Where & How to Buy Apple (AAPL) Stock in February 2026

Those who took the decision to buy Apple stock in the firm’s early days will have been handsomely rewarded by now. Founded by college dropouts Steve Jobs and Mike Wozniak in 1976, the Silicon Valley giant has cemented itself as a stubborn force in the tech world, having become the world’s first organization to pass the $3tr valuation milestone in 2022.

But while Apple is clearly no longer a candidate for a bullish bet on a fledgling underdog, its best days may still be yet to come. Besides the consumer tech products it has become synonymous with, Apple is becoming a major player in the realms of cloud solutions, streaming platforms and virtual reality, and even plans to enter the booming electric vehicle industry in years to come.

In this guide, we will determine whether Apple is still a good buy today, in addition to addressing where and how to buy Apple stock in 2026 with zero commission.

-

-

An Overview of How to Buy Apple Stock

Step 1: Find an online broker that suits your investment strategy, goals, and experience. Then, create an account by filling out the registration form.

Step 2: Verify your trading account by submitting two forms of ID and adding a payment method to your account.

Step 3: Deposit enough funds to buy Apple shares from your chosen broker.

Step 4: Search for the Apple (APPL) ticker symbol and read through any available insight or news.

Step 5: Decide how much APPL stock you would like to buy and execute the order.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: For US users available Crypto trading.

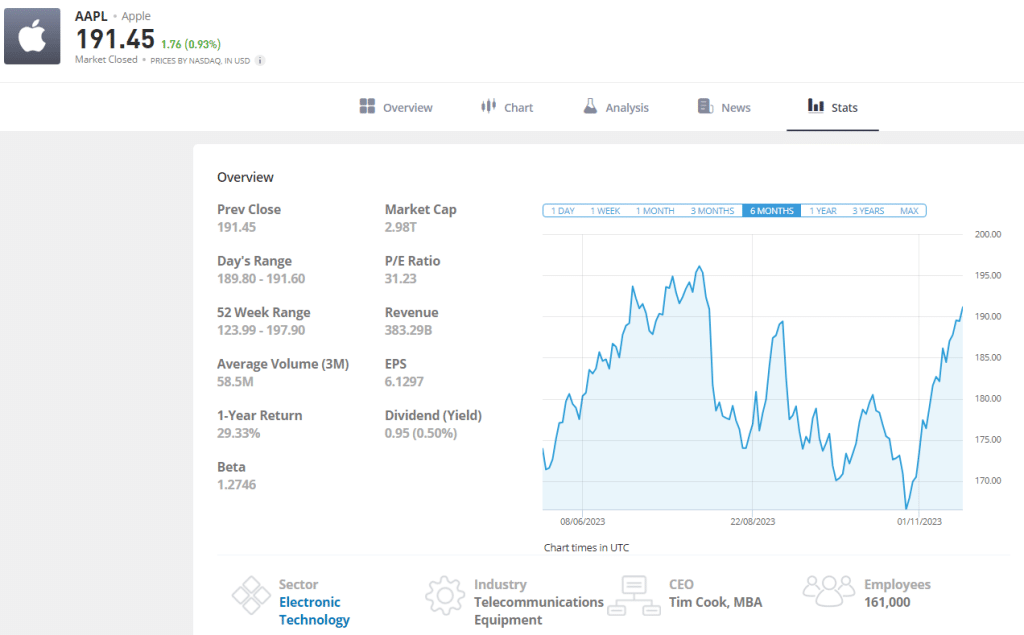

Apple (AAPL) stock data February 2026

What is Apple?

The world’s largest company with a market capitalization of close to $3tr, Apple is the undisputed champion of the global technology hardware market, having pioneered iconic, generation-defining products such as the Macintosh computer, the iPad, iPod, iPhone, Apple Watch, and more.

