Sterling Trader Platform Review – Pros & Cons

This particular software, Sterling Trader Pro, was developed by Sterling Trading Tech (not a broker, but a company that develops trading software) and is one of the two most popular direct access trading platforms for stocks trading. In addition to its use by many individual day traders and proprietary trading firms, it is widely used by institutional traders and brokerage firms.

This Sterling Trader review aims to give you an objective overview of the key features of Sterling Trader Pro.

What is Sterling Trader platform?

The Sterling Trading Tech company is a software company that offers a wide range of trading platforms to institutions and individual traders. Sterling’s tools are quite advanced with several helpful features, so if you’re a sophisticated trader, you’ll want to read more on this.

Unlike most brokers, Sterling Trading Tech is not a broker. Instead, it is a software company that sells its trading software to brokers, giving it to their clients. Therefore, you have to go through a broker that works with it to use its software. I will talk more about them later.

The Sterling software can be used for a variety of different purposes. For example, the company offers tools for order entry, and it also offers tools for risk management, trade reporting, calculating margin requirements, and more.

A popular program that the company offers is Sterling Trader Pro. The program is an advanced desktop program that provides many of the day and swing traders’ features.

The platform is a white-label program. As a result, Sterling will sell a license to a broker that will brand the program as their own. That is a practice that is common in the industry.

The Sterling platform is also available on the web and mobile devices. Additionally, Sterling can help you with risk analysis if that’s something you’re interested in.

The Sterling platform is designed with a simple interface and the bare essentials to make it easy to use.

Sterling has a complete trading software suite available to professionals, hedge funds, and other institutional investors. As well as this, there are many helpful resources offered in this section that can be used by institutions of all types, from API solutions to software that can be used for compliance.

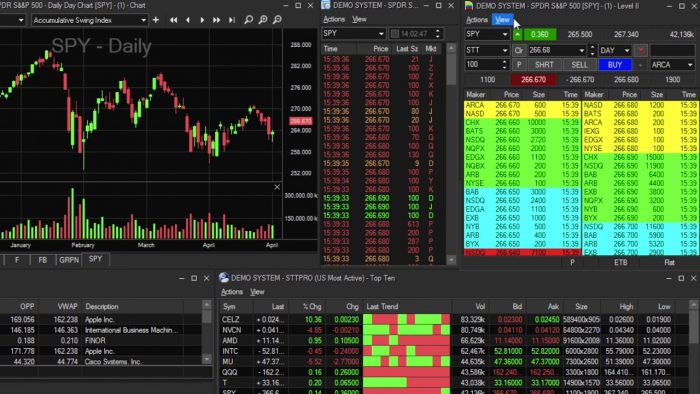

Sterling Trader Pro is the crown jewel of the company. It provides users with advanced stock, futures, and options trading tools in a desktop package. A few of the highlights of the program are as follows:

- Quotes at Level II

- Basket trading

- Professional-level charting

- Foreign exchange access

- Research tools

- Types of advanced orders

- Lists of watch lists

- Strategies for multi-leg options

- Greek values

- All CME futures contracts

- All Bovespa futures contracts

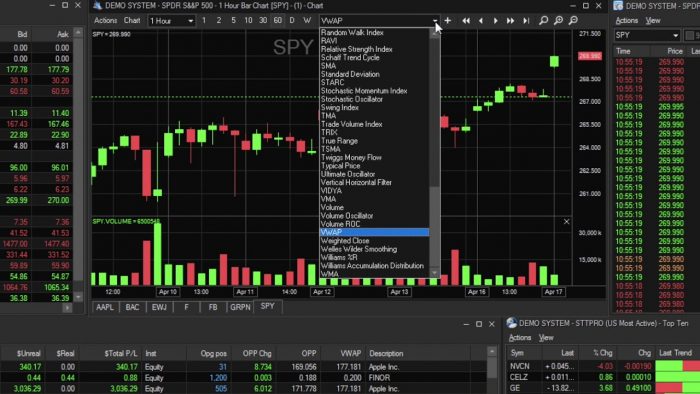

The Charting on Pro package includes a lot of advanced functionality. Over 70 technical studies were found during the investigation. Here are some examples:

- Money Flow Index

- Elder Thermometer

- Random Walk Index

The chart window can be detached and expanded in full screen. In addition, with the help of tabs at the bottom of the charting window, it is possible to chart multiple stocks simultaneously with multiple windows.

