Bitcoin (BTC) Price Prediction June 2025– Buy or Sell?

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Everyone is interested in Bitcoin price predictions these days, and it’s not difficult to see why. The world of cryptocurrencies has suffered a huge setback in the past few months. As we move into a new year, many analysts have predicted the crypto market to bounce back. If this will happen, Bitcoin (BTC) ,the king of cryptocurrencies will be at the forefront.

Bitcoin has seen enormous growth in recent years, reaching unprecedented heights in price and value. But with this price explosion comes a lot of speculation and confusion – so who should you believe when it comes to Bitcoin price prediction? Well, for crypto enthusiasts and investors that want to learn about bitcoin and its price history, this blog is the perfect resource. This article will dissect the current bitcoin market and give you an overview of what to expect for the bitcoin price prediction in 2025. So whether you’re looking to buy or sell bitcoin, read on to learn all you need to know!

Bitcoin Price Prediction- Overview

With the high volatility and uncertainty surrounding the value of cryptocurrencies, it might be challenging to accurately predict the future price of crypto. This is why a coin’s fundamental and technical analysis is crucial in Bitcoin price prediction. In this guide, fundamental and technical analyses were employed to predict the future price of Bitcoin (BTC).

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

What is Bitcoin?

Before we delve into Bitcoin price prediction proper, we need to first understand what Bitcoin is.

Bitcoin is a digital asset and payment system invented by Satoshi Nakamoto. Bitcoin is a peer-to-peer digital currency, meaning that all transactions occur directly between identical, independent network users without using a middleman. This idea introduced the world to cryptocurrency as it is unique in that no government or central bank controls it, which has made it attractive to some investors and users.

The SHA-256 algorithm, a member of the SHA-2 family of hashing algorithms adopted by other cryptocurrencies, is used to secure Bitcoin. Transactions are verified by network nodes through cryptography and recorded in a dispersed public ledger called the blockchain. The Bitcoin network runs based on the proof-of-work mechanism. Proof-of-work is a blockchain consensus mechanism in which computing power is used to verify cryptocurrency transactions and add them to the blockchain.

Through its brand and domain, news and educational resources, user-friendly products, and the recommendations of its millions of users, Bitcoin.com attracts and retains a large number of newcomers to crypto. The network introduced a token called Verse. Verse is a rewards and utility token distributed to users who contribute to and participate in the Bitcoin.com ecosystem. It is time to introduce a method to reward their community for buying, selling, spending, swapping, investing, and staying informed about cryptocurrencies. You can earn a share of trading fees by funding liquidity pools and get VERSE rewards whenever you use the card. Only 2% of the token is available, and the sale is ongoing.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Why was Bitcoin made?

Bitcoin was created in 2009 to solve an existing problem – how to conduct transactions online without having to rely on a third party. By building a blockchain system, Bitcoin enables secure, transparent, and tamper-proof transactions.

BTC tokenomics

Bitcoin has a maximum supply of 21 million tokens with a mining reward per block halved every four years. Every 10 minutes or so, a block is mined, earning the miner 6.25 BTC. The prize is halved every 210K blocks or every 4 years if there are 10 minutes in each block. The last Bitcoin will be mined around 2140 if the current protocol is maintained. As of November 2022, the token’s total supply is 19,218,143, which is also the circulating supply and has over $318 billion market cap.

Who is the team behind Bitcoin?

One of the most crucial things to consider before Bitcoin price prediction is the team behind the cryptocurrency. Bitcoin has a robust community driven by a strong and seasoned team. Satoshi Nakamoto (an alias that could be for a person or a group of people) described Bitcoin in its whitepaper. The leadership is filled with experienced personnel like the CEO Dennis Jarvis, who was part of Apple management and a senior product manager at Rakuten; Andrei Terentiev, the director of Engineering and the co-founder of O3 labs.

