How to Invest in Silver Stocks in 2024

The use of silver is invaluable for many industrial applications as it is a unique precious metal. In addition, among all metals, silver is the best electrical and thermal conductor, making it highly valued for electrical applications. Consequently, silver’s demand is primarily driven by the industrial sector.

As with gold, investors highly value silver due to its similar investment characteristics. Investors can use silver as a haven metal to hedge against inflation and weather an economic downturn. In early 2022, silver was used as an inflation hedge. Despite inflationary and geopolitical concerns, it exhibited double-digit growth. So let’s get into how to buy stock in Silver 2024.

How to Buy Stocks in Silver in 2024

- First: Create an account with eToro – To open a new trading account, visit the official eToro site and click on ‘Start Investing.’ Enter your login information.

- Second: Verification – eToro complies with the most current KYC standards set by top-tier financial authorities, so be prepared to provide identification and proof of address.

- Third: Deposit – You can deposit funds into your new account with a debit card, credit card, e-wallet, or bank transfer.

- Fifth: Identify your favorite Silver Stocks instantly by typing ‘Silver’ in the top toolbar or clicking the ‘Discover’ tab in the navigation menu.

- Sixth: Buy- At the top right-hand corner of the screen, click on the ‘Trade’ button to buy Silver stock for as low as $10.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Best Brokers To Buy Silver Stocks

There are many companies in the metals sector that mine silver. However, most mining companies tend to concentrate on producing industrial metals such as iron ore, copper, and aluminum. Mining companies often produce silver as a byproduct of their primary products. Meanwhile, precious metal companies tend to specialize in the production of gold. Although many companies mine silver, the amount of silver they contribute to their revenues is often very small.

Even though these factors limit the range of silver investment options, a few silver stocks are well worth considering.

There are two stock trading platforms out there that we have picked out as the best available in the market. First, it is possible to buy Silver stocks from eToro at zero commissions, as these companies are properly regulated.

eToro offers a greater choice of US stocks and the chance to buy into financial options. Additionally, eToro offers a wide range of powerful social trading tools perfect for those just starting.

1. eToro — Where to Buy Silver Stocks Cheaply and Safely

When it comes to where to buy Silver stocks, top broker eToro has the ready-made answer for you. With eToro, you can purchase Silver shares with no commission for as little as $10. In addition, there is only a 0.24% spread fee.

Over 3,000 stocks are available to trade at eToro. More than 900 are traded overseas on exchanges such as the London FTSE, Euronext Paris, and the Hong Kong Stock Exchange. Additionally, eToro provides its users with access to the best biotech , the oil, and the most undervalued stocks, to name a few.

Various commodities including silver and silver stocks, indices, forex, 67+ crypto coins, and 264 Exchange Traded Funds (ETFs) are also available. Beginner investors may find ETFs particularly interesting because they enable them to invest in many stocks. In addition, you should give ETFs a look since they are a low-cost way of spreading investment risk, which makes them a worthwhile option.

As a result of its regulation, eToro stands out as one of the best stock apps on the market. FinCEN and FINRA regulate eToro in the US. Additionally, the broker is regulated in Europe and Australia.

eToro has pioneered two great ways of social trading for beginners; Social trading is the concept whereby investment newbies can benefit from the experience and insight of others.

eToro’s CopyTrader software lets you select from thousands of traders and automatically copy their trades for free. eToro offers 70 Smart Portfolios with which you can get access to a strategic position in a market in one go.

Here are some reasons to choose eToro:

- More than 25m verified users

- It is regulated in the US by the SEC, FinCEN, and FINRA

- Investors are insured for up to $500k with SIPC

- A great selection of 3,000 international stocks to choose from

- There is no commission on stock trades

- Spreads on NASDAQ stocks are tight

- USD deposits free of charge

- The smartphone app is available for free

- Crypto/personal finance wallet for eToro Money

- There is a Smart Portfolio option and a CopyTrader option available

| Number of Stocks: | 3000+ (international) |

| Pricing System: | No commission. Spread fee only |

| Cost of Buying Silver stocks: | A spread fee of just 0.24% |

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Silver Stock Price

The Silver Institute noted that some geopolitical and economic factors, including the Russian invasion of Ukraine, the multi-decade high inflation rate, lower growth projections for the global economy, and rising interest rates, pose challenges.

