Best Spread Betting Strategies – Top Techniques for Beginners

To take advantage of tax-free profits from spread betting online, you will need a strategy in place. That will guarantee that you conduct your spread betting ventures in a risk-averse manner.

The purpose of this guide is to provide you with a list of the best spread betting strategies you should consider before risking your hard-earned money.

1

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$50

Spread min.

50 pips pips

Leverage max

50

Currency Pairs

49

Trading platforms

Funding Methods

Regulated by

FCACYSECASIC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1.5 pips

EUR/USD

1 pip

EUR/JPY

2 pips

EUR/CHF

5 pips

GBP/USD

2 pips

GBP/JPY

3 pips

GBP/CHF

4 pips

USD/JPY

1 pip

USD/CHF

1.5 pips

CHF/JPY

6 pips

Additional Fee

Continuous rate

Variable

Conversión

50 pips pips

Regulation

Yes

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

61% of retail CFD accounts lose money.

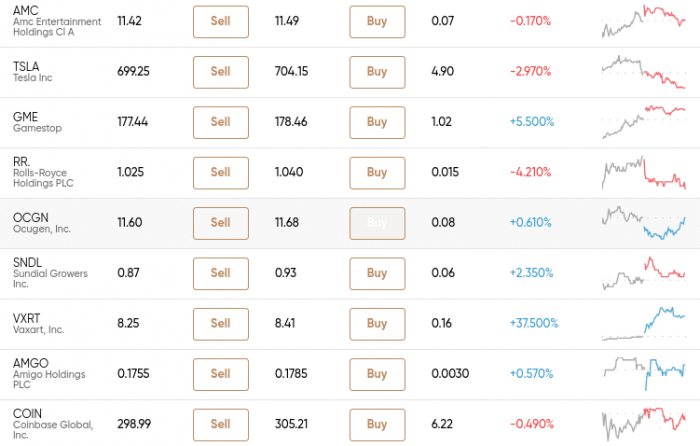

List of the Best Spread Betting Strategies

The following section will provide a detailed explanation of the best spread betting strategies. Furthermore, the following is a summary of each strategy that you may want to take into account.

- Start With a Risk-Free Demo Account on Pepperstone

- Spread Bet the Financial News

- Look for All-Time Highs on Popular Stocks

- Consider Spread Betting Trading Signals

- Learn About Consolidating Markets

Spread Betting Strategy 1: Start With a Risk-Free Demo Account

Newbie traders should begin with a demo account facility as their best spread betting strategy. Using this method, you can spread bet to your heart’s content without risking a penny. The reason for this is that the best spread betting demo accounts allow you to trade in live market conditions – but with paper money instead of actual capital.

As an example of where you might find the best spread betting demo accounts, Pepperstone might be a good choice. Share spread betting is just one of many financial instruments. This FCA-regulated broker offers. After registering an account, you can begin using the spread betting demo facility.

You should only use a demo account to spread bets with stakes similar to your investment budget if you want to be on the safe side. So, for example, you do not need to use the demo account at stakes of £100 per point if you want to spread bet at an average stake of £1 per point.

Spread Betting Strategy 2: Spread Bet the Financial News

Almost all of the best spread betting strategies will be based on technical analysis. To identify a potential trend, you will study historical price movements charts on an asset. Mastering this skill takes many years, as you can imagine.Similarly, in the world of sports betting, using technical analysis can also help enhance your football predictions by evaluating team performance and statistics to make more informed decisions.

That is why trading the financial news is one of the best spread betting strategies for beginners. You will look to take advantage of important economic developments reported by the mainstream media by placing spread bets.

These are a few examples of how this spread betting strategy might be applied in practice.

Example 1 – Going Long

Let’s say you’re looking at the spread betting market for the FTSE 100 index. According to the FTSE 100, it stands at 6,944 points at writing.

According to a recent report, the US economy is expected to grow by 2.9%

Initially, 2.2% was forecast

There is no doubt that this is good news for the economy, and thus – it will feed down to the FTSE 100 index.