The software’s order ticket allows direct access to the routing process. For example, you can submit a short sell order by clicking on a discrete short button. When you click on this button, level II data appears at the bottom of the order window.

It is possible to save custom layouts. As you can see, the default layout does not have any links between the windows, and I found this setup to be a slight nuisance. However, it is possible to link them together.

It is somewhat odd that the main menu is located in the bottom-right corner of the platform’s layout. Additionally, in the default layout, the menu window is not completely expanded when opened. Therefore, to find all the menu icons, you’ll want to grab the right side and pull the window out so you can see all the icons. Among them are:

- Option chains

- Options order entry

- Seeking Alpha

- Charting

- Level II order entry

- RSS feeds

The platform is also available in an Elite version for institutions. This version provides a few additional services not offered by the regular platform. A few examples of these are algorithmic trading and access to a few foreign stock markets, including Toronto and Shanghai.

Sterling Trader platform pros & cons

Pros:

- Trading equities, single and multi-leg options, and futures on a single platform

- Highly configurable charting package with more than 60 studies and indicators

- High performance, real-time access to Level I and Level II market data

- Broker and clearing firm neutral with a deep network

- Hotkeys and hot buttons which can be fully customized and configured

- Portfolio management - live P&L in real-time

- Over 60 ticker watchlists are available

- Basket trading

- functionality that includes API, DDE, and RTD

- functionality that includes imbalance monitoring and imbalance alerting

- Ability to customize the screen for stocks and options

Cons:

- For new or low-volume traders, monthly software and data feeds can be burdensome.

- Lackluster charting

- Limited scanner

- No native Mac version, only for Windows

What can you invest in and trade on Sterling Trader platform?

Invest in equities

With Sterling Trader Platform, you will be able to:

- Provide equity trading services to all major US exchanges and brokerage firms

- Market access to the largest American, Canadian, Brazilian, European, Hong Kong, and Shanghai markets on a worldwide basis

- Real-time level 2 market data

- Configurable charts with over 60 options

- Hot keys and hot buttons that can be customized

- Alerts and imbalances on exchanges

- Advanced real-time scanning tools

- Basket trading

- Portfolio and position management

- Server-side stop orders and native stop orders

- Support for ActiveX APIs as well as FIX APIs

- Custom alerts for trading

- Basic access to Business Wire news and Seeking Alpha

- Market data watch lists

- DDE and RTD capability

Trade futures

As a result of the Futures Order Entry functionality in Sterling Trader Pro, Sterling Trader Pro offers traders a one-stop-shop for their futures trading needs. Trading all futures products from CME and BOVESPA can be completed quickly with hotkeys, allowing you to enter orders quickly and easily.

- All CME futures products are supported.

- You can also trade futures products from Bovespa (Brazil).

- Futures products are displayed on the screen

- Market depth, order entry, and position detail in one window

- Including Profit/loss totals and averaging

Invest in options

Having the powerful options trading tools needed by professional options traders, Sterling Trader Pro includes both single-leg order functionality and complex order functionality.

Options chain

- The strike price of each call or put for a particular underlying symbol can be viewed.

- Quickly identify in-the-money options to make quick decisions.

- Calculate volatility and greeks.

Options order entry

- A level 2 style window displaying the current bid and offer on each exchange

- Displays the stock's current statistics at the same time

- Link to options chain for quicker order entry

Complex options order entry

- There are 11 pre-configured options spreads (including Butterfly, Calendar, etc.

