individually in the following section, including their fees, rewards, and availability.

A dedicated crypto Visa card can make your purchase activities much easier if you regularly invest in Bitcoin (or any other crypto). In addition, the cards are linked directly to your crypto balance, so there is no need for lengthy conversions – resulting in considerable cost savings. Alternatively, you might want to find the best crypto banks that pay high-interest rates on crypto staking.

Now that we know what the best crypto cards are let’s look at the ones featured in the previous section to understand your options.

1. eToro Money Card – The Best Crypto Credit Card

We recommend the eToro Money card as the best crypto credit card available. There are more than 24 million registered users of eToro, one of the leading online brokers in the world. As a result of its exceptional reputation for security, the platform is regulated by leading organizations, including the FCA, ASIC, CySEC, FinCEN, and FINRA.

Recently, eToro launched a crypto card that lets users spend crypto balances like FIAT money. Your eToro Money account is linked directly to your card, separate from your trading account. Before using the card, eToro users must create an eToro Money account. This process is seamless and can be completed digitally.

With the eToro Money card, you can use your crypto holdings wherever Visa debit cards are accepted. In addition, you can use the eToro Money card around the world with highly competitive exchange rates – and there are no setup or monthly fees associated with it. For example, up to $25,000 of realized equity on eToro will allow fee-free withdrawals of £650 ($849) per month, while over $25,000 of realized equity will allow up to £1,000 ($1,306) per month.

Users can deposit as little as $10 fee-free with eToro Money, another great feature. Instant withdrawals are also available from your eToro Money account, making it easy to use your funds for trading and spending. Furthermore, eToro Money provides each user with a unique account number and sort code, simplifying the payment process!

You can also store all your digital assets with eToro’s best crypto wallet, making it a convenient and safe way to store them.

| Provider | Supported Coins | Fees | Rewards | Availability |

| eToro Money Card | 50+ | No monthly fees | Automatically accrue staking rewards on eligible coins | Anywhere that Visa cards are accepted |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

- Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

- Clarification: eToro Money card is only for the UK users available.

2. Crypto.com – The Best Crypto Card With Up To 8% Cashback

The Crypto.com credit card is another great option to consider. With the Crypto.com card, users can trade more than 250 digital currencies through one of the best crypto apps available. Apart from the trading component, Crypto.com’s dedicated Visa card is one of the best, letting users spend their crypto holdings online or in person.

The card has no annual fees and lets you top up with FIAT currency or cryptocurrency. The Crypto.com card comes in five tiers, each offering a different amount of cashback. The highest cashback tier, Obsidian, pays an impressive 8% on eligible transactions. However, Crypto.com users can only access this tier if they stake £300,000 ($391,530) worth of CRO.

The Midnight Blue tier does not require any CRO staking; this tier offers 1% cashback on eligible purchases. On the Crypto.com app, cashback distributions are deposited directly into your crypto wallet in CRO. Payments can be made worldwide with the Crypto.com card, which offers competitive exchange rates.

Crypto.com offers a specific amount of free withdrawals for each tier of cards, starting at £180 ($234) for the Midnight Blue card. There is also a monthly minimum of £1,800 ($2,349) in free currency exchange transactions, and anything above this will cost 0.5%. In addition, higher tiers offer exclusive benefits, such as access to airport lounges and priority customer service. In 2022, Crypto.com is considered one of the best crypto staking platforms for beginners.

| Provider | Supported Coins | Fees | Rewards | Availability |

| Crypto.com | 90 | No monthly fees | Up to 8% cashback | Anywhere that Visa cards are accepted |

Cryptoassets are a highly volatile unregulated investment product.

3. BlockFi – The Best Crypto Card With Restriction-Free Cashback

Users of BlockFi can receive an introductory offer where they can receive 3.5% on eligible purchases – capped at $100 worth of BTC and 1.5% on all other purchases. Using the BlockFi crypto card, users can also refer a friend and earn $30 worth of BTC. In addition, the BlockFi card offers users who spend over $50,000 per year 2% cash back instead of 1.5%. That makes it one of the best crypto interest accounts for 2022.

BlockFi requires good credit to use its card, yet the pre-approval process won’t affect your credit score. Additionally, there is no spending limit once the card is acquired, and BlockFi even reimburses 0.25% of all eligible crypto trades made with the card. With these factors in mind, BlockFi’s Visa card is undoubtedly one of the most popular crypto credit cards.

| Provider | Supported Coins | Fees | Rewards | Availability |

| BlockFi | 8 | There is no monthly fee | 3.5% cashback for the first 90 days of use; 1.5% after that | Anywhere that Visa cards are accepted |

Cryptoassets are a highly volatile unregulated investment product.

