Where & How to Buy AirBnB (ABNB) Stock in 2026

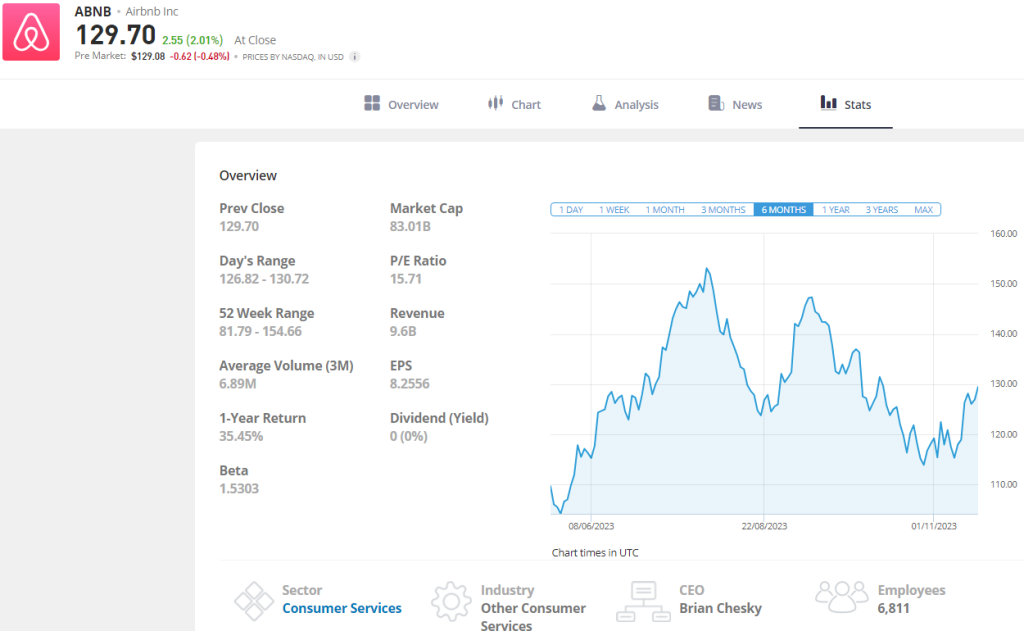

As large cap stocks go, AirBnb stands out for its relative youth and acute success. Having made its market debut just three years ago in December 2020, the holiday rental platform now boasts a market capitalization of $83bn.

Its IPO was also considered one of the most valuable in history, with shares opening on the NASDAQ at 113% above its initial offering price, seeing the firm soar to more than $100bn in value overnight.

But despite almost single-handedly revolutionizing the hospitality industry, the vulnerability of AirBnB’s model was brutally exposed during the pandemic, with vast price swings occurring as restrictions swept across the globe.

However, AirBnB remains a highly dominant force in the global hospitality market, commanding a gross margin of more than 73%. In this guide, we will examine these factors in determining whether AirBnB is still a good buy today, in addition to addressing the question of where and how to buy AirBnB stock in 2026 on a commission-free basis.

-

-

How to Buy AirBnB Stock (ABNB) – Quick Steps

Step 1: Find a reputable brokerage that offers ABNB stock with low trading and account management fees. Proceed to set up an account by filling out the required forms.

Step 2: Verify your account by uploading two forms of ID and connecting a valid payment method.

Step 3: Fund your account with enough to buy AirBnB shares. Most brokers will have a minimum deposit requirement.

Step 4: Search for AirBnB with the ticker symbol (ABNB).

Step 5: Fill out the order form and execute a BUY trade.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

AirBnB (ABNB) Stock Data January 2026

What is AirBnB?

Founded in 2008 by CEO Brian Chesky, Airbnb has shaken up the hospitality industry, allowing homeowners to temporarily rent out their properties to travelers. Based in San Francisco, the company operates in the form of an online marketplace, similar to traditional property rental platforms, where users can search based on criteria such as location, cost, and amenities. The scope of properties available on AirBnB is almost limitless, ranging from single rooms to entire mansions, villas, and even castles.

