Best Fastest Trading Platform – Cheapest Online Brokers Revealed

The landscape of financial markets and trading technologies has undergone substantial evolution from the era of conventional trading systems. The advent of high-frequency trading, propelled by advancements in technology and enhanced connectivity, marks a significant shift in trading methodologies.

The choice of trading platform plays a crucial role in the efficacy of high-frequency trading strategies. This article provides an analytical review of leading trading platforms with a focus on speed, and outlines the essential attributes to consider when choosing a broker for high-frequency trading.

Best fastest trading platforms 2026

There are several fast brokers out there that you might consider using, however, the top brokers are as follows:

- eToro – The best overall fast trading platform

- Libertex – The best fast trading platform through MT5

- AvaTrade – The best fast trading platform for high leverage

4

Payment methods

Features

Customer service

Classification

Mobile App

Fixed commissions per operation

Account Fee

- Buy shares and ETFs with 0% commission

- Social and copy trading network

- Invest and trade crypto with low fees

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Account Info

Fees per operation

- Amazing research tools

- Almost no fees

- User-friendly platform

Schwab Stock Slices is not intended to be investment advice or a recommendation of any stock. Investing in stocks can be volatile and involves risk, including loss of principal. Consider your individual circumstances prior to investing.

Account Info

Fees per operation

- Great selection of long-term investment products

- Access US-listed stocks

- ETFs

Investing involves risk, including risk of loss.

Account Info

Fees per operation

- Offers low-commission CFD and Forex trading

- Exposure to 78 different stock markets

- No minimum deposit required

The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed income can be substantial.

Account Info

Fees per operation

Best fastest trading platforms reviewed

1. eToro – number 1 platform for fast trading and social investing

eToro is often regarded as the number one platform for fast trading and social investing due to several key features:

- User-friendly interface: eToro’s platform is designed to be intuitive and accessible, making it easy for both beginners and experienced traders to navigate and execute trades quickly.

- Social trading features: eToro is known for its pioneering role in social trading. Users can follow and copy the trades of experienced investors, facilitating a more interactive and collaborative approach to trading.

- Wide range of instruments: The platform offers a diverse array of trading instruments, including stocks, cryptocurrencies, ETFs, and commodities, allowing traders to diversify their portfolios easily.

- High-speed execution: eToro is equipped with technology that ensures fast and reliable trade execution, which is crucial for traders engaging in high-frequency trading strategies.

- Educational resources: eToro provides a wealth of educational content and resources, helping users to stay informed and make well-informed trading decisions.

- Regulatory compliance: eToro is regulated by several financial authorities, which adds a layer of security and trust for its users.

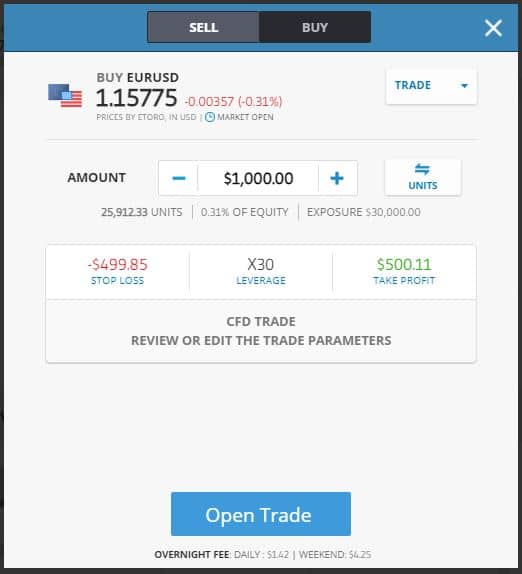

eToro offers leverage trading, allowing traders to amplify their market exposure with a smaller initial investment. For example, with x30 leverage on major currency pairs, a $100 investment effectively controls $3,000 in the market. Similarly, x20 leverage on minor currencies turns a $100 investment into a $2,000 market position, and x15 leverage on key commodities allows a $100 investment to command a $1,500 position.

