10 Best DeFi Coins to Invest In February 2026

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

One of the most exciting proponents of cryptocurrency and blockchain technology is Decentralized finance (DeFi). Essentially, DeFi is a cheaper, more transparent, and more secure financial solution to the current central financial intermediaries at work today.

DeFi networks are typically powered by native utility tokens, that present good investment opportunities for both long term and short term investors. DeFi coins are used to access governance, pay for network fees, power smart contracts, reward stakers and more. The best DeFi coins have multiple use cases, deflationary mechanisms and a strong tokenomic design.

In this article, we’ll go through the best DeFi coins to buy in 2026 and explain why each token could be a good addition to your portfolio. We will also take a look at the risks involved with investing in DeFi coins.

-

-

- $SPONGEV2 tokens can only be obtained by staking $SPONGE

- Stake your Sponge V1 tokens to recieve a V2 token bonus

- Earn more crypto with the SPONGE P2E game

Project LaunchedDecember 2023Purchase Methods- ETH

- USDT

- Debit

10 Best Defi Coins to Buy in February 2026

DeFi has opened up a whole new variety of cryptocurrencies with the top platforms being powered by the best DeFi coins. Below is our list of the top 10 DeFi projects to watch:

- Sponge V2 (SPONGEV2) – The latest token to buy in December. SPONGE returns to the meme coin market in a much improved and more powerful form, bringing both fun and utility to investors. The team is planning to develop a play-to-earn Sponge game where users will have the chance to earn more SPONGEV2 tokens.

- UniSwap (UNI): The native token of the Uniswap DEX which can be used to trade altcoins. UniSwap is known for its large range of altcoins and simple user interface. UNI is used to pay for fees, execute transactions and access governance. UNI can also be traded on other decentralized exchanges such as Binance and Huobi.

- Chainlink (LINK): Top DeFi project that enables blockchain networks to interact with external systems and applications. Chainlink is a blockchain abstraction layer than facilitates the deployment of universally connected smart contracts. The network provides off-chain information that is used by complex smart contracts. $LINK tokens can be staked for passive rewards while supporting operations across the oracle network.

- Aave (AAVE): Aave is an Ethereum-based platform that supports automated crypto loans. Users can borrow crypto by depositing collateral. AAVE is considered a fairly strong investment in 2026 and has been given an average risk analysis based on InvestorsObserver research. As the popularity of DeFi increases, Aave will lead the way for collateralized crypto loans.

- Avalanche (AVAX): Avalanche is a layer 1 blockchain network that supports decentralized applications as well as the development of custom blockchain networks. The network hopes to dethrone ethereum as the most popular blockchain network through fast transactions and a focus on scalability. AVAX is the native utility token of the network that is used to power transactions and reward staking efforts.

- Internet Computer (ICP): Internet Computer is the first ‘world computer’ blockchain network that allows anyone to build blockchain based systems and applications. The project hopes to achieve blockchain singularity through cross-chain capabilities and powerful smart contracts. The ICP token will be used to power the entire ecosystem. The coin has three main utilities including staking which can provide investors with passive rewards.

- MakerDAO (MKR): The governance token of the Maker Protocol which is used to manage the DAI blockchain network. MKR tokens can be used to vote over the development of the protocol, which is entirely governed by community. MKR tokens are expected to appreciate in value along with the success of DAI.

- Arbitrum (ARB): Arbitrum is a layer-2 protocol that enables users to build on Ethereum whilst taking advantage of low fees and market-leading scalability. The technology delegates complex computational tasks to increase efficiency and speed. The ecosystem is powered by the $ARB token which can be used for governance and to transfer value.

- The Graph (GRT): The Graph is an indexing protocol that powers numerous web3 applications. The technology can be used by anybody to publish open APIs that can be sued to retrieve blockchain data. GRT is used to secure the network. Users must stake GRT tokens to access the platform and will receive passive rewards for doing so.

