eTrade vs Fidelity – Which Broker Is Best in 2026?

If you want to trade financial assets from the comfort of your home, you will need a top-rated trading platform. With a wide range of options to choose from, two brokers stand out from the rest.

In this eTrade vs Fidelity review, we examine all the key metrics, from fees and commissions, tradable assets, mobile trading, safety, and more. Weighing up the pros and cons will help you make the best choice for you. So, keep reading as we reveal our number one broker for 2026.

eTrade vs Fidelity Comparison

What are eTrade and Fidelity?

eTrade and Fidelity are online brokers that allow you to buy and sell financial instruments from the comfort of your own home. Both trading platforms offer commission-free stock and ETF trading as well as heaps of other assets.

To start trading you need to open a brokerage account, deposit funds, and you will then have unrestricted access to multiple markets at the click of a button. Moreover, thanks to the growing popularity of mobile trading apps nowadays, you can buy and sell tradable assets from your mobile device. This means you don’t have to wait until you get home to make a trade.

Launched in 1982, eTrade is a US-based broker with more than 3 million users. In terms of the fundamentals, it is regulated by top-level financial authorities including the US SEC and FINRA. Despite not providing access to cryptocurrency trading, eTrade allows you to trade Ether and Bitcoin futures.

Simply put, with crypto futures you can gain exposure to digital currencies without having to own the underlying asset. Similar to how futures contracts for commodities give traders the ability to speculate on future prices of oil and gold, Ether and Bitcoin futures give you that chance to speculate on the future prices of the cryptos.Z

Regulated by the US SEC and FINRA, Fidelity was launched in 1946 and since then has become home to more than 25 million investors. Fidelity’s traders benefit from 100% commission-free ETF and stock trading. If you are interested in investing in international stocks then Fidelity covers 22 different stock markets. Furthermore, you can also access automated trading services in the form of managed accounts. Fidelity offers a wide range of managed accounts from robo-advisory services to personalized solutions created by experts.

eTrade vs Fidelity Tradable Assets

What assets can you buy and sell with either broker? In this section of our eTrade vs Fidelity analysis, we will be exploring the different products and markets that are on offer. In summary, you can trade stocks and ETFs, options, bonds, and mutual funds with either broker.

Starting with eTrade, there are heaps of asset classes available from over 2,000 ETFs to more than 80,000 government and corporate bonds. However, eTrade only covers US markets which means that international stocks are unavailable. Also, forex and CFD trading are not supported by this broker.

