9 Best Brokers for Nasdaq 100 in February 2026

If you’re looking to gain exposure to the US non-financial sector then the Nasdaq 100 index may just be your answer. The Nasdaq 100 gives traders and investors heaps of liquidity which results in tight spreads and higher returns. In this in-depth review, we reveal the best brokers for Nasdaq 100 and examine why the US Tech 100 index is so popular.

-

-

9 Best Brokers for Nasdaq 100 2026

Providing the highest quality service, value, and trading features, in this section you will find the best trading platform for the Nasdaq 100 index and its top competitors. Just scroll down for a detailed review of each broker.

- AvaTrade: AvaTrade stands out as a Nasdaq 100 broker with low fees. You can trade the Nasdaq 100 as a CFD on the platform along with various other markets including forex, stocks and bonds. AvaTrade offers both retail and professional trading accounts.

- IG: IG provides exposure to the Nasdaq 100 through over 10,000 stocks and Smart Portfolios. The platform is easy to use and has a strong focus on research and analysis, providing traders with a variety of helpful tools.

- Fidelity: Fidelity offers zero-commission trading for ETFs and some stocks, including many in the Nasdaq 100. The platform also offers advanced trading tools, real-time data and multiple account types to suit all traders.

- TD Ameritrade: TD Ameritrade is a well-known US brokerage firm with a long history. The platform is regulated in several jurisdictions and provides access to the highly-rated Thinkorswim trading platform. Traders can access educational resources and technical analysis tools.

- XM: XM is a CFD and forex trading platform, offering CFDs in the Nasdaq 100. The platform is known for its tight spreads and excellent customer support options. You can contact customer support via phone, email and live chat. Traders can access MT4 and MT5 through the platform.

- CMC Markets: CMC Markets is a reputable platform that is listed on the London Stock Exchange. The paltform offers over 8000 stock CFDs and is compatible with MT4 for in-depth analysis.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

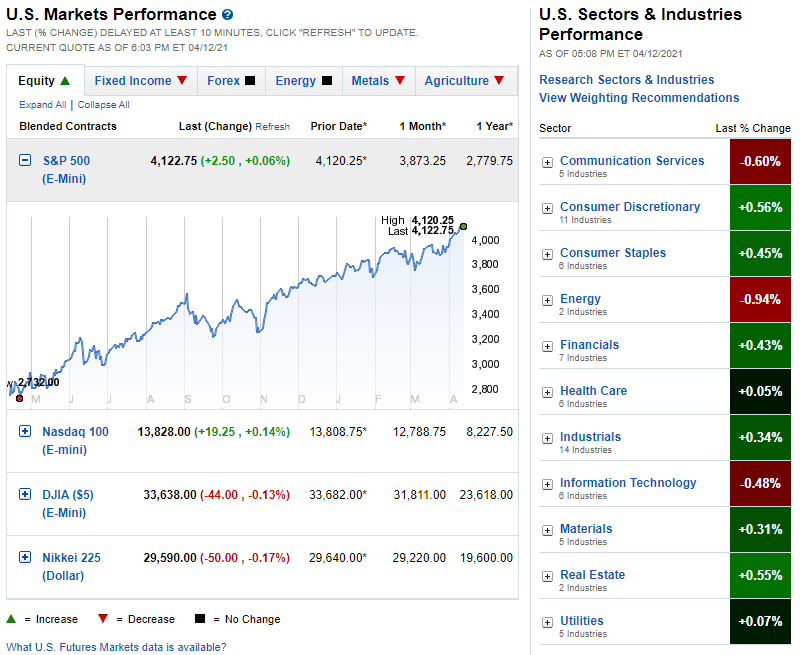

What is the Nasdaq 100?

The Nasdaq 100 index, otherwise referred to as the US Tech 100, is an index that is made up of 100 of the largest non-financial companies. These companies are listed on the NASDAQ stock exchange and are valued by their market capitalization. The constituents that make up the Nasdaq 100 index span across various industries such as computer engineering and biotechnology.

Ways to Trade and Invest in Nasdaq 100

Investing in or trading the Nasdaq 100 index begins by choosing a top-rated and regulated broker. For this, we recommend AvaTrade because you can trade with low fees, and you can take advantage of advanced charting tools and APIs.

Simply put, the Nasdaq 100 is an index that tracks the performance of the biggest 100 non-financial companies in the United States. However, there are some key gaps between investing in and trading the US Tech 100 index.

Gaining exposure to the Nasdaq 100 index can be broken down into two areas:

- You can trade on the index’s price via spread bets and CFDs, which are basically financial derivatives that can be traded with leverage.

- You can invest in the Nasdaq 100 by purchasing exchange-traded funds that track the price movements of the index. Alternatively, you can buy shares of the companies that make up the index thus creating a portfolio that replicates the actual performance of the underlying index.

One important note to bear in mind is that trading the Nasdaq 100 index through spread betting and CFDs is best suited to short-term investors whereas gaining exposure to the index through investing in shares and ETFs is best suited for long-term investors.