Traders can manage their positions via eToro’s web portal or mobile app. Account creation is straightforward, providing access to CopyPortfolios and a social trading network of over 17 million users. This feature enables traders to replicate the strategies of experienced and successful traders, including those proficient in fast trading.

eToro’s regulatory compliance and global certifications ensure a secure trading environment. To start trading, a minimum deposit of $200 is required after setting up an account.

eToro fees:

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros

Pros

- Low to no fees

- Tight spreads

- Huge range of assets to trade – including stocks, indices, ETFs, cryptocurrencies, currencies, and commodities

- Social trading and copy trading tools are available

- Regulated by the UK FCA

- Smooth and efficient account setup process

Cons

Cons

- Does not support signals for forex trades

- Not suitable for traders who use advanced charting tools

- A charge of $5 for withdrawals

- Exclusive use of USD as the account’s primary currency

- Need for enhancements in customer service quality

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

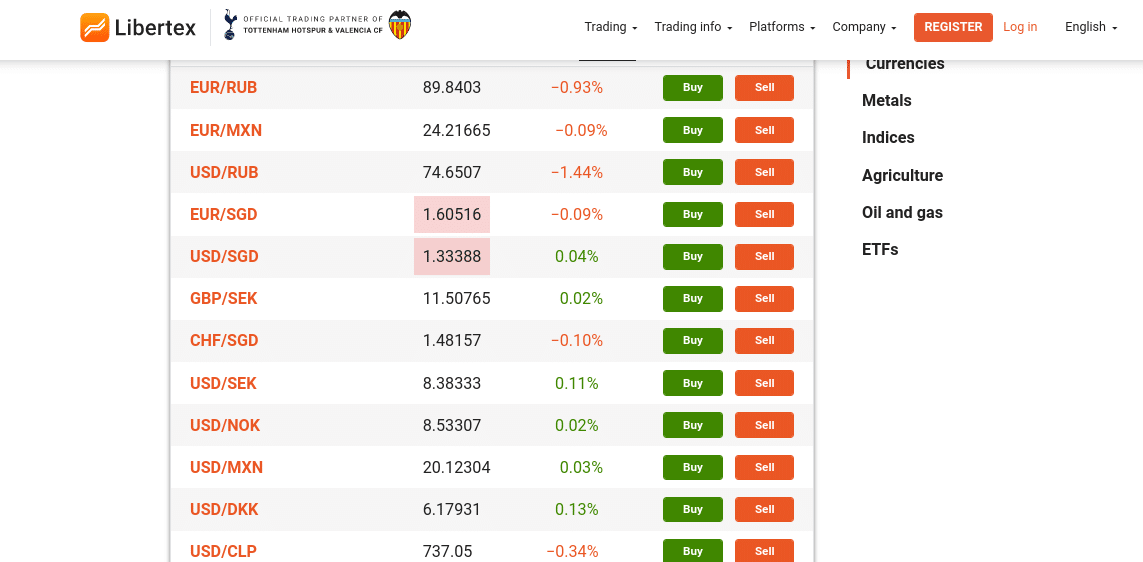

2. Libertex – the best fast trading platform through MT5

Libertex is often chosen as the best fast trading platform for use with MT5 for several reasons:

- Advanced trading features: Libertex, through MT5, offers advanced trading features and tools that are essential for fast trading. This includes comprehensive charting tools, technical analysis options, and automated trading capabilities.

- High leverage options: For experienced traders, Libertex provides high leverage options, enhancing the potential for significant market exposure and profitability in a short amount of time.

- Zero spread offering: Libertex’s zero spread feature is particularly advantageous for fast trading, allowing for immediate execution at the most competitive prices.

- Comprehensive asset range: The platform supports a wide variety of asset classes, including stocks, commodities, and currencies, which is beneficial for traders looking to diversify their fast trading strategies.

For professional traders who meet the criteria of experience, Libertex offers an exceptional leverage option, reaching up to 1000x on certain currency pairs, a feature that is notably high in the industry. Compatible with both MT4 and MT5, Libertex also provides its own bespoke trading platform, which includes a comprehensive array of tools.

These tools encompass market sentiment analysis, an integrated news feed, and various customizable signal services, catering to the diverse needs and strategies of advanced traders. This combination of high leverage, platform compatibility, and advanced trading tools makes Libertex a standout choice for seasoned traders.

