Best Spread Betting Platforms & Brokers of February 2026

A spread betting platform might be worth considering if you are based out of the United States and looking for tax-efficient trading since spread betting is illegal in the United States at the time of writing. As a result, US residents cannot open spread betting accounts with most spread betting companies in the UK but may trade Contract for Difference (CFDs).

In this guide, we review the best spread betting platforms of 2026 but keep in mind that US law does not allow spread betting, so you will have to access it overseas. Also, we demonstrate how to get started with a spread betting account through a step-by-step walkthrough of how spread betting works.

Our List of Best Spread Betting Platforms in 2026

- Pepperstone – Best Spread Betting Platform for Advanced Traders

- IG – Spread Betting Platform With 17,000 Markets

- Markets.com – Best Spread Betting Platform for Beginners

- CMC Markets – Experienced Spread Betting Platform

Best Spread Betting Brokers Reviewed

Choosing a provider should be based on a number of factors, even though all offshore spread betting platforms are tax-free. For example, you need to determine what assets the platform supports, the minimum trade size, commissions, payment options, and customer support.

Following is a list of the best spread betting brokers available on the market at the moment. But keep in mind that spread betting is illegal in the United States at the time of writing. As a result, US residents cannot open spread betting accounts with most spread betting companies in the UK

1. Pepperstone – Best Spread Betting Broker for Advanced Traders

Pepperstone is the best spread betting platform for advanced traders. This top-rated provider offers CFDs, forex, and spread betting.

Pepperstone is suited more for seasoned investors, making it unique among the two platforms. Spread betting platforms, for example, are compatible with MT4, MT5, and CTrader. You can connect these platforms to your Pepperstone trading accounts.

You get advanced trading tools, indicators, customized charts, and technical indicators with all of them. In addition, Pepperstone offers thousands of financial instruments to trade. From shares, indices, and forex to hard metals, US Treasury notes, and energy, we cover it all.

Pepperstone charges different spread betting fees depending on the type of account you choose. Spread betting with a ‘Standard’ account will not incur any commission. The spread takes care of it all. Choosing the ‘Raw’ account will allow you to trade with no spreads on most markets.

However, you will be charged a commission of £2.29 per slide. You can deposit funds into Pepperstone with a debit/credit card, bank transfer, or PayPal if you like the sound of the platform for your spread betting needs. It has almost 90,000 clients worldwide and is licensed and authorized by the FCA.

Pepperstone fees:

| Fee | Amount |

| Crypto trading fee | 0.2 points |

| Inactivity fee | Free |

| Withdrawal fee | Free |

Pros:

- Spread betting is tax-free

- Multiplatform compatibility

- Accounts with 0% commission

- Raw accounts for zero spreads

- Licensed by the FCA

- PayPal is accepted

Cons:

- There is no proprietary platform

- ETFs are not available

Your Money Is At Risk.

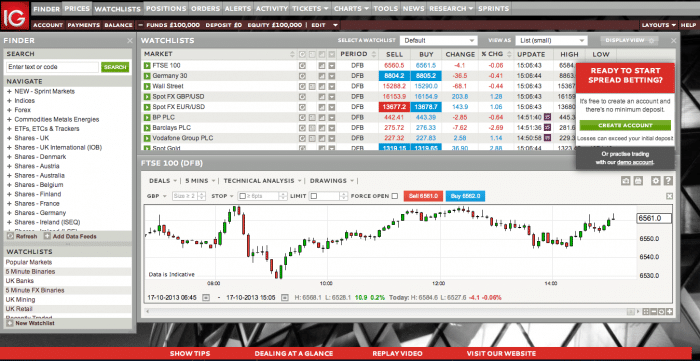

2. IG – Spread Betting Platform With 17,000 Markets

IG is a well-known and trusted online brokerage firm with several divisions in the investment industry. Spread betting, CFDs, forex, and traditional shares and funds are all included in this category. Over 17,000 spread betting markets are available to you at IG – that’s a lot.

The focus is on forex, indices, shares, and commodities, with a strong focus on forex. There is a long and short position available on every spread betting market, as well as leverage. If you are a UK retail client, you are limited to 1:30.