Bitcoin use cases

The primary use of Bitcoin is purchasing products and services online. Several companies accept Bitcoin as payment. Over 15,000 merchants across the world accept Bitcoin as a payment method. Bitcoin is also used by many as a long-term investment and hedge against inflation. This is because the asset is deflationary in nature which means that it can withstand ongoing inflation rates.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

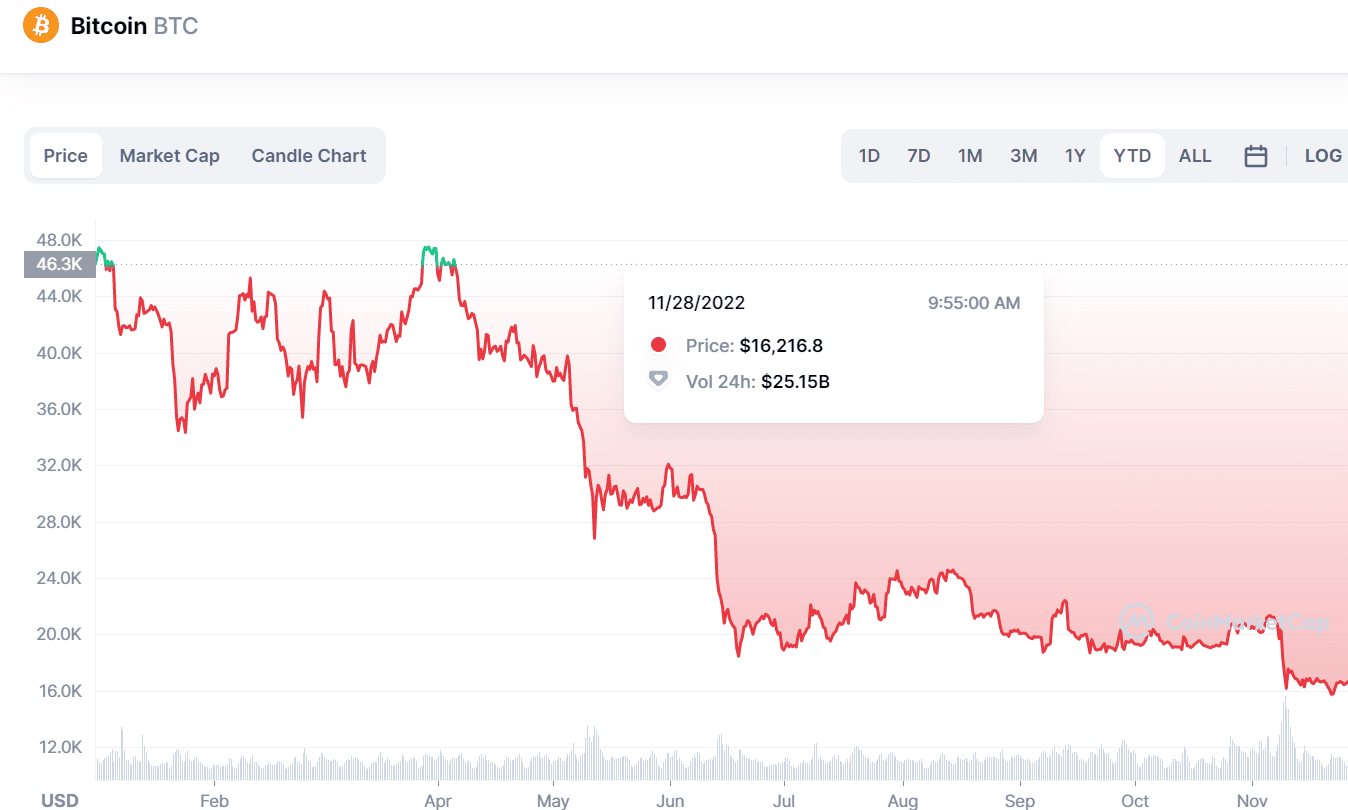

Bitcoin Price History

2009-2013

If we want an accurate Bitcoin price prediction, we need to understand the price history of the cryptocurrency. At launch in 2009, Bitcoin was around $0.01 per token. The first significant rise happened in July 2010 when the jumped to $0.09. By October of that year, it was already $0.1. Bitcoin broke the $1 mark in April 2011 and had over a 3000% increase in the following months to reach $30 in June. This changed a bit for the last months of the year as the price went down to $2 by the end of 2011.

