Where and How to buy Roblox (RBLX) Stock in 2025

Roblox is a video game developer that has seamlessly navigated technological and generational shifts in the industry. Released in 2006, the firm’s flagship title of the same name still attracts a huge player base today, with more than 30 million daily users.

The firm’s footprint in the video games industry is still growing healthily too. Its user base has more than doubled over the past three years, and the game finally released on Playstation in October.

But this steady growth and intergenerational legacy doesn’t quite reflect in the firm’s stock market performance – share prices remain highly volatile, and hit an all-time-low earlier this year.

In this guide, we will address these factors in determining whether Roblox stock is a smart bet in 2025, in addition to examining where and how to buy Roblox stock.

-

-

How to Buy Roblox (RBLX) Stock – Quick Steps

Step 1: Begin the process by selecting an online broker and initiating the setup of your investment account.

Step 2: Complete the account verification, often requiring the submission of two forms of government ID, as stipulated by many brokers.

Step 3: Deposit funds into your account using a debit or credit card, or through a bank transfer. While some brokers have no minimum deposit requirement, others may set it as low as $10.

Step 4: Locate your chosen stock to access the most recent news and performance data.

Step 5: Execute a purchase order once your account is funded, allowing you to establish an investment position.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

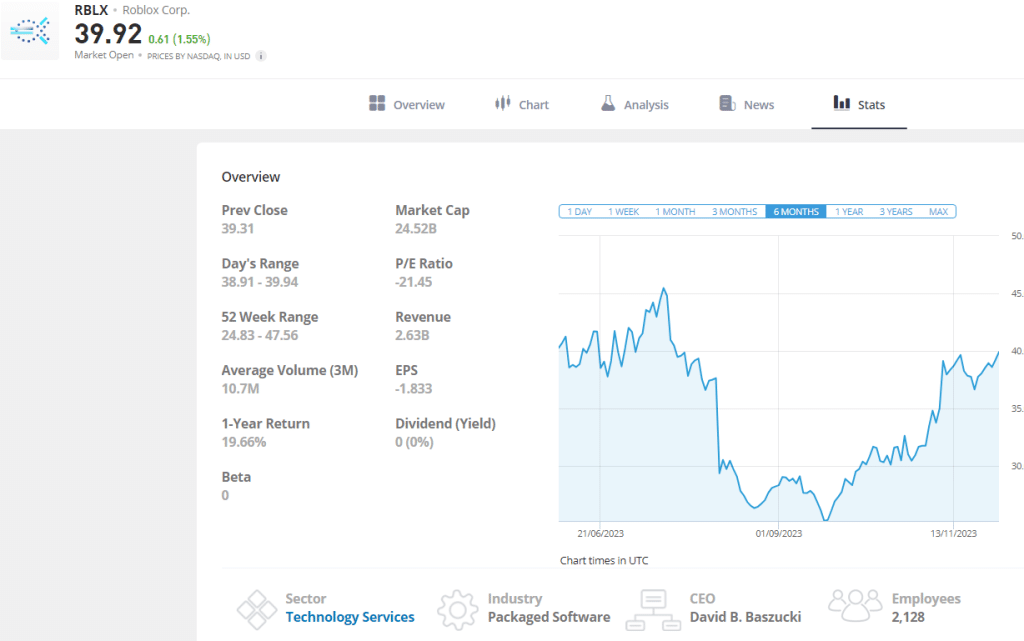

Roblox (RBLX) Stock Data December 2025

What is Roblox (RBLX)?

Roblox is a renowned online gaming platform allowing users to design, create, and play games designed by its own community.

While a niche and somewhat innovate concept at the time of launch in 2006, the platform has now amassed millions of users and become an iconic brand within the gaming world. The game’s emphasis on user-generated content, ranging from adventure to role-playing and obstacle courses, is thought to be the main driving force behind its popularity.

The game also possesses its own virtual currency, Robux, which is thought to add to the immersion of the world. From a business standpoint, Robux also presents a major revenue stream, with players able to purchase the currency using real money.

Overall, Roblox has gained immense popularity, particularly among a younger demographic. Its fostering of creativity and social interaction, and democratization of game development has also earned it significant praise and respect from the wider gaming industry.

Roblox (RBLX) Stock Price 2025

2023 was a year of mixed fortunes for Roblox investors, with share prices consistently swinging between record lows and impressive highs.

Despite opening at close to an all-time low ($27.8) at the beginning of the year, the stock soared in February after the company announced a 17% yearly uptick in income for Q4 2022, in addition to beating earnings–per-share (EPS) and daily user estimates. By mid-February, share prices had risen to $45, a 60% year-to-date increase.

Similarly, following an early May slump, Roblox’s Q1 earnings report showed year-over-year upticks of 22% for average daily users, 23% for engagement hours, and 15% for revenue. This sparked a share price rally lasting more than two months, peaking at around $45 in July.

But September saw the stock hit an all-time-low of $26, as the firm’s Q2 earnings showed a major uptick in net losses.

At the time of writing, Roblox’s share price sits at $40, more than 42% down from the beginning of 2023.

Is Roblox (RBLX) a Good Investment in 2025?

While 2023 was a year of extreme swings for Roblox stock, it could be set to end the year on a high.

Perhaps most importantly, the game has finally launched on the Playstation platform, which boasts by far the biggest player base of any console. Roblox’s player base has already doubled over the last three years, so the move is likely to spell even greater growth potential. In fact, since the announcement of the launch on September 14, Roblox’s stock price has surged more than 42%.

