Best Micro Currency Trading Platforms – Cheapest Online Brokers Revealed

Platforms offering micro currency trading represent real-time trading in a currency or asset measured in 1,000 units. Thus, the trader can speculate on the price through the lower initial balance and lower capital requirements rather than trading a full unit, which decreases the risks.

The micro currency trading platform is one of the most popular options among beginning traders since it allows them to experience real trading without a significant investment. It is increasingly common to use micro currency trading platforms to test algorithms, robots, and strategies within a real environment with a limited risk of loss.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

-

-

The Best Micro Currency Trading Platforms 2026

- eToro: eToro is a fully regulated broker in more than 140 countries with 10 offices worldwide and user base of over 30 million. The broker is available to use on desktop and mobile making it suitable for trading on the go. The platform is well-known for its innovative social trading features which make it possible to view the trades of other investors. It is possible to trade over 40 currency pairs on the platform.

- AvaTrade: You can trade micro currencies through AvaTrade via the AvaOptions trading platform. This platform supports options trading on over 40 forex pairs. AvaTrade also supports forex CFDs which can be traded on the main platform. The broker offers low commissions and variable spreads.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

What is Micro Currency Trading?

Micro currency trading is a type of forex trading that involves using smaller trading sizes, or ‘micro lots’. Most micro trades are opened and closed within a short space of time to take advantage of small price fluctuations. In forex, a micro lot of 1000 units of the base currency that is being traded.

Micro traders typically place several trades each day to maximize their profits and take advantage of opportunities around the clock. Due to the fast pace of microcurrency trading, it comes with a lot of risk. Therefore, this strategy is most suitable for advanced traders.

Why Might Some Trades Choose Micro Currency Trading?

Although micro trading comes with risk, it remains a popular choice amongst advanced traders. The main advantage of micro currency trading is that traders can trade multiple lots at one time which provides greater control over risk. Furthermore, trading small lot sizes means that the risk per trade is lower. This is advantageous when implementing volatile day trading strategies.

Best Micro Currency Accounts Reviewed

1. eToro – Overall Best Micro Currency Trading Platform

We chose eToro as our first choice for a micro currency trading platform in 2026. With its wide variety of markets, easy-to-use interface, and high level of regulation, it is now home to over 30 million users.

The 17 international exchanges offer over 2,400 stocks. In addition to major exchanges like NYSE, NASDAQ, and London Stock Exchange, you can also trade company stocks listed in Germany, France, Sweden, Hong Kong, and other countries. This stock trading platform has no commissions, making it one of the best.

A fee is not charged for purchasing or selling a stock. You will also not be charged any maintenance fees. Palantir stocks can also be purchased at eToro for just $18. eToro’s support for fractional ownership makes this possible regardless of the share price.

Furthermore, eToro is an excellent choice for first-time investors since it is user-friendly. The account can be opened within minutes, and the platform allows users to trade automatically within minutes. Copy Trading is one of the platform’s most innovative features. By using it, you can copy an experienced investor’s portfolio. On eToro, you can also trade pharmaceutical stocks.

A minimum investment of $200 is required for online trading to use this Copy Trading option at no additional fee. You can fund your eToro account with a debit or credit card, a bank transfer, or an e-wallet such as Neteller or PayPal. The company is licensed by FINRA in the U.S., ASIC in Australia, and CySEC in Cyprus. So eToro is the best choice to start micro currency trading.

eToro fees:

Fee Amount Stock trading fee Free Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- Easy-to-use broker

- No fees or commissions when buying stocks

- Listed on 17 international markets, over 2,400 stocks and 250 ETFs

- Trade digital currencies, commodities, and foreign exchange

- You may use a debit card, credit card, or e-wallet to make deposits

- The ability to copy other users’ trades

Cons:

- Incompatible with advanced traders who enjoy performing technical analysis

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. AvaTrade -Various resources and educational materials

AvaTrade was established in 2006 as a CFD and forex broker and is regulated by some leading financial institutions.

AvaTrade offers forex trading and CFDs for commodities, indices, ETFs, and stocks. With AvaTrade, you can trade seven different cryptocurrencies without commissions or transaction fees.

Also, the AvaTrade platform offers beginner traders a variety of resources and tools, such as access to over 250 financial instruments, including cryptocurrency trading 24/7, and a free paper trading account for $100,000 worth of virtual funds.

