TD Ameritrade vs eTrade – Which Broker Is Best in 2026

If you’re on the search for a top-rated and cheap online broker, you may have already encountered so many different options. But, trading online only requires one broker, so this begs the question: which platform should you choose? Read our thorough TD Ameritrade vs eTrade comparison to find out.

This review explores all key areas from trading fees to safety and regulation. By the end of this guide, you will have everything you need to choose the right broker for you. Which trading platform claims the number one spot in our list of cheapest brokers for 2026?

TD Ameritrade vs eTrade Comparison

What are TD Ameritrade and eTrade?

Simply put, TD Ameritrade and eTrade are both online trading platforms that offer tradable assets at the click of a button. All you have to do is create a brokerage account to gain access to everything including stocks, ETFs, and cryptocurrencies.

Depending on the type of trader you are there are some key differences between the two brokers, but more on this later. Let’s dive straight in.

eTrade is a US-based trading platform that was launched in 1982. In terms of fundamentals, eTrade is subject to regulation from top-level financial authorities including the SEC (Securities and Exchange Commission) and FINRA (the Financial Industry Regulatory Authority).

eTrade and TD Ameritrade are regarded as secure stockbrokers because they both have extensive track records, are listed on the NASDAQ, and are regulated by major US financial regulators. eTrade is now owned by Morgan Stanley, after the investment banking company completed the acquisition in an all-stock transaction in October 2020.

Trading costs are very important when weighing up your options to select an online broker that suits your trading needs. eTrade offers minimal trading costs, such as free stock and ETF trades. Its mobile trading platform is one of the most popular on the market and has an array of useful research tools like strategy builders and robo-advisor features.

If you’re a trader with an eye out for international market trading then look elsewhere because eTrade’s product portfolio only covers US financial markets. In addition, this trading platform does not support forex trading either.

TD Ameritrade is one of the largest US-based trading platforms and was launched in 1975. As you would expect it also falls under regulation from top financial authorities such as the FINRA or Financial Industry Regulatory Authority, the SEC or Securities and Exchange Commission, and the CFTC or the Commodity Futures Trading Commission.

TD Ameritrade vs eTrade Tradable Assets

Let’s take a look at the types of tradable assets both brokers have on offer to help you decide which broker offers exactly what you are looking for.

There are a variety of tradable assets on offer with eTrade such as stocks, futures, options, ETFs, mutual funds, bonds and CDs, and prebuilt portfolios. However, these are only available on the US market and those of you who are forex or CFD traders look away now because eTrade does not offer forex trading or CFDs.

On the other hand, TD Ameritrade does offer forex trading. You can trade different assets, from options to crypto and forex, as well as taking full advantage of its robo-advisory and social trading features. TD Ameritrade also does not offer CFDs.

If you pick TD Ameritrade as your chosen broker you can trade forex via its Thinkorswim platform. This is one of the main points that gives TD Ameritrade an advantage over its main competition.

Mutual funds

Both TD Ameritrade and eTrade only cover products from the US market. TD Ameritrade offers more than 13,000 mutual funds from leading fund providers and a wide selection of NFT funds. Mutual fund trading at TD Ameritrade and eTrade covers different investment goals, asset classes, and volatility exposure. With a range of tools and resources, you can pick funds that suit your trading goals.

But why invest in mutual funds in the first place? Selecting your own blend of mutual funds is an effective and steadfast method of diversifying your investment portfolio.

Futures

eTrade’s offering of futures is satisfactory as its users can trade futures on three exchanges as well as having access to Bitcoin future trading. TD Ameritrade provides the same futures trading on the following exchanges LIFFE, CME, ICE, CFE, and ICE EU.