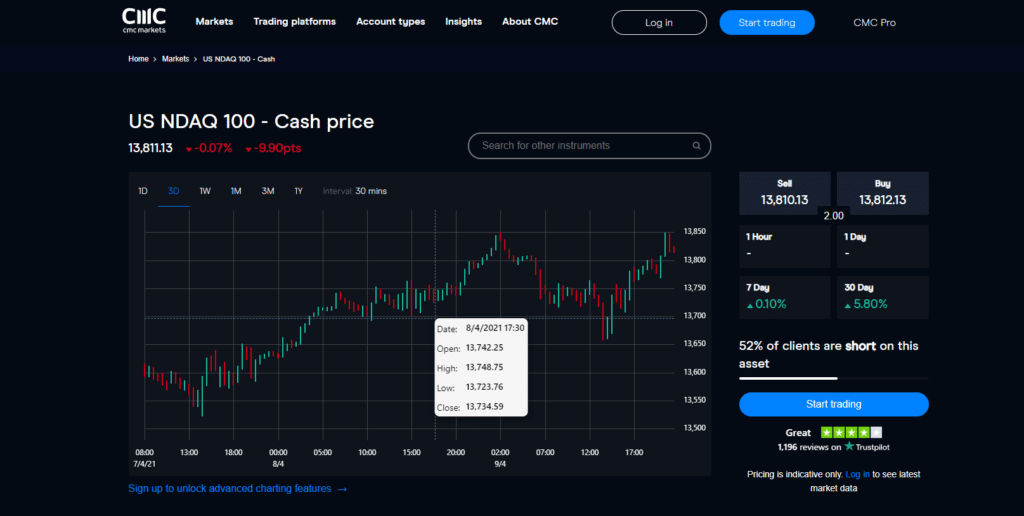

Trading the Nasdaq 100 index with cash indices

Cash indices allow active traders to speculate on the current market price of the US Tech 100. Cash indices are commonly used by short-term investors due to their tight spreads. It is important to remember that overnight fees are not built into the spreads, so closing your positions before the end of the trading hours may be a good idea to avoid overnight fees.

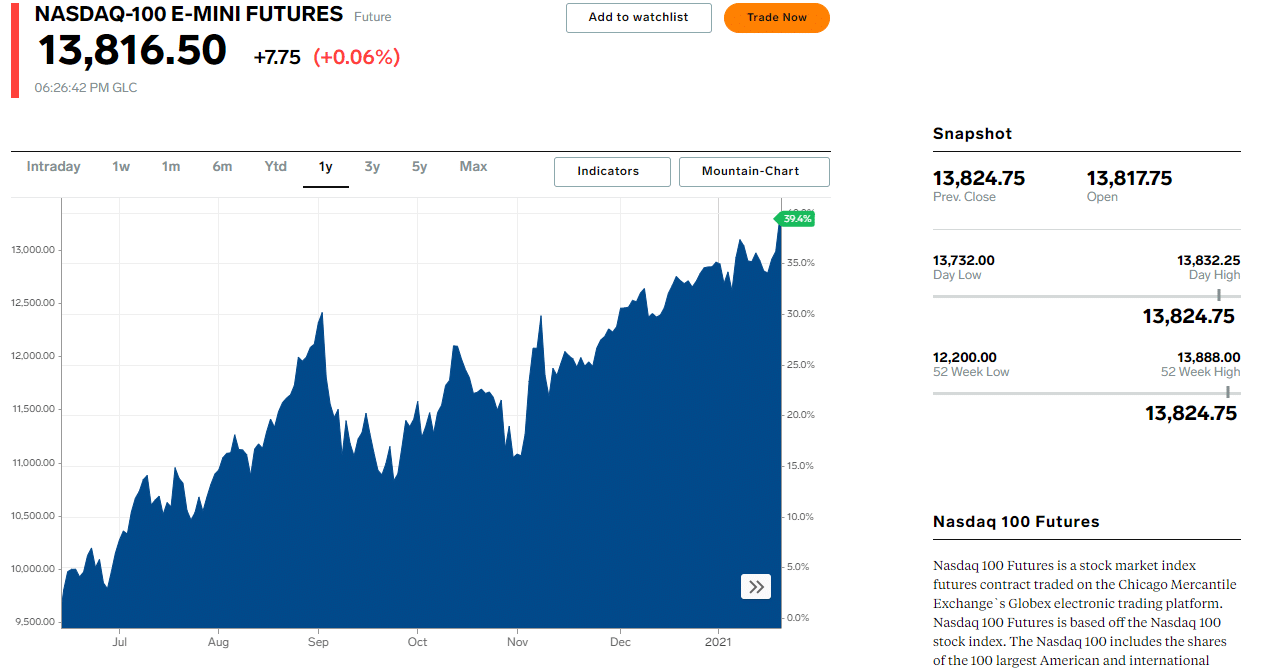

Trading the Nasdaq 100 with index futures

Index futures give traders the opportunity to speculate on the market price of the Nasdaq 100 at some point in the future. Trading index futures is a trading strategy that is typically used by long-term investors. This is due to the fact that the overnight fees are built into the spread. As a result of this, the spreads are somewhat wider in comparison to cash indices, however, you do not have to worry about overnight fees or closing your positions at the end of the trading day.

How do you invest in the Nasdaq 100?

Investing is used as a means to gain returns from increasing price movements in the Nasdaq 100 index. Despite not being able to directly invest in the index itself, you can invest in shares of the 100 non-financial companies that make up the Nasdaq 100, or you could invest in ETFs.

Those who choose to invest in the Nasdaq 100 are required to offer the full value of the position as leverage is not provided for investment positions.

