Best Copy Trading Platforms for June 2025

Copy-trading allows you to mirror the portfolio and ongoing trades of an experienced investor. This allows you to invest in a truly passive nature – as your chosen trader will determine which assets to buy and sell.

In this guide, we review the Best Copy Trading Platforms for 2025 and walk you through the process of getting started today.

When choosing a copy trading platform, it is important to pay attention to platform fees, asset availability, minimum deposit and the type of trading platform that is used. Our team spent time testing different copy trading platforms to find the top options to consider.

-

-

The Best Copy Trading Brokers in 2025

Below you find a breakdown of the best copy trading platforms for 2025. Scroll down to read our in-depth review of each provider!

- eToro: eToro is known as the best copy trading platform for beginners because it provides a simple interface, a free demo account and detailed trader profiles with everything that you need to know about each expert trader. The copy trading feature automates the process of mirroring the trades of experts. As well as copy trading, eToro supports Smart Portfolios and social trading. The platform is regulated by the FCA, CySEC, ASIC, SEC and several other authorities around the globe.

- ZuluTrade (via AvaTrade): ZuluTrade is a great platform for copy trading that provides access to over 10,000 traders to copy. It can be accessed through AvaTrade, which is a regulated broker with a strong reputation in the US. The account setup process is easy and ZuluTrade provides a good range of technical analysis tools.

- Meta Trader 4 (via Libertex): To copy trade using MetaTrade 4, you will need to go through a third-party broker such as Libertex. Users can copy the trades of EAs (expert advisors) which provides signals. The signals can be used as part of a manual trading strategy or alongside automated trading.

- Meta Trader 5 (via FinmaxFX): MT5 offers mirror trading which allows users to copy the strategies of others. The fees vary depending on your account and the trader that you choose to follow. To use MT5 for copy trading, you will need to create an account with a third-party broker that is compatible with MT5.

- Mirror Trader (via AvaTrade): MirrorTrader supports the copying of trading strategies, rather than individual traders. Users can select a strategy that they want to copy and then automate their trading accordingly.

- cTrader (via Pepperstone): cTrader is a reputable platform for both beginner and advanced traders. Through the platform, expert traders can share their strategies and beginner traders can copy. The platform provides a range of risk management tools and educational resources.

- Duplitrade (via Pepperstone): Duplitrade is another advanced trading tool that can be used to copy trading strategies. The platform requires a minimum deposit of $5000 so is more suited to experienced traders.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What is Copy Trading?

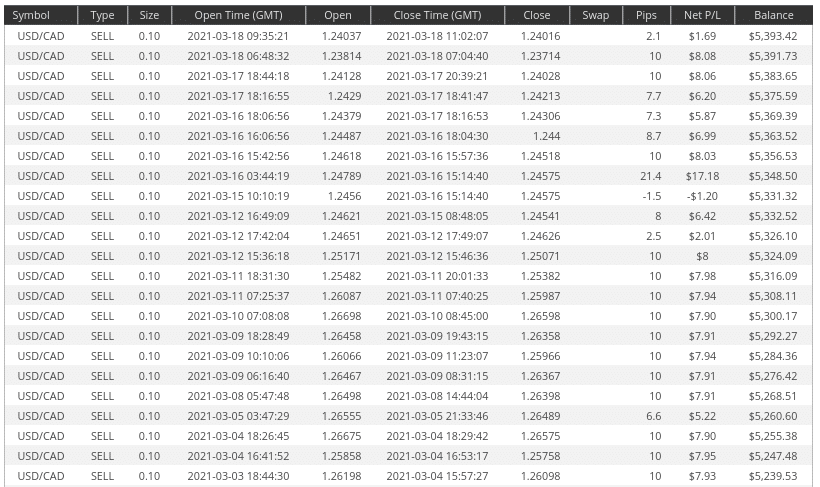

Copy trading is the process of mirroring your trading strategy to that of another trader or algorithm. That is to say, you will be ‘copying’ another trader who actively places trades that align with your strategy. So, if your chosen trader decides to go long on AUD/USD – the same position will be automatically opened under your trading account.

If the same trader then decides to short-sell Facebook stocks, again, you will do the same. The main concept here is that you can actively trade without needing to spend a lot of time on research and analysis. This is because your chosen trader will conduct the required research for you and make decisions accordingly. This includes the end-to-end process of analyzing the markets, performing research, and placing orders.

Past performance is not an indication of future results

In turn, any profits or losses that your chosen copy trader makes will be reflected in your own brokerage account. This will, of course, be at any amount proportionate to what you have invested – and there be might some fees or commissions involved.

Here’s a simple example of how copy-trading works in practice:

- You invest $2,000 into a copy trading platform

- You allocate the entire $2,000 into a day trading pro that specializes in commodities

- The commodity trader risks 10% of their portfolio going long on gold

- In turn, you risk $200 from your own portfolio

- This particular trade results in gains of 30%

- On your stake of $200 – you made a profit of $60

Of course, not all trades like the example above will result in financial gain. The key point here is that everything that the trader does is mirrored like-for-like in your own portfolio. As such, both profits and losses need to be taken into account.

Best Copy Trading Platforms Reviewed

There are a variety of core factors that you need to look for when choosing the best copy trading platform for your financial goals. For example, will you be copy trading directly with a regulated broker like eToro, or through a third-party platform such as MT4?

Additionally, you need to understand what fees and commissions you will need to pay to copy trade – and what financial markets you will have access to.

After reviewing dozens of providers that are active in the space – the best copy trading platforms can be found below.

