Where & How To Invest in Oil Stocks in 2026

Despite being the world’s most traded commodity, oil is a highly competitive and volatile market, and prices often swing dramatically in response to changes in market conditions.

This was clearly observed in the bear market of 2022, when the price of crude oil soared as a result of global inflationary pressures. The conflict in Russia and Ukraine had a similar effect, with oil prices hitting their highest level since 2014.

Contrastingly, prices saw a major downward trend in 2023, nearly halving from their 2022 peak. But more change could be on the horizon, with tensions in the Middle-East and production cuts by Russia and Saudi Arabia likely to play a role.

This volatility presents significant opportunities for investors. With that in mind, here is our guide on where and how to invest in oil stocks in 2026.

-

-

How to Invest in Oil Stocks – Quick Steps

Step 1: Find an online trading platform that supports your trading strategy and goals.

Step 2: Create an account by filling out the registration form. Then, complete the account verification by uploading two forms of ID.

Step 3: Connect a payment method to your trading account. Spend time using the demo trader (if available), before depositing funds into your account.

Step 4: Search for Oil stocks through the broker’s explore feature.

Step 5: Fill out the order form and then complete the order. Oil stocks will appear in your portfolio after a few minutes.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

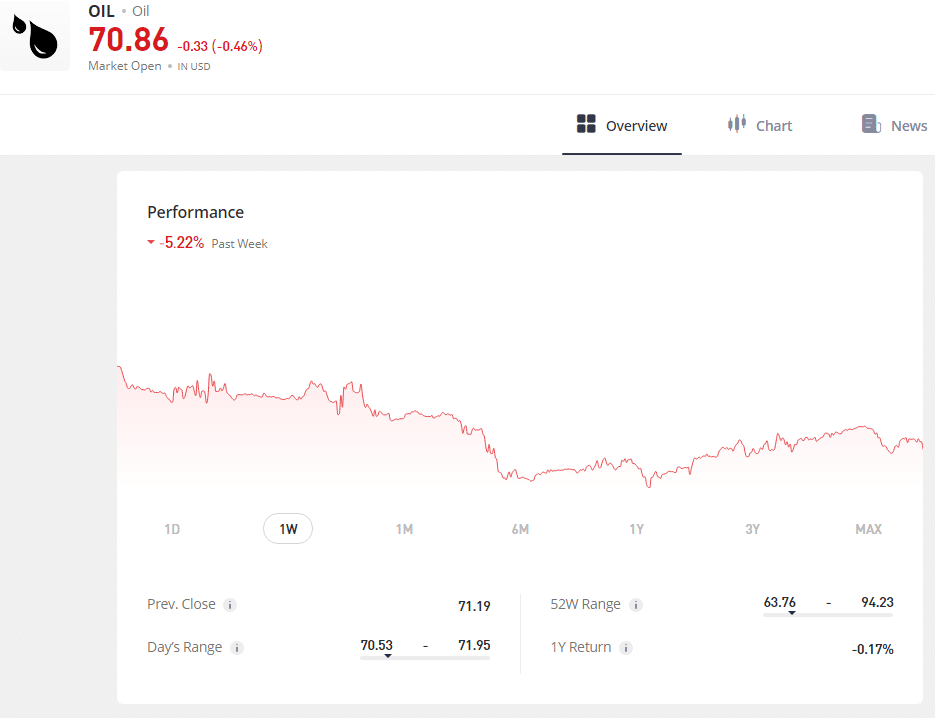

Oil Stock Price Data February 2026

What are Oil Stocks?

The oil trade, from extraction all the way to distribution, persists in being one of the world’s most lucrative areas of business. This, combined with the often generous dividend programs offered by oil firms, makes it an attractive prospect for many retail investors.

Timing is critical when it comes to investing in oil, with the market considered to be one of the most volatile. However, the world’s demand for oil is thought to be at an all time high in 2023, and is expected to continue rising.

Investors considering investing in oil are advised to target firms that are somewhat immune to the frequent downturns in the sector. In this respect, the industry’s biggest players, in addition to producers with relatively low productions costs, are considered to be the strongest options.

As with many industries, investors have the option to invest in individual oil companies, or buy into a mutual fund comprising the entire sector.

Oil Stock Price 2026

The oil market experienced a dip in 2023. At the time of writing, US oil futures have seen seven consecutive weeks of decline, their longest running downturn since 2018. eToro’s Oil mutual fund is 40% down on its 2022 peak at $71.

Recent figures also show that WTI Crude is down 5% year-on-year, while Brent Crude is down 6% in the same period.