Alternatively, you could visit your chosen spread betting broker and enter a long position on the FTSE

The FTSE will make you money if it goes up from its current price of 6,944 points

Example 2 – Going Short

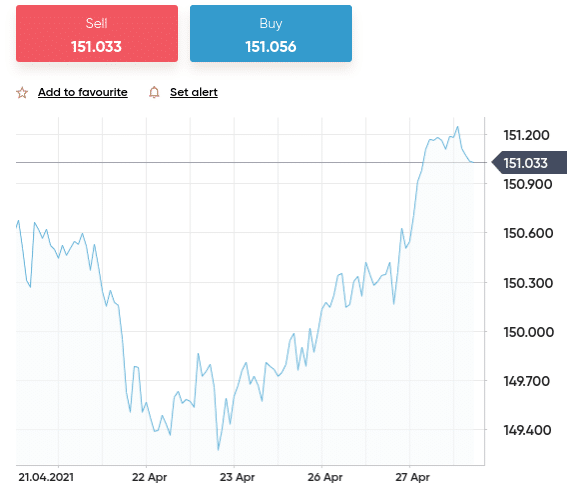

Let’s assume you want to access the forex spread betting markets, which means you will trade currencies.

- The Bank of England has just lowered interest rates

- As a result, foreign investors will be less likely to invest in the economy

- Therefore, the value of the pound sterling will also fall

- You might consider entering a short spread in response to this new financial development

- GBP/USD betting position

- You will make money if this forex pair declines in value as expected

It is relatively straightforward to spread bet on the financial news, as you can see. As a result, it isn’t exceedingly difficult to determine whether a news story is positive or negative and determine how the market will react. When the market reacts negatively, you go short. When the market reacts positively, you go long. Similarly, with an online sportsbook, you can apply this approach by betting on market movements, just as you would with sporting events, taking advantage of market trends and outcomes.

Spread Betting Strategy 3: Look for All-Time Highs on Popular Stocks

Beginners often look for stocks nearing all-time highs when they are spread betting. Therefore, the stock is very close to its previous peak – if it breaches, it will be worth more than it has ever been.

- Despite relying on technical data for your spread betting trade, you do not need to use indicators or chart-drawing tools.

- Rather, it’s just a matter of looking at the historical performance of the respective stock.

- A stock will often bounce back when it reaches its all-time high price level.

- As a result, investors may be eager to cash in their profits – just in case the stock doesn’t make it.

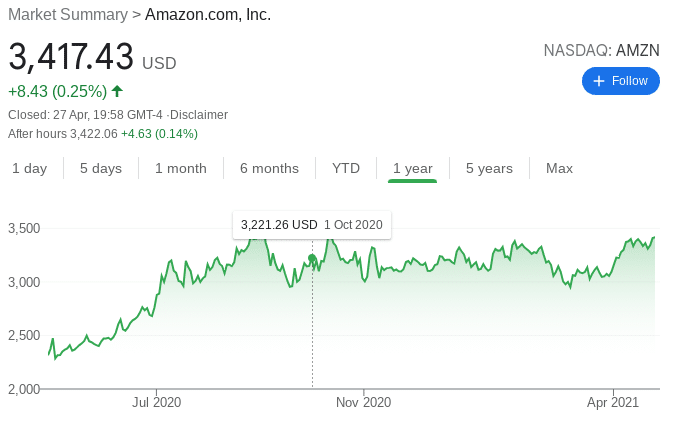

Amazon is one of the best examples. Amazon’s stock price reached its all-time high of $3,531 in September 2020, as you can see from the chart below. The stocks, however, haven’t been able to break out of this level since then.

Amazon came close to completing the order several times but reverted each time. An experienced spread betting trader would have made money from this – since they would have short-sold the stocks as they approached the all-time high price.

Spread Betting Strategy 4: Consider Spread Betting Trading Signals

Newbies should also consider trading signals as one of the best spread betting strategies. Essentially, you will sign up for a subscription service, where you will receive trading tips from the provider.

