Where & How To Buy Rivian Stock (RIVN) in 2026

Partly thanks to Tesla’s widespread success and influence, demand for electric vehicles (EVs) is soaring. This has compelled the majority of legacy brands to enter the market, but it has also seen the emergence of several newcomers, Rivian being one such example.

Though valued much lower than Tesla at $16.5bn (versus the market leaders’ $776bn), Rivian is arguably targeting a different segment of the market entirely. Its flagship R1T is a pickup truck, and it also produces delivery vehicles, having recently struck a deal with Amazon to produce a fleet of at least 100,000 electric vans.

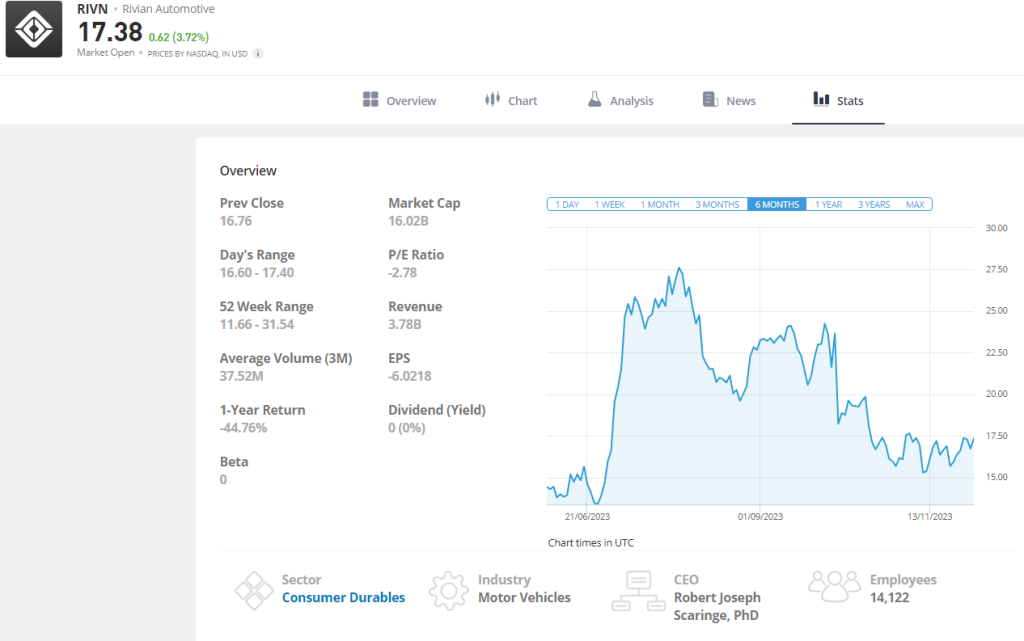

But Rivian stock has not fared well in recent years. It opened on the NASDAQ at $129 in 2021, but has since plunged to $17, with an earnings per share (EPS) ratio of -$6.

In this guide, we will address these factors in determining whether Rivian is a smart bet in 2026, in addition to examining where and how to buy Rivian stock.

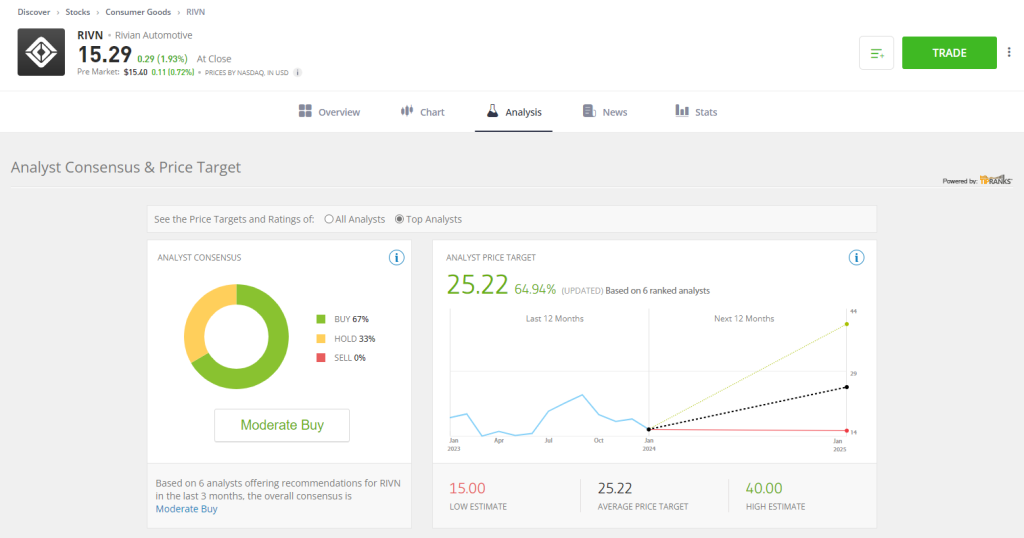

-

-

How to Buy Rivian Stock Online in 2026 Overview

Step 1: Select an online broker that suits your investment strategy and goals. Then, create an account by filling out the registration form.