However, the long-term price forecast for Silver stock is positive. At the time of writing, Silver Mar is trading at $23 on the Nasdaq. The value of the stock is predicted to reach $2 by 2025 and then $30 by 2026. By 2030, the stock could reach a value of $60.

Silver price forecasts as based on key indicators that affect the value of Silver stock. These include the price of gold, inflation levels, the performance of the Euro, and the futures market positioning. The price of gold is positively linked to silver stock price. Recently, gold has experienced a spike in demand which could send the value of the precious metal upwards.

Similarly, inflation is at an all-time high which suggests that the price of Silver is headed upwards. During times of high inflation, investors hedge their wealth with silver and gold.

Buy Silver Stocks with eToro

Below is an overview of how to invest in Silver stocks with eToro- our recommended broker. However, the process can be applied to any broker that you wish to use. Always be sure to read through instructions carefully and conduct thorough research before making any investment decisions.

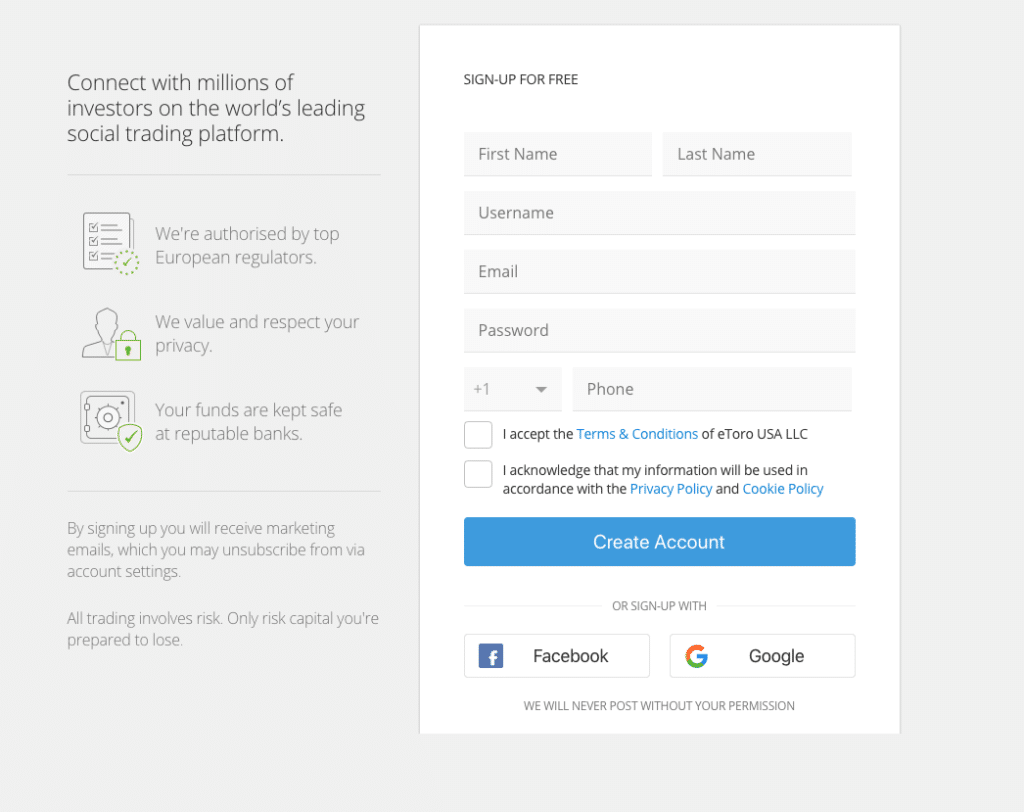

Step 1: Create an Account and Upload your ID

The first step is to complete the online registration form. Here, you will be asked to fill in basic personal details such as your name, mobile number, address and email. You will also be prompted to create a password.