- Covered Calls, Iron Condors, Straddles).

- Fully customizable spread order entry

Sterling Trader platform fees & commissions

Sterling Trader Pro is an application offered by most direct access brokers at a price. It is estimated that the monthly platform fee can vary between $100 and $300, depending on the broker. There are, however, many brokers that will waive this platform fee for you if you trade more than 300,000 shares per month with them.

Data fees (monthly)

Besides the platform fee, you also have to pay data fees (like Level II data) when you use the platform. There is no need for you to pay for Level II data if you already have it from other sources and only intend to use Sterling Trader Pro to execute your trades, in which case all you need is the Level I data (much cheaper than Level II)

- Fees and rebates are passed through from the exchange, and there is no markup or markdown on the fees and rebates.

- Depending on the venue, there are typically fees of up to $.0030 per share to remove liquidity.

- Depending on the venue, rebates are available for adding liquidity up to $.0020 per share.

- Some venues route out for a fee ranging from $.0035 per share to $.0050 per share.

The fee structure of some trading venues can be inverted, meaning that they rebate when liquidity is removed and charge when liquidity is added. Certain order types may be subject to a special fee schedule, restrictions such as non-display, or may be subject to a special fee schedule based on the price of the securities. For example, securities priced below $1 will typically be subject to a higher fee schedule. In addition, certain venues, typically Dark Pools, charge trade reporting fees that are passed through to the customer, along with some venues that charge fees for odd-lot executions.

Trading activity fee

Each member shall pay FINRA's Trading Activity Fee (TAF) to FINRA at the following rate: $0.000119 per share, with a maximum charge of $5.95 per trade, for each covered equity security that is sold. In addition, there is a fee of $0.002 per contract for the sale of an option. For each round turn transaction of a security future, a fee of $0.00008 will be assessed, provided that there is a minimum charge of $0.01 per round turn transaction; Additionally, if the execution price for covered security is less than the Trading Activity Fee rate ($0.000119 for covered equity securities, $0.002 for covered option contracts, or $0.01 for a security future) on a per share, per contract, or round turn transaction basis, then there will be no fee assessed.

Depending on your needs, you may be interested in:

| Sterling Package Selection & Pricing | Non-Pro | Pro |

| Sterling Trader Pro | $265 | $265 |

| Market Data Included:

NYSE Level 1 (Consolidated Tape A) NYSE MKT Level 1 (Consolidated Tape B - ARCA / AMEX) Nasdaq Level 1 and Level 2 OPRA |

$30 | $155 |

Sterling Trader platform user experience

There are several reasons why Sterling Trader Pro is designed to be a robust execution platform for VERY active day traders (and institutions), those who trade several hundred thousand shares per month. Also, it is designed PRIMARILY for those who trade stocks. Sterling Trader Pro and DAS Trader are two of the most popular trading platforms direct access brokers use.

Sterling Trader Pro is an unnecessary overkill if your trading style is mainly swing trading and you aren't into short-term trading.

Sterling Trader platform features, charting, and analysis

1. Layouts and linked floating windows

Sterling Trader Pro provides a wide variety of layouts customized based on the trader's needs. In addition, the floating windows feature allows you to create almost any layout you can imagine with just one click of your mouse.

You can also link together multiple windows with just this feature. The other windows linked to the ticker will automatically sync up when you change the ticker symbol in one window. That means that the ticker symbol will be displayed across the whole page.

It is a downside to the flexibility of the layout that it may take some time for you to go through all the settings and sub-settings to decide exactly what you want.

When you are using multiple monitors to trade, there is no reason why you cannot arrange other windows, such as Trade Monitor, Trade Summary, Position Summary, etc., on a second monitor if you are using more than one screen.

2. Execution (direct access order routing)

That is where Sterling Trader Pro shines.

In order to execute your trades on any of these ECNs or exchanges, you can choose from a variety of options. As a consequence, you have the option to change the routing on the fly depending on the ticker you are trading or the type of order (market orders, limit orders, stop orders, etc.).