By following these guidelines, you’ll know what markets to access, how to enter the market, and at what price. As part of risk management, you will also be informed what stop-loss and take-profit orders to place.

For example:

- Imagine you sign up for a forex signal service

- GBP/USD shows a new trend, according to the provider

- When you enter at 1.3950, you receive a signal telling you to go short

- Additionally, you are instructed to place a stop-loss and take-profit order at 1.4109 and 1.3750, respectively

Once you have the above information, you should contact your spread betting broker and place the suggested orders. Importantly, if you use a credible signal service with a history of successful trades, you can spread bet without any research or financial analysis.

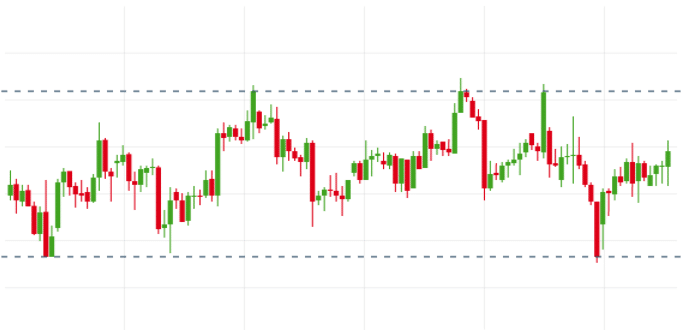

Spread Betting Strategy 5: Learn About Consolidating Markets

You’ll need to learn about consolidation periods for this spread betting strategy. You will be performing your first technical analysis in depth. Among the easiest and most straightforward techniques to learn, this one is a very good choice for beginners.

An asset remains within a tight price range for an extended period during a consolidation period.

For example:

- Over the past 5 days, IBM stock has fluctuated between $142.50 and $143.20.

- Thus, IBM stocks have traded within a tight range of just.

- In other words, IBM stocks rose above $143.20 or fell below $142.50.

- A consolidation period like this is an excellent example.

- Your chosen spread betting broker will let you trade a consolidating market once you identify it.

- Following the same example as above, you would have to place two limit orders first.

- A short position should be entered at $143.20 (or below).

- The next step is to enter a long position at $142.50 (or just above).

- By doing so, you can continue to enter long and short positions to make small but frequent gains for as long as the stocks remain in this trend.

You should also place stop-loss orders above and below the upper and lower points of the range to trade risk-aversely. In this way, your capital is protected for the consolidation period’s eventual ‘break out.’

Technical Analysis vs. Fundamental Analysis

We examined some of the best spread betting strategies above from a fundamental and technical analysis perspective. First, however, we should make it clear that by truly mastering the art of technical analysis, you will be able to deploy a much greater number of strategies.

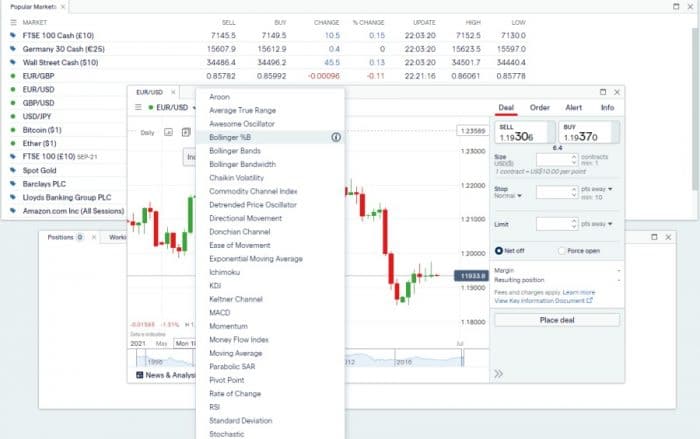

Technical indicators facilitate charting analysis, and there are over 100 of them. While some technical indicators focus on volatility and market depth, others focus on support and resistance levels.

Also included are price averages over the past 50, 100, and 200 days and volume and sentiment indicators. In order to make consistent profits from the spread betting markets, you should take the time to learn about technical analysis as soon as possible.

