Vantage Markets Review 2025 – Pros & Cons Revealed

For thousands of new traders on the hunt for the best online trading platform, wading through the endless search results can be a time-consuming and tiresome task. With that said, how do you decide which broker is right for you?

In this Vantage Markets review 2025, we cover everything you need to know from fees and commissions to payments and account types so that you can spend more time trading and less time searching.

What is Vantage Markets?

Established in 2009, Vantage Markets has been offering access to the most liquid financial market in the world via forex trading, as well as other financial instruments such as CFD derivatives.

Vantage Markets was designed to help both beginner and advanced traders reach their financial goals. This CFD and forex trading platform supports a wide range of trading platforms from the Vantage Markets trading app, to the world-class MetaTrader 4 and MetaTrader 5 trading suites.

Trading Forex and CFDs involves significant risk and can result in the loss of your invested capital.

One of Vantage Markets’ best selling points is that it offers market-leading spreads as low as 0.0 pips, as well as low non-trading fees. These are important factors to bear in mind when selecting a trading platform because they help to keep your trading costs as low as possible.

Overall, Vantage Markets is a great trading platform for new traders to learn the ins and outs of online trading with a variety of features and tools at their disposal. Users can access more than 1000 forex, commodities, indices, and share CFDs from the comfort of their own homes. Moreover, keen forex traders can identify global market volatility with daily forex signals.

Vantage Markets Pros & Cons

What we like

- Access to 1000+ Forex, share, commodities, and stock index CFDs

- Regulated by several top-tier financial institutions such as the FCA, CIMA, VFSC, and ASIC

- Vantage Markets Clients’ funds are held in segregated accounts with an AA-rated bank in Australia

- Leverage of up to 500:1

- Paper trading demo account with a virtual account balance of $100,000

- Fast and easy account opening process

- 3 trading accounts for all types of traders

- Spreads from 0.0 pips and commission from $0 depending on the account type

- Nine account base currencies helps to avoid conversion fees

- Wide range of funding methods

- Forex spreads from just 0.0 pips on Vantage Markets Raw ECN accounts

What we don’t like

- Product selection limited to CFDs

Trading Forex and CFDs involves significant risk and can result in the loss of your invested capital.

What Can You Trade on Vantage Markets?

Vantage Markets provides access to 1000+ forex, commodities, indices, and share CFDs. In this section, we will explore the different types of CFD instruments you can trade when you open an account with Vantage Markets.

Forex

The forex market is the largest financial market in the world with a daily trading volume of more than $6 trillion. Nearly all trades on every single market such as futures and stock markets are affected by forex trading. Banks, governments, businesses, and individual traders all take part in this highly liquid global forex market. Their participation leads to market volatility, which forex traders can then take advantage of by using financial vehicles such as leverage to maximise their profits.

Vantage Markets forex traders have access to more than 40 currency pairs with spreads from 0.0 pips when using a RAW ECN account. For example, the minimum spread for the EUR/USD pair is 0.1 pips and for the AUD/USD pair is 0.2 pips. These range from major, minor, and exotic forex pairs such as:

- EUR/USD

- AUD/USD

- GBP/USD

- USD/JPY

Additionally, you can choose your exposure levels with forex leverage of up to 500:1. This means that an initial deposit of $1,000 could give you exposure to $500,000 of purchasing power.

When it comes to cryptocurrency trading, you can access 7 crypto-to-fiat pairs including Bitcoin and other altcoins:

- BCH/USD

- BTC/USD

- EOS/USD

- ETH/USD

- LTC/USD

- XLM/USD

- XRP/USD

Indices CFDs

Gain direct access to stock exchange indices with the highest liquidity via your MetaTrader 4 and MetaTrader 5 trading platforms. Integrated with the oneZero MT4 bridge, Vantage Markets offers fast execution speeds.

Vantage Markets supports the most liquid stock exchange indices such as the S&P 500, FTSE 100, DAX 30, NAS 100. This means that you can boost your portfolio diversification by trading index CFDs on markets such as the ASX Trade24, Singapore Exchange, Chicago Board of Trade, Eurex, ICE Futures Europe Financials, ICE Futures US Currencies, and Cboe Futures Exchange.

At Vantage Markets, all trading strategies such as scalping, hedging, swing trading, and automated trading, are supported. You can also use up to 200:1 leverage when trading index CFDs.