1. eToro – Overall best platform for copy trading in 2025

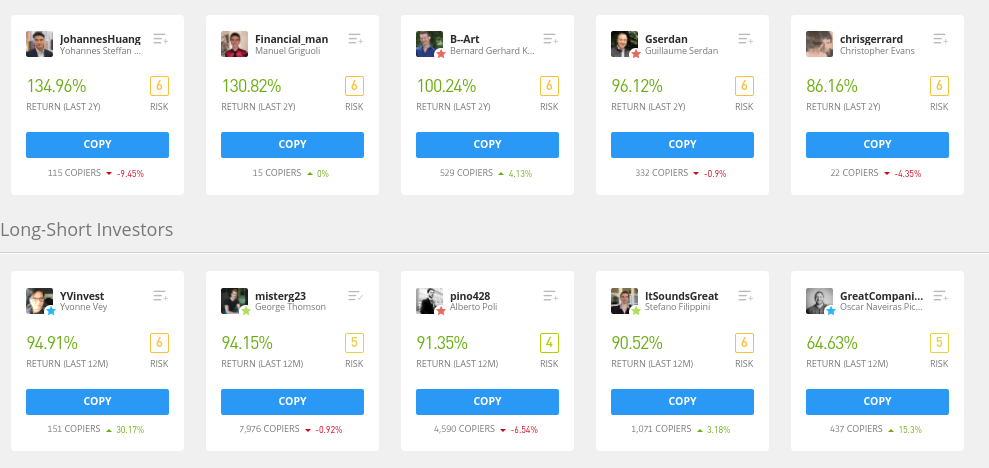

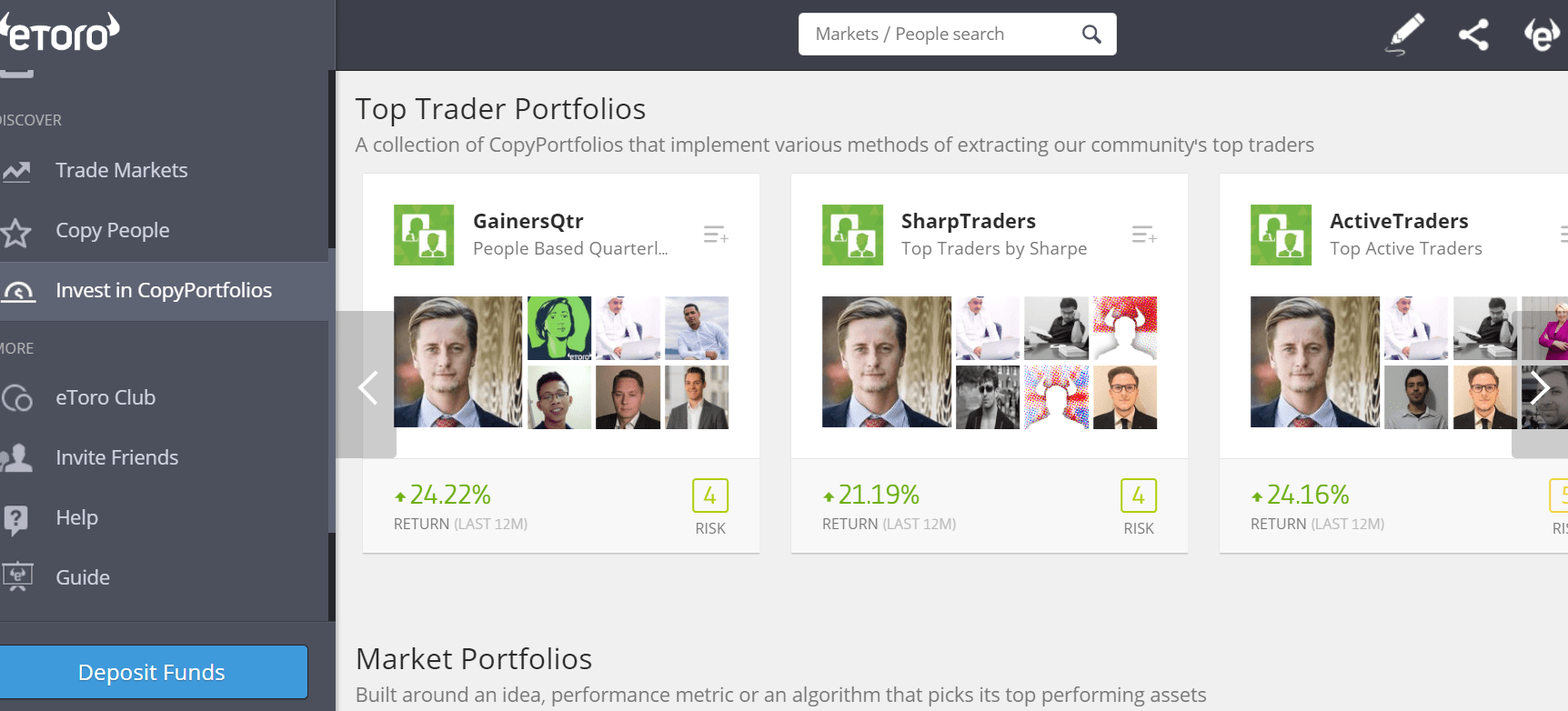

eToro is considered to be one of the best copy trading platforms on the market. The platform uses social trading features to provide a copy trading interface that is simple to navigate. Users can scroll through detailed trader profiles to find one that best suits their needs, risk appetite and strategy.

eToro provides data around each trader’s past performance and strategy so that users can make informed trading decisions. Furthermore, the platform supports copy trading for a range of financial instruments including stocks, ETFs, cryptocurrencies, commodities and more.

