LYNX Broker Review – Pros & Cons

Traders, especially those who have just gotten started, often underestimate the importance of the right broker. As a trader, what broker you choose can often have a direct and significant impact on your profitability.

In this guide, we review LYNX as a trading platform and a brokerage. We analyse key metrics such as fees, commissions, tradable assets, payment options, regulations, and more.

What is LYNX?

LYNX is just an introducing broker for Interactive Brokers, and it means that whatever funds you deposit to LYNX will be held by the Interactive Brokers service. However, the fees will be charged by LYNX itself. How this works in practice is that LYNX accepts all your trades and subsequently places an order with Interactive Brokers for the sum total of the trades that have been made through its platform. Interactive Brokers fulfill this order, and the instruments/positions thus acquired are used to execute orders placed by LYNX traders

LYNX is considered to be a highly reliable and safe platform for a variety of reasons: the primary one among them being that both LYNX and Interactive Brokers are regulated by top-tier financial regulatory agencies around the world. In addition to this, LYNX also has a long positive track record since it has been providing brokerage and trading platform services to traders for over 15 years.

There are several things about the LYNX platform that make it one of the most sought platforms in the trading space. For example, the platform offers the ability to trade a variety of assets, ranging from cryptocurrencies to commodities and more. In addition to this, the platform also provides a very robust selection of trading tools, research, and advanced charting features. The extensiveness and accuracy of their research capabilities have made them very popular with beginner traders who do not usually have the resources or the requisite experience to do their own due diligence on trades. On the other hand, the wide range of technical analysis and charting tools that the platform offers have made it a platform of choice for most experienced traders.

LYNX also allows you to trade on both CFDs as well as the underlying asset. There are several differences between the two forms of trading. When you buy and sell CFDs, you do not actually own the underlying asset, rather, you are just making bets on the direction in which you think the price of the asset will move.

Trading CFDs also allows you to use a higher level of leverage, not worry about the liquidity and trading volume of a particular instrument, and profit regardless of the direction in which the prices move as long as your bet was right. On the other hand, when you trade the underlying asset, you can only buy if there is someone else selling, and vice versa. You also cannot employ a very high degree of leverage, and your choice of platforms becomes somewhat limited. The advantages, however, of trading the underlying asset directly include benefits and perquisites afforded only to real shareholders, such as voting rights and dividends when it comes to equities, as well as coupon payments when it comes to fixed income instruments.

LYNX Broker Pros & Cons

The tabular representation of the different pros and cons associated with using the LYNX platform has been discussed and listed below.

| Pros | Cons |

|

|

What Can You Invest in and Trade on LYNX?

There are a variety of assets that you can trade through LYNX, and they each have their peculiarities. As mentioned earlier, LYNX allows you to trade stocks, currencies, commodities, cryptocurrencies, options, futures, and CFDs. Each of these instruments has been discussed below.

Invest in Forex

The LYNX forex offering is one of the primary attractions that get people to trade through the platform. LYNX boasts of some of the most extensive collections of currency pairs among all the forex brokers that are available in the market, with the option to trade 105 currency pairs. It contains options to trade major, minor, and even some exotic currency pairs. In addition to this, LYNX is also known for its highly competitive spreads for both the Standard and Pro accounts, which allow you to trade on forex products at some of the cheapest rates in the industry

Another major advantage that LYNX offers is that it contains a lot of forex-specific tools and analysis methods that can further assist advanced traders who might be trying to use complex technical analysis for their trading strategies. It also includes a very extensive and up-to-date research board, that allows traders to combine their technical analysis skills with fundamental analysis and creates a holistic and profitable trading strategy.

Trade Stocks

The LYNX platform also allows you to trade and invest in shares. The platform allows you to trade on 78 financial markets and through over 13,000 ETFs. You can do this in two ways: you can either buy the underlying shares, or you can trade on share CFDs. If you wish to trade or invest in the actual underlying shares, then you will have to pay a commission on each trade you make. On the other hand, stock CFDs can be traded on by only using spreads. Trading on CFDs will also allow you to employ leverage, and the amount of leverage you can employ will depend on the market and the security that you choose to trade. LYNX allows you to choose from a variety of shares and markets that you can trade or invest in, which gives traders more variety. Their spreads and commissions are very competitive, and they also support the use of automated trading strategies in order to further assist and amplify your profitability.

