Merrill Edge vs Fidelity – Cheapest Broker Revealed

In this Merrill Edge vs Fidelity comparison, we will cover all the key metrics from fees and commissions to payments and tradable assets. So, keep reading as we reveal our top recommended broker for 2026.

Buying and selling shares and other assets from the comfort of your own home has never been easier. However, to do this you will need a top-rated online broker. With so many options out there, how do you decide which trading platform is best for you? Keep scrolling to find out.

Merrill Edge vs Fidelity Comparison

Merrill Edge

Visit SiteMerrill, Merrill Lynch, and/or Merrill Edge investment advisory programs are offered by Merrill Lynch, Pierce, Fenner & Smith Incorporated ("MLPF&S") and Managed Account Advisors LLC ("MAA") an affiliate of MLPF&S. MLPF&S and MAA are registered investment advisers. Investment adviser registration does not imply a certain level of skill or training.......

What are Merrill Edge and Fidelity?

Merrill Edge and Fidelity are online trading platforms that allow you to trade and invest in financial instruments with ease. Both brokers are aimed at the beginner, intermediate, and advanced investors.

The list of markets and products include stocks, ETFs, futures trading, bonds, and options. There are a couple of key factors that separate these brokers and depending on your investment goals you will be able to decide which platform suits you best.

Merrill Edge and Fidelity are free trading platforms that offer commission-free stock and ETF trading. As a result, both brokers have attracted a large number of clients. In particular, Fidelity has around 35 million active traders and Merrill Edge has approximately 2.4 million users.

As for the fundamentals, Fidelity and Merrill Edge are regulated by top financial authorities including the Financial Industry Regulatory Authority, and the US Securities and Exchange Commission. All in all, with access to free ETF and stock trading it is easy to see why so many people trust and use these brokers on a daily basis. Commission-free trading helps to keep expenses to a minimum.

Merrill Edge vs Fidelity Tradable Assets

In this section of our Fidelity vs Merrill Edge review, we will cover the different types of securities you can trade and invest in.

Stocks and ETFs

The majority of beginner traders prefer to trade and invest in stocks and ETFs because of their high liquidity and accessibility. Stock markets make it easy to buy and sell shares of stocks that are listed on major exchanges such as the LSE, NYSE, and the NASDAQ.

Once you have opened an account and deposited funds, you can purchase and sell shares through Fidelity and Merrill Edge. Furthermore, both brokers charge 0% commission for trading stocks and ETFs.

With Fidelity, you can access fractional shares and dollar-based trading on a low-cost basis. Fractional shares are an effective way to diversify your investment portfolio on a budget. You can get started with zero-commission trades of US stocks and ETFs with no account minimums or account fees, and opening an account with Fidelity is easy and fully digital.

Trading and investing in fractional shares has been adopted by mainstream brokerage firms nowadays as they offer great flexibility and liquidity for new and advanced investors. With that said, you can buy and sell US stocks and ETFs with as little as $1 per order. Fidelity has tons on offer, with more than 7,000 US-listed stocks and ETFs available for fractional share trading.

If you’re unfamiliar with fractional share trading, here’s a quick breakdown of how it works on Fidelity.

- Let’s suppose you want to invest $100 in Microsoft stock

- Type in the ticker symbol and tap on the relevant result

- Click on transact, and then trade from the Fidelity native mobile trading app

- Specify the action, quantity type, and quantity of your trade

- If the price of Microsoft shares was $1,000 you would then own 10% of the fractional share.

On the flip side, you cannot buy fractional shares directly from Merrill Edge, but you can reinvest dividends in fractional shares. Dividend reinvestments occur when you use cash dividends given by a fund or company to purchase additional shares of the same investment.

Fidelity also covers 22 different stock markets which means that you can access shares of stock listed on non-US stock exchanges thus allowing you to build a diversified investment portfolio. Merrill Edge on the other hand is restricted to US stock exchanges only. However, with Merrill Edge, you can also invest in penny stocks.