Many believe this relentless success will see a new chapter in 2024 upon the release of the firm’s highly anticipated Apple Vision Pro – a $3,500 headset capable of both virtual and augmented reality, designed for both professional and casual use.

Beyond this, the the firm boasts a huge array of applications, services and software, and is even being rumored to enter the automotive market at some stage in the future.

This consistent innovation and market dominance has translated into exceptionally strong market performance. Despite being founded in 1976, the firm’s stock price has increased by a further 40% in the past year.

Apple (AAPL) stock price 2026

Apple stock has enjoyed an impressive 2023, up 45% since the turn of the year, and hitting a record high at $195.38 on June 25th.

This is despite tough economic conditions and four consecutive quarters of revenue loss, with Mac and iPad income falling 34% and 10% year on year respectively. iPhone sales saw an uptick of less than 3%, allowing Apple to narrowly avoid a year of decline across its entire hardware suite.

But Apple’s ‘services’ business line (including Apple Music, Apple TV+ and Apple Store purchases) proved particularly lucrative throughout 2023, earning a record high of $85.2bn and 7.1% of annual growth (up from $78.8bn). The growth of Apple’s services is now outpacing both iPhone and company-wide growth.

Overall, Apple’s net profit fell nearly 3% from $99.8bn in 2022 to $97bn in 2023, while Q4 earnings also saw a downturn, dropping 1% from the previous quarter.

Apple’s Q4 earnings call on November 2 saw the firm’s share price drop from $176.08 to $175.17 the following day, with Wall Street analysts expecting 6% revenue growth in FY24. Apple stock currently has a market cap of 2.93 trillion, making it one of the biggest tech companies in the world.

But regardless of this underwhelming growth, Apple stock arguably still comes at a premium, making it a questionable buy for retail investors.

Is Apple (AAPL) a good investment in 2026?

Despite a period of relatively slow growth post-pandemic, Apple remains the world’s largest company by market capitalization ($2.976tr), and surely the most influential player in the consumer tech industry.

2023 statistics show that there are more than 1.46bn active iPhone users worldwide, while Apple Mac has a rapidly growing command of the computer market share (around one fifth).

But, being one of the great forces of commerce in the modern age, Apple has extended its influence to a number of key markets – most notably, a growing presence in the audio (headphones and speakers), wearables, streaming and cloud solutions markets.

With these being increasingly pivotal areas in the modern consumer tech landscape, prospective investors should be encouraged by Apple’s growing dominance in these spaces.

Additionally, Apple looks poised to become a major player in the virtual reality market, with the Apple Vision Pro slated for release in 2024. Talk of Apple’s entry into the electric vehicle market has also gathered pace in recent years, with a release currently projected for 2026.

And crucially, Apple’s slowed revenue growth is mitigate by its consistently impressive growth margins, which hit record levels in September 2023 at 44.1%. These figures mean that Apple remains comfortably the world’s most profitable company.

But there is still room for concern when it comes to Apple’s stagnated growth, with smartphone competitors such as Google and gaining market share in 2023.

It would also be remiss of investors to turn a blind eye to the ongoing antitrust lawsuits against Apple in both the US and Europe. In both cases, Apple stands accused of manipulating its app store for the purposes of forcing a 100% monopoly on tap-and-pay wallets. According to the complaints, Apple “coerces” people who use its devices into using its own wallet for transactions.

While Apple’s market dominance and expansion into diverse sectors offer promising investment indicators, concerns linger over stagnant growth and increased competition. The imminent foray into virtual reality and electric vehicles signals innovation, but ongoing antitrust lawsuits pose risks. Investors should carefully weigh these factors, recognizing both potential rewards and challenges before deciding on Apple stock.

Where to Invest in Apple stock in 2026

eToro is a popular choice for buying tech stocks such as Apple. Features such as fractional share trading, low minimum deposits, and a user-friendly interface make it an accessible platform for beginners.

Other popular choices include Robinhood, Webull and Charles Schwab.