Libertex fees:

| Fee | Amount |

| Stock trading fee | Commission. Between 0.1% and 0.2%. |

| Forex trading fee | Commission. 0.008% for GBP/USD. |

| Crypto trading fee | Commission. From 0.47% to 2.5%. |

| Inactivity fee | $5 a month after 180 days |

| Withdrawal fee | Free |

Pros

Pros

- Supports both MT4 and MT5

- High leverage, up to 1000:1 for professional traders

- Very low minimum deposit – as little as 10 GBP

- Regulated and insured by CySEC

- Very low fees and commissions

Cons

Cons

- Execution times are slower than its competitors

- Restricted selection of account options

- Scant educational resources for novice traders

- Absence of the MetaTrader 5 platform

- Lack of FIX API trading capabilities

- Unavailability of managed account services

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

3. AvaTrade – the best fast trading platform for high leverage

Experienced traders may want to consider Avatrade as an option for fast trading in 2026. This is largely because the platform offers cutting-edge tools as well as high leverage trading and access to a diverse range of financial instruments. The platform is also compatible with MT4 and MT5 as well as a portfolio of automated trading platforms.

AvaTrade is considered one of the best platforms for fast trading and high leverage due to several key features:

- Diverse Trading Instruments: AvaTrade offers a broad range of financial instruments, including forex, stocks, commodities, indices, cryptocurrencies, ETFs, and even bonds. This diversity allows traders to diversify their portfolios and take advantage of different exchanges and markets, making it a versatile platform for various trading strategies.

- Advanced Trading Platforms: The broker provides access to several trading platforms, including AvaTradeGo, MetaTrader 4, MetaTrader 5, DupliTrade, and AvaOptions, catering to both novice and professional traders. These platforms offer robust tools and features for efficient and fast trading.

- High Leverage Options: AvaTrade allows for higher leverage, which is a significant advantage for traders looking to maximize their market potential. While high leverage can increase exposure and potential returns, it’s important for traders to be aware of the risks involved.

- Mobile Trading Capability: With AvaTradeGO, the broker’s mobile application, traders can manage their accounts on the go. This app is available on both iOS and Android platforms, making it convenient for traders to execute trades quickly and monitor their portfolios from anywhere.

A key feature of the AvaTrade platform is its provision of exceptionally high leverage options. A substantial number of currency pairs, including major ones, are available for trading with leverage up to 400:1. This high leverage ratio is a significant draw for traders who are prepared to embrace higher risks in pursuit of amplified profit opportunities.

Additionally, AvaTrade distinguishes itself with its competitive spreads. For instance, the EUR/USD pair can be traded with spreads as low as 0.9 pips. This competitive pricing structure reduces the overall trading costs, offering a cost-effective solution compared to many other trading platforms

AvaTrade fees

| Fee | Amount |

| CFD trading fee | Variable spread |

| Forex trading fee | Spread. 0.9 pips for EUR/USD |

| Crypto trading fee | Commission. 0.25% (over-market) for Bitcoin/USD |

| Inactivity fee | $50 per quarter after three months of inactivity |

| Withdrawal fee | Free |

Pros

Pros

- Licensed in six separate countries and in accordance with UK regulatory standards

- Features a professional desktop platform and supports the vanilla FX settings.

- MT4 and MT5 compatible for advanced analysis

- Tight spreads and minimal costs

- Leverage up to 400x

- Minimum deposits are quite minimal, as little as 100 USD/GBP.

Cons

Cons

- The broker offers a limited choice of assets

- AvaTrade imposes substantial inactivity fees.

- Foreign exchange trading costs are considered moderate, aligning with industry averages.

71% of retail CFD accounts lose money with this provider.