If ETF trading is more your style then Merrill Edge will certainly impress you with more than 2,000 different exchange-traded funds for you to choose from.

Both brokers offer stock, ETF, mutual funds, bonds, and options trades. But, if you are looking for a trading platform that facilitates forex trading, futures, CFDs, and cryptocurrency trades then you will have to look elsewhere. Having said this, there is a third alternative broker that we have in mind, but more on this later on.

Merrill Edge vs Fidelity Account Types

Merrill Edge has a wide variety of account types and depending on your life situation, financial goals, and investment objectives, you can choose the right account type that suits your needs. Certain accounts provide some tax advantages that are suited to your trading goals, such as retirement and education accounts; whereas other account types are a better option if you are looking for higher fund liquidity.

With that said, Merrill Edge offers the following account types:

- Retirement accounts – including Roth IRA, Traditional IRA, Small business 401(k) plan, SEP IRA, and SIMPLE IRA.

- College planning – 529 college savings plans, Custodial accounts (UGMA and UTMA) which allow you to invest on behalf of a minor.

- Investing and savings accounts – individual online brokerage account, a custodial account, bank accounts.

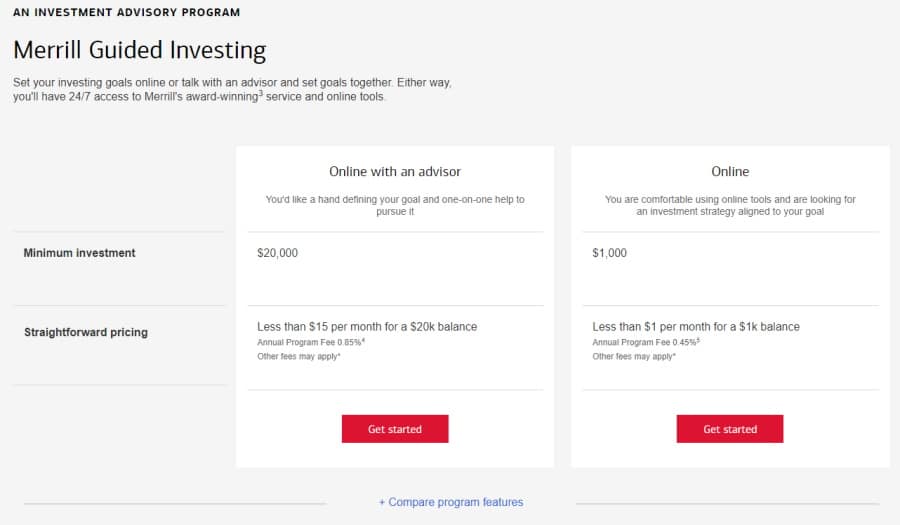

- Managed portfolios – Merrill Guided Investing, and Invest with an advisor.

