Best Electronic Trading Platform – Cheapest Online Brokers Revealed

If you live in the United States and want to trade online, you’ll need to select the best electronic trading platform to suit your demands. Low fees, a large range of support marketplaces, user-friendly features, and excellent customer service are all aspects of the greatest online trading platforms.

Of course, you’ll want to make sure that the trading software you choose is regulated. The greatest electronic trading platforms of 2025 are reviewed in this guide.

Best Electronic Trading Platforms 2025 List

- eToro – The Best Overall Electronic Trading Platform

- Webull – The Best Platform for Multiple Electronic Trading Platforms

- ETrade – The Best Electronic Trading Platform for Beginners

Best Electronic Trading Platforms Reviewed

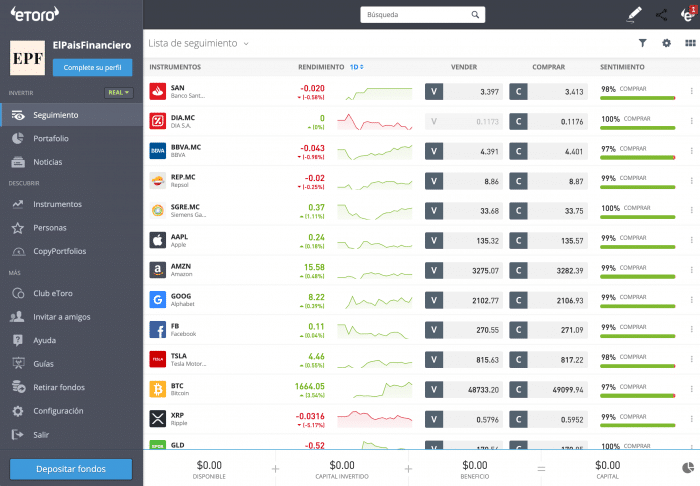

1. eToro: The Best Overall Electronic Trading Platform

eToro, which was founded in 2007, is an online trading platform with over 17 million users. It is our choice for the greatest electronic trading platform. With the click of a mouse, you may trade a wide range of asset classes on our top-rated platform.

But first, let’s discuss how beneficial this top-tier electronic broker is. The online trading platform’s commission-free environment has been lauded by the industry, as eToro does not charge fees to trade stocks, shares, or ETFs.

Over 2,400 equities from 17 US and international stock exchanges, 250+ ETFs (exchange-traded funds), 16 cryptocurrencies, and thousands of CFDs are available. This includes everything from gold and silver to oil and FX in terms of the latter.

Aside from the assets already listed, all of eToro’s marketplaces offer commission-free trading. This means that the spread is the only ‘cost’ you need to consider when trading. There are no annual maintenance fees, and deposits are only 0.5% of the total. After all, you don’t have to worry about currency conversion fees while trading foreign assets. The broker, however, comes out on top as the greatest electronic trading platform.

In terms of user-friendliness, eToro is a good choice for beginners. Because the platform is free of complicated financial language, the process of locating an asset and putting buy and sell orders may be accomplished quickly. As if that weren’t enough, eToro is also known around the world for its CopyFunds portfolios, which are a quick and easy method to get started with online trading. Additionally, you can use the Copy Trading tool to invest passively.

This works by choosing a verified trader, deciding how much money you want to invest (minimum $200), and then having all of your ongoing trades mirrored in your own eToro account. If you only want to trade little sums, eToro demands a $25 cryptocurrency stake, $50 in stocks, and $200 in ETFs.

When it comes to security, eToro is authorized and regulated by the Financial Conduct Authority (FCA), one of the world’s most stringent financial watchdogs, providing investors with a cutting-edge regulatory environment. Regulators in Cyprus and Australia have also granted it a license. Importantly, when you register an account with eToro, your funds are protected by the Financial Services Compensation Scheme (FSCS). Finally, it accepts a variety of payment options, including debit/credit cards, bank transfers, and electronic wallets such as PayPal.

eToro fees

| Fee | Amount |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros:

- Low to no fees

- Tight spreads

- Huge range of assets to trade - including stocks, indices, ETFs, cryptocurrencies, currencies, and commodities

- Social trading and copy trading tools are available

- Regulated by the FCA

Cons:

- Does not support signals for forex trades

- Not suitable for traders who use advanced charting tools

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

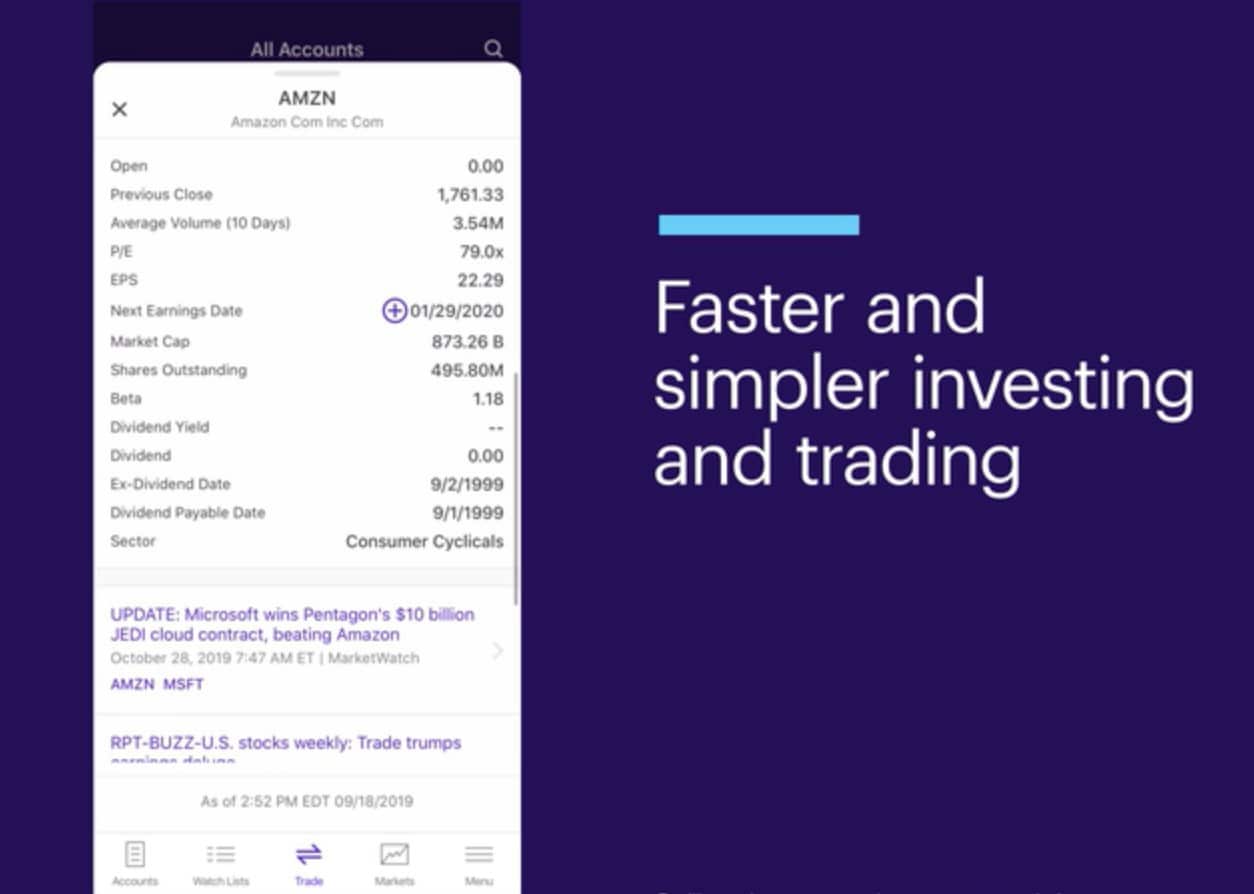

2. Webull - The Best Platform for Multiple Electronic Trading Platforms

Webull is the platform of choice for electronic traders who want to trade across several platforms without paying commissions. To execute your trading techniques, you can use the MT4, MT5, or a variety of additional trading platforms with Webull. Their platforms are well-designed and well-structured, and they allow you to place a wide range of orders. Furthermore, the platform has very minimal fees and commissions, which increases your overall profitability.

