Best OTC Brokers & Trading Platforms of July 2025

Trading technology, and the financial markets, have evolved a long way since the days of the outcry trading system. With new technology and OTC trading, most traders have begun to move away from traditional exchange-traded products and are now demanding more specific, tailored products. For this, you will need to use an OTC trading platform.

As with other trading strategies, one of the key factors that influence your degree of success as an OTC trader is the platform you choose. In this guide, we analyze the different top OTC brokers and identify the characteristics that you must consider in order to choose the right broker for your needs.

-

-

3 Best OTC Trading Platforms in 2025

There are several brokers that provide the option to trade over the counter. However, each of these brokers is suitable for a different type of trader and have their own pros and cons. Here is a list of the top OTC brokers, followed by a review of each of them:

- TD Ameritrade: Access a market-leading crypto OTC platform to trade cryptocurrencies without a crypto wallet. TD Ameritrade has a strong reputation and offers award-winning educational resources to traders. The platform itself provides advanced features for research and analysis making it a suitable option for experienced traders.

- Avatrade: AvaTrade is suitable for more experienced traders who would like to use advanced tools to conduct technical analysis. The platforms supports OTC forex trading as well as stocks and some cryptocurrencies. AvaTrade also provides automated trading tools via MT4, which is a widely used charting tool.

- Pepperstone: Pepperstone is a popular online broker that supports over 800 instruments across various platforms including MT4, MT5, cTrader and others. Pepperstone caters to scalp traders with the Razor trading account and provides low spreads on most assets.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

What is OTC (Over-The-Counter)?

Over-the-counter (OTC) refers to the process of trading assets directly between a broker-dealer network, instead of through a centralized exchange. Brokers can set the price and which they will buy and sell an asset and trades can be executed without other participants knowing the price at which the transaction was complete.

Over-the-counter trading can involve equities, debt instruments, and derivatives. There are two types of OTC products: those that cannot be traded on the exchange because they are highly tailored to meet the specifications of their traders or those that are not listed because they do not meet the requirements to be listed on a stock exchange. Examples of the former include highly complex and structured derivatives, while the latter would include small-cap companies that cannot get their stocks listed on the market.

OTC markets are less regulated than traditional exchanges and liquidity can be poor. This makes OTC trading more risky than traditional trading strategies.

What are over the counter stocks?

OTC stocks are stocks that are not listed on a stock exchange. such as the NASDAQ. Instead, these stocks are held by market makers who facilitate the buying and selling of the assets. OTC stocks are usually tied to small companies that cannot get listed onto an exchange. Some stocks are also for companies that were listed years ago but got delisted from the exchange.

OTC stocks are sometimes referred to as penny stocks because they trade for less than $1 and the companies that sell then often have low market capitalization.

How does OTC trading work?

Over the counter markets do not have a physical location however, they can be accessed through an online broker. Traders will need to create an account with a broker that supports OTC instruments.

Once you have decided on a stock to trade, the broker will place the order with the market maker on your behalf. This process shares similarities with traditional stock trading. You can place a buy or sell order and set price limits.

To facilitate OTC trading, a broker must have access to an electronic matching platform such as the Pink Open Market, also known as “pink sheets”. Other platforms include OTC Markets Groups, OTCQX and OTCQB.

What are the risks of OTC trading?

Over-the-counter (OTC) trading can be risky for investors who are not familiar with the market. Since OTC trading is not regulated by centralized exchanges, it can be difficult to determine the fair value of a security, and investors may be vulnerable to fraudulent activity.

Additionally, the lack of transparency in OTC trading can make it easier for insider trading and market manipulation to occur. OTC securities also tend to be less liquid than those traded on exchanges, meaning that it may be more difficult to sell a security at a fair price. Therefore, investors should exercise caution and thoroughly research any OTC securities they are considering investing in, and consider working with a financial advisor who is experienced in OTC trading.

What are the advantages of OTC trading?

One advantage of OTC trading is that it provides investors with access to a wider range of securities than those available on centralized exchanges. OTC markets can include stocks, bonds, and derivatives that are not listed on major exchanges, allowing investors to find opportunities that may not be available through traditional channels.