Stock and ETF trades

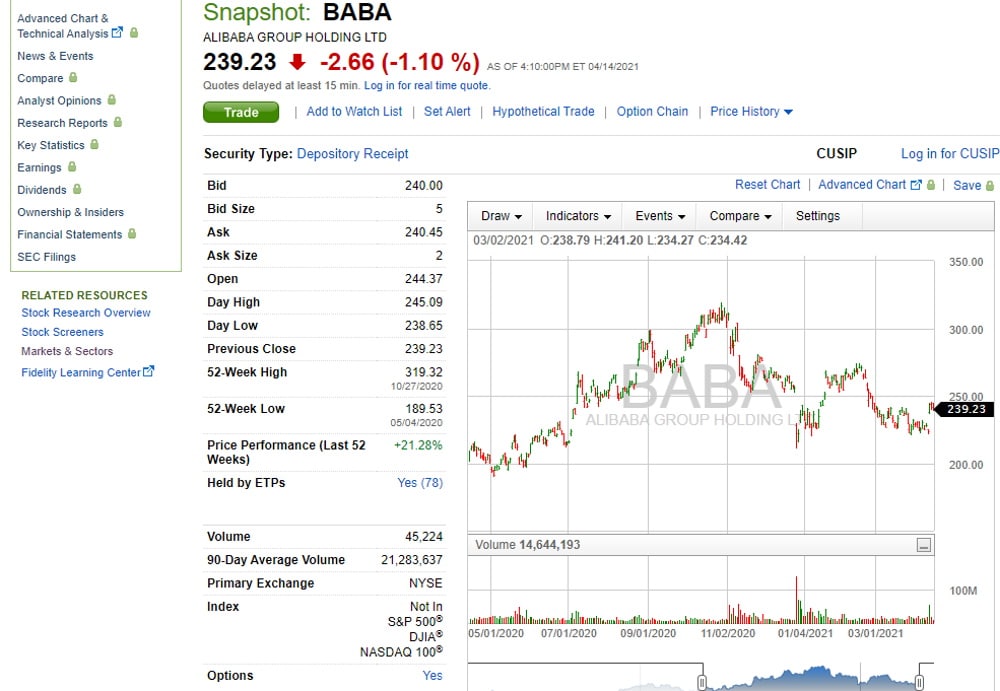

With eTrade, you can buy, sell and hold stocks on all the major US stock exchanges including the New York Stock Exchange and NASDAQ. There are around 2,300 exchange-traded funds to choose from.

On the other hand, Fidelity stands out from the crowd with its international stock market offering, as the majority of US-based trading platforms do not cover foreign stock exchanges. As a result, Fidelity covers more than 20 different stock markets.

But, why trade international stocks in the first place? Investing in foreign stocks is an effective way to maximize your portfolio’s diversification because you have access to a broader variety of assets. When it comes to Fidelity’s selection of ETFs, you can browse through:

- active equity ETFs

- factor ETFs

- sector ETFs

- stock ETFs

- bond ETFs

Fidelity offers commission-free stock ETFs, ranging from Fidelity US Multifactor ETFs to Fidelity International High Dividend ETFs. Furthermore, when it comes to expense ratios this online broker boasts some of the most competitive figures, with an average of 0.084%.

What is the appeal of trading ETFs? Simply put, exchange-traded funds are great investment vehicles for beginner traders looking for low-cost trading opportunities to make returns. Firstly, ETFs make it possible to diversify your investment portfolio on a budget. Additionally, you can trade ETFs throughout the trading day, which gives you plenty of liquidity and a higher return on investments.

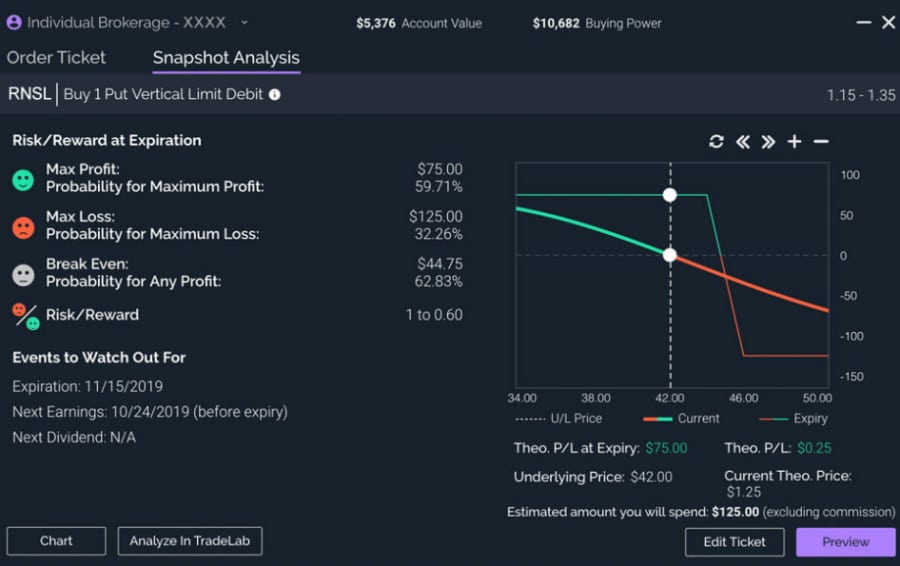

Options trades

Options trading offers many advantages and can help boost your existing trading strategy. With options contracts, you can get cheaper exposure to stocks when compared to purchasing shares outright, which maximises both potential returns and losses depending on market price fluctuations.