In contrast, IG offers much higher limits for professionals who open a trading account. Taking into account spread betting currency pairs, indices, and commodities, this stands at over 1:222. In addition, IG allows you never to lose more than your balance permits when entering a leveraged position as it provides Negative Balance Protection.

IG offers Commission-free spread betting. However, IG spreads are largely very competitive, so keep an eye on them. Indices and shares, for instance, can be traded for 0.1 points, commodities for 0.3 points, and forex for 0.6 points.

You can trade directly through the provider’s website if you believe IG can meet your spread betting needs. Additionally, the broker has a mobile app compatible with iOS and Android devices. At this top-rated spread betting platform, the minimum deposit is $250.

IG fees

| Fee | Amount |

| Crypto trading fee | $0.02 commission |

| Inactivity fee | £10 per month after 1 year |

| Withdrawal fee | $0 |

Pros:

- Stocks starting at just £3

- More than 80 currency pairs are available

- Support for 17,000 markets, including spread betting

- There are no commissions charged, and spreads start at just 0.6 pips

- Use the IG app or website to trade

- Licensed by the FCA and ASIC

- Brokerage experience spanning more than four decades

- Debit cards and bank transfers are accepted for funding your account

Cons:

- The minimum deposit is $250

Your Money Is At Risk.

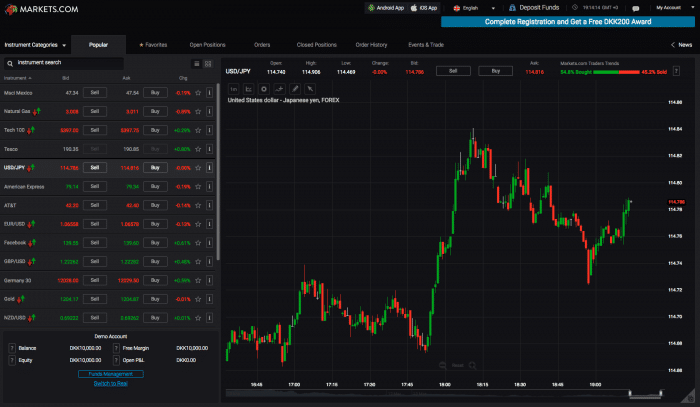

4. Markets.com – Best Spread Betting Platform for Beginners

Markets.com offers a platform for beginners to trade online. An easy-to-use and jargon-free trading platform, accessible via the web browser, makes it easy to trade online.

Along with conventional CFDs, Markets.com offers a comprehensive spread betting service. There are currently 67 currency pairs, 28 commodities, 40 indices, 60 ETFs, and over 2,000 shares covered. Leverage is allowed for all these markets – according to UK regulations.

Markets.com is a spread betting platform that allows you to start with a free demo account. Spread betting can thus be practiced without risking any money. The platform also has a section called ‘Introduction to Trade,’ which offers a range of guides and explainers.

Fees will vary depending on which spread betting market you choose. Unlike forex, commodities, and indices, you don’t have to pay commission when you trade forex, commodities, and indices. According to Markets.com, spreads on EUR/USD are 0.90 pips, gold is $0.50, and spot crude oil is just $0.05.

If you’re interested in stocks, you should also consider a commission. It stands at an eye-watering $10 per slide. So no matter how much you stake, you will be charged $10 to enter and $10 to close a stock trade – plus the spread. Furthermore, Markets.com allows you to open an account in minutes, accepts Visa and MasterCard deposits, and is regulated by the FCA.

Markets.com fees

| Fee | Amount |

| Crypto trading fee | Variable |

| Inactivity fee | After 3 months of inactivity, $10 per month |

| Withdrawal fee | No withdrawal fee |

Pros:

- Newbie-friendly

- Several markets to choose from

- CFDs and spread betting

- Most assets are subject to 0% commission

- Starting spreads of 0.9 pips

- Compatibility with MT4

- Regulations of the FCA

Cons:

- Stocks have a commission of $10 per slide

- E-wallets are not supported

Your Money Is At Risk.

5. CMC Markets – Experienced Spread Betting Platform

CMC Markets was founded in 1989 and is a well-known broker. It trades under the symbol CMCX on the London Stock Exchange as a regulated broker.

Traders can trade bitcoin, cryptocurrencies, and forex on the site.

Other asset classes, such as bonds, real stocks, and futures, may not be ideal for traders with this broker.