AirBnB went public in December 2020 and immediately gained significant attention from investors, making it one of the most valuable flotations in history. Following this huge initial success, the firm has gone one to branch out from offering traditional accommodation, with users now having the option to book various ‘experiences’ and activities hosted by locals. Further expansion into areas such as vehicle hire are anticipated for the future.

But while investors have generally been drawn to AirBnB growth stock in the past, the stock has developed a reputation for volatility in the trading community.

Investors are drawn to Airbnb’s innovative approach to travel and its ability to adapt to changing consumer preferences. However, in the trading community, the stock has become known for its volatility.

AirBnB (ABNB) Stock Price 2026

AirBnB’s share price has endured a volatile 2023. On January 3, the stock opened at close to its lowest price to-date ($87.3), down 50% from its 2022 peak, as investors shied away from growth stocks amid an ongoing bear market.

But things changed virtually overnight when the Californian firm revealed its Q4 2022 earnings on February 14. Earnings per share jumped to 48 cents, almost doubling analysts’ predictions, as the company posted a 24% yearly increase in revenue for the quarter.

A similarly reactive swing occurred following the release of AirBnB’s Q1 2023 earnings, this time taking a turn for the worse. Despite year-on-year revenues jumping again (20%), the firm warned of “unfavorable” second-quarter performance for its Nights and Experiences in its shareholder letter, owing to pent up 2022 demand following the COVID Omicron variant.

AirBnB stock hit its 2023 peak on July 28 – closing at $153.11, 75% up from its January slump – amid a strong rally for the Nasdaq Composite index. However, Q3 earnings reports saw prices soon plummet once again, with key competitor Bookings Holdings’ revenue growing at a far greater rate (and at double the size). This, despite 18% year-on-year revenue growth, saw AirBnB’s share price sink to $114.

Though recovering somewhat, bearish sentiment still surrounds AirBnB at the time of writing (November 2023) – this could render it a smart pick for prospective investors.

Is AirBnB (ABNB) a Good Investment in 2026?

The investment community tends to waver between bullish and bearish when it comes to AirBnB stock. While many commend the firm for its rapid growth and disruption of the hospitality industry, others remain concerned by such issues as the oversaturation of hosts and the addition of steep additional costs such as cleaning and processing fees.

And somewhat ironically given AirBnB’s disruptor status, many are also concerned by the competitor landscape. In September 2023, Booking.com operator Booking Holdings reported revenue increases of nearly 29% to $20.6bn, while AirBnB posted a 19.57% increase to $9.6bn. In simpler terms, AirBnB’s largest competitor is not only bigger, but also growing faster.

However, AirBnB is still growing almost twice as fast as its next biggest rival, Expedia. In September, the Vrbo and Hotel.com operator’s revenue stood at $12.57bn, an 11% increase year-over-year.

Prospective investors should also keep an eye on AirBnB’s expansion plans, with the firm looking to rapidly increase its presence in regions such as East Asia and South America, and also beef up its standing in the long-term rental market (the fastest growing segment of bookings on the platform).

Despite this, AirBnB remains comfortably in profit. Figures show that the firm spent just shy of $1.3bn in aid of its ambitious plans during the first three quarters of 2023, and yet still boasted an impressive 26% operating margin.

But paradoxically, at the time of writing, AirBnB’s share price is more than 17% down ($129.5) compared to its annual high, proving that the bearish sentiment towards the stock remains.

So with share prices seemingly at a major discount, and the stage set for major expansion plans in 2024 and beyond, AirBnB could prove to be a bargain pick for investors in 2026.

2007: Airbnb was an idea.

2023: $38 million in revenue a day. pic.twitter.com/iX1rtV6lBg

— Jon Erlichman (@JonErlichman) November 1, 2023

Where to buy AirBnB (ABNB) stock in 2026

In the following section, we will take a look at where to buy ABNB in 2026. Before choosing a broker, it is a good idea to understand your investment goals, risk appetite, and strategy. This will help you to choose an option that is best suited to your needs.