Past performance is not indicative of future results.

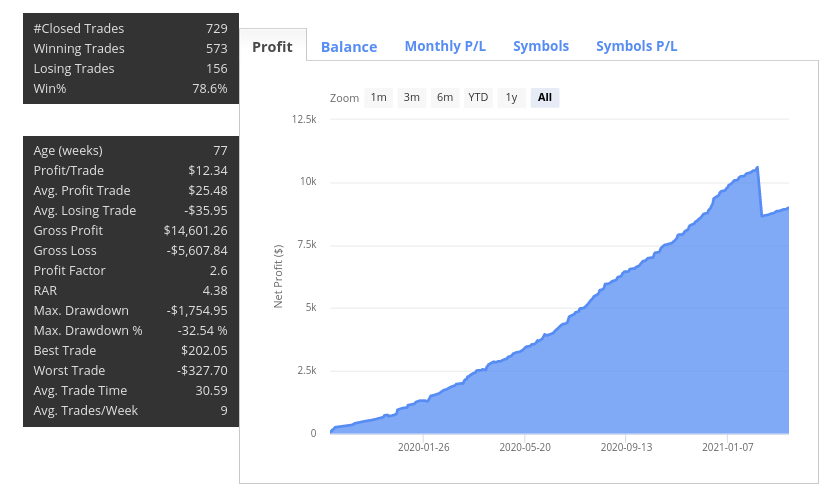

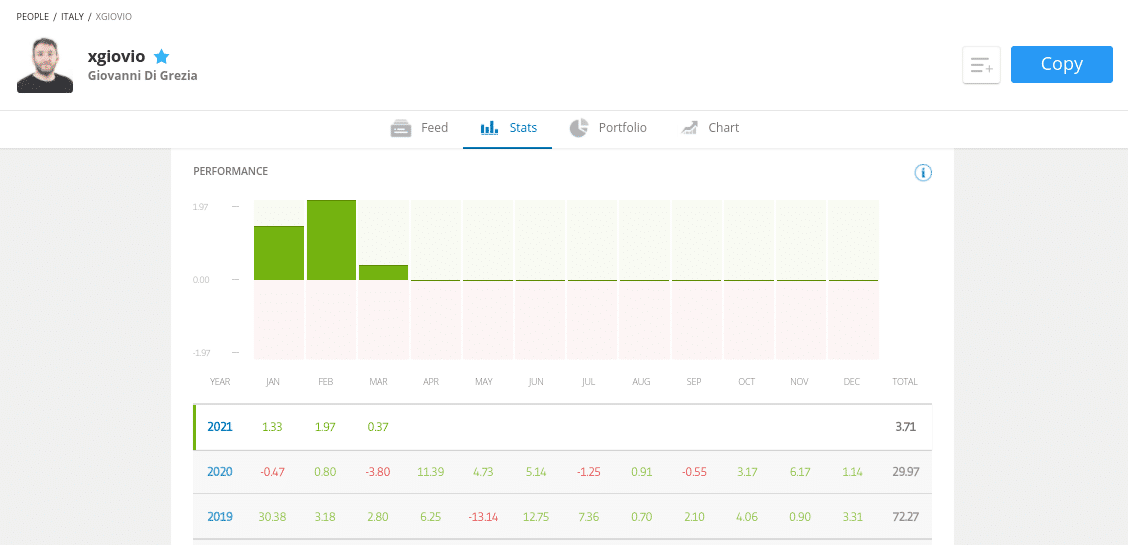

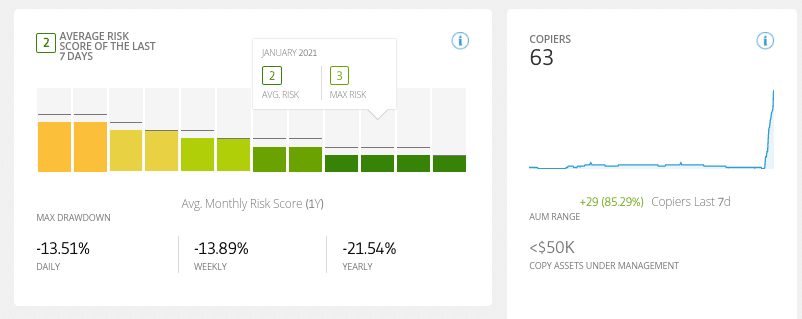

You then have the opportunity to take a much closer look at each trader’s historical performance at eToro. As an illustration, it’s possible to track the monthly gains or losses of the trader since they joined eToro, in addition to their associated risk rating.

You can also view the average number of days or weeks the trader keeps a position open and what their maximum drawdown is. Crucially, this allows you to spend some time assessing whether or not the investor has what it takes to trade on your behalf.

Once you have selected a trader to copy, it’s then just a case of deciding how much to invest. The minimum deposit for copy trading on eToro is $200.

eToro fees

Fee Amount Stock trading fee Free for US stocks Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee Spread, 1% for Bitcoin Inactivity fee $10 a month after one year of inactivity Withdrawal fee $5 Pros:

- eToro offers hundreds of different copy trading profiles to choose from which means that it is suitable to a variety of strategies.

- It is possible to trade some stocks commission-free.

- eToro supports 2,400+ stocks and 250+ ETFs listed on 17 international markets.

- The platform is licensed in several jurisdictions.

- eToro offers a demo account that can be used to test the copy trading feature without depositing any funds.

- The platform is available to use on both mobile and desktop.