While Webull's platforms are far superior and more suited to most trading strategies, they do have some disadvantages. To begin with, they have a limited asset selection, consisting solely of stocks, indexes, and options. As a result, you won't be able to trade commodities or currencies with Webull. Furthermore, while registering an account with Webull is a simple and uncomplicated process, the site only accepts bank transfers for depositing and withdrawing funds.

Webull fees

| Fee | Amount |

| Stock trading fee | U.S. SEC transaction fee (sells only) - $0.0000051*Total $ Trade Amount (Min $0.01) |

| Forex trading fee | N/A |

| Crypto trading fee | Variable spread |

| Inactivity fee | Free |

| Withdrawal fee | $25 via wire transfer (U.S.) - $45 via wire transfer (international) |

Pros:

- Free trading on stocks, ETFs, and options

- Easy account opening process

- User-friendly trading platforms

Cons:

- Only bank transfers for depositing/withdrawing funds

- Lower asset variety than other platforms

Your capital is at risk when trading at this site with real money

3. ETrade - The Best Electronic Trading Platform for Beginners

As a newbie, you may find it difficult to navigate the world of electronic trading, owing to the industry's jargon and technical words. If this is the case, Etrade is the platform for you, as it allows you to learn how to trade utilizing electronic trading tactics quickly and efficiently. ETrade, for example, has a large library of instructional resources that you may utilize to learn about various methods, their applicability, and the many situations in which they might be applied.

There are also a number of other characteristics that make ETrade a viable option for you to explore. Their simple features make it simple to trade stocks, options, and ETFs without paying a commission. In addition, the mobile app is more modern than most competitors and provides access to a large range of services. This will allow you to do more than just keep track of your performance while on the go, as their app allows you to configure complicated price alerts and place unique order kinds. However, one of the platform's main flaws is that its user-friendly design does not extend to the website.

Pros:

- Free trading on stocks, ETFs, and options

- Advanced mobile app with complex features

- User-friendly trading platforms

Cons:

- Website is difficult to navigate

- Lower asset variety than other platforms

Your money is at risk

Electronic Trading Platforms - Fee Comparison

| Name of Broker | Electonic trading tool | Commissions |

| eToro | Social trading platform - CopyTrade | Zero |

| Webull | Largest variety of trading platforms to choose from | Zero |

| ETrade | Ability to trade options through the mobile app | Zero |

Electronic Trading Apps Assets & Software Comparison

| Asset Class/Software | eToro | Webull | ETrade |

| Forex | Yes | No | No |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | No |

| Cryptocurrencies | Yes | No | |

| Indices | Yes | Yes | Yes |

| MT4 Trading Platform | No | No | No |

| MT5 Trading Platform | No | No | No |

How to Choose the Best Electronic Trading Platform for You

There are a few factors to consider while selecting the best electronic trading platform for your needs. Because the broker you choose has such a direct and proportionate impact on the success of your trading strategy, you should think about a variety of factors before deciding. The following is a list of the several factors that must be considered.

Regulation and Safety

It is vital that you choose a regulated broker for a variety of reasons. The first and most essential reason is that regulated brokers are investigated and monitored to guarantee that they are not deceiving or exploiting their consumers. Because there is a clear clash between their trading and brokerage divisions, this is especially important for market-making brokers. As a result, if you trade with an unregulated broker who constructs markets, they may misreport prices in their favor on occasion if they are losing money. This will have a negative impact on your profits as a trader. When dealing with a licensed broker, this danger is eliminated because they are unable to influence prices and are instead compelled to be honest in all of their dealings.

Another advantage of using a regulated broker is that your money is safe and secure. Numerous incidents of brokers fleeing with investor monies and other assets have occurred, resulting in huge losses for investors. Regulated brokers are unable to do so since they are required to ensure the funds held on their platform. This ensures that the funds you deposit are safe and that you can access them at any time.

If you want to be sure that the broker you're working with is safe and regulated, only engage with brokers who have been approved by Tier-1 authorities. There are several of these agencies, each of which is linked to a different country and relates to a different jurisdiction and/or asset class. The Commodities Futures Trading Commission (CFTC) supervises commodity trading in the United States, whereas the Cyprus Securities and Exchange Commission (CySEC) oversees brokers.

