IG Trading Platform Review – Pros & Cons Revealed

If you’re interested in options, CFDs, and forex trading as well as investing in stocks directly from the share dealing service, IG might be exactly what you are looking for. With market-leading spreads and low commissions on share CFDs, IG gives you access to thousands of popular international markets from the comfort of your own home. So, is IG the right online broker for you?

In this IG review 2026, we cover everything from fees and commissions to payments and security so that you can spend less time researching and more time trading with a top-rated and regulated broker.

What is IG?

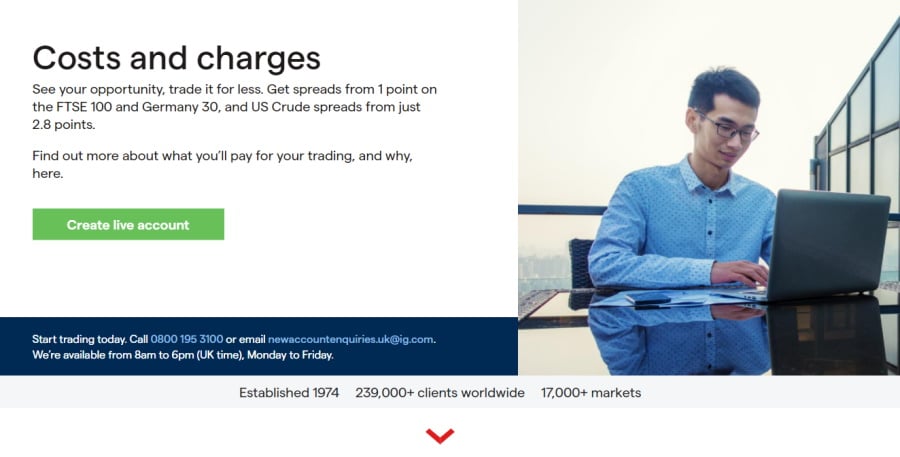

Established in 1974, IG provides access to more than 17,000 financial markets and is home to around 240,000 traders worldwide. This CFD and forex broker enables heaps of beginner and experienced traders to capitalize on unique trading opportunities via spread betting and CFDs.

On the other hand, if you prefer to gain ownership of the underlying assets you can invest in thousands of ETFs and shares, or select a wealth portfolio managed by an IG expert trader. If you are a short-term investor then spread betting and CFDs allow you to increase your purchasing power with leverage. Moreover, as CFDs and spread betting are derivatives you can speculate on the market’s prices without taking ownership of the underlying asset.

Alternatively, IG also facilitates long-term trading with more traditional investments. IG’s share dealing service allows you to buy and sell heaps of international stocks on low commissions, with as little as £3 on shares of stocks listed on the London Stock Exchange. You could also use IG’s Smart Portfolios and choose a managed and diversified portfolio that suits your trading needs and risk tolerance.

In terms of security, IG is regulated and authorized by the UK’s Financial Conduct Authority, and client funds are held in segregated bank accounts under trustee arrangements. IG has several segregated bank accounts at multiple credit-worthy corporate banks including Barclays and Lloyds. Your funds and assets may be compensated up to £85,000 by the Financial Services Compensation Scheme (FSCS).

Are you new to online trading? If so you can open a demo account, which is commonly referred to as a paper trading account, with access to £10,000 worth of virtual funds to practice your trading strategy in a risk-free simulated environment. Demo accounts are great tools to help you familiarise yourself with the trading platform and to gain vital trading experience without risking your own account funds.

IG Pros & Cons

What we like

- Free account-opening process which is fully digital and streamlined.

- Market-leading spreads from 0.6 pips on major forex pairs such as EUR/USD and 0.3 pips on commodities like Spot Gold.

- With share CFDs you buy and sell at the actual market price, so IG does not attach a spread. Instead, IG charges a commission every time you open a trade and again when you close it.

- To protect your trade against slippage you can use a guaranteed stop order.

- Wide range of payment options including via debit card, credit card, bank transfer, or PayPal.

- Demo account with £10,000 of virtual funds to practice your trading strategy before opening a live account.

- Access to several trading platforms, including web and mobile trading apps, MetaTrader 4, Trading Signals, automated trading, DMA trading, and more.

- Regulated and authorized by a wide range of financial institutions including the UK’s Financial Conduct Authority, and US Commodity Futures Trading Commission (CFTC), and the National Futures Association.

- Client funds are held in segregated bank accounts.

- IG offers negative balance protection for CFD and FX spot trading.

- No deposit fee and instant deposits when you use Visa or Mastercard debit cards.

- No processing fees for withdrawals.

What we don’t like

- Credit card deposits incur a 1% charge for Visa and 0.5% charge for Mastercard.

- Cryptocurrency trading is only available to professional traders.

- IG does not support fractional share trading.

- Absence of fundamental data on assets.

71% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

What Can You Trade on IG?