AvaTrade fees:

Fee Amount CFD trading fee Variable spread Forex trading fee Spread. 0.9 pips for EUR/USD Crypto trading fee Commission. 0.25% (over-market) for Bitcoin/USD Inactivity fee $50 per quarter after three months of inactivity Withdrawal fee Free Pros:

- Low non-trading fees

- No deposit or withdrawal fees

- You can open a trading account with a $100 deposit

- Various resources and educational materials

- No commissions on trading

- Demo accounts are available for free.

Cons:

- Inactivity fee and administration fee are above average

- Unable to invest in traditional methods, such as stock

- Fractional share trading is not permitted

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Micro Currency Accounts Fees

Trading Platform Stock Trading fees Forex trading fees Overnight fees eToro Free. Fixed spread. 2 pips for GBP/USD. CFD fees overnight. Stocks, ETFs, and cryptos don’t charge overnight fees. AvaTrade 0% Commission, typical spread for Amazon Stocks is 0.13% and leverage up to 5:1 0% Commission, typical spread for EUR/USD is 0.9 pips and leverage up to 30:1 The daily overnight interest charged/paid equals the trade amount * the daily overnight interest. As an example, considering a trade involving 1,000 EUR/USD at -0.0064% overnight interest and a one-day charge, the calculation is as follows: 1,000 * -0.000064 = -0.064 = -$0.06 Micro Currency Trading Apps Assets & Software Comparison

Trading Platform Assets Software Features eToro Shares, ETFs, Forex, commodities, indices, cryptocurrencies Proprietary Trading socially, copy trading, copy portfolios AvaTrade Shares, Forex, commodities, indices Proprietary, MT4 It is possible to deposit funds directly from the mobile app Best Micro Currency Stock Trading App

Acorns: Best for investing with little money

As a savings and investing platform, Acorns aims to help millennials overcome the challenges they face. After your credit card, debit card, or PayPal account is linked to Acorns, the difference is invested in one of five diversified exchange-traded mutual fund portfolios. Alternatively, automatic investments can be set up directly from your bank account. Using Acorns Earn, users can make investments in different brands. Investing in your Acorns Invest account is a portion of your purchase. Users can open an Acorns account with no minimum balance requirement, but two pricing options are. It costs $3 per month for a personal plan and $5 per month for a family plan. Despite sounding low, these fees can easily accumulate and lower investment returns.

- Fees: $3 or $5, depending on account type

- Account minimum: None

How to Choose the Best Micro Currency Trading Platform for You

Regulation and Safety

On the home page, you will typically find a disclaimer or explanation. Furthermore, you can easily access the brokerage through the SIPC website.

Deposit Insurance Corporation (FDIC)

Investing in stocks, bonds, options, and annuities through brokerage accounts or retirement accounts does not qualify for FDIC insurance because the value of investments cannot be guaranteed. The brokerage should fully back if it offers CDs, MMDAs, checking, or savings accounts.

What Kind of Insurance Do Brokers Provide to Protect You in Case the Company Fails?

Each SIPC member should have a minimum insurance coverage limit of $500,000, with a cash claim facility of $250,000. Besides providing additional security beyond the requirements for SIPC membership, a firm adhering to the Customer Protection Rule should also provide additional protection.

Is There Any Guarantee of Protection Against Fraud?

Will the company reimburse you for fraud losses? Be sure to check the brokerage’s reimbursement requirements before submitting a claim. If any special precautions must be taken, ensure you know what documentation is needed.

Assets

The online trading world is home to investors of every size and shape. Those who would like to trade futures or options may do so, while those who only wish to invest in stocks may do so. First, check whether the provider offers your chosen market.

Besides the markets we’ve discussed today, the best online trading platforms for beginners offer markets on the following assets:

- Stocks and Shares

- Exchange-traded funds, mutual fund bonds, and index funds

- Commodities and Forex

- Bitcoins and other cryptocurrencies

You can easily learn whether your preferred financial market is supported on the trading platform’s website.

Fees

It’s important not to focus on fees alone, but you should learn how much your brokerage will cost.

Some might consider a small premium justified if their platform offers features their competitors lack. Of course, trading commissions and accounting fees reduce investment returns, but you should avoid losing too much.