Fastest trading platforms – fee comparison

Below is a table comparison of each of the brokers that have been mentioned above.

| Name of Broker | Fast trading tool | GBP/USD Spread | EUR/USD Spread |

| eToro | Social trading platform – CopyTrade | 2 pips | 1 pip |

| Libertex | Highest leverage for professional traders – up to 1000x | 0 (fee of 0.006%) | 0.9 pips |

| Avatrade | High leverage of up to 400x alongside vanilla options | 1.6 pips | 0.9 pips |

Fastest Trading Apps Assets & Software Comparison

| Asset Class/Software | eToro | Libertex | AvaTrade |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Cryptocurrencies | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

| MT4 Trading Platform | No | Yes | Yes |

| MT5 Trading Platform | No | Yes | Yes |

How to Choose the Best Fastest Trading in 2026

In selecting an optimal high-speed trading platform, it is imperative to deliberate on various critical factors that directly influence the efficacy of your trading approach. This comprehensive analysis encompasses several key considerations.

Regulation and Safety

Amidst increasing incidents of online financial malfeasance, engaging with a broker that is not only regulated but also provides robust security measures is paramount. Such brokers undergo regular scrutiny by authoritative entities and adhere to stringent operational standards, ensuring a secure trading environment.

Authenticating a broker’s regulatory compliance involves verifying their registration with oversight bodies like the Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC). These regulatory bodies enforce compliance with financial regulations. The absence of registration with a regulatory authority might indicate infrequent inspections and potential risks.

While regulated brokers are generally preferred for their adherence to security protocols, some traders opt for unregulated brokers due to the greater operational flexibility and reduced external intervention they offer. Nonetheless, this choice comes with increased risk.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Assets

High-performance trading platforms should provide a diverse range of asset classes to cater to the needs of active traders. This comprehensive offering enables efficient execution of numerous trades per day and facilitates effective diversification of trading portfolios, mitigating overall risk.

Platforms that support a wide array of asset classes often boast enhanced functionality, as they must accommodate diverse trading styles and strategies. On these platforms, traders can seamlessly transition between equities, currencies, commodities, indices, ETFs, and cryptocurrencies, streamlining their trading process.

Fees

Thorough consideration of fees is paramount when selecting a trading platform, particularly for active traders who execute numerous trades each day. Platforms with exorbitant trading fees can significantly erode trading profits, favoring those with competitive or even zero-fee structures.

Trading fees encompass the costs associated with placing each trade, while non-trading fees pertain to the expenses incurred for maintaining an account with the brokerage firm.

Before committing to a platform, traders must meticulously review all applicable fees, especially those relevant to their specific trading strategies and asset classes. Fees tend to vary across asset classes and may be influenced by regional regulations. Opting for a platform with lower fees is always the preferred choice, ensuring maximum profitability for traders.

Trading Commission

“A commission is a fixed fee that you pay for each exchange order you place. One of the advantages of commissions is that they are known in advance, allowing you to easily incorporate commissions and account for them when backtesting a strategy or developing a trading plan.

Commissions are typically volume-based, meaning the higher your trading volume, the lower the commissions that you will have to pay. However, commissions can sometimes be higher than spreads. Spreads are the difference between the buy and sell prices for an asset, and they are typically a percentage of the asset’s price.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Different brokers offer distinct spreads and commissions, and some brokers even provide a combination of both. While both spreads and commissions have their own advantages and disadvantages, commissions are typically preferred by high-frequency traders because they are fixed, predictable, and relatively low when a certain trading volume is surpassed.

When choosing a broker that charges commissions, you should always check if this broker offers rebates or discounts. Since high-frequency trading strategies typically involve large volumes, it will be easier for you to meet the threshold and be eligible for rebates, if any.

Spreads

Spreads are another type of cost that traders should be aware of when using a high-speed trading platform. Spreads are the difference between the asking price of an asset and the price that traders can actually trade the asset for. Brokers add spreads onto trades to generate revenue.

Spreads can be fixed or variable. Fixed spreads remain constant throughout the trading day, while variable spreads fluctuate during the trading day based on market volatility and liquidity. Traders should be informed of the spread their broker utilizes and whether it is fixed or variable.

Different brokers offer different spreads for different trading products. Even within the same asset class, spreads can vary. Traders should compare spreads across multiple brokers before making a decision.

Other Trading Platform Fees

Non-trading fees on different platforms can be categorized into three main types: account management fees, deposit/withdrawal fees, and inactivity fees.

Account management fees are charged to cover the costs associated with managing your trading account. This includes safeguarding your funds, providing access to the trading platform, and maintaining your account details.