- Stacks (STX): Stacks enables Bitcoin to be used as an asset for smart contracts and decentralized applications. The Stacks Bitcoin Layer unlocks $500B BTC to be used within the DeFi space. The $STX token is used to fuel the smart contracts for Bitcoin and rewards miners on the Stacks network. The network also allows holders to earn BTC by stacking.

- Tezos (XTZ): Tezos is a blockchain network that differs from the likes of Ethereum and Bitcoin because it is not in danger of a hard fork. The network is based on smart contracts and is ‘built to last’. XTZ tokens are used to maintain and operate the network. XTZ can be used for holding, sending, spending, and baking. Holders are rewarded for baking with XTZ tokens.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

What are DeFi Coins?

To understand what DeFi coins are, you must first understand the basics of DeFi platforms. DeFi platforms are blockchain projects built for a particular decentralized finance function. For example, UniSwap is a decentralized exchange that can be used to trade DeFi tokens whereas The Graph is a protocol that collects and stores blockchain data.

There are thousands of cryptocurrencies available, however, not all of them are DeFi coins. DeFi coins are cryptocurrencies that represent their respective DeFi blockchains and protocols. They are used to facilitate, sustain, and even govern their blockchains. Some platforms like SushiSwap and UniSwap use their native tokens as rewards for investors who lock their cryptocurrencies in their liquidity pools.

Some of the best DeFi coins show massive potential for growth by creating an ecosystem wherein developers, investors, and token holders can all benefit. DeFi coins are an entirely different category to some of the first cryptocurrencies that were created due to their utility for financial solutions.

Key features of a DeFi coin

To help you better understand what DeFi coins are, here is an overview of the key features of a DeFi coin.

DeFi coins

✔️ Provide users with access to DeFi services such as exchanges, blockchain networks and crypto wallets.

✔️ Are native to decentralized applications and are developed using smart contracts.

✔️ Can be used as governance tokens.

Are DeFi Tokens a Good Investment in 2026?

So, are DeFi tokens a worthwhile addition to your crypto portfolio in 2026? We spent time reviewing DeFi price predictions, expert analysis and recent crypto news to find out the answer.

Overall, it seems that DeFi coins are a strong investment in 2026 for several reasons. Investing in DeFi unlocks access to staking, lending and yield farming which can provide much better returns than traditional savings accounts. Furthermore, DeFi coins are a good way to diversify your portfolio away from centralized finance which could be beneficial during economic difficulties.

The main drawback of investing in DeFi coins is volatility. Like all crypto assets, the price of DeFi coins can be unstable because their value is influenced by supply and demand, investor sentiment and media hype. One way to combat this instability is to invest in stablecoins which are usually pegged to the value of a fiat currency like USD.

Another disadvantage of investing in DeFi coins is that they are unregulated. This means that the future of DeFi is largely uncertain which makes it difficult to predict future performance.

DeFi token price predictions

Price predictions for the best DeFi coins are currently bullish which means that experts predict their value to rise. This is due to positive investor sentiment surrounding the upcoming Bitcoin halving and Bitcoin spot ETF which could cause the value of Bitcoin to rise. A Bitcoin bull run could spark confidence and increased interest in the cryptocurrency markets which could attract investors to DeFi coins.

Pros and Cons of Investing in Defi Cryptos

Cryptocurrencies are a risk investment. DeFi coins present both advantages and disadvantages that could either bring returns or losses to investors. As a result, it is important to conduct thorough research and analysis before making any investment decisions. It is also a good idea to familiarize yourself with the pros and cons of buying DeFi tokens.

Pros:

- DeFi coins can earn interest through staking, lending and yield farming. The rates for locking up DeFi coins are often significantly higher than the interest rates provided by traditional fiat savings accounts.

- Decentralized finance is an emerging industry that is still in early stages of development. Therefore, some DeFi tokens may be undervalued which means that investors could see appreciation over time.

- DeFi tokens are decentralized which means that their value is not impacted by third-party control. Instead, decentralized systems are governed by token holders who can vote on outcomes. The systems are supported by blockchain technology which is transparent, immutable and secure.