Step 2: Verify your account by submitting two forms of ID. This could include a passport, driver’s license or bank statement.

Step 3: Connect a payment method to your trading account and deposit funds via bank transfer or debit card.

Step 4: Search for the RIVN ticker symbol and use the available resources to understand the current market conditions.

Step 5: Click ‘TRADE’ and fill out the order form. Rivian stock will then appear in your portfolio.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Rivian (RIVN) Stock Data January 2026

What is Rivian (RIVN)?

US-based Rivian Automotive is another major player in the ever-expanding electric vehicle market. Founded in 2009 by current CEO Robert Scaringe, the firm has become known for its innovative approach to creating all-electric vehicles with offroad capabilities.

The company’s flagship products include the R1T, an electric pickup truck, and the R1S, an electric SUV. However, the firm has recently expanded beyond consumer cars with its line of ‘Fleet’ vehicles, including the Delivery 500 and Delivery 700 electric delivery vans.

Notably, the firm’s innovation and influence has earned it a major partnership with Amazon as part of the e-commerce giant’s efforts to fully electrify its delivery vehicles.

Rivian Automotive is expecting to commence a period of substantial growth in years to come. Having recovered emphatically from major production delays in 2023, the firm now projects that it will product 54,000 vehicles by the end of the year.

Rivian Atomotive Stock Price 2026

On paper, Rivian has proved a disappointing bet for early investors. The stock is down nearly 90% since its IPO in 2021, and the company has been firmly in the red since its inception, with its latest earnings report showing an operating loss of $1.44bn.

Despite this, 2023 has been relatively positive for the automaker. In Q2, it reported a near-70% increase in revenues versus Q2 2022. Q3 was a similar story, with the firm reporting another uptick in revenues and announcing that its vehicle delivery targets were to be revised upwards. Additionally, Rivian has managed to cut losses per vehicle by 50% since the beginning of the year.

Unfortunately, thanks to headwinds in the broader market, this success has not translated into stock market success. For instance, by close of trading on the day following the release of Tesla’s Q3 earnings, Rivian’s share price had dropped by 9%. The EV market leader had reported a 3% dip in operating margin versus the year prior, spelling a potential struggle for the wider industry.

At the time of writing, Rivian’s share price sits at just below $17, versus its 2023 peak of $27.

Is Rivian (RIVN) a Good Investment in 2026?

Rivian Automotive has had a tough ride in the EV market so far. Despite floating at $78 a share, raising $12bn and earning an early valuation of $77bn, the firm has been faced with formidable competition and wavering demand. As a result, the automaker’s share price has dropped nearly 90% since its IPO.

The increasingly saturated EV market has and continues to play a major role in this. In Q3 2023, Rivian Automotive sold 16,000 vehicles, claiming less than 5% of the market share. This pales in comparison to the likes of Tesla (156,000) and Hyundai/Kia (31,000). Other legacy brands including Ford and Volkswagen also possess larger market shares than Rivian.

However, beneath the surface, there is reason for Rivian investors to remain positive in 2026. Firstly, to gain perspective on Rivian’s current position, one need only look at the trajectories of their biggest rivals. Tesla, for instance, sold a mere 32,000 vehicles in 2014 – by the end of 2023, it expects to have shifted 1.8m.

Additionally, while still comparatively low, Rivian’s vehicle output rate is growing fast, having increased by more than 1,500% since it entered the EV market in Q4 2021.

And while Rivian Automotive is still yet to turn a profit, its losses per vehicle are falling sharply, from $139,277 in Q3 2022 to $31,000 in Q3 2023. This trajectory could potentially see the firm turn a profit for the first time in 2024.

Finally, it must be noted that Rivian Automotive does not quite fall into the same market segment as some of the industry leaders. Its flagship product, the R1T, is a pickup truck, and is clearly distinct from Tesla’s Cybertruck in terms of design, spec and price point. Its other key business line comes in the form of its fully electric delivery vehicles, of which Amazon has recently purchased a large quantity.

Providing delivery targets continue to be met, there is clearly promise for Rivian Automotive in the years ahead. Taking the above into consideration, and at a sub-$20 price, this could be a smart bet for investors in 2026.

