Where to Buy IOTA? – Beginner’s Guide

The process of buying IOTA couldn’t be simpler. To get started, you need to open a trading account with a regulated broker, deposit some funds with your debit/credit card or via Paypal, and then decide how many digital tokens you wish to purchase.

Using a commission-free, FCA-regulated broker, we walk you through the simple process to buy IOTA.

Where to Buy IOTA – Step by Step Guide 2026

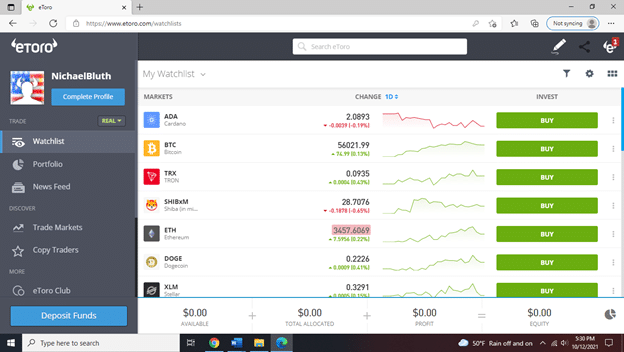

1. eToro – Best Place To Buy IOTA Coin

eToro is the most reliable online platform for buying IOTA. Over 20 million investors use this popular stock broker – regulated and authorized by the Financial Conduct Authority. Moreover, the eToro platform is easy to use and does not contain complex jargon, so many account holders are inexperienced investors.

It is possible to buy cryptocurrency at eToro without paying a commission. However, you will also encounter this problem when you finally cash out your IOTA investment. In addition to IOTA, you can also buy Bitcoin, Ethereum, Ripple, and 14 other popular digital currencies. One of the best things about crypto is the low minimum investment (about 17 GBP).

Money can instantly be deposited into your eToro account using a credit or debit card. PayPal, Skrill, and Neteller are all e-wallets you can use for depositing funds. It is also possible to use your bank account to deposit funds. eToro offers a passive investment tool that may interest you if you are looking to build a long-term cryptocurrency portfolio. It will give you access to various digital currencies through its CryptoPortfolio.

The portfolio at eToro is rebalanced regularly, so you can be sure that it reflects the wider cryptocurrency industry. In addition, you can also copy an experienced cryptocurrency investor at eToro using the Copy Trading tool. Investments here start at just $500, and any trades that the individual makes will be reflected in your eToro account. Finally, eToro’s investment app or online platform makes opening an account simple.

eToro fees

| Fee | Amount |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros:

- No commissions when buying or selling cryptocurrencies

- Over 20 million users

- e-wallets, debit/credit cards, and bank transfers are accepted

- with just $25 as a minimum investment per transaction

- Supports automated crypto trading using copy trading

- Thousands of stocks and more than 250 exchange-traded funds

Cons:

- There is a $5 withdrawal fee

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

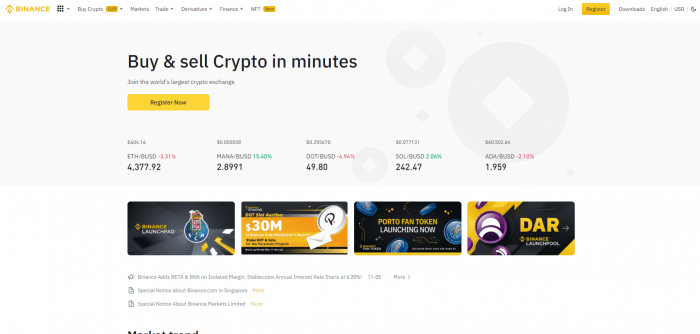

2. Binance -Top-Rated Crypto Exchange Buy IOTA Coin

Binance is the most popular cryptocurrency exchange and broker in the United Kingdom. If, however, you would like to buy IOTA with Bitcoin or any other digital currency you currently hold, Binance is a great option. Despite being only launched in 2017, this provider is already the largest cryptocurrency exchange regarding trading volume and liquidity.

You won’t need to upload any I.D if you are simply planning on making a deposit with cryptocurrency rather than using fiat money, as we briefly covered previously. However, you need to provide an email address and a strong password when you register. You can deposit funds into your account by transferring funds from your Bitcoin wallet when you sign up.

Then, all you need to do is find the BTC/IOTA trade page and make the trade. The exchange also offers hundreds of trading pairs, so it is a good choice if you plan to trade digital currencies. These include many smaller-cap cryptocurrencies that you may not find elsewhere. There is a 0.1% fee per slide on Binance.

