Crypto Fraud Revenues Drop 65% After the Market Meltdown

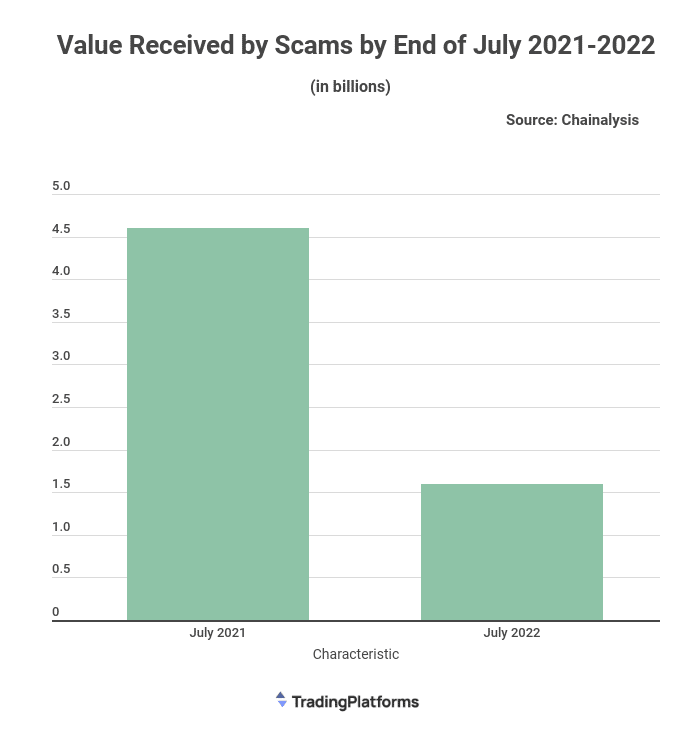

The crypto market meltdown has taken its toll on fraudsters. According to data from TradingPlatforms.com, crypto scam revenues have dropped by 65% to $1.6B in one year. This is a significant drop from the $4.5B fraud revenues recorded at the end of June 2021.

Speaking on the data, TradingPlatforms’ Edith Reads said. “The data collected by our platform reflects the current state of the crypto industry. The market is young and ever-changing, so new scams are constantly popping up while old ones die out. As the market has matured, we’ve seen a decrease in overall scam activity. However, this doesn’t mean that investors should let their guard down. There are still plenty of scams, and it’s important to be vigilant.”

Common Crypto Scams

Cryptocurrency fraud has become a dominant topic over the past few years. There are many different types of scams, but some of the most common include:

Pump and Dump Schemes: These schemes involve artificially inflating the price of a coin through false or misleading information, then selling it off once the price has risen. This leaves investors with worthless coins.

Pyramid/Ponzi Schemes: These schemes encourage investors to put their money into a “high-yielding” investment, with the promise of high returns. However, the scheme is a fraud, and early investors are paid off with money from new investors. Eventually, the scheme collapses, leaving everyone but the organizers at a loss.

Exit Scams: This type of scam occurs when a crypto project or company raises money through an initial coin offering (ICO), then disappears with the funds.

How to Avoid Crypto Fraud

The cryptocurrency industry is in crypto winter, with prices of major coins such as Bitcoin and Ethereum down by more than 80% from their all-time highs. This has led to a decrease in investment activity and, consequently, less revenue for scammers.

When the market is in a downturn, there’s simply less money to be made from scams. This is because investors are more cautious with their money and are less likely to invest in high-risk ventures. In a bull market, people are more inclined to take risks, which creates opportunities for fraudsters.

It is essential to research and exercise caution when investing in cryptocurrency to avoid becoming a victim of fraud. Investors should be wary of promises of high returns with little or no risk. If it sounds too good to be true, it probably is. Additionally, you should not invest more than you can afford to lose.

Question & Answers (0)