1. eToro – Best platform to purchase Apple shares in 2026

eToro is considered to be one of the most suitable platforms for buying Apple Stock because it supports fractional investing which means that you can buy APPL for $10. This allows investors with a low budget to gain exposure to the tech company.

Furthermore, eToro offers a range of ready-made Smart Portfolios that include APPL shares. These portfolios are a good way to invest in a diverse basket of shares that have been hand-picked by experts. The platform provides insight into each portfolio so that investors can make a choice based on their risk appetite, performance history, and the weight of Apple in each portfolio.

eToro is a social trading platform which means that users can gain insight into APPL stock from experts and other traders. When you view the APPL stock on eToro, you will be able to view recent posts, updates, and investing decisions that have been made by other users. This is a good way to understand the current market sentiment around Apple stock.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum. For US users available Crypto trading.

2. Robinhood – Invest in Apple from your phone

Robinhood is the ideal brokerage for investors who are looking to manage their Apple trades from their phones. The broker offers an excellent mobile app that is ea

sy to navigate and provides all the tools that you need to manage your portfolio from anywhere.

Furthermore, it is possible to buy APPL from $1 through Robinhood. This is appealing to new investors who want to start with a small portfolio and gradually build over time. Robinhood also supports zero commissions for buying Apple shares, making it one of the most low-cost options.

As well as traditional stock trading, it is possible to trade APPL options through Robinhood. Options trading is a high-risk trading strategy for active traders with experience.

3. Charles Schwab – Access a range of educational resources and market insight before buying APPL

Charles Schwab is one of the most well-known US brokerages that offer stocks, ETFs, bonds, options, margin trading, and more. Investors can buy Apple shares or invest in Apple ETFs through the platform, to diversify their portfolio.

The broker is not a zero-fee platform. Instead, investors pay a fixed $0.65 fee per contract. This makes Charles Schwab most suitable for long-term investors.

One of the most appealing features of Charles Schwab is the range of educational resources and market insight that is available to investors. The platform simplifies the process of understanding the markets and researching APPL stock before making any investment decisions. Amongst the resources available include webinars, news, expert insight and live market data.

4. Webull – The best Apple trading platform for day trading

So far, we’ve taken a look at online brokerages that are suitable for long-term investing. Webull is an alternative platform that is ideal for day trading Apple in 2026. The platform has its own charting tools and can also be connected to the popular MetaTrader4 platform.

Traders can access a variety of indicators, price charts, APIs, and signals using the Webull platform. This makes it possible to implement more advanced trading strategies that are sometimes preferred by experienced traders.

To assist with developing a robust day trading strategy, Webull offers a demo trading account. This is a good way to practice trading Apple without putting any real money at risk.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: For US users available Crypto trading.

How To Invest in Apple With eToro

In the next section, we will take an in-depth look at how to buy Apple stock from our recommended broker, eToro. We have chosen to use eToro in this example because the platform caters to a variety of investment strategies and is free to sign up to.

