What Is Bitcoin? A Complete Guide To Bitcoin for Beginners

Launched in 2009 by a developer named Satoshi Nakamoto, Bitcoin has since become the most famous cryptocurrency in the world. But what is Bitcoin and how does it work? Bitcoin is a digital asset designed to be used for exchange and as a form of payment that is not controlled by a central authority, group or specific entity, thereby eliminating the need for third parties to be involved in financial transactions.

From 2009 until now, Bitcoin has been the inspiration for many other projects in the crypto space, and some founding teams have even tried to develop altcoins (Bitcoin-like projects) that follow the same successful path. In this Bitcoin for beginner’s article, we will discuss in more detail how Bitcoin works, its key features, use cases, and introduce the beginner’s guide to using Bitcoin.

-

-

What is Bitcoin?

In the year 2009, Bitcoin was launched as the first cryptocurrency and the first successful decentralized payment system worldwide. Its creator remains enigmatic, signing under the pseudonym Satoshi Nakamoto. Bitcoin is entirely a digital currency and does not exist in physical form. Bitcoin can be transferred quickly and securely around the world, requiring only an internet connection. The value of the currency is determined by the free market, which is determined by supply and demand.

Running on a decentralized network, Bitcoin operates without being centrally controlled, avoiding the control of banks or governments. This digital currency is based on open-source technologies and peer-to-peer cryptography. The system is developed on blockchain technology, ensuring full and permanent transparency. Any change to this technology can only be made by majority consensus of users.

Bitcoin can be subdivided into smaller units, called “satoshis”, with the possibility of reaching up to 8 decimal places. It can fulfill the role of a means of payment, but at the same time it is regarded as a reserve of value similar to gold. This association is explained by the significant evolution of the price of a single Bitcoin, starting from less than one cent and reaching thousands of dollars. When discussed in the context of financial markets, Bitcoin is designated by the symbol BTC.

To make it easier for users to secure cryptocurrency, there are several bitcoin wallet providers, each providing a unique address for receiving coins. As mentioned before, Bitcoin is based on open-source technology, and a significant number of developers have contributed and continue to contribute constantly to the development of the protocol.

Bitcoin Tokenomics

Bitcoin has significant importance and contains numerous incentives within its own ecosystem. The Bitcoin mining process brings new coins to the network, and in order to make transactions, users need to pay a small amount of Bitcoin. Additionally, those who primarily facilitate transactions are motivated by the rewards they receive for their computing resources and energy consumed during the mining stage.

The purpose of the rewards is to motivate miners to contribute to maintaining, securing and strengthening the reliability of the entire network. These block rewards are issued in the form of the blockchain’s native currency, giving miners the ability to sell, trade, or keep them as they see fit.

Bitcoin has a limited supply of 21 million coins. At the time of Satoshi Nakamoto’s release online, the network had no Bitcoins other than the first ones mined. This means that the supply of Bitcoin gradually increases as more and more users join the project. In 2022, the amount of Bitcoin reached 19,168,887 coins.

Bitcoin is a solution for payments and speculative investments. Additionally, for many, the currency has a similar role to gold, being a way to store value in a digital form. Bitcoin is the number one cryptocurrency with a market capitalization of $381 billion and a value of $20,077 in October 2022.