Deposit or withdrawal fees are levied when you deposit or withdraw funds from your account. These fees are typically deducted from the amount you are depositing or withdrawing.

Inactivity fees are charged when your account remains inactive for a predetermined period. This inactivity includes not logging into your account, placing any trades, or depositing any funds. Some brokers may offer refunds for inactivity fees if your account becomes active again shortly after paying the fee.

Trading tools & features

Apart from the aforementioned qualities and requirements, there are other factors that traders must consider when choosing a broker. These factors relate to the resources and tools that the platform offers. A comprehensive suite of tools is always preferable to a limited one, even if you don’t intend to utilize all of them.

Fractional ownership and low minimums

For traders with limited funds, fractional ownership is an invaluable feature that allows them to participate in the stock market without the need to purchase entire shares. Fractional ownership enables traders to buy a portion of a share, such as one-tenth of a share, making even high-priced stocks accessible to those with smaller investment budgets.

This feature not only democratizes the stock market but also simplifies portfolio diversification. With fractional ownership, traders can easily spread their investments across multiple stocks, mitigating risk and enhancing their overall portfolio performance.

Automated trading

The automated trading capabilities offered by a platform are another important consideration when choosing one. While the most popular method is through the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, some brokers allow you to set up and execute automated trading strategies directly on their own platforms.

Traders can utilize a variety of automated trading strategies to streamline their trading process and optimize their returns. These strategies can include trading signals, bots, and copy trading, where traders can replicate the trading patterns of experienced traders.

In this regard, it is crucial to find a broker that supports automated trading methods to seamlessly integrate these strategies into your trading workflow.

Orders

“Trading platforms offer a variety of order types to cater to different trading strategies and risk management objectives. These include market orders, which execute immediately at the current market price, limit orders, which specify the maximum price you are willing to pay or minimum price you are willing to sell at, stop-limit orders, which combine the features of stop orders and limit orders, and stop-loss orders, which automatically sell a position when the price reaches a certain level to limit losses.

In addition to order types, trading platforms also provide different order timeframes, which determine the duration for which the order remains active. These timeframes include:

- Good-till-canceled (GTC): The order remains active until it is filled or canceled by the trader.

- Day Order: The order expires at the end of the trading day.

- One week: The order expires one week after being placed.

- One month: The order expires one month after being placed.

- End of week: The order expires at the end of the current week.

- End of month: The order expires at the end of the current month.

- End of Year: The order expires at the end of the current year.

- Good-till-date (GTD): The order expires on a specified date.

- Immediate or cancel (IOC): The order is either filled immediately or canceled.

It is crucial for traders to choose a broker that supports a wide range of order types and timeframes to effectively execute their trading strategies and manage risks accordingly.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Research and analysis

To make informed trading decisions, it is essential to select a trading platform that provides robust research and analysis tools. These tools should include advanced charting capabilities, real-time news updates, market signals, and technical analysis indicators.

Traders often employ a combination of technical and fundamental analysis to inform their trading decisions. This integrated approach provides traders with a comprehensive understanding of market trends and dynamics, enabling them to make sound trading choices.

As traders progress in their trading journey, they may require access to more sophisticated tools and analysis features. Therefore, it is crucial to evaluate the platform’s research and analysis capabilities before making a decision. A platform with comprehensive and professional-grade tools can significantly enhance a trader’s ability to make informed decisions and optimize their trading performance.

Demo account

A demo account is an invaluable tool for aspiring traders to gain hands-on experience and refine trading strategies without risking real money. These virtual trading accounts replicate the functionality and market data of live trading platforms, allowing traders to practice their skills in a risk-free environment.

By utilizing a demo account, traders can seamlessly transition from theory to practice, gaining confidence in their trading decisions and developing a deeper understanding of market dynamics. The immersive experience provided by a demo account empowers traders to experiment with various strategies, refine their risk management techniques, and identify potential pitfalls before venturing into the live market.

The most reputable trading platforms recognize the importance of demo accounts and offer them with features that closely mirror real-world trading conditions. This ensures that traders can confidently apply their strategies and skills in the live market, increasing their chances of success and minimizing potential losses.