1. eToro – Our top pick for buying AirBnB stock

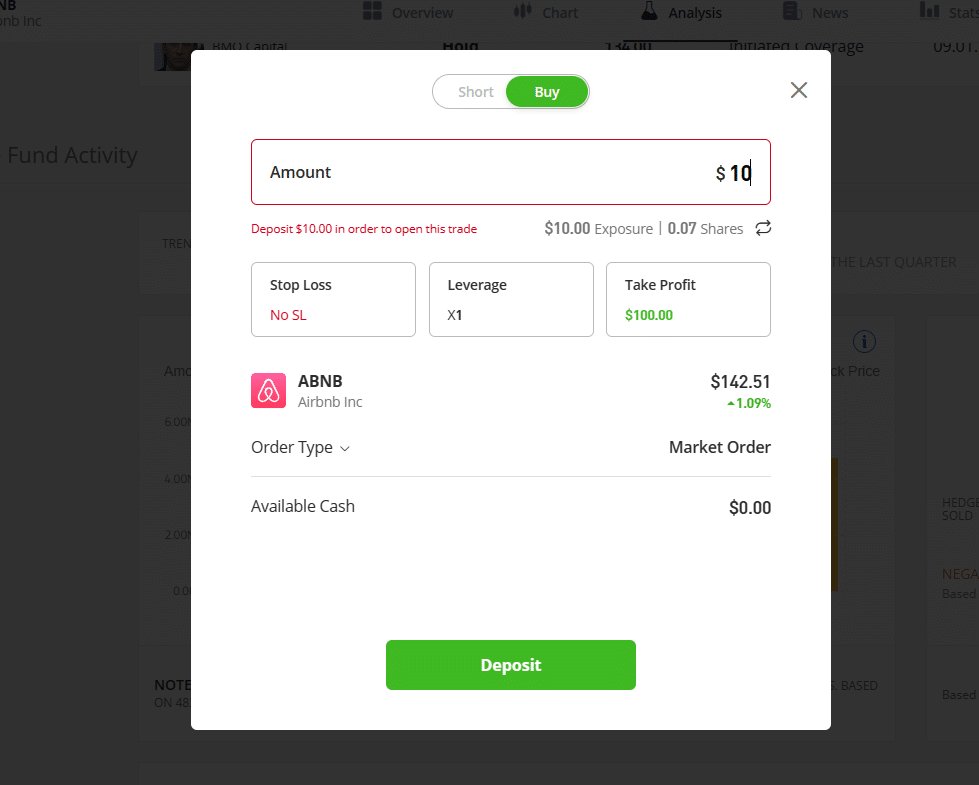

eToro is our recommended broker for investing in AirBnB for several reasons. Firstly, the platform offers a variety of ETFs, Indices, and ready-made portfolios that can be used to invest in ABNB whilst diversifying with other promising stocks.

Secondly, the brokerage does not charge any commissions for trading AirBnB stocks or ETFs. This makes it a good option for investors who have a lower budget and want to maximize the amount of ABNB that they can buy.

Lastly, eToro supports fractional trading which means that you can buy shares in AirBnB for $10. On top of this, the minimum deposit is $20, which is suitable for less experienced investors.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Robinhood – The best mobile investment app to buy AirBnB stock

Robinhood is a reputable broker that provides access to over 5000 instruments, including AirBnB. Like eToro, it is possible to buy ABNB with zero fees and you can invest with as little as $1.

Robinhood is available to used on both desktop and mobile. The broker is known for providing one of the best investment apps that can be used to manage your portfolio on the go.

As well as this, Robinhood provides access to a range of ETFs and options that can be used to gain exposure to AirBnB shares. The app caters to both long-term and short-term strategies and offers excellent educational resources for new investors who want to learn the ropes.

3. Charles Schwab – The best brokerage account for building a long term ABNB investment portfolio

Charles Schwab is a reputable brokerage firm that is catered to long term investors who are looking for a safe and secure way to build a portfolio of US stocks, including AirBnB.

The platform offers a range of tools that can be used to build a robust US stocks portfolio. This includes ongoing support from professionals and a variety of educational materials.

The brokerage also offers ready-made investment strategies which can be tailored to meet your needs. This means that users can invest in ABNB whilst implementing a tried and tested strategy.