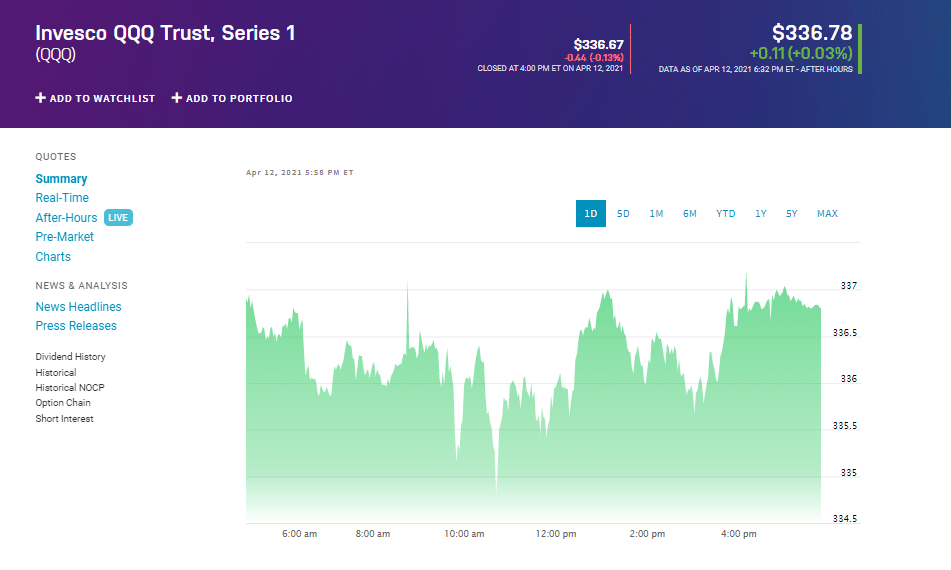

Investing in the Nasdaq 100 index through ETFs

ETFs track the price of the underlying asset, which in this case is the Nasdaq 100 index. ETFs are typically made up of a variety of shares of the non-financial firms that constitute the Nasdaq 100 index. Therefore purchasing ETF shares will replicate the exposure you would expect to gain if you were to buy Nasdaq 100 shares.

Investing in the Nasdaq 100 index through stocks

Buying individual shares of stocks that make up the Nasdaq 100 is another effective way of gaining exposure to the index through investing. Every time you buy stocks, you take ownership of them. The most popular stocks that most investors focus on when it comes to gaining exposure to the Nasdaq 100 index are Apple and Microsoft stocks. The Nasdaq 100 is weighted by market capitalization, which therefore means that price movements of these large tech companies will have a greater influence and impact on the overall performance of the index.

Nasdaq 100 tracker funds

Alternatively, investing in Nasdaq 100 tracker funds is an effective way of gaining exposure to the index. Much like index funds, tracker funds track the performance of the underlying index. Put simply, when you invest in Nasdaq 100 tracker funds, its value will depend on the price movements of the actual Nasdaq 100. Basically, when the price of the Nasdaq 100 index rises so does the value of the tracker fund.

Why Trade The Nasdaq 100?

Investing in or trading the Nasdaq 100 index is popular amongst the online investing community because it gives you exposure to the 100 largest non-financial companies that are also listed on the NASDAQ stock exchange. Furthermore, the US Tech 100 is amongst the most popular and widely tracked indices.

Additionally, the Nasdaq 100 offers high levels of liquidity which are perfect for day traders who benefit from very tight spreads allowing them to open and close positions with inexpensive costs.

Best Nasdaq 100 Brokers Rated and Reviewed

There are thousands of trading platforms to choose from, all allowing you to buy and sell tradable assets from the comfort of your own home.

Choosing the right broker that suits your trading objectives can be hard, which is why we have compiled a list of the top ten best brokers for the Nasdaq 100. You need to consider what markets each platform offers, what its trading and non-trading fees are, and other key investment metrics.

To clear the fog, below you will find a compilation of the best online brokers for the Nasdaq 100 in 2026. Whether you’re looking to trade or invest in the Nasdaq 100 we have you covered.

1. AvaTrade – best CFD broker with low CFD fees

AvaTrade is a global CFD and Forex trading platform regulated by multiple financial organizations including ASIC, the Central Bank of Ireland, and the Financial Futures Association of Japan, just to name afew.

AvaTrade is a great CFD broker for day traders looking to trade CFD instruments because it offers industry-leading low spreads. For instance, the majority of currency pairs can be bought and sold with a spread of less than 1 pip.

As well as AvaTrade’s tight spread offering, the CFD broker allows you to trade CFD assets without paying any commission. When it comes to tradable markets, AvaTrade covers thousands of financial instruments. In addition to CFDs and forex, you can also gain access to bonds, indices, cryptocurrencies, and futures. Therefore, if you’re interested in a specific market, AvaTrade will have you covered.

During our comprehensive review of AvaTrade we found that there are multiple trading platforms to choose from. As such, you can trade using:

- The in-house developed Webtrader along with AvaTrade’s mobile trading app

- Third-party trading platforms including MetaTrader 4 and MetaTrader 5

- Fully-fledged CFD options trading platform called AvaOptions

Pros:

- Dedicated CFD and forex broker

- Wide range of stock index CFDs, ETF CFDs, commodity CFDs

- AvaTrade users have access to social trading via third-party providers ZuluTrade and DupliTrade

- Offers AvaSocial, a social trading mobile application

- Low CFD fees and tight spreads

Cons:

- High inactivity fee

There is no guarantee that you will make money with this provider. Proceed at your own risk..

