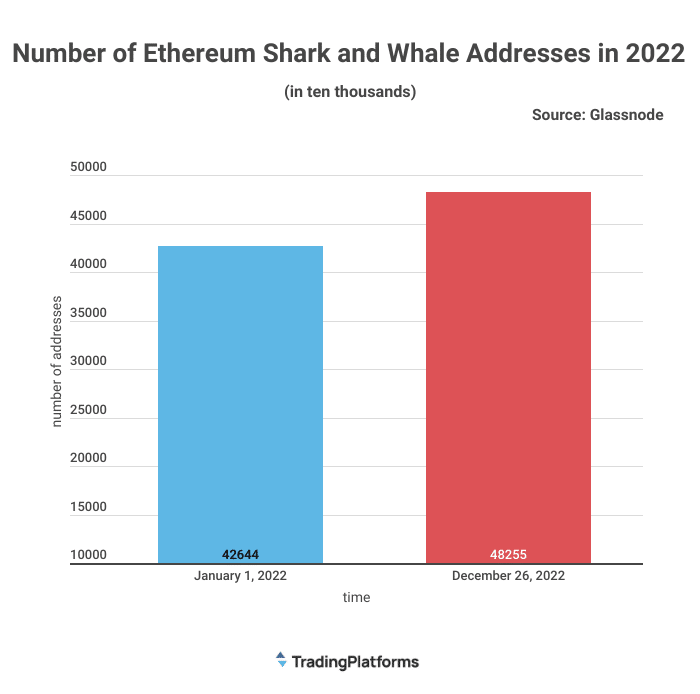

The year 2022 saw a notable surge in the number of Ethereum sharks and whales. According to a TradingPlatforms.com data presentation, the number of ETH addresses holding 100 ETH or more hit a high of 48,255 on December 26th. This represented a 13% increase from 42,644 on January 1st.

TradingPlatform’s investments expert Edith Reads affirms that the growth in those numbers is a positive sign for ETH investors. She holds that their increase indicates a wider trend toward bullish investor sentiment. To her, the move suggests a strong belief in the crypto asset’s future growth prospects.

Edith explained, “The rising number of sharks and whales on Ethereum indicates their confidence about where the crypto is heading regardless of any short-term volatility. This is promising news for those who believe ETH will appreciate going into 2023 and beyond.”

Why Are ETH Shark and Whale Addresses Increasing?

TradingPlatforms’ report tallies with recent Santiment findings showing a spike in these addresses. The latter drew parallels with a similar occurrence two years ago when whales and sharks acted as catalysts for a 50% surge in the digital asset’s worth. That implies a repeat of the same if the shark and whale activities continue.

With Ethereum’s current low price, many whales and sharks are taking advantage of the opportunity to acquire more of the asset. This activity has been further bolstered by the upcoming Shanghai Upgrade, which is set for a March 2023 rollout.

The Shanghai upgrade is set to be a major event for Ethereum, as it will enable validators to unstake their funds more quickly. This means that investors can take advantage of rising prices without waiting for stacking contracts to release their funds. As such, many whales and sharks are looking at ETH as an attractive investment opportunity.

What Are the Implications of Growing ETH Shark and Whale Activity?

The increasing whale and shark activity within ETH shows that despite its recent dip, ETH remains one of the most popular digital assets among big-time investors looking for lucrative opportunities. Sharks and whales are influential players in the cryptocurrency market because they have the financial resources and liquidity to make large trades that can move the market.

Their presence in the ETH market can have both positive and negative implications. On the positive side, they can provide liquidity to the market, helping stabilize the ETH’s price.

On the negative side, they can manipulate the market by buying or selling large amounts of Ethereum to influence the price. This type of market manipulation is often referred to as “pump and dump,” and can harm smaller traders who get caught up in the price movements.

Question & Answers (0)