Best Metals Trading Platform 2026 – Online Metal Trading Apps

Metal brokers help their clients to trade precious and non-precious metals on financial exchanges such as the New York Mercantile Exchange, Nadex, Dubai Gold & Commodities Exchange, Shanghai Futures Exchange, and London Metal Exchange.

A metal broker offers services like CFDs and Spreadbetting to trade metals such as gold, silver, copper, platinum, and palladium. But, first, let’s check the best metal trading platforms.

Best Metals Trading Platforms in February 2026

- eToro – Overall Best Metal Trading Platform

- TD Ameritrade – Highly-Reputed Platform For Metal Trading

- Interactive Brokers – Excellent Platform To Trade Metals

Best Online Metal Trading Platforms Reviewed

Here we have listed the best metal trading platforms to meet your trading needs.

1. eToro – Overall Best Metal Trading Platform

You can trade metals online with eToro in most cases. The broker allows you to purchase gold via an ETF with over 13 million clients. Although the SPDR Gold Shares market is the most popular, this platform offers the best SPDR ETFs.

On eToro, shares and ETFs are not subject to commissions. Furthermore, there is no monthly fee to keep your metal investment for as long as possible. At eToro, you can also trade metals in other markets. CFDs on gold, for example, can be traded with a leverage of up to 1:20. In addition to shorting gold, you can also sell it if you believe it is overpriced. eToro offers commission-free metals CFDs as well.

eToro requires a minimum deposit of $50 USD for UK and EU users, and $100 USD for the US users to open an account. On the stock market, shares and gold ETFs start at $10, and investments in ETFs start at $500. However, CFDs can be accessed with even less capital, especially if leverage is used. eToro accepts debit/credit cards, e-wallets, and bank transfers for deposits. In addition, eToro, a broker regulated by the FCA, has an excellent mobile investment app that allows you to invest in metals.

eToro fees

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros:

Pros:

- Easy to use, simple interface

- Highly regulated

- Copy-trading service

- Spreads are very low

- 0% commission is charged

- Diversification of assets

- Depositing funds is simple and easy

Cons:

Cons:

- The platform may not be suitable for advanced traders

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. TD Ameritrade – Highly-Reputed Platform For Metal Trading

There is no doubt that TD Ameritrade is among the world's most reputable brokerage firms. It offers a huge library of stocks, ETFs, and investment funds and has been around for more than four decades.

However, TD Ameritrade also operates a fully-fledged metal trading facility. The platform offers gold and silver trading.

The platform's global client base can trade all supported metals 23 hours daily. TD Ameritrade's 'Thinkorswim' platform is best suited for experienced traders.

Due to its professional-level tools and features, it may appear daunting to the untrained eye.

TD Ameritrade Fees:

| Fee | Amount |

| Stock trading fee | 0% |

| Forex trading fee | Not Supported |

| Crypto trading fee | Not Supported |

| Inactivity fee | No |

| Withdrawal fee | Free |

Pros:

Pros:

- A US-based brokerage firm

- Offering thousands of stocks and funds

- Includes commodities, forex, futures, and cryptocurrencies

- No commissions on US stocks and ETFs

- Fast deposits via bank transfer

- Excellent regulatory standing

- Extensive research materials

Cons:

Cons:

- Does not accept debit/credit cards or e-wallets

There is no guarantee that you will make money with this provider. Proceed at your own risk..

3. Interactive Brokers – Excellent Platform To Trade Metals

Interactive Brokers was founded in 1978 and is a US-based company offering free trading platforms regulated by several financial authorities, including the UK's Financial Conduct Authority, the US Securities and Exchange Commission, the Commodity Futures Trading Commission, and Hong Kong's Securities and Futures Commission. The firm is also a member of the NYSE FINRA SIPC.

With a market capitalization of $28.08 billion, Interactive Brokers is regulated by numerous global authorities and traded on NASDAQ under the ticker symbol IBKR. Additionally, Interactive Brokers is a publicly-traded company that publishes its financial statements, making it a trusted trading platform for millions of traders.

The most attractive features of Interactive Brokers are commission-free trades and no account minimums. Furthermore, Interactive Brokers offers one of the most extensive product and market offerings. You can trade traditional stocks and ETFs, futures, CFDs, and forex through this discount broker on a commission-free basis, diversifying your portfolio at a low cost.

With Interactive Brokers, you can invest in stocks listed on international exchanges to diversify your investment portfolio. Using this free trading platform, you can also trade and invest in fractional shares of stocks. Thus, beginners and experienced traders can invest as much money as possible to meet their trading objectives and time horizons and diversify their portfolios without determining how many whole shares they can afford to purchase.