Step 2: Confirm your identity

Regulated brokers require KYC information to protect users. This means that you will have to submit two forms of identity to the broker which can include a passport, drivers license, birth certificate and proof of address.

Step 3: Deposit Funds

Once your account has been verified, you will be able to deposit minimum funds. eToro’s minimum deposit requirement is $20 but this will change depending on the broker that you use. You can use credit card, debit card, bank transfer, Skrill and Neteller to deposit funds into your eToro account. You can also use PayPal.

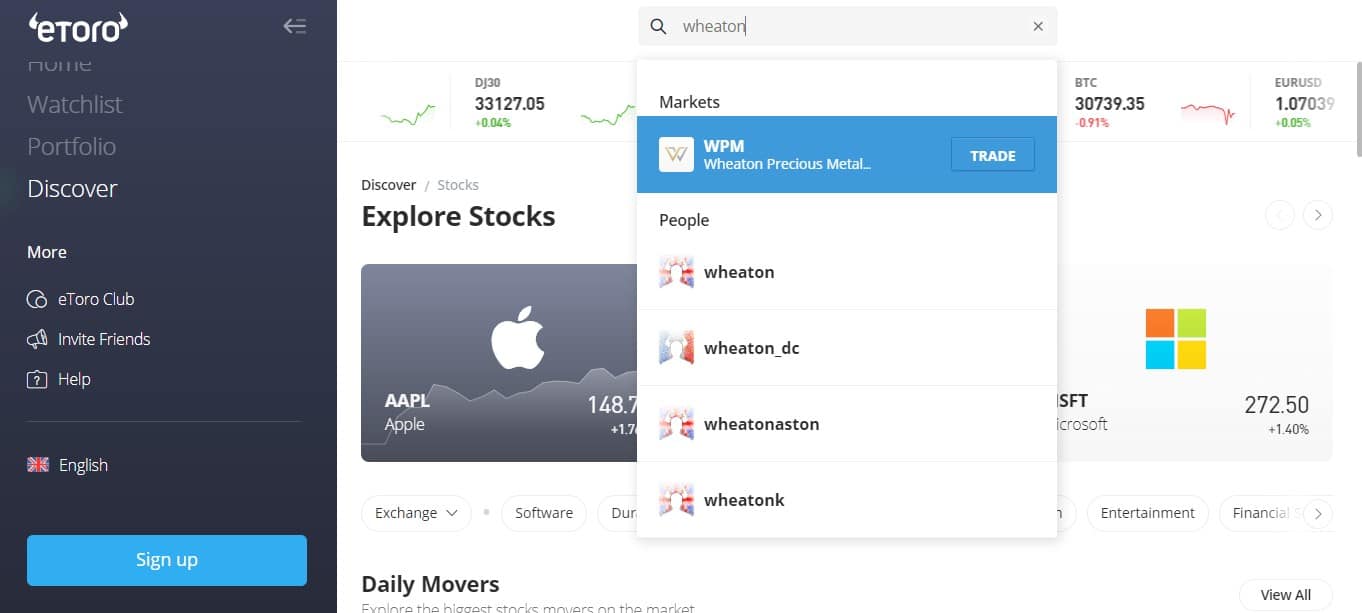

Step 4: Search for Silver Stocks

After you have funded your account, you should use the platform’s search bar to look for silver stocks or any other stock you wish to purchase. Once you have entered the amount you wish to credit into the trade, you must confirm the transaction.