There was no significant rise or fall in 2012, as Bitcoin ended the year at around $13. The first quarter of 2013 was characterized by a steady rise of the coin to $30, which changed drastically in late March, finally breaking the $100 mark in April 2013. At this point, experts started looking more into this new ‘digital money’ and its viability. The $1000 mark was broken by November, even though it closed the year at around $530.

2017-2022

The following 3 years were not eventful, as the currency never rallied back to the $1,000 mark until 2017. 2017 remains one of the best years of Bitcoin. The $1,000 mark was broken in January, the $2,000 mark in May, BUT $19,000 IN DECEMBER. With this wonderful attention also came negative comments/skepticism about crypto.

2018 was not as successful, as Bitcoin ended the year at around $3,800. 2019 was also uneventful, as there was no significant move. The coin ended the year at around $7,200. The 2020 pandemic had a positive impact on the price of Bitcoin. The coin closed in 2020 at $29,374. In the first half of 2021, Bitcoin soared to a record high of nearly $64,000 before dropping below $30,000 in the summer. In November, Bitcoin reached a new record high of almost $68,000, but by January 2022, it had fallen to around $35,000. Since it rallied to around $50,000 in March, it has experienced a downward trend.

Read more: Bitcoin Price Prediction: Experts Forecast Bullish Trends for 2024

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

How Has Bitcoin Performed So Far in 2025?

Although Bitcoin reached a record high of $68,000 in November 2021, it has not been the same story in 2022. Bitcoin ended January 2022 at $37,920. It rallied back to $50,000 in March but has been moving sideways, around $20,000 since then.

How Did The Crypto Winter Affect Bitcoin?

The Crypto winter was a period of time which was characterized by a 20% drop from recent highs. The crypto winter did not affect long-term holders of the coin (between 3 to 5 years) as they still had their investments in the ‘profit’ area. However, short-term holders of Bitcoin may have seen significant losses.

The crypto winter effected almost all tokens and created bearish market conditions. Some believe that it is during this time that it is best to buy in order to prepare for the market to recover and prices to rise back up.

How Did The Russia Conflict Affect Bitcoin?

Bitcoin has been hit a bit by the Russia conflict – falling by over 10% in price. The stock market was also hit hard, which has raised questions as to whether Bitcoin is tied to some stocks.

How Has The FTX Saga Affected Bitcoin?

The FTX collapse has hit Bitcoin hard. Bitcoin price dropped by 25% within a week, which meant the token has fallen to almost 70% over the past year.

Why has Bitcoin Dropped?

Bitcoin is a digital asset, and as such, it is susceptible to price fluctuations. This includes rises and falls in value due to market fluctuation (known as ‘volatility’). Rising interest rates may have caused investors to sell off their holdings in Bitcoin, while other cryptocurrencies, such as Ethereum, are also seeing a slight drop in value. However, the two significant events that have caused this drop are the FTX collapse and the Russia-Ukraine conflict.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

What Is The Current Price of Bitcoin?

As of the time of writing this, the price of Bitcoin is $43,700, according to CoinMarketCap.

Bitcoin Price Prediction 2025

It is hard to predict the future of a highly volatile market like the crypto market. However, suitable parameters like fundamental analysis, technical analysis, impactful events, etc come in handy in Bitcoin price prediction.

Bitcoin Fundamental Analysis

The fundamental analysis looks at the company’s inherent value behind the project, and this is the area where Bitcoin holds a positive outlook.

Being the first cryptocurrency out there, Bitcoin has a wide range of adapters, and it will remain a choice of investment for many crypto investors. Although it has limited utilities, this reputation as the ‘first’ continues to be a reason for many people to hold on long-term. Also, many people will buy more tokens when the token is experiencing a downward trend. This can further cause a price increase before the end of the year.

Bitcoin Technical Analysis

Technical analysis is very crucial in Bitcoin price prediction because it looks into metrics like trade volume, market cap, etc. As of the time of writing this, the 24-hour trade volume of ADA is around $19.4 billion. With a market cap of $317.7 billion, the 24-hour volume per market cap value is 0.06. This shows that, in terms of liquidity, the token is showing positive signs of rallying back to around $17,000 before the end of the year.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Bitcoin Latest News- 28/11/2022

Financial Regulator Clarifies That Bitcoin and Ether Are Not Securities in Belgium

The Financial Services and Markets Authority (FSMA) of Belgium has outlined its arguments against the classification of bitcoin, ether, and other cryptocurrencies as securities or investment instruments. They contend that since these digital assets have no issuer and are products of computer code rather than by the execution of an agreement between an issuer and an investor, the nation’s securities laws do not apply to them. The regulatory authority noted that additional regulations could apply to these crypto assets and those providing certain related services if they have an exchangeable or fungible payment or exchange function.