There is no extra charge for working with a Schwab consultant and the platform offers $0 fees for online US stock trades. However, broker-assisted trades are charged at $25 per trade. It is important to be aware of this before proceeding to make any investment decisions.

4. Webull – The best mobile app for day trading ABNB

Webull is a good investment app for experienced traders who are looking to implement advanced trading strategies to take advantage in the short term price movement of Airbnb stock.

The platform can be connected to the reputable MT4 trading platform and also offers its own charting tools that can be used to conduct technical analysis and execute an active trading strategy.

Webull also provides a demo trading account that allows users to test the platform with paper funds. This is suitable for new users who will need to spend time becoming accustomed with the platform before putting any real money at risk.

Regarding fees, Webull charges $0 for stock trading which means that it is possible to trade ABNB commission-free.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Alternative Ways To Invest in Airbnb

Buying ABNB stock is not the only way that you can invest in Airbnb in 2026. Alternative options such as ETFs, mutal funds, and index funds could be a good option for investors who are looking to build a diverse portfolio.

Similarly, you could consider investing in alternative holiday rental companies that are connected to Airbnb. Examples include Booking Holdings (BKNG) or Expedia Group Inc (EXPE).

Gain exposure to Airbnb properties by investing in real estate

Another way to invest in Airbnb is to invest in rental properties through short term rental REITs. A REIT, or Real Estate Investment Trust, is a publicly traded company that owns a portfolio of properties. Reits enable investors to gain exposure to the short term property market without the large upfront costs of buying a property out right.

How To Buy Airbnb Shares on eToro

Investing in any financial asset comes with risk. Therefore, it is important to understand each stage of the process and ensure that you are following the right steps to invest safely.

In the following section, we provide an in-depth guide on how to buy Airbnb shares through eToro, our recommended broker. The process should take no longer than 30 minutes and it is a good idea to use a secure and private internet connection for this.

Are you ready to buy Airbnb stock?

✔️ You have a minimum of $20 that you can afford to lose if the value of ABNB stock goes down.

✔️ You have an understanding of how the stock markets work and have spent researching Airbnb.

✔️ You understand risk management and have an awareness of the steps required to reduce your risk exposure.