Commodity CFDs – Precious metals, energies, and soft commodities

With a Vantage Markets MT4 and MT5 brokerage account, you can take long-term position trades in commodities such as physical gold and silver, with the ability to go either long or short.

The added benefit of CFD trading is that you do not take ownership of the underlying asset, as you speculate on future price movements of the market.

Gold trading is widely accepted as a safe haven amongst traders and investors across the world. In the current volatile market environment, adding Gold to your investment portfolio through the Vantage Markets MT4 and MT5 platforms can work towards reducing the impact of significant black swan events that shake the markets.

Moreover, Vantage Markets also offers access to soft commodities trading which is a robust market full of corporate and independent traders of the physical assets that back the futures market. In the financial sector, the term ‘soft commodities’ is generally used to refer to assets that are grown as opposed to those that are mined.

There is a constant demand for soft commodities, especially as the global population continues to grow.

Vantage Markets account holders can trade energy markets with the click of a button from your desktop PC or mobile device. Traded on the futures markets and quoted in USD per gallon, Vantage Markets gives users exposure to Gasoline and Crude Oil through the immensely popular MetaTrader 4 trading terminal.

Let’s take a look at some of the different commodities you can trade with a Vantage Markets trading account:

| Asset | Market | Minimum Spread | Leverage | Contract Size |

| Natural Gas Cash | Nymex/CME | 5 pips | 20:1 | 10,000 BTU |

| West Texas Crude Oil Future | Nymex/CME | 16 pips | 100:1 | 1,000 barrels |

| Brent Crude Oil Cash | Market Cash | 36 pips | 100:1 | 1,000 barrels |

| US Cocoa Cash | Nymex/CME | 50 pips | 20:1 | 10 lbs |

| Coffee Arabica Cash | Nymex/CME | 29 pips | 20:1 | 37500 lbs |

| XAUUSD | FX Spot | 1 pips | Max 500:1 | 100 oz |

| XAGUSD | FX Spot | 18 pips | 100:1 | 5,000 oz |

Share CFDs

Vantage Markets’ leveraged share CFDs allow users to trade both long and short in 50 of the largest shares of stock listed on the NYSE, Nasdaq, as well as companies listed on UK, EU, and Australian stock exchanges. At Vantage Markets you can trade US share CFDs from just $0 per order per side, as well as use leverage of up to 20:1, which means that you can start with a relatively small initial margin.

Vantage Markets caters to all trading styles. So whether you are a short or long-term investor, and prefer to trade actively or passively with an expert advisor, you can trade share CFDs on a speculative basis with leverage, and gain exposure to highly liquid share CFDs across the US, UK, EU, and AU exchanges.

For example, you could trade share CFDs of Apple (APPL), Microsoft, Google, Amazon, Total, Sanofi, Bayer AG, and ANZ Banking Group Limited with leverage up to 20:1, with a commission as low as $5 – €10 depending on the asset you choose.

Vantage Markets Fees, Commissions, and Account Types

If you’re wondering why we’ve included account types in the fees and commissions section of this review, this is because the trading fees vary depending on the type of account you choose.

Vantage Markets offer three trading accounts:

- The Standard STP Account is ideal for beginner traders who are looking for straightforward access to financial markets with 100% zero commissions.

- The RAW ECN account is perfect for advanced traders who need deep liquidity and market-leading spreads.

- The PRO ECN account is designed for active professional investors and portfolio managers who trade high volume.

For a complete breakdown of the trading fees and commissions you are likely to encounter when trading with any of the aforementioned account types, please refer to the following table.

| Account Type | Minimum Deposit | Minimum Trade Size | Leverage | Spreads from | Commission |

| Standard STP | $250 | 0.01 lot | Up to 500:1 | 1.1 pips | $0 |

| RAW ECN | $50 | 0.01 lot | Up to 500:1 | 0.0 pips | From $0 |

| PRO ECN | $10,000 | 0.01 lot | Up to 500:1 | 0.0 pips | From $1.50 per lot per side |

When it comes to non-trading fees, Vantage offers very competitive fees including no deposit or withdrawal fees, as well as no inactivity fees. It is important to note that when it comes to withdrawing money from your account it needs to go to a bank account in the same name as your verified Vantage Markets trading account.

| Non-trading fee | Charge |

| Account Fee | None |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Neteller withdrawals are limited to $10,000 per transaction and are charged a 2% fee, capped at $30 per transaction.