4. Nexo – Mastercard crypto card with Apple Pay support

The Nexo Card also connects with Google Pay and Apple Pay, meaning contactless payments can be made. Users can also create their own ‘virtual cards’ with unique credentials, making online transactions safer. Nexo also allows users to withdraw up to €10,000 ($10,958) per month from ATMs.

Payments made with a Nexo card are made in the local currency. As a result, you can save up to €20,000 ($21,917) per month on FX fees. Finally, Nexo offers a crypto interest account with a stunning 17% APR on eligible coins and the crypto card.

| Provider | Supported Coins | Fees | Rewards | Availability |

| Nexo | 32+ | No monthly fees | Up to 2% cashback on all transactions | Anywhere that Mastercard cards are accepted |

Cryptoassets are a highly volatile unregulated investment product.

5. Celsius – Zero-Fee Crypto Card Coming Soon

The Celsius card appears to be the best option for crypto credit card users looking for free monthly fees and high rewards. It is unclear what percentages you will receive on your crypto holdings, but you will receive weekly rewards. In addition, due to the card’s designation as a credit card rather than a debit card, Celsius allows users to repay the balance in FIAT, stablecoins, or rewards.

If you join the Celsius website’s waiting list, you’ll receive priority updates and be able to participate in exclusive activities. Finally, Celsius offers crypto-backed loans from as little as 1% APR, making it one of the best crypto loan sites.

| Provider | Supported Coins | Fees | Rewards | Availability |

| Celsius | 50+ | No monthly fees | Not yet announced (waiting list) | Not yet announced (waiting list) |

Cryptoassets are a highly volatile unregulated investment product.

6. Gemini – Premium Crypto Credit Card with Instant Reward Payments

Lastly, if you’re looking for the best crypto credit card, you should consider Gemini. The Winklevoss Twins founded Gemini, one of the world’s most popular cryptocurrency exchanges. The company offers a variety of cryptocurrency-based products and services, including the ‘Gemini Credit Card.’

It promises to offer crypto rewards on every purchase, with up to 3% cashback on eligible purchases. Users can choose to be rewarded in BTC, ETH, or a selection of 50+ cryptocurrencies. In addition, Gemini Credit Card will not charge an annual fee, foreign exchange fees, or exchange fees.

Interestingly, Gemini promises to offer instant rewards, eliminating the need to wait until the end of the month before receiving reward amounts. In addition to choosing between silver, black, or rose gold color scheme. As a result of the Gemini Credit Card’s leveraging of the Mastercard network, users can make transactions.

| Provider | Supported Coins | Fees | Rewards | Availability |

| Gemini | 50+ | No monthly fees | Up to 3% cashback on transactions | Anywhere that Mastercard cards are accepted |

Cryptoassets are a highly volatile unregulated investment product.

Best Crypto Credit Cards Comparison Fee

Now you know that many of the best crypto exchanges offer crypto cards that let you access your trading balance directly. The table below compares the supported coins, fees, rewards, and availability of each of the crypto cards listed in the previous section – allowing for easy comparison.

| Provider | Supported Coins | Fees | Rewards | Availability |

| eToro Money Card | 50+ | No monthly fees | Stake rewards are automatically accrued on eligible coins | Anywhere that Visa cards are accepted |

| Crypto.com | 90 | No monthly fees | Up to 8% cashback | Anywhere that Visa cards are accepted |

| BlockFi | 8 | No monthly fees | You will receive a 3.5% cashback for the first 90 days of use and a 1.5% cashback afterward. | Anywhere that Visa cards are accepted |

| Nexo | 32+ | No monthly fees | Up to 2% cashback on all transactions | Anywhere that Mastercard cards are accepted |

| Celsius | 50+ | No monthly fees | Not announced yet (waiting list) | Not announced yet (waiting list) |

| Gemini | 50+ | No monthly fees | Up to 3% cashback on transactions | Anywhere that Mastercard cards are accepted |

How do Crypto Cards Work?

A crypto card functions exactly like a regular credit or debit card. However, the crypto card holder will usually receive a physical card (either a Visa or Mastercard), complete with an expiration date, a card number, and CVV/CVC code. This feature enables the card to be used via the Internet, a card machine, or contactless technology.