Binance will charge you a 1.8% fee if you decide to use a debit or credit card to deposit funds. The eToro fee is 0.5% cheaper than the 3.99% and 5% charged by Coinbase and Coinmama, respectively. If you’re interested in trading Bitcoin futures and options, Binance is a good platform to consider. Binance also offers an app that allows you to buy, sell, and trade on the go.

Binance fees

| Fee | Amount |

| Crypto trading fee | Commission, starting from 0.1% |

| Inactivity fee | Free |

| Withdrawal fee | 0.80 EUR (SEPA bank transfer) |

Pros:

- That is the largest cryptocurrency exchange in the U.K in terms of trading volume.

- Support for hundreds of cryptocurrency pairs

- Just 0.1% trading commission

- In the U.K., bank transfers and credit/debit cards are accepted.

- Cryptocurrency scene with a great reputation

- Tools and features that are ideal for advanced traders

Cons:

- New investors should avoid it

- Debit/credit card deposits are charged 1.8%

Your money is at risk.

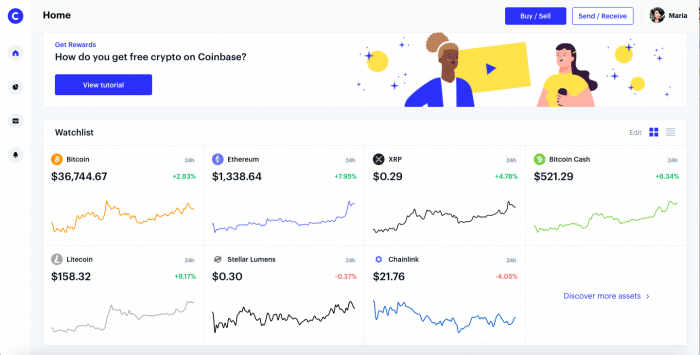

4. Coinbase – Largest Crypto Exchange in the US To Buy IOTA Coin

Among the top crypto exchanges on the market, Coinbase is the largest one. Customers will have access to a clear interface and a large range of trading pairs on the exchange.

Cryptocurrency exchange Coinbase is located in Wilmington, Delaware, and is the largest of its kind in the United States. Coinbase’s easy-to-use interface makes it even easier for beginners to trade. Coinbase Pro is also a good option for experienced traders.

In addition to this, Coinbase is one of the most popular cryptocurrency companies in the world. Coinbase Pro offers both exchange and trading. Moreover, users can access a business payment platform, custody services, and cryptocurrency COIN.

Coinbase fees

| Fee | Amount |

| Cryptocurrency trading fees | Commissions starting at 0.50% |

| Fee for inactivity | It’s free |

| Fees for withdrawals | 1.49 % to an account in the U.S. |

Pros:

- New users and experts alike will find the interface easy to use.

- Coinbase, one of the world’s most liquid exchanges, manages transactions quickly

- Many altcoins are supported by Coinbase

- Requires low minimum balances

Cons:

- The fee schedule that is complex

- Other platforms have a higher cost of trading

Your money is at risk.

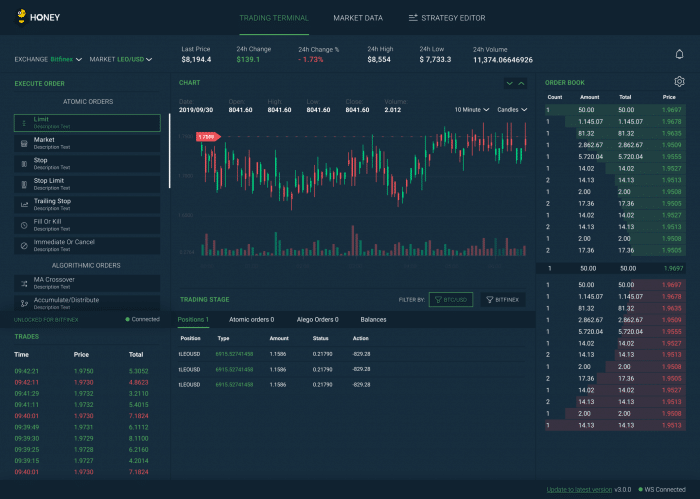

5. Bitfinex – One of the Oldest Exchanges in the World

Bitcoin exchange Bitfinex was founded in 2012, making it one of the oldest in the world. Bitfinex is headquartered in Hong Kong, and iFinex Inc manages it. It is one of the most liquid cryptocurrency exchanges globally, specializing in digital tokens (BTC/USD pairs) and seven other major altcoins such as Ethereum and Monero.