- Investing in DeFi tokens provides access to web3 applications such as play-to-earn games, crypto casinos, exchanges and more.

Cons:

- DeFi coins are volatile assets that could fall if the wider crypto market performs badly.

- The tokens are unregulated which means that there are no set rules around governance, token distribution or project design. Investors are not protected by insurance.

- Incorrect transactions cannot be cancelled or changed. This means that you could lose funds if you accidently send crypto to the wrong wallet or lose your private keys.

A Closer Look at the Top 10 Defi Coins for February 2026

Before making any investment decisions, it is important to understand the fundamentals of a DeFi coin. The 10 coins that we have listed above each present a promising opportunity for 2026 due to good utility and a strong tokenomic design. In the following section, we will take a closer look at each cryptocurrency to determine what each coin is used for and why it might be good addition to your portfolio.

1. Sponge V2 (SPONGEV2) - The latest token to buy in December

If you're looking for a token to buy this month, look no further than the new version of the famous SPONGE meme coin. It returns to the meme coin market in a much improved and more powerful form, bringing both fun and utility to investors. In addition to fun and entertainment, the team is planning to develop a play-to-earn Sponge game where users will have the chance to earn more SPONGEV2 tokens.

Users will have both a free and a paid version of the new Sponge P2E game. They can choose to enjoy the free version or use their $SPONGEV2 tokens to purchase game credits. By purchasing these credits, users will be able to participate in game sessions and increase their chances of winning more $SPONGEV2 tokens.

The total supply of SPONGEV2 tokens is 150 billion, of which 29.63% will be distributed to purchase tokens via Stake to Bridge, 43.09% will be locked for 4 years for Stake rewards, 10% will be used for CEX liquidity, 7.5% for marketing, 8% for P2E rewards and 4.47% for game development.

It is important to note that SpongeV2 does not have a regular pre-sale, but is tied directly to the SPONGE price. In order to receive Sponge V2, you must fulfil one of two conditions:

- Purchase and use the Sponge V1 token via the purchase widget available on the Sponge.vip website.

- Participate in the Sponge V1 token raffles on the Sponge.vip platform.

The more V1 tokens you leave in the game for a longer period of time, the more V2 tokens you will win. Once the remaining supply of SpongeV1 has been used up, Sponge V2 will be available to claim.