Mobile app

The ability to access the market and your portfolio from anywhere is a crucial aspect of high-speed trading. As a result, it is essential to select a trading platform that offers a robust mobile app. The best apps should provide all the tools and functionalities needed to manage trades, monitor market movements, and analyze data on the go.

Leading platforms like eToro and XTB offer trading apps that are fully capable of replacing the desktop trader, offering a seamless and intuitive experience for mobile traders. This is ideal for traders who want to stay abreast of market developments and manage their positions around the clock, without compromising on features or functionality.

Payment methods

A wide range of deposit and withdrawal options is a key consideration when choosing a broker. While most brokers accept bank transfers and credit/debit cards, it is preferable to choose brokers that offer alternative deposit methods, such as e-wallets like PayPal, Skrill, and others. This allows you to easily fund and withdraw money from your account, enhancing your overall trading experience.”

Benefits of using multiple deposit methods:

-

Convenience: Diversifying your deposit options provides greater flexibility and convenience, allowing you to choose the most suitable method for each transaction.

-

Speed: E-wallets generally offer faster processing times for deposits and withdrawals compared to traditional bank transfers.

-

Security: Reputable e-wallet providers employ robust security measures to protect your financial information.

By offering a variety of deposit methods, brokers cater to a wider range of traders, including those who prefer e-wallets for their convenience and speed. This also promotes better customer satisfaction and retention.

Customer service

The final consideration when choosing a trading platform is the level of customer support it offers. A responsive and supportive customer support team is crucial for traders of all levels, providing assistance with technical issues, account management, and trading strategies.

Top-tier trading platforms typically offer multiple support channels, including live chat, phone support, and email support. Live chat is particularly valuable as it provides immediate assistance and allows traders to resolve issues promptly. Additionally, look for platforms with 24/7 customer support availability, ensuring that traders can access assistance at any time of day or night.

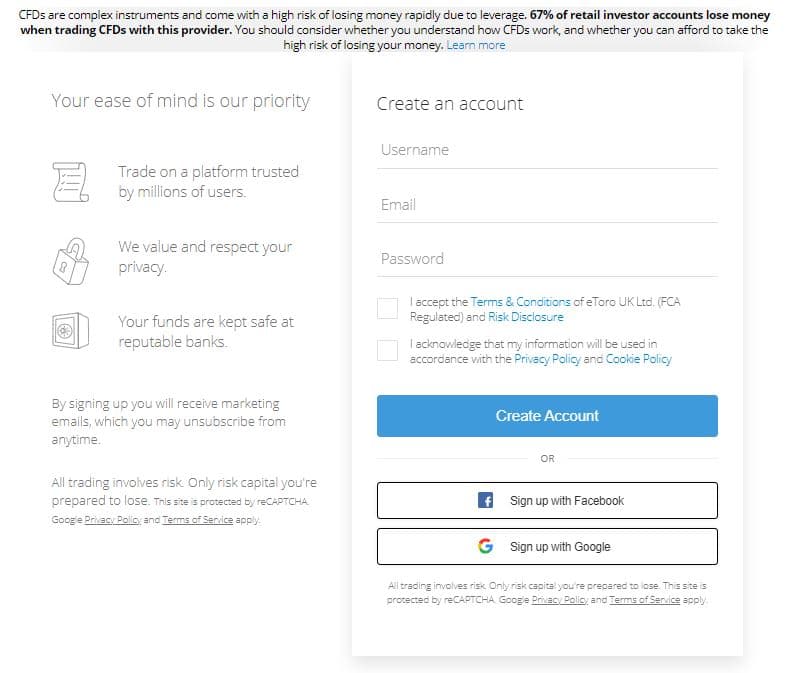

How to get started with the best fastest trading platform – eToro

The best rapid trading platform, eToro, has a straightforward five-step process for creating an account that is relatively easy to follow. Below, we’ve gone into further detail on each of these.

1. Open a trading account

To get started, create an eToro account. Simply visit their website and click the “Join Now” button to accomplish this. You have two options for logging in: from scratch or through your Facebook or Gmail account.

67% of retail investor accounts lose money when trading CFDs with this provider.