Some highlights:

- Standalone Level II (color-coded) windows integrated with order entry.

- In order to execute trades on multiple tickers at the same time, you can enter orders and execute trades on the same ticker. When you enter an order for one ticker, it doesn't interfere with any other tickers you watch or trade.

- The use of multiple tickers at the same time throughout the day is essential for active traders who watch and trade multiple tickers at the same time.

- Quick modification of open orders. That is unique to Sterling Trader Pro.

To change the size and price of an open order, one can right-click on it and do so on the fly without having to cancel the current order and replace it with a new one. Many traders find this function to be very useful.

Hotkeys: Sterling Trader Pro offers the most comprehensive set of hotkeys in the market. You can program pretty much any hotkey you need with Sterling Trader Pro, and it is a fairly straightforward process.

APIs are available for more advanced traders to integrate with third-party or custom applications.

3. Charting

Despite Sterling Trader Pro's ability to chart, its capabilities are limited, which is unfortunate. This software does come with plenty of commonly used technical indicators, studies, and drawing tools, but it lacks the ease of use, flexibility, and depth expected from software of this type.

The charts are nothing compared to what other charting software such as Thinkorswim, TC2000, or eSignal can offer.

However, that is not a surprise. Sterling Trader Pro is designed not for charting but strong execution. The majority of traders use Sterling Trader Pro primarily for trading. Other providers provide charting services, which some traders use as well. Among the most popular programs are Thinkorswim (100% free), TC2000 (paid), and eSignal (paid).

Sterling Trader Pro charts can be configured to display your executed trades on them. That would be useful for you to review your trades and improve how you enter and exit your trades. However, there is no charting function for options in Sterling Trader Pro.

4. Option chains and order entry window

The Sterling Trader Pro is capable of trading both directional options and some complex options spreads.

5. Active trading with Lightspeed

At Lightspeed, they provide professional traders with all the tools they need to succeed in stock trading. Their active trader platform is being continuously developed and improved to provide an optimal user experience for the active trader. In addition to their intuitive interface layouts and institutional quality stock and options scanners, they aim to help traders achieve their goals, regardless of their trading strategy. In addition to that, they offer some of the lowest trading fees in the industry.

Sterling Trader platform account types

Sterling Trader Pro is a full-featured Level II direct access trading platform for professionals that deal with the increasingly fast moving electronic markets. It provides advanced pinpoint accuracy for order routing and management and real-time profit/loss capabilities that make it particularly suitable for managing groups of traders.

- Key Sterling Trader Pro Features:

- Direct access to all exchanges and ECNs

- Charting package with advanced features

- Level II order entry system with advanced features that can be customized

- with programmable keys and instantaneous order entry features

- Customized and linked windows

- providing real-time profitability information

- Intelligent routing and management of orders with advanced pinpoint accuracy

- Integrates easily with the internal network using Microsoft Windows and Intel technology

- Provides full control over system components for the fastest access to markets and exchanges

- APIs are available for connecting with external applications

- 230 USD monthly platform fee

There is no charge for demo versions of Sterling Trading Tech's trading platforms, including Sterling Trader Pro, for 2 weeks. The process for accessing their platform is to fill out a form to try a FREE demo of their Sterling Trader Pro platform. Get full production platform functionality and tools using delayed data.

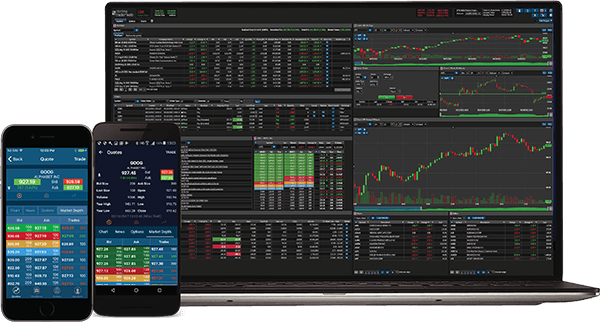

Sterling Trader platform mobile app review

You can use the mobile app or browser platform if you do not need the complexity of the desktop system. You will take advantage of some of the tools that the day traders will appreciate. For example, the order ticket allows you to trade on several markets.