The CMC Markets range of stock CFDs and ETF CFDs is extensive. CMC Markets charges $0.002 per share for CFD trades on stocks. CMC Markets does not charge account or deposit fees, so non-trading commissions are similar.

CMC Markets fees

| Fee | Amount |

| Crypto trading fee | $0.02 commission |

| Inactivity fee | £10 per month after 1 year |

| Withdrawal fee | $0 |

Pros:

- There is no deposit fee

- You can pay with bank transfers, debit and credit cards, and e-wallets

- There is no minimum deposit requirement

- Demo trading accounts provide virtual account balances that are refundable

Cons:

- Leverage levels at CMC Markets are not modified

- Verifying an account can be a bit difficult

Your Money Is At Risk.

Best Spread Betting Platforms – Fees & Leverage Comparison

| Platform | Crypto trading fee | Inactivity fee | Withdrawal fee |

| Pepperstone | 0.2 points | Free | Free |

| IG | $0.02 commission | $10 per month after 1 year | $0 |

| Markets.com | Variable | $10 per month after 3 months of inactivity | No withdrawal fee |

| CMC Markets | $0.02 commission | £10 per month after 1 year | $0 |

What is Spread Betting?

The term spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. Instead, a security price movement is predicted by placing a bet. Spread betting companies quote the bid and ask price (also called the spread), and investors bet on whether the underlying security price will be lower or higher than the bid.

Spread betting does not involve the ownership of the underlying security; instead, the spread bettor speculates on its price movement.

It should not be confused with spread trading, in which you take opposite positions in two (or more) different securities and profit if the difference in price between them widens or narrows over time.

75.26% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Regulation

Spread betting is considered gambling in the United Kingdom (although the Financial Services Authority still regulates it); therefore, it is not taxable. Despite spread betting being regulated by the UK’s Financial Services Authority (FSA), the US considers it an Internet gambling activity prohibited. Additionally, all US income (including winnings from gambling) is taxable. Traders see the leverage available from options as highly desirable in the absence of alternatives, which may explain why option trading is so popular.

Pros and Cons

1. Spread Betting Benefits

Long/Short

Investing allows investors to bet on both rising and falling prices. Investors who trade physical shares must borrow the stock they intend to short sell, which can be time-consuming and expensive. Short selling is easy with spread betting.

No Commissions

Brokers make money by offering spreads. Investors can determine their position size and monitor trading costs more easily since there is no separate commission charge.

Tax Benefits

In some tax jurisdictions, spread betting is considered gambling, and subsequently, any realized gains may be taxable as winnings rather than capital gains or income. Therefore, spread betting investors should keep records and consult an accountant before completing their taxes.

2. Limitations of Spread Betting

Margin Calls

When investors are unfamiliar with leverage, they may take positions too large for their accounts, leading to margin calls. As a result, the trader should ensure they never risk more than 2% of their investment capital (deposit) on any one trade and should always know precisely the position value of the bet they intend to place before engaging in it.

Wide Spreads

Spread betting firms may widen their spreads during periods of volatility. As a result, stop-loss orders may be triggered, increasing the cost of trading. Therefore, you should be cautious about placing orders immediately before company earnings announcements and economic reports.

Options Assets

To find the best spread betting platform for your needs, you need to look at the markets the broker offers. These markets are generally offered by the brokers discussed here:

- Shares: Stocks listed in the UK and overseas

- Hard Metals: Silver, gold, and platinum

- Energies: Petroleum, natural gas

- Forex: Major, minor, and exotic currency pairs

- Indices: FTSE 100, Dow Jones 30, Nasdaq 100, S&P 500, etc.

Check the platform’s website to see what markets it offers.

Platform & Usability

Spread betting is one of the more recent forms of trading, which is why you’re seeking out the best platform for beginners. You’ll want to ensure that the user experience is suitable for your level of experience. A newbie, for example, may not want to choose a platform with advanced trading tools and jargon.

Instead, you should be able to place buy and sell positions as easily as possible. The same should apply to the mobile app and the main online platform. For example, you may need to enter or exit a spread betting position while on the move.

Trading Tools & Features

The best spread betting platforms will offer various trading tools and features that may interest you.