Crypto can not be blamed for FTX collapse, Robert Kiyosaki

The ‘Rich Dad Poor Dad’ author said he is still bullish on Bitcoin and emphasized that it will be wrong to blame the crypto sector for FTX collapse. The famous author called FTX “one of the biggest scams in history.” He additionally described: “FTX is a Ponzi scheme where they depended upon the funds from the next stupid investors to finance it.” He added, “Once again, ladies and gentlemen, I’m still in favor of bitcoin. I’m not against it as many people in my age group are because I think bitcoin is solid.”

The well-known author often warns that the real estate, bond, and stock markets are crashing. He has advised investors to purchase cryptocurrencies immediately to avoid recorded history’s most significant market meltdown.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Upcoming Events That Could Affect The Price of BTC

The launch of the utility token VERSE is one of the events to have an eye on. This could lead to an increase in demand for Bitcoin, which in turn will cause the price to go up. Investors and traders need to stay current with all the latest happenings to make informed decisions about investing in BTC. There are always events that can affect the price of BTC – this includes political changes, economic crashes, etcetera- so it is essential for you not only to be aware of them but also to have a plan ready should they occur.

Will Bitcoin Recover in 2025?

According to many Bitcoin price predictions, the digital currency might not recover drastically as many would hope for. Some analysts predict that Bitcoin prices could drop as low as $15,000 by the end of the year. However, others believe that Bitcoin will rebound and could go as high as $17,000 before the end of the year. If you’re considering investing in Bitcoin, it’s essential to do your own research before making a decision.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

What Could Affect The Price of Bitcoin Over The Next Year?

Several factors could affect the price of bitcoin over the next year, including economic conditions, regulation, and innovation in the cryptocurrency space. Also, a large company integrating Bitcoin as a payment method can significantly increase its value.

Why Might Some Investors Consider Investing in Bitcoin Right Now?

Bitcoin remains the digital gold of the crypto space. This investment has stood the tests thrown at it in the last 13 years. Investors love a project with such a solid background. Another reason investors consider investing in Bitcoin in the US is the capped total supply of 21 million tokens. This has helped maintain the coin’s value, despite the volatile nature of cryptocurrencies.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Why Might Some Investors Avoid Bitcoin Right Now?

Bitcoin has been receiving a lot of criticism because of its energy-intensive proof-of-work consensus mechanism. The proof-of-work consensus mechanism has proven to be energy intensive. A bitcoin transaction takes approximately 1,173 kWh of electricity to complete. For context, this can power an average American home for six weeks. Investors concerned about climate change might not want to consider investing in Bitcoin. Also, the coin has not been performing well this year, even though many investors prefer to jump on a project at a time like this, some consider the rate of fluctuation to be concerning.

How To Invest in Bitcoin (BTC)

If you are looking to buying Bitcoin, follow these steps:

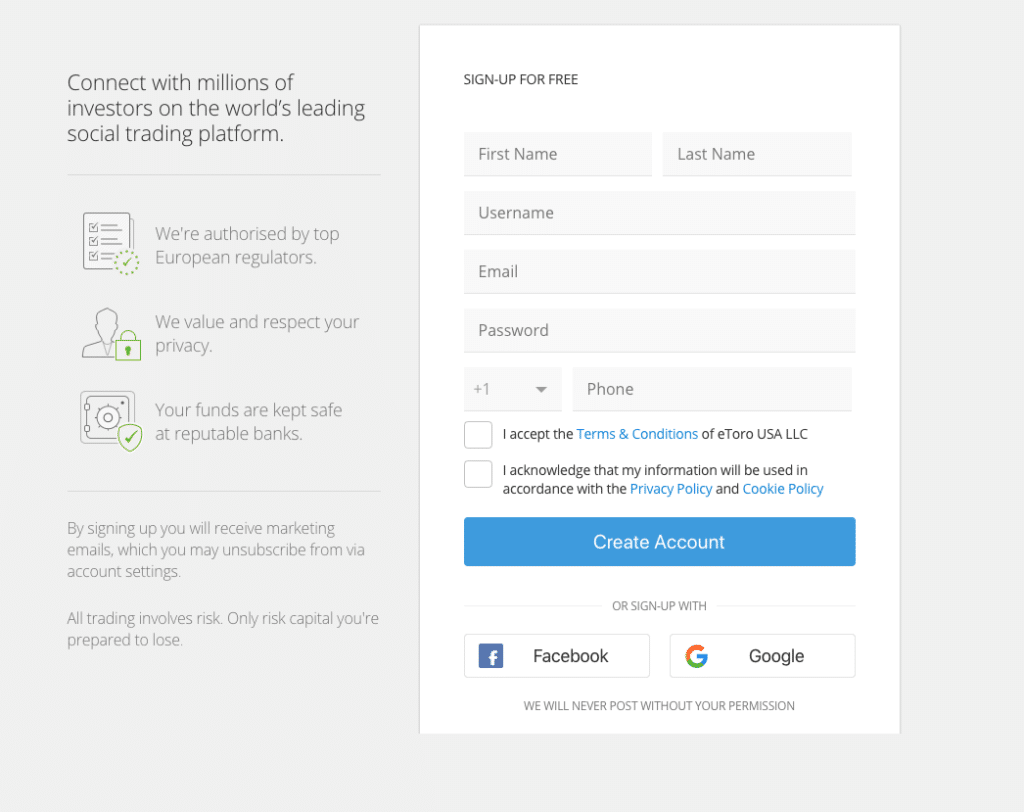

Create an eToro account

eToro is unquestionably one of the best cryptocurrency trading platforms. The platform is, first and foremost, heavily regulated by the CySEC and the FCA. This is particularly important in cryptocurrency markets because it guarantees that any cryptocurrencies you trade with eToro are done safely and without risking your money. The fact that eToro is a 100% commission-free trading platform makes it so appealing for trading Bitcoin. After registering for free, you will be charged a platform fee monthly or annually.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

Sign up for eToro

To apply for an eToro investment account, you’ll need the following:

- To be 18 years or older (we’ll ask for proof)

- To live in one of the countries where we offer our services (we’ll ask for proof; check our blocked countries here)

- A computer and/or smartphone connected to the internet

- A valid phone number connected to your smartphone

- A valid email address

Here is how to create an eToro in five simple steps:

- Go to eToro.com and go to the eToro ‘Create an account page

- Choose a username, enter your email address, and set a password. Alternatively, you can sign up with your Facebook or Google accounts.

- Check eToro’s Terms and Conditions, Privacy Policy, and Cookie Policy, and tick the boxes to accept them.

- Click the ‘Create Account’ button.

- Check your email inbox and verify your email address.

If you skipped the verification step after creating the account:

- Go to Settings, or enter your eToro account and click on Settings, then account.

- Under Credentials, click the ‘Verify’ button next to your email address.

- Check your email inbox. You will see an email from [email protected].

- Click the ‘Verify now’ button.

- You will be redirected to the eToro platform and will see a confirmation message.

To add your personal information to customize your account to your level of investment skills:

- Click on the ‘Complete Profile’ button.

- Read the message that pops up and click ‘Continue’.

- Fill out your basic personal information; this needs to match your Proof of Identity.

- Click on the arrow to continue.

- Enter your address, which needs to match your Proof of Address.

- Enter your place of birth and country of citizenship. You may be asked to complete the ID number.

- Select your answers to complete the investment knowledge assessments.

- Accept the Terms and Conditions.

Phone verification is part of the mandatory account verification process at eToro. To verify your phone number on your eToro investment account:

- Go to Account Settings (or enter your eToro account and click Settings in the left-hand menu, then click account).

- Under Credentials, click the ‘Add’ button next to your phone number.

- Enter a valid mobile phone number and click ‘Continue’.

- Type the SMS code you received on your phone.

