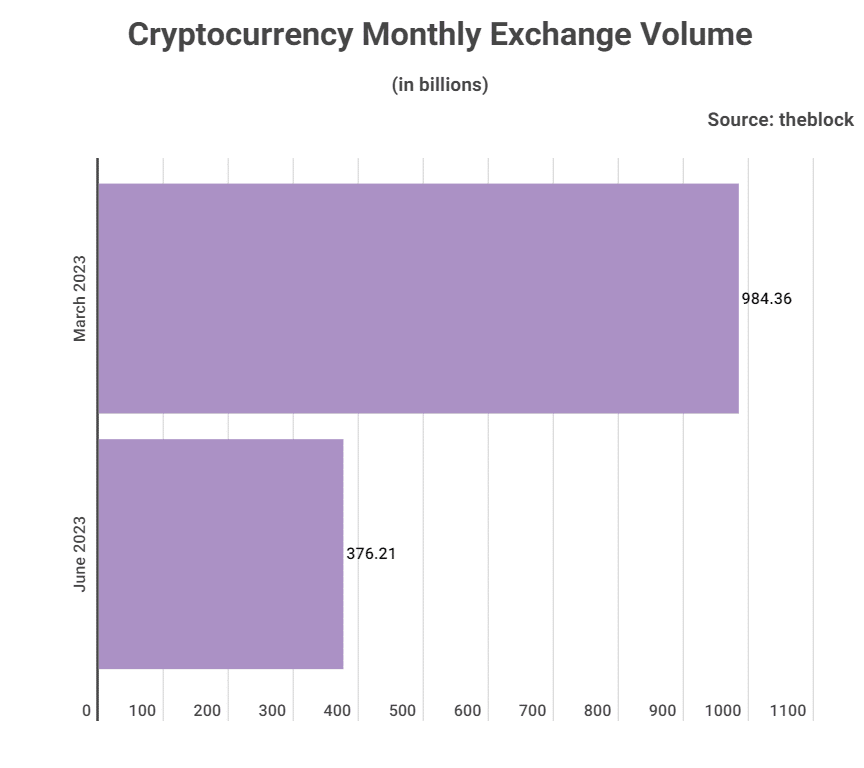

The cryptocurrency market, known for its volatility and dramatic price swings, is currently facing a concerning trend. Over the last four months, monthly exchange volumes have experienced a significant decline, dropping by more than 600 billion dollars, according to TradingPlatforms.com. Cryptocurrency monthly exchange volume, which calculates spot market volume across all crypto exchanges, was $376.21 billion in June, down over 600B from $984.36 billion in March.

TradingPlatforms’s financial expert Edith Reads commented on the findings,” The decline in monthly exchange volumes is a reflection of the increased caution among investors, driven by regulatory pressure and market uncertainty. However, it’s important to remember that the crypto industry has always been subject to fluctuations, and we could see a rebound in trading volumes once the market finds its footing again.”

Identifying the Culprits: Factors Driving the Decline

Several factors have contributed to the recent drop in crypto monthly exchange volumes. Some of the most significant include:

Market sentiment shift: After a period of unprecedented growth, the cryptocurrency market has experienced a change in sentiment, with investors becoming more cautious due to increased regulatory scrutiny and concerns about the sustainability of the bull run.

Regulatory pressure: Governments worldwide have been tightening their grip on the crypto industry, introducing new regulations and enforcement actions. This has increased uncertainty, prompting investors to adopt a wait-and-see approach.

Reduced retail interest: The reduced influx of new retail investors has impacted trading volumes. As the hype surrounding cryptocurrencies has cooled off, retail investors are less likely to enter the market or trade as actively as they did during the peak of the bull run.

Institutional hesitation: Institutional investors have also shown reluctance to increase their exposure to cryptocurrencies amid the current market conditions. This has further contributed to the decline in trading volumes.

Implications for the Broader Crypto Industry

The recent plunge in crypto exchange volumes has several implications for the broader industry. Some potential consequences include:

Reduced liquidity: Lower trading volumes can lead to reduced liquidity in the market, making it more challenging for investors to buy or sell cryptocurrencies without impacting their prices significantly.

Market consolidation: As trading volumes decline, smaller exchanges may struggle to stay afloat, potentially leading to market consolidation and the emergence of dominant players.

Slower innovation: With fewer funds flowing into the crypto ecosystem, projects may face challenges in raising capital, which could slow down the pace of innovation in the industry.

Opportunity for long-term investors: The downturn in trading volumes may present an opportunity for long-term investors to accumulate cryptocurrencies at potentially lower prices as short-term traders exit the market.

The recent plunge in crypto monthly exchange volumes offers a fascinating insight into the current market climate. As the industry continues to evolve, time will tell if this decline is part of a larger pattern or just a temporary blip. In either case, the impact on the broader crypto ecosystem remains to be seen.

Question & Answers (0)