Interactive Brokers Fees:

| Fee | Amount |

| Stock trading fee | 0% |

| Forex trading fee | Not Supported |

| Crypto trading fee | $5.00 per contract |

| Inactivity fee | No |

| Withdrawal fee | One free withdrawal request per month. |

Pros:

Pros:

- Clients in the US can trade stocks and ETFs commission-free

- Low margins with low-interest rates

- Access to social trading services and robo-advisory services

- Allow users to purchase shares of stocks listed on international exchanges.

- Fractional shares can be purchased and sold.

Cons:

Cons:

- A $20 monthly inactivity fee applies to accounts with less than $2,000 in balance.

- The interface can be confusing for new or inexperienced traders.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How to Choose the Best Metals Trading Platform for You

Regulation

According to a new study, metals markets are becoming more difficult to regulate due to more subtle forms of manipulation and new trading platforms.

In line with the report, opaque pricing mechanisms and weakly regulated market platforms are vulnerable to manipulation by powerful market participants, including trading houses, major producers, and financial institutions.

Politicians need to combat such practices urgently to prevent the substantial economic harm these distortions may cause and prevent the international tensions they can start.

In the final report of a two-year investigation released last week, the US Senate raised charges of alleged manipulating of oil, aluminum, and coal markets by Wall Street banks. In addition to other regulatory burdens and listless markets, these factors have led many banks to give up physical trading and ownership of commodities.

That has raised concerns that risks may be transferred to companies with less regulation.

The report notes that national authorities regulate commodity markets and that unclear and overlapping jurisdictions often hamper this process. For example, the Financial Conduct Authority regulates the London Metals Exchange in London, but it does not consider itself responsible for its approved warehouse network.

Commodities

Usually, gold, silver, and platinum are involved in metals trading. Therefore, the outlook for the global economy and major currencies is closely tied to the metals trading market.

Fees

Platforms that trade metals aim to make money. Exactly how they do this varies from platform to platform. Therefore, you should always check what fees will be charged when trading metal on your chosen site.

Metals Trading Commission

Each time you place a buy or sell order, some metal trading platforms charge a commission. Except in a few rare cases, this will be a variable percentage. For example:

- Consider that you are trading gold with your chosen broker and that they charge a 0.1% commission

- You place a $500 purchase order

- A commission of just $0.50 (0.1% of $500) is charged for entering a trade.

- The trade is worth $600 when you close it.

- Closing the trade again will result in a 0.1% commission, so that's $0.60 (0.1% of $600).

As a result, the best metal trading platforms in 2022 will offer commission-free trades. You will only pay a spread fee in this scenario.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Commodity Trading Spreads

There is a spread between the raw material price and the finished product price created from that commodity. There are some favorite trades in the futures market based on commodity-product spreads.

An investor typically trades on the spread by taking a long position in raw materials and a short position in a finished product.

Leverage Fees

Leverage is likely needed unless you have substantial capital in your metal trading platform account. In addition, you will incur overnight financing fees when you trade leveraged products.

That is a fee you pay to the platform you choose to keep the open position overnight. The fee will be deducted from your account balance daily and charged to your credit card. Due to this, you should check the cost of your chosen platform. It is usually expressed as a percentage and multiplied by the stake. The greater the stake and the greater the leverage, the more you'll pay.

Other Fees

The best metal trading platforms also charge fees in other areas.

That includes:

- Inactivity Fee: When your account remains inactive for an extended period, even the best metal trading platforms charge you. Usually, this occurs after 12 months, but it can occur much sooner.

- Transaction Fees: To deposit or withdraw funds, you might need to pay a fee.

- Currency Conversion Fees: You may be charged a fee by some metal trading platforms when you trade a precious metal not priced in your base currency.

Trading Tools and Features

Making consistent profits from trading metals online is difficult. That is especially true for those who are new to the field. Therefore, you should check if your chosen platform offers a variety of tools and features that can help you succeed at currency trading.

Leverage

As discussed earlier, metals trading can be challenging without substantial capital. As a result, if you're looking to day trade, you'll be targeting very small profit margins.

Therefore, if leverage is something you need, check whether your chosen metal trading platform offers it. You will again be limited by your country of residence - with the UK, Europe, and other regions capped at 1:30.

Order Types

Many types of orders are available on the best metal trading platforms. Along with buy/sell and market/limit orders, this should include take-profit and stop-loss orders. You will be able to trade metal online in a risk-averse manner.