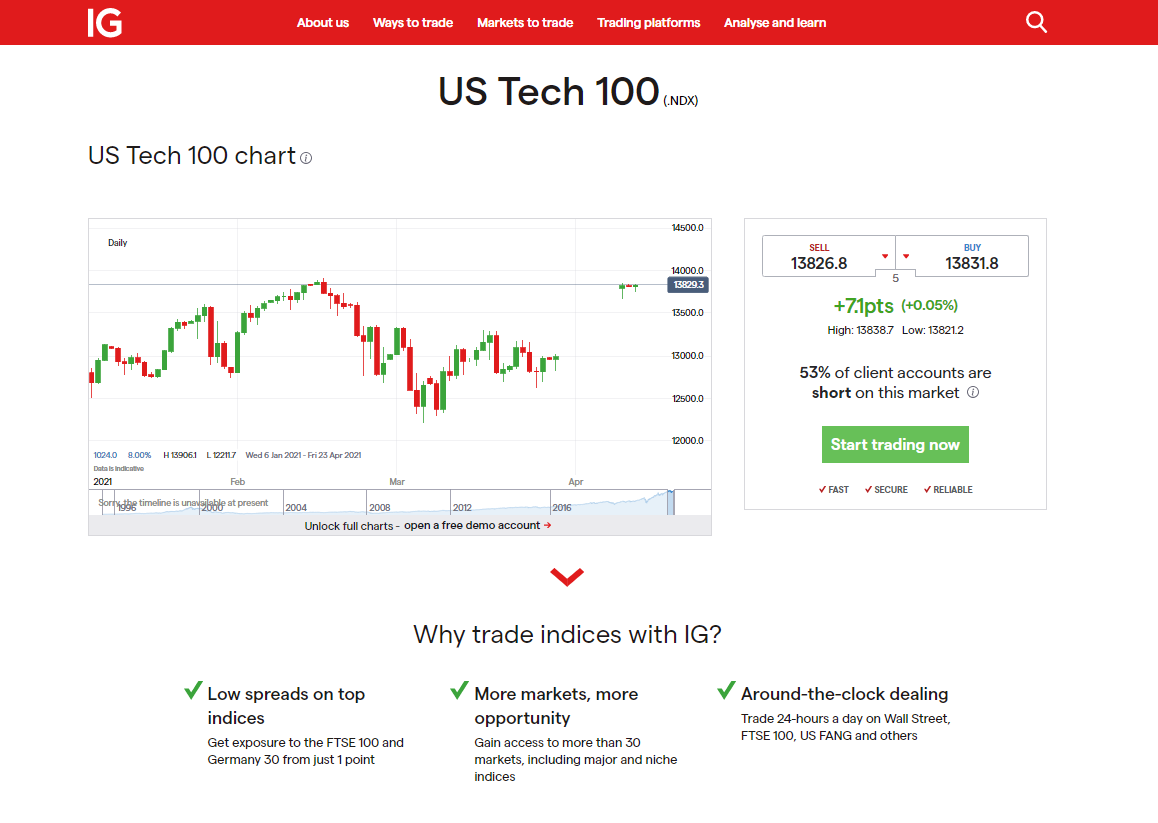

2. IG - best index trading platform for CFDs

IG’s origins can be traced back to 1974 when it was launched and since then has become a popular CFD broker. Falling under standards and regulations from several financial authorities including the FCA and BaFin, IG is also listed on the LSE.

With its acclaim as a global CFD trading platform, it has a staggering selection of well over 10,000 stock CFDs and 1,900 ETF CFDs. Furthermore, IG’s offering of tradable assets is not capped at CFDs.You can choose from forex, cryptocurrencies, commodities, indices, options, and much more.

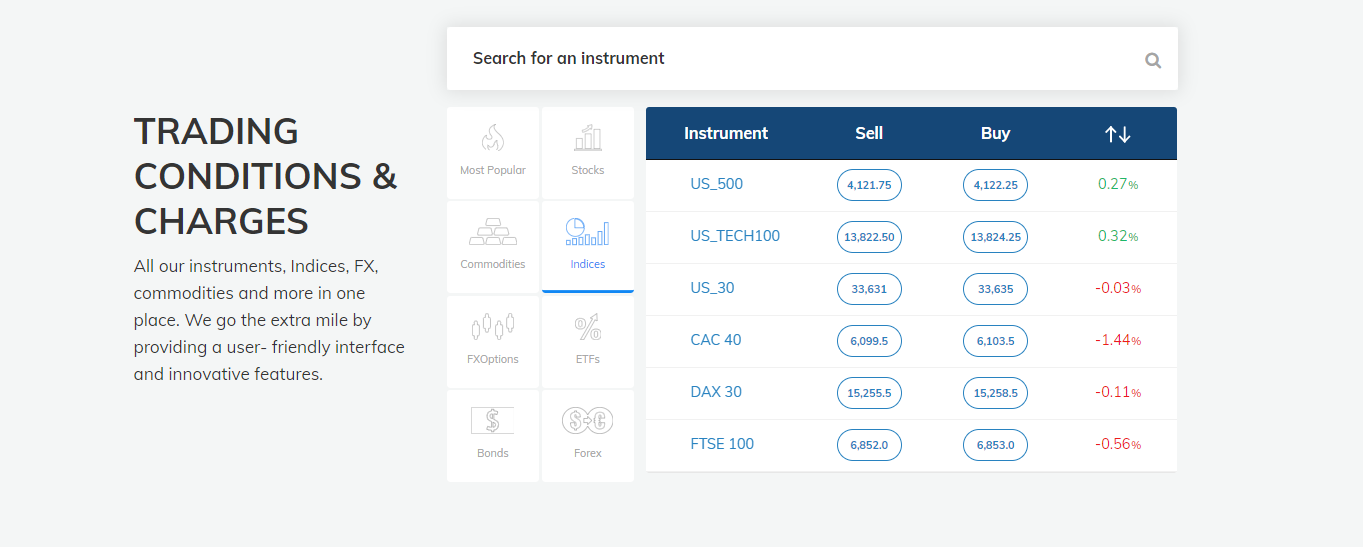

If you are reading this guide then chances are you are looking for a top-rated and trusted broker to trade and invest in the Nasdaq 100 index. Put simply, with IG you will not be disappointed. You can pick from some of the industry’s most popular indices and gain exposure to the Nasdaq 100 from just 1 point.