- Click ‘Verify’ and check the green banner at the bottom to confirm your phone is verified.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Verify ID

You need a copy of your valid passport or both sides of your government-issued identification card to verify your identity. This copy must contain the following:

- Full Name

- Date of Birth

- Photograph

- Valid Expiry Date

To prove your address.

This should be a different document from your proof of identity. The proof of address must be issued in the last 3 months (except valid government-issued identification documents, such as a driving license) and must contain the following information:

- Your name

- Your current residential address

- The date of issue

- The issuing authority

- A reference to the issuing authority (logo, contact information, website, etc.)

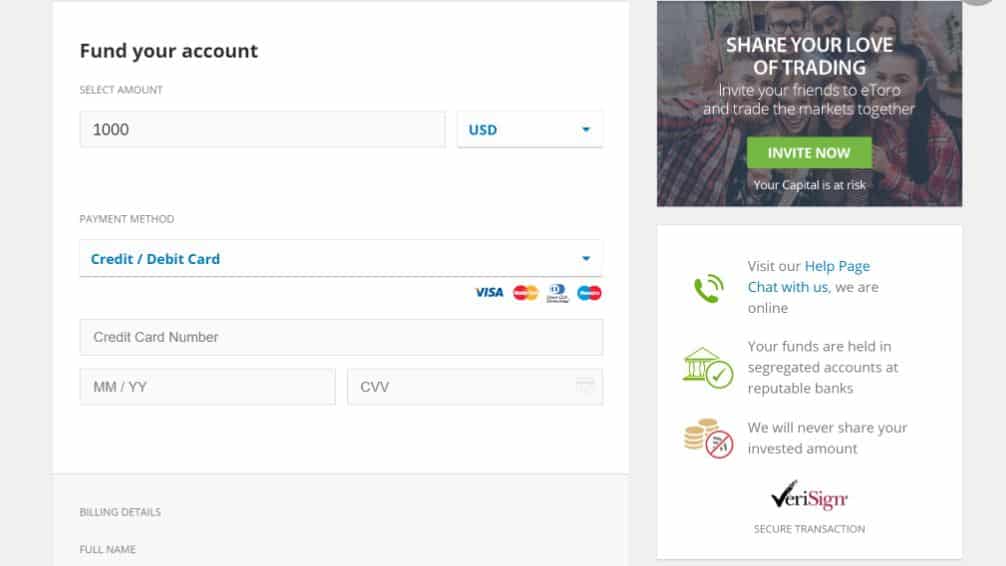

Deposit funds

To deposit funds in your eToro account, you can choose from any of the available methods of payment in your country and follow these instructions:

- Log in to the trading platform

- Click on ‘Deposit Funds’.

- Enter the amount and your preferred currency.

- Select the method of payment from the dropdown menu and complete the transaction

Search for BTC

Now that your funds are available in your account, you’ll be ready to go! Navigate to the trading platform and search for Bitcoin (BTC). Click on the trade pair order you want to execute.

Place an order

After choosing the trading pair (something like BTC/USDT), click the “BUY” button to execute the order and confirm the transaction.

Transfer crypto to cold wallet

If you’re looking to move your Bitcoin (BTC) from eToro to a crypto wallet, here are the simple steps:

- Click on the “Portfolio” tab of your account.

- Click on the crypto you would like to transfer.

- You will see all of your open trades for that cryptocurrency. Click on the specific trade you would like to transfer.

- On the “Edit Trade” screen, click “Transfer to Wallet”

- Review the transfer’s details. Click “Transfer” to initiate the process.

- You’ll get a notification that your request has been sent. “Pending Transfer” will appear in the trade line. Until the transfer process is completed, you can cancel your request.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

What Are The Best Alternatives To Bitcoin Right Now?

If you have paid attention to many Bitcoin price predictions, you would know that there is no guarantee the king of cryptocurrencies will bounce back as soon as many would hope. Therefore, we have included a list of emerging tokens making waves in the crypto market now.

Conclusion

In this blog, we have examined the future for Bitcoin by checking fundamental and technical analysis. Obviously, nothing spectacular should be expected before the end of the year, but one thing Bitcoin has shown in the last few years is that it will always bounce back. A key takeaway from this Bitcoin price prediction is that Bitcoin is an investment for the long term.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.