Cons:

- eToro does not provide any advanced charting tools and does not support trading bots.

- The minimum deposit for copy trading is $200 which is fairly high.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

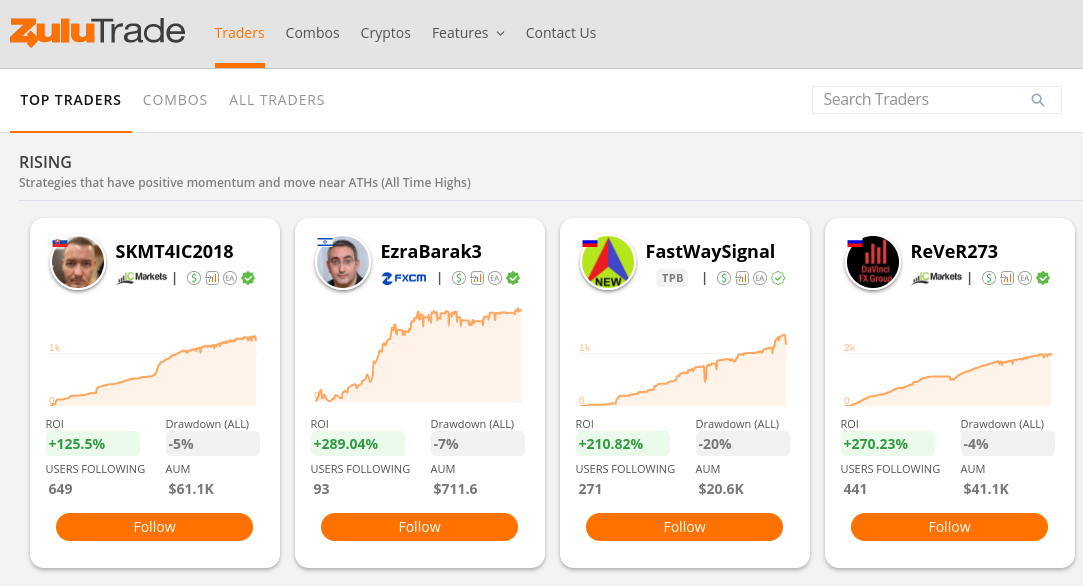

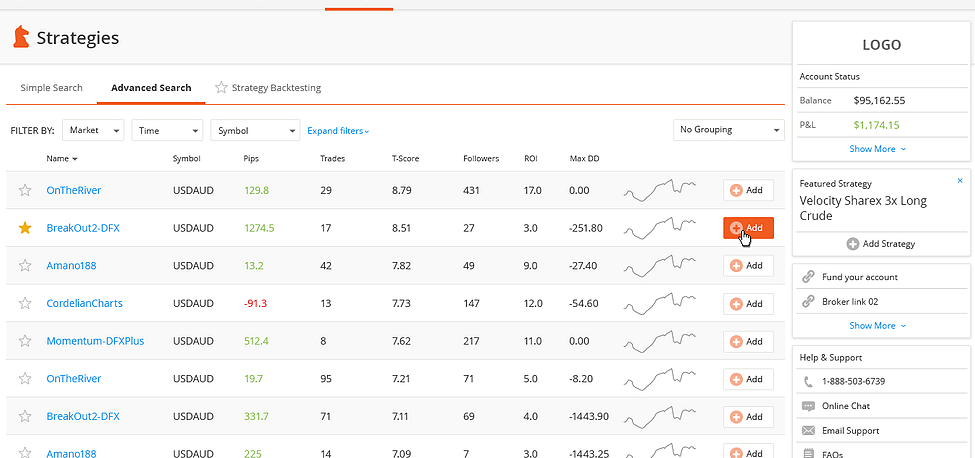

2. ZuluTrade (via AvaTrade) – Best copy trading broker with access to advanced tools

ZuluTrade is a copy trading platform that is suitable for both beginner and experienced traders. To use the tool, you must sign up to a partner broker such as AvaTrade and then connect your account to ZuluTrade.

You will then be able to access a range of copy trading features including price charts, live market data and signals. Users can pick which traders to copy based on a trader leader board. Here, the top traders are ranked by the platform based on their performance.

It is possible to view details about each trader before making any decisions. This includes ROI, total followers, past performance and insight into their trading strategies.

ZuluTrade also provides users with a plethora of tools to conduct their own research and analysis. This allows users to improve their skills and ensure that they are making justified decisions before putting any money at risk. You can also test out the platform with a demo account before live trading.

Although ZuluTrade claims to be transparent with its fee structure – we had to do a bit of digging to locate the respective commission rate. We found that based on certain conditions – this amounts to 20%. For example, if you invest $1,000 and your chosen trader makes 50% in month 1 – this amounts to gains of $500. Of this figure, the ZuluTrade will keep $100, which leaves you with net gains of $400.

AvaTrade fees

Fee Amount CFD trading fee Variable spread Forex trading fee Spread. 0.9 pips for EUR/USD Crypto trading fee Commission. 0.25% (over-market) for Bitcoin/USD Inactivity fee $50 per quarter after three months of inactivity Withdrawal fee Free Pros:

- Supports advanced charting tools that can be used for technical analysis.

- Commission-free platform with spreads from 0.9 pips.

- Wide range of tradable instruments available.

- ZuluTrade has a user-friendly interface that is easy to navigate.

- Detailed trader profiles that provide insight into how profitable different traders are.

- ASIC regulated.

Cons:

- Trading is limited to CFD assets.