With this in mind, you can access 9 different options markets with Fidelity and just 5 with eTrade. The trading fees are relatively low as well, but more on this later on.

eTrade vs Fidelity Account Types

When it comes to account types both brokers have a wide range of accounts that cater to almost every type of trader out there.

Our broker comparison found that both platforms offer individual brokerage accounts, joint accounts, business accounts, retirement accounts (Roth IRA and Traditional IRA accounts), managed portfolios, pension accounts, education savings accounts, and custodial accounts. Fidelity also offers trust and estate accounts, and charitable accounts.

Opening an account with either Fidelity or eTrade is a streamlined and fully digital process. All you have to do is upload proof of ID and address and provide some other personal information. It typically takes around 3 business days for Fidelity to verify your details, which is considerably faster than eTrade that usually takes around 7 business days.

eTrade vs Fidelity Fees & Commissions

As we previously mentioned, both free trading platforms offer zero-commission ETF and stock trading as well as low non-trading fees. Having said this, there are several fees that you need to take into consideration when opening a brokerage account with any broker.

So, here’s a brief breakdown of all the major trading and non-trading fees you are likely to encounter with Fidelity and eTrade:

| Inactivity fee | Deposit fee | Withdrawal fee | Account fee | US Stock fee | ETF fee | USD margin rate | Transfer fee | Options fee | |

| eTrade | No | $0 | $0 | $0 | 0% | 0% | 6.45% | $25 | $0.65 per contract |

| Fidelity | No | $0 | $0 | $0 | 0% | 0% | 7.075% | $0 | $0.65 per contract |

When it comes to trading US stocks and ETFs both brokers provide 100% zero-commission trading. However, seeing as Fidelity gives you access to foreign markets you could also invest in shares of international stock. Fidelity charges a fixed rate commission depending on the market. For example, if you choose to trade stocks and ETFs on European markets this will cost you €19 per trade, and £9 per trade on UK markets.

Margin trading

Margin trading is when you borrow funds from a broker to buy shares of stock. A margin account will give you greater buying power and allows you to use secondary funds to increase your financial leverage. Buying on margin maximizes both potential profits and potential losses.

For example, let’s say you have $5,000 in a margin trading account, but you decide to invest in a stock that costs more than your available account balance. Depending on the broker’s margin rates and fee structure, some have an initial margin requirement of 50%. This means you could buy up to $10,000 worth of stock, which essentially doubles your buying power.

The margin rate that you pay is based on the sum of your margin balance. In short, the lower the margin balance, the higher the margin rate, and vice versa.

Here’s a look at Fidelity and eTrade’s margin rates:

| Margin Balance | Fidelity margin rate | eTrade margin rate |

| $1M+ | 4.000% | 5.45% |

| $500,000-$999,999 | 4.250% | 6.45% |

| $250,000–$499,999 | 6.575% | 6.95% |

| $100,000–$249,999 | 6.825% | 7.45% |

| $50,000–$99,999 | 6.875% | 7.95% |

| $25,000–$49,999 | 7.825% | 8.45% |

| $0–$24,999 | 8.325% | 8.70% |

Fidelity’s base margin rate is 7.075% and eTrade’s base margin rate is 6.45%.

Non-trading fees

As we have already seen, both brokers provide low non-trading fees including no inactivity and deposit fees. These are important metrics that you need to consider, especially if you are looking for a cost-effective way to buy and sell financial instruments.

eTrade vs Fidelity User Experience

In terms of the overall user experience, it should be noted that both eTrade and Fidelity are great matches for both new and advanced investors. During our research, we found that both trading platforms are user-friendly and well designed. Navigating your way around the websites and platforms is simple and with great search functionality, you can find exactly what you are looking for.