Forex Trading

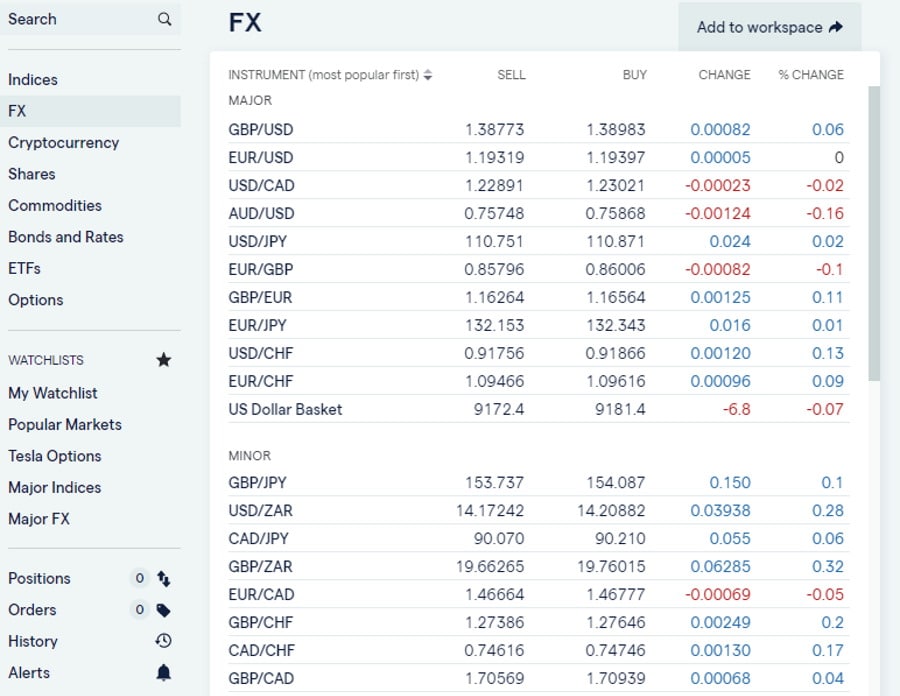

You can trade forex with CFDs and spread bets to gain access to a variety of major, exotic, and minor currency pairs with competitive spreads and up to 30:1 leverage. The trading costs are included in the spread, which is the difference between the buy and sell price. IG has some of the lowest spreads on the market. For example, the minimum spread for the EUR/USD pair is 0.6 pips.

The forex market is the largest financial market and is a marketplace that facilitates the exchange of fiat currencies against one another. As reported by the 2019 Triennial Central Bank Survey of Fx and OTC derivatives markets the forex market witnesses a daily trading volume of $6.6 trillion.

With IG you can trade a wide range of major, minor, and exotic currency pairs such as GBP/USD, EUR/USD, GBP/JPY, and USD/TRY. One of IG’s top-selling points is its market-leading spreads as this appeals to beginner traders looking for a free trading platform to trade on a low-cost basis. For example, if you wanted to trade the EUR/USD forex pair you could do so with a minimum spread of just 0.6 pips and leverage up to 30:1.

Shares Trading

IG clients can invest in and trade thousands of international shares, and take advantage of longer trading hours. How do you buy and sell shares of international stocks on IG? Simply put, there are two ways to trade and invest in stocks online. You can either speculate on the price movements of the underlying stocks, or you can invest in shares directly through the IG share dealing service.

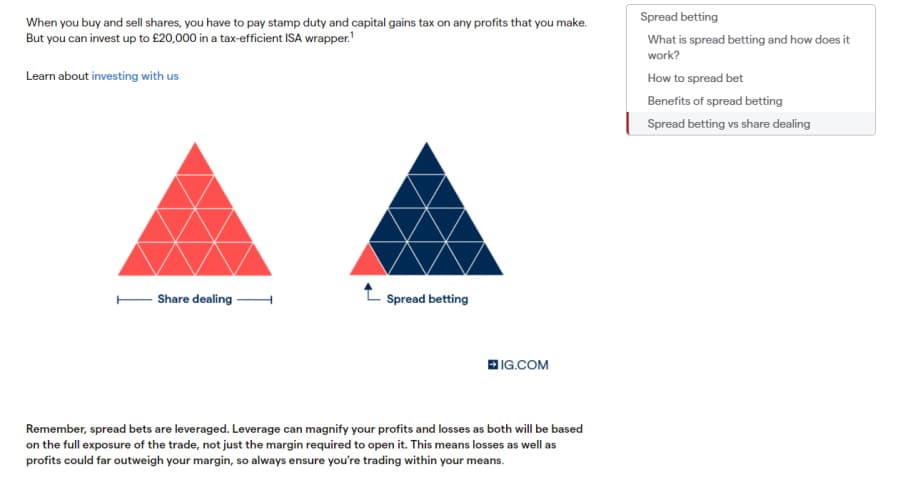

When it comes to trading stock CFDs and spread betting these trading strategies are leveraged, meaning you can gain exposure to shares while only paying a portion of the cost. While leverage amplifies any potential profits it also maximises potential losses. Spread betting and CFDs allow you to trade shares online without ever taking ownership of the underlying asset, as well as being able to trade falling and rising markets.