Best Spread Betting Platforms – List

- Pepperstone – Best Spread Betting Broker for Advanced Traders

- IG – Spread Betting Platform With 17,000 Markets

Best Spread Betting Platforms

Before you can begin spreading betting online, you will need to open an account with a broker. A broker must hold a license with the FCA, support your preferred market, as well as low offer fees and commissions.

Below we have reviewed a small selection of top-rated spread betting trading platforms for your consideration.

1. Pepperstone – Best Spread Betting Broker for Advanced Traders

Technical analysis is a great method for deploying the best spread betting strategies. Pepperstone is worth considering if you are familiar with pricing charts. You can trade CFDs and spread bets with this FCA-regulated broker across many asset classes – some without paying spreads.

When you sign up for a Peppersonte Razor Account, which works like an ECN account, that will be the case. As a result, you will pay a small commission of $3.50 per slide, but in return, you will get the best spreads available in the market. Pepeprstone allows you to place spread bets directly with market participants. Alternatively, you can choose the commission-free Standard Account, which has less competitive spreads.

Pepperstone offers a variety of financial markets on its spread betting platform. These include stocks, commodities, forex, and indices. Pepperstone does not have a minimum deposit and supports Paypal, debit/credit cards, and bank transfers. If you would like to trade through a third-party platform, Pepperstone is also a great alternative. MT4 (MT4), MT5 (MT5), and cTrader are all supported by the broker.

| Fee | Amount |

| Stock trading fee | $0.02 per US stock |

| Forex trading fee | Spread, 1.59 pips for GBP/USD |

| Crypto trading fee | Spread, 50 pips for Bitcoin |

| Inactivity fee | Free |

| Withdrawal fee | Free |

Pros:

- Capital gains taxes do not apply to spread betting

- Multiplatform compatibility

- Commission-free accounts

- Razor accounts for zero spreads

- Licensed by the FCA

- PayPal accepted

Cons:

- There is no proprietary platform

- ETFs are not available

76.25% of retail investor accounts lose money when trading CFDs with this provider.

2. IG – Spread Betting Platform With 17,000 Markets

IG is a well-known and well-trusted online brokerage firm with many divisions in the investment industry. The category includes spread betting, CFDs, forex, traditional shares, and mutual funds. At IG, you have access to over 17,000 spread betting markets.

Investing is primarily in forex, indices, shares, and commodities, emphasizing forex. Every spread betting market offers long and short positions and leverage. You are limited to 1:30 if you are a retail client.

For professionals who open an IG account, the limits are much higher. That stands at over 1:222 when you consider spread betting on currency pairs, indices, and commodities. As IG provides Negative Balance Protection, you will never lose more than the amount of your balance when you enter a leveraged position.

Commission-free spread betting is available from IG. However, keep an eye on IG spreads since they are largely very competitive. For example, traders can trade indices and shares for 0.1 points, commodities for 0.3 points, and forex for 0.6 points.

If you believe IG can meet your spread betting needs, you can trade directly through their website. You can also download a mobile app for your iOS or Android device. There is a $250 minimum deposit for this spread betting platform.

| Fee | Amount |

| Stock trading fee | Variable |

| Forex trading fee | apply a 0.5% |

| Crypto trading fee | $0.02 commission |

| Inactivity fee | £10 per month after 1 year |

| Withdrawal fee | $0 |

Pros:

- Starting at just £3

- There are more than 80 currency pairs to choose from

- Support for more than 17,000 markets, including spread betting

- Spreads start at 0.6 pips, and there are no commissions charged

- You can trade using the IG app or website

- ASIC and FCA-licensed

- More than 40 years of brokerage experience

- You can fund your account with debit cards or bank transfers

Cons:

- $250 is the minimum deposit

Your Money Is At Risk.