For instance, the first step of opening an account and depositing funds is fully digital and simple, given that it does take more than 2 business days to verify your account with either broker. Then, in terms of finding your desired assets, you can use the predictive search functions.

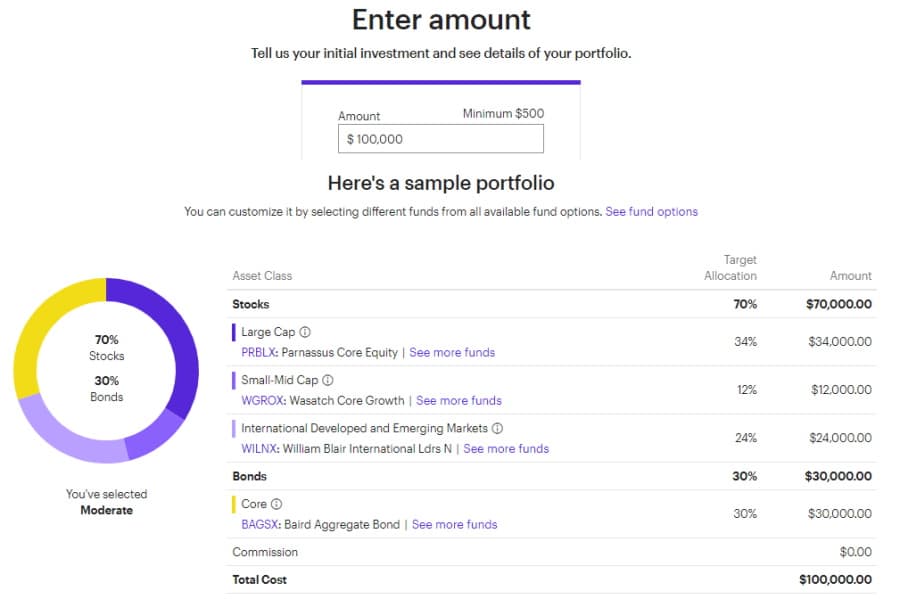

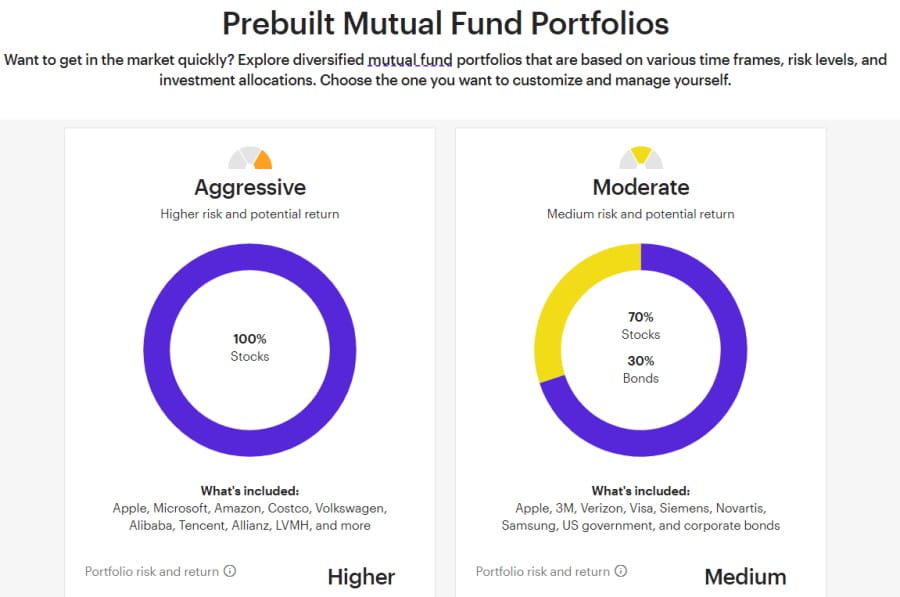

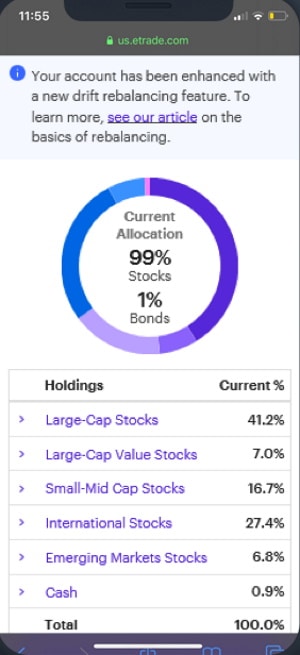

Otherwise, if you prefer automated trading services then you could use Fidelity’s managed accounts which include robo-advisory services as well as pre-built portfolios compiled by experts. On the other hand, you could use eTrade’s pre-built portfolios with a minimum $500 deposit for mutual funds and a $2,500 minimum investment for ETFs.

You can select a diversified portfolio of ETFs or mutual funds depending on your risk tolerance. Purchasing the pre-built portfolios takes a matter of minutes and is super easy to do with either platform. Furthermore, you will be able to invest in popular and major stocks such as Apple, Amazon, and Microsoft with the click of a button, in a hands-off approach to investing.

Both investment platforms are user-friendly and provide two-step authentication for extra security when logging in and out of your account.

Order types

When it comes to placing orders, both brokers have a wide range of order types, such as market and stop-limit orders, that you can use when trading your favourite stocks. Once you have chosen the stock or ETF that you want to invest in, simply click on the ‘order type’ tab and a drop-down menu will appear giving you the ability to place an order type.

The two most popular order types that all new traders need to understand are limit and market orders. Simply put, a market order is the most standard kind of trade that sells or buys straightaway at the current market price. A limit order, on the other hand, commonly referred to as a pending order, gives traders the ability to trade assets at a specified price at a future date.