Vantage Markets User Experience

The Vantage Markets web trading platform is supported by the MetaTrader trading suite. Both MT4 and MT5 trading platforms are widely popular with all types of traders due to their fully customizable designs and intuitive interfaces. Additionally, there are dozens of languages to choose from such as Chinese and English.

In terms of search functionality, all tradable assets are divided into relevant categories, but there is no search box where you can manually search for an instrument. However, the overall feel and experience of the MT4 web trading platform is streamlined and simple. You can also place basic order types such as Stop Loss and Take Profit.

As we have already mentioned, new traders can take advantage of the demo account that offers up to $100,000 worth of paper funds. This means that you can trade in a simulated trading environment that is based on live market conditions without the risk of losing any actual capital.

Furthermore, you can also integrate social trading into your trading strategy via the following supported platforms:

- ZuluTrade

- MyFXBook Autotrade

- DupliTrade

- Vantage social trading

Vantage Markets Features, Charting, and Analysis

Charting tools and features

Toolbar – At the top of the main MT4 trading window you have the toolbar which allows you to navigate through the terminal adjusting and modifying things to suit your trading style and preference.

Charts – In the center of the screen, the chart section allows you to populate up to 4 different charts at the same time.

Market Watch – The Market Watch window is located at the left side of the terminal and this lists all the supported markets that you can trade as well as the real-time bid and ask prices, otherwise referred to as the spread, the High and Low prices, and the Time.

What about technical indicators?

A variety of technical indicators can be implemented into your charts by clicking on the Add Indicators icon. You can choose from the most popular Trend indicators and Oscillators such as:

- Bollinger Bands

- Moving Average

- MACD

- RSI

- Parabolic SAR

Furthermore, you can open a new chart in the same template as your existing charts by clicking on your preferred market and dragging it over the open chart that you want to copy.

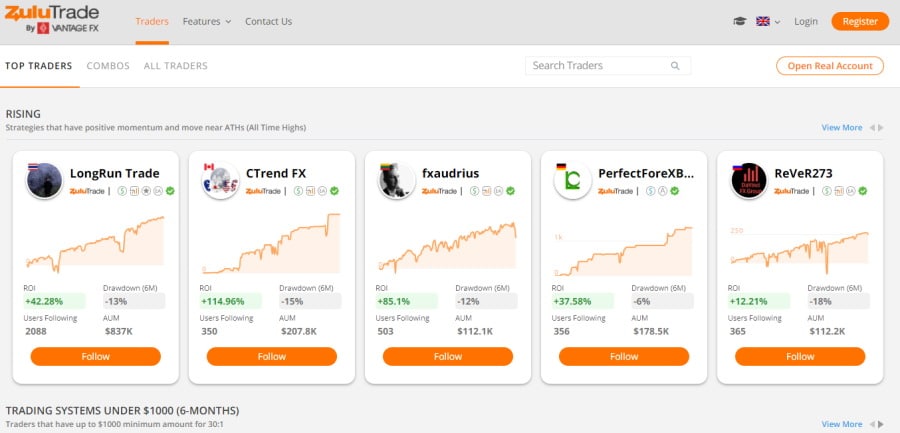

Social Trading

Vantage Markets traders can take advantage of social forex trading with ZuluTrade and gain exclusive access to a network of over 10,000 experienced forex traders and profitable investment strategies.

Getting started is simple enough. Just pick the professional trader you want to follow and diversify your portfolio with several strategies. Your trading account will replicate the performance of the professional traders that you follow. In terms of ease of use, the social trading features are streamlined into your Vantage MT4 trading account.

Copy Trading

When you link your Vantage Markets trading account to DupliTrade, you can access a portfolio of professional proprietary investors. Then you simply need to select the traders you want to copy based on their past performances and trading style, and their trading strategies will be copied to your Vantage Markets MetaTrader account.

Educational Resources and Free Trading Tools

If you hover over the Clients tab in the navigation bar you will find an array of educational materials ranging from platform manuals and video tutorials to educational webinars, daily market updates, an economic calendar, and forex sentiment indicators.

In other words, there is an abundance of accessible resources for novice traders to sink their teeth into and develop their online trading skills and knowledge.

Vantage Markets Mobile App Review

With the Vantage Markets trading app, you can gain exposure to global markets through CFD derivatives anywhere at any time from your iOS or Android mobile device.