There are a number of different graph styles available, for instance, a table graph. In addition to a watchlist, the Level II quotes will also be color-coded. Additionally, this platform gives its users the ability to trade options through it as well.

This company's mobile app provides a range of features not available in other apps. They include option chains as well as Level II quotes. Additionally, there is a chart and 30 technical studies that will be available. The watchlist will appear on the left side, and news articles will also have their section.

Sterling Trader platform deposit and withdrawal methods

Since Sterling Trading Tech is not a brokerage firm, it does not offer brokerage services. Instead, it is a software company that sells its trading tools to brokers, who sell them to their customers. As a result, they do not have any deposit or withdrawal methods.

Sterling does not allow you to trade through it. In order to do this, you would need to open an account with a brokerage firm that has an established business relationship with Sterling. Then you would be able to access Sterling's software.

There may be differences in prices and actual tools between brokers. Below are some examples of brokerage houses that offer Sterling Trader Pro:

- Lightspeed

- Interactive Brokers

- Capital Markets Elite Group (offshore broker)

- Cobra Trading

- Lime Execution

- Score Priority

Each of them manages their deposit and withdrawal methods.

Sterling Trader platform contact and customer service

Even though The brokers themselves mainly handle sterling's tools, a few resources are available on the company's website. Sterling offers extensive user guides for each of its products on its website. In addition, the keyword search tool allows users to find topics easily.

Sterling also publishes release notes as part of its software upgrade process on its site. In addition, the company's newsletter Sterling Squawk can be found on its website every month.

In addition, Sterling has an extensive YouTube channel. Videos explain how the company's services work.

Is Sterling Trader platform broker safe?

Sterling offers access to the North American, European, and Brazilian markets. With Sterling, you can trade stocks, options, and futures using advanced features found in our award-winning professional trading platforms, including baskets, algorithms, complex options, an order-staging desk, and ActiveX API. Sterling is connected to hundreds of destinations worldwide, including dark pools, proprietary broker routes, smart routes, ECNs, and exchanges - you can also create your custom routing. In addition, the sterling Trader Manager enables you to monitor your risk levels easily.

Trading and risk management are equally important as compliance with regulatory legislation. There is a solution from Sterling that allows you to manage your start-of-day files and your easy-to-borrow lists. In addition, Sterling offers you a full package of reporting tools that can be easily integrated into your end-of-day trade processing, including FIX drops and OATS reports. Furthermore, Sterling can also create custom trade reports for your firm or route orders through the Sterling Aggregator to ensure that current trade regulations are met, in addition to generating custom trade reports for your firm.

How to start trading with Sterling Trader platform

With Sterling Trader Pro, you can now integrate your existing Interactive Brokers account with Sterling Trader Pro. That includes Lightspeed, Interactive Brokers, Capital Markets Elite Group (offshore broker), Cobra Trading, Lime Execution, or Score Priority. Therefore, in order to access the tools that the platform offers, you will need to have a verified account with one of those brokers.

Sterling Trader platform review - conclusion

There is a lot of advanced software offered by Sterling Trading Tech at the present time, and swing traders should take note of this. However, the lack of brokerage services directly through Sterling and the rather steep prices seem to be the primary downsides. That's why we highly recommend eToro. Americans can now use the eToro platform to safely and legally buy cryptocurrencies (but not to trade CFDs). eToro accounts usually open in under 10 minutes since the provider can verify your ID automatically. Debit/credit cards, bank transfers, e-wallets are all acceptable ways to fund your account. In addition, at eToro, you can buy Bitcoin with PayPal. With all this, eToro is the best crypto exchange in Australia for you.

eToro - Alternative to Sterling Trader platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.