- Copy trading fees are fairly high and members must pay a monthly subscription fee of $10 to use the platform.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

3. Meta Trader 4 (via Libertex) – Best forex copy trade platform for 2025

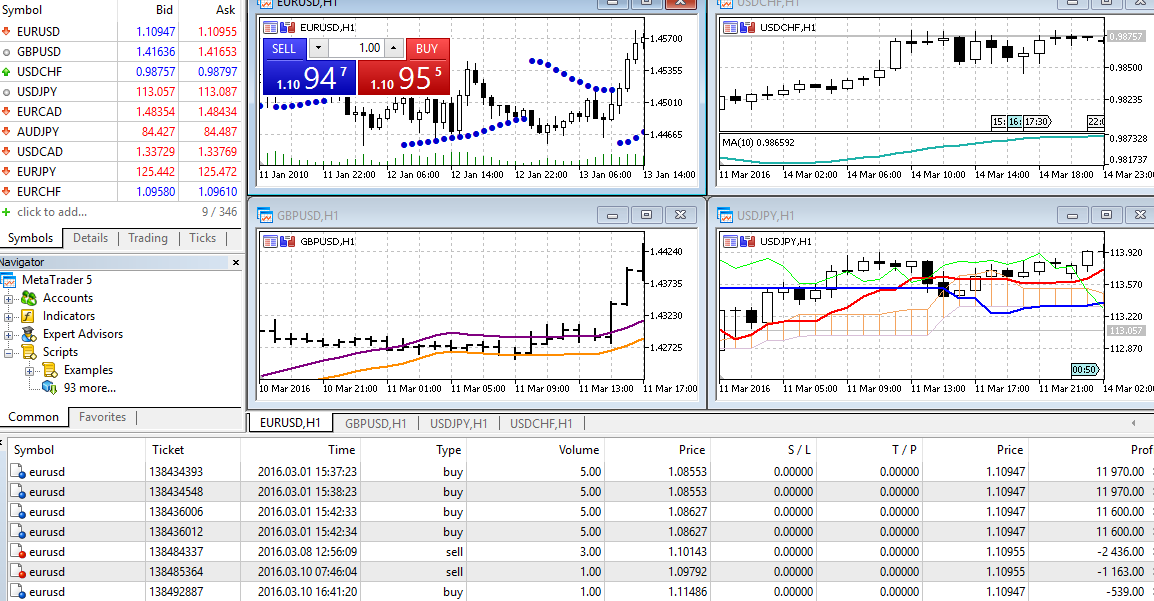

Meta Trader 4 (MT4) is the most utilized third-party trading platform in the online investment arena. The platform comes packed with advanced tools, technical indicators, and pricing charts – making it ideal for seasoned day traders. With that said, MT4 isn’t just suited for experienced pros – as the platform offers a number of copy trading features.

At the forefront of this is its support for forex EAs (Expert Advisors). The concept here is that by downloading a software file and installing it into MT4 – the forex EA will trade on your behalf 24 hours per day. The respective software file will have a set of pre-defined conditions built into it via an algorithm.

When the algorithm spots a profit-making opportunity, it will proceed to place a trade. This allows traders to trade passively without any need for intervention.

There are, however, two main considerations that you need to make when using this top-rated copy trading platform. Firstly, you will need to personally find a suitable forex EA – as this isn’t provided by MT4. There are thousands of providers in the space – so make sure you perform lots of research.

Secondly, MT4 is a third-party trading platform and not a broker. As such, you will need to find a suitable online broker that not only offers support for MT4 and forex EAs – but heaps of markets and competitive fees. In this respect, Libertex is arguably one of the better options. This is especially the case if your chosen forex EA takes a day trading strategy. After all, Libertex charges tight spreads – so the EA can target modest but frequent gains without getting hammered by indirect fees.

Libertex also offers commission-free trading on many stock CFDs. Other assets come with a commission that typically sits below 0.1% per slide. The minimum deposit is $100 at Libertex and you can fund your account with a debit/credit card, e-wallet, or bank account transfer. With that said, it’s also worth using the Libertex demo account facility first and then linking this to MT4. In doing so, you can test your chosen forex EA out in a risk-free manner.

Libertex fees

Fee Amount Stock trading fee Commission. 0.034% for Amazon. Forex trading fee Commission. 0.008% for GBP/USD. Crypto trading fee Commission. 1.23% for Bitcoin. Inactivity fee $5 a month after 180 days Withdrawal fee Free Pros:

- Tight spreads from 0.9 pips

- 60 FX currency pairs available to trade.

- Libertex provides users with a range of charts and tools that can be used to conduct technical analysis.

- MT4 supports a variety of APIs and EAs that can be used for copy trading and auto trading.

- Libertex offers a demo account funded with $50,000.

Cons:

- Libertex is limited to CFD trading.

- The platform lacks educational materials for beginners.

- Libertex is not compatible with MT5 (only MT4).

85% of retail investor accounts lose money when trading CFDs with this provider.

4. Meta Trader 5 (via FinmaxFX) – Popular high leverage platform for copy trading

Meta Trader 5 (MT5) is the younger counterpart to MT4. This third-party trading platform works much the same as MT4 – albeit, it is often used by those looking to CFDs as opposed to just forex. MT5 also comes with more advanced charting tools and technical indicators – and just like MT4, offers full support for forex EAs and automated trading robots.

With that said, MT5 also offers a fully-fledged mirror trading feature that works in a similar way to eToro. This is because you can browse through thousands of traders that use the MT5 platform and then elect to copy their ongoing trades like-for-like. MT5 charges a monthly subscription fee for this that will vary depending on your account and the specific trader you are copying.