Best Spread Betting Platforms – Fees Comparison

| Platform | Crypto trading fee | Inactivity fee | Withdrawal fee |

| Pepperstone | 0.2 points | Free | Free |

| IG | $0.02 commission | $10 per month after 1 year | $0 |

Best FTSE Spread Betting Platforms – Leverage Comparison

| Platform | Max. Leverage: Stocks | Max. Leverage: ETFs | Max. Leverage: Forex | Max. Leverage: Commodities | Max. Leverage: Indices |

| Pepperstone | 5:1 | 5:1 | 30:1 | 10:1 | 20:1 |

| IG | 5:1 | 5:1 | 30:1 | 10:1 | 20:1 |

How To Get Started With A Spread Betting Platform

After reading this Pepperstone review, you now know the platform’s key features and relevant aspects. The next step is to learn how to use it.

Step 1: Open a Trading Account and Verify Your Identity

Creating an account on the Pepperstone app should take less than a minute, and the first step is to enter your account details. Next, click “Create Account” and enter your email address on the website. After that, you can sign up with Pepperstone through your existing Google, Facebook, or Apple account.

76.25% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Deposit Funds

Pepperstone requires a deposit of at least $200 to open an account. Debit cards, credit cards, or wire transfers can be used to deposit funds. Click on ‘Fund my account’ to deposit funds

Step 3: Practice Options Trading on a Demo Account

Pepperstone’s demo account is a good place to start for those brand new to spread betting and are interested in trying out a new strategy; Pepperstone’s demo account is a good place to start. You will be able to practice your strategy with no risk of depositing any money or risking any of it.

Step 4: Start Trading with Spread Betting

You will need to select a market to trade in before placing your first real-money spread betting order. Entering the name of the asset or market into the search box at the top of the page is the easiest way to do this.

If you believe the asset price will go up, you need to take either a long or a short position. Lastly, enter your stake per point and confirm your order.

Spread Betting Tips

Are you looking for some more spread betting tips before investing your hard-earned money? If this is the case, you’ll find several beginner-friendly strategies below.

Tip 1: Understand Risk Management

To limit your potential losses when spread betting online, you should put a risk management trading plan in place. There are several ways to do this, including:

Set a limit on how much you will risk per bet. A good rule of thumb for newbie traders is never to risk more than 1% of their balance.

Always place a stop-loss order. If your spread betting position goes down by a specified amount, it will automatically close. As an example, if you are trading at $1 per point and want to limit your losses to $10, then set your stop-loss order at 10 points.

In addition, you should use take-profit orders, which will automatically close your trade when specified exit points are reached. You could, for example, set a profit target of 20 points on a particular trade.

Tip 2: Stick With High Liquid Markets

You will avoid unpleasant levels of volatility when you trade blue-chip stocks, gold, or index funds. Market volatility is not conducive to beginning traders. Instead, if you stick to a high liquid asset, your potential profits and losses will remain relatively stable.

Tip 3: Trade During Busy Market Hours

By trading only during the standard hours, you can avoid many of the risks associated with volatile markets. As a result, you shouldn’t trade before the markets open in the morning or after they close in the evening. The same goes for weekend trading.

There will be little liquidity outside of standard hours because some spread betting platforms offer 24/5 trading. As a result, asset prices will move more volatilely.

Conclusion

By putting in place some spread betting strategies, you’ll be able to target the financial markets in a risk-averse manner. Perhaps trading financial news would be a good place to start – an easy-to-implement strategy. After you have progressed through the learning journey, you will move on to more advanced strategies based on technical analysis.

To access the global markets, you will need to open an account with an FCA-regulated broker. However, there are thousands of markets on Pepperstone, making it a great option. Additionally, you can open a free demo account with the broker, and the minimum real-money deposit is just £20. Keep in mind that spread betting is illegal in the United States at the time of writing, so if you’re based in the United States and looking for tax-efficient trading, then a spread betting platform might be worth considering. However, since many spread betting companies in the UK do not allow US residents to open spread betting accounts, they can only trade Contract for Difference (CFDs).

Pepperstone – Overall Best Spread Betting Platform

76.25% of retail investor accounts lose money when trading CFDs with this provider.