For traders searching for a more passive approach to investing then IG has you covered with its Smart Portfolio. Simply put, this robo-advisory service is offered to UK-based clients and provides iShares ETF portfolios which are managed by the investment management corporation BlackRock.

Pros:

- UK-based clients can take advantage of its robo-advisory service IG Smart Portfolio

- Wide range of research tools including trading ides and 30 technical indicators for charting

- Low non-trading fees including no account or deposit fees

- Fully digital and easy account opening process

- Access to a variety of educational resources and materials from a demo account to live webinars

- Home to around 240,000 traders

- Offers MT4

Cons:

- Customer services not available 24/7

- Lack of fundamental data

There is no guarantee that you will make money with this provider. Proceed at your own risk..

3. Fidelity - best broker offering zero-commission ETFs

Fidelity is a US-based broker that was launched in 1946 and offers 100% zero-commission on US stocks, indices, and ETF trades. Furthermore, this broker charges $0.65 per option contract and users have access to analyst reports for thousands of stocks and cover dozens of third-party research providers. In terms of the fundamentals, Fidelity is regulated by the SEC and FINRA.

Moreover, Fidelity provides advanced charting tools, real-time analyst quotes, and the ability to manage multiple stocks at once, giving it its strong reputation as one of the leading index brokers in the trading scene. For mobile traders, the Fidelity mobile trading platform also provides great research tools and features on a single user-friendly interface.

In terms of account types, there are heaps of options to choose from including Roth IRA accounts to a Fidelity account for Businesses. Fidelity also offers low non-trading fees including no inactivity fees or account fees. To see how we compared and contrasted Fidelity with another US-based top-rated broker, check out our Fidelity vs TD Ameritrade review here.

Pros:

- Set a wide range of price and research alerts and push notifications with the desktop, web and mobile trading platforms

- Wide range of order types to choose from including Stop Limit orders and Multi-contingent orders

- Advanced investment research tools including trading ideas and industry analysis

- Free stock and ETF trades

- Low non-trading fees

- Regulated by the US SEC and FINRA

Cons:

- Demo account only accessible on the desktop trading platform

- Above average margin fees

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. TD Ameritrade - best trading platform for social trading with Thinkorswim

Established in 1975, TD Ameritrade is one of the largest US-based trading platforms out there. In terms of regulation, TD Ameritrade is regulated by top-level financial authorities including the SEC, CFTC, and FINRA. Additionally, it is also listed on the Nasdaq stock exchange under the ticker symbol AMTD.

TD Ameritrade users have access to low non-trading fees and an abundance of advanced research and charting tools. From the comfort of your own home, you can trade everything from stocks to options with just a small commission per contract of $0.65. If you are interested in futures contracts and other more advanced assets, TD Ameritrade provides its own desktop trading platform, Thinkorswim.

The Thinkorswim trading platform has more tradable assets on offer compared to its web trading platform including forex and futures, as well as an array of technical research features. There is also a wide range of educational resources for both beginner and advanced traders looking to develop their trading knowledge. These features include a demo account with $100,000 worth of paper funds, educational video content, webinars, and more.

Pros:

- Demo account providing $100,000 worth of virtual money

- Top-rated Thinkorswim trading platform with heaps of research and technical tools

- Free ETF and stock trading

- Low non-trading fees

- SEC, CFTC, MAS, and FINRA-regulated

- All clients are covered by SIPC

- Heaps of tradable assets from cryptos to stocks and a wide variety of account types

Cons:

- Clients can only trade on US markets

- Only available deposit option is via bank transfer

There is no guarantee that you will make money with this provider. Proceed at your own risk..