Step 5: Place a Trade

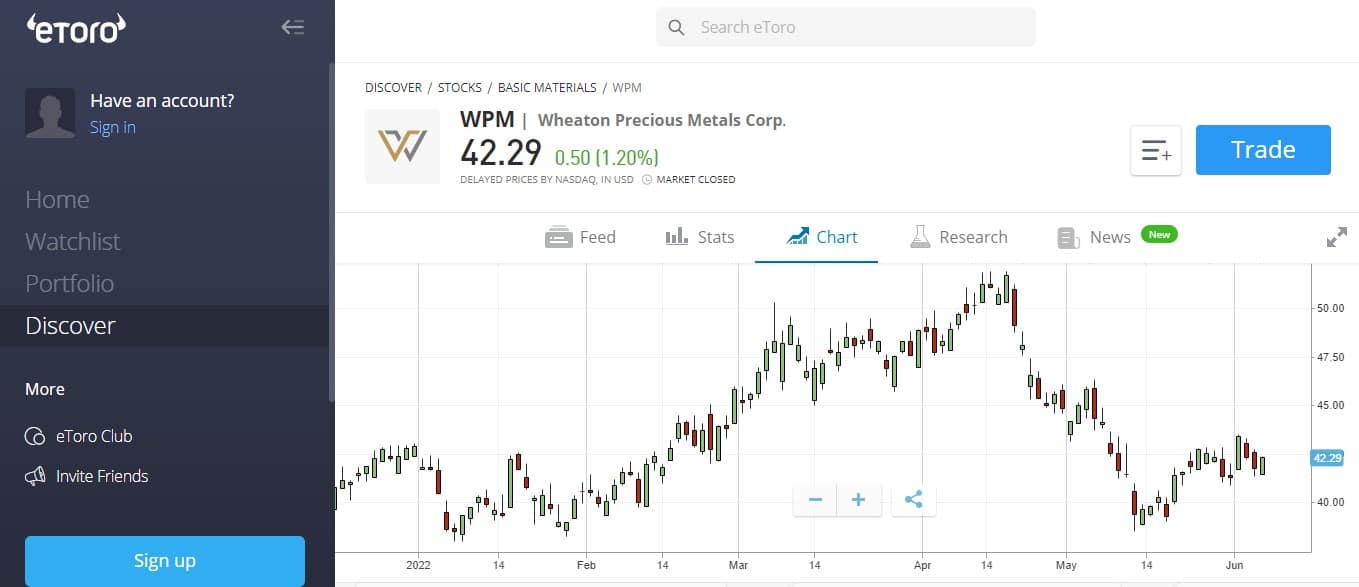

Silver stocks can be researched on your Silver stock homepage before buying them. In addition to reading your chatfeed, where recent news and comments about silver will be listed, you can check your profile. Additionally, you can also access powerful charting options here to apply your knowledge of technical charting and make your prediction about the Silver price.

Click on the blue ‘Trade’ button when you are ready to begin trading. This will open the buying dialogue box that appears below.

All you have to do is enter the amount of USD you want to spend here. In addition, you can set leverage on your purchases, but this can get complicated (not to mention risky), so it is not recommended for beginners.

Set Stop Loss

The stop loss prevents you from losing too much money if your trade is a mistake or the price drops dramatically. In addition, the software will automatically exit the trade when the price drops to a certain level.

Set Take Profit

In addition, you can set a ‘take profit price level to benefit from price increases. The software will also automatically terminate the trade at this level if the price increases.

Open your Silver Position

If you decide to set your stop loss and take profit levels later, you can do so, or you can ignore them entirely. As soon as you are satisfied with the details of your trade, click the blue ‘Open Trade’ button. (If the NASDAQ is not yet open, you can ‘Set Order’ instead, which will activate your trade instructions as soon as the NASDAQ opens).

Almost certainly, your trade will be executed immediately. Upon receiving your eToro notification, you will be able to view your trade-in in your eToro portfolio.

What Silver Stock to Buy?

There is a widespread belief that the price of silver is likely to rise in the near future. There’s a concern that the Federal Reserve’s easing of economic stimulus measures enacted during the pandemic will create headwinds for the stock market. As a result, safe-haven investments – such as precious metals such as gold and silver – are becoming a hot topic of conversation.

However, which are the best stocks in the category?

Majestic Silver Stock

First Majestic gets about half its revenue from silver and half from gold, making it one of the purest silver plays in the mining sector.

Despite being a Canadian company, First Majestic focuses on Mexico since Mexico produces more silver than any other country. The company operates three mines in Mexico and is developing several other silver mines.

First Majestic also operates Jerritt Canyon Gold Mine. First Majestic purchased this mine in 2021 as part of its diversification strategy. As a result, it has more exposure to silver than any of its peers, even after adding a primary gold mine.