For traditional investments IG’s share dealing service allows you to invest in major stocks to sell them for a profit at some point in the future. When you invest in shares without leverage you take ownership of the underlying asset and therefore earn profits from dividend payments as well as gain stakeholder rights.

Indices Trading

Indices measure and track the performance of a basket of shares that are listed on an exchange such as the London Stock Exchange and the New York Stock Exchange. Indices are traded through financial derivatives such as contracts for differences and spread bets as there are no underlying physical assets to trade.

The key benefits of index trading include:

- It is a cost-effective way of diversifying your investment portfolio in the sense that speculating on the price movements of a basket of shares is cheaper than buying and selling shares individually.

- With index trading, you can gain full exposure to a whole economy or sector in a single trade.

- If you have a short position on multiple stocks which are included in an index, you could hedge against the threat of any potential increments in price with a long position on that particular index. If the index increases, your position will earn a return, which would balance out a percentage of the losses on the short stock positions.

With IG you can trade major indices such as the FTSE 100, Germany 30, Japan 225, and US 500 with tight spreads as low as 1 pip.

Commodities Trading

Commodities trading involves speculating on the price of raw physical resources including precious metals, energies, and agricultural products with leveraged CFDs and spread bets.

But what is spread betting?

Spread betting is favoured amongst investors and traders worldwide as a tax-free financial derivative because it allows you to speculate on financial markets. This means that you open positions based on whether you believe the price of the underlying asset will either rise or drop.

By default, the purchase price is greater than the market price and the sell price is lower. The difference between the sell and buy prices is referred to as the spread. Consequently, traders choose their bet size which is the bet amount placed per unit of price movement. The more the market moves in the direction of your forecast the greater the return. However, if the market moves in the opposite direction you will suffer losses.

You can trade commodities such as energies, base and precious metals, and agricultural products with IG. The standard spread for Spot Gold is 0.3 pips and 2.8 pips for US Crude Oil.

Options Trading, Futures Trading, and more

IG clients also have access to options, futures trading, spot trading, weekend trading, and more with the click of a button.

Crypto Trading

IG restricts cryptocurrency trading to professional traders only. As such advanced investors have access to popular digital assets such as Bitcoin, Ether, Litecoin just to name a few. To be eligible for a professional account you need:

- To have traded leverage derivatives in significant amounts within the last 12 months.

- Own and manage a financial instrument portfolio with a value greater than $500,000.

- Have at least one year of experience in the financial industry, and have been employed in a professional setting that required an understanding of derivatives trading.

IG Fees & Commissions

IG has low non-trading fees such as no deposit or withdrawal fees. With access to thousands of markets and heaps of derivatives trading methods to choose from, IG’s fee structure can be rather convoluted, especially for beginners.

There are different fee models for the different types of asset classes which are as follows:

- Share CFDs, real shares, and options incur trading commissions

- The trading fees are built into the spreads when it comes to stock index CFDs, commodity CFDs, bond CFDs, and forex trading.

- Smart Portfolios incur an administration fee and you pay the trading spread.

IG’s ETF CFD and international shares

You can go short or long on more than 16,000 global stocks and 6,000 ETFs with IG’s user-friendly trading platform.

When it comes to share CFDs, you trade at the real market price, and as a result, IG does not attach its own spread but charges a commission every time you open the trade and again when you close the position.

The CFD commission charges are calculated as a portion of the transaction value for the majority of markets and as cents per share for Canadian and US markets. Let’s take a look at the commission charges in the table below:

| Share Category | Commission per side | Minimum Charge (online) | Minimum Charge (phone) |

| UK (FTSE 350) | 0.10% | £10 | £15 |

| US | 2 cents per share | £10 | £15 |

| Euro | 0.10% | €10 | €25 |

| Japan | 0.20% | JPY1500 | JPY2500 |

When you open a live trading account, IG sends you a comprehensive breakdown of all the commissions and financing rates that apply to you.

If you are looking to trade stock CFDs, the commission is based on a variable percentage which is multiplied by the trade total. The exact rate of commission varies depending on the exchange you choose and always comes with a minimum.

For example, if you want to trade shares of company stocks that are listed on the London Stock Exchange (LSE) you will incur a 0.10% commission. Therefore, a £30,000 trade would result in a commission charge of £30. Nevertheless, all trades come with a minimum commission, as you can see in the table above, which means that you will have to pay £10 per trade unless the trade amount is more than £10,000.

Competitive spreads

This CFD and forex broker offers some of the most competitive spreads in the industry. When you consider the commission-free structure on all non-stock CFDs, this makes IG stand out even more from its competitors.

To gauge just how tight the spreads are, let’s take a look at several examples:

- The FTSE 100 has a minimum spread of 1 pip.

- The EUR/USD major currency pair has a minimum spread of 0.6 pips.