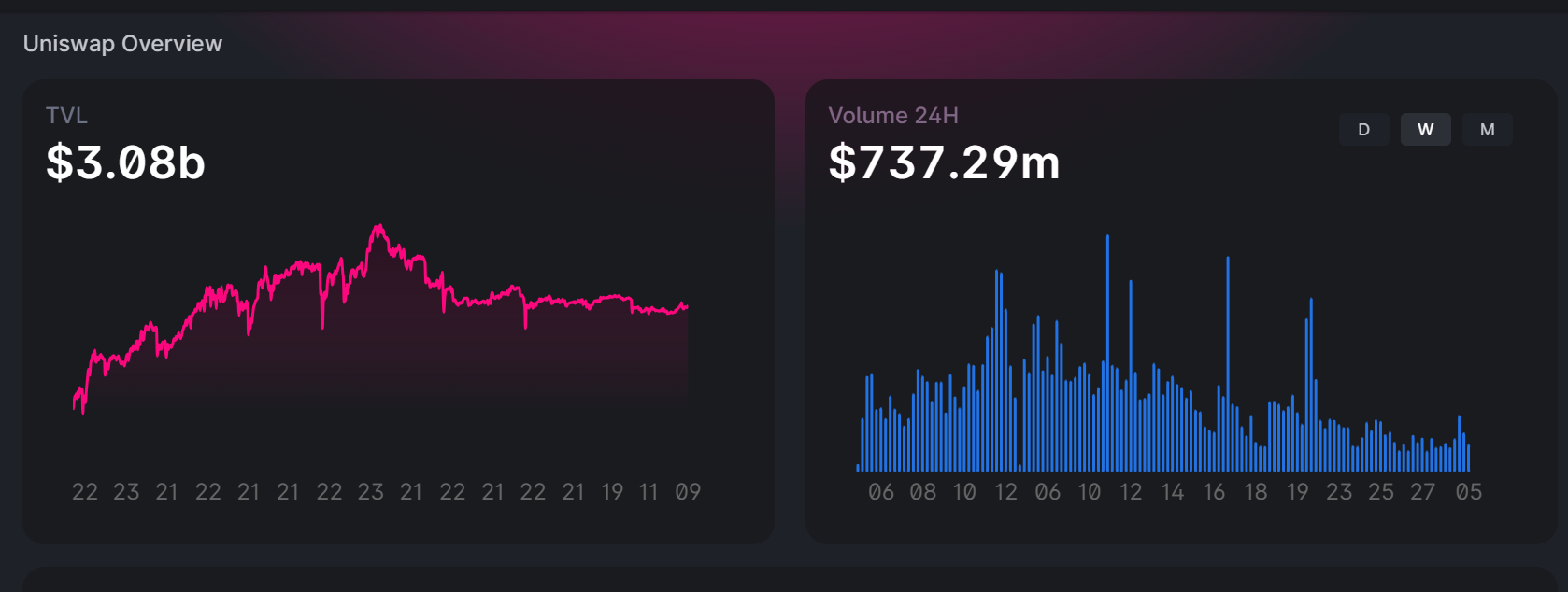

2. UniSwap (UNI): A leading DEX with a native utility token that can be staked for passive rewards

UniSwap is one of the largest decentralized exchanges that surpassed $1.5 trillion in trading volume in April 2023. The platform is popular due to its friendly design and extensive selection of assets that are available. There are currently over 1000 coins available to trade on V3 of the DEX including altcoins, stablecoins and DeFi coins.

UniSwap is supported by the UNI utility token. Token holders govern the UniSwap platform and can vote on the development of the platform. The more UNI held in a crypto wallet, the more voting power the wallet owner will get. UNI can also be used for swapping and staking for passive rewards.

UNI is an ERC20 token with a limited supply of 1 billion. 60% of tokens will be distributed to the community, 21.3% are held for the team, 18% are given to investors and 0.7% are awarded to project advisors. UNI is an inflationary token that will increase by 2% per year after the initial capped supply is reached. However, tokens will be taken out of circulation by investor staking which will limit the supply available and allow the coin to maintain its value.

Is Uniswap a good investment?

$UNI is considered to be one of the best DeFi coins to buy in 2026 due to the fact that UniSwap is the most liquid decentralized exchange. As the DeFi space grows, Uniswap will attract more users which will increase demand for the UNI token. Furthermore, investors can increase their investment passively by staking UNI for rewards. This means that it is possible to make a return on your investment even if the value of UNI remains the same.

Risks of investing in Uniswap

On the other hand, UniSwap is not the only DEX option and the exchange comes with several disadvantages that could make other platforms more appealing. Most notably, UniSwap charges high transaction fees which make it less attractive for traders who have a low budget.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

3. Chainlink (LINK): A blockchain abstraction project that aims to connect different blockchain networks

Chainlink is an Ethereum-based project that facilitates interactions between the Ethereum network and off-chain data sources. The project aims to connect the world to blockchains allowing data to be moved between existing networks to verify on-chain and off-chain reserves. The technology will power the next generation of DeFi applications.

You can invest in the project by adding $LINK tokens to your crypto portfolio. LINK is an ERC20 asset that is used to reward node operators and support the Chainlink network. Project developers have also introduced LINK crypto staking which allows investors to earn rewards for locking up their tokens.

Is Chainlink a good investment?

Analysts at InvestorObserver have given Chainlink a long-term technical score of 95 which suggests that the coin is a good long term investment opportunity. Furthermore, $LINK has remained a steady performer and is ranked at number 12 on Coinmarketcap. The technology will play an integral role in the development and expansion of web3 and DeFi. Chainlink has few notable competitors in the industry. Compared to it's competitors, Chainlink is the most developed and has managed to secure the largest amount of smart contracts.