By looking at the bottom line, you can identify stockbrokers who are too expensive to consider and those who are irrelevant for your investment needs.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Share Dealing Fees

Stock purchases are not the only investments that incur share dealing fees, such as ETFs, mutual funds, and investment trusts. However, a trading app will always charge you a flat-rate fee.

Regardless of the amount invested, the fee remains the same. Therefore, larger investment amounts are advantageous.

- Consider signing up with Hargreaves Lansdown, a reputable trading platform.

- If you purchase £150 worth of shares, B.T. charges a flat fee of £11.95.

- In percentage terms, your commission is almost 8%.

- You will be charged the same amount for cashing out your shares as you paid when you purchased them.

The transaction would have been commission-free if you had used eToro, our top-rated trading platform. All markets are commission-free on the platform. Buying shares on the platform doesn’t require you to pay stamp duty tax!

Trading Commission

If you choose to trade assets with a CFD instrument, your chosen trading platform will charge you a variable fee. A small order won’t be penalized for entry-level traders.

You will pay a different commission if you trade on a different trading platform.

-

UK Share CFDs – GBP denominated 0.075% per trade fee

-

Minimum Per Order – GBP 4.50

-

UK 100 Index CFDs – GBP 0.0075% per trade fee

-

Minimum Per Order – GBP 1.50

Spreads

The best brokers make money through their spreads when they do not charge commissions. An instrument’s value is defined as the difference between its buy and sell price.

- Take eToro as an example and trade Apple stocks

- According to the trading platform, the ‘buy price’ is $135.10.

- The price quoted is $134.85.

- The spread between the two is 0.18% based on the difference between the two prices

On eToro, you are instantly 0.18% in the red when you open an Apple trade. For your trade to break even, its value must increase by 0.18%. 0.18% is excellent, especially in this instance since eToro has no commission.

Other Trading Platform Fees

Expenses such as commissions, commissions, and spreads need to be examined closely. In addition, there may be other charges associated with the trading platform you choose, such as:

- Overnight Financing: An overnight financing fee is charged to keep your position open after a certain period. eToro does this after 10 pm in the U.K. As a result, CFDs work only for short-term strategies since every trading platform charges for them

- Transaction Fees: A few broker sites provide fee-free deposit and withdrawal services, while others charge a fee. That might be due to your preference for a particular payment method or to the fact that you want to use a platform with a currency other than GBP.

- Inactivity Fees: Some brokerages charge an inactivity fee after a certain period of inactivity.

- X. Trading Fees: Brokers usually charge an F.X. when buying, selling, or trading a non-listed asset. Hargreaves Lansdown, for example, will charge you its standard share dealing fee of £11.95, plus a 1% F.X. markup, when you buy U.S. stocks.

- All things considered, fees and commissions can make or break your ability to make gains, so do your research before opening an account.

Trading Tools & Features

Some brokers keep things simple rather than offering more than the ability to buy and sell assets. Depending on your provider’s offerings, you can improve the success of your investment endeavors with a wide array of tools and features.

Fractional Ownership and Low Minimums

Trading does not always involve risking thousands of pounds on one investment. On the other hand, some of you may just be getting started, so you may want to trade with small stakes. Therefore, we prefer to use the best brokers that offer “fractional ownership.”

If you’re not familiar with the concept, a fraction of an asset can be purchased or traded instead of buying the asset outright. For example, you can start trading cryptocurrencies with just $25 through eToro, our best trading broker recommendation.

Automated Trading

In the online space, automated trading is becoming increasingly popular. This trading strategy is all about active trading without the need to do any research. Some automated trading tools will even place orders for you. That is ideal for traders with little experience and little time to analyze the markets.

Automating your trades can be done in several ways. They first purchase a trading robot on the web, then install it into MT4. Ensure your chosen company supports this platform so you can do this.

To be on the safe side, you should do this directly with an FCA broker if you are interested in using an automated trading platform. Copy Trading, for example, is free on eToro. To copy a verified eToro trader, you simply select which trader you want to mirror, and the platform will then duplicate all trades within your portfolio.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Orders

You must place a series of orders regardless of the trading platform you use or the asset you wish to access.

It tells your chosen trading platform how you intend to increase your profits. All brokers will offer buy and sell orders to enter and exit a trade.