However, the crypto cards are backed by the cryptocurrencies you have in your account with the card provider, unlike regular bank cards. In the case of an eToro Money card, the funds in your eToro Money account will be used to facilitate transactions. By purchasing Bitcoin (or another supported crypto), you can pay for goods and services with your digital currency holdings.

Merchants do not receive cryptocurrency payments. Instead, the card provider converts the required funds into FIAT currency in real-time when you purchase using your crypto card. Therefore, the merchant receives payment in their preferred currency, while you can still fund the transaction using crypto. Ultimately, this is a ‘win-win’ situation for all parties.

In addition to significantly streamlining the purchasing process, crypto cards also offer other benefits. For example, most credit cards offer cashback for crypto purchases, often at higher rates than traditional bank cards. In addition, many providers offer fee-free ATM withdrawals up to a certain threshold or lower FX fees.

Benefits of Crypto Credit Cards

Getting a crypto credit card offers a variety of practical benefits for cardholders, as you are probably already aware. Below are three of the most notable advantages:

Lucrative Rewards

The crypto cards discussed within this guide offer impressive rewards to their cardholders in the form of cashback. Cashback on crypto cards will be paid in crypto – either the provider’s native token or a popular coin such as BTC. Crypto.com’s credit card may be the best option for cashback rewards due to its 8% cashback rate on the highest tier.

Make Payments Using Crypto

The main advantage of crypto cards is instantly and easily spending your crypto holdings. For example, if you make a profitable crypto trade and wish to use the proceeds without a crypto card, you need to convert the cryptocurrency into FIAT and send the funds back to your bank account – which can be a lengthy process. To streamline the process, crypto cards enable users to spend the crypto they have in their balance as if it were FIAT while taking advantage of the Visa or Mastercard network.

Can Be Used Abroad

In addition, most crypto cards provide competitive exchange rates to be used abroad. As a result, people who travel frequently will appreciate it because it offers an ‘all-in-one’ spending solution. Additionally, some crypto card providers waive foreign exchange fees up to a certain threshold, offering an alternative to using a traditional bank card.

How to Choose the Right Crypto Credit Card for You

Even though our list presents an overview of the best crypto cards, it may still be difficult to decide. This decision ultimately depends on your unique circumstances and needs, so it’s essential to do as much research as possible.

These are five things to consider when selecting a crypto credit card to help with the decision-making process:

Fees

Fees are a factor to consider, as there is no point in getting a crypto card if it will cost you too much every month. However, in most cases, crypto cards are reasonably priced, and they may even be cheaper than some traditional debit cards.

Fees for monthly or annual accounts and ATM withdrawals are the most common fees to be aware of. However, Crypto.com does not charge a withdrawal fee of up to £180 ($234) per month on the Midnight Blue tier. Additionally, the provider offers free currency exchange transactions worth at least £1,800 ($2,349) per month.

Rewards

A crypto credit card often comes with rewards in crypto, like many crypto staking platforms. In addition, several of the cards on our list offer cashback, although they usually have eligibility requirements attached.

Supported Cryptos

Rather than supporting just one or two cryptocurrencies, the best crypto credit cards offer support for a variety. For example, users can pay with the eToro Money card using over 50 different cryptos, an excellent example. In addition, users can use Ethereum and numerous other altcoins to pay merchants using these digital currencies.

Eligibility Criteria

Some crypto cards have eligibility criteria that would-be users must meet due to their nature. For example, in some cases, users may be required to secure a certain amount of their native token before using the card.

Usability

As a final consideration, the card’s usability is also crucial since it will ensure you can use the card the same way as a traditional debit card. Due to their use of the Visa or Mastercard network, all of the cards presented in this guide are accepted worldwide. The merchant will never know that you are using a crypto-backed debit card since the funds are automatically converted to FIAT before payment.

How to Qualify for and Use a Crypto Card

Let us conclude by looking at the process of obtaining and using a crypto card. We recommend the eToro Money card since there are no monthly fees and supports over 50 cryptocurrencies.

Here are six quick steps to obtaining an eToro Money card, all from the comfort of your own home.