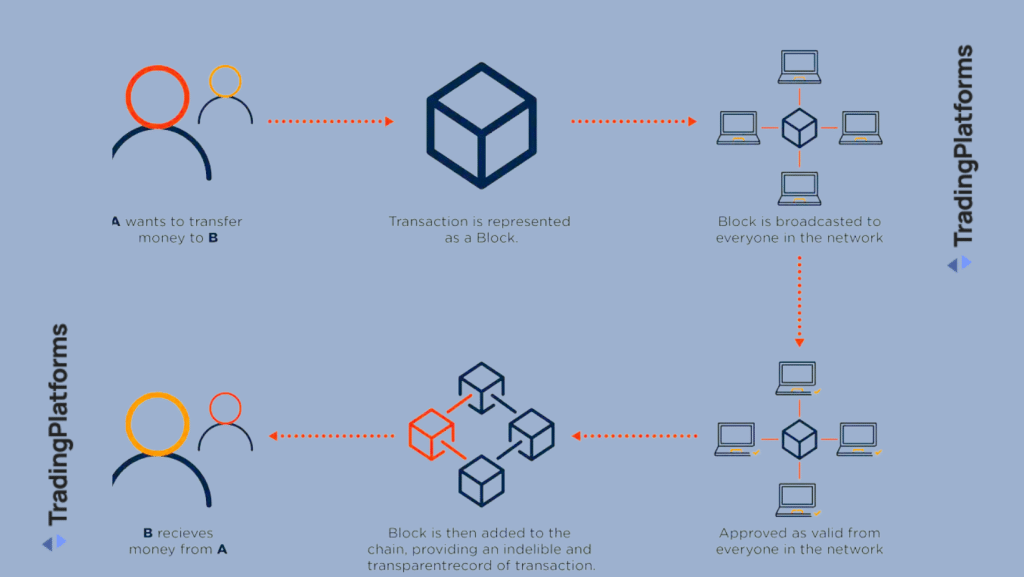

How Does Bitcoin Work?

A very important thing to mention that will help you better understand how Bitcoin works, is that its structure consists of three key components that together constitute the decentralized payment system.

- First of all, there is the Bitcoin network, a network that ensures communications and data transfers within the Bitcoin ecosystem,

- the Bitcoin currency (BTC) – the native currency of the network,

- the Bitcoin blockchain, a public digital ledger that records all Bitcoin transactions.

Bitcoin operates through a peer-to-peer network, where users who wish to exchange Bitcoin with others on the network can execute and validate transactions without depending on intermediaries. Users can choose to connect directly to the network using their own computers and download its public ledger, where all past Bitcoin transactions are recorded.

Bitcoin mining

Bitcoin mining is an operation where transactions are recorded in the blockchain and new coins are mined. This process is a complex one, as users have to solve mathematical problems by means of specialized computers with high performance. Although in the past it was possible to mine Bitcoin at home, with the passage of time and increased computing requirements, most in this field decide to join a mining group, called a “pool”, where members’ resources are pooled to increase efficiency.

Miners use specialized hardware – application-specific integrated circuits (ASICs) – to solve these mathematical problems. Also, this process is competitive: the first who manages to add the next block to the blockchain is rewarded with Bitcoin.

Bitcoin halving

Mining of 210,000 blocks, which happens roughly once every four years, is an event known as a “halving”. In this event, the reward given to Bitcoin miners for processing transactions is halved. The effect is that the rate of circulation of new Bitcoins is halved, which has a significant impact on the activity of the entire network. The next halving is expected to take place in April or May of 2024, when the reward for each block will be reduced to 3.125 BTC. Over time, the impact of each halving will diminish as the reward approaches zero.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

What Is Bitcoin Used For?

First, Bitcoin was designed and introduced as a solution for direct (peer-to-peer) payments. However, its usability has evolved considerably as it has gained value and entered into fierce competition with other blockchain networks and cryptocurrencies. Here is an overview of what Bitcoin is used for.

✔️ Transactions

In the project roadmap, Satoshi Nakamoto specifies that the transaction represents the transfer of value between various wallets and is always recorded in the blockchain chain. Crypto wallets keep a secret element also called a private key or seed, which is essential for signing transactions. This signature provides mathematical proof that transactions originate from the owner of the wallet, while preventing unauthorized intervention on initiated transactions. All transactions are recorded in the network and start the confirmation process in 10-20 minutes through a process called “mining”.

✔️ Long term investing

For ten years since its launch, Bitcoin has generated significant gains for many investors. However, if you have recently started your journey in the world of investments, we recommend that you document yourself very well about the project and review the Bitcoin guide. Bitcoin certainly has value, but it should be approached realistically and not seen as a get-rich-quick route. As with any long-term crypto investment, adopting a consistent, methodical and long-term strategy provides much better returns.

✔️ Access to decentralized applications

Decentralized applications, or dApps for short, are software developed to run on a blockchain network or peer-to-peer (P2P) computing infrastructure, rather than being hosted on a single server. Bitcoin, being a cryptocurrency developed on the Blockchain decentralized network, provides a platform for such applications.

