FTSE 100 Spread Betting – Beginner’s Guide

The best way to trade the FTSE 100 is with spread betting, regardless of whether you want to go long or short. Due to the fact that there is no tax on profits, stamp duty is waivered, and leverage of up to 20x is available.

This guide explains how FTSE 100 Spread Betting works and which FCA brokerage sites you should consider. Nevertheless, if you are based out of the United States and are looking for tax-efficient trading, spread betting might be worth considering since it is illegal to trade spread betting in the US.

1

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$50

Spread min.

50 pips pips

Leverage max

50

Currency Pairs

49

Trading platforms

Funding Methods

Regulated by

FCACYSECASIC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1.5 pips

EUR/USD

1 pip

EUR/JPY

2 pips

EUR/CHF

5 pips

GBP/USD

2 pips

GBP/JPY

3 pips

GBP/CHF

4 pips

USD/JPY

1 pip

USD/CHF

1.5 pips

CHF/JPY

6 pips

Additional Fee

Continuous rate

Variable

Conversión

50 pips pips

Regulation

Yes

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

61% of retail CFD accounts lose money.

FTSE 100 Spread Betting In 5 Minutes – Quickfire Guide

Following the quickfire guide below, you can easily open an FTSE 100 spread betting position from the comfort of your home.

- You should open an account with an FCA-authorized and licensed spread betting platform.

- Deposit funds into your newly created spread betting account. You can deposit as little as £200 with Pepperstone and choose from Visa or MasterCard debit/credit cards or e-wallets.

- Click on the FTSE 100 market under the ‘Indices’ section.

- Select a buy order when you believe the FTSE 100’s price will rise. If you believe the FTSE 100 will fall in value, place a sell order.

- You must enter and confirm the amount you wish to stake on each point movement (e.g., £10 per point).

All you need to do is sign up for an FTSE 100 spread betting position at Pepperstone

Spread Betting FTSE 100 Explained

In its simplest form, spread betting the FTSE 100 allows you to profit from the rise and fall of the index. If you expect that the value of the FTSE 100 will rise, you will place a ‘long’ spread betting position. Instead, you will place a ‘short’ position at your chosen spread betting broker if you think the opposite will happen.

Speculating correctly will also yield a profit. Otherwise, you will lose money. FTSE 100 future value trading does not involve taking ownership of any assets. That is the same as a conventional CFD trading site – in the sense that the spread betting market will follow the real-time price of the FTSE 100.

76.25% of retail investor accounts lose money when trading CFDs with this provider.

In the section below, we discuss in greater detail why FTSE 100 spread betting is such an attractive market for traders. Among them are:

- Using spread betting platforms, you can profit from rising and falling markets by going long or short

- 20x leverage spread betting on the FTSE 100

- You can trade commission-free on spread betting sites such as Pepperstone and Pepperstone

Furthermore, FTSE 100 spread betting markets can also be traded without stamp duty or capital gains tax. The approach contrasts radically with traditional stock and forex trading platforms.

How Does FTSE 100 Spread Betting Work?

Before you spread bet the FTSE 100, you need to know several key aspects. Then, when you enter this market with your eyes wide open, you will be more likely to make consistent gains and protect your bankroll from losses.

So, in this part of our guide to FTSE 100 Spread Betting, we will explain the fundamentals in much greater detail.

Point Movements and Stakes

In the first place, the FTSE 100 is priced in points, whereas traditional shares are priced in pennies.

For example:

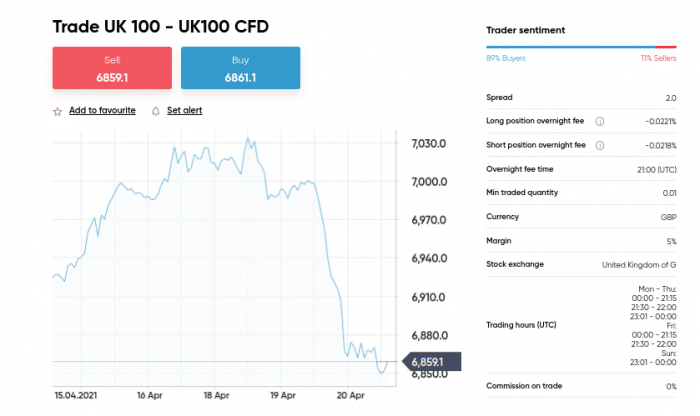

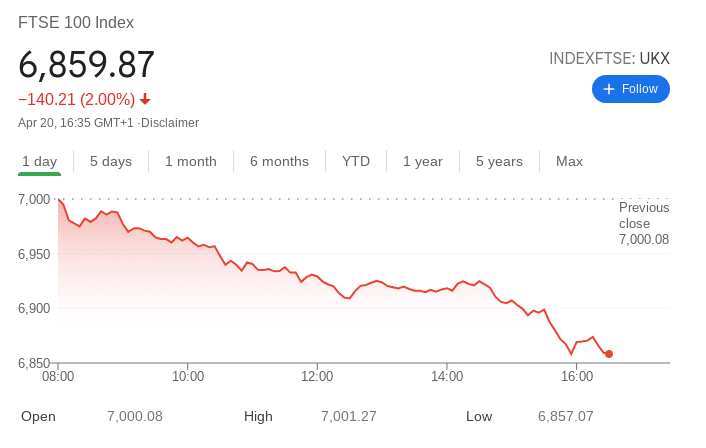

- FTSE 100 is trading at 6,859.87 points at the time of writing.

- FTSE 100 would be worth 7,545.87 points if the index increased by 10%

- That would represent a price movement of 686 points in spread betting

On this trade, you will make or lose money depending on two key metrics:

- How much you stake per point movement

- No matter whether you correctly predicted the price movement of the FTSE 100

For example, if you had invested 50p per point on the FTSE 100, you would have made £343. That is because the index rose by 686 points. However, the same stake would have resulted in a loss of £343 if you had placed a ‘short’ order.

The best spread betting platforms for FTSE 100 allow you to set up a guaranteed stop-loss order – allowing you to limit your losses. So, for example, if your stop-loss had been set at 40 points, the maximum you could have lost on the above trade would have been £20 (40 points x 50p per point).

Entering and Exiting the Market

Trading the FTSE 100 spread betting market requires you to select either a long (buy order) or a short (sell order) position.

- You bet that the index will rise by entering the trade with a long position.

- A short position means that you expect the index to fall in value when entering the trade.

To exit your FTSE 100 spread betting trade (i.e., close your position), you need to:

- In the case of long orders, you need to close with short orders

- In the case of short orders, you need to close with long orders

According to what has been stated above, FTSE 100 spread betting positions are entered and exited in much the same way as forex and CFDs.

Leverage

Spread betting and CFD markets are based on financial derivatives. That means that you can speculate on the future price of an asset – such as the FTSE 100 – without actually owning it. Due to this, you can spread bet the FTSE 100 with leverage.

76.25% of retail investor accounts lose money when trading CFDs with this provider.

The FCA allows retail investors to trade the FTSE 100 with leverage as high as 20x. So if you stake £1 per point, your position is multiplied by £20.

In other words:

- Imagine you enter a long position in the FTSE 100 at a rate of £2 per point

- You apply the leverage of 20x on this trade

- The FTSE 100 increases by 30 points

- If you had not used leverage on your position, you would have made £60

- As a result of using 20x leverage, your profit is amplified from £60 to £1200

To trade leveraged spread betting successfully, you need to understand all the risks involved. For example, you can lose your entire stake if your position goes against you by a certain amount.

In the case of 20x leverage, this translates to a 5% margin requirement (20/100). Consequently, if your FTSE 100 spread betting trade went in the wrong direction by 5%, your position would be closed by the broker, and you would lose your margin.

Market Duration

Regardless of what spread betting instrument you wish to trade, all markets have an expiration date. Spread betting retains its status as ‘gambling,’ meaning capital gains on spread betting are not subject to tax.

On the FTSE 100, most spread betting brokers offer at least two trade durations: a daily market and a quarterly market. So if you still have an open position on the FTSE 100 when it expires, close it.

You will still make 40 points if you are 40 points in profit and the expiry date is triggered. Then, simply open a new position if you wish to remain in the market.

FTSE 100 Trading vs. Spread Betting: What is the Difference?

To trade the FTSE 100, you must use a financial derivative. The FTSE 100 is a composite index of 100 individual shares, each with a different weighting. Diageo, for example, has a weighting of 3.83%, while Natwest Group has a much lower weighting of 0.50%. In this case, the former has a market capitalization of £74 billion, whereas the latter has £22 billion.