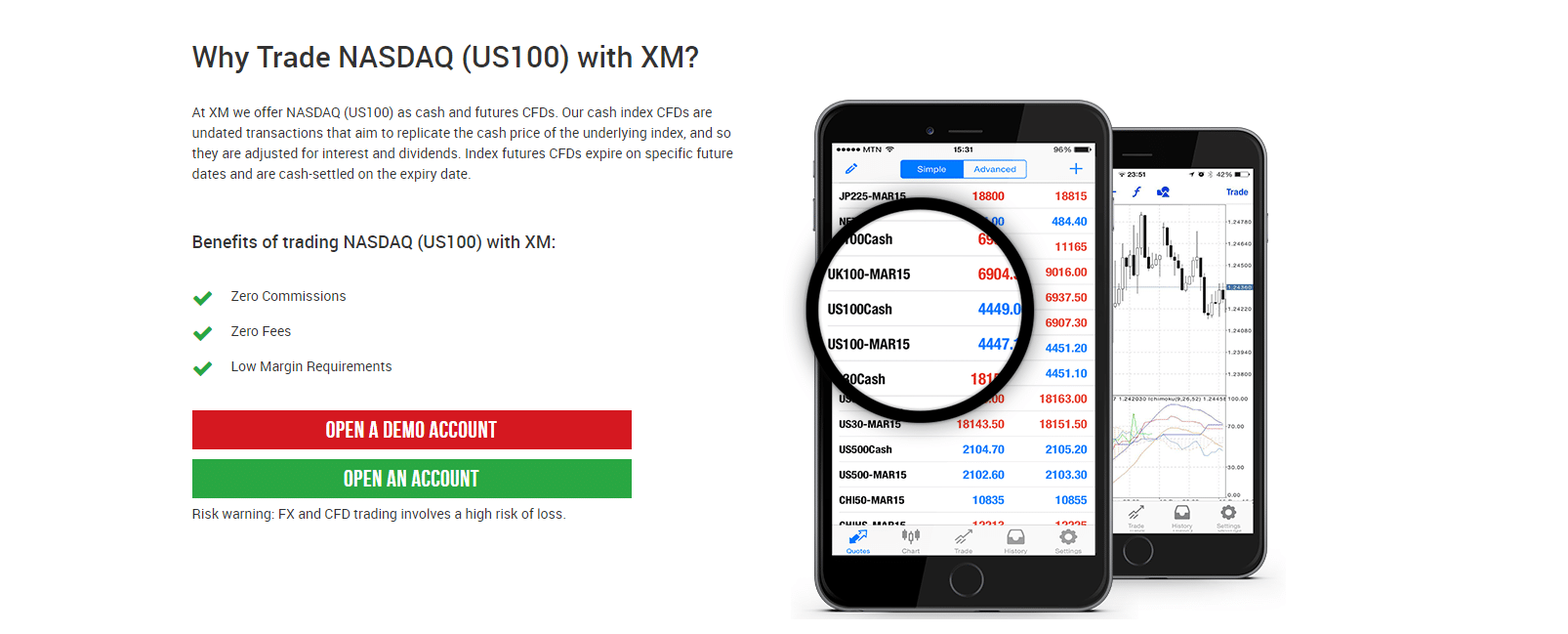

5. XM - best trading platform with low spreads for CFDs

XM is a popular CFD and forex trading platform that offers more than 1,200 stock CFDs, 28 stock index CFDs, forex trading, commodity trading, shares, and stocks. XM offers tight spreads as low as 0 pips on some forex pairs.

CFD trading at XM is 100% commission-free, however, spreads can differ depending on the type of assets you pick. Typically, XM offers very tight spreads that are lower than the industry average. For instance, XM charges a spread of 2 pips for the Nasdaq 100 equity index.

Additionally, XM has low cost account fees. For example, you won’t pay a withdrawal or deposit charge, and there are no account fees. On the flip side, there is a £15 inactivity fee charged after 12 months of inactivity.

In terms of how trading platforms go, XM is unusual in that it does not provide its own in-house developed trading platform. Instead, it provides the popular and top-rated third-party trading platforms - MT4 and MT5. The main difference between the two is that you can only trade stock CFDs with the MetaTrader 5 platform.

Pros:

- Customer support is available through live chat, email and telephone

- Provides MetaTrader 4 and MetaTrader 5 trading platforms

- Commission-free trading with tight spreads for forex and CFDs

- Low non-trading fees

- Offers a demo account and educational resources for beginner traders

- More than 1,200 stock CFDs to choose from

- Great charting tools with more than 30 technical indicators

Cons:

- No fundamental data for assets

- Customer services are not available 24/7

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. CMC Markets - best trading platform with advanced research tools

Established in 1989, CMC Markets is a renowned and globally recognized CFD broker. It is regulated by many top-level financial authorities such as the FCA, ASIC, MAS just to mention a few. As far as transparency is concerned, CMC Markets is listed on the London Stock Exchange under the ticker symbol CMCX.

When it comes to product selection and tradable assets, CMC Markets is mainly a CFD and forex broker and therefore only provides CFD, cryptocurrency, and forex trades. So, if you are a trader with an eye for other asset classes including bonds, real stocks, and futures, this broker is perhaps not for you.

With CMC Markets you have access to 8,000 stock CFDs and 1,000 ETF CFDs. CMC Markets charges a $0.02 commission per share for stock CFD trades. It's a similar story when it comes to non-trading fees as CMC Markets does not charge an account or deposit fee. Users can pick between its in-house developed trading platform Next Generation or the third-party platform MetaTrader 4.

Pros:

- Zero deposit fees

- Payment options include bank transfers, debit or credit cards, and e-wallets

- Low non-trading fees

- $0 minimum deposit

- Choose either Next Generation trading platform or MT4

- Demo trading account offers refundable virtual account balance for practice trades

Cons:

- Leverage levels at CMC Markets cannot be modified

- Account verification process can be slightly complex

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Nasdaq 100 brokers fees comparison

Deposit fee Withdrawal fee Account fee Inactivity fee ETF fee Stock fee Index CFD Min Spread IG $0 $0 No $12 per month after 2 years 0.10% 0% for US shares. Trading spread bets and CFDs 0.10% min commission 1 AvaTrade $0 $0 No $50 per 3 months after 3 months 0.13% for Nasdaq Inc ETF 0.13% for US Tech 100 stocks 1 for US Tech 100 index CFD Fidelity $0 $0 No No 0% 0% $49.95 transaction fee TD Ameritrade $0 $0 No No 0% 0% n/a XM $0 $0 No $15 one-off fee after 1 year then $5 per month n/a $0.04 per share Spreads as low as 2 CMC Markets $0 $0 No £10 per month after 1 year Min spread 1 0.11% $0.02 per unit How to Get Started With a Nasdaq 100 Broker

Now that you have a clear understanding of how to invest in or trade the Nasdaq 100 index and all the key metrics you need to bear in mind, it's time to take you through the starting process with a broker you can trust. We recommend AvaTrade when it comes to trading and investing in the Nasdaq 100 because the platform offers a range of tools for research and analysis.