Additionally, OTC trading is often less expensive than trading on centralized exchanges, since there are typically fewer intermediaries involved in the transaction. The flexibility of OTC trading also allows for customized transactions that can be tailored to meet specific investor needs.

Furthermore, OTC markets can provide greater privacy and anonymity for investors who may prefer to keep their transactions confidential.

Best OTC Brokers Reviewed and Rated

After extensive research on all the OTC trading platforms available to traders and investors, we have come up with the top 3 platforms that you can use. Each of these platforms has been discussed below in detail.

1. TD Ameritrade – Crypto OTC trading platform that does not require a DeFi wallet

TD Ameritrade is a reputable brokerage firm that is known for providing a top stock exchange. The platform also offers OTC crypto trading on 7 tokens including GBTC, ETHE, BITW, BCHG, GDLC, LTCN and OBTC.

It is important to note that TD Ameritrade has recently be acquired by Charles Schwab. It is still possible to access the OTC crypto trading feature however, traders with need to open an account with Charles Schwab to be able to place trades.

The integration of the two brokers means that TD Ameritrade customers can now access the advanced ThinkorSwim trading platform which supports a variety of advanced trading strategies. ThinkorSwim is a customizable charting tool through which users can test their strategies and place complex trades. Having access to a platform such as this is important for OTC trading which can be volatile.

Regarding fees, TD Ameritrade charges a $6.95 commission for over-the-counter trades. Traders should be aware of this charge before placing any trades and ensure that their accounts are funded sufficiently.

Even though it is only possible to trade crypto OTC on TD Ameritrade, the platform supports a range of alternative assets that can be traded during market hours. These include stocks, ETFs, forex, options and indices.

Pros:

- TD Ameritrade offers industry-leading educational resources to help new users to understand online trading.

- Traders can implement advanced trading strategies through the ThinkorSwim platform.

- TD Ameritrade and Charles Schwab both have robust reputations within the financial space.

- Demo accounts are available for users to practice their trading strategies without putting any money at risk

Cons:

- A commissions of $6.95 is charged for each OTC trade which is fairly high.

- The platform only supports crypto OTC trading.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

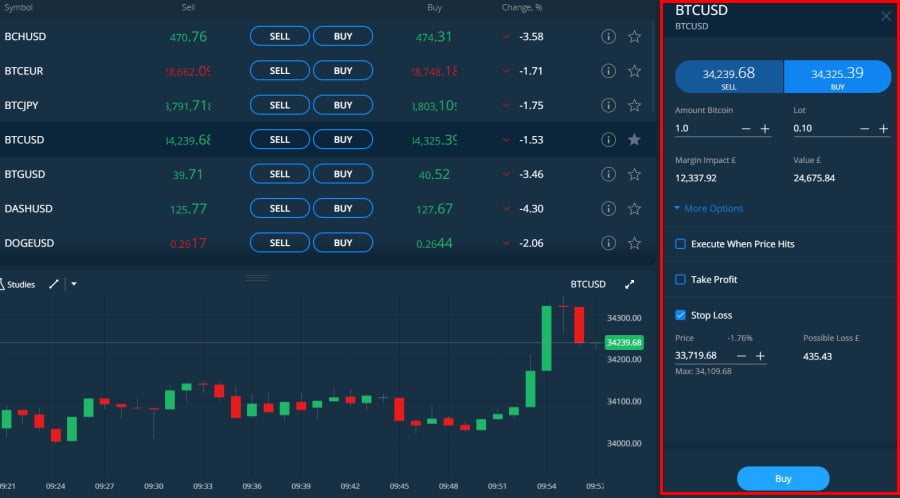

2. Avatrade - Trade OTC stocks and other financial derivatives using advanced tools

If you’re an experienced trader who is looking for advanced trading tools, high leverage trading, and access to a variety of financial assets, then Avatrade is the right choice for you. Not only does Avatrade support MT4 and MT5 trading platforms, but it is also among the best OTC trading brokers. It supports a variety of automated trading tools such as DupliTrade, AvaSocial, and ZuluTrade.