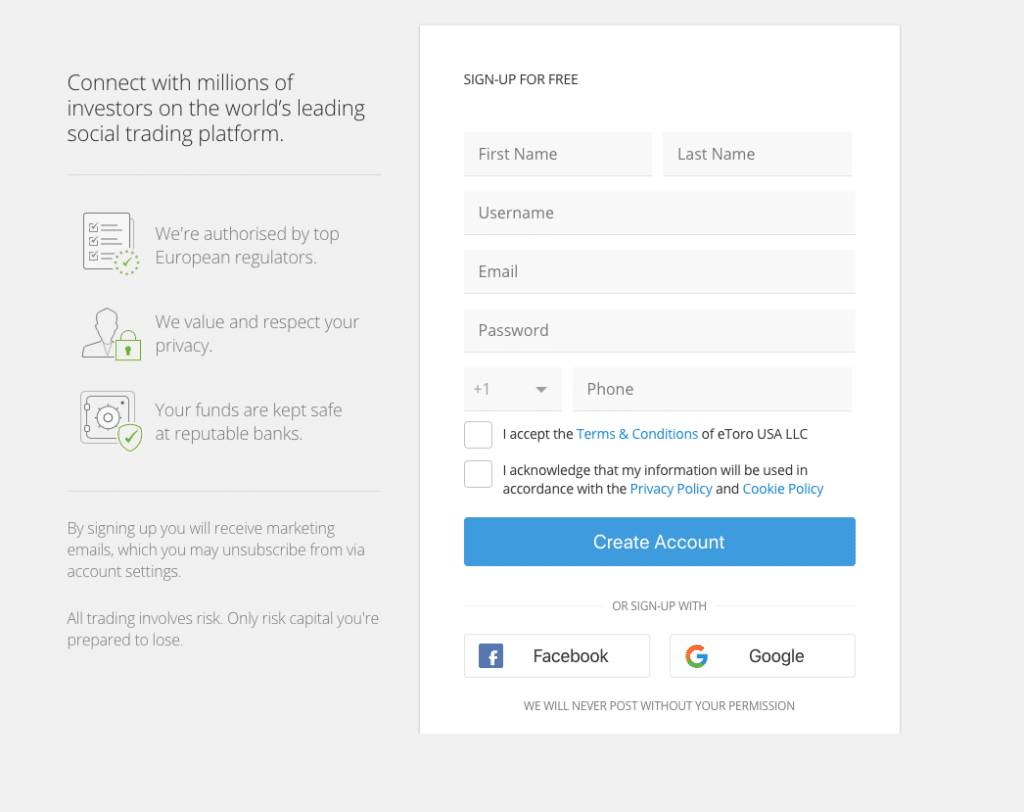

Step 1: Create an eToro brokerage account

If you don’t already have an eToro account, the first step is to create one. eToro is licensed in 7 jurisdictions which means that it must comply with KYC requirements. This involves asking users for their names, contact details, and addresses.

Complete the registration form with all of the required details to sign up.

There is an option to sign up with a Facebook or Google account which could make the process of opening a brokerage account quicker.

Account verification

Once you have completed the initial registration, you will be asked to verify your ID. For this, you will need to upload photos of two ID documents to the platform. One form of ID must verify your name and the other must verify your address.

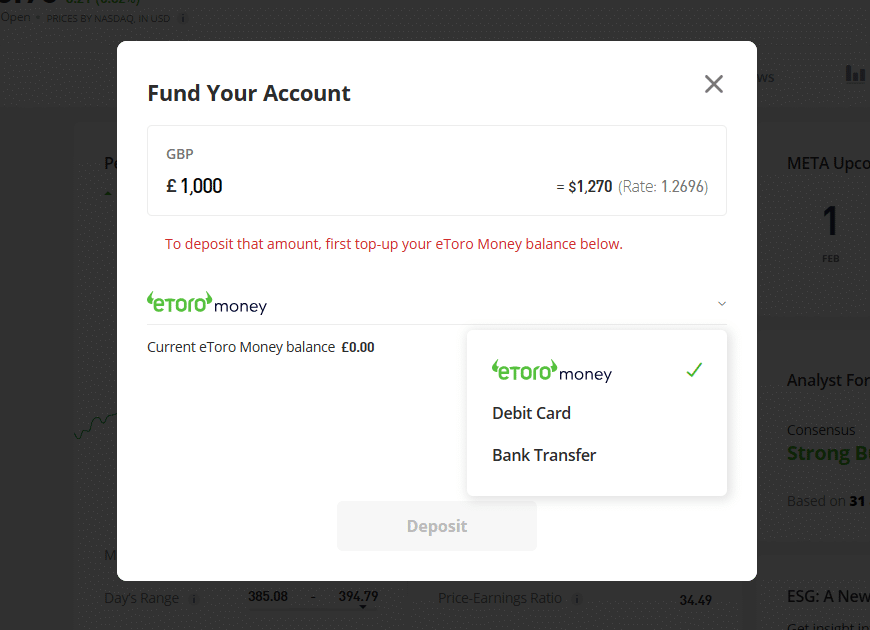

Step 2: Fund your account

You will be able to access your eToro brokerage account and use the demo trading account without depositing any funds. It is a good idea to spend time familiarizing yourself with the platform before making any investment decisions.

To buy Airbnb stock, you will need to connect a payment method to your eToro account and deposit a minimum of $20.

Click ‘deposit funds’ and then choose from the available payment methods.

eToro accepts payments with a debit card or bank transfer. It is also possible to deposit crypto funds from your eToro money wallet if you have one.

The platform does not charge any fees for depositing funds. However, investors should be aware of potential fees that could be involved with buying ABNB.

Enter the amount that you would like to deposit and then click ‘deposit’. You may need to verify this with your bank.