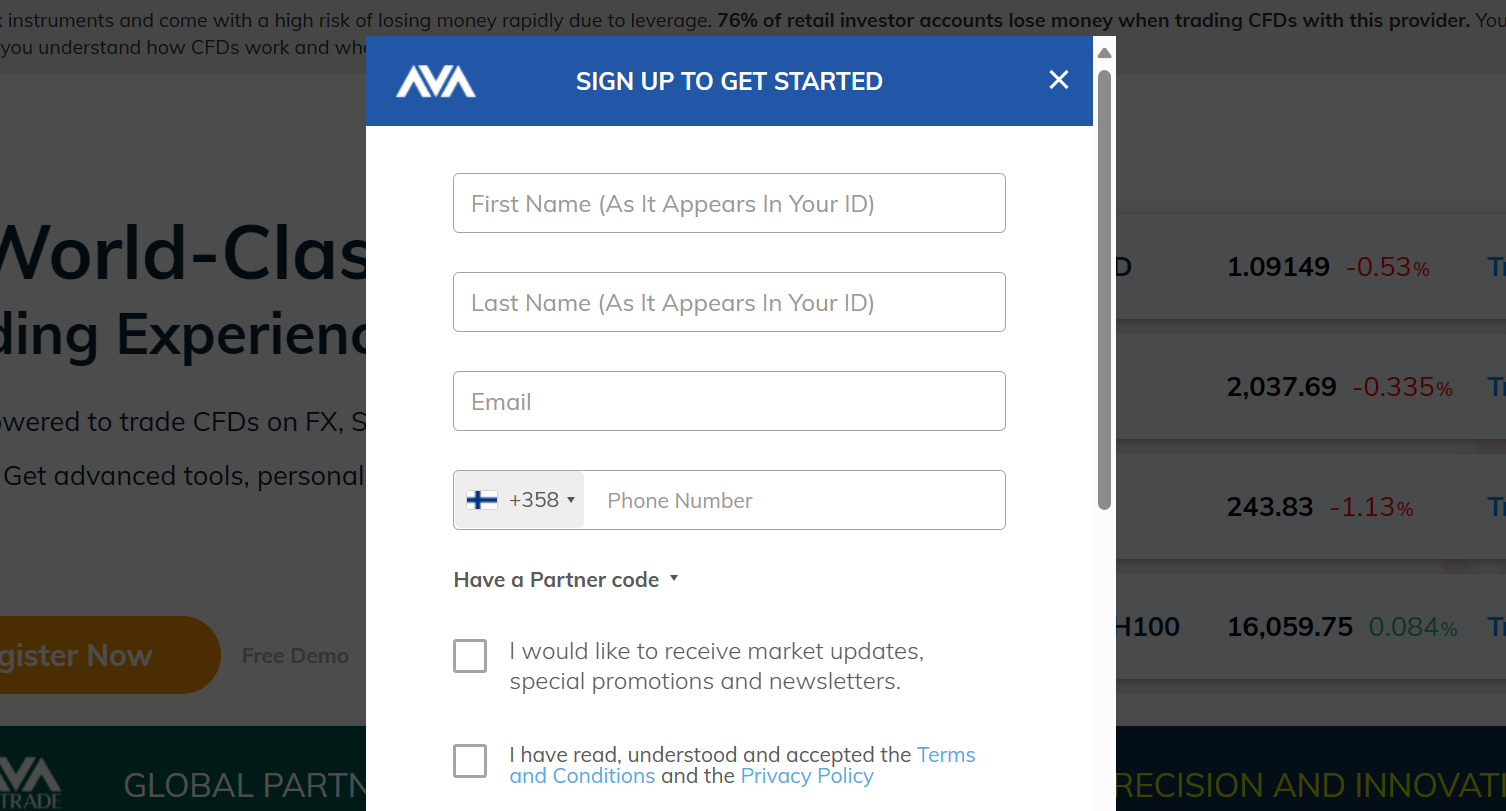

Step 1: Open an account with AvaTrade

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Opening an account with AvaTrade takes just a few minutes. You will need to enter your personal details and provide proof of identity and proof of address. Acceptable forms of ID include birth certificates, passports, bank statements and recent utility bills.

When signing up, use an email address that you have access to. You will need to verify your account by clicking a link in an email that will be sent to your inbox.