Does Rivian pay dividends?

Rivian does not pay a dividend to investors and never has paid a dividend. This is due to the fact that the company has yet to turn a profit. If Rivian Automotive manages to become profitable in the coming years, the company could start offering dividends to investors. However, this is not guaranteed.

Where to Buy Rivian Shares in 2026

Investors have the option to purchase Rivian Automotive stock using different online brokerage platforms, and eToro is among the favored choices. eToro provides an interface known for its user-friendliness, imposes low minimum deposit requirements, and facilitates fractional share trading, catering to the accessibility needs of beginners.

Other popular choices include Robinhood, Webull and Charles Schwab.

1. eToro – Best platform to buy Rivian (RIVN) stock

eToro is considered to be one of the best all-around brokers for stock trading in 2026. This is because the platform has a clear interface, is licensed in seven jurisdictions, and offers market-leading social trading tools.

The platform not only allows individual Rivian stock investments but also offers innovative options through Smart Portfolios and ETFs. This diversity caters to a range of investment strategies, enabling users to tailor their approach to match their financial goals.

eToro offers a zero-commission policy for US stocks and ETFs, making it a cost-effective choice for investors looking to acquire Rivian shares on a lower budget.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. Robinhood – Buy Rivian stock on your phone

Robinhood is a good investment platform to consider if you are looking to manage your investment portfolio from your phone. The app has a simple interface and comes with a range of educational resources and tools that can be used to guide an informed investment strategy.

Furthermore, it is possible to invest in RIVN shares from just $1 through Robinhood and the platform charges 0% commissions on US stocks. This makes it an attractive option for traders who are on a budget. Investors can also buy RIVN stock on Robinhood through ETFs which support a diverse investment strategy.

3. Charles Schwab – Invest with the help of professionals

Charles Schwab is a well-known investment platform that caters to long-term investors who are looking for professional support. The broker offers personal investment advice to all users free of charge and provides an extensive range of tools for building a robust portfolio.

Rivian is available to buy through Charles Schwab commission-free. It is also possible to invest in Rivian through ETFs and indices that are supported by the brokerage.

During our research, we were impressed with the wide selection of research tools and educational materials that are available to Charles Schwab customers. This is a good platform for investors who are looking to improve their knowledge before investing.

4. Webull – The best platform for short term Rivian investors

Webull is an attractive option for short-term investors and traders because it offers a selection of charting tools and systems that can be used to implement advanced trading strategies. This includes compatibility with the popular MetaTrader 4 charting tool.

It is possible to buy RIVN shares from $1 on Webull. The platform also has a commission-free fee structure for US stocks and it is possible to use a demo account to practice trading before using any advanced trading strategies.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

How To Buy Rivian Stock From eToro in 2026

In the following section, we will provide an in-depth guide on how to invest in Rivian Automotive through eToro – our recommended brokerage account.

Before you proceed with buying Rivian stock, conduct thorough market research and consider consulting with a financial advisor to make sure that the investment meets your personal financial goals.

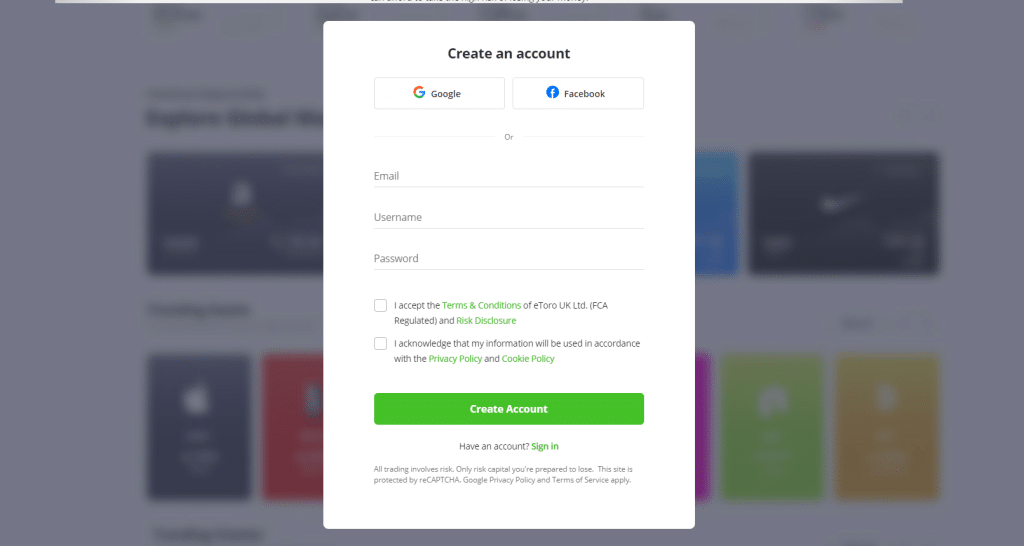

Step 1: Create an eToro brokerage account

The first step involves signing up to the eToro investment platform. As a licensed broker, eToro requires users to provide personal information including their name, email address, and residential address.