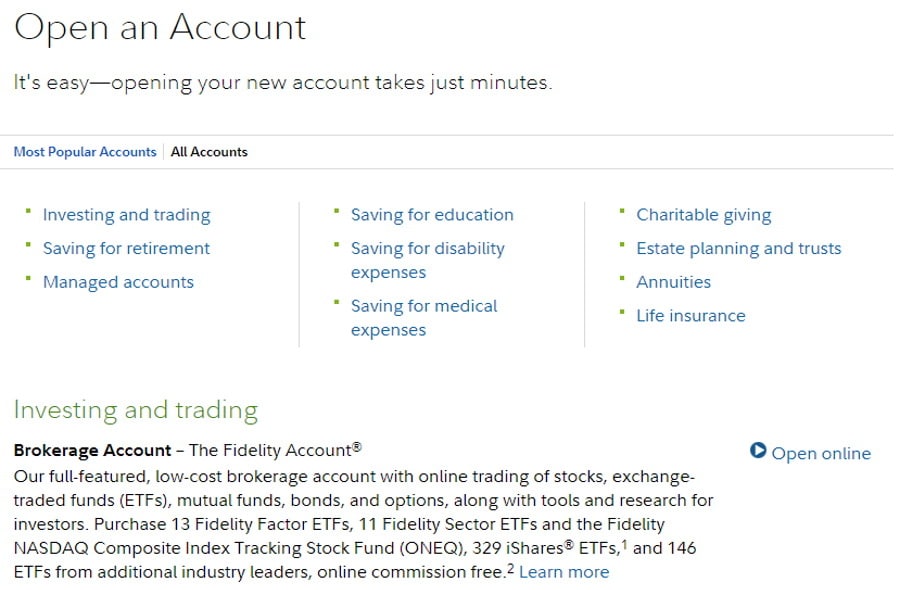

Fidelity also offers a huge selection of account types from saving for retirement accounts to individual brokerage accounts. Opening an account is simple, easy, and fully digital.

- Retirement accounts – Rollover IRA, Traditional IRA, Roth IRA

- Investing and trading accounts – brokerage account, brokerage, and cash management account

- Saving for education accounts – 529 account

- Managed accounts – Fidelity Go account, Fidelity Personalized Planning and Advice, Portfolio Advisory Services Accounts.

Merrill Edge vs Fidelity Fees & Commissions

As we have already discussed, both Merrill Edge and Fidelity are discount brokers, which means that trading and non-trading fees are kept to a minimum. Nevertheless, there are several key fee types that you need to bear in mind when choosing and opening a brokerage account.

Share dealing fees

Both Fidelity and Merrill Edge allow you to buy and sell ETFs and stocks without having to pay share dealing fees. Most brokers nowadays are offering commission-free trading, and the main benefit of that is it helps you to keep your trading costs to a bare minimum.

Fidelity charges $0.65 per options contract, 0% commission for stock and ETF trades, $1 per CDs and bond in secondary trading, and $0 for US Treasuries which are bought and sold online. When we compared Fidelity’s non-trading fees with those of its competitors we found that it has very low fees. For example, it does not charge a fee for ACATS transfers, and IRA closeouts.

With Merrill Edge, there are no account fees, account minimums, but there is a $49.95 charge for a full account transfer.

When it comes to margin trading Merrill Edge’s lending base rate is 5.25%, and the effective margin rate is volume-tiered which means that the effective rate depends on the margin amount.

Fidelity’s base margin rate is 7.075% and has been effective since March 2020. The interest rate varies depending on a tiered schedule with larger margin loans incurring less interest.

It is worth mentioning that both brokers do not charge account, inactivity, deposit, and withdrawal fees.

Fidelity also provides foreign currency transfer services to facilitate your investment goals. The following currencies are supported:

- Australian dollar (AUD)

- British pound (GBP)

- Canadian dollar (CAD)

- Danish krone (DKK)

- Euro (EUR)

- Hong Kong dollar (HKD)

- Japanese yen (JPY)

- Mexican peso (MXN)

- New Zealand dollar (NZD)

- Norwegian krone (NOK)

- Polish zloty (PLN)

- Singapore dollar (SGD)

- South African rand (ZAR)

- Swedish krona (SEK)

- Swiss franc (CHF)

In summary, both free trading platforms provide a cost-effective way to trade and invest in financial assets with the click of a button. However, Fidelity allows you to diversify your portfolio that bit extra by offering fractional share trading and access to international stock exchanges, without having to pay a penny in commissions.

| Inactivity fee | Deposit fee | Withdrawal fee | Account fee | US Stock fee | ETF fee | USD margin rate | Transfer fee | |