The Vantage Markets trading app provides investors of all levels of trading experience with mobile access to a wide range of forex pairs, commodities, indices, share CFDs, and social trading.

Equipped with a range of technical indicators including MACD and Bollinger Bands, charting tools, and several timeframes, the Vantage Markets trading app supports user-friendly mobile charting.

As well as being able to manage your trading portfolio you can deposit and withdraw funds with the click of a button. Moreover, Vantage Markets has teamed up with Trading Central to offer market analysis, financial news updates, extensive market analysis, all in real-time from the Vantage Markets app.

Vantage Markets Payments

Vantage Markets allows traders to open accounts and deposit funds in eight different base currencies which include AUD, USD, EUR, GBP, NZD, SGD, JPY, and CAD.

The available payment methods include via credit card, debit card (Visa and Mastercard), wire transfer, and a whole host of e-wallets and e-payment options such as Skrill, Neteller, and FasaPay to name a few. The processing times vary from instant to 2-5 business days depending on the payment method. The same applies for the deposit fees with credit/debit cards incurring zero fees while Skrill and Broker-to-Broker Transfer are subject to bank transfer fees.

When it comes to withdrawals, Vantage does not charge any fees but payments to and from international banking institutions may incur intermediary transfer fees which have nothing to do with Vantage Markets. Additionally, all withdrawn funds are required to go to a bank account under the same name as the Vantage Markets trading account.

In terms of making a withdrawal, traders can simply log into the client portal and tap on the withdraw tab from the main menu.

| Payment Method | Processing Time | Fees | Available Currencies |

| Domestic Electronic Funds Transfer | 1-2 business days | $0 | AUD |

| International EFT | 2-5 business days | $0 | AUD, USD, GBP, EUR,SGD, JPY, NZD, CAD |

| BPAY (Australia Only) | 1-2 business days | $0 | AUD |

| Credit/Debit Card (Visa/Mastercard) | Instant | $0 | AUD, USD, GBP, EUR,SGD, JPY, NZD, CAD |

| JCB | Instant | $0 | JPY |

| China Union Pay | Instant | 1.30% – 2.50% | USD |

| Neteller | Instant | Subject to Neteller’s fees | AUD, USD, GBP, EUR,SGD |

| Skrill | Within 24 business hours | Subject to Skrill’s fees | USD, EUR, GBP, CAD |

| Broker-to-Broker

Transfer |

2-5 business days | Subject to bank transfer fees | AUD, USD, GBP, EUR,SGD, JPY, NZD, CAD |

| FasaPay | Instant | $0 | USD |

| Domestic Fast Transfer (Australia Only) | Up to a few hours, during AEST Business hours | $0 | AUD |

| POLi Payments (Australia Only) | Within 24 business hours | $0 | AUD |

| AstroPay | Instant | $0 | USD and the majority of local currencies |

| Thailand Instant Bank Wire Transfer | Instant | $0 | USD |

Vantage Markets Refer a Friend and Deposit Bonus

When you refer a friend you could earn a bonus of $150 and $100 for your referral when they open a Vantage Markets trading account, deposit at least $1,000, and start trading assets. The process is easy, simply share the unique link via social media platforms and when your friends follow the link and start trading with a Vantage Markets account you will receive a $150 bonus and your friends will receive $100, both of which can be redeemed whenever you want.

To opt-in to the Deposit Bonus simply make a deposit and Vantage Markets will offer you a 50% credit bonus on your initial deposit (up to $500 credit) as well as a 10% credit bonus for deposits greater than $1,000 (up to $19,500 credit). Moreover, you will also gain a 10% credit bonus on any deposits you make in the future.

Vantage Markets Contact and Customer Service

For any questions or issues you may have you can get in touch with the customer support team at Vantage Markets via email, Live Chat, or telephone 24 hours a day, 7 days a week.

If you have any questions regarding the account opening process then you are advised to contact customer services on Monday to Friday between the hours of 9 am and 5 pm via [email protected].

Additionally, you can also browse through an in-depth FAQs page and a dedicated Help Centre for general queries.

Is Vantage Markets Safe?

Vantage Markets is part of Vantage Global Prime Pty Ltd. and is regulated and authorised in various jurisdictions around the world. This includes top-tier financial regulators such as the Cayman Islands Monetary Authority (CIMA), VFSC under Section 4 of the Financial Dealers Licensing Act, the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC).