- Spot Gold CFDs have a minimum spread of just 0.3 pips.

To speculate on price movements over the long term, you can buy and sell CFDs on futures for commodities and indices. The main benefit of these long-term trading strategies is that the overnight financing fees are included in the spread. This means that it is easier to pinpoint your break-even level on your trades.

Opening a position in a forward or future is typically more beneficial over the long term. With this in mind, the minimum spread when trading CFDs on futures for the FTSE 100 index is 4 pips, and for CFD Spot Gold futures the contract spread is 0.6 pips.

It’s important to keep in mind that when calculating your trading costs, to factor in that spreads can change throughout the standard trading hours as market prices fluctuate continuously.

Non-trading fees

There are a few non-trading fees that you need to consider before opening an account with IG.

Overnight Funding Fee

The overnight funding fee is a charge you incur when you keep cash CFD trades open past 10 PM GMT. For example, let’s say that you wanted to purchase 10 contracts of EUR?USD with a spread of 0.6, held for one night on Wednesday.

Forex trades are settled on a T+2 basis, which means that if you hold a position for one night on a Wednesday, you will pay to hold the position for a total of three nights as opposed to one. On the flip side, you will only pay the admin fee once.

The overnight funding fee is calculated at IG using the following formula: nights held * (tom-next rate including the annual admin fee which is 0.8% for all contracts) * trade size. You also need to consider that with dollar trades you also have to pay a 0.5% conversion fee.

Inactivity Fee

You pay a £12 inactivity fee per month after 2 years.

ProRealTime Charts

There is a £30 a month subscription fee to use advanced charts from the top-rated third-party provider ProRealTime.

Credit Card Deposit Fee

When depositing funds into your account via credit card there is a 1% charge for Visa and 0.5% for Mastercard.

IG User Experience

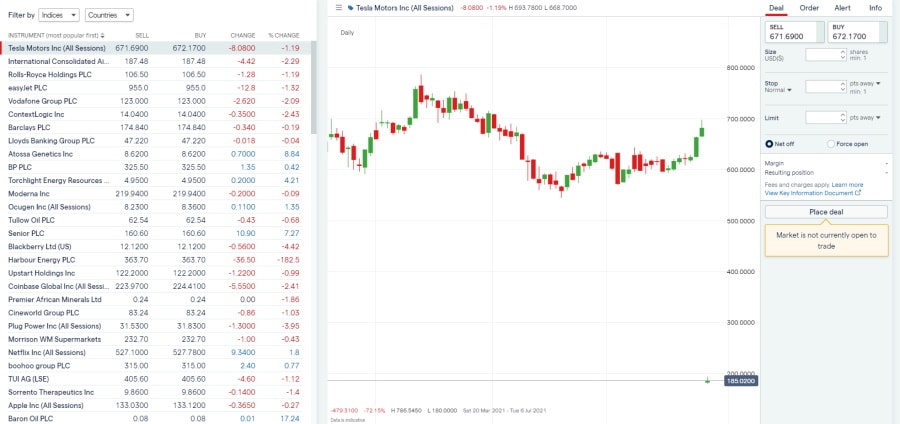

The IG web trading platform is user-friendly and easily customizable to suit your trading preferences. The interface allows you to set things up to match your trading needs. Along the left-hand column, you will find all the different markets, watchlists, your positions, orders, trade history, and more.

Additionally, you can set price change alerts, price level alerts, and indicator alerts with the click of a button. You can also access trading signals from the third-party provider Autochartist.

On the right-hand side of the trading terminal, you can access notifications and tweets from popular financial news outlets such as Bloomberg, CNBC, City A.M., CoinDesk, DailyFX, IGSquawk, and more.

The search functionality is very intuitive and populates a list of relevant instruments with a convenient preview of the Sell, Buy, Change, and percentage change statistics.

If you are a beginner with little trading experience IG is a good broker that provides heaps of educational resources from seminars and webinars to special reports and podcasts. If you want to learn how to trade online as well as build an extensive knowledge of investing then IG can be considered a trading encyclopedia.

The web trading platform is perfectly suited to casual new traders who want to access the financial markets with ease. For instance, after you have opened an account and deposited funds, you will have unfettered access to your preferred market with the click of a button.

The main dashboard is user-friendly and well designed. It offers great customizability so that you can easily monitor and manage your portfolio in real-time alongside a wide range of convenient resources such as trading signals.

IG Features, Charting, and Analysis

There is a wide range of analysis and educational features and materials to browse through on IG by simply tapping on the Analyse and Learn tab on the main ig.com site. This populates a rich dropdown menu of tools and resources such as:

- An Overview

- Managing your risk

- Maximizing trading success

- How to trade online

- Trade analytics tool

- News and trade ideas

- Strategy and planning

- Financial events

- Seminars and webinars

- Subscriptions and downloads

- Special reports

- Trading podcasts

- Investing podcasts

- Economic calendar

- Glossary of trading terms

Our IG review found that the education and analysis department is one of the most comprehensive that currently exist in the financial sector. The podcasts, seminars and webinars are perfect for gaining exposure to experienced investors’ trading ideas and sentiments.