For instance, suppose you wanted to purchase stocks at the price of $25, you could do this by placing a limit order for $25. By doing so you would not pay anything above the set limit order for that specific stock. But, you could purchase it for a lower amount than the $25 per share as defined in the order.

Notifications and alerts

During our research we found that both trading platforms allow you to set a variety of alerts and notifications from the market and quote information, to news updates and research. Fidelity breaks its alert types into three subsections which include Research and Market Monitoring, Account Services, and Products and Offerings.

Setting alerts and notifications is a great way to stay in the loop with the latest updates and news regarding your investments and price movements in real-time. This is particularly useful when used in conjunction with a mobile trading app, which leads us onto the next key topic of this broker comparison.

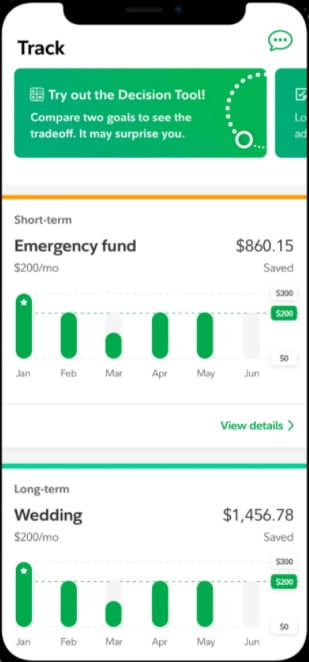

eTrade vs Fidelity Mobile App

The best mobile trading apps allow you to buy and sell tradable assets with 100% no commissions. As well as being able to trade on the go, they also allow you to set price alerts and push notifications, monitor your portfolio of investments, and enter orders to sell or buy with the click of a button.

With this in mind, both Fidelity and eTrade offer native mobile trading apps that are compatible with iOS Apple, and Android devices.

eTrade has created two mobile trading apps that are designed for active traders of all experience levels. Users are attracted to eTrade’s mobile apps because of their ease of use and their robust research and analysis tools. eTrade provides two mobile apps:

- The standard eTrade app, which is designed for new investors, offers the same functionality as its web trading platform counterpart.