Alternatively, you also have the option of obtaining a forex EA or robot from a third-party platform and then installing it into MT5. Either way and much like MT4 – MT5 is a trading platform that sits between you and your chosen broker. As such, you will need to find a suitable brokerage site that is compatible with MT5.

One of the best MT5 brokers that we came across is FinmaxFX. This CFD trading platform offers everything from forex, stocks, and cryptocurrencies to metals, energies, and bonds.

Perhaps the main draw with FinmaxFX is that is a high-leverage MT5 broker. For example, while retail traders in the UK, Europe, and Australia are capped to just 1:30 on major forex pairs, FinmaxFX offers leverage of up to up to 1:200. This means that a small account balance of $200 would permit a maximum forex trading position of $40,000. A leverage of 1:200 is also offered on indices and gold. Non-gold commodities and bonds can be traded with leverage of 1:100, stocks at 1:20, and cryptocurrencies at 1:10.

Although you need to tread with caution when using such high levels of leverage, this allows you to engage in a copy trading strategy with a small amount of capital. Additionally, your chosen MT5 copy trader or forex EA might take scalping or day trading strategy – meaning that it will target small gains. As such, leverage via FinmaxFX ensures that your financial gains are viable. In terms of account minimums, this starts at $100 at this top-rated broker.

FinmaxFX fees

Fee Amount Stock trading fee Commission. 0.034% for Amazon. Forex trading fee Commission. 0.008% for GBP/USD. Crypto trading fee Commission. 1.23% for Bitcoin. Inactivity fee $5 a month after 180 days Withdrawal fee Free Pros:

- Leverage of up to 1:200 offered for retail traders.

- Supports CFDs via stocks, commodities, forex, and cryptocurrencies.

- FinmaxFX is available on mobile and desktop, making it suitable for trading on the go.

- No deposit or withdrawal fees.

- The platform is compatible with a good variety of EAs and APIs.

Cons:

- No traditional stocks or investment funds available.

- FinmaxFX is regulated offshore.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. Mirror Trader (via AvaTrade) – Best copy trader for custom strategies

Mirror Trader is an innovative copy trading tool developed by Tradency. This particular tool is different from the other providers we have discussed thus far – as you will be basing your mirror trading decision on a specific strategy as opposed to selecting an individual trader.

This allows users to automate their trading endeavors based specifically on their desired strategy. For example, you might come across a strategy that focuses on scalping. This will see the copy trading tool place dozens of low-risk buy and sell positions throughout the day when an asset is stuck in a tight pricing range.

Alternatively, you might decide to copy a strategy that focuses on breakouts. This is when an asset smashes through a previously identified resistance level.

Either way, there are heaps of strategies offered by the Mirror Trading tool. You can easily review each strategy in great detail – by looking at its average monthly gains, risk rating, return on investment, maximum drawdown, and more. With that said, Mirror Trader is a third-party add-on, so you will need to link it up with a supported online broker.

Once again, AvaTrade is a good option here – which we discussed in detail in our earlier section on ZuluTrade. When it comes to fees, Mirror Trading itself doesn’t charge anything to use its copy trading tool. Although some brokers charge an additional subscription to link your Mirror Trading account, AvaTrade offers this on a fee-free basis. As AvaTrade is a commission-free broker, this means that the only trading fee you need to factor in is the spread.

AvaTrade fees

Fee Amount CFD trading fee Variable spread Forex trading fee Spread. 0.9 pips for EUR/USD Crypto trading fee Commission. 0.25% (over-market) for Bitcoin/USD Inactivity fee $50 per quarter after three months of inactivity Withdrawal fee Free Pros:

- Mirror Traders supports custom strategies based on each trader’s individual needs and goals.

- The platform provides retail traders with access to information that is usually only available to institutional investors.

- Mirror Trader uses signals from a variety of strategy developers.

- Users can access a good range of educational resources.

- Islamic trading accounts are available.

Cons:

- Assets are limited to CFDs.

- Mirror Trader is not a broker which means that it can’t be used as a standalone platform.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. cTrader (via Pepperstone) – Market-leading algorithmic copy trading tool

Much like MT4 and MT5, cTrader is a third-party trading platform that can be accessed through a brokerage platform such as Pepperstone. The platform is particularly popular with advanced traders that need access to complex order types, fast entry execution, and Level 2 pricing fees.

That being noted, cTrader is also behind a growing community that consists of both amateurs and seasoned pros alike. This is because experienced traders can broadcast their proven strategy to the cTrader platform and in turn – this can be copied like-for-like. This is a win-win situation, as less-experienced traders get to trade in a fully automated manner while the strategy broadcaster will earn a commission.

Once you have chosen an investment strategy to follow, you can then set up risk-management tools to suit your financial goals. For example, you can elect to apply leverage on your positions or set a maximum stop-loss price. There is full transparency on cTrader, meaning that you can view the historical trading results of your chosen strategy broadcaster before taking the plunge.

There are two ways in which you might be charged to copy a strategy via cTrader. In some cases, this is based on volume – so the more you invest the less you will pay. In other cases, you will pay a performance fee. This means that the more profit the trader makes you, the more they make themselves.

This popular cTrader broker specializes in low-cost CFD instruments. This includes everything from forex and gold to stocks and indices. There are no fees charged by Pepperstone to use cTrader, which is great. In terms of actual trading commissions, this depends on the account you decide to open – of which there are two to choose from. The ‘Standard account is commission-free, with all fees built into the spread. The ‘Raw’ account comes with 0 spreads, but a fixed commission.