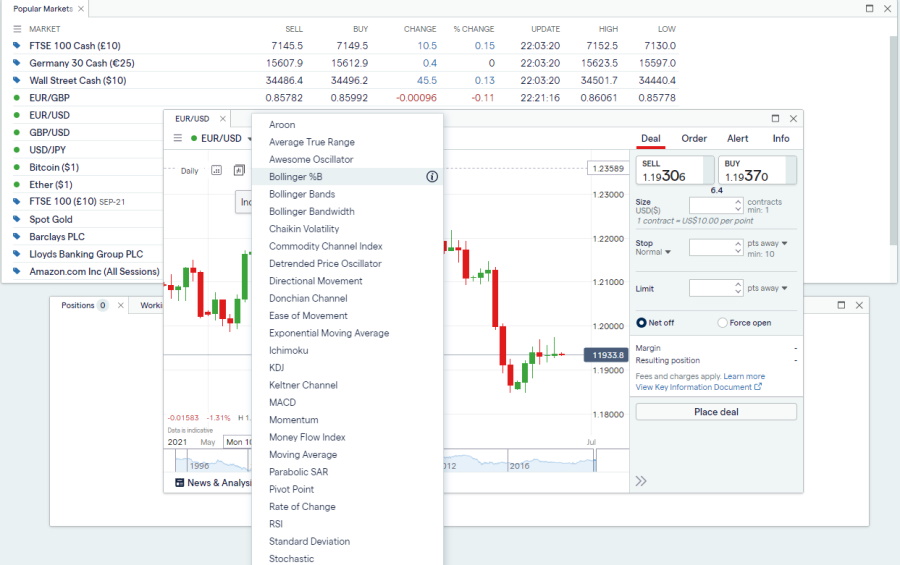

Charts

During our research, we found that the charting experience on the IG web trading platform was very straightforward and offers all the features to satisfy the majority of your trading needs and goals.

You can customize the charts in the following ways:

- You can modify the date range from one day up to five years,

- Merge as many as four charts in a single trading window

- Choose from 30 technical indicators including Average True Range, Awesome Oscillator, Bollinger Bands, Chaikin Volatility, Detrended Price Oscillator, MACD, Parabolic SAR, Stochastic, and Volume Weighted Moving Average.

- Use a range of drawing tools such as Elliot wave, Fibonacci retracement, Gann line, point to point, and more.

- Customize the appearance of the charts such as choosing between candlesticks, Heikin-Ashi, Line, HLOC, and Mountain charts.

- Save, edit and delete any charts you create.

- Customize the colours and band-width of the candlesticks.

Setting price change, price level, and indicator alerts is easy and is done by tapping on the alert tab on the trading window and specifying the exact parameters for the alerts. You can then view and manage all your saved alerts, by clicking on the alert management tab on the left side of the web trading platform.

IG Account Types

IG can be broken down into three key sections – CFDs, spread betting and share dealing. As such, this CFD and forex broker provides several trading account types.

So, let’s take a look at each account type:

Share Dealing Account

Firstly, IG’s share dealing account is only available for UK-based clients. The share dealing account provides access to ETFs, traditional stocks, mutual funds and investment trusts. Simply put, with a share dealing account you can buy and sell traditional shares and other financial instruments. The key difference between a share dealing account and CFD derivative trading is that with the former you take ownership of the underlying asset and therefore get shareholder rights including dividend payments.

There are three further sub-categories of trading accounts within the share dealing department:

- The standard dealing account

- The stocks and shares ISA account protects the initial £20,000 invested every year from dividend tax.

- The smart portfolio ISA has a minimum deposit of £500.

CFD Trading Account

There is no minimum balance to open a CFD account with IG. After you have deposited funds into your brokerage account you can start trading with the click of a button and the main charge on each trade is the spread or a commission for share trades.

With an IG CFD account, you can control your exposure through a variety of risk management tools, such as guaranteed stop orders and automated price alerts. Beginner traders can also practice their trading strategies and familiarize themselves by using the paper trading account before opening trades with a live trading account.

When it comes to margin trading with a CFD trading account this starts from 0.25% for forex trading and 5% for shares and indices.

Spread betting account

Spread betting allows you to speculate on rising and falling prices in financial markets without having to take ownership of the underlying asset. Spread betting is a popular trading strategy in the United Kingdom as profits are tax-free.

With a spread betting account you can access more than 17,000 markets, trade without having to pay capital gains tax or stamp duty tax, take advantage of long and short trading opportunities, and you can open trades on margin.