Roblox has also taken significant measures to reduce operating expenditure and increase free cash flow. While development costs saw the firm accumulate nearly $300m in losses in Q3 this year, its free cash flow neared $60m, owing partly to the completion of a new US data center.

The launch of Roblox Connect could also contribute heavily to increased user engagement. The communication feature, launched in November, allows users’ avatars to call one another, using motion capture to replicate body language and facial expressions. It is thought that this will increase user play time, resulting in more purchases of Robux, the game’s virtual currency.

Prospective investors should remain wary of Roblox’s poor operating margin in 2023, with losses doubling to $600m year-over-year. However, with cash flow lookings positive and healthy growth likely to be on the horizon, this should not be too troubling.

Taking these factors into account, Roblox is arguably somewhat undervalued at $40 a share, making it a smart bet in 2025.

Where to Buy Roblox (RBLX) Stock in 2025

To buy Roblox shares in 2025, you will need to find an online brokerage that supports US investors. Luckily, there are plenty of options to choose from.

In the following section, we take a look at four reputable brokers that suit different investing strategies to help you find the best online broker for your needs.

1. eToro -Our recommended platform to buy Roblox shares

eToro is a leading online brokerage that supports over 3000 different stocks, including RBLX.

The platform is one of the best options for buying Roblox shares because it charges no account management fees and 0% commissions for US stocks. Furthermore, the platform can be used on both desktop and mobile which makes it suitable for all types of investors.

eToro offers fractional investing in RBLX from $10 per trade, as well as Roblox ETFs and smart portfolios. The latter options allow investors to build a diverse portfolio of stocks in the gaming or tech sector.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Robinhood – The best mobile app to invest in RBLX

Robinhood is a reputable mobile investment app that can be used to build a portfolio of US stocks and shares. The platform is known for its user-friendly interface, low fees, and excellent educational resources.

Furthermore, it is possible to invest in RBLX from just $1 through the platform, making it an attractive option to new investors who want to start with a small amount of capital.

As well as traditional stocks, Robinhood also offers options trading. This is suitable for experienced traders who prefer an active trading strategy. Options trading allows users to speculate on the future price of RBLX and take advantage of smaller price movements.

3. Charles Schwab – The best platform for educational tools and analysis

Charles Schwab is a well-known US investment platform that specializes in helping customers to build long-term investment portfolios.

The broker offers a range of investment products including traditional investment accounts, retirement accounts, and ready-made portfolios.

Additionally, Charles Schwab provides all customers with 1-to-1 support, free of charge. This means that you can seek the advice of a professional before buying any RBLX shares.

Investors can also access a range of educational resources to improve their market knowledge and investing skills. This makes the broker stand out as a viable option for beginners.

4. Webull – The best RBLX trading platform for active traders

For traders that prefer an active trading strategy, Webull might be a good option to consider. The trading app provides access to a range of charting tools that can be used to execute advanced trading strategies and conduct technical analysis.

This includes access to the Meta Trader 4 charting tool which is one of the best trading platforms for day trading and automated trading.

Webull provides an easy-to-use mobile app that supports trading on the go. This is appealing to day traders who often manage their positions around the clock to make sure that they don’t get caught out by sudden price swings.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Our Verdict on Roblox (RBLX) Stock in 2025

As with any investment, the decision to buy Roblox stock requires a careful evaluation of a number of factors, taking both past performance and future prospects into account.

Critically, Roblox has established itself as pioneer of user-generated content in the gaming industry, earning a massive player base and continuing to expand its global influence. The firm has also displayed respectable financial growth, with its share price hitting impressive highs following some strong financial quarters in recent.

However, Roblox’s stock market journey has been punctuated by significant volatility. Share prices, while seeing both highs and lows throughout 2023, currently stand at $40, a sizeable decline from the beginning of the year. In addition to these factors, investors must bare in mind the dynamic nature of the gaming industry, where user engagement and monetization strategies play pivotal roles.

But on the whole, given Roblox’s proven staying power within the gaming industry, combined with its fresh expansion into the Playstation player base, the stock is likely to be a safe bet in 2025.

Roblox (RBLX) Stock FAQs

How much does a share of Roblox cost?

At the time of writing, Roblox is priced at $40.45 per share on the NASDAQ exchange.

Why is Roblox stock so low?

Roblox has stock has seen intense volatility in 2023. The firm’s operating loss figures have played a major role in this, in addition to pressures in the wider economy.

Does Roblox pay a dividend?

Roblox does not currently pay a dividend, and has said that it does not anticipate doing so for the foreseeable future.

Is Roblox stock safe?

Roblox’s share price has been volatile in recent years, but given the firm’s impressive user base and growth, and its inherent capacity to integrate AI technology into its operations, the stock is likely to be a good bet in 2024.

References:

- https://www.nasdaq.com/articles/roblox-stock-are-the-trick-or-treaters-finally-spending-again

- https://www.roblox.com/games/15308ro759682/Roblox-Connect

- https://blog.playstation.com/2023/09/14/roblox-coming-to-playstation-on-october-10/#

- https://www.demandsage.com/how-many-people-play-roblox/#:~:text=It%20got%20out%20to%20a,214%20million%20monthly%20active%20users

- https://www.alphaquery.com/stock/RBLX/fundamentals/quarterly/operating-expenses

Sam Alberti

View all posts by Sam AlbertiSam Alberti has recently joined Trading Platforms as a content editor, having spent the past four years working as a journalist across various financial and business niches. He graduated from the University of Kingston in 2019 with a Master’s Degree in Journalism and an NCTJ Diploma, and has since developed a passion for both consumer and corporate finance. He now specializes in producing engaging and thoroughly-researched web content on all things finance.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up