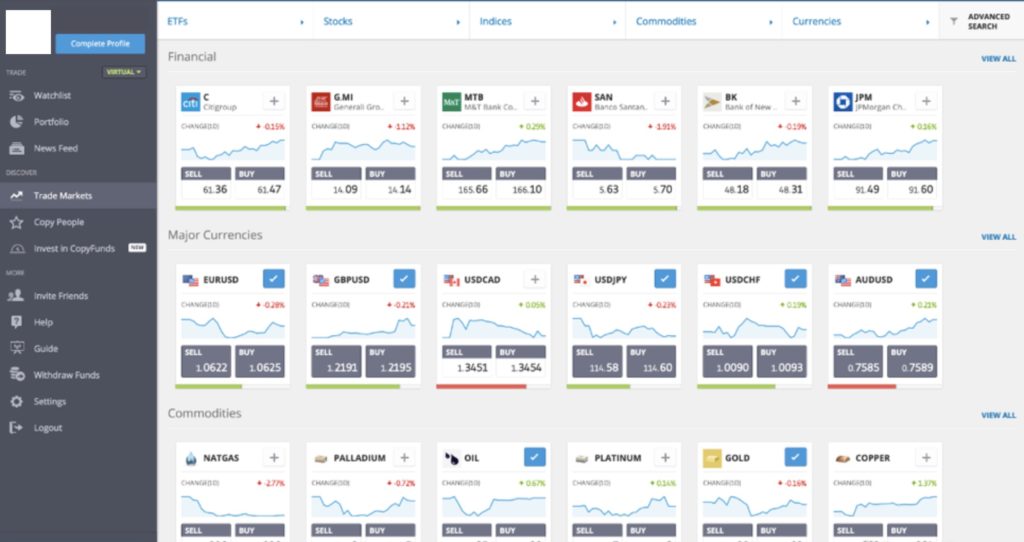

Social Trading

TD Ameritrade offers social trading through its social trading platform Thinkorswim. By navigating to the tools tab you can create a public profile and track other investors, interact with them via social media like chat rooms, and give details about your individual trading outcomes.

This is perfect for beginner traders who are looking for guidance or want to copy other traders’ investment strategies. Completing your copied trade can be made easier with the click of a button. You can also use unique research resources and chart data created by the trading community on Thinkorswim.

Managed portfolios

What is a managed investment portfolio? If you are a long-term investor and want to save time then a managed portfolio may be exactly what you need. TD Ameritrade and eTrade offer managed portfolios that are goal-oriented portfolios. All you have to do is fill in a number of questions regarding your trading objectives, risk threshold, and time scale and the broker will recommend a managed portfolio that suits your goals.

There are three managed portfolios available at TD Ameritrade which are as follows: Personalized Portfolios, Selective Portfolios, and Essential Portfolios. These managed portfolios are great if you are a beginner trader and need extra support and guidance.

TD Ameritrade’s Essential Portfolio is a robo-advisory service. Robo-advisors are online trading platforms that give financial planning strategies based on advanced algorithms. Usually, a robo-advisor gathers data from traders about their trading objectives through an online questionnaire and then bases its trading advice and strategies on that data while also investing the assets based on the users’ preferences. TD Ameritrade’s Selective Portfolios come with an advisory cost and require a minimum investment of $25,000.

eTrade offers 4 managed portfolios to help its traders reach their trading objectives – these include Blend Portfolios, Dedicated Portfolios, Fixed Income Portfolios, and Core Portfolios. There is a huge variety of products and the managed portfolios the eTrade has on offer are very user-friendly and fully customizable.

TD Ameritrade vs eTrade Account Types

In this section of our TD Ameritrade vs eTrade review, we explored what account types are available. Put simply, both TD Ameritrade and eTrade offer plenty of account types to cover all traders’ needs.

With that said, both stockbrokers offer online brokerage accounts such as standard brokerage accounts, retirement accounts including traditional and Roth IRA accounts, education accounts, speciality accounts, managed portfolios as we have already mentioned, margin and automated trading accounts.

TD Ameritrade vs eTrade Fees & Commissions

As we mentioned before, TD Ameritrade and eTrade are both low-cost stockbrokers especially as there are no account minimums. Nevertheless, there are numerous fees that you should take into consideration before opening any brokerage account with a broker.