Invest in Indices

You can also invest in indices and ETFs through LYNX. and the fees for these are a lot lower than the industry average, in addition to having a very diverse variety. For example, you can invest in several different types of indices. They allow you to invest in standard exchange indices and sector indices, for starters. In addition to this, you can also invest in portfolios and indices that are curated by industry professionals. The platform also allows you to trade over 260 different funds, however, these funds can only be based out of Europe.

Trade Commodities

The LYNX platform also allows you to trade on commodities. They offer several commodities on the platform, ranging from precious metals such as gold and silver to other essential commodities such as oil and natural gas. The fees that you will spend to trade commodities can be a combination of spreads, commissions, or both. At the same time, LYNX also allows you to trade using leverage. One of the disadvantages of using LYNX, however, is that since the platform allows you to actually trade on the commodities through the spot, futures, and options market instead of offering CFDs, the amount of leverage that you can employ is limited and much lower than most of the company’s competitors.

Trade Cryptocurrencies

LYNX is also unique from most other trading platforms in that it allows you to trade cryptocurrencies in a unique way. The platform offers over 3 different ways to trade cryptocurrencies, which are:

- Bitcoin and Ethereum ETNs are traded on the Stockholm Stock Exchange and the US OTC (Pink) markets

- Bitcoin Index is available on the New York Stock Exchange (NYSE), on the CME Group, and the Chicago Board Options Exchange (CBOE)

- Bitcoin futures are available on the CME Group

LYNX Fees & Commissions

On the whole, the fees that LYNX charges are lower than its competitors, with the exception of a few specific asset classes. The trading fees charged by a platform can be divided into two types: trading fees and non-trading fees. Trading fees refer to the fees that a trader incurs whenever they make a trade, this could be in the form of a commission or a spread. On the other hand, non-trading fees are fees that are not directly related to the trading activity on the account. For example, this could include inactivity fees, deposit and withdrawal fees, as well as account management charges. Each of these types of fees has been discussed below in detail

As far as the trading fees associated with trading through LYNX are concerned, these differ depending on the asset class that you choose to trade. For example, if you choose to trade shares, then you will end up paying the following commissions depending on the country where your stocks are listed:

| Market | Commission per $1000 trade |

| US | $2.50 |

| UK | $6.30 |

| Germany | $3.60 |

The commission that LYNX charges on stock and ETF trading are based on the volume that you trade. For example, for US stocks, the minimum commission that you will pay on every trade is $5 and is limited to 2% of the total trade volume at the rate of $0.01 per share for the first 2000 shares that you choose to trade.

As far as forex trading is concerned, the fees associated with trading through LYNX are a bit higher than the average. For example, the average commissions that you would end up paying for a $10000 position open in these instruments for a week employing a 30x leverage have been listed below.

| Pair | Commissions |

| EUR/USD | $7.25 |

| GBP/USD | $6.30 |

| AUD/USD | $6.45 |

| EUR/GBP | $7.35 |

The forex fee associated with each of these pairs is €4 per one lot. A lot is 100,000 units of the respective currency, for example, €100,000 for EURUSD trading.

As far as the non-trading fees of the platform are concerned, they are generally low. There are no account management fees that you have to pay to hold an account with the platform, or deposit and withdrawal fees that are charged when you add or remove funds from your account. However, only the first withdrawal of every month is free. After that, you will be charged a fee depending on the currency in which you choose to withdraw your funds

At the same time, the LYNX platform does charge an inactivity fee to its users. However, this works a little differently from standard inactivity fees. LYNX will charge you a minimum of 5 Euros every month as transaction costs. So, for example, if you only incur 3 Euros as transaction costs in a given month, then an additional 2 Euros will be charged to your account. Accounts that hold more than 100,000 Euros are exempted from this rule. New customers are also exempt from the platform fee after making their first deposit and in the following three months.