For the spreads, margin and leverage take a look at the following table:

| Market | Retail Margin | Leverage equivalent | Minimum spreads from |

| Forex | 3..33% | 1:30 | 0.6 |

| Indices | 5% | 1:20 | 0.1 |

| Shares | 20% | 1:5 | 0.1 |

| Commodities | 5% | 1:5 | 0.3 |

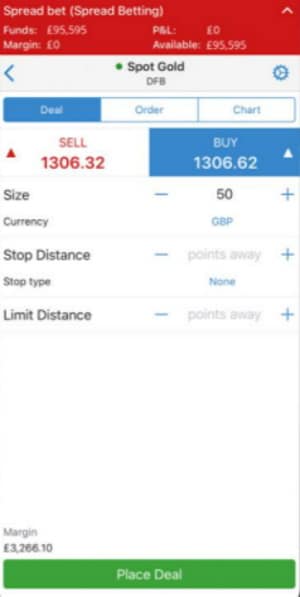

IG Mobile App Review

The IG mobile trading app has been designed for both Apple and Android mobile devices, including tablets and smartphones. During our research, we found that the trading app is user-friendly that features an easy-to-use interface on both mobile and desktop devices.

You can open, manage, modify and close your trades from wherever you are, as well as manage your risk with a variety of tools such as trailing and guaranteed stop orders.

The IG trading app features full-screen customizable charts that allow you to analyze the markets with 30 technical indicators. The main benefit of a mobile trading app is the convenience of being able to trade wherever you are. With this in mind, IG allows you to trade on the move with real-time prices and market data.

Additionally, you can set price alerts for any market with the click of a button and receive them via email, text, or push notification in real-time. You can also create alerts for important market events using the economic calendar. There is also the option to get actionable purchase and sell signals.

The mobile trading app is not just tailored for beginner traders, as there are plenty of features for advanced investors such as GTC and good-till-date orders, points through currency and partial fills, as well as being able to save previous stake sizes and stop distances for a more streamlined dealing experience.

IG Payments

When it comes to depositing funds into your IG trading account you need to make sure that any credit card, debit card, PayPal, or bank account is under your name as the broker does not accept funds from third parties.

Depositing funds into your trading account can be done with a debit/credit card, PayPal, or bank account. Deposits made via credit cards, debit cards, or PayPal are credited to your account instantly. On the other hand, it typically takes up to three business days for bank transfers to process. You also need to ensure that your account ID and legal name are added as a reference for the payment.

As we have already mentioned, depositing with a Visa or Mastercard debit card is free. But, the deposit fee for a Visa credit card is 1% and 0.5% for Mastercard.

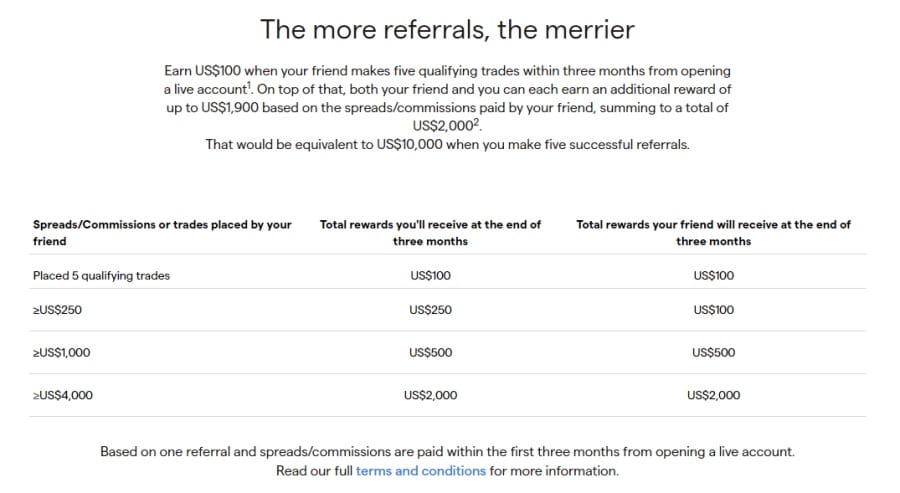

IG Refer-A-Friend Program

You can earn up to $10,000 when you refer friends to IG. When your referral makes five qualifying trades within three months from opening a live trading account you could earn $100. Furthermore, both you and your friend can each receive an additional bonus of up to $1,900 depending on the spreads and commissions incurred by your friend that equally $2,000. This means that with five referrals you could earn $10,000.

To start making referrals today simply login to your My IG and go to the settings page and tap on refer a friend from the menu. Then share your unique referral link via email, SMS, or social media to invite your friends to open an IG account and start trading.