Head to the official eToro website and click ‘create account’ to get started.

The registration form takes less than 10 minutes to complete. Make sure that you are using a private internet connection before sharing your details online.

Verifying your eToro account

After filling out the signup form, new users are required to verify their ID by providing proof of address and proof of identity. You will be asked to take photos of two documents and upload them to the eToro platform.

Once you have uploaded your documents, it can take up to 48 hours for your investment account to be verified.

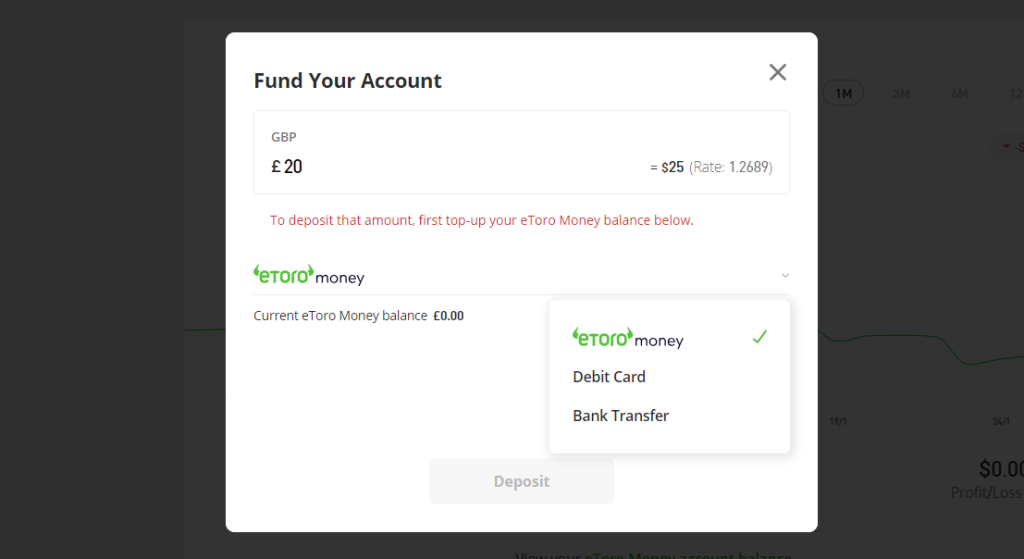

Step 2: Fund your eToro account

To buy Rivian stock, you will need to deposit at least $20 into your eToro account. eToro accepts debit card and bank transfer payments.

In your account dashboard, click ‘deposit’ and then fill out the form. eToro does not charge any deposit fees however, it is a good idea to check whether your banking provider will charge fees.

Step 3: Search for Rivian ticker symbol

If you’re looking to invest in individual Rivian stocks, you can do so by searching for the Rivian ticker symbol in the eToro ‘discover’ feature and then clicking ‘trade’. Here, you will be able to view Rivian Automotive stock data and expert analysis.

You should take time to thoroughly research the stock before making any investment decisions. This includes using the resources that are available on eToro and also using third-party resources to learn about the stock market.

Alternative Rivian Automotive stock investments

If you would like to invest in an alternative Rivian stock investment, such as an exchange-traded fund or mutual fund, you can find these through the eToro ‘discover’ section. Simply search for the fund’s ticker or browse through available funds by clicking on the relevant category.