The exact commission depends on the underlying currency of the asset you are trading. For example, assets priced in USD will cost you $3.50 per slide. Pepperstone is also a great choice as the platform has been around since 2010 and is regulated. There is no minimum deposit at this free trading platform and you can fund your account with a debit/credit card (Visa or MasterCard), bank transfer, or Paypal.

Pepperstone fees

Fee Amount Stock trading fee $0.02 per US stock Forex trading fee Spread, 1.59 pips for GBP/USD Crypto trading fee Spread, 50 pips for Bitcoin Inactivity fee Free Withdrawal fee Free Pros:

- Spread betting is tax free (individual circumstances may apply).

- cTrader offers fast executions and charting systems that are suitable for scalping.

- cTrader offers 10 different time frames which is more than other providers.

- The platform provides users with industry-leading risk management tools

- cTrader is compatible with regulated brokers.

Cons:

- No proprietary platform, cTrader can only be access through a third-party broker.

- Broker availability is limited.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

7. Duplitrade (via Pepperstone) – The best copy trading tool for diversification

Duplitrade offers a similar service to Mirror Trader, insofar that you will have access to a wide variety of trading strategies – all of which you can copy like-for-like. With that said, we found that Duplitrade has a broader scope of strategies on its platform – making it ideal for diversification purposes.

To give you an idea of some of the strategies offered by Duplitrade, one option that you might consider is the ‘Major’ system. As the name suggests, this focuses exclusively on major currency pairs like EUR/USD and GBP/USD. This copy trading strategy makes buy and sell decisions through technical indicators such as the RSI, ADX, and Parabolic SAR.

Another popular copy trading strategy at Duplitrade is that of the ‘Robust’ system. On top of major forex pairs, this also focuses on gold and indices. This strategy will focus on mean reverting points and breakouts in a fully automated manner.

In terms of getting started, Duplitrade requires access to your chosen brokerage account. Once again, we think that Pepperstone is the best option in this respect – due to previously discussed low commissions and spreads on offer.

Before getting started with Duplitrade, it is important to note that the minimum deposit stands at a whopping $5,000. The good news is that you can spread this $5,000 across as many copy trading strategies as you wish. This allows you to take a more risk-averse approach to automated trading.

Pepperstone fees

Fee Amount Stock trading fee $0.02 per US stock Forex trading fee Spread, 1.59 pips for GBP/USD Crypto trading fee Spread, 50 pips for Bitcoin Inactivity fee Free Withdrawal fee Free Pros:

- The platform has an easy-to-use interface that is suitable for amateurs and experienced traders alike.

- Traders can diversify by copying numerous strategies simultaneously.

- Copy trading can be automated.

Cons:

- Duplitrade can only be accessed through a third party platform.

- The minimum deposit of $5000.

- The number of signal providers available is limited.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Types of Copy Trading Systems

In reviewing the best copy trading brokers for 2025 – you might have noticed that there are many different ways in which you can get involved.

To ensure you select a copy trading system that best meets your needs, here is an overview of the different types of copy trading brokers that you might come across.

All-in-One Copy Trading Brokers

eToro is unique in the sense that it offers an ‘all-in’ copy trading feature. eToro is primarily a regulated brokerage site that allows you to buy, sell, and trade assets without paying any commission. Its copy trading tool is therefore an add-on that is offered in-house.

Crucially, this means that there is no requirement to use a third-party platform like MT4 or download automated trading software. Instead, you simply need to open an account with the broker and choose a verified investor that meets your financial goals and tolerance for risk.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Robots and Algorithmic Software

The next copy trading option that you have at your disposal is to utilize an automated robot. Otherwise referred to as a ‘bot’ or ‘EA’, the best trading robots are pre-programmed by third-party developers and backed by an algorithm.

- The main concept here is that the robot will trade in a fully automated manner.

- It doesn’t have the capacity to ‘think’ like a human trader. Instead, the robot places trades based on the underlying code it has been programmed to follow.

- In simplistic terms, the robot might go short on a forex pair if it falls through an identified support level.

- Or, the robot will go long on a crypto-asset if it rises by more than 10% in a 24-hour period. Either way, your chosen copy trading robot will function 24 hours per day.

This in itself is a major advantage, as human traders will only be able to dedicate a certain amount of time per day. On the flip side, the main drawback with automated robots is that they are somewhat intransigent. This is because they can only follow pre-programmed code – so have no understanding or knowledge of financial news or fundamental analysis.

Additionally, robots and automated software programs need to be installed into a third-party platform like MT4, MT5, or cTrader. This means that you will also need to find a suitable brokerage site and connect it to the respective platform.

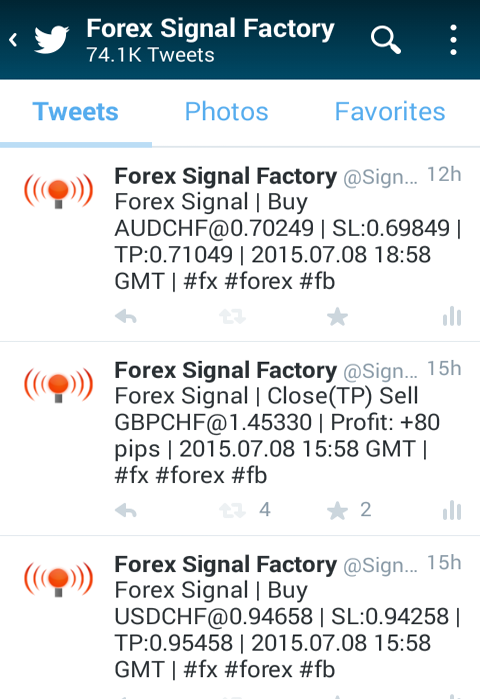

Signals (Semi-Automated)

Another great option to consider in your search for the best copy trading platform is a signals service provider. This allows you to copy trade but in a semi-automated manner. In its most basic form, your chosen signal provider will send you trading suggestions based on algorithmic analysis. You can then choose whether to follow the suggestions or not.