Assets

The second factor to consider before dealing with an electronic trading platform is the asset range it provides. Even if you only want to trade one or two asset classes, trading on an electronic trading brokerage platform that offers a diverse variety of asset classes is usually a smart choice. If you decide to widen your trading horizons and start trading other assets, this will come in handy.

Furthermore, platforms that provide access to more than one asset class usually offer more features than other platforms because they must appeal to a range of traders. On multi-asset electronic trading platforms, you can often trade equities, currencies, commodities, indices, ETFs, and cryptocurrencies.

Fees

Your out-of-pocket expenses are also a key component that affects your bottom line. They also influence the types of tactics you can utilize on a certain platform. A quick trading platform with high commissions on each trade, for example, will prevent you from scalping because the charges will wipe out your narrow profit margins, resulting in negligible earnings or even losses.

The fees charged by a platform are divided into two categories: trading fees and non-trading fees. A trader's transaction charges, which might include a commission or a spread, are known as trading fees. On the contrary, non-trading fees are charges that are not directly related to the trading activity of the account. Account administrative costs, inactivity fees, and deposit and withdrawal fees are all examples of this.

It's critical to understand the various expenses that a platform imposes before you begin trading on it. These expenses typically differ by asset class, as well as by region and location, so you should research the ones that pertain to your trading needs. Always choose a platform with lower fees over one with higher expenses for the same capabilities.

Trading Commission

A commission is a one-time payment for each trading order that you place. One of the advantages of commissions is that they are known in advance, allowing you to readily account for them when backtesting a technique or constructing a trading plan. Commissions are usually calculated depending on trading volume, thus the more you trade, the lower your commissions will be. Commissions, on the other hand, may be higher than spreads on occasion.

Varying brokers provide different spreads and commissions, and some even combine the two. While both spreads and commissions have advantages and disadvantages, traders prefer commissions because they are predictable, transparent, and very inexpensive if a certain trading volume is exceeded. If you're looking for a commission-based broker, make sure to inquire about any rebates or discounts. Meeting the barrier and being entitled to refunds, if any, will be straightforward because most electronic trading strategies often involve large volumes.

Spreads

Spreads are a type of trading fee that a platform might charge. They refer to the difference between the purchase and sale prices of an item. Spreads can be fixed or variable on platforms. Variable spreads change during the day depending on market volatility and liquidity, whereas fixed spreads remain constant. You must be aware of your broker's spread and if it is fixed or variable. Different brokers have widely different spreads depending on the items you want to trade, and spreads might change even within a particular asset that you are trading.

Other Trading Platform Fees

Non-trading expenses, often known as other platform costs, are divided into three groups. The first is the account administration fee, which is a one-time fee that you must pay each year in order to use the site. Following that are the fees for adding and withdrawing monies from your account. This could be a flat fee that applies to all deposits and withdrawals, a fee that only applies to particular types of deposits and withdrawals, or a fee that applies to both deposits and withdrawals.

The third type of cost is an inactivity fee, which is charged only if you do not use your account, execute transactions, or contribute cash to your account for a specified period of time.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Electronic Trading Tools & Features

Apart from the above-mentioned traits and needs, there are a number of other factors to consider when selecting a broker. This is a list of the features and tools available on the platform. If you don't utilise all of your tools, it's always better to have a larger selection than a smaller one. The following are the most significant elements to look for in a successful electronic trading platform.

Fractional Ownership and Low Minimums

The most significant factor to examine is the possibility of fractional ownership. This allows you to purchase a fraction of a share, such as 0.01 or even less. This is particularly useful if you do not want to put a large amount of money into your trading account. Some shares, for example, can cost as much as $2000, and fractional ownership options are the only way to purchase them with a small financial commitment. This feature is now available on a variety of platforms, and it's something you should keep in mind.

A tangent of fractional ownership of shares on a platform is low minimum deposit requirements, which allows you to open an account with little capital commitments. As a result, platforms with minimal minimum deposit requirements.

Automated Trading

The next thing to keep in mind while trading is the automatic trading services that they give. While some brokers provide their own tools for building up and executing automated trading strategies, the MT4 and MT5 trading platforms are the most widely used. Several distinct types of automated trading techniques are available. You could trade with bots, trading signals, or replicating transactions from another trader, for example. In any event, finding and using a broker who permits you to use automatic trading systems is crucial.