76.25% of retail investor accounts lose money when trading CFDs with this provider.

That is the reason why, when trading the FTSE 100, you can choose to do so using a CFD instrument or a spread betting market. Even though both are operated practically like-for-like, spread betting is the best option because profits are tax-free.

What are the Advantages of FTSE 100 Spread Betting?

For several reasons, traders and financial speculators enjoy FTSE 100 spread betting. However, if you’re still unsure whether this form of FTSE 100 trading is right for you, below, we elaborate on some of its key advantages.

FTSE 100 Spread Betting Tax

A major advantage of trading through an FTSE 100 spread betting broker is no taxation to worry about. In contrast, the profits are taxable as capital gains if you buy shares the traditional way and sell them for more than you paid for them.

In addition, if you receive a dividend from your shares, it is also taxable. Furthermore, if the company is listed on the London Stock Exchange (LSE), you will have to pay stamp duty tax at the time of purchase.

If you want to invest in FTSE 100 shares, FCA-regulated broker eToro waives the 0.5% mentioned above stamp duty tax.

If, however, you trade the FTSE 100 through a spread betting instrument, you won’t have to pay capital gains tax. That is because financial spread betting falls within the remit of gambling, as we briefly discussed earlier.

5% Margin Requirement

The FTSE 100 is a relatively stable asset class under normal economic conditions. That is due to its backing by some of the biggest companies in the market. Consider companies such as AstraZeneca, GlaxoSmithKline, HSBC, British American Tobacco, and Unilever.

You will have a limited opportunity to make viable gains when you trade with small amounts, although this is ideal for risk-averse investors. For example, if you have £100 in your trading account and make 2% – this amounts to just £2 gains. Fortunately, a spread betting margin can be used in this situation.

If you increase your stake in the FTSE 100 by 20x, the margin requirement is just 5%. Therefore, small gains of £2 turn into profits of £40 very quickly.

Great for making gains when the market is falling

An economy in crisis is the perfect time to profit from spread betting on the FTSE 100. During the past five years, we have seen plenty of examples of this – the Brexit referendum stands out as the most recent example.

When the economy is uncertain, the FTSE 100’s value will suffer. FTSE 100 will decline because investors will exit their stock or ETF positions.

Consider shorting it through spread betting instead of sitting on the fence when the FTSE 100 goes down. The more the index falls, the more profit you’ll make.

Low Cost

Another advantage of trading at an FTSE 100 spread betting site is that fees, commissions, and spreads are typically low. Pepperstone, for example, offers spread betting on the FTSE 100 without commission. Moreover, Pepperstone charges an industry-leading spread on the FTSE 100 of just 2 points.

Best FTSE 100 Spread Betting Strategies 2026

To trade the FTSE 100, you need to have a strategy in place. This should always be the case no matter what financial market you speculate on.

You might want to consider the following FTSE 100 spread betting strategies:

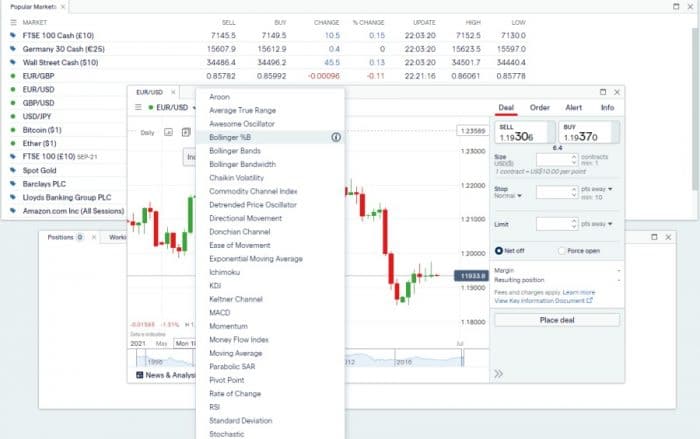

Technical Analysis: You need to learn the art of ‘technical analysis if you plan to day trade or swing trade the FTSE 100. That means learning how to analyze and interpret historical and current pricing charts in their simplest form. Indicators that measure support and resistance levels, volatility, and trading volume aid technical analysis.