- The Power eTrade mobile application was primarily intended for more complex securities such as option and futures trading. Furthermore, the Power eTrade platform gives you access to paper trading services.

In terms of executing trades on the mobile trading platforms, both brokers have made the process very simple and easy, which means investing in shares of your favourite stocks can be made in a matter of minutes with the click of a button.

eTrade vs Fidelity Trading Tools, Education, Research & Analysis

Depending on the type of trading style you prefer to adopt, both Fidelity and eTrade have options to suit both passive and active traders. Firstly, when it comes to passive trading strategies both brokers offer access to prebuilt portfolios and robo-advisors.

eTrade offers prebuilt portfolios for ETFs and mutual funds that are based on varying investment strategies from conservative to aggressive. These types of managed portfolios are great for new traders who need extra support with their investments.

Fidelity goes that one step further and offers two strategies to help its investors build diversified portfolios. The first strategy is via risk-based pre-built portfolios that can be used as a guide, and secondly, you can use single-fund strategies that Fidelity’s experts monitor and manage to give you a more hands-off approach to online trading.

Research and Educational resources

Firstly, eTrade has an entire page dedicated to beginner traders which can be found under the ‘New to Investing’ tab on the homepage. Once you click on the link you can find relevant and useful video and written content that simplifies the process of online trading, making any beginner’s nerves settle.

- Investing Basics

- Advanced Trading

- Retirement Planning

- Tax Planning

Alternatively, if you prefer to attend webinars then you will be pleased to know that eTrade also offers live webcasts for both beginner and experienced investors.