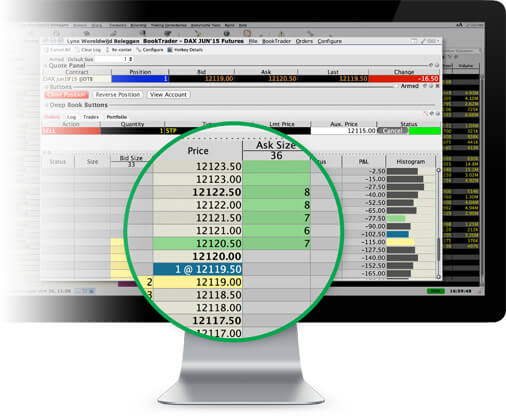

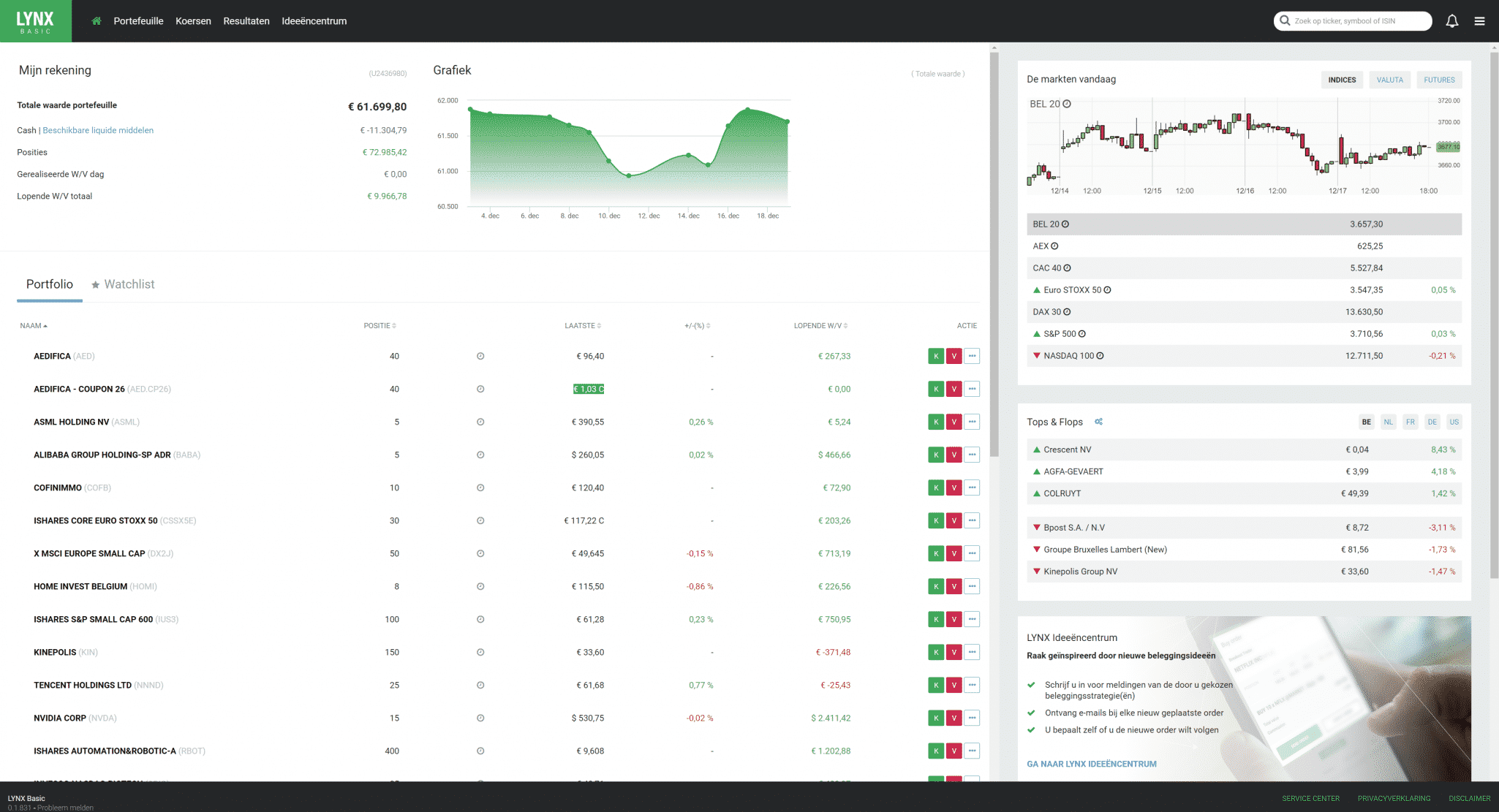

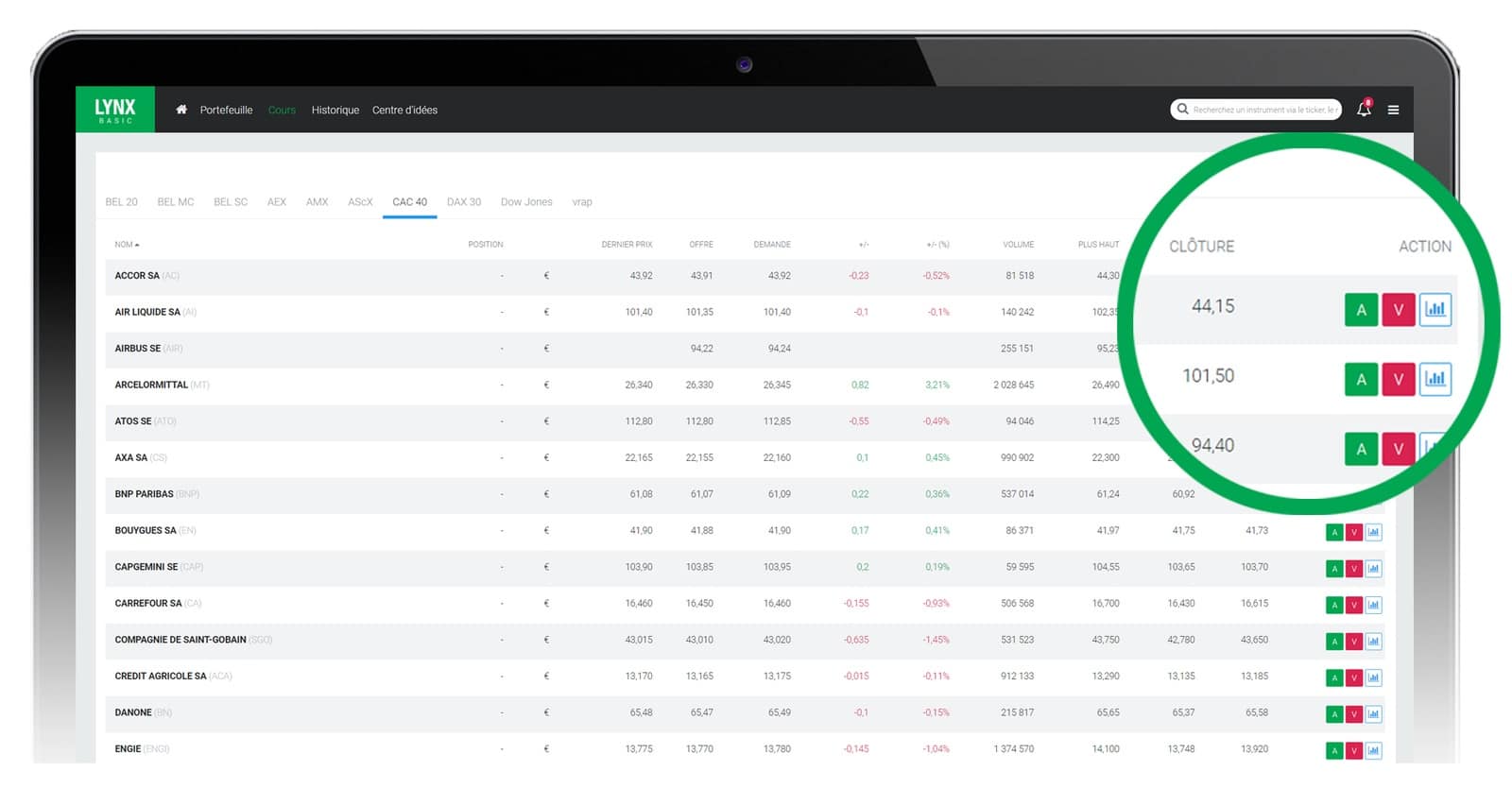

LYNX User Experience

The user experience associated with the LYNX web platform is generally mixed, however, it leans primarily to the positive side. There are two web trading platforms that LYNX offers for you to choose from: the LYNX Basic, and the Account Management. LYNX Basic is LYNX’s own web trading platform, while Account Management is provided by Interactive Brokers. For transferring money and managing your account, you can only use the Account Management platform. LYNX Basic is available in a variety of languages, such as English, Dutch, French, and Polish.