✔️ Yield farming and lending

The process of yield farming is a way for investors to earn rewards by storing cryptocurrencies in a decentralized application. The term “yield farming” represents a practice similar to that in traditional finance, where users get rewards (interest) for the assets they own. Decentralized platforms allow users to store various cryptocurrencies on blockchains such as Ethereum, Bitcoin, and Polygon.

Lending is another method used by investors to increase their profits. Bitcoin lending on various online platforms is a very widespread method by which investors can quickly obtain funds, benefiting from interest in exchange for the borrowed amount. As a result, they can get substantial returns from their Bitcoin loan. Additionally, users can opt for short or long term loans depending on their investment strategy.

Pros and Cons of Using Bitcoin in 2023

As a cryptocurrency that has grown over time and managed to bring considerable returns to investors, today Bitcoin remains an attractive investment for beginners as well as experienced investors who want to increase their returns. However, like any successful crypto project, Bitcoin has both advantages and disadvantages.

What we like

- More and more companies are including Bitcoin in their trading operations, and financial programs and websites regularly display the price of Bitcoin alongside traditional values such as stocks and gold.

- It is a cryptocurrency developed on blockchain technology, being a decentralized and secure currency in transactions, bypassing the traditional fees charged by banks and financial institutions.

- It represents a new digital form of gold. Bitcoin, with only 12 years of existence, has spread widely and offers much easier use in transactions.

- The mining system provides the opportunity to earn rewards.

What we don’t like

- There is significant competition for Bitcoin in the market as new cryptocurrencies are launched with more extensive and attractive utilities.

- Bitcoin mining involves considerable energy consumption, which has raised concerns about its carbon footprint and impact on the environment.

- Even though Bitcoin transactions are secure, users must be careful to protect their private keys, as losing them can lead to the loss of funds.

- The price of Bitcoin is very volatile, which causes the price to fluctuate in short periods of time. In 2022, from example, the price of the coin dropped from nearly $48,000 to $16,000.

How Does Bitcoin Make You Money?

For anyone who wants to make a profit through Bitcoin, there are numerous methods to achieve this goal. So, read on to discover the most effective ways that Bitcoin could make you money in 2026.

Long-term appreciation

Since its launch in 2009, Bitcoin has experienced a significant increase in value, attracting the attention of investors. Over the years, the price of Bitcoin has been characterized by significant volatility. A significant factor that has contributed to Bitcoin’s long-term appreciation is its limited supply. With a maximum cap of 21 million coins, Bitcoin operates on a deflationary model compared to traditional fiat currencies. This rarity, marked by increasing demand from institutional and retail investors, has resulted in the Bitcoin price reaching new highs over time.

Yield farming

The concept of yield farming in the context of Bitcoin is relatively new and involves storing cryptocurrency to make a profit. Although this process is more often associated with other cryptocurrencies and decentralized financial platforms (DeFi), it should be emphasized that Bitcoin itself does not offer the same opportunities for such practices as other types of tokens.

Short-term Bitcoin trading

Short-term investments in cryptocurrencies involve an increased level of risk, but offer the potential for quick gains. Given the rapid price changes in the crypto market, it is difficult make a precise Bitcoin price prediction. This uncertainty can have significant consequences.

Is Bitcoin a Good Investment?

We cannot provide any assurance that Bitcoin is one hundred percent a good and profitable investment. Considering the coin’s success and growth trajectory over the years, many investors have earned considerable income from investing in Bitcoin. Currently, the crypto market is extremely volatile, and the price of Bitcoin has seen significant price fluctuations in short periods of time. Assessing whether or not it is a good investment depends on your financial profile, your investment portfolio, the level of risk you are willing to accept and your financial goals.

Bitcoin vs Fiat Currency – Key Differences

To better understand how Bitcoin works and what is the difference between it and a fiat currency, it is important to specify from the beginning what a fiat currency is and what its key characteristics are. First, compared to decentralized cryptocurrencies like Bitcoin, fiat currencies are issued by a government. The value of fiat currencies, such as the US dollar or the euro, is dictated by market supply and demand dynamics. Most of the currencies in use globally today, in physical or electronic form, incorporate the Fiat model.