Hedging: It is always a good idea to be prepared for a potential market slump if you have a significant investment in the economy, such as stocks, ETFs, or even homegrown REITs. Hedging the FTSE 100 may be a good idea if there is a possibility of this happening very soon. As a result, you will enter a short position with your chosen spread betting broker. Short-selling the FTSE 100 would be profitable even if the economy did take a turn for the worse.

Buy the Dip: The FTSE 100 is prone to temporary dips, as are all indices. For example, it might be related to bad news regarding the economy, like worse-than-expected GDP results. Because these dips are more often than not temporary, you can enter a long position at a discount. You will make a profit if and when the FTSE 100 recovers.

If you have not yet mastered your FTSE 100 trading strategy, consider opening a free demo account with Pepperstone. Then, your strategy can be practiced in a completely risk-free environment.

Best FTSE 100 Spread Betting Platforms for 2026 – List

- Pepperstone – Best Spread Betting Broker for Experienced Traders

- IG – Spread Betting Platform With 17,000 Markets

Best FTSE 100 Spread Betting Platforms for 2026

You’ll need to open an account with an FCA-regulated spread betting broker before you can start placing orders on the future value of the FTSE 100. However, despite the multitude of options available, below, we discuss the best FTSE 100 platforms currently available.

1. Pepperstone – Best Spread Betting Broker for Experienced Traders

Pepperstone is an FCA-authorized and regulated CFD and spreads betting broker. As a result, a trader with experience in the FTSE 100 may find the platform more suitable. Furthermore, Pepperstone offers many account types designed for seasoned professionals, not only in terms of tools and platforms.

Pepperstone spread betting accounts can be linked to MT4 or MT5. It is well known that these third-party platforms are super popular with experienced traders, as they offer advanced chart reading tools and technical indicators. In this way, you will be able to perform a short-term analysis of the FTSE 100. In addition, the Razor Account will often give you spreads of 0 pips – or slightly over, depending on market conditions.

Either way, this account ensures that you do not trade through a middle man – which means you are not speculating against other market participants. A small commission of $3.50 with the Razor Account is very competitive. Besides the FTSE 100, Pepperstone also offers spread betting on shares, hard metals, energy, forex, and other indices such as the Dow Jones, DAX, and NASDAQ 100. Deposits can be made via PayPal, debit/credit card, or bank wire at Pepperstone.

| Fee | Amount |

| Stock trading fee | $0.02 per US stock |

| Forex trading fee | Spread, 1.59 pips for GBP/USD |

| Crypto trading fee | Spread, 50 pips for Bitcoin |

| Inactivity fee | Free |

| Withdrawal fee | Free |

Pros:

- Capital gains tax-free spread betting

- Multiplatform compatibility

- Accounts with 0% commission

- Zero spreads are based on raw data

- Licensed by the FCA

- PayPal is accepted

Cons:

- There is no proprietary platform

- ETFs are not available

76.25% of retail investor accounts lose money when trading CFDs with this provider.

2. IG – Spread Betting Platform With 17,000 Markets

In the investment industry, IG is a well-known and trusted company with several divisions in online brokerage. This category includes spread betting, CFDs, forex, and stocks and funds. With IG, you have access to more than 17,000 spread betting markets.

With a strong focus on forex, indices, shares, and commodities. Long and short positions are available and leveraged on every spread betting market. You are limited to 1:30 if you are a retail client.

For professionals who open an IG account, the limits are much higher. That stands at over 1:222 when you consider spread betting on currency pairs, indices, and commodities. IG also offers Negative Balance Protection, which ensures you will never lose more than your balance permits when entering leveraged positions.

Commission-free spread betting is available from IG. However, keep an eye on IG spreads since they are largely very competitive shares, or an index can be traded for 0.1 points, a commodity can be traded for 0.3 points, and a currency can be traded for 0.6 points.

If you believe IG can meet your spread betting needs, you can trade directly through their website. In addition, the broker offers a mobile app for iOS and Android devices. This top-rated spread betting platform requires a $250 minimum deposit.

| Fee | Amount |

| Stock trading fee | Variable |

| Forex trading fee | apply a 0.5% |

| Crypto trading fee | $0.02 commission |

| Inactivity fee | £10 per month after 1 year |

| Withdrawal fee | $0 |

Pros:

- Stocks starting at $3

- There are over 80 currency pairs to choose from

- Support for more than 17,000 markets, including spread betting

- Commissions are not charged and spreads start at just 0.6 pips

- You can trade using the IG app or website

- FCA and ASIC licensed

- More than 40 years of brokerage experience

- You can fund your account with debit cards or bank transfers

Cons:

- $250 is the minimum deposit

Your Money Is At Risk.