Therefore, we’ve broken down the key fees that you are most likely to encounter when using either TD Ameritrade or eTrade.

| Commission (US stocks) | Mutual fund | Inactivity fee | USD margin rate | Deposit fee | Withdrawal fee | Account fee | |

| TD Ameritrade | $0 | $49.99 | No | 9.5% | $0 | $0 | No |

| eTrade | $0 | $19.99 | No | 6.45% | $0 | $0 | No |

Both trading platforms have low non-trading fees including no deposit fees, withdrawal fees, inactivity fees, annual fees, or account fees. More importantly, stock and ETF trading is free, while TD Ameritrade also offers low forex trading fees which sets it apart from eTrade due to the fact that it doesn’t offer forex trading at all.

All in all, both trading platforms provide a low-cost way to buy and sell financial instruments without having to leave your home. However, it depends on your trading preferences and if you’re a keen forex trader, whether you choose TD Ameritrade or eTrade.

Stocks

With TD Ameritrade $0 commission applies to stocks, options, and ETFs that are listed on a U.S. exchange. In terms of options trades without assignment fees, a $0.65 per contract fee is charged $0.65 per contract for options trades, with no exercise or assignment fees. Online OTC (over-the-counter) stock trades have a $6.95 commission fee.

Margin

If you’re the type of trader who favors margin trading, which essentially means that you trade with borrowed funds from the trading platform itself, then TD Ameritrade charges 9.5%, and eTrade charges a 6.45% interest rate, more commonly known as the margin rate in financial trading terms.

TD Ameritrade vs eTrade User Experience

TD Ameritrade offers a well-rounded web trading platform built on a user-friendly and simple design and interface. On the other hand, the web trading platform cannot be customized.

TD Ameritrade offers web, desktop, and mobile trading platforms. For new traders, the TD Ameritrade web trading platform is apt for placing trades and researching tradable assets such as stocks and ETFs.

On the flip side, if you are an experienced and advanced trader who favors trading complex financial assets, Thinkorswim, TD Ameritrade fully-developed desktop platform could be perfectly suited for you. Thinkorswim offers a wider range of products including forex trading and futures trading and has state-of-the-art technical analysis and financial research tools.

In terms of design, the TD Ameritrade web trading platform is simple to use and has good overall functionality to give users what they are looking for.

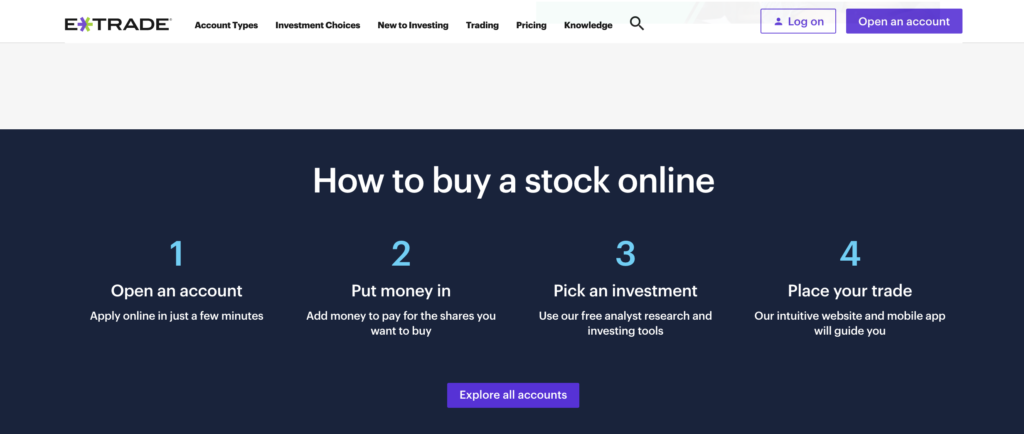

eTrade offers a fully-fledged web trading platform along with a mobile trading platform. The eTrade web trading platform offers tradable assets including stocks, ETFs, bonds, mutual funds, and options. It has a very user-friendly interface and is easy to use, making it very similar to TD Ameritrade in many respects. One thing to note is that eTrade does not offer a desktop trading platform to new traders. To sum up, both are very similar in terms of style and design and offer all the functionality that both new and experienced traders would need to trade with the click of a button.