Risks of investing in Chainlink

The main drawback of investing in $LINK is that it has no real uses cases other than staking. Unlike other DeFi coins, LINK is not used for governance or platform access. Instead, investors can stake their tokens for rewards or simply hold them as a long term investment.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

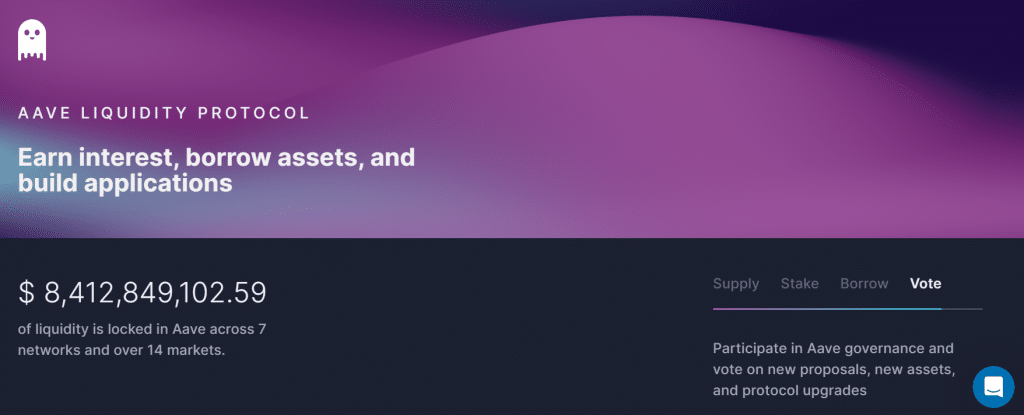

4. Aave (AAVE): Leading crypto loans provider that is built on the Ethereum network

Aave is an open source liquidity protocol that supports crypto lending, borrowing and building. The platform allows users to earn interest on their crypto by providing liquidity to the network. These tokens are then used to fulfill loan requests. Borrowers can loan crypto by using their tokens as collateral. It is also possible to earn crypto through staking and to use AAVE tokens to participate in platform governance.

AAVE is a utility token with a capped supply of 16 million coins. The supply will be gradually distributed over time by the Aaave protocol to incentivize supplying and borrowing assets on the network. AAVE also supports the governance system of the network that plays a role in development and expansion. The token ensures that Aave remains fully decentralized.

Is Aave a good investment?

Aave is the leading lending protocol on the Ethereum network. Aave removes the need for centralized authorities, improving access the lending and borrowing. AAVE is currently ranked number 37 on Coinmarketap and the price chart appears to be bullish. Experts predict that the token will experience major growth by next year, reaching a potential high of $806.23 which could provide generous returns to investors.

Risks of investing in Aave

The main disadvantage of the Aave protocol is over collateralization, which means the borrowers must lock up crypto that is worth more than the amount they want to borrow. Furthermore, lending yields are relatively low due to the fact that the platform has good liquidity.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

5. Avalanche (AVAX): A layer 1 blockchain network is supported by the AVAX utility token

Avalanche is one of Ethereum's biggest rivals. It is a Layer 1 blockchain network that allows developers to build custom blockchain networks and decentralized applications. The network aims to dethrone Ethereum as the most popular blockchain network with higher transaction output.

The main focus of the Avalanche blockchain is to allow users to build anything they want. Avalanche is scalable and offers low-code tooling that makes it easy to launch a web3 application in very little time. The network is supported by the native AVAX token which is used for governance and to power transactions in the ecosystem.

AVAX has a max supply of 720,000,000. 50% of the entire supply is held for staking rewards with only 10% of tokens being distributed to the team. The token is deflationary which means that the circulating supply will gradually decrease over time, increasing scarcity and driving value to the token. Coins are burned when they are used to pay for platform fees. The burning mechanism will stabilize the price of AVAX for long term investors.