| Merrill Edge | No | $0 | $0 | $0 | 0% | 0% | 5.25% | $0 |

| Fidelity | No | $0 | $0 | $0 | 0% | 0% | 7.075% | $0 |

Merrill Edge vs Fidelity User Experience

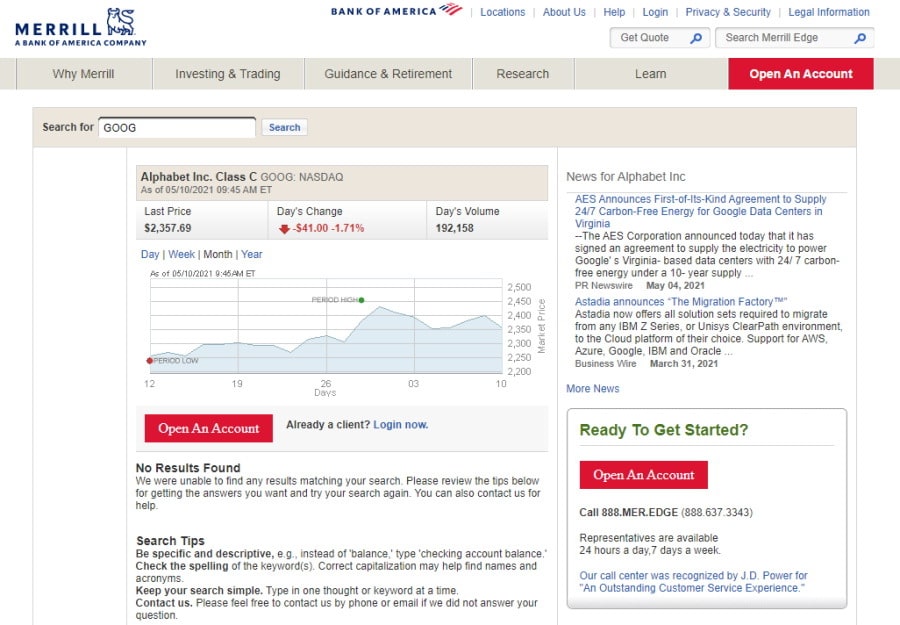

When it comes to user experience, our Fidelity vs Merrill Edge review found that both are suited to new and advanced traders. This is evident from the instant you land on the website for the first time. For example, there are no complex terms or financial jargon, and the layout is very user-friendly and well designed.

There are tons of informational materials scattered throughout the site, making it perfect for new investors to familiarize themselves with how online trading works. The same applies to searching for and trading securities. All you have to do is enter the ticker symbol or name of the asset in the search bar and both platforms will bring up a list of relevant suggestions related to your search entry.

Moreover, the user experience on Fidelity is especially good when placing an order. For instance, let’s suppose you wanted to invest in stocks, all you would need to do is specify the action, quantity type, and the amount you would like to invest, and click on the preview order button. Simply put, you wouldn’t need to bother with calculating how many shares you could afford to invest in, because Fidelity supports fractional share trading.

This means that you could invest in US stocks and ETFs for as little as $1 with the click of a button.

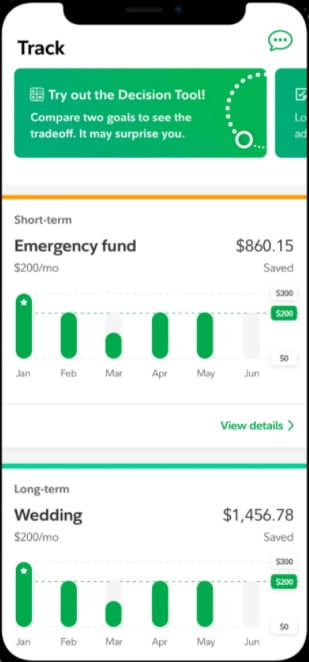

Merrill Edge vs Fidelity Mobile App

Both Merrill Edge and Fidelity allow you to buy and sell assets and monitor your portfolio via a fully-fledged mobile trading app that is compatible with iOS Apple and Android devices. When it comes to user experience, both mobile apps are very easy to use and make online trading simple and straightforward.

In terms of logging in and security of the apps, while two-step authentication is not supported by either trading app, you can implement biometric authentication which is a convenient and safe alternative.

When it comes to finding the assets of your choice, the search functions are great. All you have to do is enter the ticker symbol or the company name for a list of relevant results to appear. If you want to search for non-US stocks through Fidelity’s mobile trading platform then you will need to enter the country code.