The platform is, on the whole, designed to be easy to navigate. However, it lacks customizability, which means that you do not have the option to adjust the layout of the platform to your own needs. This can be a negative feature for some traders who prefer to trade using platforms that allow them to customise their own views. This also means that you might require some time to get used to the platform and the navigation before you can actually begin trading. Luckily, LYNX offers the functionality of a demo account that can assist you in this regard.

The execution and search features on the platform are also top-notch. You can search for companies based on stock tickers as well as company names. The platform also offers you the ability to search for products across asset classes. For example, if you were to search for Apple, you would be able to see the Apple stock, CFDs, the as well as the various options and futures contracts available for Apple.

You can use the following order types:

- Market

- Limit

- Stop

- Stop limit

- Trail

- Trailing %

There are also order time limits you can use:

- Good ’til cancelled (GTC)

- Good ’til the end of the day (GTD)

A major disadvantage of using the LYNX platform is that you cannot set price alerts on the platform. However, a factor that differentiates LYNX from most competitors is that LYNX provides a clear portfolio report and a separate fee report. You can access these through the ‘Performance’ and ‘Portfolio’ tabs.

LYNX Features, Charting, and Analysis

There are several research tools that are available for trading through the LYNX desktop trading platform for your perusal. For example, LYNX provides trading ideas. These can be found under the Analyst Rating Tab for any product that you wish to trade under this tab, the recommendations and research of analysts from some of the biggest investment banks and asset management companies.

In addition to this, the platform provides a wide selection of fundamental data that you can use to analyse stocks. For example, you can check the financial statements of a company going back 6 years, a dividend calendar showing when and how many dividends the company issued, and a list of peer companies that you can compare against or use to set a benchmark for the industry.

In terms of the technical analysis indicators too, the features on LYNX are almost unlimited. There are more than 100 technical tools that you can use, in addition to other features and options that are specific to asset classes. However, the educational facilities on the platform are rather limited, therefore you will need to have some degree of trading experience before being able to use the functions to their fullest extent.

You also have a variety of other tools that you can use, such as a Market Scanner, where you can filter stocks by various criteria such as sector, price, volume, etc. You can use this tool for other asset classes as well, like bonds, futures, or CFDs.

LYNX Account Types

If you are looking to open an account on LYNX, there are 3 types of accounts that you can open, based on the ownership format you wish to have for these accounts:

- Individual – you are the only account owner

- Joint – there are multiple account owners

- Corporate – a legal entity is the account owner; here, a minimum deposit (or portfolio transfer) of €20,000 applies

In addition to this, you will also need to whether you wish to only have a cash account, or a margin account too. If you are looking to short products, then you will need to have a margin account. However, these are only available for users who are above the age of 21

Normal (cash) accounts can be opened if you’re older than 18. With a cash account, it takes three days after selling stock to gain access to the sum credited. That’s because according to industry standards, most securities have a settlement date that occurs on the trade date plus 2 business days (T+2). That means if you sell a stock on a Monday, the settlement date would be Wednesday. This doesn’t really make a difference for investors, but for traders, a margin account usually works out better, because your funds are instantly crested to your account, allowing you to use them for other opportunities.

LYNX Mobile App Review

The LYNX mobile platform is available on both iOS and Android and can be used in a variety of languages including but not limited to English, German, Spanish, French, Russian, Chinese, and Japanese. It is much handier when compared to the web platform, and the navigation is much easier. In addition to this, user-friendliness is further assisted by the look of the platform. However, this is still lacking as compared to some of the closest competitors that LYNX has.

The LYNX mobile app allows you to enable two-step authentication. You can also enable biometric logins, which will allow you to sign in using your fingerprint instead of typing in your login details every time you wish to open your account

The search function on the mobile app also works just like the web trading platform, allowing you to search across asset classes by typing in the name of the company or the ticker for the product. After you have selected the product are you interested in, you will be greeted by an information and trading window that shows:

- Asset market information

- An interactive chart with technical indicators

- Related news

- Some fundamental data

- Summary of the latest analyst report

- The buy and sell buttons that take you to the order panel

However, perhaps the most unique function that the platform has is its chatbot. The chatbot is also called the IBot and has several useful features. For example, you can use it to set price alerts, quickly execute an order, or get basic information. It understands several basic commands such as “apple price” or “buy 1 apple share.” You can also use the IBot to search for a variety of information about the company, such as the dividend yields or PE ratios. Some other functions, like displaying a chart, are also available via the chatbot.