When it comes to placing orders, both trading platforms offer a range of different order types from stop and stop limits to Market on Close and Trailing Stop %. There are also more complex order types such as GTD and FOK which would suit the more seasoned investors.

TD Ameritrade vs eTrade Mobile App

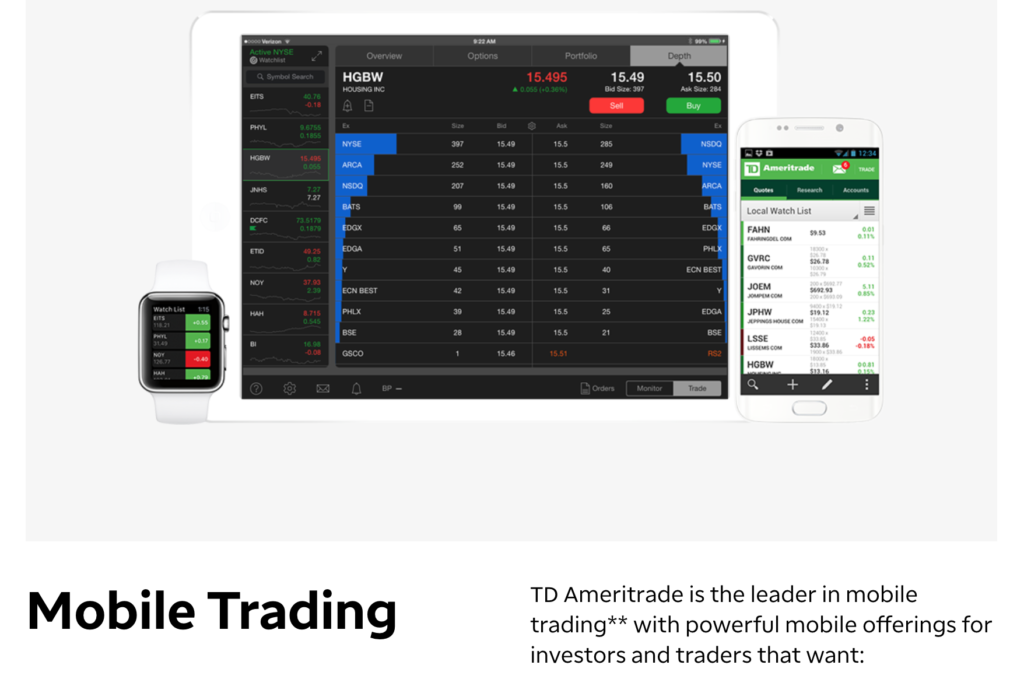

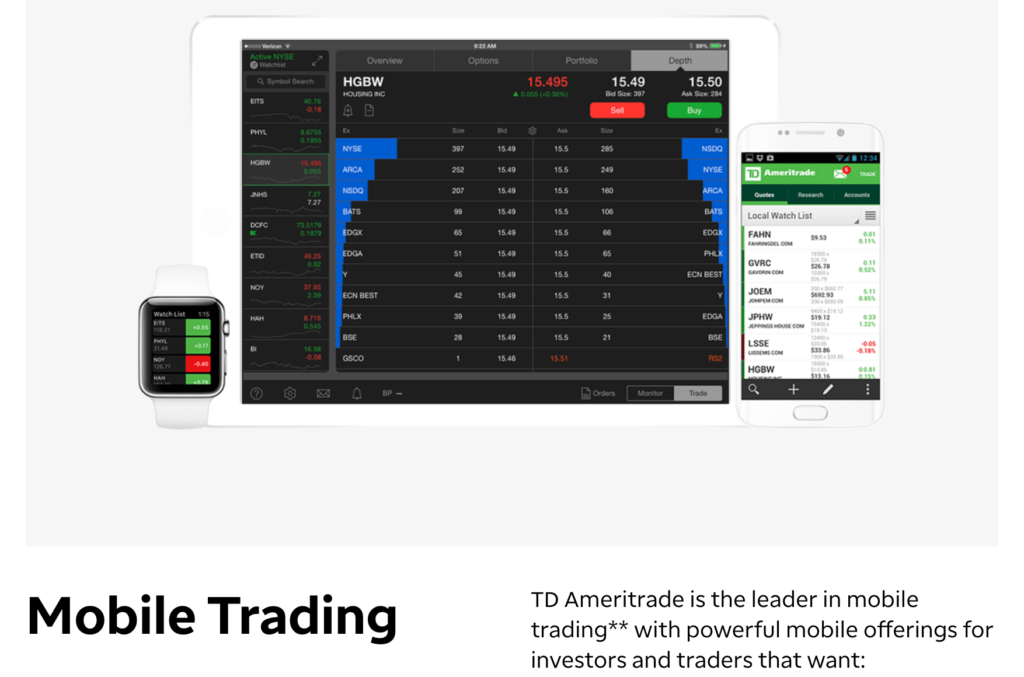

Both TD Ameritrade and eTrade enable mobile trading via in-house developed mobile trading apps. These are available on either iOS and Android devices – allowing you to sell and buy assets when you’re on the go. With regards to the user experience, this more or less reflects the verdict that we offered in the previous section.

The eTrade mobile trading app is easy to use and offers one-step login authentication. When it comes to performance and configuration, it’s very similar to the web trading platform. It offers good search functionality; a broad selection of order types, and you can toggle notifications on and off depending on your preferences.

TD Ameritrade’s mobile trading apps are superb. They are easy to use and are designed with both beginner and experienced traders in mind. The two mobile trading apps are TD Ameritrade Mobile and Thinkorswim TD Ameritrade Mobile Trader. Both mobile trading apps are optimized for Apple Watch which is a rarity amongst brokers. This gives traders the chance to trade stocks and ETFs via a mobile device strapped to their wrist.

TD Ameritrade’s mobile trading application is user-friendly, offers two-step authentication login, search functions, and allows you to easily set notifications.

This is particularly useful for investors who want to be updated regularly about ongoing trades. Let’s say, you have a position open on crude oil – whereby you have stop-loss and market orders pending. The mobile trading app will send a real-time push notification to your mobile device once your orders are matched by the markets.