With the expansion of online technology and trading, most beginner traders are buying and selling assets on their own rather than paying experts to manage their portfolios for them. Nevertheless, before you start trading and investing in financial instruments, you need to comprehend and be aware of the various kinds of orders and their advantages.

Subject to your trading goals and needs certain order types can be utilized to make trading more efficient and effective. For example, a market order instructs the broker to execute a trade at the best market price possible. Market orders are typically executed very quickly, given that there is adequate liquidity in the market.

On the other hand, stop-loss orders are orders to sell or buy a stock when the price matches a predetermined amount, referred to as the stop price. Once the stop price is met, stop orders become market orders.

With this in mind, both Merrill Edge and Fidelity allow you to set a range of order types from your mobile device. Some of these orders include:

- Market orders

- Limit orders

- Stop-loss orders

- Trailing stop orders

- Order time limits such as GTC (Good-till-cancelled), and Fill or Kill

Mobile trading is one of the fastest-growing sectors in the online trading scene. One of its most attractive features is that you can set price alerts and push notifications. With these settings, you can be alerted in real-time when certain price conditions are met and when order types have been executed so that you can always stay in the loop.

Both mobile trading apps allow you to set both alerts and notifications with the click of a button.

Merrill Edge vs Fidelity Trading Tools, Education, Research & Analysis

Thus far in our Merril Edge vs Fidelity comparison, we have covered several key metrics including tradable assets, fees and commissions, and mobile trading. In this segment, we will examine what trading tools and educational materials you can access with both trading platforms.

Automated trading

If you are a beginner trader with little to no experience in online trading then automated trading provides you with extra support to manage your investments. With this in mind, Merrill Edge provides automated portfolio management which includes robo-advisor services with a minimum investment of $1,000. In addition, you can also access a managed investment advisory program that provides one-on-one support with an expert. There is a $20,000 minimum investment when using this service.

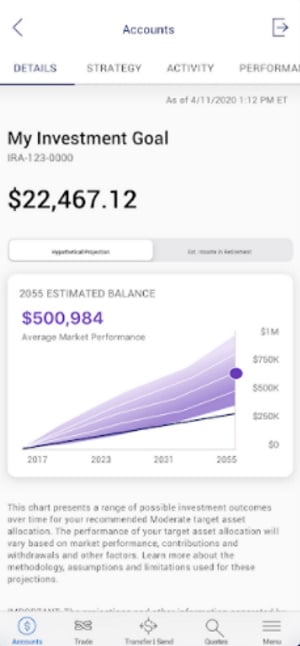

Fidelity also provides heaps of automated trading accounts, which are ideal if you need help with your portfolio management. Some of these managed accounts include Fidelity Go which is a robo-advisory service that has a minimum investment of just $10. Alternatively, if you are looking for a larger investment, there are separately managed accounts that include preset portfolios.