Orders

Different platforms also allow you to place a variety of order types. This could be done in two ways, one is by choosing the type of order, and the other is by choosing the timeframe for which the order is valid. The type of orders available on most electronic trading platforms are:

- Market order

- Stoploss order

- Stop limit order

- Limit order

On the contrary, the type of timeframes that you can place on orders could include:

- Good-till-canceled (GTC)

- Day Order

- One week

- One month

- End of week

- End of month

- End of Year

- Good-till-date (GTD)

- Immediate or cancel (IOC)

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Research and Analysis

Research and analysis tools are essential, especially for fast trading systems. Technical and fundamental research and analysis tools may be provided via a platform. Technical tools include charting and analytical methods, which can be either general for the entire market at large, or asset-specific. Economic calendars, financial reports, expert estimates, and other relevant data are all valuable resources.

Traders often perform only one of the two forms of analysis, but both are important since they influence price and, as a result, the overall profitability of your strategies. If you have a broker who uses both fundamental and technical analysis, this process may be made easier.

Demo Account

Some platforms take some getting used to since they are designed and organized in a specific way. A demo account can assist you in this by allowing you to test the platform's navigation and order execution. Having a demo account on a platform, on the other hand, helps you to quickly test your strategies in live market conditions, which will in turn permit you to enhance your trading experience without having to risk any real capital. This is a highly useful tool, and you should always use a broker who allows you to open a sample account.

Mobile App

As a trader, you'll be entering and closing multiple positions quickly and automatically. Although you may want to keep track of how your portfolio is doing at any one time, electronic trading does not usually need a high level of careful maintenance. As a result, a mobile app is very useful because it allows you to maintain track of your positions and trade even when you are not near a laptop or computer. Simultaneously, most mobile apps include features such as price alerts and push notifications for a variety of circumstances, allowing you to stay informed while on the go.

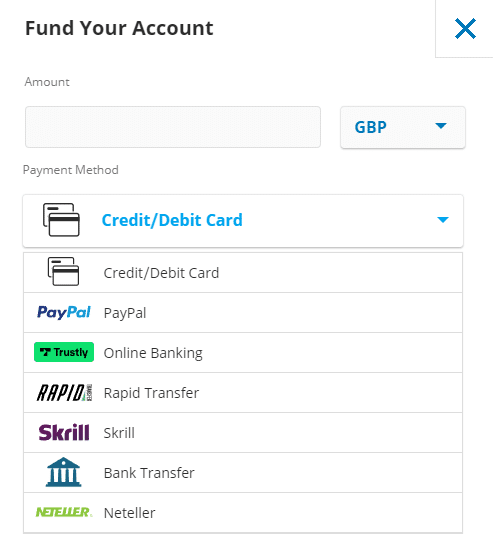

Payment Methods

The quantity of choices for withdrawing and depositing funds into your trading account is an important factor to consider. While most brokers allow bank transfers and credit/debit cards, it is advisable to use brokers who support extra deposit methods, such as electronic wallets like PayPal and Skrill. This will make depositing and withdrawing funds from your account a breeze.

Customer Service

Last but not least, consider the platform's customer care capabilities. Platforms with live chat features are always preferred because they allow you to swiftly and easily get answers to your questions as they arise. Simultaneously, seek platforms that have customer service teams available 24 hours a day, 7 days a week, which will enable you to contact them whenever you run into a problem and obtain answers to your questions.