TD Ameritrade vs eTrade Trading Tools, Education, Research & Analysis

Both eTrade and TD Ameritrade offer top-rated research tools, trade ideas, data on asset fundamentals, and a wide range of educational resources to help build your trading knowledge.

If you are new to online trading or just putting your trading strategy to the test then these two trading platforms will suit you. TD Ameritrade and eTrade provide trading ideas for stocks, ETFs, mutual funds, and more. These trading ideas come from third-party sources; the likes of Thomas Reuters and Morningstar to name a few.

eTrade and TD Ameritrade both provide fundamental analysis, predominantly on stocks. Traders can study financial statements for the last five years.

Charting

TD Ameritrade has fully-developed charting tools. There are 400 technical indicators to use and the charts can be tweaked very easily. The sheer amount of technical indicators that this broker has on offer is unrivaled amongst competitors.

In comparison, eTrade has satisfactory charting tools and the ability to make use of 30 technical indicators. The charts can be easily edited but lack in the number of technical indicators when compared to TD Ameritrade. Technical indicators are analytical signals yielded by the price, volume, and interest of either a contract or security used by investors who use technical analysis to forecast market movements.

TD Ameritrade vs eTrade Demo Account

Demo accounts are great if you are just testing the waters of the online trading universe. Without beating around the bush, they enable you to trade with virtual money or paper trading funds as they are commonly termed. This means that you can buy and sell tradable assets without the risk of losing your money. Our TD Ameritrade vs eTrade comparison found that both brokers offer a demo trading account.