Trading ideas

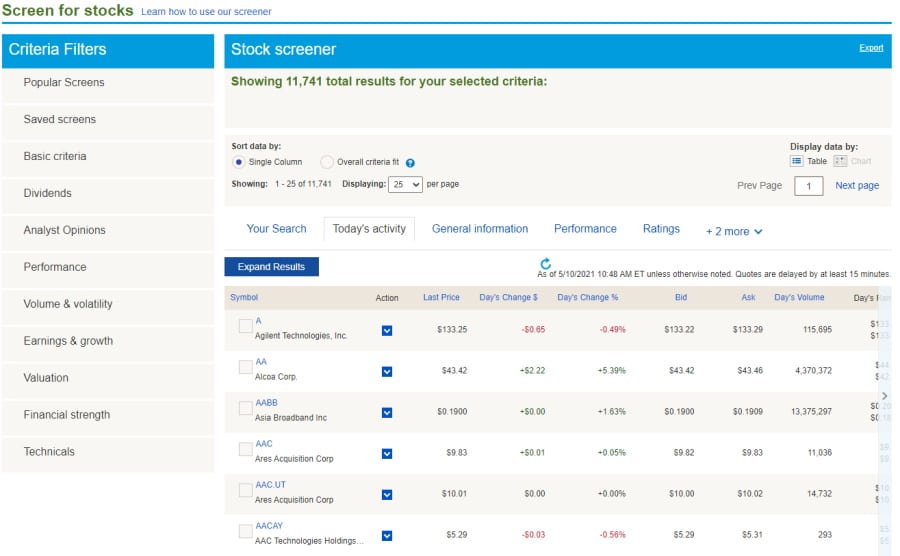

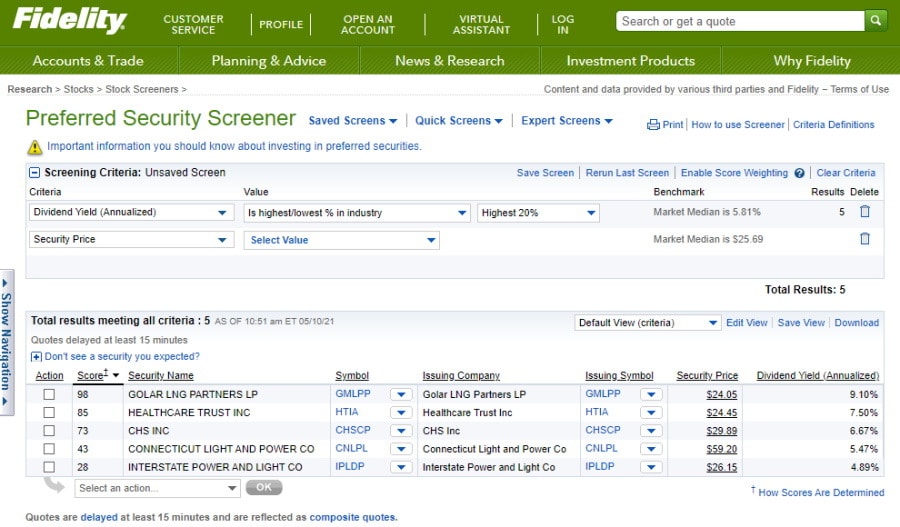

Starting with Merrill Edge, by clicking on the Research tab at the top of the site you can access trading ideas for stocks, options, ETF trades, mutual funds, fixed income, and a market overview. In addition to this, Merrill Edge traders also have access to stock screeners from third-party providers including Morningstar and CFRA.

Stock screeners allow traders to instantly filter through heaps of securities based on set criteria, to pinpoint stocks and other assets that match their own trading goals. Some stock screeners also give you the option to set notifications that alert you to unique trading opportunities.