Bitfinex has had an uneven start; as a trading platform; soon after its introduction, the exchange was involved in two hacks and faced several other controversies, including allegations of insolvency and price manipulation. It has nevertheless managed to become one of the largest crypto exchanges in the world in terms of volume because of its unique features.

Margin-trading is available on the Bitfinex exchange, and in-house indicators for both Bitcoin longs and shorts provide trading signals to other major players in the market. Additionally, the exchange supports fiat trading, deposits, and withdrawals.

As a result of the backlog of applicants, it might take a long time for a new user to complete the verification process. However, the fact that traders are keen to use the platform despite a long verification process and a turbulent record speaks well for the exchange.

Bitfinex fees

| Fee | Amount |

| Cryptocurrency trading fees | A fee of 0.20% for all coins |

| Fee for inactivity | It’s free |

| Fees for withdrawals | Cryptocurrency deposits are free. There is a fee of 0.100% for deposits and withdrawals in fiat, with a minimum fee of $60. |

Pros:

- That is best suited to experienced traders.

- Supports more than 100 crypto coins.

- Trades who lost money during the 2016 crypto hack on the exchange were repaid by ethical.

- Wire transfers can be used for deposits and withdrawals.

Cons:

- US clients are not supported.

- Fees for trading are high.

- A non-regulated exchange.

- Deposits cannot be made with debit/credit cards or e-wallets.

Your money is at risk.

6. Bittrex – Excellent for IOTA Coin Trading

Bittrex is a blockchain crypto platform that offers crypto trading, digital wallet services, account security, and more. Bittrex Global, its counterpart, specializes in international trading.

Another platform feature is placing instant buy/sell orders, storing multiple wallets, and automating trading. Rami Kawach, Richie Lai, and Bill Shihara founded the company in 2014.

Bittrex’s mobile app is compatible with Android and iOS devices.

Bittrex fees

| Fee | Amount |

| Cryptocurrency trading fees | 0.50% per trade when you buy and sell |

| Fee for inactivity | It’s free |

| Fees for withdrawals | Variable but low |

Pros:

- The minimum account balance is low

- A total of more than 100 coins

- There are several trading pairs

- A debit card, ACH transfer, or wire transfer can be used to fund the account

- Cold storage of assets and two-factor authentication

Cons:

- Margin trading is not allowed

- Beginners have limited access to educational resources

- Customer service is limited

- Customer access issues are reported regularly in the Better Business Bureau profile

- Residents of New York, Connecticut, Vermont, and Hawaii are not eligible

Your money is at risk.

Where to Buy IOTA – Fee Comparison

| Platform | Crypto trading fee | Inactivity fee | Withdrawal fee |

| eToro | Spread, 0.75% for Bitcoin | $10 a month after one year | $5 |

| Binance | Commission, starting from 0.1% | Free | 0.80 EUR (SEPA bank transfer) |

| Coinbase | Commission, starting from 0.50% | Free | 1.49% to a U.S. bank account |

| Bitfinex | A fee of 0.20% for all coins | Free | For fiat withdrawals, the fee is 0.100% with a minimum of $60. |

| Bittrex | 0.50% per trade when you buy and sell | Free | Variable but low |

What is IOTA?

Using distributed ledger technology, IOTA is a popular decentralized project. MIOTA is the native currency of the network. IOTA is a network that connects everyday people to the Internet of Things (IoT).

IOTA is self-described as a non-profit organization, but several key partnerships have been formed. Among them are Volkswagen and Bosch.

- IOTA performs significantly better than other blockchain projects like Bitcoin.

- In contrast to Bitcoin, IOTA transactions are fully confirmed within ten seconds.

- Sending payments on the Bitcoin network can be expensive during busy periods.

- IOTA transactions, on the other hand, are free.

Though IOTA can transform the IoT in the future, most people purchase the coins speculative. IOTA buyers believe the digital currency will rise in value with time.

Why Buy IOTA?

According to the above – and as in the case of all digital currencies – IOTA buyers are primarily interested in making a profit. Even though it was launched in 2016, this digital currency has done well. In 2017, IOTA first appeared on a public exchange at a price of around $0.50, according to CoinMarketCap.

The price of IOTA surpassed $5 per coin by the end of the year. That is an increase of over 900%. However, the price of IOTA has dropped by a significant amount since its peak at $5. The price of IOTA fell to $0.17 during the Coronavirus pandemic in April 2020.