OPEC+, the group of oil-producing countries, has recently pledged to cut 2.2 million barrels of crude oil production per day for the first quarter of 2024 in order to tackle oversupply. However, with output from non-OPEC nations expected to surge next year, investors remain skeptical.

As a result, Barclays, for instance, has revised down its price forecasts for 2024 by $4 per barrel to $93.

Are Oil Stocks a Good Investment in 2026?

After an exceptional year, oil stocks saw a sharp decline in 2023, with prices nearly halving from their 2022 peak.

However, as the Israel-Palestine conflict continues to unfold in Gaza, analysts are keeping a close eye on how the markets will respond. For instance, it is thought that prices could even reach the $150 mark if other nations become embroiled in the conflict.

Similarly, recent analysis has forecasted an increase of two million barrels per day in oil demand for 2023, pointing to a continued trend of COVID-19 recovery. The analysis also notes that global demand has already reached a record high at more than 102 barrels per day.

However, the gradual reduction in fossil fuel consumption and demand over time is likely to detract from this in the long run. For instance, the International Energy Agency has projected a reduction in demand of one-quarter by 2030, and 80% by 2050. This will of course drive the price of oil down, compromising returns on investment.

But encouragingly for oil investors, OPEC+ nations are continuing to commit to production cuts in order to tackle excess supply, with Russia and Saudia Arabia extending production cuts of one million and 300,000 barrels per day respectively until the end of the year.

Taking all of this into account, Q4 2023’s dwindling oil prices could present a prime opportunity for investors to invest in oil stocks and set themselves up for gains in 2024.

Where to Buy Oil Stocks in 2026

To buy oil stocks in 2026, you will need to find an online broker that provides access to commodities, including oil.

The majority of reputable brokers support a range of oil stocks. Below is an overview of four platforms that you could consider in February 2026.

1. eToro – Buy shares in Oil from $10

eToro is a social trading platform that provides access to a range of Oil CFDs.This includes traditional Oil, Soy Oil, Heating Oil, and Euro Oil. The platform also offers an OilWorldWide smart portfolio which makes it possible to build a portfolio of diverse Oil stocks.

The social trading aspect of eToro means that users can access real-time investment insight from other traders and communicate with other eToro users to learn about different strategies.

eToro charges 0% commissions for Oil stocks however, the platform charges a spread on every trade. The minimum deposit for the platform is $10 and it is possible to use the demo trading account free of charge.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. Robinhood – Commission-free stock investments

Robinhood is a popular investment app that caters to advanced traders who want to build a portfolio from their mobile phones. The platform provides traditional Oil stocks as well as Oil stock options.

The app is easy to use and the minimum trade amount is just $1. This makes Robinhood an appealing option for traders who want to buy Oil stock in small increments.

As well as a market-leading trading app, Robinhood is known for offering exceptional research resources that can be used to improve your market knowledge and develop a robust trading strategy.

3. Charles Schwab – The best online broker for long-term oil investing

Charles Schwab is the best platform for investors who want to invest in Oil stocks long-term. The platform offers a range of investment products to support users in creating a robust, long-term portfolio.

Furthermore, Charles Schwab offers free expert advice for all users. This allows investors to learn from professionals and make decisions based on market expertise.

Charles Schwab has a strong reputation which makes it a trustworthy platform to consider. Furthermore, the broker charges minimal fees for Oil stocks and has a minimum deposit requirement of $0.

4. Webull – The best trading platform for Oil ETFs

It is possible to trade Oil on Webull through ETFs. The trading platform offers iPath, B S&P GSCI, and Crude Oil TR ETN.

The platform is most suitable for active traders who are looking for a platform that supports advanced trading strategies. To facilitate this, Webull provides access to the MetaTrader 4 charting tool as well as a range of helpful educational materials.

The Webull trading platform is available to use on mobile and offers a demo trading account. The demo trader makes it possible to practice trading oil on the platform without putting any real funds at risk.

Best Oil Stocks to Buy in 2026

For those looking for a guide to the best oil stocks in the United States, here are three of the major companies you should keep an eye out for when choosing a stock that fits your needs and investment goals.

1. ConocoPhillips

With a market cap of more than $133b, ConocoPhillips is one of the world’s largest oil firms. It specializes in the exploration and production (E&P) of natural oil and gas, and has a global presence, operating in more than a dozen countries.

One of ConocoPhillips’ most appealing traits is its reliable access to low-cost oil, having acquired oil fields from major competitors in North America. This enables the firm to remain profitable even amidst poor market conditions.

With uncertainty around the future of oil, the firm is also planning to return a considerable percentage of its free cash flow to investors over the coming years. This will mean paying dividends, repurchasing shares and paying variable cash returns.