This includes:

Leverage

Unlike traditional stock trading platforms, you can trade on spread betting platforms with leverage. That allows you to increase the size of your position, as we briefly discussed earlier. However, you are limited by the FCA.

For example:

- Spread betting vs CFD: The best spread betting platform we found – Pepperstone, allows you to trade major forex markets with a leverage of 1:30.

- As an example, if you traded GBP/USD with a stake of £10 per point, your position would increase to £300 per point

- As a result, if you gained 20 points on this trade, your profit would increase from £200 to £6,000

Traders seeking much higher limits can find them at Pepperstone, which offers up to 1:500 on major pairs. First, therefore, ensure that your spread betting platform offers Negative Balance Protection. That will help you avoid losing more than what is in your trading account.

Risk Management

Spread betting is riskier than conventional stock investing – so you want to choose a platform that offers risk management tools. On this page, we have discussed how most platforms offer stop-loss orders.

When a spread betting trade goes against you by a certain amount, this option will automatically close it. So, for example, when you stake £5 per point and limit your losses to £50, you can set up a stop-loss order at 10 points. Additionally, you will never lose more than you can afford due to Negative Balance Protection.

Education, Research & Analysis

To help you become a better trader, Pepperstone, one of the best spread betting platforms for beginners, offers many educational tools to help you get started. The provider, for instance, offers fully-fledged spread betting guides, covering risk management and potential spread betting strategies. Additionally, you can download the ‘investment’ app, which offers mini-courses on all things trading.

Payments

Even if you intend to start with a demo account, you will likely need to spread bet with real money at some point. As such, it’s worth checking to see if your chosen spread betting broker supports your preferred payment method.

The spread betting platforms typically accept both credit cards and debit cards. E-wallets are now accepted by many too, which are also instant and safe. A bank account transfer might take a couple of days to process if you want to deposit through a traditional method.

You should also find out whether any fees are associated with the payment method you choose. In this regard, Pepperstone is great as it does not charge for deposits or withdrawals. Markets.com, for example, charges £10 on withdrawals under £100.

75.26% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Spread Betting Strategy

Traders worldwide are currently using spread betting strategies, so there is no straightforward answer to this question. For example, the trader who profits from long-term corporate growth may move in and out quickly to take advantage of a falling share price, while the trader who profits from short-term corporate growth may move in and out slowly. Others trade based on instinct and wider economic trends, whereas some are technical boffins who love to dig into raw data. There is no right or wrong strategy – the best one for you is the one that works for you at the moment.

A good way to learn about trading strategies is to get familiar with a few. Nevertheless, learning one or two simple spread betting strategies can be a good way to get started, and by doing so, you can begin to build up your trading capital. Then you might consider expanding your spread betting business to increase your earning potential.

Below is a quick look at some of the more popular spread betting strategies used by spread traders from all walks of life to increase the likelihood of winning more often. To learn more about all the strategies available, you can refer to the following menu.

Scalping

In the early stages of trade, one of the most popular strategies is called ‘scalping. The theory behind scalping is that by quickly taking small profits and closing financial spread betting positions, a trader is less exposed to downturns in price and can build up a large pot of money over time by taking a series of smaller trades.

In this case, the trader is preserving capital by scalping individual profits as they arise, creating a steady income stream, and preserving capital throughout the trading day with minimal downside exposure.

Scalping’s main strength is also its main weakness, and less disciplined traders may quickly become frustrated at closing positions that deliver hundreds of PIPs in their favor at such an early stage. However, for risk-averse traders, especially those new to the game, trading on multiple short-term bases is a great way to get started without jeopardizing their capital.

Scalping requires constant engagement throughout the trading day if you expect to make any significant profit, continuously opening and closing positions in response to the market, and incorporating the comparatively high trading costs associated with such a strategy. While this can be more stressful than longer-term trading, each spread bettor requires a hands-on approach.

Market Trends

Another common trading strategy spread bettors use to take a position based on market trends. Then, they jump on the bandwagon after several factors are triggered and ride the wave of price movements. However, rather than a few minutes (as with scalping), this is carried out throughout the trading day, making transaction costs as low as possible while presenting potentially huge gains.