LYNX Deposit and Withdrawal Methods

LYNX allows you to choose from a variety of base currencies, which include EUR, USD, GBP, CZK, DKK, PLN, NOK, and SEK. This is a very useful feature for European traders because it allows them to escape conversion charges by adding funds to their local currency.

The deposit options for the platform are limited since you can only do so via bank transfer. There are no fees associated with depositing funds to your trading account, and they take up to 4 business days to show up on the platform. As with all other trading platforms, you can only add funds from an account that is registered under your own name.

LYNX also does not charge any withdrawal fees for the first withdrawal you make every month. Every subsequent withdrawal is charged based on the currency you choose to withdraw funds in. withdrawals only happen through bank transfer, and can take as much as 4 business days to show up in your account. You can only withdraw funds to accounts that are in your name.

LYNX Contact and Customer Service

The LYNX customer service can be accessed in 3 ways: a live chat which is only available for certain countries, email, and phone support

The live chat is usually not preferred by traders, since while it might provide quick answers, it is unable to solve complex queries or provide relevant solutions to problems that are out of the ordinary. On the other hand, the phone support can do this, however, it might take time to get through to the LYNX customer support team via phone in case there is a high volume of incoming queries. The best option is to contact them via email, where they usually reply within a day and are able to resolve any query efficiently and effectively.

Is LYNX Broker Safe?

The LYNX platform is safe, and you can be sure about this for one simple reason: they are regulated by agencies in both Ireland and the Netherlands. They are known for their platform’s ease of use, below-average fees, and reliable service. Over the course of their years of service, they have had very few complaints, and they constantly update their platform and portfolios to take care of any small and big issues that might arise while trading. They are, therefore, a highly safe and reliable platform for you to trade on.

How to Start Trading with LYNX

The process to begin trading with LYNX is simple and straightforward, and only comprises 4 steps. These steps have been discussed below in detail.

Step 1: Open a Trading Account

The first step is to head over to the LYNX website and register yourself for a trading account. All you need to do is to set up your login credentials and enter your contact details. This includes your email ID and your phone number too. You will also be asked to fill out a questionnaire about your trading experience and financial knowledge.

Step 2: Verify Your Identity

The next step for you is to verify your identity on the platform before you are allowed to trade. Since LYNX is regulated, they need their new users to complete the Know Your Customer (KYC) process. This involves submitting proof of identity to the platform.

For UK residents, you can do this very easily online by submitting either a copy of your passport, driving license, firearms license, tax credit, pension, or other educational grants. It should be a document that lists out your name, address, and establishes that you are a resident of either the UK or whichever country you have mentioned in your registration form.

Step 3: Deposit Funds

The next step for you to do once your account has been verified is to deposit funds into your account. The minimum deposit requirements for LYNX are 3000 Euros, the highest on the market. The platform also does not charge any deposit fees.

In order to deposit funds into your account, you can only do so via bank transfer. However, the bank account that you use has to be in your name and should have adequate funds. If you choose to use a bank transfer, then it will take up to 3 business days.

Step 4: Start Trading with LYNX

Once your account has been created, verified, and funded, then the next step is for you to begin trading. Simply log in to your account and search for the instrument that you wish to trade. Then, enter the size of the order, the type of order that you wish to place, the order time limit if any, the stop-loss and take profit percentages, and click on either buy or sell. The order will be executed almost instantaneously.

LYNX Review – Conclusion

In conclusion, the LYNX trading platform is one of the most reliable and safe trading platforms for investors and traders of all experience levels, and it also contains among the largest variety of asset classes to trade on. Their trading platform and its functionalities are almost unparalleled in the industry, and it also has low spreads and fees on the trading of stocks and forex pairs. All in all, LYNX is definitely a strong option to consider for your trading needs.

eToro – Alternative for LYNX

There are two main reasons why eToro is considered to be one of the best platforms in the world for stock trading. The first reason is their platform, which has been designed like a social media platform o make it easy for beginner traders to navigate it. They also offer a demo account and tutorials for you to be able to familiarise yourself with the platform before you begin trading.

The second reason is their social trading tools. In addition to being able to see what other traders think about a particular stock, eToro also gives you the option to copy trade other more experienced traders and profit from their expertise.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.