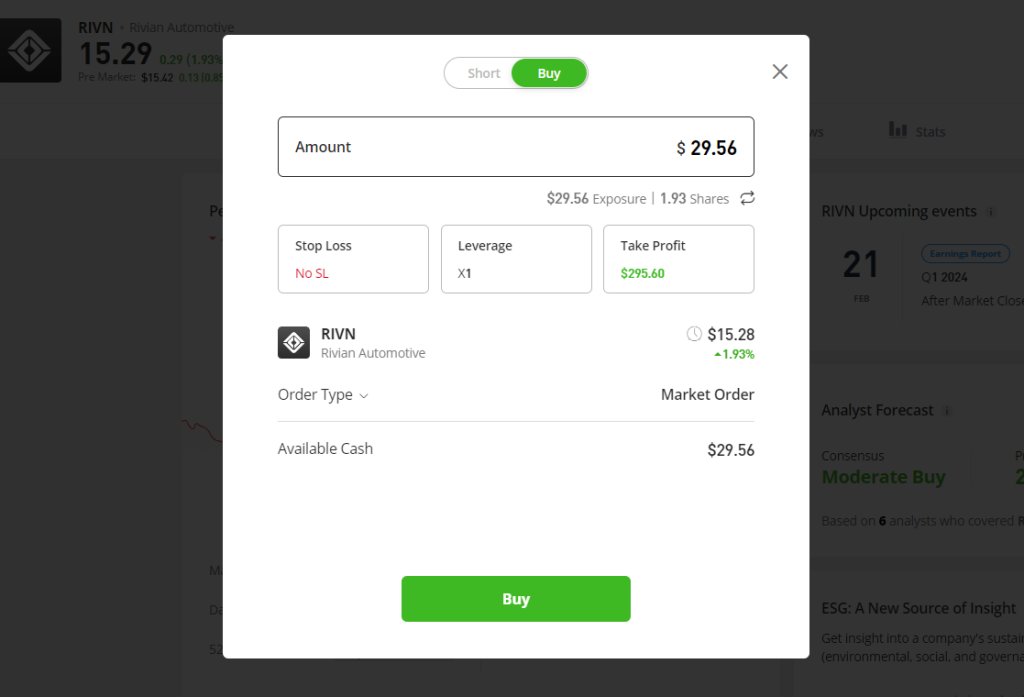

Step 4: Place a market order

After you have spent time researching Rivian shares and consulting professionals, you can place a market order by clicking ‘trade’ within the eToro platform.

On eToro, you can either Buy or Short Rivian stock. It is also possible to trade with leverage up to x5 – this is suitable for experienced investors.

Before placing the order, set stop loss and take profit targets according to your risk appetite. Then, click ‘buy’ to confirm the trade’. Rivian stocks will appear in your eToro portfolio within a few minutes.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

How To Sell Rivian Stock

The stock market is volatile and the current market price can fall at any time. Therefore, it is important to understand how to sell Rivian stock after you have invested. Follow the steps below to sell Rivian Automotive through eToro.

- Open your eToro portfolio. Here, you will be able to view your open trades.

- Look for the Rivian ticker symbol. Once you have found it, click ‘close’.

- Confirm the transaction by clicking ‘close trade’.

- Withdraw your fund to your bank account by clicking ‘withdraw funds’ and entering the amount that you would like to withdraw.

Our Verdict on Rivian (RIVN) Stock in 2026

Investors are encouraged to assess long-term prospects, market conditions and recent performing in judging whether to buy Rivian stock in 2026. While the firm has been plagued with challenges since its IPO, its consistent innovation and endorsements from giants such as Ford and Amazon present positive signs for investors.

Moreover, the firm has demonstrated great resilience in 2023, responding to setbacks by increasing vehicle production and reducing its losses per vehicle.

Troubling, however, is the state of play in the fiercely competitive EV, which has significantly hindered Rivian’s performance on the stock market. As a result, the firm’s share price remains well below its 2023 peak.

However, investors must also take note of Rivian’s unique market position, the firm arguably filling a gap in the market with its all-electric delivery and offroad vehicles.

Taking all of this into account, and at such a low price point, Rivian is likely to be a worthwhile bet in 2026.

Rivian stock FAQs

How can I buy stock in Rivian?

Potential investors can explore various online brokerage platforms, including eToro, Robinhood, Charles Schwab, and Webull. These platforms offer diverse features, from social trading to commission-free structures. In TradingPlatforms’ view, eToro is the best all-round choice for most investors.

Is Rivian a good stock to buy?

While past performance has been questionable, Rivian’s low price and growth prospects make it a potentially smart buy.

Does Rivian pay a dividend?

Rivian does not pay a dividend. Companies decide whether to distribute dividends based on various factors, and Rivian, being a relatively new public company, has not established a history of dividend payments.

Are EV stocks a good investment?

Investing in electric vehicle (EV) stocks can be a good option for some investors, but it comes with risks. Factors such as market trends, government policies, and the specific performance of each company play a role. While the EV sector shows growth potential, investors should conduct thorough research and consider their risk tolerance before making investment decisions.

References

Sam Alberti

View all posts by Sam AlbertiSam Alberti has recently joined Trading Platforms as a content editor, having spent the past four years working as a journalist across various financial and business niches. He graduated from the University of Kingston in 2019 with a Master’s Degree in Journalism and an NCTJ Diploma, and has since developed a passion for both consumer and corporate finance. He now specializes in producing engaging and thoroughly-researched web content on all things finance.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up