The best providers in this space will also offer Risk-management orders. In addition to stop-loss and take-profit orders, you may also want to consider trial stops-loss and guaranteed stops-losses.

Research and Analysis

You should only execute positions based on research unless you are trading recklessly. Otherwise, it’s just gambling. Various analysis tools are available on the best online trading platforms to aid your research.

eToro, for instance, provides you with price charts on all its assets. As well as fundamental data on major stocks, it also provides market sentiment. Some brokers also offer direct access to financial news, which is important for long-term investors.

Demo Account

Demo accounts are indispensable to all traders, whether seasoned pros or newcomers. The best trading platforms offer these to their users to get a sense of real market conditions without putting themselves at risk. So they use paper funds instead.

A demo account with eToro comes preloaded with $100,000, for example. It’s great for testing the waters before you make a real deposit since you’re still going to have access to the same markets, prices, and trading volume. In addition, demo accounts are good for trying new strategies, even if you have some experience with online trading.

Mobile App

A mobile investing app for Android and iOS is usually available from the top trading platforms. You might plan to use your desktop or laptop to trade.

If you find yourself on the move, you might have to place a trade. As an example, Gamestop saw its share price drop by 60% in the 24 hours before writing this guide.

You would have suffered severe losses if you could not sell this stock until you got home if you had positions in it.

Instead of continuing to lose money, you could have exited the position by using a top-rated mobile app and reduced your losses significantly.

Other essential account features can also be found in the best mobile trading apps. For example, the eToro mobile app lets you see the value of your portfolio in real-time and make deposits and withdrawals. You can even chat with customer support via live chat.

Payment Methods

A trading platform will require you to deposit some funds when you open an account. Then, you can use debit or credit cards to make trades instantly in the best trading apps.

Despite this, some trading platforms only allow deposits via bank accounts. Your trading account will not receive this right away, so it won’t be appropriate if you need to buy an asset right away. Check the fees associated with the payment method you choose as well.

Customer Service

Customer support channels offered by a trading platform are always a good idea to check out. There should ideally be a live chat function available. A real-time agent is also available for phone support. You might have to wait several hours for a response if, however, the trading platform only provides support via email.

How to Start Stock Trading – eToro

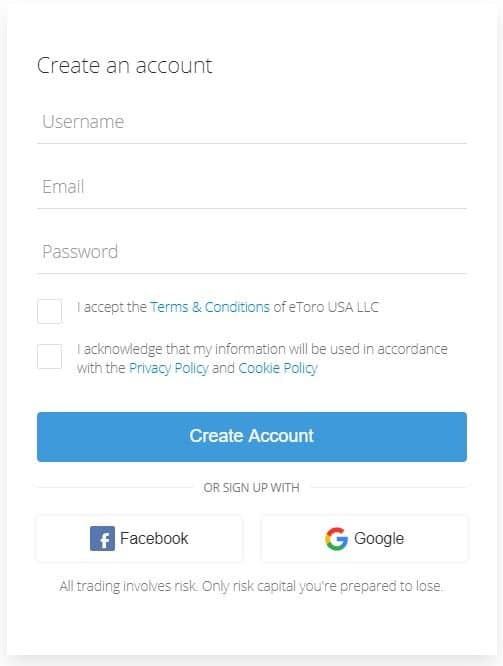

Step 1: Open a Trading Account

- Click here, fill out your details, click on ‘create an account,’ and that’s it. You are now part of the eToro family.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

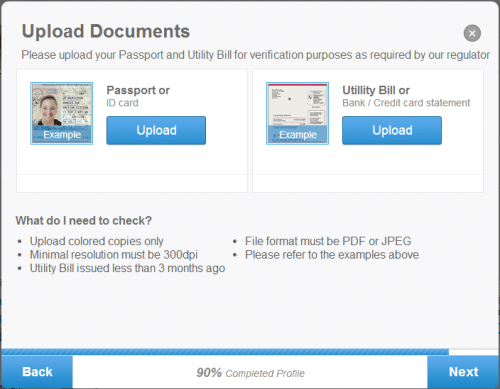

Step 2: Upload ID

- Uploading documents is a simple process that can be done by clicking here. Documents can be uploaded in the following formats: .pdf, .jpg, or .doc