- For example, popular signal service Learn2Trade has a team of in-house traders that will manually scan the forex and cryptocurrency markets.

- Like all seasoned traders, they will make use of advanced technical indicators and chart drawing tools.

- Then, when a trader spots a trend that it thinks represents a risk-averse opportunity – Learn2Trade will send out a signal.

- This will tell you exactly what orders need to be placed at your chosen brokerage site.

Here’s an example of what a trading signal looks like:

- Asset: BTC/USD

- Order: Long (Buy)

- Entry: $51,500

- Stop-Loss: $49,600

- Take-Profit: $54,050

As you can see from the above, you are copy trading in a semi-automated manner because you first need to decide whether or not you wish to act on the signal. Then, you will need to head over to your chosen broker and place the suggested orders manually.

This option is potentially more suited for those of you that wish to copy trade in a more controlled manner, as opposed to automating the entire process.

Copy Strategies

You might also consider copying a specific trading strategy as opposed to mirroring an individual investor like-for-like. This is a service offered by third-party trading platforms like Duplitrade and Mirror Trader. Both of these providers offer a wealth of different strategies – most of which focus on short-term day trading or scalping.

You can select a strategy based on its past performance or the respective financial instrument. You can also select a strategy based on risk and its return on investment since hitting the live markets. Much like a forex EA or automated robot – this copy trading strategy requires you to engage with multiple stakeholders.

For example, not only do you need to open an account with a provider like Duplitrade, but you then need to select a specific strategy. And of course, you will also need to find a suitable online broker that offers support for your chosen copy trading provider.

How to Choose Traders to Copy

Although copy trading allows you to take a hands-off approach to invest, you still need to put a little bit of groundwork in. This is because you need to spend some time researching the many copy traders that your chosen platform offers.

In fact, when using a top-rated provider like eToro, you’ll have access to thousands of verified investors – so you need to know what to look out for in choosing the best trader for your financial goals.

To help clear the mist – below we discuss the most important factors to consider when searching for the best traders to copy.

✔️ Assets

One of the first things that you should look for when choosing a trader to copy is the assets that they trade. Not all traders will choose to trade in the same markets for example, some traders may focus on commodities whereas others might trade mostly cryptos.

It is important to choose a trader that trades in markets that suit your risk appetite and goals. Markets such as ETFs and commodities are considered to be less risky than cryptocurrencies or forex. On eToro, it is possible to view the history of each trader so that you can get an idea of the type of assets that they tend to trade. It is also possible to see an overview of their portfolio.

✔️ Trading Performance

Once you have filtered down by your chosen asset class – it’s then time to focus on performance. After all, you’ll want to be copying traders who have a proven record of profitable trades.

Past performance is not an indication of future results

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

The only way to do this is to look at the trader’s historical performance. At eToro, you can specify two key metrics to find a top-rated trader that meets your goals – which are listed below.

- Percentage Gains: You can enter the minimum amount of profit that you want your chosen trader to have made in percentage terms.

- Period: Then, you can specify a time period – from one month to two years.

For example, you might want your chosen trader to have made at least 30% over the past two years. In entering your requirements, eToro will only show you traders that meet this criterion.

✔️ Risk

Another key metric to look at when choosing a trader to copy is risk level. Often, traders with the most impressive returns take more risk to achieve these outcomes. On the other hand, traders who generate modest profits may have a lower risk score.

The risk level that you decide to take will depend on whether or not you can afford to lose the funds that you deposit into your account. During a volatile market, it might be wise to choose a low-risk trader that might provide more stability than a higher-risk option.

Most platforms provide a clear risk score for each trader. However, on some platform you may have to do a bit of digging to find this information.

✔️ Average Duration

Another key metric that we like when selecting a copy trader is that of the average trade duration. This is because you can assess the specific strategy that the trader takes.

For example, if the trader has an average trade duration of 6 months – then you know that they are a long-term buy and hold investor. If the individual has an average trade duration of just 5 hours, then you know they are a day trader.

Short trading strategies are typically more volatile than long-term strategies however, they can generate more regular profits.

Conclusion

This guide has reviewed the best copy trading platforms to consider in 2025. We have covered everything from copy trading brokers, automated robots, signals, and third-party platforms like Mirror Trade and Duplitrade. While all of the providers discussed today are worth considering – we found that the overall best copy trading platform is eToro.

This regulated broker – which is home to over 20 million clients, allows you to choose from thousands of copy traders. The minimum investment per trader is a reasonable $200 and you can exit your position at any given time.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQs

What is the best copy trading platform?

We found that the best copy trading provider in 2023 is eToro. This is because the platform is easy to navigate and gives you access to thousands of verified copy traders and there are no fees or commissions charged.

Is copy trading profitable?

Copy trading can be profitable if the trader or strategy that you choose to mirror places successful trades. However, there is no guarantee that the trader that you copy will be successful. There is risk that you will lose money through copy trading.

Can you lose in copy trading?

Yes you can lose in copy trading if the trader that you choose to copy places an unsuccessful trade. It is also possible to lose if you do not use risk management tools such as stop loss levels.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

References:

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up