Is Avalanche a good investment?

Avalanche is considered to be a good addition to any DeFi portfolio. First and foremost, the network provides fast transaction speeds and robust scalability. The AVAX token itself has strong utility and a deflationary supply which should drive value to the coin over time. Some experts predict that the price of AVAX will increase by the end of the year, offering returns of around $9.63.

Risks of investing in Avalanche

Although Avalanche offers high transaction speeds and scalability, the network lacks the support of Jump Capital to create a chain that could handle 1 million TPS. This could make it tricky for the blockchain to dethrone Ethereum as it originally set out to. Another disadvantage of the DeFi project is poor staking accessibility. To become a validator, you must stake 2000 AVAX tokens. This means that the project may struggle to attract investors who want to earn rewards from ethereum staking.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

6. Internet Computer (ICP): Internet Computer is a scalable blockchain network that can be used to build any online system

Internet Computer is an innovative blockchain network that can be used to build online systems without the need for traditional cloud computing services. This enables end-to-end decentralization which will contribute towards the expansion of DeFi and Web3.

The Internet Computer ecosystem is powered by the native ICP token. The tokens are used to pay node providers, participate in governance and to power transactions across the network. The total supply of ICP tokens is variable. The projects facilitates both minting and burning mechanisms which balance each other out and maintain a steady token supply. As the user base grows, the burning mechanism will increase which will eventually cause the supply to become deflationary.

Is Internet Computer a good investment?

ICP has solid technical foundations and great usability which make it a promising investment. What's more, the Internet Computer ecosystem has the ability to scale to the likes of Ethereum. The technology is completely operational and has already been used by a number of projects to build dApps and other web3 systems. According to a recent roadmap that published on Medium, the project plans to become an alternative to today's internet within the next 10 years. If this the team manage to achieve this goal, the value of ICP could increase significantly.

Risk of investing in Internet Computer

Internet Computer is considered to be a low risk investment however, that doesn't mean that investors are guaranteed to see returns. The performance of ICP will depend on the roll out of the Internet Computer network. The network must attract more users for the token supply to become deflationary. If Internet Computer does not manage to scale to the level that it hopes to, the token may not appreciate in value.

7. Maker (MKR): The governance token of the MakerDAO protocol

One of the hottest DeFi coins to invest in 2026 is MKR, the native crypto of the MakerDAO protocol. MakerDAO is a centralized organization that supports the DAI stablecoin. DAI is the world's first unbiased stablecoin that is pegged to the value of the US dollar. The token can be used by anyone in any place which will encourage the wider adoption of cryptocurrency.

MKR is a governance token that allows holders to vote on network outcomes. The token does not offer staking but will appreciate in value according to the success of the DAI token which make it an attractive investment opportunity. The more that are held in a wallet, the more voting rights that investor will receive. The maximum supply of MKR tokens is 1,005,577, the total circulating supply varies depending on the performance of DAI. The maximum supply is not set in stone and could change depending on network requirements.

Is Maker a good investment?

Current Maker (MKR) price predictions are bullish with experts predicting that the price will more than double by 2025. The Dai token is poised to offer significant advantages to the crypto landscape as the first unbiased cryptocurrency with a steady value. Due to its low volatility and accessibility, Dai could play a big role in the future of DeFi. As a result, MKR could appreciate in value and offer a return to early investors.

Risks of investing in MKR

The main risk associated with investing in MKR is that the value of the token depends entirely on the success of DAI. Therefore, if DAI is not widely accepted, investors may struggle to see returns.

8. Arbitrum (ARB): A layer 2 protocol that enables users to interact with Ethereum while taking advantage of low fees and high speeds

Blackrock recently announced their plan for an Ethereum ETF which has increased investor interest in Ethereum related tokens. One of the best Ethereum DeFi coins to consider is Arbitrum, a layer 2 protocol that enables users to interact with Ethereum whilst keeping fees low.