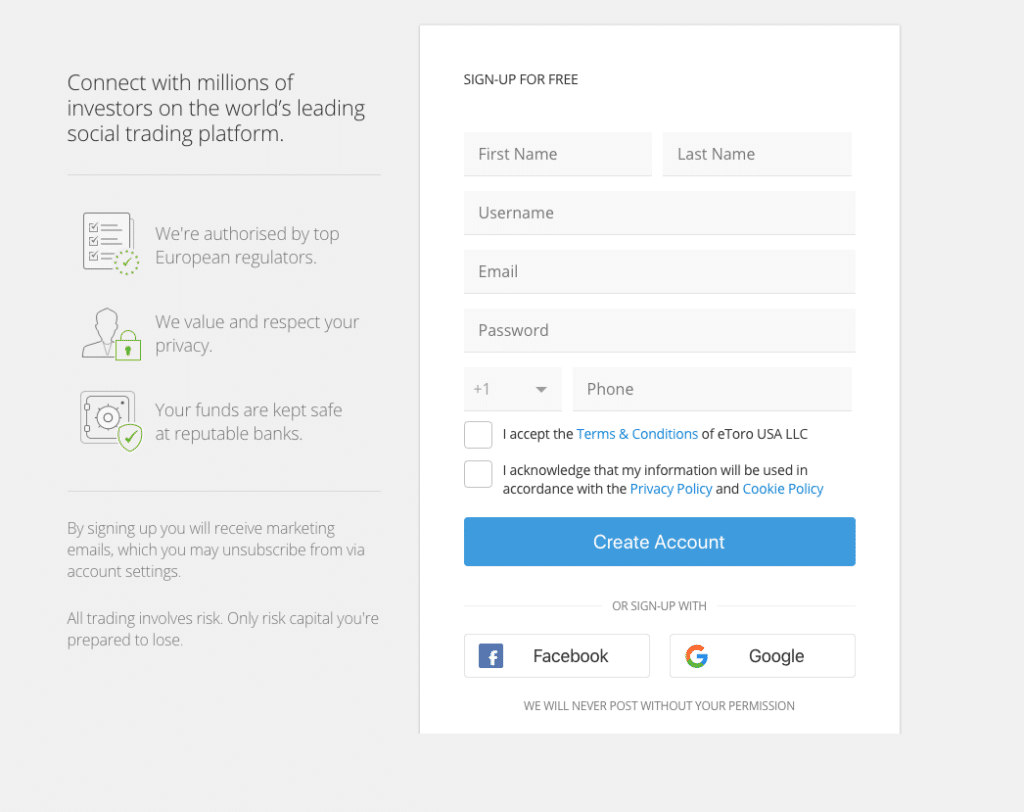

Step 1: Complete the registration form

To create an eToro brokerage account, you will need to sign up with your personal information. This includes providing your email address, phone number, and residential address.

Once you have filled out the registration form, you will be required to provide proof of ID. This entails taking photos of two ID documents and uploading them to the system.

The verification can take up to 48 hours to complete. During this time, you will be able to access the eToro platform but you won’t be able to withdraw any funds.