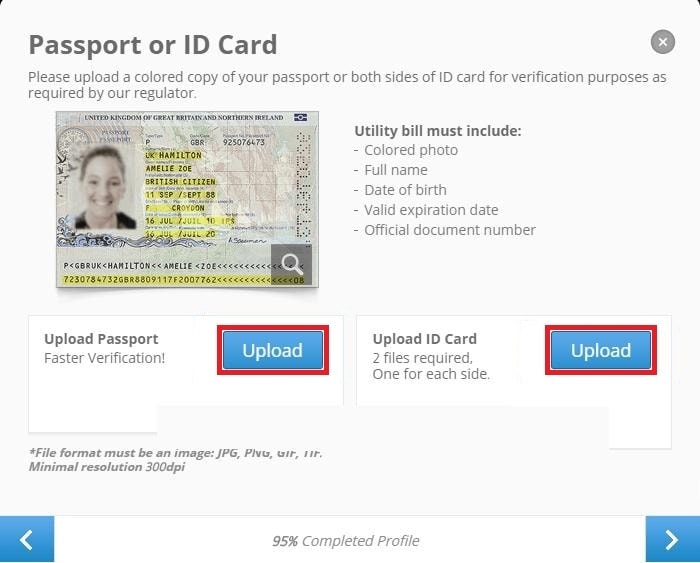

2. Confirm identity

The next step is to confirm your identity. This is part of the platform’s security protocol.

To confirm your identity you will need to upload a passport or drivers license as well as a proof of address. This step can take up to 48 hours to complete.