However, perhaps the biggest USP of Avatrade is that it offers extremely high leverages for most trades. For example, on most currency pairs, it offers a leverage of 400x, making it extremely popular for experienced traders who are comfortable with the risk. At the same time, Avatrade also has very tight spreads (0.9 pips for the EUR/USD pair and 1.6 pips for the GBP/USD pair) which are fixed throughout the day. It offers the opportunity to trade CFDs, thus allowing you to trade on vanilla options with low fees on high leverage.

Pros:

- Supports a good range of third-party charting tools to facilitate advanced trading strategies.

- Supports FX vanilla options and has a professional desktop platform.

- Trades can access OTC stocks and forex instruments.

- Avatrade offers leverage of up to 400x on some financial instruments.

Cons:

- AvaTrade supports limited base currencies.

- Not available to US clients.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

3. Pepperstone - OTC broker that supports automated trading for forex, stocks, cryptos and more

Pepperstone is another very popular OTC broker that has over 500,000 users worldwide. It is a no-dealing desk broker and offers both ECN and STP accounts by providing access to some of the top liquidity providers in the industry, such as banks

It provides access to over 800 instruments and forex pairs through a range of advanced trading platforms. When you choose to set up an account with Pepperstone, you have the option to choose which platform you wish to trade through, based on your level of experience and trading requirements. This includes the MT4 and MT5 platforms alongside other niche platforms and trading tools such as cTrader, MyFXBook, MirrorTrader, and RoboX.

They offer two types of accounts, the Razor and the Standard accounts. The Razor, as the name suggests, is an ideal trading account for those looking to scalp trade, whereas the Standard is much more suitable for all other trading requirements. All in all, Pepperstone is definitely known for having one of the lowest spreads and fees in the market, being as low as 0.1 pips sometimes for major currency pairs like the EUR/USD.

For OTC trading, a commission of $6 is charged per round lot.

Pros:

- More than 800 instruments available to trade across a variety of markets.

- OTC trading can be accessed through MT4 or MT5 which both offer advanced tools.

- Pepperstone offers competitive spreads on all instruments.

- The platform offers 28 different plugins for algorithmic trading.

Cons:

- A commissions of $6 is charged per round lot for OTC trades.

- Pepperstone is catered towards experienced traders and does not offer many resources for beginners.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

What To Look for in an OTC Broker

When it comes to finding a good OTC broker, traders have a number of options to choose from.

First and foremost, it is important to make sure that the broker actually supports OTC trading. Not all brokers will have access to an electronic matching system so will not all be able to facilitate OTC.

The best way to find out whether or not a broker offers OTC trading is to carefully read through the website and FAQ section. Look for brokers that mention OTC trades or access to Pink sheets.

Once you have found a platform that supports OTC trading, there are a number of other features that you should consider before creating an account.

✔️ Regulation and Safety

It is important for you to select a broker that is regulated for a variety of reasons. The first and primary reason is that regulated brokers are inspected and monitored to ensure that they do not manipulate or exploit customers.

This is particularly important when it comes to market-making brokers since they have a conflict of interest between their trading division and brokerage division. Therefore, if you are trading with an unregulated broker that makes markets, they might have a tendency to skew prices in the wrong direction in case they are facing significant losses.

This will adversely affect you as a trader on the other side of the trade, and reduce your profitability. However, this risk does not present if you are dealing with a regulated broker, since they cannot manipulate prices based on their whims and fancies.

✔️ Assets

The next factor to consider before trading through an OTC trading platform is the variety of assets that it offers. Even if you are only going to be trading one or two asset classes, it is always advisable for you to trade on an OTC trading brokerage platform that provides variety in terms of the asset classes. This will be useful later if you choose to expand your trading horizons and begin trading other assets too

In addition to this, platforms that offer access to more than one asset class also usually have more features than other platforms since they have to cater to a variety of traders. Usually, multi-asset OTC trading platforms allow you to trade stocks, currencies, commodities, indices, ETFs, and cryptocurrencies.

