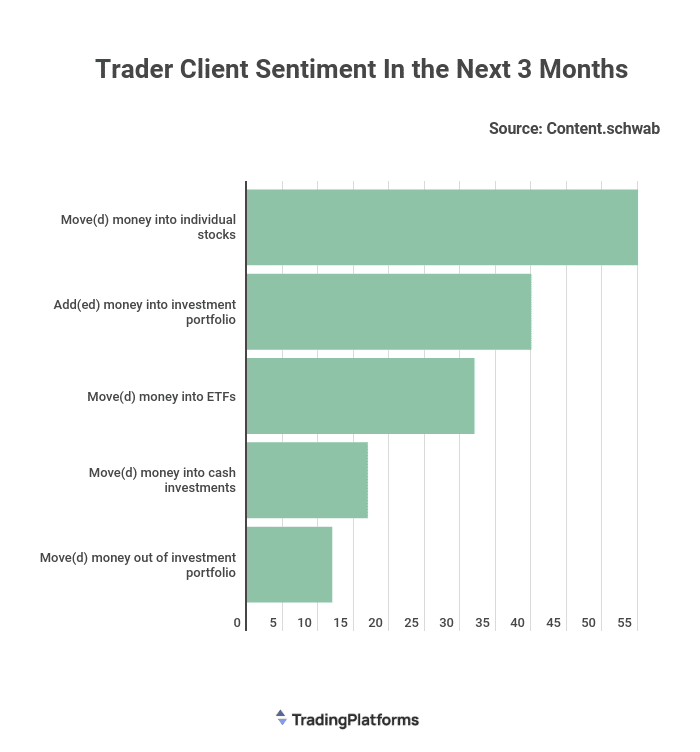

The US market is becoming hard to predict. Investors are shifting from one strategy to the next, anticipating a better outcome. There have been portfolio changes in the last quarter, and the coming quarter will also see changes. According to TradingPlatforms.com, 55 percent of US investors are anticipated to shift money into individual stocks in Q4’22.

Speaking on the data, TradingPlatforms specialist, Edith Reads, said. “US investors are turning to stocks as the economy improves. They’re also anticipating a rise in interest rates, which is making stocks more attractive. However, it’s important to remember that the stock market is still volatile, and investors need to be cautious.”

She continued, “We always recommend that investors speak to a financial advisor before making any major changes to their portfolio. They can help you understand the risks involved and make sure you’re making the best decision for your individual circumstances.”

Although most investors move to individual stocks, 32% feel safe investing in ETFs. Only 10% of investors are buying the crypto dip, suggesting investors’ confidence in the virtual asset is low.

Who’s Likely to Boost Investment

Younger investors, such as millennials and Gen Zers, will likely increase their stock market portfolio. A sign that individuals are forming and maintaining healthy financial routines.

The older generation is the most likely to say they plan to reduce their stock holdings this year. However, this is probably due more to the advancing age at which they plan to retire. It is not a genuine concern about market volatility or inflation.

Although inflation is a concern, it is not strong enough to deter investors. People are shifting and adjusting their portfolios but not exiting the market. The shift is due to market volatility as investors put their best foot forward.

Even with Individual Stock, be Cautious!

Investing in various things might help spread out the risks you take. Do not put all your eggs in one basket. You might lower the risk and volatility of your investment returns without giving up too much potential benefit. Select the correct group of investments within an asset category.

Significant investments in your firm’s stock or any individual stock expose you to high levels of risk. You might lose a large portion of your investment or even all of it. A company’s stock price can be volatile and might not fully reflect the underlying business conditions. These risks might be magnified for smaller companies.

When adding individual stocks to your portfolio, start slowly with a small number of shares. Review your stock selections periodically to ensure they meet your investment goals and that the company’s prospects have not changed.

Question & Answers (0)