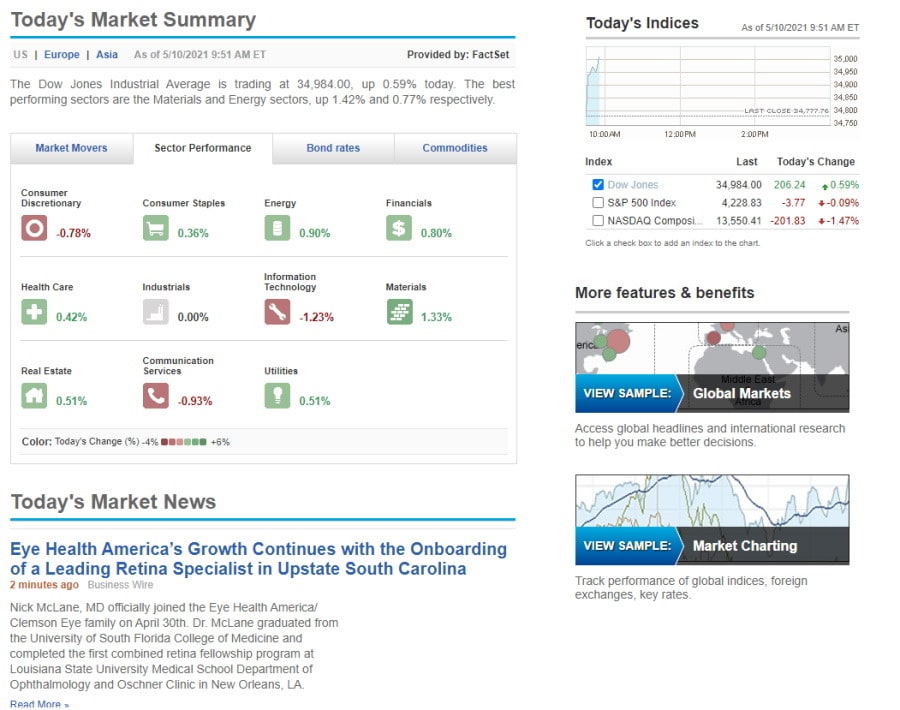

Fidelity also offers a wide range of news and research tools, including stock screeners and trading ideas for ETFs, stocks, and more. Simply click on the News & Research tab and pick from a range of options in the dropdown menu. The fundamental analysis is provided by Zack’s Investment Research, and technical events are provided by Recognia.

Charting tools

Both Merrill Edge and Fidelity have good charting tool facilities. The charts are easily customizable and you can use dozens of technical indicators.

Educational materials

Both trading platforms provide heaps of educational resources from webinars to video tutorials. Merrill Edge goes that one step further and divides the educational materials into groups based on experience levels.

At Fidelity you can develop your online trading knowledge by using the following resources:

- Newsfeed

- Real-time quotes that are available for stocks, mutual funds, indexes, options, and more.

- The Fidelity Learning Center includes market trends and insights from third-party providers, as well as materials on investing and trading strategies for both beginner and experienced traders.

- Webinars are divided into 4 categories: Upcoming events, on-demand webinars, strategy desk coaching sessions, and classes for beginners.

When it comes to Fidelity’s webinars you can even sign up for a monthly email newsletter that sends you updates regarding upcoming webinars so you can pick and choose the right webinars for your trading goals.

Merrill Edge vs Fidelity Demo Account

For beginners and experienced investors alike, a demo account provides the perfect learning environment to practice online trading without risking real capital. But what exactly is a demo trading account? A demo account, or paper trading account, is a simulated trading environment where traders have access to virtual money, otherwise referred to as paper funds, with which they can practice their investing strategies and familiarize themselves with the trading platform.

During our extensive broker research, we found that out of the two trading platforms in question only Fidelity offers a demo account. The paper trading account is available via its Active Trader Pro desktop platform.

The Active Trader Pro demo account is fully customizable, allows you to access delayed streaming data, technical and market filters, and practice your online trades without having to worry about the risk of losing your own money.

Merrill Edge vs Fidelity Payments

In summary, depositing and withdrawing funds with Merrill Edge is a straightforward process with a bank account, as credit cards, debit cards, and e-wallets are not supported payment methods.

Furthermore, the only available account base currency is USD which means that if you have a personal bank account in a non-USD currency you will face a conversion fee. An effective way to avoid these conversion fees is to open a multi-currency bank account with a digital bank such as Monzo, Starling Bank, and Revolut.

In terms of the deposit processing times this can take up to 2 business days for the funds to appear in your brokerage account, and there are no deposit or withdrawal fees.

On the other hand, Fidelity covers 16 different base currencies from USD and EUR to AUD and CHF. This helps to reduce non-trading fees because when you fund your brokerage account with the same currency as your bank account, or when you trade financial instruments in the same currency as the base currency of your brokerage account, you will not incur conversion fees.

When it comes to depositing funds into your Fidelity trading account you can use checks, ACH transfers, and e-wallets such as PayPal. As we have already seen with Merrill Edge, credit cards and debit cards are not available payment options with Fidelity either. ACH transfers typically take 2 business days for the funds to show up in your account.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Fidelity | $0 | FREE | 2 business days | FREE |

| Merrill Edge | $0 | FREE | 2 business days | FREE |

Merrill Edge vs Fidelity Customer Service

Starting with Fidelity, you can contact customer support via live chat, telephone, and email. The majority of brokers are experiencing high call volumes which means that waiting times can be long especially during busy periods. There is also a virtual assistant, or chatbot, that has a ton of relevant and useful information for you to access.