You can also place orders for:

- Trailing Stop-Loss

- Guaranteed Stop-Loss

- Good for the Day (GFD)

- Good 'Till Cancelled (GTC)

- One-Cancels-the-Other (OCO)

Alerts

The best way to stay on top of the game is to choose a metal trading platform that provides alerts. It would be even better if these alerts were delivered to your mobile phone in real-time.

You might be notified if a major metal pair breaches a key residence line. Alternatively, the platform might alert you when a story breaks that might impact the price of a currency pair in the future.

With the best metal trading platforms, you'll never miss out on significant fundamental and technical events.

Education, Research, and Analysis

If you are just started as an online metal trader, it's best to choose a platform that can help you improve your knowledge of the industry. For example, eToro offers everything from metal trading guides and videos to weekly webinars.

In the case of research, the best metal trading platforms offer financial news and market insights. That is great for keeping abreast of key market developments and can help with your trading decision-making process.

The best metal trading platforms provide advanced chart reading tools for technical data. In addition, they should provide customizable screens, technical indicators, and chart drawing tools.

User Experience

Metal trading has alarming pace-exchange rates change seconds after they're set. So you'll want to make sure that your chosen metal trading platform offers a great end-to-end user experience. For example, is it easy to find a metal market you like and is it easy to place orders?

We found that there is often a huge difference in how user-friendly a metal trading platform is during our research process.

Some platforms, such as TD Ameritrade, are more suitable for seasoned metals professionals. The reason is that TD Ameritrade's metal trading facility is packed with advanced functionalities and features. Experienced traders may find this useful, but beginners may find it overwhelming.

Demo Account

The demo account allows you to practice your metal trading endeavors without risk. Many metal trading platforms allow you to open a demo account that simulates real trading conditions.

That is great for learning the ropes of a complicated metal trading scene - as you can keep practicing until you are ready to risk your own money. However, there is a time limit on how long you can use the demo account facility on some forex platforms - usually 30 days.

Payment Methods

There is a wide variety of everyday payment methods available on the top metal trading platforms we reviewed. That makes depositing and withdrawing money incredibly easy. eToro, for example, not only supports instant deposits through debit and credit cards and e-wallets.

However, our review of metal trading platforms found that some only accept bank transfers. Therefore, you may still be entitled to an instant deposit if you use a platform based in your country of residence. However, bank transfers can take several days to arrive in many cases.

Customer Service

The top metal trading platforms provide a live chat facility available at least 24 hours, seven days a week. Moreover, support agents will be able to assist you in real-time without picking up the phone.

Some metal trading platforms we encountered only offered email support at the other end of the spectrum. So, unfortunately, you might have to wait several hours to hear back.

How to Start Metals Trading in the US - eToro

Having read this guide up to this point, you should now understand how to choose a metal trading platform. Your next step is to place your first metal trading order.

To ensure you understand what this entails, we will walk you through the setup process of the commission-free platform eToro.

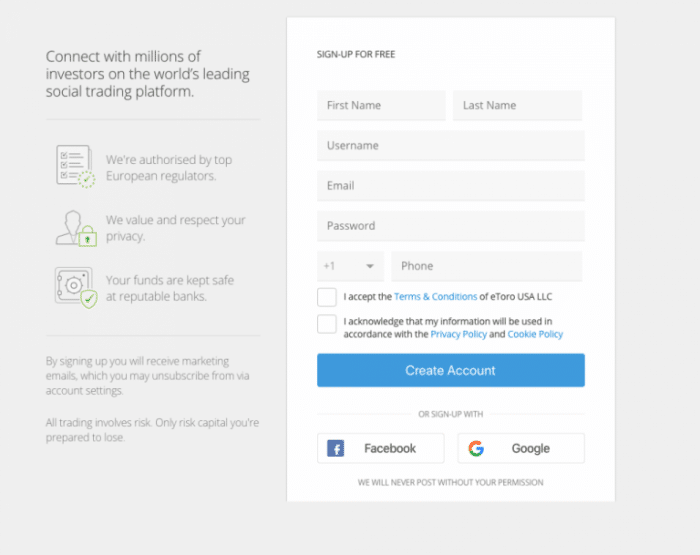

Step 1: Open an Account and Upload ID

You will still need to open an account with eToro even if you use the demo account. However, it should only take a few minutes.