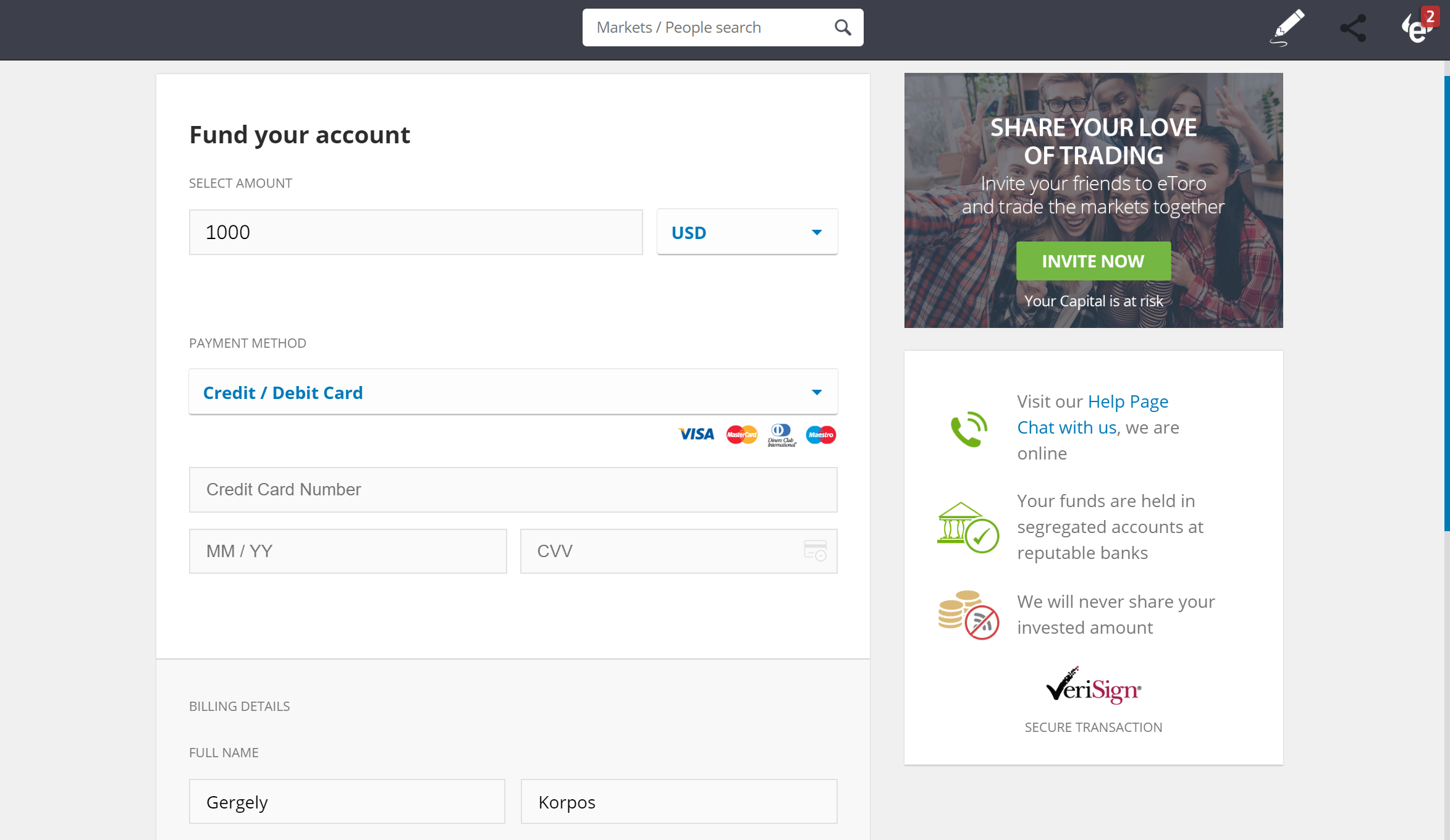

3. Deposit funds

The next step is to deposit funds into your account. You can do so either via your debit/credit card, a bank transfer, or online wallets such as PayPal and Skrill.

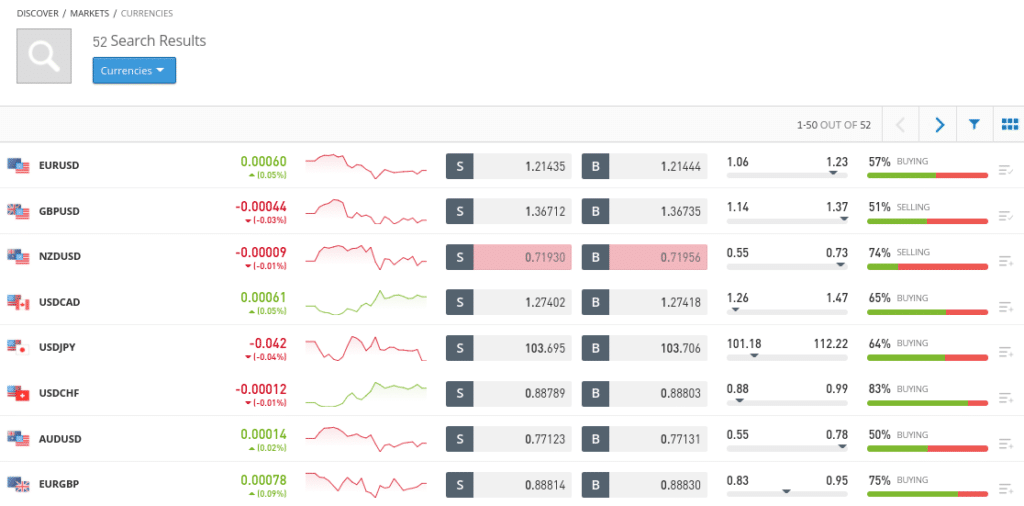

4. Search for a trading market

Finding the market you want to trade on is the following step. Just entering the name of the market into the search field will do the trick. The market of your choice is then available. Alternately, you can utilize the menu to choose an asset class and then use that to locate the market you want to trade in.

5. Place a CFD trade

Placing a trade comes last. To achieve this, just access the asset’s page, click on buy or sell, enter the trade amount, leverage, and stop loss settings, and then click execute. It won’t take long for the deal to be completed.

67% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

In conclusion, eToro emerges as the optimal choice for those embarking on fast trading. Its reputation for reliability and security caters to investors and traders across all levels of expertise. Boasting a broad spectrum of asset classes, eToro stands out for its exceptional trading platform, characterized by low spreads and minimal fees, particularly in stock and forex trading. This combination of extensive asset variety, user-friendly functionality, and cost-effective trading options solidifies eToro as a premier contender for addressing your fast trading requirements.

eToro – best fastest trading platform with competitive spreads

67% of retail investor accounts lose money when trading CFDs with this provider.