American carmaker Ford is gunning for a larger electric vehicle (EV) market share. That has come out in a recent tradingplatforms.com data presentation. The firm intends to make 50% of its annual vehicle sales electric by 2030.

Accordingly, the firm is ramping up investments in its EV production unit. In 2022 alone, Ford will pump up to $5 billion in the said unit. That figure is about twice the amount it invested in EV production in 2021. In the short term, Ford is targeting the production of over 2M EVs by 2026.

Tradingplatforms.com’s Edith Reads has been monitoring developments in the EV scene. She says, “Many are embracing electric vehicles as a sustainable alternative to fossil fuel powered vehicles. Despite the strides that the sector has made, there’s still a huge potential waiting to be fulfilled. Ford is awake to this reality hence its decision.”

Ford’s big shift

As part of its strategy, Ford has announced a major reorganization of its production line. That reorganization has seen the separation of Ford’s EV division from the parent Internal Combustion Engine one(ICE).

ICE has evolved into Ford Blue that the company has tasked with the responsibility of ensuring cash flows and profitability. To that end, it is expected to leverage Ford’s collection of ICE-driven cars cost-effectively.

On its part, the EV unit has morphed into Model e. It is the vehicle that will bring Ford the focus and expediency it requires to be competitive in that space. Ford’s CEO had in the past conceded that they lacked the agility to keep pace with the dynamism of the EV scene.

Though distinct, the two will collaborate in mutually beneficial areas for the company’s good.

Ford’s key competitors

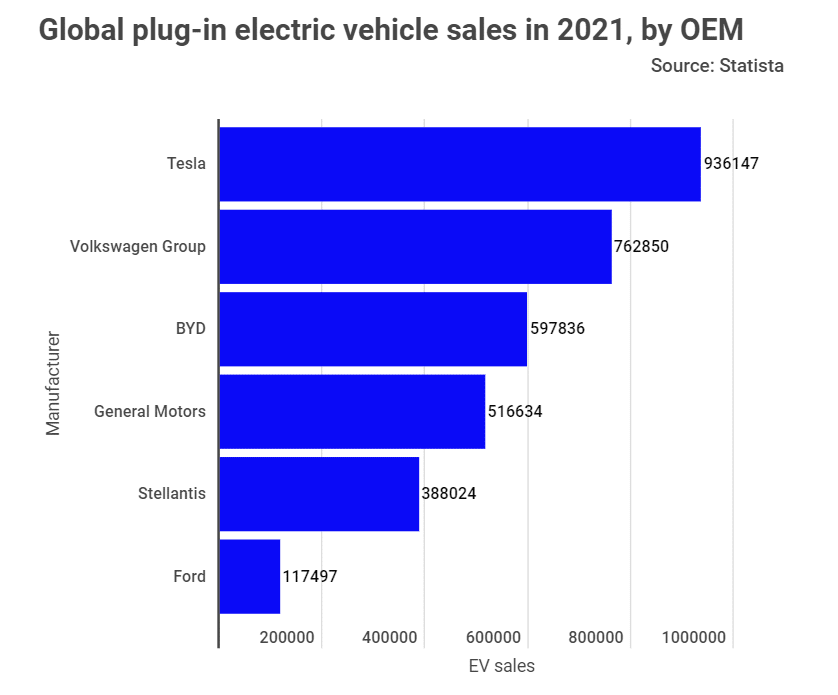

Going by market data, Ford has its work cut out. In 2021 the firm sold 117,500 BEVs and PHEVs. That’s about 13% of market leader Tesla. The latter sold 936, 147 EVs at that time.

Besides Tesla, Ford also finds itself jostling for market share with other manufacturers. For example, VW and GM are also angling for a market share. The duo has a clear head start over Ford based on their 2021 returns. While VW shipped over 700K EVs, GM did so for over 500K.

Other key competitors that it’ll have to contend with are BYD and Stellantis. BYD sold nearly 600K BEVs and PHEVs in 2021. Meanwhile, Stellantis sold about 400K of the same units.

Targeting the $1T EV market

The global EV market continues to grow in leaps and bounds. Analysts project that from 2020 to 2026, it’ll have increased by more than four-fold. That’ll see it attain the $1T mark from a CAGR of over 23% between 2021 and 2026.

Many consumers are opting for EVs today. New models are affordable and have increased battery life and efficiency. Above all, they’re a greener mode of transport.

Question & Answers (0)