Best Spread Betting Platforms – Fees & Leverage Comparison

Fees

| Platform | Stock Trading Fee | Forex Trading Fee | Crypto trading fee | Inactivity fee | Withdrawal fee |

| Pepperstone | $0.02 per US stock | Spread, 1.59 pips for GBP/USD | 0.2 points | Free | Free |

| IG | Variable | Apply a 0.5% | $0.02 commission | $10 per month after 1 year | $0 |

Leverage

| Platform | Max. Leverage: Stocks | Max. Leverage: ETFs | Max. Leverage: Forex | Max. Leverage: Commodities | Max. Leverage: Indices |

| Pepperstone | 5:1 | 5:1 | 30:1 | 10:1 | 20:1 |

| IG | 5:1 | 5:1 | 30:1 | 10:1 | 20:1 |

How To Get Started With A FTSE 100 Spread Betting Platform

After reading this Pepperstone review, you now know the platform’s key features and relevant aspects. So let’s start learning how it works.

Step 1: Open a Trading Account and Verify Your Identity

Creating an account on the Pepperstone app should take less than a minute, and the first step is to enter your account details. The website allows you to create an account by clicking “Create Account” and entering your email address. By connecting your existing account with Pepperstone, you can sign up even if you already have a Google, Facebook, or Apple account.

76.25% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Deposit Funds

To open an account with Peperstone, you must deposit at least twenty pounds. You can use a credit-debit card or wire transfer to deposit funds. Click on ‘Fund my account’ to deposit funds.

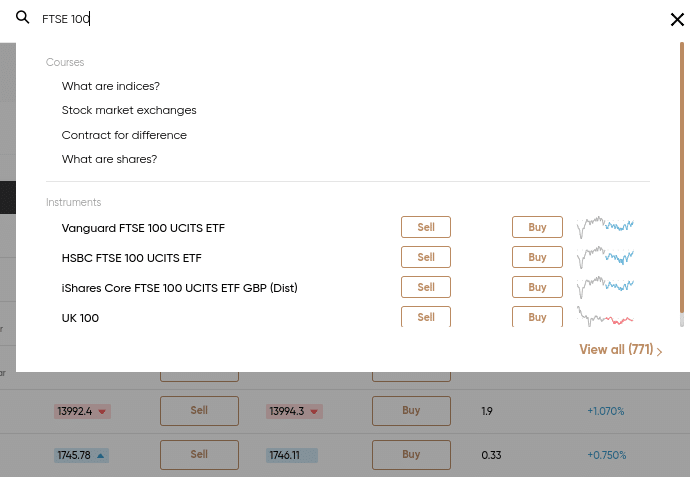

Step 3: Search for FTSE 100

At the top of the page, enter ‘FTSE 100’ in the search box. You can find the ‘100’ by looking for the image below.

Step 4: Enter Long or Short Position

By clicking the ‘buy’ or ‘sell’ buttons, you can set up your FTSE 100 spread betting position. As mentioned earlier, if you wish to go long on the FTSE 100, a buy order would be appropriate. A sell order would be appropriate if you wish to short the FTSE 100.

Step 5: Enter Stake and Confirm Order

Now you need to enter your stake. You decide how much you want to risk for every FTSE 100 point movement – for example, £1 per point.

You have successfully executed your first FTSE 100 spread betting trade at Pepperstone!

Conclusion

In this guide, we have explained the core benefits of the FTSE 100 spread betting market. You’ll also have access to leverage levels of 20x on top of the tax-free profits and the ability to go long or short.

Our research found Pepperstone to be the best spread betting broker for trading FTSE 100 online. There is a really low minimum deposit of just $20, commission-free trades, and a competitive spread of just 2 points on the FTSE 100!

Pepperstone – Best Spread Betting Platform to Trade FTSE 100

76.25% of retail investor accounts lose money when trading CFDs with this provider.