Decentralization

As mentioned before, Bitcoin is a decentralized cryptocurrency compared to fiat currencies, which is characterized by stability and control by the state. This stability gives regulators and governments the ability to weather recession and inflation more easily. Central banks’ control over fiat currency helps maintain a stable economy by allowing them to more precisely manage interest rates and the supply of credit.

Instead, Bitcoin is used as money and as a form of payment without being controlled by a person, group or specific entity, thus eliminating the need for third parties to be involved in financial transactions. Also, the technology and infrastructure that support the creation, provisioning and security processes are not run by centralized entities like banks or governments.

Regulation and security

Wallet security is essential, so it is recommended to take great care of your Bitcoin wallet. Bitcoin facilitates simple transfers and provides control over funds. However, there are also some security concerns. At the same time, Bitcoin can provide a high level of security if used properly. It is important to remember that it is your responsibility to adopt strategies and practices that protect your funds.

Transaction speeds and fees

Bitcoin transaction fees are a fundamental element of the blockchain network. Satoshi Nakamoto introduced transaction fees with the intention of preventing spam transactions, which could affect the speed and operation of the network. These fees encourage miners to verify transactions and help finance gradually decreasing blocks, thereby helping to maintain the security of the network through the support of miners.

Transaction fees also reflect the user’s desired speed for validating a transaction. When a user initiates a Bitcoin transaction, it enters a waiting area called a “mempool”. Once validated, the transaction is included in a block. Miners select the transactions they want to validate and include in the block.

Conclusion

Bitcoin is a decentralized cryptocurrency that was launched in 2009 by an anonymous developer on the blockchain network. Since then, it has become the most famous cryptocurrency in the entire world. Its popularity has been a source of inspiration for the development of many other cryptocurrencies. Over the years, Bitcoin has brought significant returns to investors and is still an attraction for investors, including beginners. However, even though the price of the coin has suffered a recent decline, investors are hopeful that it will recover. If you are interested in investing in Bitcoin, you just need to follow the steps in the beginner’s guide and do your research once more before investing.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQs About Bitcoin

What is Bitcoin in simple terms?

Bitcoin is a decentralized cryptocurrency used as money or as an electronic payment method. The currency was developed with the aim of providing a way to protect investments and facilitate the free financing of businesses, eliminating the need to turn to traditional financial institutions and avoiding their constraints and regulations.

Can you turn Bitcoin into cash?

Yes, you can turn Bitcoin into cash. There are two methods to turn Bitcoin into cash and ultimately transfer the funds to a bank account. First, you can opt for a third-party exchange broker. These intermediaries, including Bitcoin ATMs and debit cards, allow you to exchange Bitcoin for cash at a specific rate. This option is simple and safe. The second way to turn Bitcoin into cash is to sell your BTC investment on a centralized platform. When you sell Bitcoin on a centralized platform, a cash baalnce will appear in your trading account.

Is Bitcoin fake or real?

Bitcoin is a safe cryptocurrency and is not a fake crypto project, having been launched on the crypto market since 2009. Since then, several investors who bought Bitcoin have made considerable profits.

Why do people buy Bitcoin?

Bitcoin is sometimes likened to gold due to its limited supply, difficulty to mine, and the fact that it is not controlled by any government or financial institution. However, compared to gold, Bitcoin is much easier to transfer regardless of location, and its split feature is an advantage. It is also a decentralized, transparent and immutable currency.

References:

Antonio Bors Finance and Crypto Writer

View all posts by Antonio BorsAntonio is a cryptocurrency and finance writer with 3 years of experience in the finance niche. Before working as a write, Antonio studied at the Universitatea „Dunărea de Jos” din Galați where he received a Masters Degree in Organizational Communication.

Antonio is passionate about investments, blockchain and content marketing. As well as writing for Trading Platforms, Antonio has written content for Dad Accountant and the Jivvy Group. His studies and professional background in Finance and Marketing help him make reliable predictions and share them with the community of enthusiasts who share similar interests to his. Antonio actively invests in several fields, including crypto and stocks, which allows him to share his own investment experience as well.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up