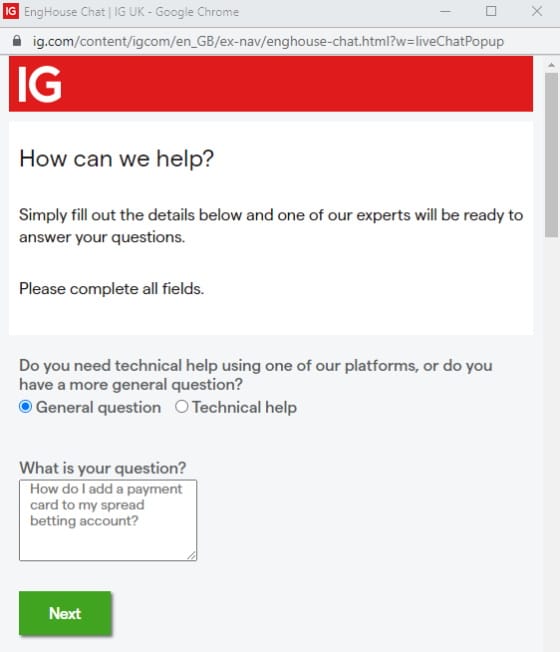

IG Contact and Customer Service

You can contact customer support at IG via email, telephone, and Live Chat, 24 hours a day from 8 am Saturday to 10 pm Friday GMT. Additionally, you can contact IG’s trading services team on Twitter @IGClientHelp. The Trading Services team is available 24 hours a day Monday to Friday.

Is IG Safe?

CFD accounts on IG are provided by IG International Limited which is licensed by the Bermuda Monetary Authority to conduct investment and digital asset business.

IG is authorized and regulated by a wide range of financial regulators including the UK’s Financial Conduct Authority, the US Commodity Futures Trading Commission and National Futures Association, the Australian Securities and Investment Commission, the Bermuda Monetary Authority, and the Financial Services Authority of Japan.

IG also offers negative balance protection for CFD and forex spot trading for EU-based clients. Moreover, all client funds are held in segregated accounts at regulated banks. UK residents are protected up to £85,000 by the Financial Conduct Authority should the broker go into insolvency.

How to Start Trading with IG

In this section, we will guide you through how to start trading with IG today.

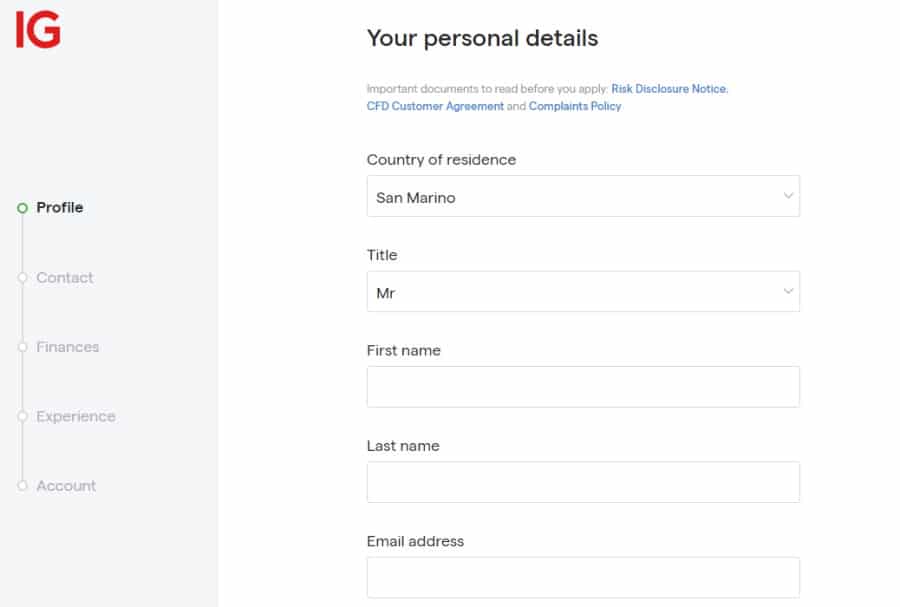

Step 1: Choose the trading account that suits you best and provide your personal details

Once you have chosen between either a share dealing account, CFD trading account, and spread betting account you will be required to enter some personal information such as your full legal name, address, date of birth, National Insurance number, and contact details.

If you choose a spread betting or CFD account you will be asked several questions regarding your trading experience and knowledge of derivatives trading. This is to gauge your suitability when it comes to trading with leverage.

Step 2: Account Verification

In keeping with standard KYC policies, you will be required to verify your identity and address by uploading a copy of your passport and a recent utility bill.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. IG supports a range of payment options including debit cards, credit cards, PayPal, and bank transfers.

To deposit funds on the IG mobile trading app simply open the app, and tap on account at the bottom of the screen, choose the account you want to deposit funds into, and tap on add funds to select your preferred payment option.

Step 4: Start buying and selling tradable assets on IG

Once you have successfully deposited funds into your trading account you can start trading on any of the supported trading platforms such as the mobile trading app, MetaTrader 4, or IG’s proprietary web trading platform.

Placing a trade on the web platform is straightforward; simply search for your preferred asset and click on it. This will populate a trading window with a chart and other useful information. On the right side of the trading window, click on either the buy or sell button, specify the size of the trade, place the order type of your choice such as limit or stop orders, and then click on place deal.

IG vs eToro

In summary, we have covered a wide range of key metrics including fees, commissions, tradable assets, payment methods, mobile trading, user experience, and more. As a result, this will give you an accurate insight into what trading with IG involves and whether it matches your trading goals and needs.