The dip proved profitable for those who purchased IOTA – it breached $2.56 just 12 months later. That results in gains of over 1,400% in one year. The price of IOTA dropped to $2.20. Accordingly, at current prices, there is a possibility of a discount.

You may find that buying IOTA is a good option if you plan to build a significant position without investing a lot of money.

By investing £200 in IOTA, you would get approximately 126 coins in return. Accordingly, eToro is an FCA-registered broker with a minimum investment of $25. Therefore, you can dip your toes into the crypto market without breaking the bank.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How Much Does It Cost to Buy IOTA?

At the time of writing, IOTA was priced at $1.14 per coin. Its price is listed in US dollars, like all crypto assets. You will still be able to participate despite this.

With payment methods, you can deposit funds in pounds and pence – and your chosen broker will convert them into USD. Your trading platform will determine how much you need to pay for IOTA. On one end of the spectrum, you have brokers such as Coinbase – which charges 3.99% to purchase a digital currency using a debit card.

Some platforms – like Coinmama – charge even more. Another example is eToro, which offers commission-free IOTA purchases with a 0.5% deposit fee.

How to Buy IOTA with PayPal

One of the world’s most popular payment methods is PayPal. Unfortunately, PayPal still makes it difficult to buy cryptocurrencies.

Using PayPal to purchase bitcoins is possible, but the fees are often eye-watering – more than 10%.

The popular eToro platform is an alternative. PayPal can be used to deposit money here, and you can purchase IOTA and other cryptocurrencies through the platform as well.

However, eToro’s pay-out options are still limited. Before sending coins to any other wallet than the eToro wallet, you must reach a certain trading status.

However, we believe that eToro is the best choice for investors who only have PayPal as a deposit method since it is one of the few trading platforms to be fully regulated (U.K. – FCA 7973792, E.U. – CySEC 109/10).

If an investor’s funds are lost, it offers deposit protection.

How to Buy IOTA with Bitcoin

Purchasing IOTA is also straightforward if you already own a cryptocurrency like Bitcoin. But, first, you’ll have to deposit Bitcoin into an exchange and swap it for IOTA.

Binance is an excellent option if you’re looking to use a platform for this purpose. Due to its low trading fees, fast deposits and withdrawals, and availability of liquidity, you will never have problems with the third-party exchange.

IOTA can be bought on Binance using Bitcoin by following the steps below:

- Create an account with Binance. You do not need to provide personal information or upload your I.D. when depositing funds using cryptocurrency.

- Copy your unique wallet address from the deposit page, then head to the deposit page and search for Bitcoin.

- Having pasted the wallet address into your wallet, you are now ready to transfer the funds to Binance.

- Within 20 minutes, your Binance wallet should show the Bitcoin.

The funds must then be exchanged once they arrive.

- Look for the IOTA/BTC pair. By doing so, you are exchanging Bitcoin for IOTA.

- Look for the order box at the bottom of the trading screen

- For immediate execution of your order, click on the ‘Market’ button.

- Please enter the amount of Bitcoin you wish to exchange for IOTA. The slider should be set to 100% if you wish to exchange the entire amount.

- Verify the order.

Your Binance wallet will be credited with IOTA coins. They can be left there, or you can withdraw them to a private IOTA wallet of your choice.

Buying IOTA Safely

Using an FCA-regulated broker like eToro to buy IOTA is safe and secure. However, a purchase made on an unregulated exchange puts your funds at risk.

Risks of Buying IOTA

As with many cryptocurrencies, the IOTA protocol has been in development since 2016 when it was founded by David Sonstebo, Sergey Ivancheglo, Dominik Schiener, and Serguei Popov, who are part of the IOTA Foundation, an organization that is driving the development of the technology and the process of its wide adoption.

The technology underpins IOTA as a platform of interconnected nodes differently from blockchains.

A user of IOTA must confirm two non-personal transactions before their own can be finalized. There are two reasons for this:

IOTA, unlike many other cryptocurrencies, does not have miners. IOTA users, however, must resolve the mathematical algorithms that verify each transaction so that each transaction can be verified as in bitcoin.

As an alternative, this transaction verification process can be completed using mobile phones and computers. There is no need for mining farms or highly powerful (and wear-and-tear) graphics cards. IOTA has an advantage over bitcoin since it does not involve the energy consumption that bitcoin requires and for which it has been widely criticized recently from an environmental standpoint.