✔️ Fees

The fees you pay are also an important consideration that will affect your bottom line. They also affect the kind of strategies that you can employ on a particular platform. For example, an OTC trading platform that charges high commissions on each trade that you make implies that you will not be able to scalp trade through it, because your small profit margins will be wiped out by the commissions, resulting in negligible profits or even losses

The fees charged by a platform can be divided into two types: trading fees and non-trading fees. Trading fees refer to the fees that a trader incurs whenever they make a trade, this could be in the form of a commission or a spread. On the other hand, non-trading fees are fees that are not directly related to the trading activity on the account. For example, this could include inactivity fees, deposit and withdrawal fees, as well as account management charges.

✔️ Research and analysis tools

Research and analysis tools are highly important, particularly for OTC trading platforms. There are two types of research and analysis tools that a platform might offer: technical and fundamental. Technical tools include charting and analysis methods and can be either general or asset-specific. Fundamental tools include economic calendars, financial reports, analyst forecasts, and other similar forms of data.

Traders usually perform only one of the two forms of analysis, however, it is important to be aware of both since they have an impact on prices and can therefore affect the overall profitability of your strategies. Having a broker that incorporates both fundamental and technical analysis can mean that this job is made easier.

✔️ Demo Account

Some platforms require getting used to because they are designed and structured in a unique way. A demo account helps with this since it enables you to understand how the navigation and order execution on the platform works. At the same time, having a demo account on a platform means that you can easily test out your strategies in real market conditions, and build up your knowledge and experience without risking real capital. This is a very useful tool, and it is always better to use a broker that allows you to open a demo account with them.

✔️ Mobile App

As an OTC trader, you will often be opening and closing multiple positions quickly and automatically. OTC trading does not usually require a very high level of close management, however, you might want to see how your portfolio is doing as a while at any given point in time. Therefore, a mobile app is very useful since it allows you to monitor your positions and trade on the move, even when you are not near a laptop or a computer. At the same time, most mobile apps also have functionalities that enable you to set price alerts and push notifications for a variety of situations, enabling you to stay informed on the move.

Conclusion

OTC platforms provide a unique service offering: the products that you can trade through them cannot normally be traded through exchanges. There are several important considerations to keep in mind when trading through an OTC trader, which have all been discussed. These include general considerations about the platform, such as the trading fees and the asset class list. But they also include the trading tools that the platform provides, such as their analysis capabilities and the different order types that can be placed through the platform.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

FAQs

What is the best OTC trading platform?

The best OTC trading platform will differ from person to person based on their requirements. During our research, we found TD Ameritrade (now part of Charles Schwab) to be a good option because it provides access to the ThinkorSwim platform, a good range of educational resources and excellent customer service.

Which is the cheapest OTC trading platform?

The cheapest OTC trading platform is Pepperstone, which allows spread-free trading with very low commissions.

Which OTC trading platform offers US shares?

Most OTC trading platforms, including AvaTrade and Pepperstone, offer US shares for traders.

Are the OTC trading platforms legit?

Yes, OTC trading platforms are often regulated by top-tier agencies, and therefore are legitimate.

What is the best OTC trading platform to buy cryptos?

The best OTC trading platform to buy cryptos is TD Ameritrade, which a selection of 7 different OTC tokens.

How do commission-free OTC trading platforms make money?

Commission-free platforms make money by charging spreads, which is the difference between the bid and ask price of an asset.

How much leverage do the best OTC trading platforms offer?

The best OTC platforms can offer leverage of as much as 400x for professional traders on a variety of asset classes.

References:

- https://www.schwab.com/stocks/understand-stocks/otc-stock

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/over-the-counter-otc/

- https://nssc.novascotia.ca/before-you-invest/what-are-risks-when-trading-over-counter-otc-markets

- https://www.investor.gov/introduction-investing/investing-basics/glossary/over-counter-otc-securities

Nishit Kumar Finance Writer and Analyst

View all posts by Nishit KumarNishit is a NGL Trader Analyst at Akari Trading. He has also worked as an analyst for Morgan Stanley and Onyx Commodities.

Before starting his career in finance, Nishit studied at the University of Warick where he was an active member of the Hedge Fund society. Due to his qualifications and experience, Nishit is considered an industry expert and enjoys writing content that could help traders to make informed decisions.

As well as writing, Nishit worked as Associate Editor for The Economic Transcript until 2021. He has also written for Newsweek and has good knowledge of current events that could affect the financial markets.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

Scroll Up