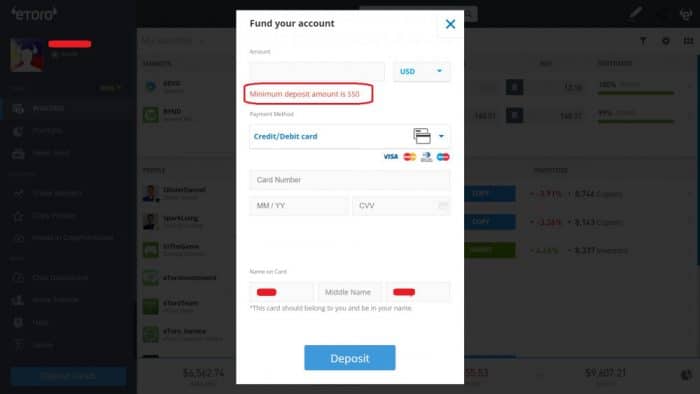

Step 3: Deposit Funds

- In the left-hand navigation box, select the “Deposit Funds” button. Enter the amount you would like to deposit. Enter your payment information and choose your preferred method of payment. Users in the U.S. have the following three payment options:

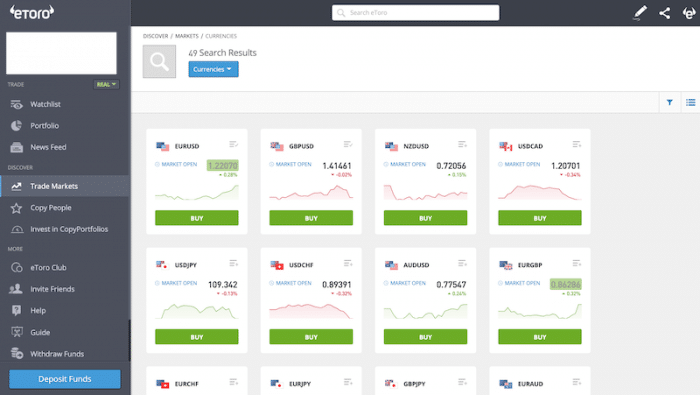

Step 4: Search For a Trading Market

Once your deposit is processed, you can begin micro currency trading on eToro, the best broker. To see what assets are supported, click ‘Trade Markets’ on the left-hand side of the dashboard. Then, if you know which asset you want to trade, search for it.

Step 5: Place a Micro Currency Trade

The order box will appear once you click the ‘Trade’ button next to the asset you wish to trade.

Conclusion

Investing online has never been easier than it is today due to the influx of trading platforms into the online marketplace. A good broker can give you access to thousands of markets, no matter whether you’re looking for stocks, Forex, cryptocurrencies, or CFDs.

According to our research, eToro is the top platform for residents of the United States. Trading with this FCA-registered broker is commission-free, and there are a lot of tradable markets. In addition, it only takes minutes to open an account, and funds can be deposited immediately via a debit/credit card or e-wallet!

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQs

What is the best micro currency trading platform?

Using a beginner-friendly platform is crucial if you are launching micro currency trading online for the first time. The perfect platform for beginners, in our opinion, is eToro's micro currency trading platform. There are no prerequisites for using the platform.What is micro currency trading?

Brokers offering micro currency trading are companies that offer live trading through 1,000 units of the base currency or asset. A trader can speculate on a price rather than trading a full unit, as the initial balance is smaller and the capital requirement is lower, which reduces risk. Starting with micro currency trading is a common choice for beginning traders who want to experience real trading without investing a large amount of money.Are the micro currency platforms safe?

In most cases, micro currency platforms are safe to use. However, the platform must be licensed by a reputable organization to be considered safe. Examples include the FCA, FINRA, and ASIC.How much leverage do the best micro currency trading platforms offer?

Jhonattan Jimenez Finance and Crypto Writer

View all posts by Jhonattan JimenezBefore starting his career as a freelance writer, Jhonattan studied at the Universidad La Gran Columbia from which he graduated in 2019. Jhonattan describes himself as a crypto enthusiast and regularly writes price prediction articles for new projects. During his time as a writer, Jhonattan has gained great knowledge about the crypto space and has mastered technical analysis skills that he uses when writing token price predictions. As well as writing for Trading Platforms, Jhonattan has written for Stocksapps.com and Buyshares.co.uk.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up