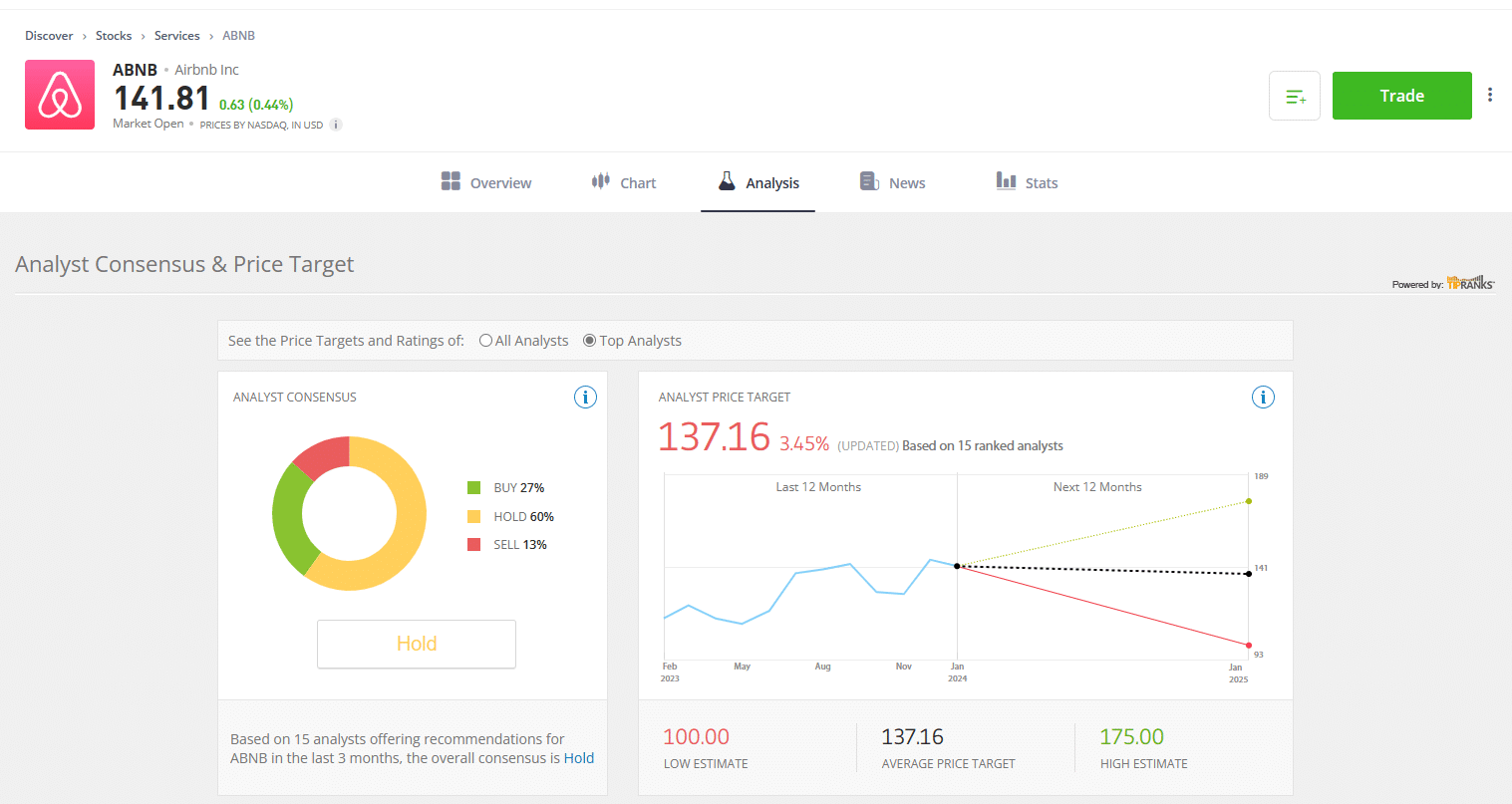

Step 3: Explore ABNB investment options and research the stock market

eToro offers several ways to buy Airbnb in 2026. You can invest in the shares directly or gain exposure by investing in an ETF or Smart Portfolio.