As for Merrill Edge, you can contact its customer services via live chat or telephone with customer support agents available 24/7. There are also a ton of frequently asked questions on the Help and Support page.

Merrill Edge vs Fidelity Safety & Regulation

In terms of the fundamentals, both Fidelity and Merrill Edge are regulated by the US Securities and Exchange Commission and are members of the Financial Industry Regulatory Authority.

As members of FINRA, both brokers offer client fund protection via the SIPC investor protection scheme which covers cash and security loss up to $500,000 which includes $250,000 for cash claims if the brokerage firm liquidates.

Merrill Edge vs Fidelity vs eToro

In summary, we have covered several key metrics from fees and commissions to tradable assets and mobile trading. However, on the basis that with Fidelity you can access the Active Trader Pro demo account, deposit funds via bank transfers as well as e-wallets, and invest in fractional shares with as little as $1, we would recommend Fidelity as the better option for both new and advanced investors.

Nevertheless, we would also suggest considering a third option that offers unique social trading tools, 100% commission-free trading, is considered one of the best online brokers, and provides access to a demo account with $100,000 worth of paper funds. Established in 2007, and regulated by top financial authorities including the UK’s FCA, ASIC, and CySEC, eToro is now home to more than 20 million active traders.

67% of retail investor accounts lose money when trading CFDs with this provider.

eToro was designed with beginner traders in mind, which is why it keeps everything very simple. When it comes to account types you can choose between a live account and a demo account. This is very convenient as you can monitor your entire investing portfolio via a single account. The demo trading account is also user-friendly and well designed, providing you with all the features and functionalities that you will find with the live brokerage account.

When it comes to tradable assets and markets, eToro facilitates forex trading with access to 49 different major, minor, and exotic currency pairs. eToro also offers competitive spreads, for example, to trade the EUR/GBP pair you would typically pay a spread of just 1.5 pips.

Additionally, eToro provides innovative social trading tools such as Copy Trader and Copy Portfolios that allow you to copy the trades of other experienced eToro investors like-for-like, and invest in a prebuilt portfolio of investors or themes such as commodities or cryptocurrencies. Copy trading is a great tool for beginner traders who want to trade assets passively with the click of a button.

Moreover, eToro also supports CFD trading including stock index CFDs and ETF CFDs which allow you to speculate on the potential price movements of the underlying asset without gaining ownership of it.

If crypto trading is more your style then you will be happy to hear that eToro covers 19 different cryptocurrencies which are as follows: Stellar Lumens (XLM), NEO (NEO), EOS (EOS), Cardano (ADA), IOTA, TRON, ZCash, Tezos, Chainlink, Uniswap, Dogecoin, Bitcoin (BTC), Ethereum (ETH), Ethereum, Classic (ETC), Dash, Litecoin (LTC), Bitcoin Cash (BCH). This is ideal for traders with an interest in Bitcoin trading with spreads as low as 0.75%.

Here’s a quick look at eToro’s trading and non-trading fees:

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Typical spread for EUR/USD: 1 |

| Crypto trading fee | 1.90% spread for Ethereum |

| Inactivity fee | $10 a month after 12 months |

| Withdrawal fee | $5 |

| ETF trading fee | Free |

| Account fee | No |

| Deposit fee | $0 |

Merrill Edge vs Fidelity – The Verdict

In summary, we have compared Merrill Edge vs Fidelity in terms of all the key metrics you should consider when choosing an online trading platform. As such, you should now have all the information you need to make an informed decision as to which broker is best suited to your trading needs and goals.

However, eToro secures the number one spot on the list as the best overall trading platform in 2026, as it not only provides access to 17 international markets, but you can trade cryptos, CFDs, stocks, ETFs, fractional shares, and more on a 100% commission-free basis.

So, to start investing in heaps of assets with 0% commission on a top-rated platform, simply follow the link below and open an eToro account today!

eToro – Best Overall Social Trading Platform in 2026

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.