Arbitrum is one of the most popular Ethereum layer 2 technologies and has a strong roadmap in place for the remainder of 2023. The project plans to launch it's owner layer 3 solution which will improve accessibility even further by allowing developers to deploy applications that are written is popular programming languages.

The Arbitrum ecosystem is powered by the native ARB utility token. ARB is an ERC20 asset that is mainly used for governance. ARB holders can vote on proposals that effect the protocol, voting power is directly related to the amount of ARB held in a wallet.

Is Arbitrum a good investment?

Blackrock recently announced it's plan for an Ethereum ETF which has caused investors to go bullish on Ethereum tokens. As one of the most popular layer 2 DeFi protocols, Arbitrum experienced a surge in investor interest following the announcement.

Arbitrum aims to be the future of Ethereum and has already managed to achieve faster speeds and lower fees than the blockchain network. Furthermore, Arbitrum is built for scalability which means that it could play a significant role in the future of web3 as dApps develop and become more advanced. As a result, Arbitrum is considered to be a strong ERC20 token to buy right now.

Risks of investing in Arbitrum

The main drawback of Arbitrum is that it is not permissionless. This means that the protocol is not available to everyone which could limit wider adoption. For the value of ARB to increase, the network will need to attract more users which could be difficult with a permissioned design.

9. The Graph (GRT): An open-source software used to store data from blockchains

The Graph an Ethereum-based open-source protocol that is used to collect and store data from blockchain networks. This data can then be searched and viewed by others to allow the distribution of important blockchain information.

The Graph is powered by the GRT utility token which maintains the integrity of the data that is stored on the network. To use the decentralized financial system, users must stake GRT tokens. In return for staking, they can receive rewards.

GRT is an ERC20 token with an initial supply of 10 billion that will increase by 3% annually to reward staking. To offset the issuance of new tokens, The Graph is designed with multiple burning mechanisms through which around 1% of tokens are burned annually. The Graph also uses a slashing mechanism to penalize irresponsible behaviors. If an indexer is slashed, 50% of their token rewards are burned.

Is the graph a good investment?

The graph token is used to access data that is stored in the network. Therefore, the more users that the network attracts, the higher the demand for the token will be. Price predictions for GRT are fairly bullish with experts predicting that the value of GRT will rise by the end of the year. As blockchain becomes more widely adopted, The Graph will be used by developers to access important data. Therefore, the network will play a pivotal role in the future of DeFi.

Risks of investing in GRT

Overall, GRT is considered to be a low risk investment. However, the project does have some weaknesses. Most notably, GRT has an unlimited maximum supply with an annual inflation rate of 3%. If demand struggles to keep up with the inflating supply, the price of the token could take a hit.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

10. Stacks (STX): A protocol that allows smart contracts and dApps to use Bitcoin as an asset

Stacks is a Bitcoin layer for smart contracts that makes it possible to build applications on Bitcoin. Stacks brings DeFi to the Bitcoin ecosystem which will help to grow the Bitcoin economy and improve accessibility.

Stacks is powered by the STX token which can be locked up to earn BTC rewards. This is known as 'stacking' and provides a way to earn passive BTC without needed to go through the intensive Bitcoin mining process.

As well as the STX utility token, Stacks uses the sBTC token to DeFi to the Bitcoin ecosystem. sBTC is pegged to the value of Bitcoin as unlocks $500B BTC in capital to be used in decentralized applications. Stacks uses a proof-of-transfer consensus mechanism which enables to network to read Bitcoin at anytime. This allows the tokens to remain directly pegged to BTC.

STX is an ERC20 token with a max supply of 1.82B. STX is used to fuel smart contracts for Bitcoin and to reward miners who participate in 'stacking'.

Is Stacks a good investment?

Stacks is a good investment in 2026 because it enables holders to earn free BTC through mining which is other wise difficult to access. With the upcoming Bitcoin halving event, now is a good time to start mining BTC and store the tokens before the predicted price increase.