With a TD Ameritrade paperMoney demo account, you start off with $100,000 of paper funds, giving you the opportunity to trade any financial instrument offered by the broker.

TD Ameritrade vs eTrade Payments

At eTrade and TD Ameritrade the only available base currency is USD. This means that for those who have a personal bank account in a different currency, you will incur conversion fees.

So how can you reduce or avoid currency conversion fees altogether? An effective solution is to open a multi-currency bank account with a digital bank such as Ally Bank in the US or Starling in the UK. Digital banks usually provide bank accounts in multiple currencies with good exchange rates, in addition to zero-cost international bank transfers. In terms of safety and regulation, most digital banks are regulated by top-tier financial authorities which protect users’ accounts in case the company goes bust. It’s also easy to create and open an account, usually taking a matter of minutes on your mobile device.

Next in our eTrade and TD Ameritrade review comes the matter of deposit fees and options. Both stockbrokers do not charge any fees for deposits. US traders can deposit cash via ACH (automated clearing house payments), checks, and wire transfers to make deposits.

On the other hand, debit cards, credit cards, and e-wallets such as Paypal and Skrill are not accepted as payment methods to make deposits. However, there is an exception to this rule when it comes to eTrade. eTrade debit and credit cards are available means for depositing cash.

An ACH transfer usually takes between one and two business days. The minimum transfer amount for TD Ameritrade clients is $50.

What about minimum deposits? The minimum deposit for both TD Ameritrade and eTrade is $0, but this varies depending on the type of account you choose and your trading strategy for example if you trade with either trading platforms’ margin accounts there is a required minimum deposit of £2,000.

| Minimum Deposit for basic brokerage accounts | Deposit Fee | ACH Transfer Processing Time | Withdrawal Fee | |

| TD Ameritrade | $0 | $0 | 1-2 days | $0 |

| eTrade | $0 | $0 | 1-2 days | $0 |

TD Ameritrade vs eTrade Customer Service

Our TD Ameritrade vs eTrade review concluded that both brokers offer telephone, email, and live chat as means of contact. Sometimes, you can get through to customer support immediately, but during heightened demand waiting times may increase. Both trading platforms offer 24/7 customer support.

In terms of responsiveness both TD Ameritrade and eTrade usually, reply to emails within 1 business day.

TD Ameritrade vs eTrade Safety & Regulation

When it comes to regulation and safety, our eTrade vs TD Ameritrade comparison found that both trading platforms are regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). Both stockbrokers are also insured by the US investor protection scheme (SIPC).

The US investor protection scheme or SIPC for short covers against the securities and cash losses in the event that the trading platform goes out of business. The SIPC cover protection is capped at $500,000, including a $250,000 cap for cash. This is noticeably more when compared to other US investor protection schemes.

Another important note to mention here is that for TD Ameritrade users, despite futures & forex trading is regulated by the CFTC it does not offer protection against losses should the broker go bust.

Both brokers also do not offer negative balance protection. But why is negative balance protection so important? Negative balance protection means brokerage account holders cannot lose more money than that which has been deposited. Simply put, you won’t end up owing money to the trading platform.

For example, if you deposited $1,000 to your brokerage account and entered a CFD trade with a 10:1 leverage, you would have a position of $10,000. Let’s say market volatility makes your position plummet by a quarter, you would end up incurring a 250% loss as a result of the leverage. This equates to a $2,500 loss. This is where negative balance protection comes in. Your $1,000 deposit would not cover the loss and you would be in a $1,500 debt.

The Verdict

In summary, both TD Ameritrade and eTrade are very popular US-based trading platforms – and for good reason. For example, both platforms allow you to sell and buy stock and ETFs commission-free, both are user-friendly and have great designs, and both offer 24/7 customer support via telephone, email, and live chat features.

If you want to start trading with the best free trading platform with zero and low fees straight away – TD Ameritrade is the way to go. There are heaps of tradable assets from dozens of international markets. Opening an account is straightforward and the minimum investment starts from $1!

Your capital is at risk. Other fees apply.