Besides having a low-cost portfolio, the company also has an excellent financial profile, consistently earning consistently excellent credit ratings, low leverage ratios, and a large cash reserve to back it up.

2. Exxon Mobil

This US-based company was created through the merger of Exxon and Mobil in 1999 and is recognized as a major producer of crude oil and gas. ExxonMobil is one of the industry’s biggest names with a market cap of over $350bn.

ExxonMobil has focused its efforts more on improving its efficiency and reducing its costs in recent years. As a result, the company has been able to reduce its oil production costs significantly through resource allocation, focusing on its highest-return assets, and better leveraging its scale. Thus, whenever oil prices are high, the company can generate a lot of cash flow.

Investors’ fascination with energy assets and high oil prices remain the primary driving forces for Exxon Mobil stock. While the firm’s share price is already up by about 130% in 2023 compared to three years prior, it is expected to have a rapid increase in future value if WTI crude settles at least $120 per barrel.

Finally, while many investors are choosing to avoid oil stocks altogether because of the growth of renewable energy sources, ExxonMobil invests in cleaner fuel sources, such as carbon capture and storage, in addition to renewable fuels. As a result, it should continue to supply the economy with fuel for a longer period.

3. Phillips 66

The Phillips 66 company is a manufacturing, logistics, and refining conglomerate and a world leader in diversified energy.

Phillips 66 enjoys one of the lowest costs in the refining industry due to its largescale, vertically integrated operations. By leveraging its integrated midstream network to obtain low-cost crude for use in refineries and petrochemicals and investing in projects that provide higher margins for its products, the company has improved its profitability.

When it comes to performance, the stock of Phillips 66 has performed a bit differently than the rest of its peers. Namely, it has seen a rise of just 5% after one year and 11% after five years.

Moreover, Phillips 66 has a very strong financial profile that includes a healthy balance sheet and easily manageable short-term debt. In addition, the company also has a large cash reserve. With low debt and high cash reserves, the firm can invest in expensive expansion projects, such as renewable energy.

Phillips 66’s focus on making smart investments and returning cash to shareholders will likely enable it to continue to add shareholder value in the coming years.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Our Verdict on Oil Stocks in 2026

In typically volatile fashion, the oil market has expanded and contracted in 2023 in response to external factors, with the sector suffering an overall decline from its 2022 peak.

But in spite of the resulting bearish sentiment, investors can be encouraged by projections of increased demand as a result of tensions in the middle-east, in addition to the commitment of OPEC+ nations to counter oversupply with production cuts.

But regardless of any market uncertainty, firms such as ConocoPhillips, Exxon Mobil and Phillips 66 have demonstrated a resilience that should encourage investors. However, as always, investors must tread carefully and adopt a diversified approach in order to minimize risk.

Oil stock FAQs

What is the best stock to buy for oil?

TradingPlatforms recommends ConocoPhillips due to its excellent credit rating, low leverage rations and large cash reserve. In addition, dividends and share repurchases have seen $6bn returned to shareholders through dividends.

Are oil stocks worth buying

While oil stocks can be risky due to their volatile nature, they also tend to have high yields. Besides company performance metrics, it is advisable to consider factors such as economic growth and geopolitics before making commodity investment decisions.

How to invest in oil stocks?

Potential investors can explore various online brokers, including eToro, which is TradingPlatforms’ recommended platform. These platforms offer diverse features, from social trading to commission-free structures.

Do oil stocks pay dividends?

Yes, many oil stocks pay dividends, providing periodic cash payments to shareholders. Dividend amounts vary based on company performance. Investors should research specific companies for dividend history, financial stability, and industry factors that can influence both stock prices and dividend payments.

References:

- https://www.woodmac.com/press-releases/energy-transition-outlook-2023/

- https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/110823-barclays-lowers-2024-brent-oil-price-forecast-to-93b-on-demand-concerns

- https://www.cnbc.com/2023/12/12/oil-steady-ahead-of-interest-rate-decisions-opec-supply-cut-doubts.html#:~:text=The%20Organization%20of%20the%20Petroleum,to%20excess%20supply%20next%20year.

- https://oilprice.com/oil-price-charts/

- https://www.eia.gov/outlooks/steo/report/global_oil.php

Sam Alberti

View all posts by Sam AlbertiSam Alberti has recently joined Trading Platforms as a content editor, having spent the past four years working as a journalist across various financial and business niches. He graduated from the University of Kingston in 2019 with a Master’s Degree in Journalism and an NCTJ Diploma, and has since developed a passion for both consumer and corporate finance. He now specializes in producing engaging and thoroughly-researched web content on all things finance.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up