Risks of investing in Stacks

The success of Stacks is directly related to the performance of Bitcoin. Therefore, if Bitcoin experiences another crash, Stacks could also struggle. Furthermore, Stacks is still in the early stages of development which means that it may be some time until widespread adoption is achieved. As it stands, the ecosystem has fewer users and applications that more established networks.

11. Tezos (XTZ): A smart contract-based blockchain network with advanced infrastructure

Tezos is a blockchain network that hopes to avoid the danger of a hard fork by utilizing an advanced infrastructure. The network will evolve and improve over time as a 'future-proof' alternative to Ethereum and Bitcoin.

Tezos is powered by the XTZ utility token which is used to maintain and operate the network. XTZ can be used for holding, baking, spending and sending.

XTZ (Tez) is used by investors to interact with dApps, pay for platform fees and earn rewards through staking. The token has no maximum supply however, deflation occurs through a process known as baking. Baking is the process of publishing new blocks to the blockchain network and is an important aspect of the PoS consensus mechanism.

To start baking blocks, users must stake XTZ tokens, which takes them out of the circulating supply. Bakers are rewarded woth passive token rewards for their contribution to the network.

Is Tezos a good investment?

Investing in XTZ is one way to take advantage of baking rewards, which can be quite lucrative. The rewards for baking a full block can reach up to 10 XTZ. Another advantage of investing in Tezos is that the network uses an eco-friendly PoS mechanism which stands out from Bitcoin's PoW mining process. As we lean towards a greener future, PoS will be preferred over PoW and green cryptos like XTZ may attract investors.

Risks of investing in XTZ

Tezos is not the only smart contract protocol and has strong competition in the market from the likes of Ethereum. The project may find it difficult to dethrone more established networks that have a higher rate of adoption. This could limit the value of the token and prevent investors from seeing significant returns.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

Conclusion

The best DeFi coins to buy in 2026 include Uniswap, Chainlink and Aave. each of these projects have bullish price predictions and positive price charts, according to analysts. Furthermore, the tokens have strong usability which mean's that they could hold their value over time.

Although many DeFi coins appear to be good investments in 2026, it is important to understand the risks involved with investing in DeFi crypto. The tokens are known for being very volatile and there is no guarantee that their price will go up.

The best way to reduce risk when investing in DeFi is to invest in a diverse selection of coins that each have unique use cases. It is also a good idea to conduct thorough research and to stay up to date with the latest market news.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

FAQs

What is DeFi Crypto?

DeFi stands for ‘Decentralized Finance’ and is one of the most popular applications of blockchain technology today. Unlike centralized finance where there is a central authority that controls the flow of money like a bank or government, DeFi allows for the same financial systems but with no regulations and is open to everyone. DeFi coins are the tokens and coins that are used on the different DeFi platforms out there.

Where can I buy DeFi coins?

Aside from getting DeFi coins from the decentralized exchanges themselves, you can buy DeFi coins in any cryptocurrency exchange such as eToro.

How do I buy DeFi crypto?

To navigate the DeFi space, you’ll need a cryptocurrency wallet such as the Trust Wallet or MetaMask. You can use your crypto wallet to connect to a crypto exchange to buy DeFi crypto. Alternatively, you can purchase the DeFi coins and tokens themselves in crypto exchanges with an account.

Can I buy DeFi coins in the US?

Yes you can! There are many crypto exchanges available in the US that let you buy DeFi coins and decentralized exchanges don’t have any restrictions regarding those transacting in terms of location.

References:

Jose Rafael Aquino Finance Wriiter

View all posts by Jose Rafael AquinoJose Rafael Aquino is a seasoned writer who specializes in the Finance and Tech industries. Jose is passionate about education and uses his writing skills to create informative content that improves the reader's understanding of complex industries.

Before he started working as a writer, Jose studied at the Ateneo de Manila University where he was awarded a Bachelor of Science in Information technology Entrepreneurship. After graduating, Jose founded AKADS PH - a tech startup that allows parents to book tutors for students. Aquino has a strong understanding of the tech industry which extends to blockchain and web3 technologies.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up