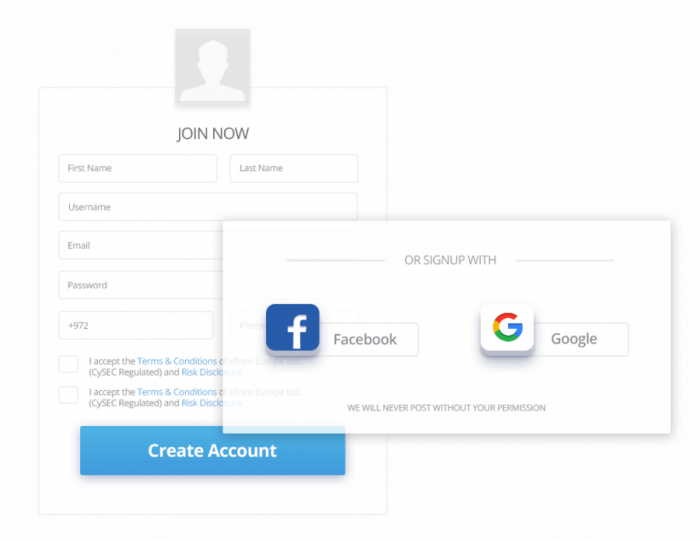

Step 1 – Open an eToro Account

Open a trading account with eToro by visiting the website and clicking ‘Join Now. Then, verify your account by clicking ‘Complete Profile’ and uploading proof of ID (e.g., passport) and address (e.g., bank statement).

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Clarification: eToro Money card is only for the UK users available.

Step 2 – Sign up for an eToro Money Account

To be eligible for eToro’s crypto card, you must establish an eToro Money account before creating your new eToro trading account. eToro Money accounts can only be accessed by members of the eToro Club, which means your trading account must contain at least $5,000 in realized equity. You can easily sign up for eToro Money on the eToro website if you meet these criteria.

Step 3 – Receive Crypto Card

You will receive your crypto card automatically once your eToro Money account is opened.

Step 4 – Make a Deposit

A deposit is required before buying crypto with your new crypto card. You can fund eToro with as little as $10, and there are no conversion fees for USD deposits. Payments can be made in the following ways:

- Credit card

- Debit card

- Bank transfer

- PayPal

- Skrill

- Neteller

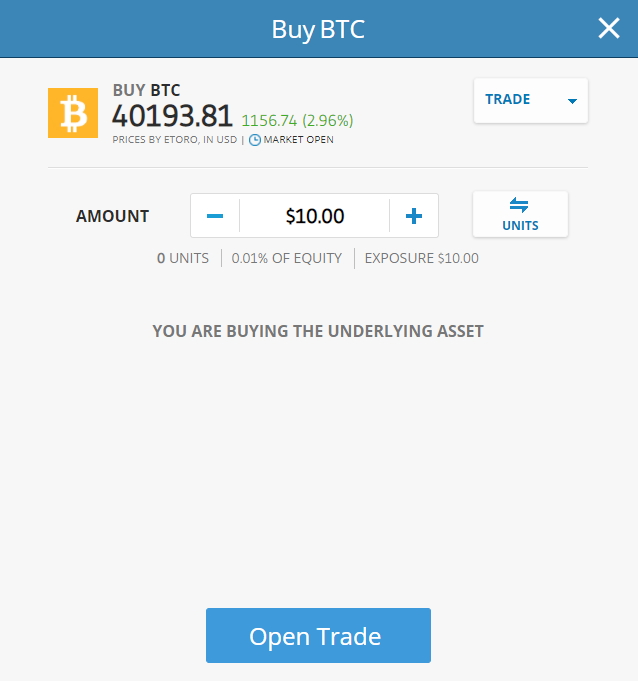

Step 5 – Buy Crypto

In the search bar, enter the name of the cryptocurrency you wish to purchase and click ‘Trade.’ In the order box that appears, enter your desired position size (at least $10) and click ‘Open Trade.’

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Clarification: eToro Money card is only for the UK users available.

Step 6 – Use eToro Money Card

Navigate to your ‘Portfolio’ section, click on the crypto you’d like to transfer, and click ‘Transfer to Wallet.’ You will then move your crypto holdings into your eToro Money account, where you can use them to make purchases using your eToro Money card.

Best Crypto Credit Card – Conclusion

This guide has provided all the information about the best crypto debit cards, including the top providers and their benefits. As crypto adoption increases every month, crypto cards will become more prevalent in the coming years, a good time to get involved.

We recommend using eToro’s crypto credit card if you are interested in setting up a crypto credit card today. You can spend your crypto holdings with the eToro Money card, which ties directly to your account balance.

eToro Money Card – Best Crypto Credit Card

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Clarification: eToro Money card is only for the UK users available.