Decentralized finance has been one of the most significant growth factors of cryptocurrency usage. In 2021, DeFi transaction volume grew by 912%, indicating the increased interest in the space.

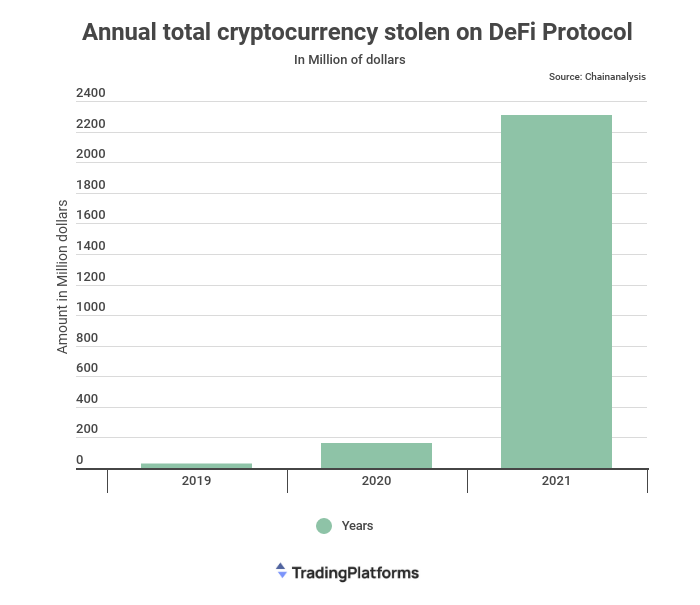

However, the increase in transactions also correlates with the increase in DeFi-related crypto crimes, according to reports by Tradingplatforms.com. During the same year, the amount of cryptocurrency stolen through DeFi platforms totaled about $2.2 billion, which was a 1300% increase from 2022’s amount.

“Decentralized tokens cause quite the spur in the crypto space, which is why many people are now coming on board. However, because just about anyone can create a DeFi token and have it listed without a code, we are now seeing an increase in crypto crimes, with DeFi rug pools becoming quite common,” Edith Reads from Tradingplatforms.com commented.

Money laundering through DeFi protocols also on the rise

The reports by Tradingplatforms.com also indicate that more crypto criminals are now turning to DeFi protocols to launder illicit funds. DeFi recorded a 1964% increase in usage for money laundering, the highest year-on-year growth.

Mining accounts for the second-highest year-over-year growth in illicit funds, coming a little shy of a 500% increase. P2P exchange services and gambling platforms were the only services to record a decrease in illicit fund usage in 2021.

What’s more, of the $3.2 billion worth of cryptocurrency stolen in 2021, assets stolen from DeFi protocols were about 72% of the total, which is roughly $2,2 billion.

DeFi protocols are an easy target for hackers

Fraudulent developers are now using DeFi protocols to come up with well-designed rug pools. The most common method is tricking investors into purchasing DeFi tokens. The developers then drain the project’s funds, causing the token’s value to crash and huge losses for the investors.

The speculation on DeFi tokens and their role in the new age of the internet makes many crypto enthusiasts bullish on these projects. Unfortunately, with just about the right technical knowledge, anyone can create a DeFi token and list it in a decentralized exchange without a code audit to publicly confirm the smart contract has no loopholes to advantage the developers.

It’s also worth noting that hackers can easily manipulate bugs in the protocols’ smart contract codes and exploit them to steal the investors’ funds.

Curbing DeFi crypto crimes is crucial to growth

Undoubtedly, decentralized finance is an exciting space with so many unchartered territories. The industry provides numerous opportunities for investors and crypto users, especially with NFTs and the Metaverse gaining traction.

However, DeFi may not realize its full potential unless drastic measures are put in place to curb illegal DeFi-related activities. In the meantime, investors can keep safe by sticking to code-audited DeFi projects and DEXs that perform audits before listing tokens on their platforms.

Question & Answers (0)