The ideal time to trade trends is when an announcement is made or a news story breaks, and the markets react to the announcement. As the first few minutes can be a volatile period, identifying the beginning of a price trend in either direction can give a trader a clear picture of which position to take and takes advantage of your dynamism over larger funds to take savvy but early positions. As opposed to scalping, this strategy allows you to open a position slightly ahead of the rest of the market to gain access to the reaction of an index price as the market moves on trend.

That is just one of countless spread betting strategies, and variations traders can employ. Ultimately, it’s up to each trader to determine what works best for them, but developing a solid trading strategy remains a key element in consistently profitable spread betting.

Reversals

Using graphical performance data, reverse traders determine when a market or index is likely to reverse based on perceived overpricing or underpricing. The upper and lower limits of an index should be evident after looking at the performance of a market over a recent period. A reversals trading strategy recommends that, as the market approaches either of these limits, you keep an eye on the index movement and prepare to capitalize on the gains made during the price correction.

Reversals trading is particularly popular because it is a reactive, low-risk strategy that does not attempt to second-guess the market but rather moves in line with its reaction. By using spread betting, you can ride the wave of a price correction without having to enter the market too early, minimizing potential losses while also reaching a happy medium in terms of gains.

Break-outs

Spread betting on breakouts can be an excellent way to profit from strong price movements, and it’s often possible to predict where a price is about to break through its previous boundaries. When spread bettors use this strategy, they wait until an index breaches its previous upper limits, usually for two or more consecutive days, indicating that the market is extremely and unprecedentedly bullish and that the price is likely to rise (similarly, the same can be done when an index (or any other asset) breaches its previous lower limits).

When trading shares in such a strategy, a stop loss should be placed at the preexisting upper limit to prevent the impact of a failed price breakout. Still, suppose it is a reactive strategy (i.e., the index is already moving favorably when the bet is placed). In that case, the downside risk is limited only to situations where the index has become overly inflated. The trader will likely have locked in his profit and moved on to the next trade by this time.

You can improve your consistency and develop some structure in your trading by examining tried and tested spread betting strategies. It is important to remember that no strategy, or combination of strategies, can guarantee success. Still, it’s a good idea to develop a system that will sustain your efforts over time to provide more frequently profitable spread trades and to stack the odds more in your favor than with a disorganized, scattergun approach.

75.26% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How To Get Started With A Spread Betting Platform

Following this Pepperstone review, you now know the platform’s key features and relevant aspects. Next, it’s time to learn how to use it.

Step 1: Open a Trading Account and Verify Your Identity

It should take less than a minute to create an account on the Pepperstone app, and the first thing you will need to do is fill out your account details. You can create an account by clicking “Create Account” on the website and entering your email. Even if you already have a Google, Facebook, or Apple account, you can sign up with Pepperstone by connecting your existing account.

75.26% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Step 2: Upload ID Documents

The FCA authorizes and regulates Pepperstone, so it needs to confirm your identity. Upload a photocopy of your passport or driver’s license, along with proof of residence (bank statement, utility bill, etc.)

Step 3: Deposit Funds

Pepperstone requires that you deposit at least twenty pounds to open an account. You may use a debit card, credit card, or wire transfer to deposit funds. To deposit funds, you may click on the ‘Fund my account’ button to do so.

Step 4: Start Trading with Spread Betting

Upon funding your Pepperstone account, you will be able to start trading right away! Discover new investment opportunities by searching for the instrument you wish to trade or new investment ideas in the Discover tab. You now need to click the Buy button after finding the instrument you wish to trade and fill in the parameters and amount to execute your trade.

75.26% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Conclusion

Overall, spread betting brokers are a viable alternative to conventional trading platforms. Essentially, you will have to pay taxes on your profits using CFD and forex trading platforms. However, trading through spread betting allows you to keep 100% of your trading profits.

Your top priority should be choosing the best spread betting broker for your needs. Look for metrics like spread betting markets that are supported, commissions and spreads, and minimum trades per point, along with FCA regulation. The best spread betting broker is Pepperstone, according to our research.

You can start trading with only a deposit of £20, and no commissions are charged. Pepperstone also offers thousands of spread betting markets that can be leveraged.

To the best of our knowledge, spread betting is illegal in the United States at present. The majority of spread betting companies in the UK do not allow US residents to open accounts.

Pepperstone – Overall Best Spread Betting Broker

75.26% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.