Selling IOTA

Selling IOTA is relatively easy, especially if you bought it. Whatever the case may be, whether an asset or another cryptocurrency is traded depends on the availability of liquidity. Liquidity refers to demand. A crypto asset is sold if its market value is equal to or greater than its purchase price.

Due to its position among cryptocurrencies, IOTA has a high liquidity level. Therefore, make sure there’s an appropriate withdrawal method before you attempt to sell your IOTAasset.

As a trustworthy broker you can rely on at any time, eToro is included in all of our articles, including the guides on ‘How to Sell Bitcoin’ and ‘How to Buy Bitcoin.’ eToro ranks among the top 10 cryptocurrencies exchanges worldwide.

Either new or experienced traders can take advantage of the eToro platform. Trading and other crypto-related tasks are made simpler by each feature on the platform. Because of this, novice investors can use eToro to trade IOTA or any other cryptocurrency without making errors. It is easy to use for novice investors.

eToro is also one of the few cryptocurrency exchanges that offer tutorials on storing coins on their platform. In general, these guides are extremely helpful in instructing beginners about cryptocurrency and trading.

Throughout this guide, we will cover five simple steps for selling IOTA on eToro. The steps above should make selling on the platform easy if you follow them carefully.

IOTA Price Prediction

According to optimistic evangelists, even if the price of IOTA reaches the moon by 70% in 2021, it is still unlikely since the Covid-19 vaccine will only be available by mid-2021. MIOTA prices are rising daily at $2.22, with a circulating supply of 2,779,530,283 MIOTA. There is a market capitalization of $6,086,761,352.

The IOTA coin is characterized by its volatility, so any price prediction that is too far-fetched would be futile. However, based on expert price forecasts and market sentiment, the mood appears to be pretty positive.

When considering the developing features of MIOTA being easy to store and additional DLT-driven advantages, IOTA crypto would be pivotal to the gradual advancement of the ledger database for scalability and storage. IOTA also makes transactions more reliable and efficient because the devices that operate it share logic and databases. By the end of 2021, this may drive the IOTA adaptability rate up to around $4.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Where to Buy IOTA

We will walk you through the investment process step-by-step in this guide on how to buy IOTA. We will demonstrate buying IOTA without paying a commission at FCA-regulated broker eToro.

Best Way to Buy IOTA – eToro Tutorial

Step 1: Open an Account

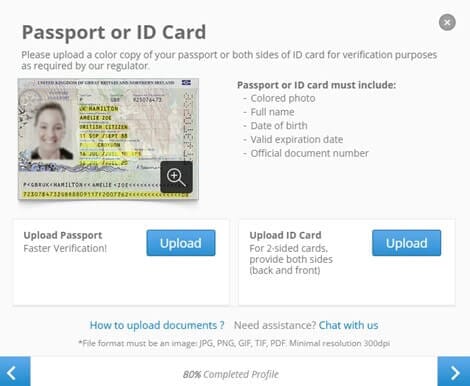

IOTA purchases on eToro must be accompanied by the opening of an account since it is heavily regulated. However, it takes just a few minutes and requires some personal information. You will then be asked to upload a copy of your passport or driver’s license – as required by anti-money laundering regulations.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

However, if you’re not planning on depositing more than $2,250 at this time, you can complete the verification process later. However, it must be done before you can withdraw funds from eToro, so it might be best to do it now.

Step 2: Upload ID

eToro does not allow you to trade until you verify your identity. Brokers are required to conduct Know Your Customer (KYC) procedures due to their FCA regulations. Documentation verifying your identity and financial background must also be uploaded along with your personal information. In addition, you must provide proof of your identity and address.

Step 3: Deposit Funds

Customers can deposit $10 for their first deposit at eToro. There are several payment methods available:

- Debit Card

- Credit Card

- Paypal

- Skrill

- Neteller

- Local Bank Transfer

The IOTA investment minimum is only $10 once you make a deposit – so you don’t need to allocate the entire amount at once.

Step 4: Buy IOTA

The last step is to complete your IOTA order at eToro. Then, just enter your stake in U.S. dollars in the box below.

Conclusion

After you invest, you may be affected by outside factors. The current price of Iota could still suffer from the negative effects of the cryptocurrency market, even if it is making all the right moves to become the Internet of things’ common currency. ICOs like EOS can fail due to glitches, exchange hacks, bitcoin “whale” selling, or even hacks caused by exchanges. We could all decide to sell everything if the world economy enters a recession, like 1929 or 2009.

eToro – Best Crypto Exchange to Buy IOTA in the US With 0% Commission

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.