You need to go to eToro's website, click 'Join Now,' and follow the instructions. A few personal details, contact information, and your national tax number are required.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Step 2: Confirm Identity

Due to its regulated status, eToro must verify all new account holders. The process at eToro takes just a few minutes and requires the following two documents:

- Your passport or driver's license

- your last utility bill or bank account statement (issued within the past 3 months)

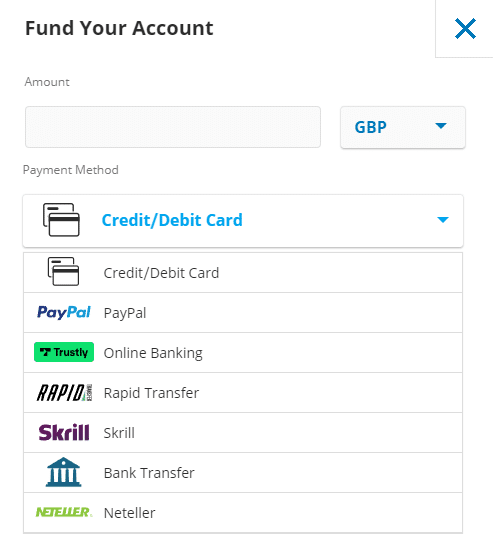

Step 3: Deposit Funds

You will now be asked to deposit funds into your newly created metal trading account.

The following deposit options are available:

- Debit cards

- Credit cards

- E-wallets (Paypal, Skrill, or Neteller)

- Bank transfer

Unless you select a bank transfer, all deposits on eToro are instantly processed.

Step 4: Search for Metals

You can search for the metal pair you wish to trade once your deposit has been processed.

Then, you have to click on the 'Trade' button.

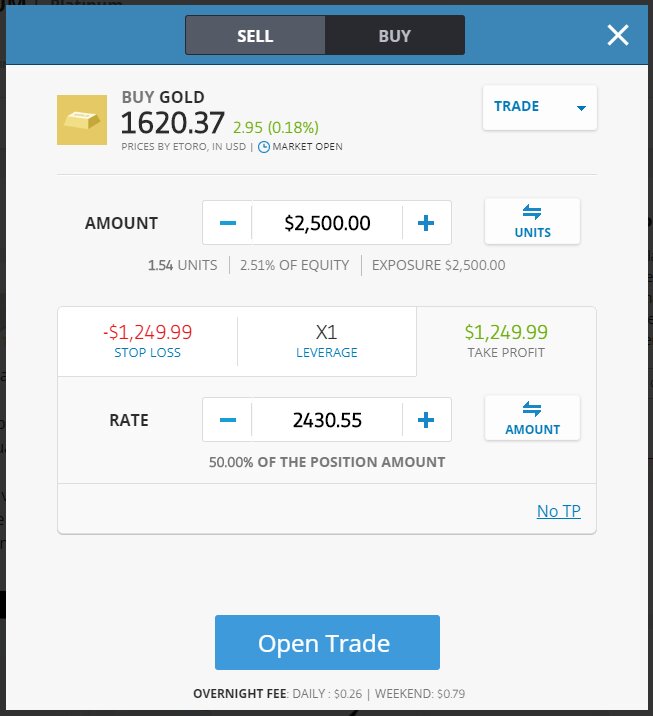

Step 5: Place a Trade

Your next step will be to set up a metal trading order.

You will need to fill out the following fields:

- Buy/Sell Order: The pair needs to be bought if you believe its value will increase. If you think the pair will decrease in value, you need to place a sell order.

- Amount: This is the amount you want to stake in this metal trade. At eToro, this should always be entered in US dollars.

- Leverage: To trade with leverage, select your desired multiple.

- A metal trade can also be executed at a specific price that you specify. Click on 'Trade' at the top right-hand corner of the box and select 'Order.' Then, enter the price you wish to pay.

- You can also place stop-loss and take-profit orders by clicking on the respective buttons and entering your desired exit price.

To order commission-free metal trading on eToro, click on 'Open Trade'!

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

The Verdict

The platform you choose to trade metal online is one of the most important decisions you need to make.

Ultimately, you risk your hard-earned money - so make sure a reputable body regulates the provider. Furthermore, you must ensure the platform offers your chosen metal and allows you to enter positions cost-effectively.

The best metal trading platform on the market right now, based on our research, is eToro. Metal can be traded without commission and at low spreads on this heavily regulated platform.

It takes minutes to get started at eToro, the platform is easy to use, and you can make a deposit instantly with a debit/credit card or eWallet!

eToro - Overall Best Metals Trading Platform

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.