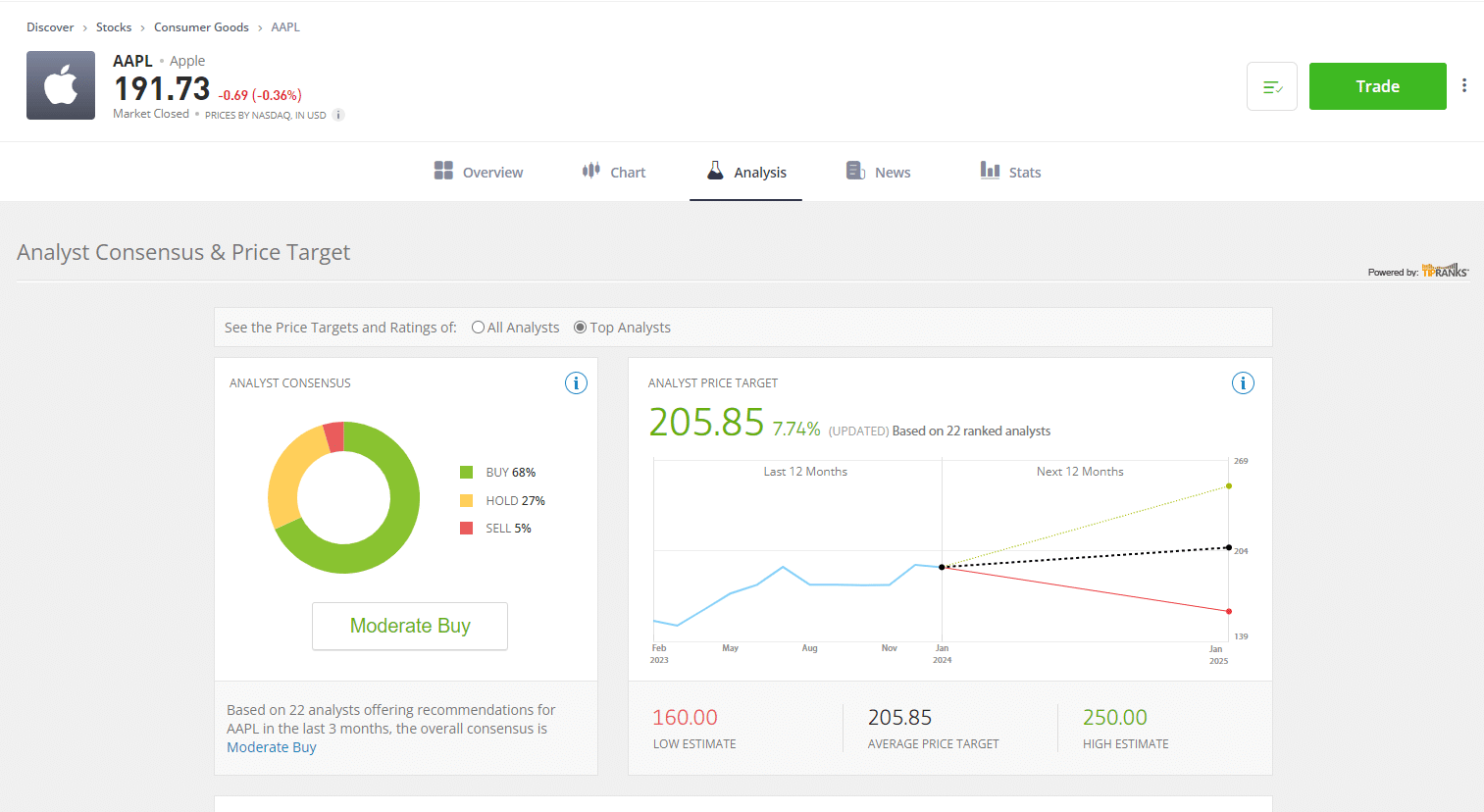

Step 2: Research APPL stock

Before you invest in Apple, it is a good idea to spend time conducting research and analysis.

You can find Apple stock analysis on eToro by searching for the Apple ticker symbol, APPL. Here, you will be able to view past performance, technical analysis, market news, and much more.

You could also use eToro’s social trading feed to understand investor sentiment and learn what other investors are doing with Apple stock.