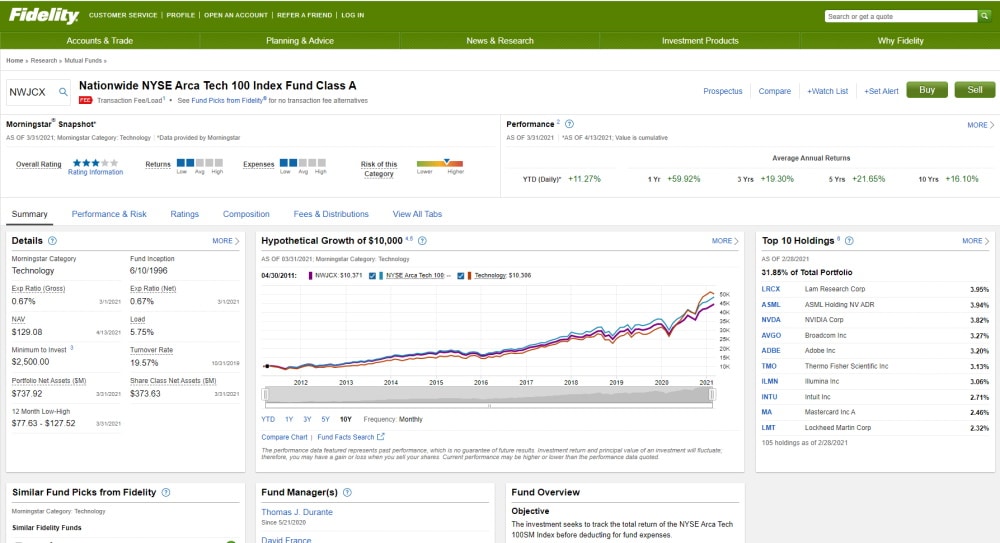

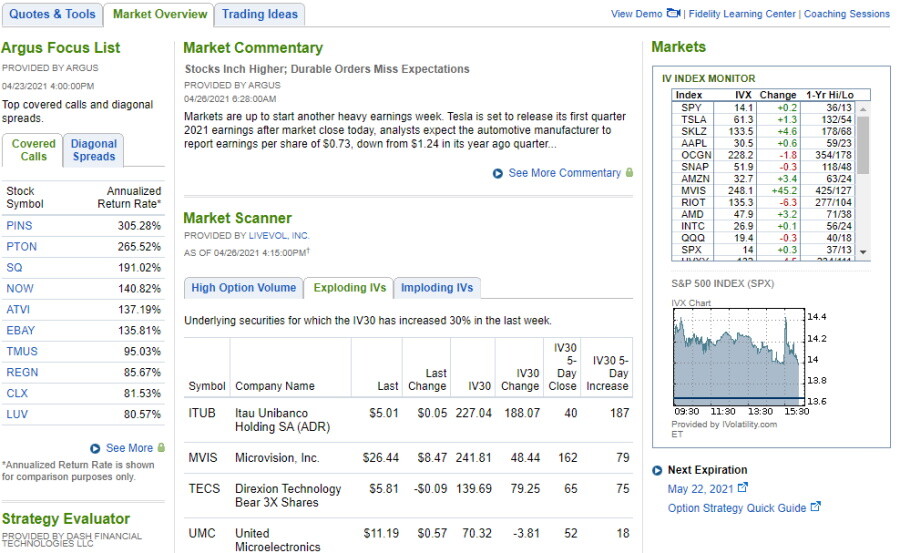

Turning our attention to Fidelity now, you can access trading ideas for the most popular stocks, mutual funds, and ETFs. With regards to stocks, by clicking on the analyst opinions section you can access summary scores that are compiled by dozens of researchers. Most of the research is provided by trusted third-party providers such as Recognia, Thomson Reuters, and MorningStar.

In terms of fundamental data, Fidelity also provides tons of useful statistics and data from market capitalization and financial statements, to price/cash flows.

As far as educational materials are concerned you can access Fidelity’s array of resources by navigating to the ‘Learning Center’ under the ‘News & Research’ tab at the top of the site. Here you can use the search bar to search for relevant information and guides. Additionally, you can access live webinars and classes for beginners, as well as signing up for weekly newsletters that are created by analysts and give their insights into the current state of the financial markets, investing strategies, and personal finance.