Use the ‘explore’ tab to research the different available options. It is a good idea to spend time carefully reviewing the different investments that are offered by eToro. The platform provides analysis and research for each asset that could help you to make an informed decision.

You can find detailed Airbnb analysis by searching the ABNB ticker symbol, selecting Airbnb stock, and then clicking ‘analysis’. eToro provides a range of helpful information such as analyst consensus and current market sentiment.

You can also use the platform’s social trading feature to understand what other investors are doing with ABNB shares. This is a good way to determine whether or not it is a good opportunity.

Step 4: Place a market order

After carefully assessing the stock, open a trade by selecting ‘trade’ in the top right-hand corner of the platform.

Here, you can select the amount of ABNB you would like to buy. You can also set stop-loss and take-profit targets.

eToro provides an option to trade Airbnb with leverage. This increases the risk involved in a trade and is only recommended for experienced investors.

After you have placed the trade, Airbnb will appear in your eToro portfolio.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

How To Sell Airbnb Shares

Investors may want to sell their Airbnb shares when they have seen returns on their initial investment or if the market becomes volatile. Most trading platforms allow investors to withdraw their ABNB earnings at anytime by following a few simple steps.

- Enter Airbnb’s ticker symbol to find the shares within your investment account.

- Select the trade by clicking on it to view the available actions that you can take.

- Close the trade by clicking the corresponding button. You will then be able to sell all of your shares or sell a fraction of your investment.

Our Verdict on AirBnB (ABNB) Stock in 2026

Despite weathering pandemic conditions to emerge as a blockbuster IPO in 2020, investing in AirBnB still requires careful consideration, particularly given the stock’s history of volatility.

In fact, 2023 was a particularly volatile year for the stock, with earnings reports, tough market conditions, and fierce competition appearing to directly impact share prices. However, between a robust gross margin and impressive growth in various markets, AirBnB’s potential is clear.

In addition, bearish sentiment still lingers around AirBnB, the stock close to 20% down from its annual high at the time of writing. This, in addition to ambitious expansion plans, should encourage potential investors, with growth seemingly on the horizon for 2024 and beyond.

Airbnb Stock FAQs

How do I buy AirBnB shares?

Potential investors can explore various online brokerage platforms, including eToro, Robinhood, Charles Schwab, and Webull. These platforms offer diverse features, from social trading to commission-free structures. In TradingPlatforms’ view, eToro is the best all-round choice for most investors.

How much does it cost to buy AirBnB stock?

At the time of writing (November 2023), AirBnB’s share price sits at $126.82, a 17% downturn from its June peak.

Is AirbnB stock a good investment?

Taking into account the bearish sentiment towards AirBnB, coupled with impressive operating margins and ambitious expansion plans, the stock could prove to be a bargain pick in 2024.

Does AirBnB pay a dividend?

Airbnb does not pay a dividend. Companies decide whether to distribute dividends based on various factors, and Airbnb, being a relatively new public company, has not established a history of dividend payments.

References:

- https://finance.yahoo.com/news/early-airbnb-investors-raked-499-193618823.html

- https://www.macrotrends.net/stocks/charts/ABNB/airbnb/research-development-expenses#:~:text=Airbnb%20annual%20research%20and%20development,a%20181.87%25%20increase%20from%202019.

- https://www.macrotrends.net/stocks/charts/BKNG/booking-holdings/profit-margins

- https://www.macrotrends.net/stocks/charts/EXPE/expedia/revenue#:~:text=Expedia%20revenue%20for%20the%20twelve,a%2035.69%25%20increase%20from%202021

- https://s26.q4cdn.com/656283129/files/doc_financials/2023/q1/Airbnb_Q1-2023-Shareholder-Letter_Final.pdf

Sam Alberti

View all posts by Sam AlbertiSam Alberti has recently joined Trading Platforms as a content editor, having spent the past four years working as a journalist across various financial and business niches. He graduated from the University of Kingston in 2019 with a Master’s Degree in Journalism and an NCTJ Diploma, and has since developed a passion for both consumer and corporate finance. He now specializes in producing engaging and thoroughly-researched web content on all things finance.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up