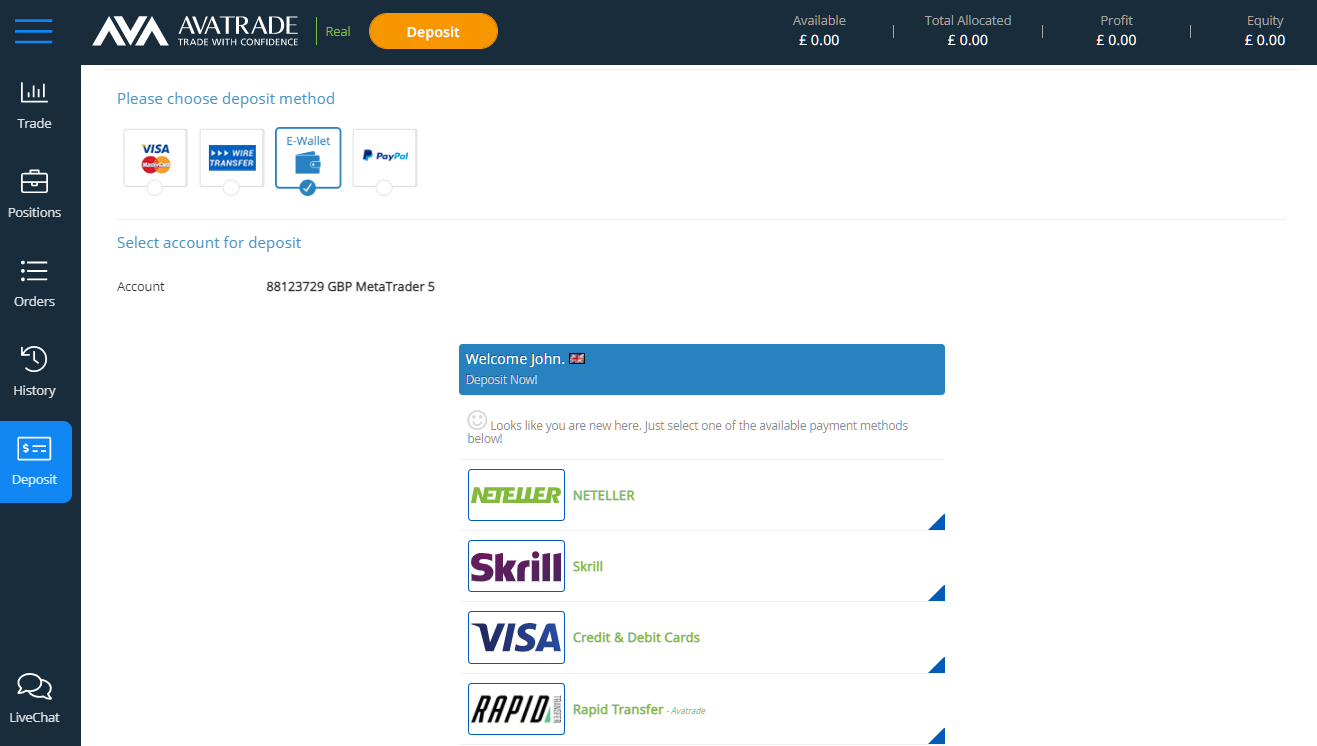

Step 3: Deposit funds

You are just one step away from trading the Nasdaq 100 index, all you need to do is fund your account. AvaTrade supports a range of payment options including e-wallets, bank transfers, and credit or debit cards. Users who deposit with an e-wallet or credit/debit card find their funds in their accounts immediately. On the other hand, if you use a bank transfer the processing time is typically around 3 business days.

Step 4: Search for the Nasdaq 100

The next step is to navigate to the trading dashboard and search for the Nasdaq 100.

You will then be able to see the price chart, conduct analysis and decide whether or not to place a trade. It is a good idea to spend time conducting thorough research. AvaTrade provides users with a good range of tools and indicators that can be used to reach a decision around whether or not to place a trade.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Step 5: Place your trade

After you have funded your account and located the Nasdaq 100 index you want to invest in, simply click the trade button where you will be prompted to specify the investment amount, which is set to a minimum investment of just $100, confirm your choices, and press the open trade button.

Conclusion

Gaining exposure to the popular Nasdaq 100 index can be achieved by either investing in ETFs, stocks, or tracker funds or trading the index with cash indices or index futures. Nevertheless, with so many brokers out there, making the right decision can be difficult.

AvaTrade also offers a paper trading account with an initial $100,000 worth of paper funds so you can experience trading the Nasdaq 100 without the risk of losing your real funds. Furthermore, you can also take a more passive approach to online investing through its automated trading features. Simply put, you can copy the trades of other experienced traders like-for-like..

There is no guarantee that you will make money with this provider. Proceed at your own risk..

FAQs

What is the Nasdaq 100 index?

The Nasdaq 100 or US Tech 100, as it is otherwise known, is an index that tracks the price movements and performance of the 100 biggest non-financial constituents, based on their market capitalization, that make up the index. These include Apple, Google, Intel, Microsoft, and Tesla just to mention a few of the most popular companies.What companies are in the Nasdaq 100?

As the name suggests there are 100 companies that make up the index. Some of the largest companies, in terms of market capitalization, include Amazon.com Inc (AMZN), Alphabet Inc (GOOG), Facebook Inc (FB), Microsoft Corporation (MSFT), NVIDIA Corp (NVDA), Qualcomm, Inc (QCOM), etc.What does the Nasdaq 100 measure?

The Nasdaq 100 index tracks the performance of the 100 largest non-financial companies that make up the index itself. The Nasdaq 100 is a market capitalization-weighted index, which means that the performance of the biggest firms will have a greater impact on the performance and price movements of the index as a whole.How much does it cost to trade on AvaTrade

Opening an account is free with AvaTrade, and there is no monthly account management fee. However, the minimum deposit to start trading is $100.References:

Michael Graw Freelance Writer

View all posts by Michael GrawMichael Graw is a freelance journalist who covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech such as TechRadar and Top10.com. Michael has also written for StockApps, Buyshares and LearnBonds.

Before starting his career as a freelance writer, Michael studied at Cornell University where he obtained a BA in Microbiology. He then went on to recieve a Ph.D in Philosophy from Oregon State University. With 6 years of finance writing under his belt, Michael is an expert in his niche and has built up significant industry knowledge during his time as a writer. Michael writes informative content with the goal of supporting readers to make better financial judgements.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

In terms of how trading platforms go, XM is unusual in that it does not provide its own in-house developed trading platform. Instead, it provides the popular and top-rated third-party trading platforms -

In terms of how trading platforms go, XM is unusual in that it does not provide its own in-house developed trading platform. Instead, it provides the popular and top-rated third-party trading platforms -