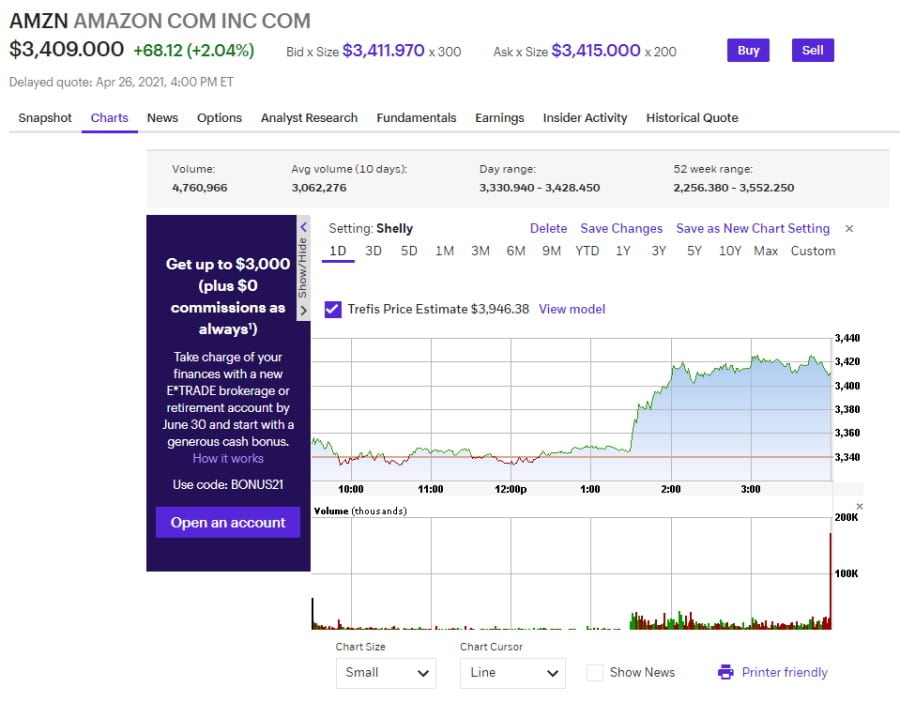

Charting tools

When it comes to charting tools, Fidelity comes out on top as it provides 50 different technical indicators and each chart can be edited and downloaded. On the flip side, eTrade gives you access to 30 technical indicators.

eTrade vs Fidelity Demo Account

Advanced and beginner traders use demo accounts to test their investment strategies and to familiarize themselves with online trading functionalities. Perhaps the greatest advantage of a demo account, or paper trading account, is that it allows you to trade and invest in assets without the risk of losing your capital.

With this in mind, Fidelity provides a demo account via its desktop trading platform (Active Trader Pro) and eTrade offers a paper trading account via the Power eTrade platform. Both demo account platforms simulate real market conditions to help you learn through trial and error without losing your own money.

eTrade vs Fidelity Payments

After opening an account with eTrade or Fidelity, you will be able to deposit funds through bank transfers into your account in up to 2-3 days. Our research found that both online brokers charge $0 deposit fees. However, some key differences separate these two popular US-based platforms.

You can deposit funds into your Fidelity brokerage account via ACH and wire transfers, checks, and e-wallets such as PayPal. Debit and Credit cards are not supported options for depositing funds. When it comes to depositing cash with eTrade you are limited to ACH and wire transfers and checks.

There are 16 different account base currencies to pick from with a Fidelity investment account which means that if you trade securities in the same currency as your account base currency you can avoid conversion fees. Conversely, USD is the only supported base currency available at eTrade.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Fidelity |

|

FREE | 1-2 business days | FREE |

| eTrade |

|

FREE | 2-3 business days | FREE |

eTrade vs Fidelity Customer Service

When we compared e*Trade vs Fidelity in terms of the quality and accessibility of their customer services we found that both offer relevant and prompt responses. You can contact the customer support departments for both brokers via telephone, email, and live chat.

When using the email service you can expect an answer or reply within one business day depending on the number of requests they have.

e*Trade’s customer services are available 24 hours a day, 7 days a week. Whereas, Fidelity’s live chat support is available between the hours of 09:00 and 04:00 on weekends and 09:00 and 22:00 Monday through Friday.

eTrade vs Fidelity Safety & Regulation

In terms of the fundamentals, both Fidelity and e*Trade comply with the regulations of top-tier financial authorities including the Financial Industry Regulatory Authority (FINRA) and the US Securities and Exchange Commission (SEC).

How are client funds protected? Fidelity Brokerage Services LLC and e*Trade Securities LLC are insured by the Securities Investor Protection Corporation (SIPC). This US investor protection scheme covers against the potential loss of funds and assets should the brokerage firm liquidate. There is a limit to this cover of $500,000, including $250,000 for cash claims.

What about negative balance protection? Simply put, with negative balance protection you cannot end up losing more money than the amount you deposited into your account. Neither of the brokers in this comparison review offers negative balance protection.

eTrade vs Fidelity – The Verdict

eTrade and Fidelity are both reputable online brokers, offering a range of financial instruments and tools. Fidelity is better suited to traders who are looking to access international stocks markets whereas eTrade is better suited to US traders who want to access ETFs and bonds.

Both platforms have a user-friendly interface and modern design. eTrade also offers two mobile apps, making it possible to manage your trades on the go. Fidelity also offers more charting tools than eTrade however, both platforms cater to experienced traders who may want to implement advanced strategies.

The final choice should come down to your individual experience and goals. Tale time to consider each platform before making any decisions that could put your money at risk.

Your capital is at risk