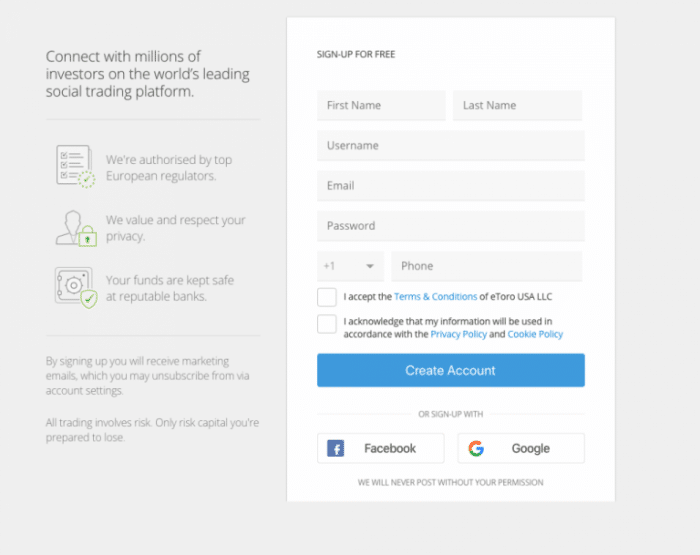

How to Get Started with the Best Electronic Trading Platform - eToro

The process of opening an account on eToro, the greatest electronic trading platform, is simple and straightforward, consisting of only five steps. These have been thoroughly discussed in this article.

Step 1: Open a Trading Account

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

The first step is to open an eToro account. By going to their website and clicking the "Join Now" button, you can do so. You can either create a new account or log in using your Facebook or Gmail credentials.

Confirm Identity

You'll need to verify your identity after you've made an account. Because eToro is a highly regulated broker, you must provide confirmation of identity and address before your account may be authenticated. As proof of identity, any government-issued ID, such as a driver's license or passport, can be used. As proof of address, you can use a power bill or a bank statement.

Once you've uploaded the relevant documents, the eToro verification process is fairly quick. After your account has been verified, you will be able to proceed to the next stage.

Deposit Funds

The following step is to make a deposit into your account. You can use your debit/credit card, a bank transfer, or online wallets like PayPal and Skrill to make the payment.

Search for a Trading Market

The fourth phase entails locating a market on which to trade. It's as simple as typing the market's name into the search box. Following that, you can select the market that most interests you. You can also use the menu to select an asset class and then search for the market you want to trade.

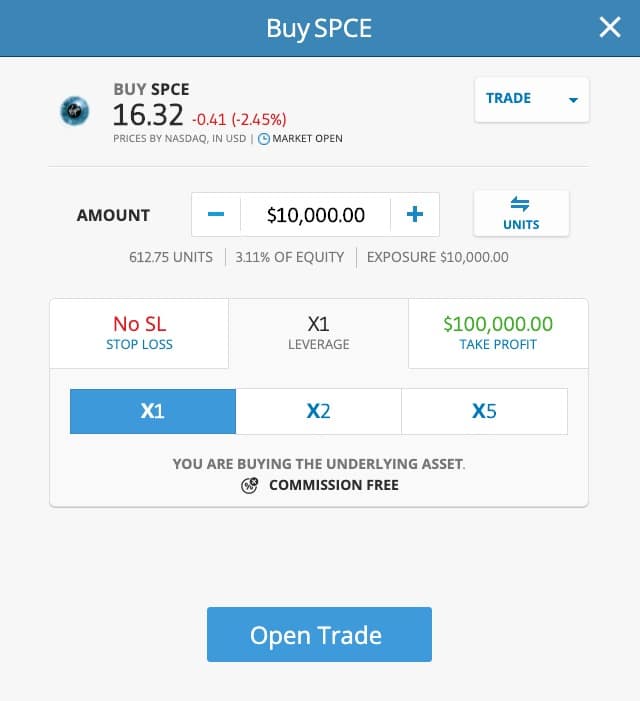

Place a CFD Trade

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Finally, all you have to do is choose the instrument you want to trade, enter the amount of money you want to invest, and click Buy Now.

Conclusion

Never before has it been so simple to invest online, thanks to the increasing number of electronic trading platforms hitting the market. The finest brokers will frequently give you access to thousands of markets, whether you're interested in stocks, forex, cryptocurrencies, or CFDs.

Our analysis revealed that eToro is the greatest electronic trading platform on the market. This FCA-regulated broker has a large number of tradable markets, all of which can be accessed without paying a commission. Plus, opening an account only takes a few minutes, and you may deposit funds instantaneously using a debit/credit card or an e-wallet!

Finally, eToro is the best place to start if you're interested in using an electronic trading platform. It is one of the most reliable and safe trading platforms for investors and traders of all levels of experience, and it provides access to a diverse range of asset classes. Their trading platform and features are practically unrivaled in the industry, and they offer stock and currency trading with low spreads and fees. Overall, eToro is a viable option to consider for your electronic trading needs.

eToro - Best Electronic Trading Platform With Competitive Spreads

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.