Are there other alternatives that offer a simpler trading experience? We recommend considering eToro as an overall top-rated social trading platform in 2026.

eToro has more than 20 million active traders and is regulated by top-tier financial institutions including the UK’s FCA, ASIC, and CySEC.

67% of retail investor accounts lose money when trading CFDs with this provider.

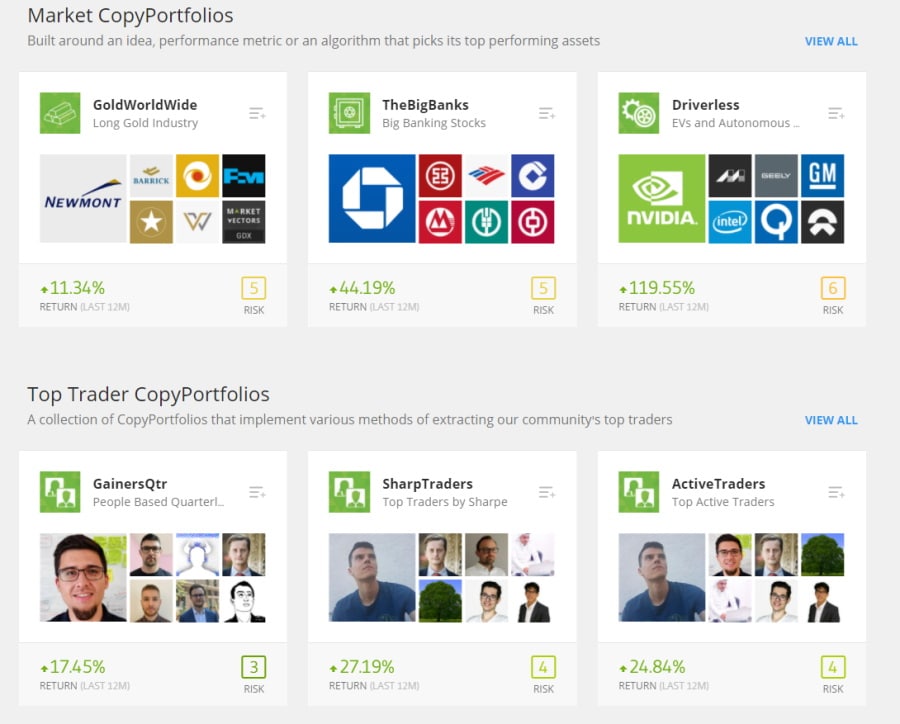

eToro facilitates a passive approach to online trading through two convenient and innovative copy trading tools called CopyTrader and CopyPortfolio. With the CopyTrader tool you can copy the trades of other eToro investors. The minimum investment is $200 for one trade and you can copy up to 100 traders at one time.

You can also buy and sell traditional shares and fractional shares of stocks on 17 international exchanges. Furthermore, regardless of the number of trades you execute, eToro allows you to invest in stocks without paying a penny in commissions.

If you are interested in cryptocurrency trading then you will be pleased to know that with eToro you can trade and own a range of digital assets including Bitcoin, Ethereum, Ripple, Litecoin, Dogecoin, and many more. As well as offering commission-free crypto trading, eToro also provides its own crypto wallet for you to store your digital assets. The added benefit of using the native eToro crypto wallet is that you can sell your cryptos with the click of a button.

In terms of crypto day trading strategies, you can also trade cryptos through CFD instruments. As we have already mentioned this means that you can trade with leverage as well as enter short positions. eToro traders have access to crypto-to-fiat and crypto-to-crypto pairs such as BTC/USD and ETH/BTC.

Past performance is not an indication of future results

When it comes to the trading fees and commissions, eToro charges 0% commission on all asset classes from stocks and cryptos to ETFs and forex. This means that you only pay the difference between the ask and bid prices. For example, when trading major stocks listed on major exchanges such as the NYSE, you will typically pay a minimum spread of 0.2%.

eToro also supports a wide range of payment options such as debit cards, credit cards, e-payments including PayPal, Neteller, Skrill, local and international bank transfers.

eToro is ideal for beginner traders with little to no trading experience. When you register for an eToro account you will have unfettered access to the paper trading demo account by switching between real and virtual accounts. You automatically start with $100,000 of virtual funds to practice online trading in a risk-free simulated environment that mirrors live market conditions.

IG Review – The Verdict

For the majority of beginner traders out there searching for a broker to engage in CFD derivatives trading as well as traditional stock trading then IG is a good option. The CFD broker supports commission-free trading as well as competitive spreads and the web and mobile platforms are easy to use. However, our IG review found that overall eToro is a better broker.

eToro offers commission-free ETF, stock, and forex trading with market-leading spreads as low as 1 pip for major currency pairs such as EUR/USD. You can trade everything from fractional shares to CFD derivatives from your live trading account, as well as copy the trading strategies of other investors via the copy trading toolkit.

eToro – Best Social Trading Platform for Stock and Forex Trading with 0% Commissions

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.