As a producer of silver, First Majestic is positioned to outperform the precious metal’s price. That should increase profits faster than silver prices since it can increase productivity while reducing costs. However, it is also susceptible to operational issues and cost overruns due to this business model. The performance of a silver mining company’s stock can be affected by mining issues, management mistakes, and exposure to other commodities.

First Majestic believes that it can be a long-term outperformer. The company hopes to become the world’s largest primary silver producer. The company invests millions of dollars each year to find and develop new silver mines.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

MAG Silver Stock

MAG Silver Corp (MAG) is an exploration and development company that explores gold, lead, and zinc deposits. Additionally, MAG owns 44% of the Juanicipio project in Zacatecas, Mexico’s Fresnillo District. Founded in 2003, the company has its headquarters in Vancouver, Canada.

Despite MAG’s leading Momentum Grade rating, investors should be aware that MAG receives an ‘F’ grade by Seeking Alpha for Valuation.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

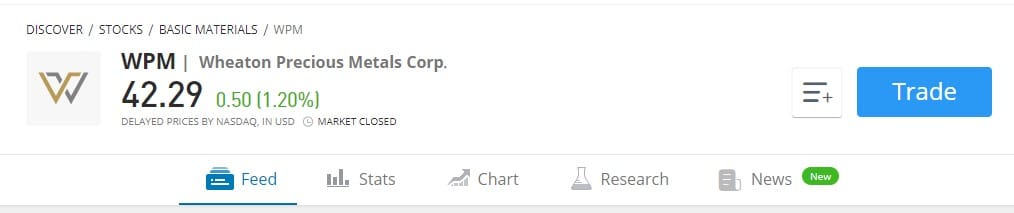

Wheaton Precious Metal Corp

Wheaton Precious Metals is a company that streams precious metals. Wheaton does not operate physical mines. Instead, it gives mining companies cash to cover some of the costs associated with mine development. The company receives rights to buy some of the metal produced by the mines at fixed prices in exchange.

Between 2022 and 2026, Wheaton expects its silver streams to account for approximately 40% of its production mix. Silver is the company’s highest exposure among its streaming and royalty competitors.

Wheaton has a contractual obligation to purchase the precious metal up until 2025 for an average price of $5.81 per ounce. Therefore, silver prices above that level generate profits for Wheaton.

Due to its focus on streaming, the company is able to generate a lot of cash. This money is used by Wheaton to invest in new streams and to pay dividends to its shareholders. In addition, due to Wheaton’s business model, it can benefit from rising silver prices in the same way as mining companies. In contrast, it does not come with the risks or potential cost overruns associated with physical mining.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

How To Buy Stocks in Silver – Conclusion

Silver’s price can fluctuate a lot. Over the past decade, silver price rose more than 45% in 2020, giving some of those gains back in 2021, declining about 10% in 2021, then rallying by double digits in early 2022. Silver prices fluctuated in response to economic, inflationary, and geopolitical factors. Cryptocurrencies and precious metals were affected by those factors.

Despite the inflation-protection properties of silver, there is more to it than that. Metal has important industrial applications. For example, it is essential for the production of clean energy. As a result, solar energy and electric vehicles (EV) are the two fastest-growing industries.

The growing demand for silver could continue to drive its price higher in the coming years. In addition, silver could provide a way to profit from the growth of clean energy.

Most investors prefer silver stocks over physical metals such as coins and bars. Silver companies can often seek growth opportunities as silver demand rises, allowing them to achieve greater profits faster than silver prices increase. In that case, they should outperform silver. In addition, investors can avoid the hassles and risks that come with acquiring, storing, and insuring physical assets by not owning the physical metal.

Silver, a unique precious metal with the consumer, industrial, and investor demand, is playing a growing role in the economy. As a result, silver mining stocks and silver-focused ETFs may make an attractive addition to many portfolios.

We recommend eToro to perform all your silver stock investments. You can start trading with a minimum investment an all the benefits of the best regulated platform on the market.

eToro – Overall Best Platform to Buy Silver Stocks

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.