Furthermore, client funds are held in segregated accounts with an AA-rated Australian bank, which happens to be amongst the top four financial institutions in Australia with a market capitalization of just under $94 billion.

Vantage Markets also has Professional Indemnity Insurance, otherwise referred to as errors and omissions. This means that business owners, employees, and other authorized representatives are protected if clients claim that the standard of service is substandard.

Vantage Markets also provides negative balance protection which means that if your account balance drops below zero you will be covered.

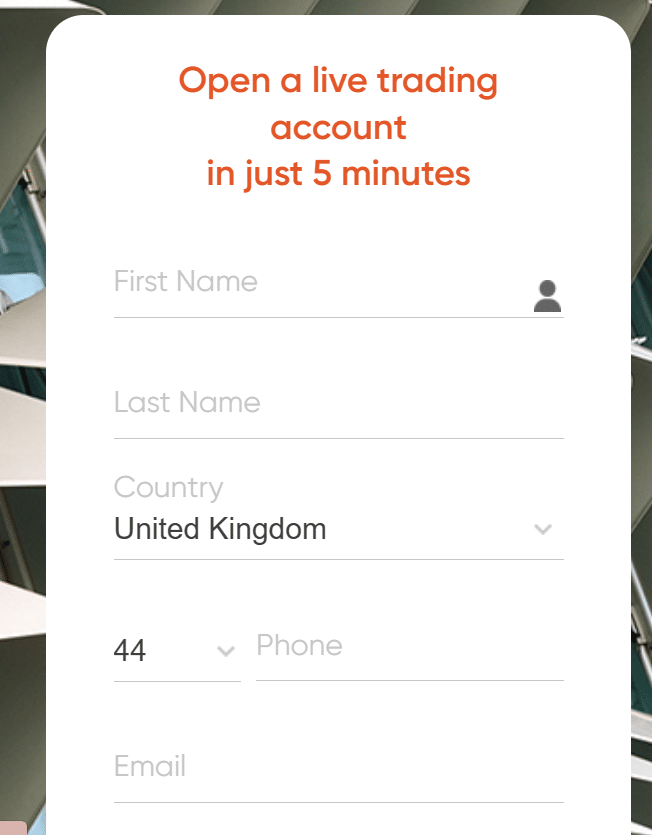

How to Start Trading with Vantage Markets

To start online trading with Vantage Markets all you need to do is follow the steps below.

Step 1: Open a Live Trading Account

To open a live trading account simply head over to the vantagemarkets.com website and click on the open live account at the top of the screen. This will take you to an online form where you are required to enter your details including full name, country of residence, phone number, email address, and the account type you wish to trade with. Then simply click on the red Open Live Account button.

Step 2: Verification and Deposit Funds

In keeping with strict KYC regulations, you will need to upload proof of identity and residency which can be copies of your passport and a recent utility bill.

Once your account has been verified by Vantage Markets you can deposit funds into your account via a myriad of payment methods. For example, if you choose to deposit via a Visa credit card, not only are there $0 deposit fees but your funds will be credited to your account instantly.

Step 3: Start Trading

As we have already discussed, you can trade using the MetaTrader 4 and MetaTrader 5 trading platforms, as well as ZuluTrade’s social trading services, DupliTrade’s copy trading services, or the fully-fledged mobile trading app.

To buy on the MT4 trading platform simply right-click over the asset in the Market Watch window and click on New Order. This will populate an order ticket in the middle of the terminal where you can specify the volume, place stop loss, and take profit orders. Once you are happy with your choices simply click on the Sell by Market or Buy by Market buttons to execute the trade.

Vantage Markets Review – The Verdict

All in all, Vantage Markets is a widely popular and regulated broker that has tons on offer. From low commissions and market-leading spreads to social and copy trading capabilities, it’s hard to find fault with this free trading platform.

With access to hundreds of markets via CFD instruments, you can speculate on the price movements of the markets without taking ownership of the underlying assets. Furthermore, you can trade with leverage of up to 500:1. To jump-start your online trading journey, simply follow the link below and open a Vantage Markets account today!

Vantage Markets – Best CFD and Forex Broker With Leverage Up To 500:1

Trading Forex and CFDs involves significant risk and can result in the loss of your invested capital.