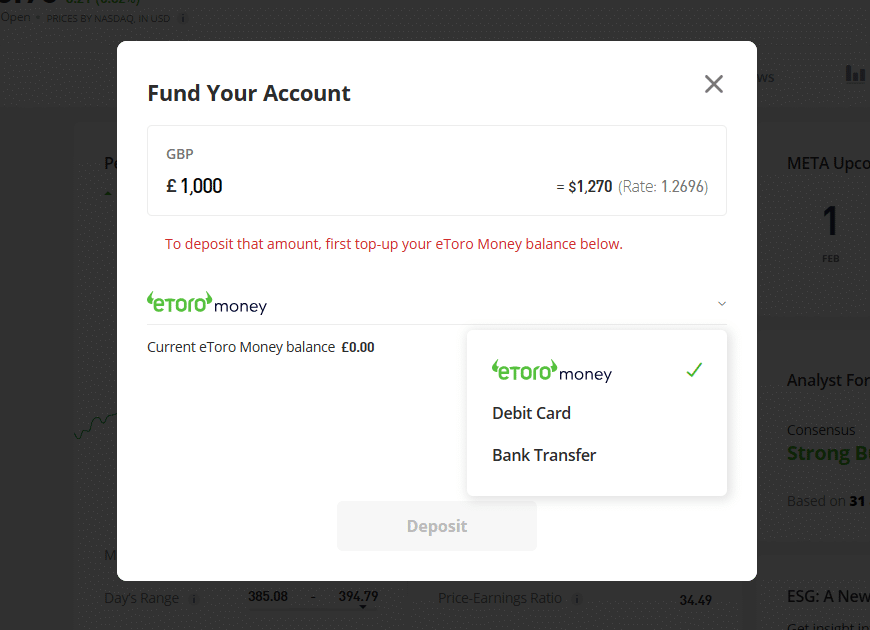

Step 3: Deposit funds

Once you have researched Apple stock, as well as Apple stock funds, the next step is to deposit money into your eToro trading account.

eToro accepts payments with debit cards and bank transfers. The minimum deposit amount for individual stocks is $20 and for ETFs or indices, it is $50.

Step 4: Place a market order

Once you have deposited funds into your account, open a trade by searching for the ticker and selecting the Apple stock that you would like to buy.

Then, click ‘trade’.

Here, you will be able to customize the trade to fit your investment strategy. Double-check each of the parameters before confirming the order. Apple stocks will appear in your portfolio within minutes.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: For US users available Crypto trading.

How To Sell Apple Stock in 2026

If Apple’s stock price starts to drop, or if you manage to see returns on your investment, it is useful to understand how to sell Apple shares.

The process of doing so is relatively straightforward. To sell the technology company stock, you will need to head to your eToro portfolio. Here, you will be able to see an overview of your investments.

Find Apple Stock and then click ‘close’ on the right-hand side of the screen.

An order form will appear on your screen. You can use this to customize the closing trade and make sure that everything seems how it should before proceeding. Once you have checked the form, click ‘close trade’.

After closing the trade, your profits from Apple will appear in your cash balance. you can then transfer these to your bank account or use them to invest in alternative growth stocks.

Our Verdict on Apple (AAPL) Stock in 2026

Purchasing Apple stock in 2026 warrants a careful evaluation of both its storied history and its evolving position in the dynamic tech landscape.

Despite facing diminishing hardware revenues, Apple’s strategic forays into burgeoning markets like streaming, cloud solutions, and virtual reality present compelling opportunities. The company’s impressive growth margins and profitability also underscore its resilience in a competitive market.

However, concerns linger over stagnant growth, heightened competition, and ongoing antitrust lawsuits, in addition to the stock’s premium price tag. As investors weigh up the decision to buy Apple stock, a balanced assessment of potential rewards and risks is crucial.

FAQs

Can I buy Apple stock directly?

No, Apple stock must be purchased through a brokerage platform. One popular option is eToro, a user-friendly platform offering access to a variety of stocks, including Apple.

How much is $10,000 invested in Apple 20 years ago?

Apple has enjoyed a 36.6% annual compound growth rate for the past two decades. Based on that, $10,000 invested 20 years ago would be worth around $5m in 2023.

How can I buy Apple stock?

Potential investors can explore various online brokerage platforms, including eToro, Robinhood, Charles Schwab, and Webull. These platforms offer diverse features, from social trading to commission-free structures. In TradingPlatforms’ view, eToro is the best all-round choice for most investors.

Does Apple pay a dividend?

Yes, Apple pays a dividend of $0.24 per share, with a dividend yield of 0.49%.

References:

Sam Alberti

View all posts by Sam AlbertiSam Alberti has recently joined Trading Platforms as a content editor, having spent the past four years working as a journalist across various financial and business niches. He graduated from the University of Kingston in 2019 with a Master’s Degree in Journalism and an NCTJ Diploma, and has since developed a passion for both consumer and corporate finance. He now specializes in producing engaging and thoroughly-researched web content on all things finance.

eToro: Best Trading Platform - Trade Stocks & ETFs

61% of retail CFD accounts lose money. Your capital is at risk.

Visit eToroeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.61% of retail CFD accounts lose money. Your capital is at risk.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up